As filed with the Securities and Exchange Commission on September 11, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALPHA TAU MEDICAL LTD.

(Exact Name of Registrant as Specified in its Charter)

| State of Israel |

|

7372 |

|

Not Applicable |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

Alpha Tau Medical Ltd.

Kiryat HaMada St. 5

Jerusalem, Israel 9777605

+972 (3) 577-4115

(Address, including zip code, and telephone

number, including area code, of Registrant’s principal executive offices)

Alpha Tau Medical, Inc.

1 Union Street 3rd Floor

Lawrence, MA 01840

(833) 455-3278

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Michael J. Rosenberg

Joshua G. Kiernan

Latham & Watkins LLP

99 Bishopsgate

London EC2M 3XF

United Kingdom

Tel: (+44) (20) 7710-1000 |

|

Shachar Hadar

Matthew Rudolph

Meitar | Law Offices

16 Abba Hillel Silver Rd.

Ramat Gan 5250608, Israel

Tel: +972 (3) 610-3100 |

Approximate date of commencement of proposed

sale to the public:

From time to time after the effectiveness of this

registration statement.

If only securities being registered on this Form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (the “SEC”),

acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED SEPTEMBER 11. 2023

PRELIMINARY

PROSPECTUS

1,100,000 ORDINARY

SHARES,

ALPHA TAU MEDICAL LTD.

This prospectus relates to the resale by the selling

shareholder named in this prospectus (collectively, the “Selling Shareholders”) from time to time of up to an aggregate of

1,100,000 ordinary shares, no par value per share (the “ordinary shares”) in amounts, at prices and on terms that will be

determined at the time of any such offering. The ordinary shares being registered for resale hereunder were acquired by the Selling Shareholders

pursuant to a Secondary Share Purchase Agreement, dated as of August 10, 2023 in a private transaction and we are registering the ordinary

shares for resale pursuant to an undertaking that we entered into as part of such private transaction.

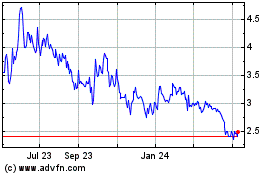

Our ordinary shares and warrants are listed on

the Nasdaq Stock Market LLC under the trading symbols “DRTS” and “DRTSW,” respectively. On September 1, 2023,

the closing prices for our ordinary shares and warrants on the Nasdaq Stock Market LLC were $3.59 per ordinary share and $0.3250 per warrant.

We will not receive any of the proceeds from the

sale of the ordinary shares by the Selling Shareholders. Any ordinary shares subject to resale hereunder will have been issued by us and

acquired by the Selling Shareholders prior to any resale of such shares pursuant to this prospectus.

The Selling Shareholders named in this prospectus

and any of their pledgees, assignees and successors-in-interest, may offer or resell the ordinary shares from time to time through public

or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices.

The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the ordinary shares. The Selling

Shareholders and Althera Medical Ltd., one of our large shareholders, will pay certain expenses associated with the registration of the

securities covered by this prospectus, as described in the section entitled “Plan of Distribution.”

For additional information on the methods of sale

that may be used by the Selling Shareholders, see “Plan of Distribution” beginning on page 9 of this prospectus.

We may amend or supplement this prospectus from

time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements

carefully before you make your investment decision.

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and are subject to reduced public company reporting requirements.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and other risk factors contained

in the documents incorporated by reference herein for a discussion of information that should be considered in connection with an investment

in our securities.

Neither the Securities and Exchange Commission,

the Israeli Securities Authority nor any state securities commission has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

2023.

TABLE OF CONTENTS

No one has been authorized to provide you with

information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof.

You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside the United States: We have

not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for

that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions

relating to this offering and the distribution of this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains

forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts

contained in this prospectus, including statements regarding our future financial position, business strategy and plans and objectives

of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology

such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “expect,” “predict,” “potential” or the negative of these

terms or other similar expressions. Forward-looking statements include, without limitation, our expectations concerning the outlook for

our business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future

market conditions or economic performance and developments in the capital and credit markets and expected future financial performance.

Forward-looking statements

involve a number of risks, uncertainties and assumptions, and actual results or events may differ materially from those projected or implied

in those statements. Important factors that could cause such differences include, but are not limited to:

| ● | We have incurred significant

losses since inception and have not generated any revenue to date. We expect to incur losses over the next several years and may not

be able to achieve or sustain revenues or profitability in the future; |

| ● | We may need substantial additional

funding, and if we are unable to raise capital when needed, we could be forced to delay, reduce or terminate the development of our Alpha

DaRT technology or other product discovery and development programs or commercialization efforts; |

| ● | Our limited operating history

may make it difficult for you to evaluate the success of our business to date and to assess our future viability; |

| ● | Our approach to the development

of our proprietary Alpha DaRT technology represents a novel approach to radiation therapy, which creates significant and potentially

unpredictable challenges for us; |

| ● | The commercial success of our

Alpha DaRT technology, if authorized or certified for commercial sale, will depend in part upon public perception of radiation therapies,

and to a lesser extent, radiopharmaceuticals, and the degree of their market acceptance by physicians, patients, healthcare payors and

others in the medical community; |

| ● | The market opportunities for

our Alpha DaRT technology may be smaller than we anticipated or may be limited to those patients who are ineligible for or have failed

prior treatments. If we encounter difficulties enrolling patients in our clinical trials, our clinical development activities could be

delayed or otherwise adversely affected; |

| ● | We do not currently engage

in commercial marketing activities or sales efforts and we have no experience in marketing our products. If we are unable to establish

marketing and sales capabilities or enter into agreements with third parties to market and sell our Alpha DaRT technology, if approved

or certified for commercial sale, we may not be able to generate product revenue; |

| ● | We currently conduct and in

the future intend to continue conducting pre-clinical studies, clinical trials for our Alpha DaRT technology outside the United States,

and the FDA and similar foreign regulatory authorities may not accept data from such trials; |

| ● | Our Alpha DaRT technology and

operations are subject to extensive government regulation and oversight both in the United States and abroad, and our failure to comply

with applicable requirements could harm our business; |

| ● | We may not receive, or may

be delayed in receiving, the necessary marketing authorizations or certifications for our Alpha DaRT technology or any future products

or product candidates, and failure to timely obtain necessary marketing authorizations or certifications for our product candidates would

have a material adverse effect on our business; |

| ● | If we do not obtain and maintain

international regulatory registrations, marketing authorizations or certifications for any product candidates we develop, we will be

