Business First Bancshares, Inc. (Business First) (Nasdaq: BFST),

the holding company for b1BANK, announced it has received all

required regulatory approvals and non-objections to complete its

merger with Oakwood Bancshares, Inc. (Oakwood), the holding company

for Oakwood Bank, a Texas banking association. On August 27, 2024,

Oakwood’s shareholders voted to approve the merger.

“We appreciate our regulatory partners’ efficient review of the

proposed transaction as well as the strong affirmation expressed by

the Oakwood shareholder base,” said Jude Melville, chairman,

president and CEO of Business First and b1BANK. “We are even more

excited about the long-term potential of this relationship than

when we first announced it and look forward to together growing

b1’s impact across the Dallas-Fort Worth market.”

Upon completion, it is expected that b1BANK’s assets will

increase to approximately $7.6 billion, with over $5.9 billion in

consolidated total loans. This will also add four full-service

banking centers to b1BANK’s footprint in the Dallas-Fort Worth

metropolitan area, as well as one branch in each of Snyder and

Oakwood, Texas. Roy J. Salley, chairman and chief executive officer

of Oakwood Bank, will join b1BANK as regional chairman, Dallas, and

William G. Hall, chairman of Oakwood Bancshares, Inc., will be

appointed to the boards of directors of Business First and

b1BANK.

The merger is expected to be completed on October 1, 2024, and

remains subject to the satisfaction of customary closing

conditions.

Raymond James & Associates, Inc., functioned as financial

advisor to Business First, and Hunton Andrews Kurth LLP served as

legal counsel to Business First. Stephens Inc. served as financial

advisor to Oakwood, and Norton Rose Fulbright US, LLP served as

legal counsel to Oakwood.

About Business First Bancshares,

Inc.

As of June 30, 2024, Business First Bancshares, Inc. (Nasdaq:

BFST), through its banking subsidiary b1BANK, had $6.7 billion in

assets, $6.1 billion in assets under management through b1BANK’s

affiliate Smith Shellnut Wilson, LLC (SSW) (excludes $0.9 billion

of b1BANK assets managed by SSW) and operates Banking Centers and

Loan Production Offices in markets across Louisiana and the Dallas

and Houston, Texas areas, providing commercial and personal banking

products and services. Commercial banking services include

commercial loans and letters of credit, working capital lines and

equipment financing, and treasury management services. b1BANK was

awarded #1 Best-In-State Bank, Louisiana, by Forbes and Statista,

and is a multiyear winner of American Banker’s “Best Banks to Work

For.” Visit b1BANK.com for more information.

Special Note Regarding Forward-Looking

Statements This document contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 that are subject to risks

and uncertainties and are made pursuant to the safe harbor

provisions of Section 27A of the Securities Act. These

forward-looking statements reflect the current views of BFST with

respect to future events and BFST’s financial performance. Any

statements about BFST’s expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or performance

are not historical facts and may be forward-looking. These

statements are often, but not always, made through the use of words

or phrases such as “anticipate,” “believes,” “can,” “could,” “may,”

“predicts,” “potential,” “should,” “will,” “estimate,” “plans,”

