0001101680false00011016802024-08-202024-08-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 20, 2024

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 20, 2024, DZS Inc. (the “Company”) issued a press release relating to the filing of its Form 10-Q for the quarter ended March 31, 2024 and related financial results. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The Company is also providing (i) the unaudited reconciliation of GAAP to non-GAAP results for reporting periods in 2022 and 2023 as detailed in Exhibit 99.2 and (ii) the unaudited reconciliation of GAAP to non-GAAP results from continuing operations for the first quarter of 2024 as detailed in Exhibit 99.3, and, in each case, is incorporated herein by reference.

The information furnished on this Current Report on Form 8-K, including Exhibit 99.1, 99.2 and 99.3, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | | |

| 99.1 | | | |

| 99.2 | | | |

| 99.3 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: August 20, 2024 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

| | | | | |

| RELEASE | EXHIBIT 99.1 |

| |

| August 2024 | |

DZS Files Q1 2024 Financial Results

DALLAS, Texas, USA, Aug. 20, 2024 – DZS (OTC: DZSI), a developer of Network Edge, Connectivity and Cloud Software solutions enabling gigabit broadband everywhere, today announced that it has filed its Q1 2024 financial results.

“As previously disclosed, we completed the restatements with respect to 2022 and the first quarter of 2023, as well as the reports for the remaining periods in 2023 and now completed the delayed filing for Q1 2024,” said Charlie Vogt, President and CEO, DZS. “Our priority throughout this process has been thoroughness and accuracy.”

Vogt added, “During the first six months of 2024, we divested our low margin Asia business, acquired NetComm’s fixed wireless, fiber extension, IoT and broadband connectivity business and raised approximately $40 million. On August 13, 2024, we filed our 2022 and 2023 GAAP financials and shortly we expect to provide non-GAAP financials for 2022 and 2023 which will illustrate the adjustments to bridge GAAP to non-GAAP. Today, we filed our Form 10-Q for Q1 2024 which reflects our former Asia business reported as discontinued operations. Our Q1 2024 financial results do not include our newly acquired NetComm business, which closed on June 1, 2024. Our priorities are aligning with customer requirements, completing our numerous FTTx trials currently underway, converting $31.8 million (exclusive of NetComm) of paid inventory as of March 31, 2024, to cash, executing on $102 million of scheduled backlog and capitalizing on our encouraging sales pipeline.”

DZS is taking advantage of new opportunities fueled by the accelerating demands of emerging applications, the industry evolution moving bandwidth and intelligence closer to the network edge and the operational requirements to deliver enhanced network assurance for improving the subscriber experience. The Company continues to advance its fiber, fixed wireless and AI-influenced broadband solutions aligned with service providers spanning North America, Europe, Middle East and Africa (EMEA) and Australia and New Zealand (ANZ) while optimizing its operational cost.

“Q1 2024 represented an industry-wide pause in capital investments due to an over-rotation of inventory by many service providers and delays with government broadband stimulus programs, including the United States Broadband Equity, Access and Deployment (BEAD) Program,” said Misty Kawecki, CFO, DZS. “We are in the final phase of optimizing our cost savings initiatives that began in Q3 2023. We reduced operating expenses 33% in Q1 2024 compared to 2022. We are laser-focused on working through our $102 million of scheduled backlog, transitioning our numerous on-going trials to orders, cultivating a robust sales pipeline and converting our paid inventory to cash which, as of the end of Q1 2024 was $31.8 million, excluding any acquired inventory with NetComm.”

DZS is now current with its Form 10-Q and 10-K filings with the SEC through Q1 2024. The inability to file these reports prior to August 5, 2024, was the reason for the Company’s suspension of trading from Nasdaq and announced delisting notice.

Following the release of second quarter 2024 financial results, DZS intends to host an earnings call to discuss restated results, which will include all of 2022, 2023, the financial results for the first and second quarters of 2024, and the divestiture of its Asia business along with its recent acquisition of NetComm.

About DZS

DZS Inc. (OTC: DZSI) is a developer of Network Edge, Connectivity and Cloud Software solutions enabling gigabit broadband everywhere.

DZS, the DZS logo, and all DZS product names are trademarks of DZS Inc. Other brand and product names are trademarks of their respective holders. Specifications, products, and/or product names are all subject to change.