unable to market and sell such product candidates outside of the United States; |

| ● | If in the future Alpha DaRT

is approved or certified for commercial sale, but we are unable to obtain adequate reimbursement or insurance coverage from third-party

payors, we may not be able to generate significant revenue; |

| ● | We may be unable to obtain

a sufficient or sufficiently pure supply of radioisotopes to support clinical development or at commercial scale; |

| ● | If we are unable to obtain

and maintain patent or other intellectual property protection for our Alpha DaRT technology and for any other products or product candidates

that we develop, or if the scope of the patent or other intellectual property protection obtained is not sufficiently broad, our competitors

could develop and commercialize products and technology similar or identical to ours, and our ability to commercialize any product candidates

we may develop, and our technology may be adversely affected; |

| ● | We are incurring increased

costs as a result of operating as a public company, and our management will devote substantial time to new compliance initiatives; and |

| ● | The other matters described

in the section titled “Risk Factors” beginning on page 6. |

We caution you against

placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information currently available as

of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this prospectus.

We undertake no obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs.

In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect

to that statement, related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions

and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant

risk factors, may appear in our public filings with the SEC, which are or will be (as appropriate) accessible at www.sec.gov, and which

you are advised to consult. For additional information, please see the section titled “Where You Can Find More Information; Incorporation

of Information by Reference” elsewhere in this prospectus.

Market, ranking and industry

data used throughout this prospectus, including statements regarding market size and technology adoption rates, is based on the good faith

estimates of our management, which in turn are based upon our management’s review of internal surveys, independent industry surveys

and publications including third party research and publicly available information. These data involve a number of assumptions and limitations,

and you are cautioned not to give undue weight to such estimates. While we are not aware of any misstatements regarding the industry data

presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed

under the heading “Risk Factors” in this prospectus and in and “Risk Factors” and “Operating

and Financial Review and Prospects” in our Annual Report on Form 20-F for the year ended December 31, 2022, as amended

(our “Annual Report”), incorporated by reference into this prospectus.

SUMMARY OF THE PROSPECTUS

This summary highlights,

and is qualified in its entirety by, the more detailed information included elsewhere in this prospectus. This summary does not contain

all of the information that may be important to you. You should read and carefully consider the entire prospectus, especially the “Risk

Factors” section of this prospectus and in our Annual Report, before deciding to invest in our ordinary shares. Unless the context

otherwise requires, we use the terms “company,” “we,” “us” and “our” in this prospectus

to refer to Alpha Tau Medical Ltd. and subsidiaries.

We are a clinical-stage

oncology therapeutics company focused on harnessing the innate relative biological effectiveness and short range of alpha particles for

use as a localized radiation therapy for solid tumors. Our proprietary Alpha DaRT technology is designed to utilize the specific therapeutic

properties of alpha particles while aiming to overcome, and even harness for potential benefit, the traditional shortcomings of alpha

radiation’s limited range. We believe that our Alpha DaRT technology has the potential to be broadly applicable across multiple

targets and tumor types. We have evaluated and continue to evaluate the feasibility, safety and efficacy of the Alpha DaRT technology

for the treatment of superficial lesions, i.e., tumors of the skin, head or neck, in multiple clinical trials conducted in clinical sites

around the world. In a first-in-human study of locally advanced and recurrent squamous cell carcinoma, or SCC, cancers of the skin and

head and neck, efficacy was evaluated in 28 tumors, and results showed that Alpha DaRT achieved 100% overall response rate and over 78%

complete response rate. The Alpha DaRT was generally well-tolerated, with limited local toxicity and no systemic toxicity. On the basis

of this clinical trial as well as some of our further clinical trials, we received marketing approval in Israel in August 2020 for the

treatment of SCC of the skin or oral cavity using the Alpha DaRT, and that marketing approval is currently in a renewal process. In June

2021, the FDA granted the Alpha DaRT Breakthrough Device Designation for the treatment of patients with SCC of the skin or oral cavity

without curative standard of care. In October 2021, the FDA granted the Alpha DaRT a second Breakthrough Device Designation, in treating

recurrent Glioblastoma Multiforme, or GBM, as an adjunct to standard medical therapies or as a standalone therapy after standard medical

therapies have been exhausted. In the second half of 2021, we treated ten patients in the U.S. in a multi-center pilot feasibility trial

conducted at Memorial Sloan Kettering Cancer Center and four other U.S. clinical sites, to explore the feasibility of delivering radiotherapy

for malignant skin and superficial soft tissue tumors using Alpha DaRT. The study met its primary feasibility endpoint, as all patients

had successful delivery of radiation by Alpha DaRT. At approximately 12 weeks and 24 weeks after treatment, all ten lesions treated demonstrated

a complete response to treatment, with no product-related serious adverse events observed. We are conducting a multi-center pivotal trial,

which we refer to as the ReSTART trial, to explore the delivery of radiotherapy for up to 86 patients with recurrent cutaneous squamous

cell carcinoma tumors using Alpha DaRT at up to 20 clinical sites around the United States and selected other clinical sites outside the

U.S. We anticipate completing recruitment of this trial in early 2024, and receiving results of the trial in 2024 for potential submission

to the FDA. If submitted and approved, we expect to commercialize our Alpha DaRT technology first in the United States before other markets,

including Israel, notwithstanding our existing marketing authorization in Israel (under which we have not yet commercialized the product).

We hold exclusive rights to our proprietary Alpha DaRT technology in our core markets, including the United States and Europe.

While local radiation

therapy has been a mainstay of cancer therapy for years, it has been mostly limited to modalities utilizing beta or gamma emissions, which

primarily destroy cells through an indirect mechanism relying on oxygen and the generation of free radicals to cause single-strand DNA

breaks. By contrast, alpha radiation has hundreds of times the linear energy transfer rate of beta-emitters. Additionally, alpha particles’

heavier mass and far shorter particle paths (less than 100 μm) relative to beta’s lighter mass and lengthier (up to 12 mm) path,

have been shown to destroy radioresistant cells in clinical studies – causing multiple, irreparable, double-strand DNA breaks and

other cellular damage upon direct impact – within a very short distance. Accordingly, we believe that alpha radiation has several

significant potential advantages for use in cancer radiotherapy, including a high relative biological efficiency (potentially enabling

it to destroy tumor cells with administration of lower levels of radiation), imperviousness to factors such as hypoxia, and a very well-defined

range of travel with limited collateral damage. Nonetheless, its use has also been limited precisely due to alpha’s extremely short

particle range in living tissue, as the range of less than 100 μm is insufficient to provide meaningful clinical utility.

