City Holding Company Increases Dividend on Common Shares by 10%

02 March 2007 - 2:08AM

PR Newswire (US)

CHARLESTON, W.Va., March 1 /PRNewswire-FirstCall/ -- City Holding

Company, "the Company" (NASDAQ:CHCO), a $2.5 billion bank holding

company headquartered in Charleston, today declared a dividend of

31 cents per common share for shareholders of record as of April

15, 2007. The dividend is payable on April 30, 2007. The dividend

represents a 10% increase from the 28 cents per share cash dividend

paid in the first quarter of 2007 and follows a 12% increase in the

cash dividend, from 25 cents per common share to 28 cents, approved

by the board in March 2006. "I am very pleased that our Company's

continued strong performance has allowed us to increase the

dividend to shareholders for the fourth consecutive year. The

decision to increase the dividend to $1.24 on an annualized basis

is consistent with the Company's strong capital and liquidity

position and is reflective of our outstanding performance during

2006." City Holding Company is the parent company of City National

Bank of West Virginia. City National operates 67 branches across

West Virginia, Eastern Kentucky and Southern Ohio. Forward-Looking

Information This news release contains certain forward-looking

statements that are included pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. Such

information involves risks and uncertainties that could result in

the Company's actual results to differ from those projected in the

forward-looking statements. Important factors that could cause

actual results to differ materially from those discussed in such

forward-looking statements include, but are not limited to, (1) the

Company may incur additional loan loss provision due to negative

credit quality trends in the future that may lead to a

deterioration of asset quality; (2) the Company may incur increased

charge-offs in the future; (3) the Company may experience increases

in the default rates on previously securitized loans that would

result in impairment losses or lower the yield on such loans; (4)

the Company may continue to benefit from strong recovery efforts on

previously securitized loans resulting in improved yields on this

asset; (5) the Company could have adverse legal actions of a

material nature; (6) the Company may face competitive loss of

customers; (7) the Company may be unable to manage its expense

levels; (8) the Company may have difficulty retaining key

employees; (9) changes in the interest rate environment may have

results on the Company's operations materially different from those

anticipated by the Company's market risk management functions; (10)

changes in general economic conditions and increased competition

could adversely affect the Company's operating results; (11)

changes in other regulations and government policies affecting bank

holding companies and their subsidiaries, including changes in

monetary policies, could negatively impact the Company's operating

results; and (12) the Company may experience difficulties growing

loan and deposit balances. Forward-looking statements made herein

reflect management's expectations as of the date such statements

are made. Such information is provided to assist stockholders and

potential investors in understanding current and anticipated

financial operations of the Company and is included pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. The Company undertakes no obligation to update any

forward-looking statement to reflect events or circumstances that

arise after the date such statements are made. DATASOURCE: City

Holding Company CONTACT: Charles R. Hageboeck, President & CEO

of City Holding Company +1-304-769-1102 Web site:

http://www.cityholding.com/

Copyright

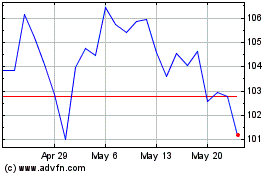

City (NASDAQ:CHCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

City (NASDAQ:CHCO)

Historical Stock Chart

From Jul 2023 to Jul 2024