UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024.

Commission File Number 001-41606

BRERA HOLDINGS PLC

(Translation of registrant’s name into English)

Connaught House, 5th Floor

One Burlington Road

Dublin 4

D04 C5Y6

Ireland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

Notice of Failure to Satisfy a Continued Listing Rule or

Standard

As previously reported in

the Notification of Late Filing on Form 12b-25 filed by Brera Holdings PLC, a public limited company incorporated in the Republic of Ireland

(the “Company”), with the Securities and Exchange Commission (the “SEC”) on April 30, 2024, the Company was delayed

in filing with the SEC its Annual Report on Form 20-F for the year ended December 31, 2023 (the “Form 20-F”), which delay

could not be eliminated by the Company without unreasonable effort and expense. Due to additional unanticipated delays in the completion

of its financial statements and related portions of the Form 20-F, which delays could not be eliminated by the Company without unreasonable

effort and expense, the filing of the Form 20-F has been further delayed.

On May 16, 2024, the Company

received a written notification (the “Notification Letter”), from The Nasdaq Stock Market LLC (“Nasdaq”), notifying

the Company that it is not in compliance with the periodic financial report filing requirement set forth in Nasdaq Listing Rule 5250(c)(1)

for continued listing on The Nasdaq Capital Market tier of Nasdaq since the Company had not yet filed the Form 20-F.

The Notification Letter further

stated that the Company has 60 calendar days, or until July 15, 2024, to submit a plan (the “Plan”) to Nasdaq to regain compliance,

and, if Nasdaq accepts the Plan, Nasdaq may grant an exception of up to 180 calendar days from the Form 20-F’s due date, or until

November 11, 2024, to regain compliance. If Nasdaq does not accept the Plan, the Company will have the opportunity to appeal that decision

to a Nasdaq Hearings Panel.

The Company intends to file

the Form 20-F within the prescribed 60-day period, which will allow the Company to regain compliance.

The Notification Letter does not impact the Company’s

listing of the Class B Ordinary Shares on the Nasdaq Capital Market at this time. However, the Notification Letter provides that the Company’s

name will be included on a list of all non-compliant companies which Nasdaq makes available to investors on its website at listingcenter.nasdaq.com,

beginning five business days from the date of the Notification Letter.

This report on Form 6-K,

except for the press release attached hereto as Exhibit 99.1, is incorporated by reference into the prospectus contained in the Company’s

registration statement on Form F-3 (File No. 333-276870) initially filed with the SEC on February 5, 2024, and declared effective by the

SEC on February 13, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 22, 2024 |

BRERA HOLDINGS PLC |

| |

|

|

| |

|

|

| |

By: |

/s/ Pierre Galoppi |

| |

Pierre Galoppi |

| |

Chief Executive Officer |

Exhibit 99.1

Brera Holdings Receives Nasdaq Notice Related to

Late Filing of its Form 20-F

DUBLIN, Ireland and MILAN, Italy, – May

22, 2024 – Brera Holdings PLC (“Brera Holdings,” “Brera” or the “Company”) (Nasdaq: BREA) today

announced that it received a written notification, dated May 16, 2024 (the “Notification Letter”), from The Nasdaq Stock Market

LLC (“Nasdaq”) notifying the Company that it is not in compliance with the periodic financial report filing requirement set

forth in Nasdaq Listing Rule 5250(c)(1) for continued listing on The Nasdaq Capital Market tier of Nasdaq since the Company had not yet

filed its Annual Report on Form 20-F for the year ended December 31, 2023 (the “Form 20-F”).

The Company has 60 calendar days, or until July

15, 2024, to submit a plan (the “Plan”) to Nasdaq to regain compliance, and, if Nasdaq accepts the Plan, Nasdaq may grant

an exception of up to 180 calendar days from the Form 20-F’s due date, or until November 11, 2024, to regain compliance. If Nasdaq

does not accept the Plan, the Company will have the opportunity to appeal that decision to a Nasdaq Hearings Panel.

The Notification Letter does not impact the

Company’s listing of its Class B Ordinary Shares on the Nasdaq Capital Market at this time. The Company intends to file the Form

20-F prior to July 15, 2024.

ABOUT BRERA HOLDINGS PLC

Brera Holdings PLC (Nasdaq: BREA) is focused

on expanding its social impact football (American soccer) business by developing a global portfolio of emerging football and other sports

clubs with increased opportunities to earn tournament prizes, gain sponsorships, and provide other professional football- and sports-related

consulting services.

