Tesco Picks MBK as Preferred Bidder in Up to $7 Billion South Korea Deal -- 2nd Update

02 September 2015 - 7:15PM

Dow Jones News

By Rick Carew in Hong Kong and Saabira Chaudhuri in London

Retailer Tesco PLC has picked Asian private-equity firm MBK

Partners LP as the preferred bidder to buy its South Korea retail

operations--its largest outside the U.K.--in a deal that could be

worth between $6 billion and $7 billion, according to people

familiar with the situation.

A sale by Tesco, if completed, would jettison a big chunk of

Tesco's global operations after a series of blunders at the U.K.

retail chain including an accounting scandal, massive write-downs,

and upheaval in its management ranks. Tesco is counting on the

proceeds from the sale, which could include a dividend being paid

out from the South Korean business, to help fund its turnaround

effort.

The deal would be among the largest transactions in Asia this

year and the largest private equity deal ever in South Korea,

topping Hahn & Co.'s $3.6 billion purchase of control of Halla

Visteon Climate Control Corp. from U.S. auto parts supplier Visteon

Corp. in December, according to Dealogic data. MBK Partners, which

manages about $8.2 billion in assets, was founded in 2005 by a

group of former Carlyle Group LP executives.

Private equity deal makers are drawn to South Korea by the size

of deals and the availability of cheap financing from local banks.

However, they have had an uneven relationship with the country,

where strong unions and government hostility have often made

turning successful deals into profitable exits difficult. The

poster child for difficulties in South Korea has been a

long-running dispute between Dallas-based Lone Star Funds and the

South Korean government. It has been in arbitration this year.

At the same time, the buyout of South Korea's Oriental Brewery

by KKR & Co. and Affinity Equity Partners in 2009 for $1.8

billion is among the most profitable deals in Asia ever by

private-equity funds. KKR and Affinity sold Oriental Brewery back

to Anheuser-Busch InBev NV for $5.8 billion last year.

MBK has been competing for the Tesco business in South Korea,

known as Homeplus, with a joint bid from KKR & Co. and Affinity

Equity Partners, according to people familiar with the situation.

MBK had initially teamed up with Goldman Sachs Group Inc. in its

bid, but Goldman later withdrew from the bidding consortium,

according to one person familiar with the situation.

The deal, if completed, would mark an about-face for the

battered supermarket chain, which under former Chief Executive

Terry Leahy embarked on an aggressive expansion plan, pushing from

five countries into 13. Tesco's South Korea arm is the

second-biggest outside the U.K., with more than 900 fully-owned and

franchise stores that serve about six million customers a week.

A deal to sell the Homeplus chain would give Chief Executive

Dave Lewis more ammunition to turn around performance at home where

Tesco has lost ground to German discounters Aldi and Lidl, which

are expanding across the U.K. at a steady clip. Mr. Lewis has cut

prices, closed unprofitable stores, reduced Tesco's product lineup

and put more staff on the shop floor in a bid to stem the slide in

market share.

Tesco in April reported a pretax loss of GBP6.38 billion for the

year as it logged a massive property write down, and the company

also reported net debt of GBP8.5 billion. In addition to Homeplus,

Tesco has yet to close a deal to sell its data-analysis unit,

Dunnhumby. The company in January hired Goldman Sachs to weigh a

sale of the business.

Write to Rick Carew at rick.carew@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 02, 2015 05:00 ET (09:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

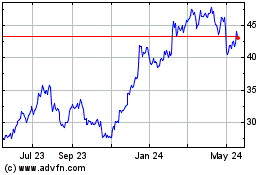

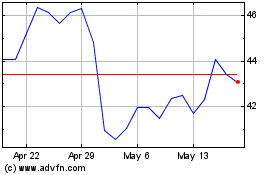

Carlyle (NASDAQ:CG)

Historical Stock Chart

From Apr 2024 to May 2024

Carlyle (NASDAQ:CG)

Historical Stock Chart

From May 2023 to May 2024