0000823277false00008232772024-01-102024-01-100000823277chscp:A8PreferredStockMember2024-01-102024-01-100000823277chscp:ClassBSeries1PreferredStockMember2024-01-102024-01-100000823277chscp:ClassBSeries2PreferredStockMember2024-01-102024-01-100000823277chscp:ClassBSeries3PreferredStockMember2024-01-102024-01-100000823277chscp:ClassBSeries4PreferredStockMember2024-01-102024-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 10, 2024

CHS Inc.

(Exact Name of Registrant as Specified in its Charter)

Commission File Number: 001-36079

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Minnesota | | | | | | | | | 41-0251095 |

(State or other jurisdiction of

incorporation or organization) | | | | | | | | | (I.R.S. Employer

Identification Number) |

| | 5500 Cenex Drive | | |

| | | Inver Grove Heights, | Minnesota | 55077 | | |

| | (Address of principal executive offices, including zip code) | | |

| | (651) | | 355-6000 | | | |

| | (Registrant’s telephone number, including area code) | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| 8% Cumulative Redeemable Preferred Stock | CHSCP | The Nasdaq Stock Market LLC |

| Class B Cumulative Redeemable Preferred Stock, Series 1 | CHSCO | The Nasdaq Stock Market LLC |

| Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 2 | CHSCN | The Nasdaq Stock Market LLC |

| Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 3 | CHSCM | The Nasdaq Stock Market LLC |

| Class B Cumulative Redeemable Preferred Stock, Series 4 | CHSCL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 10, 2024, CHS Inc. issued a press release announcing its results of operations for its quarter ended November 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in this Item 2.02, and the exhibits to this report, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Form 8-K shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall otherwise be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release dated January 10, 2024 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | | CHS Inc. |

| | | | | |

| Date: January 10, 2024 | | By: | | /s/ Olivia Nelligan |

| | | | | Olivia Nelligan |

| | | | | Executive Vice President, Chief Financial Officer and Chief Strategy Officer |

For further information

Contact: Krysta Larson

(651) 355-4587

Krysta.Larson@chsinc.com

CHS Reports First Quarter Fiscal Year 2024 Earnings

Strong Energy and Oilseed Processing Operations Contributed to $522.9 Million in First Quarter Net Income

ST. PAUL, MINN. (Jan. 10, 2024) - CHS Inc., the nation’s leading agribusiness cooperative, today released results for its first quarter ended Nov. 30, 2023. The company reported quarterly net income of $522.9 million compared to $782.6 million in the first quarter of fiscal year 2023.

First quarter fiscal year 2024 highlights:

•Earnings were strong across our segments, although down from record first quarter earnings in fiscal year 2023.

•Revenues were $11.4 billion, compared to $12.8 billion in the first quarter of fiscal year 2023.

•Our Energy segment experienced favorable market conditions in our refined fuels business, reflecting sustained global demand for energy products.

•In our Ag segment, continued robust meal and oil demand drove strong earnings in our oilseed processing business that were offset by weak U.S. export demand for grains and oilseeds.

•Equity method investments performed well, with our CF Nitrogen investment being the largest contributor.

“CHS earnings were strong for the first quarter, despite a relative decline from last year's record earnings,” said Jay Debertin, president and CEO of CHS Inc. “Our focus on execution and efficiency improvements bolstered results across all operations. We continue to see the benefits of our diversified ag and energy portfolio, our strategic footprint and investments in our supply chain. The success of our domestic soybean and canola processing business and our international origination capabilities have helped us add value to our farmer-owners' businesses."

Energy

Pretax earnings of $266.8 million represent a $129.8 million decrease versus the prior year period and reflect:

•Decreased refining margins compared to the highs in the previous year due to trade flows returning to more normal levels

•More favorable costs for renewable energy credits

•Higher margins in our propane business

Ag

Pretax earnings of $169.7 million represent a $117.6 million decrease versus the prior year period and reflect:

•Decreased margins for our grain and oilseed and oilseed processing businesses primarily due to mark-to-market timing adjustments and weak U.S. export demand

•Increased demand for wholesale and retail agronomy products as selling prices remained lower due to global market conditions

Nitrogen Production

Pretax earnings of $36.5 million represent a $60.4 million decrease versus the prior year period and reflect lower equity income from CF Nitrogen attributed to decreased market prices of urea and UAN.

