Conn’s, Inc. Announces Receipt of Delinquency Notification Letter from Nasdaq

27 June 2024 - 6:15AM

Conn’s, Inc. (NASDAQ: CONN) (“Conn’s” or the “Company”), a

specialty retailer of home goods, including furniture and

mattresses, appliances, and consumer electronics, today announced

that on June 20, 2024, it received a delinquency notification

letter (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”),

indicating that the Company was not in compliance with Nasdaq

Listing Rule 5250(c)(1) (the "Rule") because of the Company’s delay

in filing its Quarterly Report on Form 10-Q for the fiscal quarter

ended April 30, 2024 (the “Form 10-Q”) by the applicable due date

required by the U.S. Securities and Exchange Commission (the

"SEC"). The Notice has no immediate effect on the listing or

trading of the Company's common stock on The Nasdaq Global Select

Market.

The Notice states that the Company has 60 days, or until August

19, 2024, to submit to Nasdaq a plan to regain compliance with

the Rule. If Nasdaq accepts the Company's plan to regain

compliance, then Nasdaq may grant the Company up to 180 calendar

days from the prescribed due date of the Form 10-Q, or

until December 16, 2024, to file the Form 10-Q to regain

compliance; however, there can be no assurance that these events

will occur.

About Conn’s, Inc.

Conn's, Inc. (NASDAQ: CONN) is a specialty

retailer of home goods, including furniture and mattresses,

appliances and consumer electronics. With over 550 stores across 15

states and online at Conns.com and Badcock.com, our approximately

4,000 employees strive to help all customers create a home they

love through access to high-quality products, next-day delivery and

personalized payment options, including our flexible, in-house

credit program. Additional information can be found by visiting our

investor relations website at ir.conns.com and social channels

(@connshomeplus/@badcockfurniture on Twitter, Instagram, Facebook,

Pinterest, YouTube, and LinkedIn).

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the federal securities laws,

including, but not limited to, the Private Securities Litigation

Reform Act of 1995, that involve risks and uncertainties. Such

forward-looking statements include statements regarding benefits of

the proposed transaction, integration plans and expected synergies,

anticipated future financial and operating performance and results,

including estimates for growth, business strategy, plans, goals,

and objectives. Statements containing the words “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “should,” “predict,” “will,” “potential,” or the

negative of such terms or other similar expressions are generally

forward-looking in nature and not historical facts. Such

forward-looking statements are based on our current expectations.

We can give no assurance that such statements will prove to be

correct, and actual results may differ materially. A wide variety

of potential risks, uncertainties, and other factors could

materially affect our ability to achieve the results either

expressed or implied by our forward-looking statements, including,

but not limited to: our ability to integrate the W.S. Badcock

business, the possibility that our shareholders may not approve the

issuance of non-voting common stock required for conversion of the

preferred stock issued in connection with the transaction, the risk

that any announcement relating to the transaction could have

adverse effects on the market price of Conn’s common stock, the

risk that the transaction and its announcement could have an

adverse effect on our ability to retain customers and retain and

hire key personnel and maintain relationships with suppliers and

customers, our ability to achieve synergies, our inability to

operate the combined company as effectively and efficiently as

expected, our inability to achieve the intended benefits of the

transaction for any other reason, general economic conditions

impacting our customers or potential customers; our ability to

execute periodic securitizations of future originated customer

loans on favorable terms; our ability to continue existing customer

financing programs or to offer new customer financing programs;

changes in the delinquency status of our credit portfolio;

unfavorable developments in ongoing litigation; increased

regulatory oversight; higher than anticipated net charge-offs in

the credit portfolio; the success of our planned opening of new

stores; expansion of our eCommerce business; technological and

market developments and sales trends for our major product

offerings; our ability to manage effectively the selection of our

major product offerings; our ability to protect against

cyber-attacks or data security breaches and to protect the

integrity and security of individually identifiable data of our

customers and employees; our ability to fund our operations,

capital expenditures, debt repayment and expansion from cash flows

from operations, borrowings from our Revolving Credit Facility and

term loans; proceeds from accessing debt or equity markets; the

effects of epidemics or pandemics; our ability to timely file our

Exchange Act reports; maintain our listing on Nasdaq; and other

risks detailed in Part I, Item 1A, Risk Factors, in our Annual

Report on Form 10-K and other reports filed with the Securities and

Exchange Commission. If one or more of these or other risks or

uncertainties materialize (or the consequences of such a

development changes), or should our underlying assumptions prove

incorrect, actual outcomes may vary materially from those reflected

in our forward-looking statements. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. We disclaim any

intention or obligation to update publicly or revise such

statements, whether as a result of new information, future events

or otherwise, or to provide periodic updates or guidance. All

forward-looking statements attributable to us, or to persons acting

on our behalf, are expressly qualified in their entirety by these

cautionary statements.

CONN-G

S.M. Berger & Company

Andrew Berger (216) 464-6400

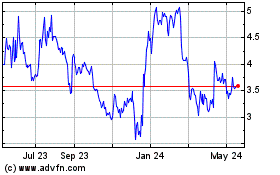

Conns (NASDAQ:CONN)

Historical Stock Chart

From Dec 2024 to Jan 2025

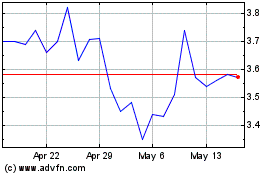

Conns (NASDAQ:CONN)

Historical Stock Chart

From Jan 2024 to Jan 2025