As filed with the Securities and Exchange Commission

on February 9, 2024

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CVRx, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

41-1983744 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

9201 West Broadway Avenue, Suite 650

Minneapolis, MN 55445

(Address of Principal Executive Offices, including

zip code)

Stock Option Agreement (Inducement Grant)

(Full title of the Plan)

Nadim Yared

President and Chief Executive Officer

CVRx, Inc.

9201 West Broadway Avenue, Suite 650

Minneapolis, MN 55445

(Name and address of agent for service)

(763) 416-2840

(Telephone number, including area code, of agent

for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

|

Smaller reporting company |

x |

| |

|

|

Emerging growth company |

x |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

As previously disclosed on a Current Report on

Form 8-K filed with the Securities and Exchange Commission (the “Commission”) on January 31, 2024, Kevin

Hykes was appointed as President and Chief Executive Officer of CVRx, Inc. (the “Registrant”), effective February 12,

2024. In connection with Mr. Hykes’ appointment, this Registration Statement on Form S-8 is being filed with the Commission

for the purpose of registering 360,000 shares of Common Stock, par value $0.01 per share, of the Registrant, upon exercise of the stock

option represented by the Stock Option Agreement (Inducement Grant) to be granted to Mr. Hykes on February 12, 2024.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information

called for in Part I of Form S-8 is not being filed with or included in this Registration Statement (by incorporation

by reference or otherwise) in accordance with the rules and regulations of the Commission.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents,

which have been filed with the Commission by the Registrant, pursuant to the Securities Act of 1933, as amended (the “Securities

Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as applicable, are hereby incorporated

by reference in, and shall be deemed to be a part of, this Registration Statement:

| (c) | the description of the Registrant’s Common Stock contained in

Exhibit 4.16 to the Registrant’s Annual Report on Form 10-K for the year

ended December 31, 2021 filed with the Commission on February 22, 2022, and any

amendment or report filed for the purpose of updating such description. |

In addition, all documents filed by the Registrant

pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act after the date of this Registration Statement and before the

filing of a post-effective amendment that indicates that all shares of Common Stock offered have been sold, or that deregisters all shares

of Common Stock then remaining unsold, shall be deemed to be incorporated by reference in, and to be a part of, this Registration Statement

from the date of filing of those documents.

Any statement contained in a document incorporated,

or deemed to be incorporated, by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein or incorporated herein by reference or in any other subsequently filed document that

also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Notwithstanding

the foregoing, nothing in this Registration Statement shall be deemed to incorporate any information from Item 2.02 or Item 7.01 of any

Form 8-K, or that is otherwise furnished under applicable Commission rules rather than filed, or any exhibits to the extent

furnished in connection with such items.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

The Registrant’s amended and restated certificate of incorporation

that will be effective upon the closing of the initial public offering contains provisions that limit the liability of the Registrant’s

directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, the Registrant’s directors will not

be personally liable to the Registrant or its stockholders for monetary damages for any breach of fiduciary duties as directors, except

liability for:

| |

· |

any breach of the director’s duty of loyalty to the Registrant or its stockholders; |

| |

· |

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| |

· |

unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General

Corporation Law; and |

| |

· |

any transaction from which the director derived an improper personal benefit. |

The Registrant’s amended and restated certificate of incorporation

and amended and restated bylaws that will be effective upon the closing of the initial public offering will provide that the Registrant

is required to indemnify the Registrant’s directors and officers, in each case to the fullest extent permitted by Delaware law.

The Registrant’s amended and restated bylaws also will provide that the Registrant is obligated to advance expenses incurred by

a director or officer in advance of the final disposition of any action or proceeding, and permit the Registrant to secure insurance

on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity regardless

of whether we would otherwise be permitted to indemnify him or her under Delaware law. The Registrant has entered and expects to continue

to enter into agreements to indemnify the Registrant’s directors, executive officers and other employees as determined by the Registrant’s

board of directors. With specified exceptions, these agreements provide for indemnification for related expenses including, among other

things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding.

The Registrant believes that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons

as directors and officers. The Registrant also maintains directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions that will

be included in our amended and restated certificate of incorporation and amended and restated bylaws that will be effective upon the

closing of this offering may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary

duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful,

might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay

the costs of settlement and damage.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

Item 9. Undertakings.

