Capital Southwest Corporation (“Capital Southwest,” “CSWC” or the

“Company”) (Nasdaq: CSWC), an internally managed business

development company focused on providing flexible financing

solutions to support the acquisition and growth of middle market

businesses, today announced its financial results for the second

fiscal quarter ended September 30, 2022.

Second Quarter Fiscal Year 2023 Financial

Highlights

- Total Investment Portfolio: $1.1

billion

- Credit Portfolio of $903.5 million:

- 94% 1st Lien Senior Secured Debt

- $84.9 million in new committed credit

investments

- Weighted Average Yield on Debt

Investments: 10.6%

- Current non-accruals with a fair value

of $9.4 million, representing 0.9% of the total investment

portfolio

- Equity Portfolio of $102.6 million,

excluding investment in I-45 Senior Loan Fund ("I-45 SLF")

- $0.8 million in new equity

co-investments

- CSWC Investment in I-45 SLF of $50.9

million at fair value

- I-45 SLF portfolio of $168.6 million

- Portfolio consists of 40 issuers: 95%

1st Lien Debt

- $110.0 million of debt outstanding at

I-45 SLF as of September 30, 2022

- I-45 SLF fund leverage of 1.73x debt to

equity at fair value at quarter end

- I-45 SLF paid a $2.0 million quarterly

dividend to CSWC; an annualized yield of 15.7%

- Pre-Tax Net Investment Income: $15.0

million, or $0.54 per weighted average share outstanding

- Dividends: Paid $0.50 per share Regular

Dividend

- 106% LTM Pre-Tax NII Regular Dividend

Coverage

- Undistributed Taxable Income at quarter

end estimated at $0.33 per share

- Net Realized and Unrealized

Depreciation on Investments: $5.0 million

- $4.2 million of net appreciation

related to the equity portfolio

- $8.4 million of net depreciation

related to the credit portfolio

- $0.8 million of net depreciation

related to I-45 SLF

- Balance Sheet:

- Cash and Cash Equivalents: $30.2

million

- Total Net Assets: $475.7 million

- Net Asset Value (“NAV”) per Share:

$16.53

In commenting on the Company’s results, Bowen

Diehl, President and Chief Executive Officer, stated, “Our

portfolio continued to perform well this quarter, producing $0.54

of Pre-Tax Net Investment Income. Deal activity remained strong, as

we closed new commitments of approximately $86 million during the

quarter. On the capitalization front, we continued to

programmatically raise equity through our equity ATM program,

raising $26.9 million in gross proceeds at 118% of the prevailing

NAV per share during the quarter. Over the past nine months, we

have raised over $97 million in equity capital and reduced our

regulatory leverage from 1.23x to 1.11x as of the current quarter

end. Finally, in consideration of the performance of our portfolio,

improvements in our operating leverage, and rising market interest

rates, the Board of Directors has declared an increase in our

regular quarterly dividend to $0.52 per share. Based on the

strength of our balance sheet, liquidity position, leverage

profile, and the current interest rate environment, we feel

confident in our ability to continue to grow Pre-Tax Net Investment

Income. In addition, given the excess earnings being generated by

the Federal Reserve's aggressive interest rate increases and the

resulting excess earnings being generated by our floating rate debt

portfolio, our Board of Directors has also declared a supplemental

dividend of $0.05 per share for the December quarter. While future

dividend declarations are at the discretion of our Board of

Directors, it is our intent to distribute supplemental dividends

for the foreseeable future while base rates remain materially above

long-term historical averages. Future supplemental dividends will

also continue to be supported by realizations in our equity

co-investment portfolio.”

Second Quarter Fiscal Year Investment

Activities

Originations

During the quarter ended September 30, 2022, the

Company originated $85.7 million in new commitments, consisting of

investments in five new portfolio companies totaling $66.6 million

and add-on commitments in five portfolio companies totaling $19.1

million. New portfolio company investment transactions that closed

during the quarter ended September 30, 2022 are summarized as

follows:

VersiCare Management, LLC, $13.5 million

1st Lien Senior Secured Debt,

$5.0 million Delayed Draw Term Loan, $2.5 million Revolving

Loan: VersiCare Management provides home and

community-based health, human services, and therapy services to

individuals with intellectual, developmental, physical and

behavioral disabilities and other special needs.

