false

0001318484

0001318484

2024-05-29

2024-05-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): May 29, 2024

Citi Trends, Inc.

(Exact name of

registrant as specified in its charter)

| Delaware |

|

000-41886 |

|

52-2150697 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 104 Coleman Boulevard, Savannah, Georgia |

|

31408 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (912) 236-1561

Former

name or former address, if changed since last report: Not applicable

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

Pre- commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, $0.01 par value |

CTRN |

Nasdaq Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On May 31, 2024, Citi

Trends, Inc. (the “Company”) issued a press release that in part provides preliminary sales results for the first quarter

of fiscal 2024 and financial guidance for fiscal 2024 (the “Press Release”). A copy of the Press Release is attached to this

Current Report on Form 8-K (“Current Report”) as Exhibit 99.1, and the portion of the Press Release regarding the

preliminary financial information and financial guidance is incorporated herein by reference.

The information contained

in this Item 2.02, including the portion of the Press Release regarding the preliminary financial information and financial guidance,

is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall it be deemed incorporated

by reference into any filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as shall be expressly set forth by specific reference in any such filing.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Interim Chief Executive Officer

On May 29, 2024, the

Board of Directors of the Company (the “Board”) appointed Kenneth D. Seipel, a current member of the Board, to the position

of Interim Chief Executive Officer, effective as of June 2, 2024. As a result of his appointment as Interim Chief Executive Officer,

Mr. Seipel will no longer qualify as an “independent director” under the Nasdaq Listing Rules and Rule 10A-3

under the Exchange Act, and will resign from his positions as a member

of the Nominating and Corporate Governance Committee, the Audit Committee and the Finance Committee of the Board, effective June 2,

2024.

Mr. Seipel, age 63, has

served as a director of the Company since 2019. He formerly served as the lead independent director of West Marine Inc., the world’s

largest retailer of boating supplies, since August 2021, after previously serving as the Chief Executive Officer from 2018 to 2021.

Mr. Seipel is currently the Principal of Retail Business Optimization LLC, a consulting firm optimizing retail execution. From March 2013

to March 2017, Mr. Seipel served as Chief Executive Officer of Gabriel Brothers Inc., an off-priced retailer selling designer

brands and fashions for up to 70% off department and specialty store prices. From March 2011 until February 2013, Mr. Seipel

served as President and Chief Operating Officer of Wet Seal Inc. Prior to that, Mr. Seipel served as the President and Chief Merchandise/Marketing

Officer of Pamida Discount Stores LLC, a regional discount chain of department stores with more than 175 locations in the United States,

from 2009 until 2011. Mr. Seipel also served as Executive Vice President of Stores, Operations and Store Design for the Old Navy

division of Gap, Inc., an American clothing brand and chain of more than 1,000 stores in the United States and Canada, from 2003

through 2008. Mr. Seipel also held various merchandising and operations management roles earlier in his career with Target Corporation,

a public retailing company and the second largest discount retailer in the United States, Shopko Stores, Inc., a privately-held chain

of retail stores, and J. C. Penney Company, Inc., a public corporation which operates a chain of mid-range department stores and

catalog sales merchant offices throughout the United States.

Mr. Seipel has no family

relationships with any director or executive officer of the Company. There are no arrangements or understandings between Mr. Seipel

and any other person pursuant to which Mr. Seipel was selected as the Company’s Interim Chief Executive Officer, and there

are no transactions involving Mr. Seipel that would be required to be reported under Item 404(a) of Regulation S-K.

In connection with his appointment

as Interim Chief Executive Officer, Mr. Seipel will receive an annual base salary of $725,000, and will receive a $70,000 starting

bonus. Mr. Seipel will be eligible to receive an annual cash bonus for fiscal year 2024 based upon achievement of certain performance

goals, with a target amount equal to 66% of his annual base salary and an opportunity to earn up to 200% of the target amount to the extent

performance goals are exceeded. In addition, Mr. Seipel will be granted a fully vested stock award having a value of $400,000, with

the number of shares determined based on the stock price on June 2, 2024. Mr. Seipel will be eligible for additional awards

of restricted stock having an aggregate value of $800,000 as of June 2, 2024, to be granted in nine monthly installments beginning

on July 2, 2024, with the number of shares of restricted stock granted in each installment determined by dividing $88,889 by the

stock price on June 2, 2024, with each grant contingent on Mr. Seipel serving as Interim Chief Executive Officer on the grant

date. The restricted stock will vest in three equal installments on June 2, 2025, June 2, 2026 and June 2, 2027, subject

to Mr. Seipel continuing to serve as Chief Executive Officer or as a member of the Board of Directors on the vesting date.