(a) The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in

the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set

forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any

material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and

(a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Securities and Exchange Commission by the Registrant pursuant to Section 13

or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and,

where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities

Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed

by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City

of Minneapolis, State of Minnesota, on February 9, 2024.

| |

CVRx, INC. |

| |

|

|

| |

By: |

/s/

Nadim Yared |

| |

|

Nadim Yared |

| |

|

President and Chief Executive Officer |

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement has been signed below by the following persons on behalf of the Registrant and in the capacities

indicated:

| Signature |

|

Title |

|

| |

|

|

|

| /s/ Nadim Yared |

|

President and Chief Executive Officer |

|

| Nadim Yared |

|

(Principal Executive Officer) |

|

| |

|

|

|

| /s/ Jared Oasheim |

|

Chief Financial Officer |

|

| Jared Oasheim |

|

(Principal Financial and Accounting Officer) |

|

| |

|

|

|

| * |

|

Director |

|

| Ali Behbahani, M.D. |

|

|

|

| |

|

|

|

| * |

|

Director |

|

| Kevin Hykes |

|

|

|

| |

|

|

|

| * |

|

Director |

|

| Mudit K. Jain, Ph.D |

|

|

|

| |

|

|

|

| * |

|

Director |

|

| Kirk Nielsen |

|

|

|

| |

|

|

|

| * |

|

Director |

|

| Martha Shadan |

|

|

|

| |

|

|

|

| * |

|

Director |

|

| Joseph Slattery |

|

|

|

* Jared Oasheim, by signing his name hereto on the 9th day

of February, 2024, does hereby sign this document pursuant to powers of attorney duly executed by the directors named, filed with

the Securities and Exchange Commission on behalf of such directors, all in the capacities and on the date stated. |

Exhibit 5.1

February 9,

2024

CVRx, Inc.

9201 West Broadway Avenue, Suite 650

Minneapolis, MN 55445

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to CVRx, Inc., a Delaware corporation

(the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission (the “Commission”)

of the Company’s Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of

1933, as amended (the “Act”), relating to the issuance of up to 360,000 shares the Company’s Common Stock, par

value $0.01 per share (the “Shares”), which may be issued upon the exercise of the 360,000 stock options granted to Kevin

Hykes in connection with his appointment as the Company’s President and Chief Executive Officer, pursuant to a Stock Option Agreement

(Inducement Grant) (the “Inducement Agreement”).

For purposes of this opinion letter, we have examined the Inducement

Agreement, the Registration Statement, the amended and restated certificate of incorporation, as currently in effect, and the amended

and restated bylaws, as currently in effect, of the Company, the resolutions of the Company’s board of directors authorizing the

issuance of the Shares and such corporate and other records, agreements, instruments, certificates of public officials and documents as

we have deemed necessary as a basis for the opinions hereinafter expressed and have made such examination of statutes as we have deemed

relevant and necessary in connection with the opinions hereinafter expressed. As to facts material to this opinion letter, we have relied

upon certificates, statements or representations of public officials, of officers and representatives of the Company and of others, without

any independent verification thereof.

In our examination, we have assumed: (i) the

legal capacity of all natural persons; (ii) the genuineness of all signatures; (iii) the authenticity of all documents submitted

to us as originals; (iv) the conformity to original documents of all documents submitted to us as certified, conformed, photostatic

or facsimile copies; (v) the authenticity of the originals of such latter documents; (vi) the truth, accuracy and completeness

of the information, representations and warranties contained in the records, documents, instruments, certificates and records we have

reviewed; and (vii) the absence of any undisclosed modifications to the agreements and instruments reviewed by us.

Based on and subject to the foregoing and

to the other qualifications, assumptions and limitations set forth herein, we are of the opinion that all necessary corporate action on

the part of the Company has been taken to authorize the issuance and sale of the Shares to be issued in accordance with the Inducement

Agreement and that, when (a) the Shares have been issued and sold as contemplated in the Registration Statement and related prospectus

and in accordance with the Inducement Agreement, and (b) the consideration for the Shares specified in the Inducement Agreement has

been received by the Company, the Shares will be validly issued, fully paid and nonassessable.

We are admitted to the practice of law in the

State of Minnesota.

This opinion speaks only as of the date the Registration Statement

becomes effective under the Act, and we assume no obligation to revise or supplement this opinion thereafter. This opinion is limited

to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein.

We hereby consent to the filing of this opinion as an exhibit to the

Registration Statement. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required

under Section 7 of the Act or the rules and regulations of the Commission thereunder.

| Yours very truly, |

|

| |

|

|

| FAEGRE DRINKER BIDDLE & REATH LLP |

|

| |

|

|

| By: |

/s/ Amy C. Seidel |

|

| |

Amy C. Seidel |

|

Exhibit 10.1

CVRx, Inc.