Pipeline Technique Ltd., $10.0 million

1st Lien Senior Secured Debt,

$3.3 million Revolving Loan: Pipeline Technique Ltd. is a

specialized welding and related energy infrastructure services

company that offers services including welding, field joint

coating, testing and fabrication services, and design of end-to-end

solutions.

Spectrum of Hope, LLC (dba Kids SPOT),

$13.1 million 1st Lien Senior

Secured Debt: Kids SPOT is a Florida and Texas-based roll

up-strategy within the behavioral healthcare space, specifically

focused on providing its patients with Applied Behavior Analysis

and speech, physical and occupational therapy.

Opco Borrower, LLC (dba Giving Home

Health Care), $9.2 million 1st

Lien Senior Secured Debt, $3.0 million

2nd Lien Loan with Attached

Warrants, $0.8 million Revolving Loan: Giving Home Health

Care provides skilled and unskilled home health services to

beneficiaries of the Energy Employees Occupational Illness

Compensation Program Act.

Gulf Pacific Acquisition, LLC, $3.7

million 1st Lien Senior Secured

Debt, $1.0 million Revolving Loan, $1.5 million Delayed Draw Term

Loan: Gulf Pacific is a leading producer of healthy and

organic rice varietals, rice flour ingredients, beans and spice

blends.

Prepayments and Exits

During the quarter ended September 30, 2022, the

Company received full prepayments on two debt investments totaling

$13.9 million and proceeds from the sale of one debt investment

totaling $0.7 million.

Binswanger Holding Corp.:

Proceeds of $9.9 million, generating an IRR of 11.4%.

Fast Sandwich, LLC: Proceeds of

$3.3 million, generating an IRR of 19.4%.

Dunn Paper, Inc.: Proceeds of

$0.7 million, generating an IRR of (5.8)%.

Second Fiscal Quarter 2023 Operating

Results

For the quarter ended September 30, 2022,

Capital Southwest reported total investment income of $26.8

million, compared to $22.5 million in the prior quarter. The

increase in investment income was primarily attributable to an

increase in average debt investments outstanding, an increase in

the weighted average yield on investments and an increase in

dividend income received from I-45 SLF.

For the quarter ended September 30, 2022, total

operating expenses (excluding interest expense) were $5.2 million,

compared to $4.4 million in the prior quarter. The increase in

expenses was primarily attributable to an increase in accrued bonus

compensation in the current quarter.

For the quarter ended September 30, 2022,

interest expense was $6.6 million as compared to $5.5 million in

the prior quarter. The increase was primarily attributable to an

increase in average debt outstanding and an increase in the

weighted average interest rate on debt.

For the quarter ended September 30, 2022, total

pre-tax net investment income was $15.0 million, compared to $12.6

million in the prior quarter.

During the quarter ended September 30, 2022,

Capital Southwest recorded total net realized and unrealized losses

on investments of $5.0 million, compared to $9.9 million in the

prior quarter. For the quarter ended September 30, 2022, this

included net realized and unrealized gains on equity investments of

$4.2 million, net realized and unrealized losses on debt

investments of $8.4 million and net unrealized losses on I-45 SLF

of $0.8 million. The net increase in net assets resulting from

operations was $9.5 million for the quarter, compared to $2.5

million in the prior quarter.

The Company’s NAV at September 30, 2022 was

$16.53 per share, as compared to $16.54 at June 30, 2022. The

decrease in NAV per share from the prior quarter is primarily due

to net realized losses on investments, partially offset by net

unrealized gains on investments and the issuance of common stock at

a premium to NAV per share under the Equity ATM Program (as

described below).

Liquidity and Capital

Resources

At September 30, 2022, Capital Southwest had

approximately $30.2 million in unrestricted cash and money market

balances, $240.0 million of total debt outstanding on the Credit

Facility (as defined below), $138.9 million, net of unamortized

debt issuance costs, of the 4.50% Notes due January 2026

outstanding, $146.9 million, net of unamortized debt issuance

costs, of the 3.375% Notes due October 2026 and $77.6 million, net

of unamortized debt issuance costs, of SBA Debentures (as defined

below) outstanding. As of September 30, 2022, Capital Southwest had

$139.4 million in available borrowings under the Credit Facility.