Corporate and Other

Pretax earnings of $43.8 million represent a $7.1 million increase versus the prior year period, primarily reflecting increased interest income due to higher interest rates.

| | | | | | | | | | | | | | | |

| CHS Inc. Earnings* |

| by Segment |

| (in thousands $) |

| | | | | | | |

| Three Months Ended November 30, | | |

| 2023 | | 2022 | | | | |

| Energy | $ | 266,835 | | | $ | 396,594 | | | | | |

| Ag | 169,720 | | | 287,299 | | | | | |

| Nitrogen Production | 36,459 | | | 96,873 | | | | | |

| Corporate and Other | 43,832 | | | 36,704 | | | | | |

| Income before income taxes | 516,846 | | | 817,470 | | | | | |

| Income tax (benefit) expense | (6,522) | | | 34,554 | | | | | |

| Net income | 523,368 | | | 782,916 | | | | | |

| Net income attributable to noncontrolling interests | 445 | | | 318 | | | | | |

| Net income attributable to CHS Inc. | $ | 522,923 | | | $ | 782,598 | | | | | |

| | | | | | | |

| *Earnings is defined as income (loss) before income taxes. | | | | | | | |

CHS Inc. (www.chsinc.com) creates connections to empower agriculture. As a leading global agribusiness and the largest farmer-owned cooperative in the United States, CHS serves customers in 65 countries and employs nearly 10,000 people worldwide. We provide critical crop inputs, market access and risk management services that help farmers feed the world. Our diversified agronomy, grains, foods and energy businesses recorded revenues of $45.6 billion in fiscal year 2023. We advance sustainability through our commitment to being stewards of the environment, building economic viability and strengthening community and employee well-being.

This document and other CHS Inc. publicly available documents contain, and CHS officers, directors and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS current beliefs, expectations and assumptions regarding the future of its businesses, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of CHS control. CHS actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause CHS actual results and financial condition to differ materially from those indicated in the forward-looking statements are discussed or identified in CHS filings made with the U.S. Securities and Exchange Commission, including in the "Risk Factors" discussion in Item 1A of CHS Annual Report on Form 10-K for the fiscal year ended August 31, 2023. These factors may include: changes in commodity prices; the impact of government policies, mandates, regulations and trade agreements; global and regional political, economic, legal and other risks of doing business globally; the ongoing war between Russia and Ukraine; the escalation of conflict in the Middle East; the impact of inflation; the impact of epidemics, pandemics, outbreaks of disease and other adverse public health developments, including COVID-19; the impact of market acceptance of alternatives to refined petroleum products; consolidation among our suppliers and customers; nonperformance by contractual counterparties; changes in federal income tax laws or our tax status; the impact of compliance or noncompliance with applicable laws and regulations; the impact of any governmental investigations; the impact of environmental liabilities and litigation; actual or perceived quality, safety or health risks associated with our products; the impact of seasonality; the effectiveness of our risk management strategies; business interruptions, casualty losses and supply chain issues; the impact of workforce factors; our funding needs and financing sources; financial

institutions’ and other capital sources’ policies concerning energy-related businesses; technological improvements that decrease the demand for our agronomy and energy products; our ability to complete, integrate and benefit from acquisitions, strategic alliances, joint ventures, divestitures and other nonordinary course-of-business events; security breaches or other disruptions to our information technology systems or assets; the impact of our environmental, social and governance practices, including failures or delays in achieving our strategies or expectations related to climate change or other environmental matters; the impairment of long-lived assets; the impact of bank failures; and other factors affecting our businesses generally. Any forward-looking statements made by CHS in this document are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise except as required by applicable law.

v3.23.4

Cover Page

|

Jan. 10, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 10, 2024

|

| Entity Registrant Name |

CHS Inc.

|

| Entity File Number |

001-36079

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity Tax Identification Number |

41-0251095

|

| Entity Address, Address Line One |

5500 Cenex Drive

|

| Entity Address, City or Town |

Inver Grove Heights,

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55077

|

| City Area Code |

(651)

|

| Local Phone Number |

355-6000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000823277

|

| Amendment Flag |

false

|

| 8% Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

8% Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

CHSCP

|

| Security Exchange Name |

NASDAQ

|

| Class B, Series 1 Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Cumulative Redeemable Preferred Stock, Series 1

|

| Trading Symbol |

CHSCO

|

| Security Exchange Name |

NASDAQ

|

| Class B, Series 2 Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 2

|

| Trading Symbol |

CHSCN

|

| Security Exchange Name |

NASDAQ

|

| Class B, Series 3 Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 3

|

| Trading Symbol |

CHSCM

|

| Security Exchange Name |

NASDAQ

|

| Class B, Series 4 Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Cumulative Redeemable Preferred Stock, Series 4

|

| Trading Symbol |

CHSCL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chscp_A8PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chscp_ClassBSeries1PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chscp_ClassBSeries2PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chscp_ClassBSeries3PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chscp_ClassBSeries4PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

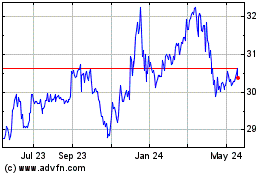

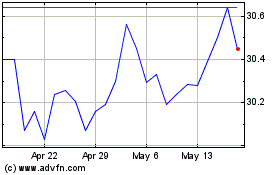

CHS (NASDAQ:CHSCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CHS (NASDAQ:CHSCP)

Historical Stock Chart

From Apr 2023 to Apr 2024