The

Board’s independent members will commence a search for a new permanent Chief Executive Officer and

plan to retain a nationally recognized executive search firm to support the process. The Board will consider external candidates, as well

as Mr. Seipel, in the search.

Departure of Chief Executive Officer

On May 29, 2024, the

Board determined that David N. Makuen would transition from the role of Chief Executive Officer, effective June 1, 2024. Mr. Makuen

has resigned as a member of the Board, effective June 1, 2024, and has withdrawn as a director-nominee for election to

serve on the Board at the Company’s upcoming annual meeting of stockholders to be held on June 20, 2024 (the “2024 Annual

Meeting”).

On May 31, 2024, the

Company and Mr. Makuen entered into a Separation Agreement (the “Separation Agreement”) effective as of June 1,

2024. Pursuant to the Separation Agreement, Mr. Makuen will receive severance payments and benefits as provided in his Severance

Agreement with the Company, dated February 17, 2020. Mr. Makuen will also remain employed with the Company as Senior Advisor

to the CEO until August 3, 2024 to aid in the transition of his role to Mr. Seipel. He will continue to receive his base salary

during this advisory period. The summary of the Separation Agreement above does not purport to be complete and is qualified in its entirety

by reference to such agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated

by reference into this Item 5.02.

Mr. Makuen’s decision

to resign from the Board was not the result of any disagreement with the Company, the Board or management on any matter relating to the

Company’s operations, policies or practices. In connection with Mr. Makuen’s resignation from the Board, the Board reduced

the number of directors that constitutes the full Board from nine to eight directors effective as of June 1, 2024.

Other than Mr. Makuen,

the director-nominees named in the Company’s Definitive Proxy Statement dated May 8, 2024 (the “Proxy Statement”)

will stand for election at the 2024 Annual Meeting. Notwithstanding Mr. Makuen’s resignation and withdrawal as a director-nominee,

the Company’s stockholders eligible to vote at the 2024 Annual Meeting may continue to use the form of proxy card included with

the distribution of the Proxy Statement to vote their shares as to the Board’s remaining nominees and the other matters being voted

on at the 2024 Annual Meeting. Previously voted proxies remain valid, other than with respect to Mr. Makuen; any votes that are submitted

with respect to Mr. Makuen’s election will be disregarded.

Item 7.01 Regulation FD Disclosure.

On May 31, 2024, the

Company announced the leadership transition described above. The portion of the Press Release regarding the leadership transition is incorporated

herein by reference.

The information contained

in this Item 7.01, including the portion of the Press Release regarding the leadership transition, is being furnished and shall not be

deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such section,

nor shall it be deemed incorporated by reference into any filings under the Securities Act, or the Exchange Act, except as shall be expressly

set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CITI TRENDS, INC. |

| |

|

| Date: May 31, 2024 |

By: |

/s/ Heather Plutino |

| |

|

Name: |

Heather Plutino |

| |

|

Title: |

Chief Financial Officer |

Exhibit 10.1

SEPARATION AGREEMENT

THIS SEPARATION AGREEMENT

(this “Agreement”) is entered into as of May 31, 2024 to be effective as of June 1, 2024 (the “Effective

Date”), by and between Citi Trends, Inc. (the “Company”) and David N. Makuen (“Executive”).

Together, the Company and Executive may be referred to hereinafter as the “Parties.”

RECITALS

WHEREAS,

Executive currently serves as Chief Executive Officer of the Company;

WHEREAS,

the Parties have been engaged in negotiations regarding Executive’s separation from service with the Company, and desire to settle

all matters between and among them by entering into this Separation Agreement on the terms and conditions set forth herein

NOW

THEREFORE, in consideration of the payments, covenants and releases described below, and in consideration of other good and

valuable consideration, the receipt and sufficiency of all of which is hereby acknowledged, the Company and Executive hereby agree as

follows:

1. Separation

from Employment. The Company and Executive acknowledge, confirm and agree that Executive’s last day of employment with the Company

shall be August 3, 2024 (the “Termination Date”), unless revised by mutual written agreement. Executive hereby

resigns as Chief Executive Officer of the Company and from the Board of Directors of the Company, effective as of the Effective Date,

and also withdraws himself as a director-nominee for election to serve on the Board of Directors at the Company’s upcoming annual

meeting of stockholders to be held on June 20, 2024. Following the Effective Date, Executive shall remain employed by the Company

through the Termination Date, as described in Section 2 below.