The regulatory debt to equity ratio at the end of the quarter was

1.11 to 1.

The Company has an "at-the-market" offering (the

"Equity ATM Program"), pursuant to which the Company may offer and

sell, from time to time through sales agents, shares of its common

stock having an aggregate offering price of up to $100,000,000. On

May 26, 2021, the Company (i) increased the maximum amount of

shares of its common stock to be sold through the Equity ATM

Program to $250,000,000 from $100,000,000 and (ii) reduced the

commission paid to the sales agents for the Equity ATM Program to

1.5% from 2.0% of the gross sales price of shares of the Company's

common stock sold through the sales agents pursuant to the Equity

ATM Program on and after May 26, 2021. On August 2, 2022, the

Company increased the maximum amount of shares of its common stock

to be sold through the Equity ATM Program to $650,000,000 from

$250,000,000.

During the quarter ended September 30, 2022, the

Company sold 1,381,716 shares of its common stock under the Equity

ATM Program at a weighted-average price of $19.48 per share,

raising $26.9 million of gross proceeds. Net proceeds were

$26.5 million after commissions to the sales agents on shares

sold. Cumulative to date, the Company has sold 11,822,228 shares of

its common stock under the Equity ATM Program at a weighted-average

price of $21.75, raising $257.1 million of gross proceeds. Net

proceeds were $252.9 million after commissions to the sales

agents on shares sold. As of September 30, 2022, the Company has

$392.9 million available under the Equity ATM Program.

In August 2016, CSWC entered into a senior

secured credit facility (as amended, restated, supplemented or

otherwise modified from time to time, the “Credit Facility”) to

provide additional liquidity to support its investment and

operational activities. The Credit Facility contains an accordion

feature that allows CSWC to increase the total commitments under

the Credit Facility up to $400 million from new and existing

lenders on the same terms and conditions as the existing

commitments. On August 9, 2021, CSWC entered into the Second

Amended and Restated Senior Secured Revolving Credit Agreement (the

"Credit Agreement"). Prior to the Credit Agreement, (1) borrowings

under the Credit Facility accrued interest on a per annum basis at

a rate equal to the applicable LIBOR rate plus 2.50% with no LIBOR

floor, and (2) the total borrowing capacity was $340 million with

commitments from a diversified group of eleven lenders. The Credit

Agreement (1) decreased the total borrowing capacity under the

Credit Facility to $335 million with commitments from a diversified

group of ten lenders, (2) reduced the interest rate on borrowings

to LIBOR plus 2.15% with no LIBOR floor and removed conditions

related thereto as previously set forth in the Amended and Restated

Senior Secured Revolving Credit Agreement, and (3) extended the end

of the Credit Facility's revolver period from December 21, 2022 to

August 9, 2025 and extended the final maturity from December 21,

2023 to August 9, 2026. The Credit Agreement also modified certain

covenants in the Credit Facility, including, among other things, to

increase the minimum obligors’ net worth test from $180 million to

$200 million. CSWC pays unused commitment fees of 0.50% to 1.00%

per annum, based on utilization, on the unused lender commitments

under the Credit Facility.

On May 11, 2022, CSWC entered into Amendment No.

2 (the "Amendment") to the Credit Agreement. The Amendment changed

the benchmark interest rate from LIBOR to Term SOFR. In addition,

on May 11, 2022, CSWC entered into an Incremental Commitment

Agreement, pursuant to which the total commitments under the Credit

Agreement increased from $335 million to $380 million.

On April 20, 2021, our wholly owned subsidiary,

Capital Southwest SBIC I, LP (“SBIC I”), received a license from

the SBA to operate as a Small Business Investment Company ("SBIC")

under Section 301(c) of the Small Business Investment Act of 1958,

as amended. The SBIC license allows SBIC I to obtain leverage by

issuing SBA-guaranteed debentures ("SBA Debentures"), subject to

the issuance of a leverage commitment by the SBA. SBA debentures

are loans issued to an SBIC which have interest payable

semi-annually and a ten-year maturity. The interest rate is fixed

shortly after issuance at a market-driven spread over U.S. Treasury

Notes with ten-year maturities. Current statutes and regulations

permit SBIC I to borrow up to $175 million in SBA Debentures with

at least $87.5 million in regulatory capital, subject to SBA

approval.