The Alpha DaRT technology

employs a series of radioactive sources that are embedded with Radium-224 to enable a controlled, intratumoral release of alpha-emitting

atoms which diffuse and decay throughout the tumor, seeking to kill cancerous cells with localized precision, while penetrating deeper

into the tumor than can otherwise be reached by the limited ranges of the alpha particles themselves. Due to the inherent limited range

of the alpha particles, we believe that the Alpha DaRT technology has the potential to deliver powerful and localized precise killing

impact to the tumor without damage to surrounding healthy tissue. By combining the innate relative biological effectiveness and short

range of alpha particles in a single-use disposable form, we believe that the Alpha DaRT could address tumors that have otherwise demonstrated

poor response to radiation therapy or other standards of care, with the potential to apply to a wide range of tumors and clinical settings.

We evaluated the feasibility, safety and efficacy

of the Alpha DaRT technology in a first-in-human study of locally advanced and recurrent SCC cancers of the skin and head and neck, the

results of which were subsequently published in the International Journal for Radiation Oncology, Biology, Physics and which elicited

a positive editorial reaction in the same journal. Efficacy was evaluated in 28 tumors of the skin and head and neck, and results showed

that Alpha DaRT achieved a >78% complete response rate. The trial was conducted in an elderly (median age = 80.5 years) and largely

pre-treated patient population, with 42% of the target lesions, including non-evaluated lesions, having already received radiation therapy.

The Alpha DaRT was generally well-tolerated, with limited local toxicity and no systemic toxicity. Following these initial positive results,

we substantially expanded our clinical evaluations in later trials to a much wider patient population. Specifically, we initiated follow-on

studies at multiple clinical sites in Israel and around the world, to evaluate Alpha DaRT in cancers of the skin, superficial soft tissue,

or oral cavity, regardless of cell type, which includes SCC as well as basal cell carcinoma, melanoma, skin metastases, and others. In

the second half of 2021, we treated ten patients in the U.S. in a multi-center pilot feasibility trial conducted at Memorial Sloan Kettering

Cancer Center and four other U.S. clinical sites, to explore the feasibility of delivering radiotherapy for malignant skin and superficial

soft tissue tumors using Alpha DaRT. The study met its primary feasibility endpoint, as all patients had successful delivery of radiation

by Alpha DaRT. At approximately 12 weeks and 24 weeks after treatment, all ten lesions treated demonstrated a complete response to the

treatment, with no product-related serious adverse events observed. As of February 28, 2023, across our clinical trials involving superficial

lesions, i.e. tumors of the skin, head or neck, Alpha DaRTs have been administered to over 145 lesions, and in a pooled analysis evaluating

those lesions that reached the evaluation endpoint per the treatment protocol of the applicable clinical trial, we have observed an overall

response rate of 97%, including a complete response rate of 78%. In August 2023, we announced that in a pooled analysis of longer term

data from 71 patients from four feasibility trials involving 81 superficial lesions, we observed an 89% complete response rate, a two-year

local recurrence-free survival rate of 77%, and no grade 2 or higher late toxicities observed six months or more after treatment. The

supportive data from these first trials also led to the U.S. Food and Drug Administration, or FDA, granting Breakthrough Device Designation

to the Alpha DaRT for the treatment of patients with SCC of the skin or oral cavity without curative standard of care.

In parallel, we are pursuing a similar approach

towards seeking FDA marketing authorization for other uses for the Alpha DaRT technology in other indications by conducting feasibility

studies and then generating potentially registrational data in other indications, such as breast, pancreas and prostate cancers, or applications

such as combinations with immunotherapies.

We have engaged with a number of prestigious medical

and educational institutions and, as of March 1, 2023, have ten clinical studies ongoing worldwide across these two parallel strategies,

of generating data in superficial tumors as well as conducting studies in other indications.

Additionally, in our pre-clinical studies, we

evaluated the Alpha DaRT on 19 tumor models (both human and mouse). Alpha DaRT sources were observed to have killed multiple types of

mouse and human tumors in vivo. The intensity of the killing activity varied between tumor types, and was dependent on the ability of

the radioactive atoms to diffuse inside the tumor and on the intrinsic sensitivity of the tissue to DNA damage induced by the radiation,

but all tumor types showed responsiveness to Alpha DaRT, i.e., there was no observed resistance. We therefore believe that our technology

may potentially be relevant for treatment across a broad range of tumors. We are currently focused on developing the Alpha DaRT for use

in a number of potential applications, particularly in refractory or unresectable localized tumors which are not being adequately addressed

by standard of care, tumor types with a high unmet need (such as pancreatic adenocarcinoma or glioblastoma multiforme), and metastatic

tumors in combination with systemic therapies such as checkpoint inhibitors. We are also investigating the potential of the Alpha DaRT

to elicit an immune response as observed in previous pre-clinical data, as well as anecdotal evidence of response from untreated tumors,

or abscopal effects, which may have the potential to inhibit or even reduce metastases.

The Company was founded in November 2015 by Uzi

Sofer, our Chief Executive Officer and Chairman, along with the inventors of the Alpha DaRT technology including Professor Itzhak Kelson

and Professor Yona Keisari of Tel Aviv University, our Chief Physics Officer and Chief Scientific Officer, respectively. Together, they

founded Alpha Tau with the goal of bringing this innovative technology out of the laboratory and into patients, in order to bring hope

to cancer patients around the world.

The main address of our principal executive offices

is Kiryat HaMada St. 5, Jerusalem, Israel 9777605 and its telephone number is +972 (3) 577-4115.

Secondary Share Purchase Agreement

On August 10, 2023, Althera Medical Ltd. (“Althera”), one

of our large shareholders, entered into a Secondary Share Purchase Agreement (the “Secondary Purchase Agreement”) with Deep

Insight Limited Partnership (“Deep Insight”), pursuant to which Althera sold and Deep Insight purchased 1,100,000 of our ordinary

shares (the “Purchased Shares”) in a privately negotiated transaction.

