Bruker Corporation (NASDAQ: BRKR) today reported financial results

for the fourth quarter and full year ended December 31, 2007. The

financial information included herein does not include the results

of the Bruker BioSpin Group, which was acquired on February 26,

2008, but only the financial results of the standalone Bruker

BioSciences Corporation, as it legally existed on December 31,

2007. On February 26, 2008, Bruker BioSciences Corporation closed

its acquisition of the Bruker BioSpin Group, and renamed itself

Bruker Corporation. Under US GAAP, this transaction will be

accounted for as an acquisition of businesses under common control,

and as a result all one-time transaction costs are expensed in the

period in which they are incurred, rather than being added to

goodwill. In addition, after the closing of the transaction all

historical consolidated balance sheets, statements of operations,

statements of cash flows and notes to the consolidated financial

statements in future filings with the Securities and Exchange

Commission will be restated by combining the historical

consolidated financial statements of Bruker BioSciences Corporation

with those of the Bruker BioSpin Group. The Bruker BioSpin Group

standalone financial results, as well as combined financial results

for Bruker Corporation, are expected to be released in mid-March

2008. At that time, the newly combined Company will also provide an

update on its financial goals for the year 2008. Financial Results

of Bruker BioSciences (excluding the Bruker BioSpin Group) For the

fourth quarter of 2007, revenue increased by 35% to $183.7 million,

compared to revenue of $135.6 million in the fourth quarter of

2006. Excluding the effects of foreign currency translation, fourth

quarter 2007 revenue increased organically by 26% year-over-year.

Net income in the fourth quarter of 2007 increased 44% to $14.0

million, or $0.13 per diluted share, compared to net income of $9.7

million, or $0.09 per diluted share, in the fourth quarter of 2006.

Included in GAAP net income for the fourth quarter of 2007 were

after-tax charges of $4.3 million, or $0.04 per diluted share, for

expenses related to the acquisition of the Bruker BioSpin Group.

For the full year 2007, revenue increased by 26% to $547.6 million,

compared to revenue of $435.8 million for the full year 2006.

Excluding the effects of foreign currency translation, full year

2007 revenue increased by 19% year-over-year, including 17% organic

growth and 2% growth from acquisitions. Net income for the full

year 2007 increased 70% to $31.5 million, or $0.30 per diluted

share, compared to net income of $18.5 million, or $0.18 per

diluted share, during the full year 2006. Included in GAAP net

income for the full year 2007 were after-tax charges of $4.7

million, or $0.04 per diluted share, for expenses related to the

acquisition of the Bruker BioSpin Group. For comparison, included

in GAAP net income for the year 2006 were after-tax charges of $5.0

million, or $0.05 per diluted share, for expenses related to the

acquisition of Bruker Optics. During the fourth quarter of 2007,

cash flow from operations was $36.4 million and free cash flow,

defined as operating cash flow less capital expenditures, was $34.3

million. During the full year 2007, cash flow from operations was

$26.3 million and free cash flow was $10.8 million. As of December

31, 2007, the Company had $72.9 million in cash and cash

equivalents, and $38.1 million in outstanding debt. Commenting on

the Company's financial performance, Frank Laukien, President and

CEO, said: "We had an outstanding fourth quarter, and we are very

pleased that during 2007 we have achieved excellent top-line

growth, with all three operating divisions delivering

currency-adjusted double digit growth year-over-year. Even more

importantly, our rapid growth, our continued operating margin

expansion and our decreasing effective tax rate contributed to

significantly improved bottom-line performance year-over-year, as

well as to solid operating and free cash flow." He continued:

"Bruker BioSciences has made very good progress over the last three

years. We will continue to strive for fast growth and further

margin improvements in order to reach industry-standard

profitability, and we will put a significant focus on balance sheet

management and cash flow generation. We are optimistic that the

renamed Bruker Corporation, which as of two days ago includes the

Bruker BioSpin Group, is well positioned to serve our customers and

markets with high-performance products and solutions. Despite the

uncertainty in the macro-economic outlook, at this point the

Company expects significant further financial improvements in the

year 2008." EARNINGS CONFERENCE CALL Bruker Corporation will host

an operator-assisted earnings conference call at 9 a.m. Eastern

Time on Thursday, February 28, 2008. To listen to the webcast,

investors can go to www.bruker-biosciences.com and click on the

live web broadcast symbol. The webcast will be available through

the Company web site for 30 days. Investors can also listen and

participate on the telephone in the US and Canada by calling

888-339-2688, or 617-847-3007 outside the US and Canada. Investors

should refer to the Bruker Corporation Quarterly Earnings Call. A

telephone replay of the conference call will be available one hour

after the conference call by dialing 888-286-8010 in the US and

Canada, or 617-801-6888 outside the US and Canada, and then

entering replay pass code 11927586. ABOUT BRUKER CORPORATION As of

February 26, 2008, the renamed Bruker Corporation (NASDAQ: BRKR)