2. Transition

Period and Services. Beginning on the Effective Date and through the Termination Date (the “Transition Period”),

Executive will remain employed by the Company in the role of Special Advisor to the Chief Executive Officer. During the Transition Period,

Executive agrees to provide transition services (the “Transition Services”) to the Company as the Company may reasonably

request, including, but not limited to, assistance in the transitioning of Executive’s responsibilities to the successor Chief Executive

Officer of the Company. During the Transition Period and in consideration of the Transition Services, Executive will (a) remain on

the Company’s payroll and continue to be paid his base salary (at his base salary rate in effect immediately prior to the Transition

Period) in equal bi-weekly payments, (b) be entitled to participate in the Company’s then-current benefit plans and programs

to the extent and on the same basis that Executive participated in such plans and programs prior to the Transition Period, and (c) be

reimbursed for reasonable business expenses, including travel and lodging, properly incurred by Executive in accordance with Company policy

and consistent with standard practices in effect with respect to Executive immediately prior to the Transition Period.

3. Separation

Obligations of the Company. In consideration of Executive’s promises contained in this Agreement, and provided that Executive

has executed the Release Agreement attached hereto as Exhibit A as of the Termination Date (and any revocation period has

elapsed), the Company agrees as follows:

a. Severance.

The Company will pay to Executive an aggregate amount of $725,000, less applicable withholding taxes and other governmental obligations,

paid as salary continuation (and not as a lump sum) beginning August 3, 2024 and continuing for twelve (12) months thereafter, in

accordance with the Company’s standard payroll practices.

b. Supplemental

Payments. The Company will pay to Executive an amount, minus all applicable taxes and withholdings, equal to the full monthly cost

(including any portion of the cost previously paid by the employee) to provide the same level of group health benefits maintained by Executive

as of the Termination Date (currently $1,157.64 per month, to be adjusted up or down for premium changes made by the Company prior to the

Termination Date), beginning on the last day of the month following the Termination Date and continuing for twelve (12) months thereafter.

c. Other

Payments and Obligations. The Company will pay or provide to Executive within five (5) business days following the Termination

Date all of the following: (i) accrued and unpaid base salary with respect to services through the Termination Date, (ii) reimbursement

for expenses for which expense reports have been provided to the Company, (iii) accrued and vested benefits under any Company benefit

plan, in each case in accordance with Company policies and plans, and (iv) reimbursement of Executive’s reasonable attorneys’

fees incurred in connection with the review of this Agreement, provided that Executive presents supporting documentation for those fees,

not to exceed $5,000.

The Company’s obligation

to make the payments set forth herein shall cease upon Executive’s breach of any of his continuing contractual obligations to the

Company, including, without limitation, Sections 3, 4, 5 and 6 of the Employment Agreement (as defined herein) and any other intellectual

property agreement, covenant not to disclose or use the Company’s confidential or trade secret information, or covenant not to compete

with the Company as may be contained in any written agreement entered into between the Company and Executive during the term of his employment

with the Company.

4. Return

of Materials. In further consideration of the promises and payments made by the Company hereunder, Executive agrees that on or before

the Termination Date, he will return all documents, confidential information, other information, materials, equipment (including, but

not limited to, cell phones, pagers, laptops, computers, or other personal computing devices) and other things in his possession or control

provided to him by the Company, created during his employment with the Company or otherwise relating to or belonging to the Company, without

retaining or providing to anyone else copies, summaries, excerpts, portions or other representations thereof. To the extent that Executive

has electronic files or information in his possession or control that relate to or belong to the Company or contain confidential information

belonging to the Company (specifically including but not limited to electronic files or information stored on personal computers, mobile

devices, electronic media, or in cloud storage), Executive agrees that he will immediately, and before receiving payment under this Agreement:

(a) provide the Company with an electronic copy of all of such files or information (in an electronic format that readily accessible

by the Company); (b) after doing so, delete all such files and information, including all copies and derivatives thereof, from all

non-Company-owned computers, mobile devices, electronic media, cloud storage, or other media, devices, or equipment, such that such files

and information are permanently deleted and irretrievable; and (c) provide a written certification to the Company that the required

deletions have been completed and specifying the files and information deleted and the media source from which they were deleted.