In November 2015, I-45 SLF entered into a senior

secured credit facility led by Deutsche Bank. The I-45 credit

facility has total commitments outstanding of $150 million from a

group of four bank lenders, which is scheduled to mature in March

2026. Borrowings under the I-45 credit facility bear interest at a

rate equal to LIBOR plus 2.15%. As of September 30, 2022, I-45 SLF

had $110.0 million in borrowings outstanding under its credit

facility.

Share Repurchase Program

On July 28, 2021, the Company's board of

directors (the "Board") approved a share repurchase program

authorizing the Company to repurchase up to $20 million of its

outstanding shares of common stock in the open market at certain

thresholds below its NAV per share, in accordance with guidelines

specified in Rules 10b5-1(c)(1)(i)(B) and 10b-18 under the

Securities Exchange Act of 1934. On August 31, 2021, the Company

entered into a share repurchase agreement, which became effective

immediately, and the Company will cease purchasing its common stock

under the share repurchase program upon the earlier of, among other

things: (1) the date on which the aggregate purchase price for all

shares equals $20 million including, without limitation, all

applicable fees, costs and expenses; or (2) upon written notice by

the Company to the broker that the share repurchase agreement is

terminated. During the quarter ended September 30, 2022, the

Company did not repurchase any shares of the Company’s common stock

under the share repurchase program.

Regular Dividend of $0.52 Per Share and Supplemental

Dividend of $0.05 Per Share for Quarter Ended December 31,

2022

On September 20, 2022, the Board declared a

quarterly dividend of $0.52 per share for the quarter ended

December 31, 2022. On October 26, 2022, the Board declared a

supplemental dividend of $0.05 per share for the quarter ended

December 31, 2022.

The Company's dividends will be payable as follows:

|

Quarterly Dividend |

|

| |

|

| Amount Per

Share: |

$0.52 |

| Ex-Dividend

Date: |

December 14, 2022 |

| Record

Date: |

December 15, 2022 |

| Payment

Date: |

December 30, 2022 |

| |

|

|

Supplemental Dividend |

|

| |

|

| Amount Per

Share: |

$0.05 |

| Ex-Dividend

Date: |

December 14, 2022 |

| Record

Date: |

December 15, 2022 |

| Payment

Date: |

December 30, 2022 |

When declaring dividends, the Board reviews estimates of taxable

income available for distribution, which may differ from net

investment income under generally accepted accounting principles.

The final determination of taxable income for each year, as well as

the tax attributes for dividends in such year, will be made after

the close of the tax year.

Capital Southwest maintains a dividend

reinvestment plan ("DRIP") that provides for the reinvestment of

dividends on behalf of its registered stockholders who hold their

shares with Capital Southwest’s transfer agent and

registrar, American Stock Transfer and Trust Company.

Under the DRIP, if the Company declares a dividend, registered

stockholders who have opted into the DRIP by the dividend record

date will have their dividend automatically reinvested into

additional shares of Capital Southwest common

stock.

Second Quarter 2023 Earnings Results

Conference Call and Webcast

Capital Southwest has scheduled a conference

call on Tuesday, November 1, 2022, at 11:00 a.m. Eastern Time to

discuss the second quarter 2023 financial results. You may access

the call by using the Investor Relations section of Capital

Southwest's website at www.capitalsouthwest.com, or by using

http://edge.media-server.com/mmc/p/gmxd6ax5.

An audio archive of the conference call will

also be available on the Investor Relations section of Capital

Southwest’s website.

For a more detailed discussion of the financial

and other information included in this press release, please refer

to the Capital Southwest Form 10-Q for the period ended September

30, 2022 to be filed with the Securities and Exchange Commission

and Capital Southwest’s Second Fiscal Quarter 2023 Earnings

Presentation to be posted on the Investor Relations section of

Capital Southwest’s website at www.capitalsouthwest.com.

