0001807120false00018071202024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 08, 2024 |

Design Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40288 |

82-3929248 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

6005 Hidden Valley Road Suite 110 |

|

Carlsbad, California |

|

92011 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 293-4900 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

DSGN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

On May 8, 2024, Design Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the three months ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item and the exhibit attached hereto are being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, whether filed before or after the date hereof and regardless of any general incorporation language in such filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Design Therapeutics, Inc. |

|

|

|

|

Date: |

May 8, 2024 |

By: |

/s/ Pratik Shah, Ph.D. |

|

|

|

Pratik Shah, Ph.D.

President, Chief Executive Officer and Chairperson |

Exhibit 99.1

Design Therapeutics Announces First Quarter 2024 Financial Results and Highlights Upcoming Program Milestones

Advancing DT-216P2, New Drug Product for Friedreich Ataxia (FA), Toward Clinical Trials

Starting Phase 1 Development for Fuchs Endothelial Corneal Dystrophy (FECD) in 2024; Observational Study Currently Enrolling Patients

Progressing GeneTACTM Pipeline Programs in Huntington’s Disease (HD) and Myotonic Dystrophy Type-1 (DM1) to Development Candidates

Cash and Securities of $270.7 Million Support Multi-Year Operating Runway and Advancement of Up to Four Programs to Clinical Proof-of-Concept

Carlsbad, Calif., May 8, 2024 - Design Therapeutics, Inc. (Nasdaq: DSGN), a biotechnology company developing treatments for serious degenerative genetic diseases, today announced first quarter 2024 financial results along with recent business highlights and upcoming milestones.

“At Design, we began 2024 with a clear vision to advance our portfolio of first- or best-in-class therapies to treat major genetic disorders, using novel small molecules that work with a patient’s natural genome,” said Pratik Shah, Ph.D., chairperson and chief executive officer of Design Therapeutics. Dr. Shah continued, “Our work in FA is differentiated by the fact that we have been able to increase levels of endogenous frataxin and we look forward to beginning patient trials with our new drug product, DT-216P2, next year. We have also made solid progress enrolling patients in our FECD observational study and remain on track to initiate Phase 1 development for DT-168 later this year. DT-168 has the potential to be the first effective treatment addressing the root cause of this degenerative corneal disease. Behind these clinical-stage programs, we have an exciting pipeline in HD and DM1, resulting in four programs with the potential to deliver clinical proof-of-concept, depending on R&D results, over the next several years under our current cash runway. We believe success in any one of these programs has the potential to generate enormous value for patients and shareholders.”

Business Highlights and Anticipated Upcoming Milestones

•Friedreich Ataxia (FA) Design’s new drug product for FA, DT-216P2, demonstrates an improved pharmacokinetic (PK) profile, injection site profile and sustained drug exposure in nonclinical studies compared to the prior formulation. Design is on track to complete GLP studies for DT-216P2 by year-end 2024 to start patient trials in 2025.

•Fuchs Endothelial Corneal Dystrophy (FECD) Design is conducting an observational study designed to confirm FECD disease characteristics and evaluate potential endpoints and progression prior to initiating an interventional treatment trial. The observational study is expected to enroll 200 patients with a planned follow-up of two years. Design expects to initiate Phase 1 development for DT-168 in 2024.

•Pipeline programs Design is advancing preclinical characterization of several lead molecules toward the selection of development candidates for Huntington’s disease (HD) and myotonic dystrophy type-1 (DM1) in anticipation of future IND submissions. In preclinical studies for HD, GeneTAC™ candidate molecules selectively dialed-down the expression of the mutant HTT gene by over 50% in the brain striatum with systemic administration. In the DM1 program, GeneTAC™ small molecules potently dialed-down the expression of the mutant DMPK gene in DM1 patient cells, eliminating foci and restoring normal splicing.

First Quarter 2024 Financial Results

•R&D Expenses: Research and development (R&D) expenses were $9.8 million for the quarter ended March 31, 2024.

•G&A Expenses: General and administrative (G&A) expenses were $4.6 million for the quarter ended March 31, 2024.

•Net Loss: Net loss was $11.1 million for the quarter ended March 31, 2024.

•Cash Position and Operating Runway: Cash, cash equivalents and marketable securities were $270.7 million as of March 31, 2024, which the company expects to fund its planned operating expenses into 2029.

About Design Therapeutics

Design Therapeutics is a biotechnology company developing a new class of therapies based on its platform of GeneTAC™ gene targeted chimera small molecules. The company’s GeneTAC™ molecules are designed to either dial up or dial down the expression of a specific disease-causing gene to address the underlying cause of disease. In addition to its lead GeneTAC™ small molecule, DT-216, in development for patients with Friedreich ataxia, the company is advancing programs in Fuchs endothelial corneal dystrophy, Huntington’s disease and myotonic dystrophy type-1. Discovery efforts are underway for multiple genomic medicines. For more information, please visit designtx.com.

