Cyclacel Pharmaceuticals Announces Closing of $8.0 Million Private Placement Priced At-The-Market Under NASDAQ Rules

03 May 2024 - 6:30AM

Cyclacel Pharmaceuticals, Inc. (NASDAQ: CYCC, NASDAQ: CYCCP;

"Cyclacel" or the "Company"), a biopharmaceutical company

developing innovative medicines based on cancer cell biology, today

announced that it has closed its previously announced private

placement for the purchase and sale of 4,968,945 shares of common

stock (or pre-funded warrants in lieu thereof), series A warrants

to purchase up to 4,968,945 shares of common stock and short-term

series B warrants to purchase up to 4,968,945 shares of common

stock at a purchase price of $1.61 per share of common stock (or

per pre-funded warrant in lieu thereof) and accompanying warrants

priced at-the-market under Nasdaq rules. The series A warrants and

short-term series B warrants have an exercise price of $1.36 per

share and are exercisable immediately upon issuance. The series A

warrants expire five and one-half years from the date of issuance

and the short-term series B warrants expire eighteen months from

the date of issuance.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the offering.

The gross proceeds from the offering were

approximately $8.0 million, prior to deducting placement agent’s

fees and other offering expenses payable by the Company. The

Company intends to use the net proceeds from the offering for

working capital and other general corporate purposes.

The securities described above were offered in a

private placement under Section 4(a)(2) of the Securities Act of

1933, as amended (the “Securities Act”), and/or Regulation D

promulgated thereunder and, along with the shares of common stock

underlying the warrants, have not been registered under the

Securities Act, or applicable state securities laws. Accordingly,

the warrants and underlying shares of common stock may not be

offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Securities Act and such

applicable state securities laws. Pursuant to a registration rights

agreement with investors, the Company has agreed to file a resale

registration statement covering the securities described above.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Cyclacel Pharmaceuticals,

Inc.

Cyclacel is a clinical-stage,

biopharmaceutical company developing innovative cancer medicines

based on cell cycle, transcriptional regulation and mitosis

biology. The transcriptional regulation program is evaluating

fadraciclib, a CDK2/9 inhibitor, and the anti-mitotic program

CYC140, a PLK1 inhibitor, in patients with both solid tumors and

hematological malignancies. Cyclacel's strategy is to

build a diversified biopharmaceutical business based on a pipeline

of novel drug candidates addressing oncology and hematology

indications. For additional information, please

visit www.cyclacel.com.

Forward-looking Statements

This news release contains certain

forward-looking statements that involve risks and uncertainties

that could cause actual results to be materially different from

historical results or from any future results expressed or implied

by such forward-looking statements. Such forward-looking statements

include, among other things, statements related to the intended use

of proceeds from the private placement. Factors that may cause

actual results to differ materially include market and other

conditions, the risk that product candidates that appeared

promising in early research and clinical trials do not demonstrate

safety and/or efficacy in larger-scale or later clinical trials,

trials may have difficulty enrolling, Cyclacel may not

obtain approval to market its product candidates, the risks

associated with reliance on outside financing to meet capital

requirements, the risks associated with reliance on collaborative

partners for further clinical trials, development and

commercialization of product candidates and Cyclacel’s ability to

regain and maintain compliance with Nasdaq’s continued listing

requirements. You are urged to consider statements that include the

words "may," "will," "would," "could," "should," "believes,"

"estimates," "projects," "potential," "expects," "plans,"

"anticipates," "intends," "continues," "forecast," "designed,"

"goal," or the negative of those words or other comparable words to

be uncertain and forward-looking. For a further list and

description of the risks and uncertainties the Company faces,

please refer to our most recent Annual Report on Form 10-K and

other periodic and other filings we file with the Securities

and Exchange Commission and are available at www.sec.gov.

Such forward-looking statements are current only as of the date

they are made, and we assume no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts

|

Company: |

Paul McBarron, (908) 517-7330, pmcbarron@cyclacel.com |

|

Investor Relations: |

Grace Kim, IR@cyclacel.com |

© Copyright 2024 Cyclacel Pharmaceuticals, Inc. All

Rights Reserved. The Cyclacel logo and Cyclacel® are trademarks of

Cyclacel Pharmaceuticals, Inc.

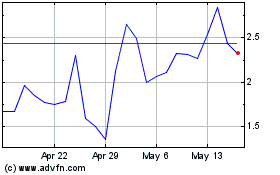

Cyclacel Pharmaceuticals (NASDAQ:CYCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cyclacel Pharmaceuticals (NASDAQ:CYCC)

Historical Stock Chart

From Jan 2024 to Jan 2025