In connection with the Secondary Purchase Agreement, we entered into

an undertaking with each of Althera and Deep Insight, pursuant to which we agreed to register the Purchased Shares for resale within 60

days of the date of the Secondary Purchase Agreement and to keep such registration statement effective until the earlier of (i) the date

that all of the Purchased Shares have been sold by Deep Insight or (ii) such time as SEC Rule 144 or another similar exemption under the

Securities Act of 1933, as amended, is available for the sale of all of the Purchased Shares without limitation during a three-month period

without registration (the “Rule 144 Period”), provided however, if at any time during a Rule 144 Period (but prior to the

Final Expiration Date) we have another similar resale registration statement effective for other shareholders, then we shall also keep

this registration statement for Deep Insight effective; or (iii) three years following the effective date of this registration statement

(the “Final Expiration Date”).

Implications of Being

an Emerging Growth Company and a Foreign Private Issuer

We qualify as an “emerging

growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An emerging

growth company may take advantage of specified exemptions from various requirements that are otherwise applicable generally to U.S. public

companies. These provisions include:

| ● | an exemption that allows the

inclusion in an initial public offering registration statement of only two years of audited financial statements and selected financial

data and only two years of related disclosure; |

| ● | reduced executive compensation

disclosure; |

| ● | exemptions from the requirements

of holding a non-binding advisory vote on executive compensation and any golden parachute payments not previously approved; |

| ● | an exemption from compliance

with the requirement of the Public Company Accounting Oversight Board regarding the communication of critical audit matters in the auditor’s

report on the financial statements; and |

| ● | an exemption from the auditor

attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) in the assessment

of the emerging growth company’s internal control over financial reporting. |

The JOBS Act also permits

an emerging growth company such as us to delay adopting new or revised accounting standards until such time as those standards are applicable

to private companies. We have elected to use this extended transition period to enable us to comply with certain new or revised accounting

standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer

an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act.

As a result, our financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as

of public company effective dates. We may choose to take advantage of some but not all of these reduced reporting burdens.

We will remain an emerging

growth company until the earliest of:

| ● | the last day of our fiscal year

during which we have total annual revenue of at least $1.235 billion; |

| ● | the last day of our fiscal year

following the fifth anniversary of the closing of the Business Combination; |

| ● | the date on which we have,

during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or |

| ● | the date on which we are deemed

to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

which would occur if the market value of our Class A ordinary shares that are held by non-affiliates exceeds $700 million as of

the last business day of our most recently completed second fiscal quarter. |

In addition, we report

under the Exchange Act as a “foreign private issuer.” As a foreign private issuer, we may take advantage of certain provisions

under the rules that allow us to follow Israeli law for certain corporate governance matters. Even after we no longer qualify as

an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions

of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange

Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange

Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from

trades made in a short period of time; |

| ● | the rules under the Exchange

Act requiring the filing with the U.S. Securities and Exchange Commission (the “SEC”) of quarterly reports on Form 10-Q

containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified

significant events; and |

| ● | Regulation Fair Disclosure

(“Regulation FD”), which regulates selective disclosures of material information by issuers. |

Foreign private issuers,

like emerging growth companies, also are exempt from certain more stringent executive compensation disclosure rules. Thus, if we remain

a foreign private issuer, even if we no longer qualify as an emerging growth company, we will continue to be exempt from the more stringent

compensation disclosures required of public companies that are neither an emerging growth company nor a foreign private issuer.

We may take advantage

of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign

private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time

as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

| ● | the majority of our executive

officers or directors are U.S. citizens or residents; |

| ● | more than 50% of our assets

are located in the United States; or |

| ● | our business is administered

principally in the United States. |

THE OFFERING

| Securities that may be offered and sold from time to time by the Selling Shareholders |

|

Up to 1,100,000 ordinary shares. |

| |

|

|

| Offering prices of the ordinary shares |

|

The securities offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Shareholders may determine. See “Plan of Distribution.” |

| |

|

|

| Ordinary shares issued and outstanding |

|

69,401,067 ordinary shares (as of August 31, 2023). |

| |

|

|

| Use of proceeds |

|

All of the shared offered by the Selling Shareholders pursuant to this prospectus will be sold by the Selling Shareholders for their respective accounts. We will not receive any of the proceeds from these sales. |

| |

|

|

| Dividend Policy |

|

We have never declared or paid any cash dividend on our ordinary shares. We currently intend to retain any future earnings and do not expect to pay any dividends in the foreseeable future. Any further determination to pay dividends on our ordinary shares would be at the discretion of our board of directors, subject to applicable laws, and would depend on our financial condition. |

| |

|

|

| Market for our ordinary shares and warrants |

|

Our ordinary shares and warrants are listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the trading symbols “DRTS” and “DRTSW,” respectively. |

| |

|

|

| Risk factors |

|

Prospective investors should carefully consider the

“Risk Factors” on page 6 for a discussion of certain factors that should be considered before buying the

securities offered hereby. |

RISK FACTORS

You should carefully consider the risks described

below and the risks described in the documents incorporated by reference herein, including our Annual Report, as well as the other information

included in this prospectus or incorporated by reference in this prospectus before you decide to buy our securities. The risks and uncertainties

described below are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we

currently deem to be immaterial. Any of the risks described below, and any such additional risks, could materially adversely affect our

business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks Related to this Offering

Sales of a substantial number of our securities in the public

market by the Selling Shareholders and/or by our existing securityholders could cause the price of our ordinary shares to fall.

The Selling Shareholders can sell, under this

prospectus, up to 1,100,000 ordinary shares constituting approximately 1.6% of our issued and outstanding ordinary shares as of August

31, 2023. Sales of a substantial number of ordinary shares in the public market by the Selling Shareholders and/or by our other existing

securityholders, or the perception that those sales might occur, could depress the market price of our ordinary shares and could impair

our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that such sales may

have on the prevailing market price of our ordinary shares.

CAPITALIZATION

The following table sets forth our cash and cash

equivalents and total capitalization on an actual basis as of June 30, 2023. The information in this table should be read in conjunction

with the financial statements and notes thereto and other financial information included in this prospectus, any prospectus supplement

or incorporated by reference in this prospectus. Our historical results do not necessarily indicate our expected results for any future

periods.

| | |

As of

June 30,

2023 | |

| | |

(in thousands) | |

| Cash and cash equivalents | |

$ | 855 | |

| Restricted cash and short-term deposits | |

| 93,506 | |

| Warrant liability | |

| 7,794 | |

| Ordinary shares, no par value; 362,116,800 shares authorized; 69,373,135 issued and outstanding, actual | |

| — | |

| Additional paid-in capital | |

| 196,045 | |

| Accumulated (deficit) | |

| (103,482 | ) |

| Total shareholders’ equity (deficiency) | |

| 92,563 | |

| Total capitalization | |

$ | 92,563 | |

USE OF PROCEEDS

All of the ordinary shares

offered by the Selling Shareholders pursuant to this prospectus will be sold by the Selling Shareholders for their respective accounts.