5. Termination

of Employment Agreements; Survival of Restrictive Covenants. Executive acknowledges and agrees that the Employment Non-Compete, Non-Solicit

and Confidentiality Agreement originally executed by the Parties on February 17, 2020 (the “Employment Agreement”)

and the Severance Agreement originally executed by the Parties on February 17, 2020 (the “Severance Agreement”)

are hereby terminated, without further action by the Parties, as of the Termination Date and shall be of no further force and effect,

and that except as expressly set forth in this Agreement, the Company shall have no continuing obligations to Executive under the Employment

Agreement or the Severance Agreement; provided, however, that Section 3 (Confidentiality), Section 4 (Covenant Not to Compete),

Section 5 (Covenant not to Solicit) and Section 6 (Covenant Not to Recruit Personnel) of the Employment Agreement shall survive

and remain in full force and effect in accordance with their terms, provided, however, that the restrictions contained in Section 4

(Covenant Not to Compete) shall expire as of June 1, 2025; the restrictions contained in Section 5 (Covenant Not to Solicit)

shall expire as of December 1, 2025; and the restrictions contained in Section 6 (Covenant Not to Recruit Personnel) shall expire

as of June 1, 2026. Notwithstanding the preceding sentence, the Company agrees (i) to consider in good faith a written request

from Executive to waive Executive’s required compliance with Section 4 (Covenant Not to Compete) of the Employment Agreement

under appropriate circumstances and (ii) that certain Merchandise Vendors (as defined in the Employment Agreement) may be doing business

with certain Competitors of the Company and it shall not be a violation of Section 5 (Covenant Not to Solicit) of the Employment

Agreement for Executive to do business with such Merchandise Vendors on behalf of a Competitor in the event that there is a pre-existing

and on-going relationship between a Competitor and such Merchandise Vendors at the time Executive begins employment with such Competitor

so long as Executive is not otherwise in violation of Section 4 of the Employment Agreement.

6. Final

Agreement. This Agreement contains the entire agreement between the Company and Executive with respect to the subject matter hereof,

and supersedes all prior agreements between the Parties, except as set forth in Paragraph 5 above. The Parties agree that this Agreement

may not be modified except by a written document signed by both Parties. The Parties agree that this Agreement may be executed in one

or more counterparts, each of which will be deemed to be an original copy of this Agreement and all of which, when taken together, will

be deemed to constitute one and the same agreement.

7. Public

Announcements. Executive and the Company agree to the statement attached hereto as Exhibit B as the public announcement of Executive’s

departure from the Company (the “Announcement”). The Executive and the Company agree that the initial public release

of the Announcement shall be made on May 31, 2024, or such other date as mutually agreed by Executive and the Company. The Company hereby

agrees that all public statements made by the Company regarding Executive and his departure from the Company shall be consistent with

the messaging in the Announcement.

8. Governing

Law. This Agreement shall be governed by and construed in accordance with the laws of the state of Georgia without giving effect to

its conflict of law principles.

9. Waiver.

The failure of either party to enforce any of the provisions of this Agreement shall in no way be construed to be a waiver of any such

provision. Any waiver of any provision of this Agreement must be in a writing signed by the party making such waiver. No waiver of any

breach of this Agreement shall be held to be a waiver of any other or subsequent breach.

10. Code

Section 409A. This Agreement shall be interpreted and administered in a manner so that any amount or benefit payable hereunder

shall be paid or provided in a manner that is either exempt from or compliant with the requirements of Section 409A of the Internal

Revenue Code of 1986, as amended (the “Code”) and applicable Internal Revenue Service guidance and Treasury Regulations

issued thereunder. The tax treatment of the benefits provided under the Agreement is not warranted or guaranteed to Executive, who is

responsible for all taxes assessed on any payments made pursuant to this Agreement, whether under Section 409A of the Code or otherwise.

Neither the Company nor its directors, officers, employees or advisers shall be held liable for any taxes, interest, penalties or other

monetary amounts owed by Executive as a result of the application of Section 409A of the Code. Executive’s right to receive

any installment payments as Severance Pay shall be treated as a right to receive separate and distinct payments for purposes of Section 409A

of the Code.

[Signature Page to Follow]

IN WITNESS WHEREOF, the parties hereto have duly

executed this Agreement as of the date first above written.

| |

CITI TRENDS, INC. |

| |

|

| |

By: |

/s/ Peter R. Sachse |

| |

Name: |

Peter R. Sachse |

| |

Title: |

Executive Chairman of the Board of Directors |

| |

EXECUTIVE |

| |

|

| |

/s/ David N. Makuen |

| |

David N. Makuen |

Exhibit A

RELEASE AGREEMENT

THIS RELEASE AGREEMENT

(this “Release Agreement”) is entered into between Citi Trends, Inc. (the “Company”) and

David N. Makuen (“Executive”), as of August 3, 2024.