This press release contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995. These statements reflect the beliefs and assumptions of the Company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The Company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward-looking statements. Factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and subsequent filings. In addition, additional or unforeseen affects from the COVID-19 pandemic and the global economic climate may give rise to or amplify many of these risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. DZS undertakes no obligation to update or revise any forward-looking statements for any reason.

For further information see: www.DZSi.com

DZS on Twitter: https://twitter.com/dzs_innovation

DZS on LinkedIn: https://www.linkedin.com/company/DZSi/

Investor Inquiries:

Ted Moreau, Vice President, Investor Relations

Email: IR@dzsi.com

DZS INC. AND SUBSIDIARIES

Unaudited Reconciliation of GAAP to Non-GAAP results (2022-2023)

($ in thousands, except per share data)

Set forth below are reconciliations of Non-GAAP Cost of Revenue, Non-GAAP Gross Profit, Non-GAAP Operating Expenses, Non-GAAP Operating Income (Loss) (also referred to as Adjusted EBITDA), Non-GAAP Net Income (Loss), and Non-GAAP Net Income (Loss) per Diluted Share to GAAP Cost of Revenue, Gross Profit, Operating Expenses, Operating Income (Loss), Net Income (Loss), and Net Income (Loss) per Diluted Share, respectively, which the Company considers to be the most directly comparable U.S. GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2022 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 244,046 | | | $ | 113,482 | | | 31.7% | | $ | 150,509 | | | $ | (37,027) | | | $ | (41,270) | | | $ | (1.47) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (1,096) | | | 1,096 | | | 0.3% | | (6,029) | | | 7,125 | | | 7,125 | | | 0.25 | |

| Stock-based compensation | (801) | | | 801 | | | 0.2% | | (15,001) | | | 15,802 | | | 15,802 | | | 0.56 | |

| Headquarters and facilities relocation | | | | | | | (827) | | | 827 | | | 827 | | | 0.03 | |

| Acquisition costs | | | | | | | (1,150) | | | 1,150 | | | 1,150 | | | 0.04 | |

| Restructuring and other charges | — | | | — | | | 0.0% | | (4,617) | | | 4,617 | | | 4,617 | | | 0.16 | |

| Executive transition | | | | | | | (927) | | | 927 | | | 927 | | | 0.03 | |

| Litigation | | | | | | | (36) | | | 36 | | | 36 | | | — | |

| Bad debt expense, net of recoveries | | | | | | | 1,153 | | | (1,153) | | | (1,153) | | | (0.04) | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 448 | | | 0.02 | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 9,328 | | | 0.33 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (6,192) | | | (0.22) | |

| Adjusted (Non-GAAP) amount | $ | 242,149 | | | $ | 115,379 | | | 32.3 | % | | $ | 123,075 | | | $ | (7,696) | | | $ | (8,355) | | | $ | (0.30) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 66,860 | | | $ | 32,030 | | | 32.4% | | $ | 41,815 | | | $ | (9,785) | | | $ | (10,954) | | | $ | (0.39) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (295) | | | 295 | | | 0.3% | | (1,814) | | | 2,109 | | | 2,109 | | | 0.08 | |

| Stock-based compensation | (280) | | | 280 | | | 0.3% | | (4,743) | | | 5,023 | | | 5,023 | | | 0.18 | |

| Headquarters and facilities relocation | | | | | | | (827) | | | 827 | | | 827 | | | 0.03 | |

| Acquisition costs | | | | | | | (111) | | | 111 | | | 111 | | | — | |

| Restructuring and other charges | | | | | | | (601) | | | 601 | | | 601 | | | 0.02 | |

| Executive transition | | | | | | | (464) | | | 464 | | | 464 | | | 0.02 | |

| Bad debt expense, net of recoveries | | | | | | | 120 | | | (120) | | | (120) | | | — | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 643 | | | 0.02 | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 1,311 | | | 0.05 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (2,004) | | | (0.07) | |

| Adjusted (Non-GAAP) amount | $ | 66,285 | | | $ | 32,605 | | | 33.0 | % | | $ | 33,375 | | | $ | (770) | | | $ | (1,989) | | | $ | (0.07) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 59,663 | | | $ | 23,285 | | | 28.1% | | $ | 33,681 | | | $ | (10,396) | | | $ | (12,564) | | | $ | (0.45) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (303) | | | 303 | | | 0.4% | | (1,061) | | | 1,364 | | | 1,364 | | | 0.05 | |