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.1 billion in investments at fair

value as of September 30, 2022. Capital Southwest is a middle

market lending firm focused on supporting the acquisition and

growth of middle market businesses with $5 million to $35

million investments across the capital structure, including

first lien, second lien and non-control equity co-investments. As a

public company with a permanent capital base, Capital

Southwest has the flexibility to be creative in its financing

solutions and to invest to support the growth of its portfolio

companies over long periods of time.

Forward-Looking Statements

This press release contains historical

information and forward-looking statements with respect to the

business and investments of Capital Southwest, including, but not

limited to, the statements about Capital Southwest's future

performance and financial condition, the timing, form and amount of

any distributions or supplemental dividends in the future, and our

ability to realize gains from our equity investments. Capital

Southwest's board of directors has not yet declared any

supplemental dividends for subsequent quarters and would only do

so, in its sole discretion. No assurance can be provided that any

future supplemental dividends will be declared by Capital

Southwest's board of directors. Forward-looking statements are

statements that are not historical statements and can often be

identified by words such as "will," "believe," "expect" and similar

expressions and variations or negatives of these words. These

statements are based on management's current expectations,

assumptions and beliefs. They are not guarantees of future results

and are subject to numerous risks, uncertainties and assumptions

that could cause actual results to differ materially from those

expressed in any forward-looking statement. These risks include

risks related to: changes in the markets in which Capital Southwest

invests; changes in the financial, capital, and lending markets;

changes in the interest rate environment; regulatory changes; tax

treatment and general economic and business conditions; our ability

to operate our wholly owned subsidiary, SBIC I, as an SBIC; and

uncertainties associated with the impact from the COVID-19

pandemic, including its impact on the global and U.S. capital

markets and the global and U.S. economy, the length and duration of

the COVID-19 outbreak in the United States as well as worldwide and

the magnitude of the economic impact of that outbreak; the effect

of the COVID-19 pandemic on our business prospects and the

operational and financial performance of our portfolio companies,

including our ability and their ability to achieve their respective

objectives, and the effects of the disruptions caused by the

COVID-19 pandemic on our ability to continue to effectively manage

our business.

Readers should not place undue reliance on any

forward-looking statements and are encouraged to review Capital

Southwest's Annual Report on Form 10-K for the year ended March 31,

2022 and subsequent filings, including the "Risk Factors" sections

therein, with the Securities and Exchange Commission for a more

complete discussion of the risks and other factors that could

affect any forward-looking statements. Except as required by the

federal securities laws, Capital Southwest does not undertake any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changing circumstances or any other reason after the date of this

press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer214-884-3829

|

CAPITAL SOUTHWEST CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES |

|

(In thousands, except shares and per share

data) |

| |

|

|

|

| |

September 30, |

|

March 31, |

|

|

|

2022 |

|

|

|

2022 |

|

| |

(Unaudited) |

|

|

| Assets |

|

|

|

| Investments at fair

value: |

|

|

|

|

Non-control/Non-affiliate investments (Cost: $835,452 and $721,392,

respectively) |

$ |

859,250 |

|

|

$ |

747,132 |

|

|

Affiliate investments (Cost: $153,192 and $140,911,

respectively) |

|

146,784 |

|

|

|

131,879 |

|

|

Control investments (Cost: $76,000 and $76,000, respectively) |

|

50,897 |

|

|

|

57,603 |

|

|

Total investments (Cost: $1,064,644 and $938,303,

respectively) |

|

1,056,931 |

|

|

|

936,614 |

|

| Cash and cash equivalents |

|

30,238 |

|

|

|

11,431 |

|

| Receivables: |

|

|

|

|

Dividends and interest |

|

14,686 |

|

|

|

12,106 |

|

|

Escrow |

|

363 |

|

|

|

1,344 |

|

|

Other |

|

893 |

|

|

|

2,238 |

|

|

Income tax receivable |

|

158 |

|

|

|

158 |

|

| Debt issuance costs (net of

accumulated amortization of $5,090 and $4,573, respectively) |

|

4,044 |

|

|

|

4,038 |

|

| Other assets |

|

5,858 |

|

|

|

6,028 |

|

|

Total assets |

$ |

1,113,171 |

|

|

$ |

973,957 |

|

| |

|

|

|

|

Liabilities |

|

|

|

| SBA Debentures (Par value:

$80,000 and $40,000, respectively) |

$ |

77,553 |

|

|

$ |

38,352 |

|

| January 2026 Notes (Par value:

$140,000 and $140,000, respectively) |

|

138,883 |

|

|

|

138,714 |

|

| October 2026 Notes (Par value:

$150,000 and $150,000, respectively) |

|

146,893 |

|

|

|

146,522 |

|

| Credit facility |

|

240,000 |

|

|

|

205,000 |

|

| Other liabilities |

|

22,434 |

|

|

|

14,808 |

|

| Accrued restoration plan

liability |

|

2,628 |

|

|

|

2,707 |

|

| Income tax payable |

|

258 |

|

|

|

1,240 |

|

| Deferred tax liability |

|

8,798 |

|

|

|

5,747 |

|

| Total liabilities |

|

637,447 |

|

|

|

553,090 |

|

| |

|

|

|

| Commitments and

contingencies (Note 10) |

|

|

|

| |

|

|

|

| Net

Assets |

|

|

|

| Common stock, $0.25 par value:

authorized, 40,000,000 shares; issued, 31,121,574 shares at

September 30, 2022 and 27,298,032 shares at March 31, 2022 |

|

7,780 |

|

|

|

6,825 |

|

| Additional paid-in

capital |

|

521,072 |

|

|

|

448,235 |

|

| Total distributable (loss)

earnings |

|

(29,191 |

) |

|

|

(10,256 |

) |

| Treasury stock - at cost,

2,339,512 shares |

|

(23,937 |

) |

|

|

(23,937 |

) |

| Total net assets |

|

475,724 |

|

|

|

420,867 |

|

| Total liabilities and net

assets |

$ |

1,113,171 |

|

|

$ |

973,957 |

|

| Net asset value per share

(28,782,062 shares outstanding at September 30, 2022 and 24,958,520

shares outstanding at March 31, 2022) |

$ |

16.53 |

|

|

$ |

16.86 |

|

|

CAPITAL SOUTHWEST CORPORATION AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

(In thousands, except shares and per share data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Investment