Stock Option Agreement

(Inducement Grant)

CVRx, Inc.

(the “Company”), hereby grants an Option to purchase shares of the Company’s common stock to you, the Participant named

below. The terms and conditions of this Option Award are set forth in this Agreement, consisting of this cover page and the Option

Terms and Conditions on the following pages. This Option Award is made and granted as a stand-alone award and is not granted under or

pursuant to the Company’s 2021 Equity Incentive Plan (as the same may be amended from time to time, the “Plan”). However,

for convenience purposes, unless otherwise defined herein, any capitalized term that is not defined

in this Agreement shall have the meaning set forth in the Plan. This Option Award is an inducement material to the Participant’s

entry into employment within the meaning of Nasdaq Listing Rule 5635(c)(4).

| Name of Participant: |

Kevin Hykes |

| |

|

| Date of Grant: |

February 12, 2024 |

| |

|

| Number of Shares Covered: |

360,000 |

| |

|

| Exercise Price: |

$[•]1 |

| |

|

| Expiration Date: |

February 11, 2034 |

| |

|

| Type of Option: |

Non-Qualified Stock Option |

The Vesting and Exercise Schedule will be as follows:

| Shares |

Vest Date |

| Vests as to 25% of the shares on February 12, 2025 and as to 1/48th of the shares each month thereafter |

By evidencing your acceptance

of this Agreement in a manner approved by the Company, you agree to all of the terms and conditions contained in this Agreement. You acknowledge

that you have received and reviewed these documents and that they set forth the entire agreement between you and the Company regarding

your right to purchase shares of the Company’s common stock pursuant to this Option.

CVRx, Inc.

By:

Title:

1

Closing price of the Company’s common stock on the Date of Grant.

CVRx, Inc.

Stock Option Agreement (Inducement Grant)

Option Terms and Conditions

| 1. | Type of Stock Option. The Option is not intended to be an “incentive stock option”

within the meaning of Section 422 of the Internal Revenue Code and will be interpreted accordingly. This Option is made and granted

as a stand-alone award, separate and apart from, and outside of, the Plan, and shall not constitute an award granted under or pursuant

to the Plan. Notwithstanding the foregoing, the terms, provisions, conditions and definitions set forth in the Plan shall apply to this

Option Award (including but not limited to the adjustment provisions contained in Section 12 of the Plan), and this Option Award

shall be subject to such terms, provisions, conditions and definitions, which are hereby incorporated into this Agreement by reference.

For the avoidance of doubt, this Option Award shall not be counted for purposes of calculating the aggregate number of Shares that may

be issued or transferred pursuant to Awards under the Plan as set forth in Section 4(a) of the Plan. In the event of any inconsistency

between the Plan and this Agreement, the terms of this Agreement shall control. |

| 2. | Vesting and Exercisability of Option. |

(a) Scheduled

Vesting. This Option will vest and become exercisable as to the number of Shares and on the dates specified in the Vesting and Exercise

Schedule on the cover page to this Agreement, so long as your Service to the Company does not end. The Vesting and Exercise Schedule

is cumulative, meaning that to the extent the Option has not already been exercised and has not expired or been terminated or cancelled,

you or the person otherwise entitled to exercise the Option as provided in this Agreement may at any time purchase all or any portion

of the Shares subject to the vested portion of the Option.

(b) Accelerated

Vesting. Notwithstanding Section 2(a), (i) this Option will vest and become exercisable in full upon a termination of your

Service as a result of your death or Disability and shall remain exercisable for the period specified in Section 6(e) of the

Plan, and (ii) if and to the extent this Option is continued, assumed or replaced in connection with a Change in Control, and if

during the three months preceding or eighteen months after such Change in Control you experience an involuntary termination of Service

for reasons other than Cause (as defined in your written employment agreement with the Company dated January 26, 2024 (the “Employment

Agreement”)) or you terminate your Service due to Constructive Discharge (as defined in the Employment Agreement), then this Option

(or any replacement award) shall immediately vest and become exercisable in full and shall remain exercisable for one year following

your termination of Service. In addition, vesting and exercisability of this Option may be accelerated during the term of the Option

under the circumstances described in Sections 12(b) and 12(c) of the Plan, and at the discretion of the Committee in accordance

with Section 3(b)(2) of the Plan.