1. General Release of Claims and Covenant Not To Sue.

a. General Release of Claims by Executive.

In consideration of the payments made or to be made to Executive by the Company and the promises contained in the Separation Agreement

entered into by and between the Company and Executive as of May 31, 2024 (the “Separation Agreement”), Executive

agrees to the following release of claims and covenant not to sue (the “Release”). Executive on behalf of himself and

his agents and successors in interest, hereby UNCONDITIONALLY RELEASES AND DISCHARGES the Company, its successors, subsidiaries, parent

companies, assigns, joint ventures, and affiliated companies and their respective agents, legal representatives, shareholders, attorneys,

employees, members, managers, officers and directors (collectively, the “Releasees”) from ALL CLAIMS, LIABILITIES,

DEMANDS AND CAUSES OF ACTION which he may by law release, as well as all contractual obligations not expressly set forth in the Release,

whether known or unknown, fixed or contingent, that he may have or claim to have against any Releasee for any reason as of the date of

execution of the Release. The Release includes, but is not limited to, claims arising under federal, state or local laws prohibiting employment

discrimination; claims arising under severance plans and contracts; and claims growing out of any legal restrictions on the Company’s

rights to terminate its employees or to take any other employment action, whether statutory, contractual or arising under common law or

case law. Executive specifically acknowledges and agrees that he is releasing any and all rights under federal, state and local employment

laws including without limitation the Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, Title VII of the

Civil Rights Act of 1964, 42 U.S.C. § 1981, the Americans With Disabilities Act, the Family and Medical Leave Act, the Genetic Information

Nondiscrimination Act, the anti-retaliation provisions of the Fair Labor Standards Act, the Employee Retirement Income Security Act, the

Equal Pay Act, the Occupational Safety and Health Act, the Worker Adjustment and Retraining Notification Act, the Employee Polygraph Protection

Act, the Fair Credit Reporting Act, and any and all other local, state, and federal law claims arising under statute or common law. It

is agreed that this is a general release and it is to be broadly construed as a release of all claims, except those that cannot be released

by law. Notwithstanding the foregoing, Executive expressly does not waive any claims he may have (i) to indemnification that he may

have against any of the Releasees in connection with his service to the Company and its affiliates for any third party claims asserted

against Executive that arise out of alleged acts or omissions alleged to have occurred through the Termination Date (as defined in the

Separation Agreement), (ii) related to any coverage that he may have under any directors and officers liability insurance policy

maintained by the Company or its affiliates, or (iii) any claims that may arise under the Separation Agreement or this Release Agreement.

In connection with such waiver and relinquishment, Executive acknowledges

that he is aware that he may later discover facts in addition to or different from those which he currently knows or believes to be true

with respect to the subject matters of the Release, but that it is his intention hereby fully, finally, and forever, to settle and release

all of these matters which now exist, may exist, or previously existed, whether known or unknown, suspected or unsuspected. In furtherance

of such intent, the releases given herein shall be and shall remain in effect as a full and complete release, notwithstanding the discovery

or existence of such additional or different facts.

b. General Release of Claims by Company.

For and in consideration of the Release in subparagraph (a) above, the Company does hereby fully, finally, and forever release and

discharge Executive from any and all claims, charges, demands, actions, liability, damages, sums of money, or rights of any and every

kind or nature that are based upon any facts currently known to the Company’s current executive officers or Board of Directors,

up to and including the present day. The Company’s release additionally includes, without limitation, any and all claims for attorneys'

fees, costs, and expenses with respect to those claims released hereby. The Company does not waive its rights or claims that may arise

after the date it signs this Release Agreement.

c. Covenant Not to Sue. Except as expressly

set forth in Paragraph 3 below with respect to Executive, the Company and Executive further hereby AGREE NOT TO FILE A LAWSUIT or other

legal claim or charge to assert any claim released by this Release Agreement.

d. Acknowledgement Regarding Payments and Benefits.

Executive acknowledges and agrees that he has been paid all wages and accrued benefits to which he is entitled through the date of execution

of this Release Agreement. Other than the payments set forth in the Separation Agreement, the Parties agree that the Company owes no additional

amounts to Executive for wages, back pay, severance pay, bonuses, damages, accrued vacation, benefits, insurance, sick leave, other leave,

or any other reason.

e. Other Representations and Acknowledgements.