We will not receive any of the proceeds from these sales. All net proceeds from the sale of the ordinary shares covered by this prospectus

will go to the Selling Shareholders.

SELLING SHAREHOLDERS

This prospectus relates

to the possible resale by the Selling Shareholders of up to 1,100,000 ordinary shares by the Selling Securityholders.

The Selling Shareholders

may from time to time offer and sell any or all of the ordinary shares set forth below pursuant to this prospectus. In this prospectus,

the term “Selling Securityholders” includes (i) the entities identified in the table below (as such table may be amended

from time to time by means of an amendment to the registration statement of which this prospectus forms a part or by a supplement to this

prospectus) and (ii) any donees, pledgees, transferees or other successors-in-interest that acquire any of the securities covered

by this prospectus after the date of this prospectus from the named Selling Shareholders as a gift, pledge, partnership distribution or

other non-sale related transfer.

The table below sets

forth, as of the date of this prospectus, the name of the Selling Shareholders for which we are registering ordinary shares for resale

to the public, and the aggregate principal amount that the Selling Shareholders may offer pursuant to this prospectus. In accordance with

SEC rules, individuals and entities below are shown as having beneficial ownership over shares they own or have the right to acquire within

60 days, as well as shares for which they have the right to vote or dispose of such shares.

The percentage of ordinary

shares beneficially owned after the offering is based on 69,401,067 ordinary shares outstanding as of August 31, 2023. Also in accordance

with SEC rules, for purposes of calculating percentages of beneficial ownership, shares which a person has the right to acquire within

60 days of August 31, 2023 are included both in that person’s beneficial ownership as well as in the total number of shares

issued and outstanding used to calculate that person’s percentage ownership but not for purposes of calculating the percentage

for other persons. In some cases, the same ordinary shares are reflected more than once in the table below because more than one holder

may be deemed the beneficial owner of the same ordinary shares.

We cannot advise you

as to whether the Selling Shareholders will in fact sell any or all of such securities. In addition, the Selling Shareholders may sell,

transfer or otherwise dispose of, at any time and from time to time, the ordinary shares in transactions exempt from the registration

requirements of the Securities Act after the date of this prospectus, subject to applicable law.

Selling Securityholder

information for each additional Selling Securityholder, if any, will be set forth by prospectus supplement to the extent required prior

to the time of any offer or sale of such Selling Securityholder’s securities pursuant to this prospectus. Any prospectus supplement

may add, update, substitute, or change the information contained in this prospectus, including the identity of each Selling Securityholder

and the number of ordinary shares registered on its behalf. A Selling Securityholder may sell all, some or none of such securities in

this offering. See “Plan of Distribution.”

The information in the table below is based upon

information provided by the Selling Securityholders. The securities owned by the Selling Shareholders named below do not have voting rights

different from the securities owned by other securityholders.

| | |

| | |

| | |

| | |

Percentage of | |

| | |

| | |

| | |

| | |

Outstanding | |

| | |

Number of | | |

Number of | | |

Number of | | |

Ordinary Shares | |

| | |

Ordinary | | |

Ordinary Shares | | |

Ordinary Shares | | |

Owned After | |

| Name of Selling Security holders | |

Shares | | |

Being Offered(1) | | |

After Offering | | |

Offering | |

| Deep Insight Limited Partnership | |

| 1,100,000 | | |

| 1,100,000 | | |

| — | | |

| — | |

| (1) | The amounts set forth in this

column are the number of ordinary shares that may be offered by such Selling Securityholder using this prospectus. These amounts do not

represent any other of our ordinary shares that the Selling Securityholder may own beneficially or otherwise. |

| (2) | The shares are directly held by

Deep Insight Limited Partnership, an Israeli limited partnership (“Deep Insight”). Deep Insight Fund GP Limited Partnership,

an Israeli limited partnership (“Deep Insight GP LP”), is the sole general partner of Deep Insight, Deep Insight GP Ltd.,

an Israeli private company (“Deep Insight GP Company”), is the sole general partner of Deep Insight GP LP. The shares may

be deemed to be indirectly beneficially owned by (i) Deep Insight Fund GP LP, (ii) Deep Insight GP Company, (iii) Barak Ben Eliezer,

as holder of 50% of the outstanding shares of Deep Insight GP Company and managing partner of Deep Insight GP LP and (iv) Eyal Kishon,

as holder of 50% of the outstanding shares of Deep Insight GP Company and chairman of the board of directors of Deep Insight GP LP. Each

of Barak Ben Elizer and Eyal Kishon disclaims beneficial ownership over these shares. The address of Deep Insight is 3 Arik Einstein

St., Herzliya, Israel. |

PLAN OF DISTRIBUTION

The Selling Securityholders, which as used herein

includes donees, pledgees, transferees or other successors-in-interest selling ordinary shares or interests in ordinary shares received

after the date of this prospectus from a Selling Securityholder as a gift, pledge, partnership distribution or other transfer, may, from

time to time, sell, transfer or otherwise dispose of any or all of their ordinary shares or interests in ordinary shares on any stock

exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices,

at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the

time of sale, or at negotiated prices.

The Selling Shareholders may use any one or more

of the following methods when disposing of shares or interests therein:

| ● | ordinary brokerage transactions

and transactions in which the broker-dealer solicits purchasers; |

| ● | block trades in which the broker-dealer

will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer

as principal and resale by the broker-dealer for their account; |

| ● | an exchange distribution in

accordance with the rules of the applicable exchange; |

| ● | privately negotiated transactions; |

| ● | short sales effected after

the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| ● | through the writing or settlement

of options or other hedging transactions, whether through an options exchange or otherwise; |

| ● | broker-dealers may agree with

the Selling Shareholders to sell a specified number of such shares at a stipulated price per share; |

| ● | a combination of any such methods

of sale; and |

| ● | any other method permitted

by applicable law. |

The Selling Shareholders

may, from time to time, pledge or grant a security interest in some or all of the ordinary shares owned by them and, if they default

in the performance of their secured obligations, the pledgees or secured parties may offer and sell the ordinary shares, from time

to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the

Securities Act amending the list of Selling Shareholders to include the pledgee, transferee or other successors in interest as

Selling Shareholders under this prospectus. The Selling Shareholders also may transfer the ordinary shares in other circumstances,

in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this

prospectus.

