First 'Speed Bump' Coming to U.S. Futures Markets

15 May 2019 - 11:23PM

Dow Jones News

By Alexander Osipovich

A futures exchange is set to blunt the advantages of ultrafast

traders by imposing a split-second delay on some trades.

Intercontinental Exchange Inc., known as ICE, can launch the

first "speed bump" in U.S. futures markets after the Commodity

Futures Trading Commission didn't block the proposal.

Some of the world's largest high-frequency trading firms had

opposed the plan, under which ICE would introduce a

three-millisecond pause before it executes certain trades in its

Gold Daily and Silver Daily futures contracts.

Trading volumes in the two contracts are tiny, with most

activity in gold and silver futures taking place at rival exchange

CME Group Inc. But traders had been closely watching the CFTC's

decision because of the precedent it could set.

Under CFTC rules, the agency had the ability to block the

proposal within a 90-day period that ended Tuesday. It had taken no

action by midnight, meaning ICE is free to introduce its speed

bump. A CFTC spokeswoman declined to comment.

"We are very pleased with the CFTC's decision to allow our rule

amendment for passive order protection -- or what is commonly

referred to as a speed bump -- in futures markets to become

effective," an ICE spokesman said.

Trading giants such as Citadel Securities LLC and DRW Holdings

LLC had attacked ICE's plan, saying it would harm markets and

discriminate in favor of some market players over others. But a few

smaller electronic trading firms welcomed the proposed speed bump,

saying it would allow greater competition in the high-speed trading

business.

Currently, high-frequency traders must keep investing in costly

technology to shave millionths or billionths of a second off the

time it takes to execute trades, or else risk falling behind their

rivals. The biggest trading firms have spent years building

ultrafast systems, such as microwave networks and direct

connections to exchanges' data centers. That gives them an edge

over newcomers without such infrastructure.

ICE's speed bump would give slower-trading firms a buffer

against quicker rivals. The planned delay would apply only to

incoming orders seeking to hit unexecuted buy or sell orders

already posted on ICE. Traders posting new orders to be displayed

on the exchange wouldn't be affected.

Such a design would give a trading firm posting a price quote a

brief window to cancel or adjust its quote if market conditions

shifted and its price went out of date. Right now, such quotes can

be "picked off" by speedy traders, who zip in with lightning-fast

technology and execute against the stale quotes before slower

players can react.

ICE's speed bump would be different from the "symmetric" speed

bumps that have cropped up on some U.S. stock exchanges in recent

years. IEX Group Inc., the upstart exchange featured in Michael

Lewis's book "Flash Boys," applies a brief delay to all orders.

Opponents of ICE's plan said it was effectively a form of "last

look" -- a controversial practice from the foreign-exchange markets

in which banks could pull out of trades at the last moment if

prices moved against them. ICE has rejected the comparison.

Some critics warned that if asymmetric speed bumps spread to

other, more significant futures markets, it could exacerbate

volatility during periods of market turmoil.

During episodes of volatility, there would be "essentially fake

liquidity on the screen," DRW founder and Chief Executive Donald

Wilson Jr. said at a futures-industry conference in March. "I think

that's a very dangerous thing."

--Gabriel T. Rubin contributed to this article.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

May 15, 2019 09:08 ET (13:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

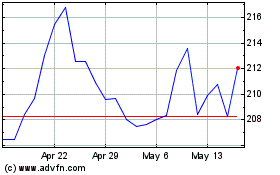

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

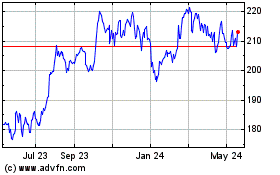

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024