This Release Agreement is intended to and does settle and resolve all claims of any nature that Executive might have against the Company

arising out of their employment relationship or the termination of employment or relating to any other matter, except those that cannot

be released by law. By signing this Release Agreement, Executive acknowledges that he is doing so knowingly and voluntarily, that he understands

that he may be releasing claims he may not know about, and that he is waiving all rights he may have had under any law that is intended

to protect him from waiving unknown claims. Executive warrants that he has not filed any notices, claims, complaints, charges, or lawsuits

of any kind whatsoever against the Company or any of the Releasees as of the date of execution of this Release Agreement. This Release

Agreement shall not in any way be construed as an admission by the Company or any of the Releasees of wrongdoing or liability or that

Executive has any rights against the Company or any of the Releasees. Executive represents and agrees that he has not transferred or assigned,

to any person or entity, any claim that he is releasing in this Paragraph 1.

2. Non-Disparagement.

Executive agrees that he will not, directly

or indirectly, make any statement, oral or written, or perform any act or omission which disparages or casts in a negative light the Company,

its products, its employees, or any of the Releasees. This Paragraph 2 shall not in any way limit any of the Protected Rights contained

in Paragraph 3 of this Release Agreement, or Executive’s ability to provide truthful testimony pursuant to a subpoena, court order

or as otherwise required by law.

3. Protected Rights. Executive understands that nothing contained

in this Release Agreement limits his ability to file a charge or complaint with the Equal Employment Opportunity Commission, the National

Labor Relations Board, the Securities and Exchange Commission, or any other federal, state or local governmental agency or commission

(“Government Agencies”). Executive further understands that this Release Agreement does not limit his ability

to communicate or share information with any Government Agencies or otherwise participate in any investigation or proceeding that may

be conducted by any Government Agencies in connection with any charge or complaint, whether filed by Executive, on his behalf, or by any

other individual. However, based on Executive’s release of claims set forth in Paragraph 1 of this Release Agreement, Executive

understands that he is releasing all claims that he may have, as well as his right to recover monetary damages or obtain other relief

that is personal to Executive in connection with any charge or complaint that may be filed with any Government Agencies relating to Executive’s

employment with the Company.

4. Acknowledgment.

The Company hereby advises Executive to consult with an attorney prior to executing this Release Agreement and Executive acknowledges

and agrees that the Company has advised, and hereby does advise, him of his opportunity to consult an attorney or other advisor and has

not in any way discouraged him from doing so. Executive expressly acknowledges and agrees that he has been offered at least twenty-one

(21) days to consider this Release Agreement before signing it, that he has read this Release Agreement carefully, that he has had sufficient

time and opportunity to consult with an attorney or other advisor of his choosing concerning the execution of this Release Agreement.

Executive acknowledges and agrees that he fully understands that this Release Agreement is final and binding, that it contains a full

release of all claims and potential claims, and that the only promises or representations he has relied upon in signing this Release Agreement

are those specifically contained in the Release Agreement itself. Executive acknowledges and agrees that he is signing this Release Agreement

voluntarily, with the full intent of releasing the Company from all claims covered by Paragraph 1 of this Release Agreement.

5. Cooperation. Following the Termination Date, the Executive

shall cooperate with the Company as reasonably requested and be reasonably available to the Company and its attorneys with respect to

any legal action or proceeding (or any appeal from any action or proceeding) or any regulatory or government agency inquiry which relates

to events occurring during the Executive’s employment with the Company (including, without limitation, the Executive appearing at

the Company’s request, upon reasonable advance notice, to give testimony without requiring service of a subpoena or other legal

process, volunteering to the Company all pertinent information and turning over to the Company all relevant documents which are or may

come into the Executive’s possession). The Company shall reimburse the Executive for all reasonable out of pocket expenses incurred

by the Executive in rendering such services that are approved by the Company, including but not limited to reasonable attorneys’

fees. In addition, if more than an incidental cooperation is required at any time after the termination of the Executive’s employment,

the Executive shall be paid (other than for the time of actual testimony) a per day fee based on his base salary as of the Termination

Date.

6. Revocation and Effective Date. Executive may revoke this

Release Agreement at will within seven (7) days after he executes this Release Agreement (the “Revocation Period”)

by giving written notice of revocation to Company. This Release Agreement may not be revoked after the expiration of the seven-day deadline.

Assuming that Executive does not revoke this Release Agreement within the Revocation Period, the effective date of this Release Agreement

shall be the eighth (8th) day after the day on which Executive executes this Release Agreement.

The Executive acknowledges and agrees that he

has carefully read and fully understands all of the provisions of this Release Agreement and knowingly and voluntarily agrees to all of

the terms set forth in this Release Agreement. The Executive knowingly and voluntarily intends to be legally bound by the same.