In connection with the sale of our ordinary shares

or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the ordinary shares in the course of hedging the positions they assume. The Selling Shareholders

may also sell our ordinary shares short and deliver these securities to close out their short positions, or loan or pledge the ordinary

shares to broker-dealers that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions

with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to

such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Each of the Selling Shareholders reserves the

right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of ordinary shares

to be made directly or through agents. We will not receive any of the proceeds from this offering.

The Selling Shareholders and any underwriters,

broker-dealers or agents that participate in the sale of the ordinary shares or interests therein may be “underwriters” within

the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares

may be underwriting discounts and commissions under the Securities Act. Selling Shareholders who are “underwriters” within

the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

In addition, a Selling Securityholder that is

an entity may elect to make a pro rata in-kind distribution of securities to its members, partners or stockholders pursuant to the registration

statement of which this prospectus is a part by delivering a prospectus with a plan of distribution. Such members, partners or stockholders

would thereby receive freely tradeable securities pursuant to the distribution through a registration statement.

To the extent required, the ordinary shares to

be sold, the names of the Selling Securityholders, the respective purchase prices and public offering prices, the names of any agents,

dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying

prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of

some states, if applicable, the ordinary shares may be sold in these jurisdictions only through registered or licensed brokers or dealers.

In addition, in some states the ordinary shares may not be sold unless they have been registered or qualified for sale or an exemption

from registration or qualification requirements is available and is complied with.

We have advised the Selling Shareholders that

the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of

the Selling Shareholders and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may

be supplemented or amended from time to time) available to the Selling Shareholders for the purpose of satisfying the prospectus delivery

requirements of the Securities Act. The Selling Shareholders may indemnify any broker-dealer that participates in transactions involving

the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

The Selling Shareholders and Althera Medical Ltd.,

one of our large shareholders (“Althera”), will pay certain expenses associated with the registration of the shares covered

by this prospectus as agreed in the Secondary Share Purchase Agreement, dated August 10, 2023 pursuant to which the Selling Shareholders

acquired the shares offered for resale hereunder from Althera in a private transaction. We have agreed to indemnify the Selling Shareholders

against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares

offered by this prospectus.

We have agreed with the Selling Shareholders to

keep the registration statement of which this prospectus constitutes a part effective until (i) all of the shares covered by this prospectus

have been disposed of pursuant to and in accordance with the registration statement or the securities have been withdrawn; (ii) such time

as SEC Rule 144 or another similar exemption under the Securities Act of 1933, as amended, is available for the sale of all of the shares

covered by this prospectus without limitation during the Rule 144 Period, provided however, if at any time during a Rule 144 Period (but

prior to the Final Expiration Date) we have another similar resale registration statement effective for other shareholders, then we shall

also keep this registration statement for the Selling Shareholders effective; or (iii) three years following the effective date of this

registration statement (the “Final Expiration Date”).

In compliance with the guidelines of the Financial

Industry Regulatory Authority (“FINRA”), the aggregate maximum discount, commission, fees or other items constituting underwriting

compensation to be received by any FINRA member or independent broker-dealer will not exceed 8% of the gross proceeds of any offering

pursuant to this prospectus and any applicable prospectus supplement.

LEGAL MATTERS

The legality of the ordinary shares offered by

this prospectus and certain other Israeli legal matters will be passed upon for Alpha Tau by Meitar | Law Offices, Ramat Gan, Israel.

Certain legal matters with respect to U.S. federal securities law and New York law will be passed upon for Alpha Tau by Latham &

Watkins LLP, New York, New York. Meitar | Law Offices and certain attorneys affiliated with the firm own less than 1% of Alpha Tau’s

ordinary shares. Latham & Watkins LLP and certain attorneys and investment funds affiliated with the firm own less than 1% of

Alpha Tau’s ordinary shares.

EXPERTS

The consolidated financial statements of Alpha

Tau Medical Ltd. at December 31, 2022 and 2021, and for each of the three years in the period ended December 31, 2022

incorporated by reference into this prospectus and Registration Statement have been so incorporated in reliance on the report of Kost,

Forer, Gabbay & Kasierer, a member of Ernst & Young Global, independent registered public accounting firm, given on

the authority of said firm as experts in auditing and accounting. The current address of Kost, Forer, Gabbay & Kasierer is 144

Menachem Begin Road, Building A, Tel Aviv 6492102, Israel.

ENFORCEABILITY OF CIVIL LIABILITIES

Service of process upon us and upon our directors

and officers and the Israeli experts named in this prospectus, most of whom reside outside the United States, may be difficult to obtain

within the United States. Furthermore, because substantially all of our assets and substantially all of our directors and officers are

located outside the United States, any judgment obtained in the United States against us or any of our directors and officers may not

be collectible within the United States.

We have been informed by our legal counsel in

Israel, Meitar | Law Offices, our legal counsel in Israel that it may be difficult to assert U.S. securities laws claims in original actions

instituted in Israel. Israeli courts may refuse to hear a claim based on a violation of U.S. securities laws because Israel is not the

most appropriate forum in which to bring such a claim. In addition, even if an Israeli court agrees to hear a claim, it may determine

that Israeli law and not U.S. law is applicable to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law

must be proven as a fact which can be a time-consuming and costly process. Matters of procedure will also be governed by Israeli law.

We have irrevocably appointed Alpha Tau Medical

Inc., as our agent to receive service of process in any action against us in any U.S. federal or state court arising out of this offering

or any purchase or sale of securities in connection with this offering. Subject to specified time limitations and legal procedures, Israeli

courts may enforce a U.S. judgment in a civil matter which is non-appealable, including a judgment based upon the civil liability provisions

of the Securities Act or the Exchange Act and including a monetary or compensatory judgment in a non-civil matter, provided that, among

other things:

| ● | the judgment was rendered by

a court of competent jurisdiction, according to the laws of the state in which the judgment is given; |

| ● | the judgment is enforceable

according to the laws of Israel and according to the law of the foreign state in which the relief was granted; and |

| ● | the judgment is not contrary

to public policy of Israel. |

Even if such conditions are met, an Israeli court

may not declare a foreign civil judgment enforceable if:

| ● | the prevailing law of the foreign

state in which the judgment is rendered does not allow for the enforcement of judgments of Israeli courts (subject to exceptional cases); |

| ● | the defendant did not have

a reasonable opportunity to be heard and to present his or her evidence, in the opinion of the Israeli court; |

| ● | the enforcement of the civil

liabilities set forth in the judgment is likely to impair the security or sovereignty of Israel; |

| ● | the judgment was obtained by

fraud; |

| ● | the judgment was rendered by

a court not competent to render it according to the rules of private international law prevailing in Israel; |

| ● | the judgment conflicts with

any other valid judgment in the same matter between the same parties; or |

| ● | an action between the same

parties in the same matter was pending in any Israeli court or tribunal at the time at which the lawsuit was instituted in the foreign

court. |

If a foreign judgment is enforced by an Israeli

court, it generally will be payable in Israeli currency, which can then be converted into non-Israeli currency and transferred out of