(c) Continued

Vesting Following Retirement. Notwithstanding Section 2(a), this Option will continue to vest on the scheduled vesting dates

set forth on the cover page of this Agreement if your employment is involuntarily terminated by the Company without Cause within

two years following the Date of Grant, provided that (i) you are not engaging in any activity competitive with the Company, violating

any ongoing post-employment obligations to the Company, or soliciting employees or customers of the Company, and (ii) you are in

compliance with all other post-employment obligations owned to the Company (including without limitation, pursuant to the Employment Agreement

and the Confidentiality Agreement (as defined in the Employment Agreement)).

| 3. | Expiration. This Option will expire and will no longer be exercisable at 5:00 p.m. Central

Time on the earliest of: |

| (a) | The expiration date specified on the cover page of this Agreement; |

| (b) | Upon your termination of Service for Cause; |

| (c) | Upon the expiration of any applicable period specified in Section 6(e) of the Plan or Section 2

of this Agreement during which this Option may be exercised after your termination of Service; or |

| (d) | The date (if any) fixed for termination or cancellation of this Option pursuant to Section 12 of

the Plan; |

provided, however, that, notwithstanding

the foregoing, in the event of the termination of your employment pursuant to Section 2(c) above, this Option may be exercised,

to the extent vested, by you (or your estate (or the person who acquires this Option by will or the laws of descent and distribution or

otherwise by reason of your death)) until 90 days following the date on which the continued vesting contemplated by Section 2(c) ends.

| 4. | Service Requirement. Except as otherwise provided in Section 6(e) of the Plan

or Section 2 of this Agreement, this Option may be exercised only while you continue to provide Service to the Company or any Affiliate,

and only if you have continuously provided such Service since the Grant Date of this Option. |

| 5. | Exercise of Option. Subject to Section 4, the vested and exercisable portion of this

Option may be exercised in whole or in part at any time during the Option term by giving notice to Company via E*Trade using the method

designated by the Company, and by providing for payment of the exercise price of the Shares being acquired and any related withholding

taxes (if applicable). The election to exercise must include the number of Shares to be purchased, the method of payment of the aggregate

exercise price and the directions for the delivery of the Shares to be acquired. If you are not the person exercising the Option, the

person submitting the notice also must submit appropriate proof of his/her right to exercise the Option. |

| 6. | Payment of Exercise Price. When you submit your notice of exercise, you must include payment

of the exercise price of the Shares being purchased through one or a combination of the following methods: |

| (a) | Cash (including personal check, cashier’s check or money order); |

| (b) | By means of a broker-assisted cashless exercise in which you irrevocably instruct your broker to deliver

proceeds of a sale of all or a portion of the Shares to be issued pursuant to the exercise to the Company in payment of the exercise price

of such Shares; or |

| (c) | By delivery to the Company of Shares (by actual delivery or attestation of ownership in a form approved

by the Company) already owned by you that are not subject to any security interest and that have an aggregate Fair Market Value on the

date of exercise equal to the exercise price of the Shares being purchased; or |

| (d) | By authorizing the Company to retain, from the total number of Shares as to which the Option is being

exercised, that number of Shares having a Fair Market Value on the date of exercise equal to the exercise price for the total number of

Shares as to which the Option is being exercised. |

However, if the Committee determines,

in any given circumstance, that payment of the exercise price with Shares or by authorizing the Company to retain Shares is undesirable

for any reason, you will not be permitted to pay any portion of the exercise price in that manner.

| (a) | If, and to the extent, that this is a Non-Qualified Stock Option, you may not exercise this Option in

whole or in part unless you make arrangements acceptable to the Company for payment of any federal, state, local or foreign withholding

taxes that may be due as a result of the exercise of this Option. You hereby authorize the Company (or any Affiliate) to withhold from

payroll or other amounts payable to you any sums required to satisfy such withholding tax obligations, and otherwise agree to satisfy

such obligations in accordance with the provisions of Section 14 of the Plan. Unless otherwise determined by the Committee, you may

satisfy such withholding tax obligations by delivering Shares you already own or by having the Company retain a portion of the Shares

being acquired upon exercise of the Option, provided you notify the Company in advance of any exercise of your desire to pay withholding

taxes in this manner. Delivery of Shares upon exercise of this Option is subject to the satisfaction of applicable withholding tax obligations. |

| (b) | If this Option is designated as an Incentive Stock Option, and any Shares received pursuant to the exercise

of any portion of this Option are sold within two years from the Grant Date or within one year from the effective date of exercise of

this Option, or if certain other requirements of the Code are not satisfied, such Shares will be deemed under the Code not to have been