has become the parent company of the entire Bruker group of

companies. After the closing of the acquisition of the Bruker

BioSpin Group, Bruker Corporation now operates in two segments, the

life science and analytical (LSA) systems segment, and the

international advanced superconductor (IAS) segment. For more

information, please visit www.bruker-biosciences.com CAUTIONARY

STATEMENT Any statements contained in this press release that do

not describe historical facts may constitute forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. Any forward-looking statements

contained herein are based on current expectations, but are subject

to a number of risks and uncertainties. The factors that could

cause actual future results to differ materially from current

expectations include, but are not limited to, risks and

uncertainties relating to the integration of businesses we have

acquired or may acquire in the future, changing technologies,

product development and market acceptance of our products, the cost

and pricing of our products, manufacturing, competition, dependence

on collaborative partners and key suppliers, capital spending and

government funding policies, changes in governmental regulations,

intellectual property rights, litigation, and exposure to foreign

currency fluctuations. These and other factors are identified and

described in more detail in our filings with the SEC, including,

without limitation, our annual report on Form 10-K for the year

ended December 31, 2006, our most recent quarterly reports on Form

10-Q and our current reports on Form 8-K. We disclaim any intent or

obligation to update these forward-looking statements other than as

required by law. -0- *T Bruker Corporation (excluding the Bruker

BioSpin Group) CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except per share data) Three Months Ended Twelve Months

Ended December 31, December 31, ---------------------

--------------------- 2007 2006 2007 2006 ---------- ----------

---------- ---------- Product revenue $ 164,910 $ 120,444 $ 482,153

$ 384,548 Service revenue 18,384 14,960 64,553 49,930 Other revenue

449 221 870 1,356 ---------- ---------- ---------- ---------- Total

revenue 183,743 135,625 547,576 435,834 Cost of product revenue

85,605 63,214 252,130 206,628 Cost of service revenue 12,492 9,239

42,308 29,872 ---------- ---------- ---------- ---------- Total

cost of revenue 98,097 72,453 294,438 236,500 ---------- ----------

---------- ---------- Gross profit margin 85,646 63,172 253,138

199,334 Operating Expenses: Sales and marketing 31,074 25,212

105,983 84,007 General and administrative 10,392 8,663 34,058

28,982 Research and development 16,164 13,464 58,466 49,959

Acquisition related charges 4,294 (105) 4,664 5,724 ----------

---------- ---------- ---------- Total operating expenses 61,924

47,234 203,171 168,672 ---------- ---------- ---------- ----------

Operating income 23,722 15,938 49,967 30,662 Interest and other

income (expense), net (530) 236 (1,355) 3,758 ---------- ----------

---------- ---------- Income before income tax provision and

minority interest in consolidated subsidiaries 23,192 16,174 48,612

34,420 Income tax provision 9,129 6,533 16,784 15,931 ----------

---------- ---------- ---------- Income before minority interest in

consolidated subsidiaries 14,063 9,641 31,828 18,489 Minority

interest in consolidated subsidiaries 44 (67) 299 8 ----------

---------- ---------- ---------- Net income $ 14,019 $ 9,708 $

31,529 $ 18,481 ========== ========== ========== ========== Net

income per share: Basic $ 0.13 $ 0.10 $ 0.30 $ 0.18 ==========

========== ========== ========== Diluted $ 0.13 $ 0.09 $ 0.30 $

0.18 ========== ========== ========== ========== Weighted average

shares outstanding: Basic 104,508 101,501 103,702 101,512

========== ========== ========== ========== Diluted 107,180 103,370

106,769 102,561 ========== ========== ========== ========== *T -0-

*T Bruker Corporation (excluding the Bruker BioSpin Group)

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) December

December 31, 31, 2007 2006 -------- -------- ASSETS Current assets:

Cash and short-term investments $ 72,876 $ 52,147 Accounts

receivable, net 114,938 79,604 Due from affiliated companies 7,203

9,028 Inventories 171,332 134,504 Other current assets 29,281

19,461 -------- -------- Total current assets 395,630 294,744

Property and equipment, net 103,100 90,349 Intangible and other

assets 54,483 48,094 -------- -------- Total assets $553,213

$433,187 ======== ======== LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Short-term borrowings $ 31,716 $ 21,857

Accounts payable 32,584 23,102 Due to affiliated companies 8,326

5,901 Other current liabilities 180,327 144,268 -------- --------

Total current liabilities 252,953 195,128 Long-term debt 6,394

22,863 Other long-term liabilities 34,702 23,491 Minority interest

in subsidiaries 505 239 Total shareholders' equity 258,659 191,466

-------- -------- Total liabilities and shareholders' equity

$553,213 $433,187 ======== ======== *T Bruker Corporation (NASDAQ:

BRKR) today reported financial results for the fourth quarter and

full year ended December 31, 2007. The financial information

included herein does not include the results of the Bruker BioSpin

Group, which was acquired on February 26, 2008, but only the

financial results of the standalone Bruker BioSciences Corporation,

as it legally existed on December 31, 2007. On February 26, 2008,

Bruker BioSciences Corporation closed its acquisition of the Bruker

BioSpin Group, and renamed itself Bruker Corporation. Under US

GAAP, this transaction will be accounted for as an acquisition of

businesses under common control, and as a result all one-time

transaction costs are expensed in the period in which they are

incurred, rather than being added to goodwill. In addition, after

the closing of the transaction all historical consolidated balance

sheets, statements of operations, statements of cash flows and

notes to the consolidated financial statements in future filings

with the Securities and Exchange Commission will be restated by

combining the historical consolidated financial statements of

Bruker BioSciences Corporation with those of the Bruker BioSpin

Group. The Bruker BioSpin Group standalone financial results, as

well as combined financial results for Bruker Corporation, are

expected to be released in mid-March 2008. At that time, the newly

combined Company will also provide an update on its financial goals

for the year 2008. Financial Results of Bruker BioSciences

(excluding the Bruker BioSpin Group) For the fourth quarter of

2007, revenue increased by 35% to $183.7 million, compared to

revenue of $135.6 million in the fourth quarter of 2006. Excluding

the effects of foreign currency translation, fourth quarter 2007

revenue increased organically by 26% year-over-year. Net income in

the fourth quarter of 2007 increased 44% to $14.0 million, or $0.13

per diluted share, compared to net income of $9.7 million, or $0.09

per diluted share, in the fourth quarter of 2006. Included in GAAP

net income for the fourth quarter of 2007 were after-tax charges of

$4.3 million, or $0.04 per diluted share, for expenses related to

the acquisition of the Bruker BioSpin Group. For the full year

2007, revenue increased by 26% to $547.6 million, compared to

revenue of $435.8 million for the full year 2006. Excluding the

effects of foreign currency translation, full year 2007 revenue

increased by 19% year-over-year, including 17% organic growth and

2% growth from acquisitions. Net income for the full year 2007

increased 70% to $31.5 million, or $0.30 per diluted share,

compared to net income of $18.5 million, or $0.18 per diluted

share, during the full year 2006. Included in GAAP net income for

the full year 2007 were after-tax charges of $4.7 million, or $0.04

per diluted share, for expenses related to the acquisition of the

Bruker BioSpin Group. For comparison, included in GAAP net income

for the year 2006 were after-tax charges of $5.0 million, or $0.05

per diluted share, for expenses related to the acquisition of

Bruker Optics. During the fourth quarter of 2007, cash flow from

operations was $36.4 million and free cash flow, defined as

operating cash flow less capital expenditures, was $34.3 million.

During the full year 2007, cash flow from operations was $26.3

million and free cash flow was $10.8 million. As of December 31,

2007, the Company had $72.9 million in cash and cash equivalents,

and $38.1 million in outstanding debt. Commenting on the Company�s

financial performance, Frank Laukien, President and CEO, said: �We

had an outstanding fourth quarter, and we are very pleased that

during 2007 we have achieved excellent top-line growth, with all

three operating divisions delivering currency-adjusted double digit

growth year-over-year. Even more importantly, our rapid growth, our

continued operating margin expansion and our decreasing effective

tax rate contributed to significantly improved bottom-line

performance year-over-year, as well as to solid operating and free

cash flow.� He continued: �Bruker BioSciences has made very good

progress over the last three years. We will continue to strive for

fast growth and further margin improvements in order to reach

industry-standard profitability, and we will put a significant

focus on balance sheet management and cash flow generation. We are

optimistic that the renamed Bruker Corporation, which as of two

days ago includes the Bruker BioSpin Group, is well positioned to

serve our customers and markets with high-performance products and

solutions. Despite the uncertainty in the macro-economic outlook,

at this point the Company expects significant further financial

improvements in the year 2008.� EARNINGS CONFERENCE CALL Bruker

Corporation will host an operator-assisted earnings conference call

at 9 a.m. Eastern Time on Thursday, February 28, 2008. To listen to

the webcast, investors can go to www.bruker-biosciences.com and

click on the live web broadcast symbol. The webcast will be

available through the Company web site for 30 days. Investors can

also listen and participate on the telephone in the US and Canada

by calling 888-339-2688, or 617-847-3007 outside the US and Canada.