| Stock-based compensation | (146) | | | 146 | | | 0.2% | | (2,723) | | | 2,869 | | | 2,869 | | | 0.10 | |

| Acquisition costs | | | | | | | (571) | | | 571 | | | 571 | | | 0.02 | |

| Restructuring and other charges | | | | | | | (356) | | | 356 | | | 356 | | | 0.01 | |

| Executive transition | | | | | | | (91) | | | 91 | | | 91 | | | — | |

| Bad debt expense, net of recoveries | | | | | | | (317) | | | 317 | | | 317 | | | 0.02 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | (174) | | | (0.01) | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 4,146 | | | 0.15 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (864) | | | (0.03) | |

| Adjusted (Non-GAAP) amount | $ | 59,214 | | | $ | 23,734 | | | 28.6 | % | | $ | 28,562 | | | $ | (4,828) | | | $ | (3,888) | | | $ | (0.14) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 46,599 | | | $ | 25,391 | | | 35.3% | | $ | 30,316 | | | $ | (4,925) | | | $ | (7,586) | | | $ | (0.28) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (146) | | | 146 | | | 0.2% | | (935) | | | 1,081 | | | 1,081 | | | 0.04 | |

| Stock-based compensation | (130) | | | 130 | | | 0.2% | | (2,541) | | | 2,671 | | | 2,671 | | | 0.10 | |

| Acquisition costs | | | | | | | (51) | | | 51 | | | 51 | | | — | |

| Restructuring and other charges | | | | | | | (436) | | | 436 | | | 436 | | | 0.02 | |

| Executive transition | | | | | | | (247) | | | 247 | | | 247 | | | 0.01 | |

| Bad debt expense, net of recoveries | | | | | | | 1,227 | | | (1,227) | | | (1,227) | | | (0.04) | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 877 | | | 0.03 | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 2,977 | | | 0.11 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (1,113) | | | (0.04) | |

| Adjusted (Non-GAAP) amount | $ | 46,323 | | | $ | 25,667 | | | 35.7 | % | | $ | 27,333 | | | $ | (1,666) | | | $ | (1,586) | | | $ | (0.05) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2023 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 204,102 | | | $ | 40,439 | | | 16.5% | | $ | 169,428 | | | $ | (128,989) | | | $ | (135,218) | | | $ | (4.29) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (586) | | | 586 | | | 0.2% | | (7,593) | | | 8,179 | | | 8,179 | | | 0.26 | |

| Stock-based compensation | (1,211) | | | 1,211 | | | 0.5% | | (14,632) | | | 15,843 | | | 15,843 | | | 0.50 | |

| Acquisition costs | | | | | | | 313 | | | (313) | | | (313) | | | (0.01) | |

| Restructuring and other charges | (6,731) | | | 6,731 | | | 2.8% | | (4,491) | | | 11,222 | | | 11,222 | | | 0.36 | |

| Executive transition | | | | | | | 2 | | | (2) | | | (2) | | | — | |

| Litigation and restatement | | | | | | | (6,257) | | | 6,257 | | | 6,257 | | | 0.20 | |

| Bad debt expense, net of recoveries | | | | | | | 998 | | | (998) | | | (998) | | | (0.03) | |

| Amortization of capitalized costs | | | | | | | (1,133) | | | 1,133 | | | 1,133 | | | 0.04 | |

| Goodwill impairment | | | | | | | (12,594) | | | 12,594 | | | 12,594 | | | 0.40 | |

| Long lived assets impairment | | | | | | | (3,073) | | | 3,073 | | | 3,073 | | | 0.10 | |

| Loss on debt extinguishment | | | | | | | | | | | 594 | | | 0.02 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 3,765 | | | 0.12 | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 25,125 | | | 0.80 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (12,731) | | | (0.40) | |