acquired by you pursuant to an “incentive stock option” as defined in the Code. You agree to promptly notify the Company if

you sell any Shares received upon the exercise of this Option within the time periods specified in the previous sentence. The Company

shall not be liable to you if this Option for any reason is deemed not to be an “incentive stock option” within the meaning

of the Code. |

| 8. | Delivery of Shares. As soon as practicable after the Company receives the notice of exercise

and payment of the exercise price as provided above, and has determined that all other conditions to exercise, including satisfaction

of withholding tax obligations and compliance with applicable laws as provided in Section 16(c) of the Plan, have been satisfied,

it shall deliver to the person exercising the Option, in the name of such person, the Shares being purchased, as evidenced by issuance

of a stock certificate or certificates, electronic delivery of such Shares to a brokerage account designated by such person, or book-entry

registration of such Shares with the Company’s transfer agent. The Company shall pay any original issue or transfer taxes with respect

to the issue or transfer of the Shares and all fees and expenses incurred by it in connection therewith. All Shares so issued shall be

fully paid and nonassessable. |

| 9. | Transfer of Option. During your lifetime, only you (or your guardian or legal representative

in the event of legal incapacity) may exercise this Option except in the case of a transfer described below. You may not assign or transfer

this Option except for a transfer upon your death in accordance with your will, by the laws of descent and distribution or pursuant to

a beneficiary designation submitted in accordance with Section 6(d) of the Plan, or, if this is a Non-Qualified Stock Option,

(i) pursuant to a domestic relations order, or (ii) with the prior written approval of the Company, by gift to a ”family

member” as the term is defined under General Instruction A(5) to Form S-8 under the Securities Act. The Option held by

any such transferee will continue to be subject to the same terms and conditions that were applicable to the Option immediately prior

to its transfer and may be exercised by such transferee as and to the extent that the Option has become exercisable and has not terminated

in accordance with the provisions of the Plan and this Agreement. |

| 10. | No Stockholder Rights Before Exercise. Neither you nor any permitted transferee of this

Option will have any of the rights of a stockholder of the Company with respect to any Shares subject to this Option until a certificate

evidencing such Shares has been issued, electronic delivery of such Shares has been made to your designated brokerage account, or an appropriate

book entry in the Company's stock register has been made. No adjustments shall be made for dividends or other rights if the applicable

record date occurs before your stock certificate has been issued, electronic delivery of your Shares has been made to your designated

brokerage account, or an appropriate book entry in the Company's stock register has been made, except as otherwise described in the Plan. |

| 11. | Governing Plan Document.

The provisions of the Plan governing awards granted thereunder shall also apply to this Option Award, and this Agreement and this

Option Award are subject to all interpretations, rules and regulations which may, from time to time, be adopted and promulgated by

the Committee pursuant to the Plan. If there is any conflict between the provisions of this Agreement and the Plan, the provisions of

this Agreement will govern. |

| 12. | Choice of Law. This Agreement will be interpreted and enforced under the laws of the state

of Delaware (without regard to its conflicts or choice of law principles). |

| 13. | Binding Effect. This Agreement will be binding in all respects on your heirs, representatives,

successors and assigns, and on the successors and assigns of the Company. |

| 14. | Other Agreements. You agree that in connection with the exercise of this Option, you will

execute such documents as may be necessary to become a party to any stockholder, voting or similar agreements as the Company may require. |

| 15. | Restrictive Legends. The Company may place a legend or legends on any certificate representing

Shares issued upon the exercise of this Option summarizing transfer and other restrictions to which the Shares may be subject under applicable

securities laws, other provisions of this Agreement, or other agreements contemplated by Section 14 of this Agreement. You agree

that in order to ensure compliance with the restrictions referred to in this Agreement, the Company may issue appropriate “stop

transfer” instructions to its transfer agent. |

| 16. | Compensation Recovery Policy. To the extent that any compensation paid or payable pursuant

to this Agreement is considered “incentive-based compensation” within the meaning and subject to the requirements of Section 10D

of the Exchange Act, such compensation shall be subject to potential forfeiture or recovery by the Company in accordance with any compensation

recovery policy adopted by the Board of Directors of the Company or any committee thereof in response to the requirements of Section 10D

of the Exchange Act and any implementing rules and regulations thereunder adopted by the Securities and Exchange Commission or any

national securities exchange on which the Company’s common stock is then listed. This Agreement may be unilaterally amended

by the Company to comply with any such compensation recovery policy. |

| 17. | Electronic Delivery and Acceptance. The Company may deliver any documents related to this

Option Award by electronic means and request your acceptance of this Agreement by electronic means. You hereby consent to receive all

applicable documentation by electronic delivery and to participate in the Plan through an on-line (and/or voice activated) system established

and maintained by the Company or the Company’s third-party stock plan administrator. |

By accepting this Agreement in a manner approved by the Company,

you agree to all the terms and conditions described above and in the Plan document.