“projects,” “continuing,” “ongoing,” “expects,” “intends” and

similar words or phrases. BFST cautions that the forward-looking

statements in this document are largely based on BFST’s current

expectations, estimates, projections, goals and forecasts and

management assumptions about the future performance of each of

BFST, Oakwood and the combined company, as well as the businesses

and markets in which they do and are expected to operate. These

forward-looking statements are not guarantees of future performance

and involve a number of known and unknown risks, uncertainties and

assumptions that are difficult to assess and are subject to change

based on factors which are, in many instances, beyond BFST’s

control. The following factors, among others, could cause actual

results to differ materially from the anticipated results or other

expectations expressed in the forward-looking statements: (1) the

expected impact of the proposed transaction between BFST and

Oakwood on the combined entities’ operations, financial condition,

and financial results; (2) the businesses of BFST and Oakwood may

not be combined successfully, or such combination may take longer

to accomplish than expected; (3) the cost savings from the proposed

transaction may not be fully realized or may take longer to realize

than expected; (4) operating costs, customer loss and business

disruption following the proposed transaction, including adverse

effects on relationships with employees, may be greater than

expected; (5) the failure to satisfy the conditions to completion

of the proposed transaction; (6) the failure of the proposed

transaction to close for any other reason; (7) the impact on BFST

and Oakwood, and their respective customers, of a decline in

general economic conditions that would adversely affect credit

quality and loan originations, and any regulatory responses

thereto; (8) potential recession in the United States and BFST’s

and Oakwood’s market areas; (9) the impacts related to or resulting

from bank failures and any continuation of the uncertainty in the

banking industry, including the associated impact to BFST, Oakwood

and other financial institutions of any regulatory changes or other

mitigation efforts taken by government agencies in response

thereto; (10) the impact of changes in market interest rates,

whether due to continued elevated interest rates resulting in

further compression of net interest margin or potential reductions

in interest rates resulting in declines in net interest income;

(11) the persistence of the current inflationary pressures, or the

resurgence of elevated levels of inflation, in the United States

and the BFST and Oakwood market areas; (12) the uncertain impacts

of ongoing quantitative tightening and current and future monetary

policies of the Board of Governors of the Federal Reserve System;

(13) uncertainty regarding United States fiscal debt and budget

matters; (14) cyber incidents or other failures, disruptions or

breaches of our operational or security systems or infrastructure,

or those of our third-party vendors or other service providers,

including as a result of cyber-attacks; (15) competition from other

financial services companies in BFST’s and Oakwood’s markets; or

(16) current or future litigation, regulatory examinations or other

legal and/or regulatory actions. Additional information regarding

these risks and uncertainties to which BFST’s business and future

financial performance are subject is contained in BFST’s most

recent Annual Report on Form 10-K on file with the SEC, including

the sections entitled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” of

such documents, and other documents BFST files or furnishes with

the SEC from time to time, which are available on the SEC’s

website, www.sec.gov. Actual results, performance or achievements

could differ materially from those contemplated, expressed, or

implied by the forward-looking statements due to additional risks

and uncertainties of which BFST is not currently aware or which it

does not currently view as, but in the future may become, material

to its business or operating results. Due to these and other

possible uncertainties and risks, BFST can give no assurance that

the results contemplated in the forward-looking statements will be

realized and readers are cautioned not to place undue reliance on

the forward-looking statements contained in this document. Any

forward-looking statements presented herein are made only as of the

date of this document, and BFST does not undertake any obligation

to update or revise any forward-looking statements to reflect

changes in assumptions, new information, the occurrence of

unanticipated events, or otherwise, except as required by

applicable law. All forward-looking statements, express or implied,

included in the document are qualified in their entirety by this

cautionary statement.

Additional Information For additional

information on Business First, you may obtain Business First’s

reports that are filed with the Securities and Exchange Commission

(SEC) free of charge by using the SEC’s EDGAR service on the SEC’s

website at www.sec.gov or by contacting the SEC for further

information at 1-800-SEC-0330. Alternatively, these documents can

be obtained free of charge from Business First by directing a

request to: Business First Bancshares, Inc., 500 Laurel Street,

Suite 100, Baton Rouge, Louisiana 70801, Attention: Corporate

Secretary.

Misty

Albrechtb1BANK225.286.7879Misty.Albrecht@b1BANK.com

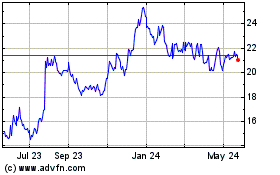

Business First Bancshares (NASDAQ:BFST)

Historical Stock Chart

From Oct 2024 to Nov 2024

Business First Bancshares (NASDAQ:BFST)

Historical Stock Chart

From Nov 2023 to Nov 2024