IN

WITNESS WHEREOF, the Executive and the Company have executed this Release Agreement as of the date specified below.

| |

|

Executive |

| |

|

|

| Date: |

|

|

|

| |

|

David N. Makuen |

| |

|

|

| |

|

Citi Trends, Inc. |

| |

|

|

| Date: |

|

|

By: |

|

| |

|

Name: |

Peter R. Sachse |

| |

|

Title: |

Executive Chairman of the Board of Directors |

Exhibit B

[Intentionally Omitted]

Exhibit 99.1

Citi

Trends Announces Leadership Transition

Ken

Seipel, a Successful Turnaround CEO in the Off-Price Retail Space and Veteran Board Member at Citi Trends, Appointed Interim CEO

David

Makuen, who Guided the Company Through the Pandemic and Served with Distinction, Steps Down as CEO and Board Member

The

Board Commences a Search Process for a Permanent CEO

Additionally,

the Company Released Preliminary First Quarter 2024 Results – Total Sales of $186.2 million, Comparable Sales Growth of 3.1%

and EBITDA Loss of $0.8 million

SAVANNAH,

Ga.--(BUSINESS WIRE)--Citi Trends, Inc. (NASDAQ: CTRN) (“Citi Trends” or the “Company”), a leading

specialty value retailer of apparel, accessories and home trends for way less spend primarily for African American and multicultural

families in the United States, today announced that its Board of Directors (the “Board”) has appointed Ken Seipel as the

Company’s interim Chief Executive Officer (“CEO”), effective June 2, 2024. In connection with the

appointment, David Makuen has stepped down as CEO and a member of the Board. To ensure a smooth and successful transition, Mr.

Makuen will serve as Senior Advisor to the CEO and the leadership team in the coming weeks.

The Board’s

independent members are commencing a search for a new permanent CEO and plan to retain a nationally recognized executive search firm

to support the process. The Board will consider external candidates, as well as Ken, in the CEO search. Citi Trends’ Board includes

several independent members with prior experience carrying out successful CEO searches.

Peter Sachse, Executive

Chairman of the Board, commented:

“On behalf

of the Board and the Company’s employees, I thank David for his dedication, hard work and strong leadership during his four

years as CEO. David’s contributions include guiding the organization through the challenging COVID-19 pandemic and leading it to

a record year in terms of financial performance in fiscal year 2021. The Board’s decision to appoint Ken and initiate a search

for a new permanent CEO is intended to position Citi Trends to return the Company to past levels of profitability and beyond. Ken has

had success in several turnaround environments. Ken previously served as the CEO of West Marine, and prior to that, led the transformation

at Gabe’s, an off-price retailer operating with very similar customer income demographics as Citi Trends. As CEO, Ken balanced

profitable growth with strong cost controls to drive record profitability. He has our full confidence.”

Mr. Makuen

stated:

“It has been

an honor and a privilege to serve as CEO of Citi Trends. This is an incredibly talented organization with some of the smartest and most

committed individuals in the retail sector. Together, we led the Company through an unprecedented period of disruption during the pandemic

and subsequent inflationary pressures, while maintaining strong customer loyalty and advancing many strategic initiatives designed to

drive future brand growth. I look forward to watching Citi Trends continue to delight customers and deliver value for many years to come.

I wish the Board and my colleagues the very best.”

Mr. Seipel,

interim CEO, concluded:

“I want to

thank the Board for its confidence and David for supporting a smooth transition. As interim CEO, I intend to leverage my experiences

driving profitable growth, capturing efficiencies and operating across economic cycles to position Citi Trends for enhanced value creation.

We will focus on driving sales, sharpening our product assortment decisions, streamlining costs, optimizing our supply chain, improving

inventory returns and leveraging benefits from recent technology investments. Although this represents a period of transition, the Board

and I plan for the coming months to be very productive and foundational for our long-range growth.”

As a result of today’s announcements, the Board will include eight members and, in line with corporate

governance best practices, Mr. Seipel will step down from his Board committee roles.

Additional information related to today’s

announcements can be found on Form 8-K filed with the U.S. Securities and Exchange Commission.

The company has provided the following

summary of preliminary first quarter 2024 results:

| ● | Total

sales of $186.3 million |

| ● | Same-store

sales increase of 3.1% |

| ● | EBITDA

loss of $0.8 million |

Additional details of the Company’s

first quarter 2024 results will be discussed on the Company’s investor call at 9:00 am ET on June 4th, 2024.