The Company seeks to build on the legacy and brand

of Brera FC, the first football club that was acquired by the Company in 2022. Brera FC, known as "The Third Team of Milan,"

is an amateur football association which has been building an alternative football legacy since its founding in 2000. The Company owns

the trademarked FENIX Trophy Tournament, a nonprofessional pan-European football competition recognized by UEFA, inaugurated in September

2021 and organized by Brera FC. "FENIX" is an acronym for "Friendly European Nonprofessional Innovative Xenial." BBC

Sport has called the FENIX Trophy "the Champions League for amateurs," and Brera FC hosted the 2023 finals at Milan's legendary

San Siro Stadium. In October 2022, the Internet Marketing Association at its IMPACT 22 Conference named Brera FC as its award recipient

for "Social Impact Through Soccer," recognizing the Company's focus at an international level with this distinction.

In March 2023, the Company expanded to Africa

with the establishment of Brera Tchumene FC, a team then admitted to the Second Division League in Mozambique, a country of nearly 32

million people. Brera Tchumene FC won its post-season tournament and in November 2023 was promoted to Mocambola, the First Division in

Mozambique. In April 2023, the Company acquired 90% of the European first division football team Fudbalski Klub Akademija Pandev in North

Macedonia, a country with participation rights in two major Union of European Football Association ("UEFA") competitions.

In June 2023, Brera acquired a strategic stake

in Manchester United PLC, a portion of which was subject to a tender offer by Sir Jim Radcliffe and sold at a 74% realized gain. In July

2023, the Company completed the acquisition of a majority ownership in the Italian Serie A1 women's professional volleyball team UYBA

Volley S.s.d.a.r.l. In September 2023, the Company assumed control of Bayanzurkh Sporting Ilch FC, a team in the Mongolian National Premier

League, which became Brera Ilch FC when the football season resumed in March 2024.

In January 2024, the Company announced the launch

of a proactive search for an Italian Serie B football club target designed to bring multi-club ownership of the highest tiers of professional

sports ownership to mass investors through the Company's Nasdaq-listed shares. In February 2024 the Brera Holdings Advisory Board was

established with MLS founder and World Cup director Alan Rothenberg, luxury lifestyle executive Massimo Ferragamo, sports business leaders

Paul Tosetti and Marshall Geller, and Italian football icon Giuseppe Rossi. Brera Holdings PLC is focused on bottom-up value creation

from undervalued sports clubs and talent, innovation powered business growth, and socially-impactful outcomes. See www.breraholdings.com

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements that are subject to various risks and uncertainties. Such statements include statements regarding the Company's ability to

grow its business and other statements that are not historical facts, including statements which may be accompanied by the words "intends,"

"may," "will," "plans," "expects," "anticipates," "projects," "predicts,"

"estimates," "aims," "believes," "hopes," "potential" or similar words. Actual results

could differ materially from those described in these forward-looking statements due to a number of factors, including without limitation,

the Company's ability to continue as a going concern, the popularity and/or competitive success of the Company's acquired football and

other sports teams, the Company's ability to attract players and staff for acquired clubs, unsuccessful acquisitions or other strategic

transactions, the possibility of a decline in the popularity of football or other sports, the Company's ability to expand its fanbase,

sponsors and commercial partners, general economic conditions, and other risk factors detailed in the Company's filings with the SEC.

The forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not

undertake any responsibility to update such forward-looking statements except in accordance with applicable law.

CONTACT INFORMATION:

FOR MEDIA AND INVESTOR RELATIONS

Pierre Galoppi, Chief Executive Officer

Brera Holdings PLC

Email: pierre@breraholdings.com

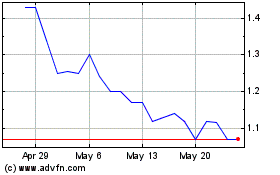

Brera (NASDAQ:BREA)

Historical Stock Chart

From Aug 2024 to Sep 2024

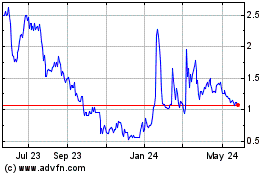

Brera (NASDAQ:BREA)

Historical Stock Chart

From Sep 2023 to Sep 2024