Israel. The usual practice in an action before an Israeli court to recover an amount in a non-Israeli currency is for the Israeli court

to issue a judgment for the equivalent amount in Israeli currency at the rate of exchange in force on the date of the judgment, but the

judgment debtor may make payment in foreign currency. Pending collection, the amount of the judgment of an Israeli court stated in Israeli

currency ordinarily will be linked to the Israeli consumer price index plus interest at the annual statutory rate set by Israeli regulations

prevailing at the time. Judgment creditors must bear the risk of unfavorable exchange rates.”

AUTHORIZED REPRESENTATIVE

Our authorized representative in the United States

for this offering as required pursuant to Section 6(a) of the Securities Act is Alpha Tau Medical, Inc., 1 Union Street 3rd Floor, Lawrence,

MA 01840.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION

OF INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference

the information we file with them, which means that we can disclose important information to you by referring you to those documents.

The information incorporated by reference is considered to be part of this registration statement, and later information filed with the

SEC will update and supersede this information. We hereby incorporate by reference into this registration statement the following documents

previously filed with the SEC:

| ● | the Company’s Annual Report on Form 20-F for the year

ended December 31, 2022 filed with the SEC on March 9, 2023 and Annual Report on Form 20-F/A for the year ended December 31,

2022 filed with the SEC on March 23, 2023; |

| ● | the description of the Company’s ordinary shares contained

in the Company’s registration statement on Form 8-A (File No. 001-41316), filed with the SEC on March 7, 2022, including

any amendments or reports filed for the purpose of updating such description; and |

| ● | the Company’s Report on Form 6-K furnished with the

SEC on August 28, 2023, containing the Company’s Interim Consolidated Financial Statements as of June 30, 2023 and Operating Results

and Financial Review in connection with the Interim Consolidated Financial Statements for the six months ended June 30, 2023. |

We have filed a registration statement on Form F-3

to register the issuance and the resale of the securities described elsewhere in this prospectus. This prospectus is a part of that registration

statement. As permitted by SEC rules, this prospectus does not contain all of the information included in the registration statement and

the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement and the exhibits and schedules

for more information about us and our securities.

Information and statements contained in this prospectus

or any annex to this prospectus are qualified in all respects by reference to the copy of the relevant contract or other annex filed as

an exhibit to the registration statement of which this prospectus forms a part.

Statements made in this prospectus concerning

the contents of any contract, agreement or other document are not complete descriptions of all terms of these documents. If a document

has been filed as an exhibit to the registration statement, we refer you to the copy of the document that has been filed for a complete

description of its terms. Each statement in this prospectus relating to a document filed as an exhibit is qualified in all respects by

the filed exhibit. You should read this prospectus and the documents that we have filed as exhibits to the registration statement of which

this prospectus is a part in their entirety.

We are subject to the informational requirements

of the Exchange Act. Accordingly, we will be required to file reports and other information with the SEC, including annual reports on

Form 20-F and reports on Form 6-K. The SEC maintains an internet website that contains reports and other information about issuers,

like us, that file electronically with the SEC. The address of that website is www.sec.gov.

We are a “foreign private issuer”

as defined in Rule 3b-4 under the Securities Exchange Act of 1934, or the Exchange Act. As a result, our proxy solicitations are

not subject to the disclosure and procedural requirements of Regulation 14A under the Exchange Act and transactions in our equity securities

by our officers and directors are exempt from Section 16 of the Exchange Act. In addition, we are not required under the Exchange

Act to file periodic reports and financial statements as frequently or as promptly as U.S. companies whose securities are registered under

the Exchange Act. We publish annually an annual report filed on Form 20-F containing financial statements that have been examined

and reported on, with an opinion expressed by, a registered public accounting firm. We prepare our annual financial statements in United

States dollars and in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. If there is any inconsistency

between the information in this prospectus and in any post-effective amendment to the Form F-1 of which this prospectus is a part,

or in any prospectus supplement, you should rely on the information in the post-effective amendment or prospectus supplement, as relevant.

You should read this prospectus and any post-effective amendment or prospectus supplement together with the additional information contained

in documents listed above under the heading “Where You Can Find More Information; Incorporation of Information by Reference.”

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us, the securities offered under this prospectus, and our other outstanding securities. The registration statement, including the

exhibits, can be read at the SEC’s website or at the SEC’s offices mentioned above under “Where You Can Find More Information;

Incorporation of Information by Reference.”

We will provide to each person, including any

beneficial owner, to whom this prospectus is delivered, a copy of any or all the information that has been incorporated by reference in

this prospectus but not delivered with this prospectus (and any exhibits specifically incorporated in such information), at no cost, upon

written or oral request to us at the following address:

Alpha Tau Medical Ltd.

Attention: VP Legal

Kiryat HaMada St. 5

Jerusalem

9777605

Israel

You may also obtain information about us by visiting

our website at www.innoviz-tech.com. Information contained in our website is not part of this prospectus.

We have not authorized anyone to give any information

or make any representation about their companies that is different from, or in addition to, that contained in this prospectus or in any

of the materials that have been incorporated in this prospectus. Therefore, if anyone does give you information of this sort, you should

not rely on it. If you are in a jurisdiction where offers to exchange or sell, or solicitations of offers to exchange or purchase, the

securities offered by this prospectus or the solicitation of proxies is unlawful, or if you are a person to whom it is unlawful to direct

these types of activities, then the offer presented in this prospectus does not extend to you. The information contained in this prospectus

speaks only as of the date of this prospectus unless the information specifically indicates that another date applies. You should read

all information supplementing this prospectus.