Investors should refer to the Bruker Corporation Quarterly Earnings

Call. A telephone replay of the conference call will be available

one hour after the conference call by dialing 888-286-8010 in the

US and Canada, or 617-801-6888 outside the US and Canada, and then

entering replay pass code 11927586. ABOUT BRUKER CORPORATION As of

February 26, 2008, the renamed Bruker Corporation (NASDAQ: BRKR)

has become the parent company of the entire Bruker group of

companies. After the closing of the acquisition of the Bruker

BioSpin Group, Bruker Corporation now operates in two segments, the

life science and analytical (LSA) systems segment, and the

international advanced superconductor (IAS) segment. For more

information, please visit www.bruker-biosciences.com CAUTIONARY

STATEMENT Any statements contained in this press release that do

not describe historical facts may constitute forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. Any forward-looking statements

contained herein are based on current expectations, but are subject

to a number of risks and uncertainties. The factors that could

cause actual future results to differ materially from current

expectations include, but are not limited to, risks and

uncertainties relating to the integration of businesses we have

acquired or may acquire in the future, changing technologies,

product development and market acceptance of our products, the cost

and pricing of our products, manufacturing, competition, dependence

on collaborative partners and key suppliers, capital spending and

government funding policies, changes in governmental regulations,

intellectual property rights, litigation, and exposure to foreign

currency fluctuations. These and other factors are identified and

described in more detail in our filings with the SEC, including,

without limitation, our annual report on Form 10-K for the year

ended December 31, 2006, our most recent quarterly reports on Form

10-Q and our current reports on Form 8-K. We disclaim any intent or

obligation to update these forward-looking statements other than as

required by law. Bruker Corporation (excluding the Bruker BioSpin

Group) CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except per share data) � � � � � � Three�Months Ended

December 31, Twelve Months Ended December 31, 2007 2006 2007 2006 �

Product revenue $ 164,910 $ 120,444 $ 482,153 $ 384,548 Service

revenue 18,384 14,960 64,553 49,930 Other revenue � 449 � � 221 � �

870 � � 1,356 Total revenue 183,743 135,625 547,576 435,834 � Cost

of product revenue 85,605 63,214 252,130 206,628 Cost of service

revenue � 12,492 � � 9,239 � � 42,308 � � 29,872 Total cost of

revenue � 98,097 � � 72,453 � � 294,438 � � 236,500 � Gross profit

margin 85,646 63,172 253,138 199,334 Operating Expenses: Sales and

marketing 31,074 25,212 105,983 84,007 General and administrative

10,392 8,663 34,058 28,982 Research and development 16,164 13,464

58,466 49,959 Acquisition related charges � 4,294 � � (105 ) �

4,664 � � 5,724 Total operating expenses � 61,924 � � 47,234 � �

203,171 � � 168,672 � Operating income 23,722 15,938 49,967 30,662

� Interest and other income (expense), net � (530 ) � 236 � �

(1,355 ) � 3,758 � � Income before income tax provision and

minority interest in consolidated subsidiaries 23,192 16,174 48,612

34,420 Income tax provision � 9,129 � � 6,533 � � 16,784 � � 15,931

� � Income before minority interest in consolidated subsidiaries

14,063 9,641 31,828 18,489 Minority interest in consolidated

subsidiaries � 44 � � (67 ) � 299 � � 8 Net income $ 14,019 � $

9,708 � $ 31,529 � $ 18,481 � Net income per share: Basic $ 0.13 �

$ 0.10 � $ 0.30 � $ 0.18 Diluted $ 0.13 � $ 0.09 � $ 0.30 � $ 0.18

� Weighted average shares outstanding: Basic � 104,508 � � 101,501

� � 103,702 � � 101,512 Diluted � 107,180 � � 103,370 � � 106,769 �

� 102,561 Bruker Corporation (excluding the Bruker BioSpin Group)

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) � � � �

December 31, December 31, 2007 2006 ASSETS � Current assets: Cash

and short-term investments $ 72,876 $ 52,147 Accounts receivable,

net 114,938 79,604 Due from affiliated companies 7,203 9,028

Inventories 171,332 134,504 Other current assets � 29,281 � 19,461

Total current assets 395,630 294,744 � Property and equipment, net

103,100 90,349 Intangible and other assets � 54,483 � 48,094 �

Total assets $ 553,213 $ 433,187 LIABILITIES AND SHAREHOLDERS'

EQUITY � Current liabilities: Short-term borrowings $ 31,716 $

21,857 Accounts payable 32,584 23,102 Due to affiliated companies

8,326 5,901 Other current liabilities � 180,327 � 144,268 Total

current liabilities 252,953 195,128 � Long-term debt 6,394 22,863

Other long-term liabilities 34,702 23,491 Minority interest in

subsidiaries 505 239 � Total shareholders' equity � 258,659 �

191,466 � Total liabilities and shareholders' equity $ 553,213 $

433,187

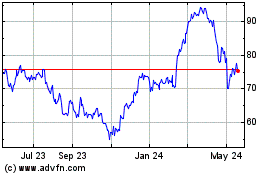

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Jul 2023 to Jul 2024