About Ken Seipel

Ken Seipel is a highly successful executive

and director in the consumer and retail sectors, with prior experience as a CEO and in C-Suite roles. Mr. Seipel joined Citi

Trends' Board in 2019 and served as Chairman of the Nominating and Corporate Governance Committee and member of the Audit and Finance

Committees. Mr. Seipel also formerly served as Lead Independent Director at West Marine, the world’s largest retailer of boating

supplies. As CEO of privately held West Marine from 2018 to 2021, Mr. Seipel completed a company turnaround, resulting in record

profits, leading to a transaction that netted shareholders a six-time return on investment. As CEO of privately held off-price retailer,

Gabe’s, from 2013 to 2017, he successfully led the business to record-level profits, resulting in a three-time investment exit

transaction for the company’s majority private equity owner. His retail experience also includes executive roles in merchandise

and operations at major Fortune 500 public companies, including Old Navy, Target and J.C. Penney.

About Citi Trends

Citi Trends is a leading specialty value

retailer of apparel, accessories and home trends for way less spend primarily for African American and multicultural families in the

United States. The Company operates 598 stores located in 33 states. For more information, visit www.cititrends.com or

your local store.

Forward-Looking

Statements

All

statements other than historical facts contained in this news release, including statements regarding the Company’s future financial

results and position, business plans and the objectives and expectations of management, are forward-looking statements that are

subject to material risks and uncertainties. The words “believe,” “may,” “could,” “plans,”

“estimate,” “expects,” “continue,” “anticipate,” “intend,” “expect,”

“upcoming,” “trend” and similar expressions, as they relate to the Company, are intended to identify forward-looking

statements, although not all forward-looking statements contain such language. Statements with respect to earnings or sales are forward-looking

statements. Investors are cautioned that any such forward-looking statements are subject to the finalization of the Company’s quarter-end

financial and accounting procedures, are not guarantees of future performance and are inherently subject to risks and uncertainties,

some of which cannot be predicted or quantified. Actual results or developments may differ materially

from those included in the forward-looking statements as a result of various factors, which are discussed in our Annual Reports and Quarterly

Reports on Forms 10-K and 10-Q, respectively, and any amendments thereto, filed with the SEC. These risks and uncertainties include,

but are not limited to, uncertainties relating to general economic conditions, including inflation, energy and fuel costs, unemployment

levels, and any deterioration whether caused by acts of war, terrorism, political or social unrest (including any resulting store closures,

damage or loss of inventory) or other factors; changes in market interest rates and market levels of wages; natural disasters such as

hurricanes; uncertainty and economic impact of pandemics, epidemics or other public health emergencies such as the ongoing COVID-19 pandemic;

transportation and distribution delays or interruptions; changes in freight rates; the Company’s ability to attract and retain

workers; the Company’s ability to negotiate effectively the cost and purchase of merchandise inventory risks due to shifts in market

demand; the Company’s ability to gauge fashion trends and changing consumer preferences; changes in consumer confidence and consumer

spending patterns; competition within the industry; competition in our markets; the duration and extent of any economic stimulus programs;

changes in product mix; interruptions in suppliers’ businesses; the ongoing assessment and impact of the cyber disruption we identified

on January 14, 2023, including legal, reputational, financial and contractual risks resulting from the disruption, and other risks

related to cybersecurity, data privacy and intellectual property; temporary changes in demand due to weather patterns; seasonality of

the Company’s business; changes in market interest rates and market levels of wages; the results of pending or threatened litigation;

delays associated with building, remodeling, opening and operating new stores; and delays associated with building and opening or expanding

new or existing distribution centers. Any forward-looking statements by the Company are intended to speak only as of the date such statements

are made. Except as required by applicable law, including the securities laws of the United States and the rules and regulations

of the SEC, the Company does not undertake to publicly update any forward-looking statements in this news release or with respect to

matters described herein, whether as a result of any new information, future events or otherwise.

Contacts

For Investors:

Tom Filandro / Rachel Schacter

CitiTrendsIR@icrinc.com

For Media:

Greg Marose

CitiTrends@Longacresquare.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

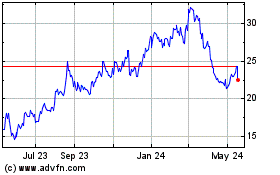

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Nov 2024 to Dec 2024

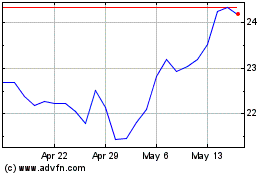

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Dec 2023 to Dec 2024