Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

02 March 2024 - 9:15AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16

or 15d-16 of the Securities Exchange Act of 1934

| For

the month of |

March

2024 |

| |

|

| Commission

File Number |

001-41460 |

Bruush

Oral Care Inc.

(Translation

of registrant’s name into English)

128

West Hastings Street, Unit 210

Vancouver,

British Columbia V6B 1G8

Canada

(844)

427-8774

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

As

previously reported on November 15, 2023, Bruush Oral Care Inc. (the “Company”) received written notice from the Listing

Qualifications Department of the Nasdaq Stock Market, LLC (“Nasdaq”) notifying the Company that the Company no longer

complied with the minimum bid price requirement for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5550(a)(2) requires

listed securities to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq

Listing Rule 5810(c)(3)(A) provides that a failure to meet the Minimum Bid Price Requirement exists if the minimum bid price is not met

for a period of 30 consecutive trading days. Pursuant to the Nasdaq Listing Rules, the Company was granted a period of 180 calendar days,

or until May 13, 2024, to regain compliance with the Minimum Bid Price Requirement. To regain compliance, the closing bid price of the

Company’s common shares must be at least $1.00 per share for a minimum of 10 consecutive trading days prior to May 13, 2024, and

the Company must otherwise satisfy The Nasdaq Capital Market’s requirements for continued listing.

On

February 27, 2024, the Company received written notice (the “Notice”) from the Listing Qualifications Department of

the Nasdaq notifying the Company that, as of February 26, 2024, based on the closing bid price of the Company’s common shares,

without par value (the “Common Shares”), for the last 10 consecutive trading days, the Company no longer complies

with Nasdaq Listing Rule 5810(c)(3)(A)(iii) (the “Low Priced Stocks Rule”) for continued listing on the Nasdaq Capital

Market. The Low Priced Stocks Rule provides that if during any compliance period specified in Rule 5810(c)(3)(A), a company’s securities

have a closing bid price of $0.10 or less for ten consecutive trading days, the Listing Qualifications Department shall issue a Staff

Delisting Determination under Rule 5810 with respect to that security.

As

a result, Nasdaq has determined to delist the Company’s securities from the Nasdaq Capital Market (the “Determination”),

and unless the Company requests an appeal of the Determination by 4:00 p.m. Eastern Time on March 5, 2024, trading of the Common Shares

will be suspended at the opening of business on March 7, 2024, and a Form 25-NSE will be filed with the Securities and Exchange Commission,

which will remove the Company’s securities from listing and registration on Nasdaq.

The

Notice stated that the Company may appeal the Staff’s determination to a Hearings Panel (the “Panel”)

pursuant to the procedures set forth in the Nasdaq Listing Rule 5800 Series. On February 28, 2024, the Company requested a

hearing before the Panel. A request for a hearing before the Panel automatically stays the suspension and/or delisting of the Company’s

securities pending completion of the hearing and the expiration of any additional extension period granted by the Panel following the

hearing. The hearing has been scheduled for April 25, 2024. At the hearing, the Company intends to present a plan to regain compliance

with the applicable rule for continued listing. There can be no assurance as to the decision of the Panel.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

Bruush

Oral Care Inc. |

| |

|

|

(Registrant) |

| |

|

|

|

|

| Date: |

March

1, 2024 |

|

By: |

/s/

Aneil Singh Manhas |

| |

|

|

Name: |

Aneil

Singh Manhas |

| |

|

|

Title: |

Chief

Executive Officer |

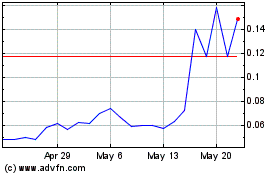

Bruush Oral Care (NASDAQ:BRSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

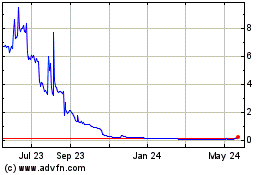

Bruush Oral Care (NASDAQ:BRSH)

Historical Stock Chart

From Apr 2023 to Apr 2024