Forward-Looking Statements

Statements in this press release that are not purely historical in nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to projections from early-stage programs, nonclinical data and early-stage clinical data; the progression or completion of certain development activities, including the selection of development candidates; the initiation and progression of studies and clinical trials for DT-216P2 and DT-168 and the timing thereof; Design’s pipeline, including the potential to have four programs with clinical proof-of-concept with Design’s current cash runway; Design's ability to advance the GeneTAC™ platform; the potential of each of Design’s programs to generate enormous value for patients and shareholders; Design’s estimated financial runway and the sufficiency of its resources to support its planned operations; and the capabilities and potential advantages of Design’s pipeline of GeneTAC™ molecules. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “believes,” “designed to,” “anticipates,” “aims,” “plans to,” “expects,” “estimate,” “intends,” “will,” “potential” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Design’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with: the acceptance of INDs by the FDA for the conduct of planned clinical trials of our product candidates and our proposed design of future clinical trials; nonclinical

development activities and results of nonclinical studies; conducting a clinical trial and patient enrollment, which are affected by many factors, and any difficulties or delays encountered with such clinical trial or patient enrollment may delay or otherwise adversely affect Design’s clinical development plans; the process of discovering and developing therapies that are safe and effective for use as human therapeutics and operating as a development stage company; undesirable side effects or other undesirable properties, which could cause Design or regulatory authorities to suspend or discontinue clinical trials and thereby delay or prevent Design’s product candidates’ development or regulatory approval; Design’s ability to develop, initiate or complete nonclinical studies and clinical trials for its product candidates; whether promising early research or clinical trials will demonstrate safety and/or efficacy in later nonclinical studies or clinical trials; changes in Design’s plans to develop its product candidates; performing clinical trials, regulatory filings and applications; reliance on third parties to successfully conduct clinical trials and nonclinical studies; competitive products, which may make any products we develop obsolete or noncompetitive; Design’s reliance on key third parties, including contract manufacturers and contract research organizations; Design’s ability to raise any additional funding it will need to continue to pursue its business and product development plans; regulatory developments in the United States and foreign countries; Design’s ability to obtain and maintain intellectual property protection for its product candidates; Design’s ability to recruit and retain key scientific or management personnel; competition in the industry in which Design operates, which may result in others discovering, developing or commercializing competitive products before or more successfully than Design; and market conditions. For a more detailed discussion of these and other factors, please refer to Design’s filings with the Securities and Exchange Commission (“SEC”), including under the “Risk Factors” heading of Design’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on March 19, 2024, and under the “Risk Factors” heading of Design’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, being filed with the SEC later today. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement and Design undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof, except as required by law.

# # #

Contact:

Renee Leck

THRUST Strategic Communications

renee@thrustsc.com

DESIGN THERAPEUTICS, INC.

CONDENSED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited) |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

$ |

9,801 |

|

|

$ |

15,730 |

|

General and administrative |

|

|

4,599 |

|

|

|

5,921 |

|

Total operating expenses |

|

|

14,400 |

|

|

|

21,651 |

|

Loss from operations |

|

|

(14,400 |

) |

|

|

(21,651 |

) |

Other income, net |

|

|

3,295 |

|

|

|

2,357 |

|

Net loss |

|

$ |

(11,105 |

) |

|

$ |

(19,294 |

) |

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.20 |

) |

|

$ |

(0.35 |

) |

Weighted-average shares of common stock outstanding, basic and diluted |

|

|

56,488,527 |

|

|

|

55,908,033 |

|

DESIGN THERAPEUTICS, INC.

CONDENSED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash, cash equivalents and investment securities |

|

$ |

270,686 |

|

|

$ |

281,798 |

|

Prepaid expense and other current assets |

|

|

3,200 |

|

|

|

2,786 |

|

Total current assets |

|

|

273,886 |

|

|

|

284,584 |

|

Property and equipment, net |

|

|

1,718 |

|

|

|

1,691 |

|

Right-of-use asset, related party |

|

|

2,762 |

|

|

|

2,938 |

|

Other assets |

|

|

427 |

|

|

|

430 |

|

Total assets |

|

$ |

278,793 |

|

|

$ |

289,643 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,372 |

|

|

$ |

1,940 |

|

Accrued expenses and other current liabilities |

|

|

5,722 |

|

|

|

7,682 |

|

Total current liabilities |

|

|

7,094 |

|

|

|

9,622 |

|

Operating lease liability, net, related party |

|

|

2,142 |

|

|

|

2,334 |

|

Total liabilities |

|

|

9,236 |

|

|

|

11,956 |

|

Total stockholders’ equity |

|

|

269,557 |

|

|

|

277,687 |

|

Total liabilities and stockholders’ equity |

|

$ |

278,793 |

|

|

$ |

289,643 |

|

v3.24.1.u1

Document And Entity Information

|

May 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

Design Therapeutics, Inc.

|

| Entity Central Index Key |

0001807120

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40288

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-3929248

|

| Entity Address, Address Line One |

6005 Hidden Valley Road

|

| Entity Address, Address Line Two |

Suite 110

|

| Entity Address, City or Town |

Carlsbad

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92011

|

| City Area Code |

(858)

|

| Local Phone Number |

293-4900

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

DSGN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

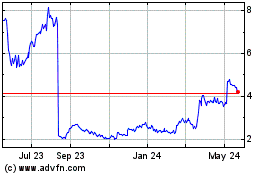

Design Therapeutics (NASDAQ:DSGN)

Historical Stock Chart

From Nov 2024 to Dec 2024

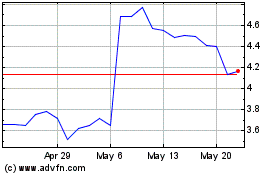

Design Therapeutics (NASDAQ:DSGN)

Historical Stock Chart

From Dec 2023 to Dec 2024