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We have issued our report dated February 9, 2024, with respect

to the consolidated financial statements of CVRx, Inc. included in the Annual Report on Form 10-K for the year ended December 31,

2023, which is incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned

report in this Registration Statement.

/s/ Grant Thornton LLP

Minneapolis, Minnesota

February 9, 2024

Exhibit 24.1

POWER OF ATTORNEY

We, the undersigned officers

and directors of CVRx, Inc., hereby severally constitute and appoint Nadim Yared and Jared Oasheim, and each of them singly (with

full power to each of them to act alone), our true and lawful attorneys-in-fact and agents, with full power of substitution

and resubstitution in each of them for him and in his name, place and stead, and in any and all capacities, to sign any and all amendments

(including post-effective amendments) to one or more registration statements on Form S-8 or any other appropriate form, and to file

the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission to register

such number of shares of the Company’s common stock to be offered pursuant to the following plans and agreements:

| Plan/Agreement |

Shares |

| |

|

| 2021 Equity Incentive Plan |

1,043,959 additional shares |

| |

|

| 2021 Employee Stock Purchase Plan |

208,791 additional shares |

| |

|

| Stock Option Agreement (Inducement Grant) |

360,000 shares |

We hereby grant unto said attorneys-in-fact and

agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in

and about the premises, as full to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that

said attorneys-in-fact and agents or any of them, or their or his substitute or substitutes, may lawfully do or cause to be

done by virtue hereof.

This Power of Attorney may be signed in any number of counterparts,

each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument.

|

/s/ Ali Behbahani

Ali Behbahani |

|

Date: January 31, 2024 |

| |

| |

|

|

|

/s/ Mudit Jain

Mudit Jain |

|

Date: January 24, 2024 |

| |

| |

|

|

|

/s/ Kevin Hykes

Kevin Hykes |

|

Date: January 24, 2024 |

| |

| |

|

|

|

/s/ Kirk Nielsen

Kirk Nielsen |

|

Date: January 24, 2024 |

| |

| |

|

|

| /s/ Martha Shadan |

|

Date: January 24, 2024 |

| Martha Shadan |

|

| |

|

|

| /s/ Joseph Slattery |

|

Date: January 24, 2024 |

| Joseph Slattery |

|

|

| |

|

|

|

/s/ Nadim Yared

Nadim Yared |

|

Date: January 24, 2024 |

| |

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

CVRx, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type |

Security

Class Title |

Fee

Calculation

Rule |

Amount

Registered |

Proposed

Maximum

Offering

Price Per

Unit |

Maximum

Aggregate

Offering

Price |

Fee Rate |

Amount of

Registration

Fee |

| Equity |

Common Stock, par value $0.01 per share |

457(c) and 457(h) |

360,000(1) |

$24.38 (3) |

$8,776,800 |

0.00014760 |

$1,295.46 |

| Total Offering Amounts |

|

$8,776,800 |

|

$1,295.46 |

| Total Fee Offsets |

|

|

|

$0 |

| Net Fee Due |

|

|

|

$1,295.46 |

| (1) | Represents shares of Common Stock issuable upon the exercise of the 360,000 stock options which will be granted to Kevin Hykes in

connection with his appointment as the Registrant’s President and Chief Executive Officer, pursuant to a Stock Option Agreement

(Inducement Grant), under Rule 5635(c)(4) of the Nasdaq listing rules. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) and

Rule 457(h) of the Securities Act. The proposed maximum offering price per share is calculated on the basis of $24.38,

the average of the high and low price of the registrant’s common stock on February 2, 2024,

as reported on the Nasdaq Stock Market, which is within five business days prior to filing this Registration Statement. |

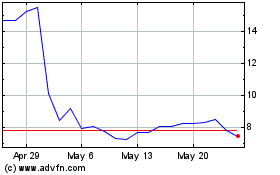

CVRx (NASDAQ:CVRX)

Historical Stock Chart

From Apr 2024 to May 2024

CVRx (NASDAQ:CVRX)

Historical Stock Chart

From May 2023 to May 2024