false000117320400011732042024-11-222024-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

(Date of earliest event reported): November 22, 2024

Cineverse Corp.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-31810 |

22-3720962 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

224 W. 35th Street, Suite 500, #947, New York, NY |

10001 |

(Address of principal executive offices) |

(Zip Code) |

212-206-8600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transmission period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Class A Common Stock, Par Value |

CNVS |

The Nasdaq Capital Market |

As previously disclosed, on June 16, 2023, Cineverse Corp. (the “Company”) sold certain securities, including warrants (the “Common Warrants”) to purchase up to 2,666,667 shares of its Class A common stock, par value $0.001 per share (the “Common Stock”), in an offering registered on a registration statement that has since expired. All of the 2,666,667 Common Warrants remain outstanding. The sale of the shares of Common Stock issuable upon exercise of the Common Warrants is being registered pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-273098) by filing a prospectus supplement dated November 22, 2024, to replace the expired registration statement. The Company is filing the prospectus supplement to register the issuance of the Warrant Shares in accordance with the terms of the Securities Purchase Agreement pursuant to which the Common Warrants were sold and because the current trading price of the Common Stock is in excess of the exercise price of the Common Warrants.

This is not a new offering by the Company and the shares will only be issued pursuant to the prospectus supplement if and when a warrant holder exercises Common Warrants and makes cash payment to the Company of the exercise price of $3.00 per share. On November 21, 2024, the last reported sale price of the Common Stock on Nasdaq was $3.71 per share.

Subject to certain beneficial ownership limitations, the Common Warrants are exercisable immediately from the date of issuance. The Common Warrants have an exercise price of $3.00 per share and expire on the five (5) year anniversary of the date of issuance. The exercise price of the Warrants is subject to certain adjustments, including stock dividends, stock splits, combinations and reclassifications of the Company’s common stock.

The opinion of Kelley Drye & Warren LLP regarding the validity of the shares of Common Stock issuable upon exercise of the Common Warrants is attached hereto as Exhibit 5.1.

The foregoing description of the Common Warrants does not purport to be complete and is qualified in its entirety by reference to, and incorporates herein by reference, the full text thereof, a copy of which is filed herewith as Exhibit 4.1.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

Exhibit No. Description

SIGNATURE

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

Dated: November 22, 2024 |

|

By: |

/s/ Gary S. Loffredo |

|

|

Name: |

Gary S. Loffredo |

|

|

Title: |

Chief Legal Officer, Secretary and Senior Advisor |

|

|

|

|

Exhibit 5.1

Kelley Drye & Warren LLP

3 World Trade Center

175 Greenwich street

New York, NY 10007

Tel: (212) 808-7800

Fax: (212) 808-7897

November 22, 2024

The Board of Directors of

Cineverse Corp.

224 W. 35th St., Suite 500, #947

New York, NY 10001

Ladies and Gentlemen:

We have acted as special counsel to Cineverse Corp., a Delaware corporation (the "Company"), in connection with the offering by the Company of 2,666,667 shares (the “Warrant Shares”) of Class A Common Stock, par value $0.001 per share (the “Common Stock”) issuable upon the exercise of outstanding warrants (the “Warrants”), pursuant to a Registration Statement on Form S-3 (Registration No. 333-273098) (the "Registration Statement") filed with the Securities and Exchange Commission ( the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Act”), and declared effective on January 25, 2024, as supplemented by the prospectus supplement relating to the Warrant Shares filed or to be filed with the Commission pursuant to Rule 424(b) promulgated under the Act (the “Prospectus Supplement”). As such counsel, you have requested our opinion as to the matters described herein relating to the issuance of the Warrant Shares.