income: |

|

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

$ |

19,632 |

|

|

$ |

14,752 |

|

|

$ |

35,380 |

|

|

$ |

28,068 |

|

|

Affiliate investments |

|

2,487 |

|

|

|

1,348 |

|

|

|

4,999 |

|

|

|

2,658 |

|

| Payment-in-kind interest

income: |

|

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

550 |

|

|

|

466 |

|

|

|

966 |

|

|

|

1,103 |

|

|

Affiliate investments |

|

834 |

|

|

|

413 |

|

|

|

1,105 |

|

|

|

751 |

|

| Dividend income: |

|

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

527 |

|

|

|

510 |

|

|

|

1,077 |

|

|

|

1,570 |

|

|

Affiliate investments |

|

— |

|

|

|

— |

|

|

|

101 |

|

|

|

— |

|

|

Control investments |

|

2,000 |

|

|

|

1,560 |

|

|

|

3,535 |

|

|

|

3,157 |

|

| Fee income: |

|

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

567 |

|

|

|

1,138 |

|

|

|

1,857 |

|

|

|

1,415 |

|

|

Affiliate investments |

|

134 |

|

|

|

105 |

|

|

|

252 |

|

|

|

146 |

|

|

Control investments |

|

50 |

|

|

|

— |

|

|

|

50 |

|

|

|

— |

|

| Other income |

|

18 |

|

|

|

4 |

|

|

|

20 |

|

|

|

7 |

|

|

Total investment income |

|

26,799 |

|

|

|

20,296 |

|

|

|

49,342 |

|

|

|

38,875 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Compensation |

|

2,254 |

|

|

|

2,298 |

|

|

|

3,796 |

|

|

|

3,730 |

|

|

Share-based compensation |

|

1,060 |

|

|

|

923 |

|

|

|

1,881 |

|

|

|

1,999 |

|

|

Interest |

|

6,629 |

|

|

|

5,405 |

|

|

|

12,113 |

|

|

|

10,360 |

|

|

Professional fees |

|

810 |

|

|

|

648 |

|

|

|

1,659 |

|

|

|

1,349 |

|

|

General and administrative |

|

1,068 |

|

|

|

982 |

|

|

|

2,285 |

|

|

|

1,958 |

|

|

Total operating expenses |

|

11,821 |

|

|

|

10,256 |

|

|

|

21,734 |

|

|

|

19,396 |

|

| Income before taxes |

|

14,978 |

|

|

|

10,040 |

|

|

|

27,608 |

|

|

|

19,479 |

|

|

Federal income, excise and other taxes |

|

178 |

|

|

|

15 |

|

|

|

251 |

|

|

|

215 |

|

|

Deferred taxes |

|

356 |

|

|

|

299 |

|

|

|

475 |

|

|

|

495 |

|

| Total income tax provision

(benefit) |

|

534 |

|

|

|

314 |

|

|

|

726 |

|

|

|

710 |

|

| Net investment

income |

$ |

14,444 |

|

|

$ |

9,726 |

|

|

$ |

26,882 |

|

|

$ |

18,769 |

|

| Realized (loss)

gain |

|

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

$ |

(2,396 |

) |

|

$ |

3,496 |

|

|

$ |

153 |

|

|

$ |

2,544 |

|

|

Affiliate investments |

|

(6,318 |

) |

|

|

— |

|

|

|

(6,303 |

) |

|

|

— |

|

|

Income tax benefit (provision) |

|

79 |

|

|

|

— |

|

|

|

(165 |

) |

|

|

— |

|

| Total net realized

(loss) gain on investments, net of tax |

|

(8,635 |

) |

|

|

3,496 |

|

|

|

(6,315 |

) |

|

|

2,544 |

|

| Net unrealized

appreciation (depreciation) on investments |

|

|

|

|

|

|

|

|

Non-control/Non-affiliate investments |

|

2,609 |

|

|

|

2,363 |

|

|

|

(1,942 |

) |

|

|

9,393 |

|

|

Affiliate investments |

|

3,338 |

|

|

|

(393 |

) |

|

|

2,624 |

|

|

|

(851 |

) |

|

Control investments |

|

(804 |

) |

|

|

(1,634 |

) |

|

|

(6,706 |

) |

|

|

(720 |

) |

|

Income tax provision |

|

(1,494 |

) |

|

|

(1,027 |

) |

|

|

(2,575 |

) |

|

|

(1,462 |

) |

| Total net unrealized

appreciation (depreciation) on investments, net of

tax |

|

3,649 |

|

|

|

(691 |

) |

|

|

(8,599 |

) |

|

|

6,360 |

|

| Net realized and

unrealized (losses) gains on investments |

|

(4,986 |

) |

|

|

2,805 |

|

|

|

(14,914 |

) |

|

|

8,904 |

|

| Realized loss on

extinguishment of debt |

|

— |

|

|

|

(17,087 |

) |

|

|

— |

|

|

|

(17,087 |

) |

| Net increase

(decrease) in net assets from operations |

$ |

9,458 |

|

|

$ |

(4,556 |

) |

|

$ |

11,968 |

|

|

$ |

10,586 |

|

| |

|

|

|

|

|

|

|

| Pre-tax net investment

income per share - basic and diluted |

$ |

0.54 |

|

|

$ |

0.45 |

|

|

$ |

1.03 |

|

|

$ |

0.89 |

|

| Net investment income

per share – basic and diluted |

$ |

0.52 |

|

|

$ |

0.43 |

|

|

$ |

1.01 |

|

|

$ |

0.86 |

|

| Net increase

(decrease) in net assets from operations – basic and

diluted |

$ |

0.34 |

|

|

$ |

(0.20 |

) |

|

$ |

0.45 |

|

|

$ |

0.48 |

|

| Weighted average

shares outstanding – basic and diluted |

|

27,987,699 |

|

|

|

22,534,443 |

|

|

|

26,757,376 |

|

|

|

21,871,805 |

|

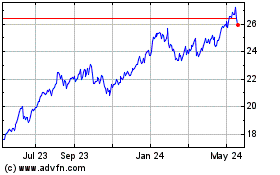

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

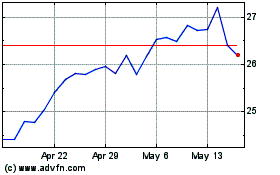

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Jan 2024 to Jan 2025