PART II

INFORMATION NOT REQUIRED

IN PROSPECTUS

Item 8. Indemnification of Directors and Officers

Under the Companies Law, a company may not exculpate

an office holder from liability for a breach of the fiduciary duty. An Israeli company may exculpate an office holder in advance from

liability to the company, in whole or in part, for damages caused to the company as a result of a breach of duty of care but only if a

provision authorizing such exculpation is included in its articles of association. Our amended and restated articles of association include

such a provision. The company may not exculpate in advance a director from liability arising due to the breach of his or her duty of care

in the event of a prohibited dividend or distribution to shareholders.

Under the Companies Law and the Israeli Securities

Law, 5728-1968 (the “Securities Law”) a company may indemnify an office holder in respect of the following liabilities, payments

and expenses incurred for acts performed by him or her as an office holder, either in advance of an event or following an event, provided

its articles of association include a provision authorizing such indemnification:

| ● | a monetary liability incurred

by or imposed on the office holder in favor of another person pursuant to a court judgment, including pursuant to a settlement confirmed

as judgment or arbitrator’s decision approved by a competent court. However, if an undertaking to indemnify an office holder with

respect to such liability is provided in advance, then such an undertaking must be limited to events which, in the opinion of the board

of directors, can be foreseen based on the company’s activities when the undertaking to indemnify is given, and to an amount or

according to criteria determined by the board of directors as reasonable under the circumstances, and such undertaking shall detail the

abovementioned foreseen events and amount or criteria; |

| ● | reasonable litigation expenses,

including reasonable attorneys’ fees, which were incurred by the office holder as a result of an investigation or proceeding filed

against the office holder by an authority authorized to conduct such investigation or proceeding, provided that such investigation or

proceeding was either (i) concluded without the filing of an indictment against such office holder and without the imposition on him

of any monetary obligation in lieu of a criminal proceeding; (ii) concluded without the filing of an indictment against the office holder

but with the imposition of a monetary obligation on the office holder in lieu of criminal proceedings for an offense that does not require

proof of criminal intent; or (iii) in connection with a monetary sanction; |

| ● | a monetary liability imposed

on the office holder in favor of a payment for a breach offended at an Administrative Procedure (as defined below) as set forth in Section

52(54)(a)(1)(a) to the Securities Law; |

| ● | expenses expended by the office

holder with respect to an Administrative Procedure under the Securities Law, including reasonable litigation expenses and reasonable

attorneys’ fees; |

| ● | reasonable litigation expenses,

including attorneys’ fees, incurred by the office holder or which were imposed on the office holder by a court (i) in a proceeding

instituted against him or her by the company, on its behalf, or by a third party, (ii) in connection with criminal indictment of which

the office holder was acquitted, or (iii) in a criminal indictment which the office holder was convicted of an offense that does not

require proof of criminal intent; and |

| ● | any other obligation or expense

in respect of which it is permitted or will be permitted under applicable law to indemnify an office holder, including, without limitation,

matters referenced in Section 56H(b)(1) of the Securities Law. |

An “Administrative Procedure” is defined

as a procedure pursuant to chapters H3 (Monetary Sanction by the Israeli Securities Authority), H4 (Administrative Enforcement Procedures

of the Administrative Enforcement Committee) or I1 (Arrangement to prevent Procedures or Interruption of procedures subject to conditions)

to the Securities Law.

Under the Companies Law and the Securities Law,

a company may insure an office holder against the following liabilities incurred for acts performed by him or her as an office holder

if and to the extent provided in the company’s articles of association:

| ● | a breach of the fiduciary duty

to the company, provided that the office holder acted in good faith and had a reasonable basis to believe that the act would not harm

the company; |

| ● | a breach of duty of care to

the company or to a third party, to the extent such a breach arises out of the negligent conduct of the office holder; |

| ● | a monetary liability imposed

on the office holder in favor of a third party; |

| ● | a monetary liability imposed

on the office holder in favor of an injured party at an Administrative Procedure pursuant to Section 52(54)(a)(1)(a) of the Securities

Law; and |

| ● | expenses incurred by an office

holder in connection with an Administrative Procedure, including reasonable litigation expenses and reasonable attorneys’ fees. |

Under the Companies Law, a company may not indemnify,

exculpate or insure an office holder against any of the following:

| ● | a breach of the fiduciary duty,

except for indemnification and insurance for a breach of the fiduciary duty to the company to the extent that the office holder acted

in good faith and had a reasonable basis to believe that the act would not prejudice the company; |

| ● | a breach of duty of care committed

intentionally or recklessly, excluding a breach arising out of the negligent conduct of the office holder; |

| ● | an act or omission committed

with intent to derive illegal personal benefit; or |

| ● | a fine or forfeit levied against

the office holder. |

Under the Companies Law, exculpation, indemnification

and insurance of office holders must be approved by the compensation committee and the board of directors and, with respect to directors

or controlling shareholders, their relatives and third parties in which controlling shareholders have a personal interest, also by the

shareholders.

Our amended and restated articles of association

permit us to exculpate, indemnify and insure our office holders to the fullest extent permitted or to be permitted by law. Our office

holders are currently covered by a directors’ and officers’ liability insurance policy. As of the date of this registration

statement, no claims for directors’ and officers’ liability insurance have been filed under this policy and we are not aware

of any pending or threatened litigation or proceeding involving any of our office holders, including our directors, in which indemnification

is sought.

We have entered into agreements with each of our

current office holders exculpating them from a breach of their duty of care to us to the fullest extent permitted by law, subject to limited

exceptions, and undertaking to indemnify them to the fullest extent permitted by law, subject to limited exceptions, including, with respect

to liabilities resulting from this offering, to the extent that these liabilities are not covered by insurance. This indemnification is

limited, with respect to any monetary liability imposed in favor of a third party, to events determined as foreseeable by the board of

directors based on our activities. The maximum aggregate amount of indemnification that we may pay to our office holders based on such

indemnification agreement is the greater of (1) 25% of our shareholders’ equity pursuant to our audited consolidated financial statements

for the year preceding the year in which the event in connection of which indemnification is sought occurred, and (2) $40 million (as

may be increased from time to time by shareholders’ approval). Such indemnification is in addition to any insurance amounts. Each

office holder who agrees to receive this letter of indemnification also gives his approval to the termination of all previous letters

of indemnification that we have provided to him or her in the past, if any. However, in the opinion of the SEC, indemnification of office

holders for liabilities arising under the Securities Act is against public policy and therefore unenforceable.

Item 9. Exhibits

The Exhibit Index is hereby incorporated

herein by reference.

Item 10. Undertakings

| (a) | The undersigned registrant hereby

undertakes: |

| (1) | To file, during any period

in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required

by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus

any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the