We have examined the Fifth Amended and Restated Certificate of Incorporation and the Second Amended and Restated By-Laws of the Company, each as amended and restated through the date hereof; records of corporate proceedings of the Company, as made available to us by officers of the Company; an executed copy of the Registration Statement and all exhibits thereto, in the form filed with the Commission; the Prospectus Supplement as filed or to be filed with the Commission; and such matters of law deemed necessary by us in order to deliver this opinion. We have assumed, without independently verifying or having any duty to verify, that all documents mentioned herein have been duly authorized, executed and delivered by all parties thereto (other than the Company) and are enforceable, and that there was no misrepresentation, omission or deceit by any person in connection with the execution, delivery or performance of any of the documents referred to herein. In the course of our examination, we have assumed the genuineness of all signatures, including signatures made and/or transmitted using electronic signature technology (e.g., via DocuSign or similar electronic signature technology), that any such signed electronic record shall be valid and as effective to bind the party so signing as a paper copy bearing such party’s handwritten signature (provided that no such assumption is made to the extent governed by the laws of the State of New York), the authority of all signatories to sign on behalf of their principals, if any, the authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted to us as copies and the authenticity of the originals of such copies, and the legal capacity of all natural persons. As to certain factual matters, we have relied upon information furnished to us by officers of the Company.

Our opinion expressed below is subject to the qualification that we express no opinion as to any law other than the General Corporation Law of the State of Delaware and the federal laws of the United States of America. Without limiting the foregoing, we express no opinion with respect to the applicability thereto or effect of municipal laws or the rules, regulations or orders of any municipal agencies within any such state. In addition, we express no opinion with respect to the enforceability of any agreement or instrument or any provision thereof (i) to the extent such enforceability may be subject to, or affected by, applicable bankruptcy, insolvency, moratorium or similar state or federal laws affecting the rights and remedies of creditors generally (including, without limitation, fraudulent conveyance laws) or general principles of equity (regardless of whether enforceability is considered in a proceeding at law or in equity), (ii) providing for specific performance, injunctive relief or other equitable remedies

(regardless of whether such enforceability is sought in a proceeding in equity or at law), (iii) providing for indemnification or contribution, which provisions may be limited by federal and state securities laws or policies underlying such laws, (iv) requiring any waiver of stay or extension laws, diligent performance or other acts which may be unenforceable under principles of public policy or (v) providing for a choice of law, jurisdiction or venue. We have assumed that such agreements, instruments or provisions are enforceable.

Based on the foregoing and solely in reliance thereon, it is our opinion that the Warrant Shares are duly authorized and, when the Warrant Shares are issued, paid for and delivered in accordance with the applicable Warrant, the Warrant Shares will be validly issued, fully paid and non-assessable.

We hereby consent to the filing of this letter as an exhibit to the Registration Statement and to the reference to it in the prospectus included therein under the caption "Legal Matters." In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Act.

This opinion is furnished to you in connection with the filing of the Registration Statement or a prospectus supplement thereto and is not to be used, circulated, quoted or otherwise relied upon for any other purpose except that purchasers of the securities offered pursuant to the Registration Statement may rely on this opinion to the same extent as if it were addressed to them. We have no obligation to update this opinion for events or changes in law or fact occurring after the date hereof.

Very truly yours,

/s/ KELLEY DRYE & WARREN LLP

v3.24.3

Document and Entity Information

|

Nov. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 22, 2024

|

| Entity Registrant Name |

Cineverse Corp.

|

| Entity Central Index Key |

0001173204

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-31810

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

22-3720962

|

| Entity Address, Address Line One |

224 W. 35th Street

|

| Entity Address, Address Line Two |

Suite 500, #947

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

206-8600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, Par Value$0.001 Per Share

|

| Trading Symbol |

CNVS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

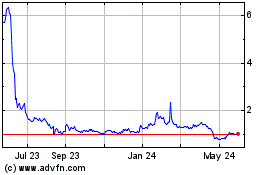

Cineverse (NASDAQ:CNVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

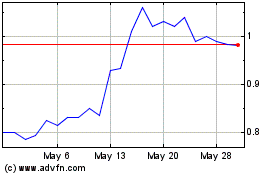

Cineverse (NASDAQ:CNVS)

Historical Stock Chart

From Dec 2023 to Dec 2024