| Adjusted (Non-GAAP) amount | $ | 195,574 | | | $ | 48,967 | | | 20.0 | % | | $ | 120,968 | | | $ | (72,001) | | | $ | (61,477) | | | $ | (1.93) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 47,517 | | | $ | 1,931 | | | 3.9% | | $ | 36,319 | | | $ | (34,388) | | | $ | (34,013) | | | $ | (1.07) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (129) | | | 129 | | | 0.3% | | (1,909) | | | 2,038 | | | 2,038 | | | 0.06 | |

| Stock-based compensation | (328) | | | 328 | | | 0.7% | | (3,370) | | | 3,698 | | | 3,698 | | | 0.12 | |

| Acquisition costs | | | | | | | 256 | | | (256) | | | (256) | | | (0.01) | |

| Restructuring and other charges | (4,673) | | | 4,673 | | | 9.5% | | (135) | | | 4,808 | | | 4,808 | | | 0.15 | |

| Litigation and restatement | | | | | | | (3,641) | | | 3,641 | | | 3,641 | | | 0.11 | |

| Bad debt expense, net of recoveries | | | | | | | 473 | | | (473) | | | (473) | | | (0.01) | |

| Amortization of capitalized costs | | | | | | | (303) | | | 303 | | | 303 | | | 0.01 | |

| Loss on debt extinguishment | | | | | | | | | | | 375 | | | 0.01 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | (610) | | | (0.02) | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 5,384 | | | 0.17 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (2,807) | | | (0.09) | |

| Adjusted (Non-GAAP) amount | $ | 42,387 | | | $ | 7,061 | | | 14.3 | % | | $ | 27,690 | | | $ | (20,629) | | | $ | (17,912) | | | $ | (0.56) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 43,384 | | | $ | 16,964 | | | 28.1% | | $ | 40,525 | | | $ | (23,561) | | | $ | (24,836) | | | $ | (0.80) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (148) | | | 148 | | | 0.2% | | (1,917) | | | 2,065 | | | 2,065 | | | 0.07 | |

| Stock-based compensation | (499) | | | 499 | | | 0.8% | | (3,826) | | | 4,325 | | | 4,325 | | | 0.14 | |

| Acquisition costs | | | | | | | 228 | | | (228) | | | (228) | | | (0.01) | |

| Restructuring and other charges | (557) | | | 557 | | | 0.9% | | (594) | | | 1,151 | | | 1,151 | | | 0.04 | |

| Litigation and restatement | | | | | | | (246) | | | 246 | | | 246 | | | 0.01 | |

| Bad debt expense, net of recoveries | | | | | | | (260) | | | 260 | | | 260 | | | 0.01 | |

| Amortization of capitalized costs | | | | | | | (306) | | | 306 | | | 306 | | | 0.01 | |

| Long lived assets impairment | | | | | | | (499) | | | 499 | | | 499 | | | 0.02 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 21 | | | — | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 4,780 | | | 0.15 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (1,794) | | | (0.06) | |

| Adjusted (Non-GAAP) amount | $ | 42,180 | | | $ | 18,168 | | | 30.1 | % | | $ | 33,105 | | | $ | (14,937) | | | $ | (13,205) | | | $ | (0.42) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 47,318 | | | $ | 22,494 | | | 32.2% | | $ | 45,055 | | | $ | (22,561) | | | $ | (23,817) | | | $ | (0.77) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (171) | | | 171 | | | 0.2% | | (1,905) | | | 2,076 | | | 2,076 | | | 0.07 | |

| Stock-based compensation | (246) | | | 246 | | | 0.4% | | (4,240) | | | 4,486 | | | 4,486 | | | 0.14 | |

| Acquisition costs | | | | | | | (107) | | | 107 | | | 107 | | | — | |

| Restructuring and other charges | | | | | | | (4,152) | | | 4,152 | | | 4,152 | | | 0.13 | |

| Executive transition | | | | | | | 2 | | | (2) | | | (2) | | | — | |

| Bad debt expense, net of recoveries | | | | | | | 23 | | | (23) | | | (23) | | | — | |

| Amortization of capitalized costs | | | | | | | (221) | | | 221 | | | 221 | | | 0.01 | |

| Long lived assets impairment | | | | | | | (230) | | | 230 | | | 230 | | | 0.01 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 1,397 | | | 0.05 | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 5,289 | | | 0.17 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (2,624) | | | (0.08) | |

| Adjusted (Non-GAAP) amount | $ | 46,901 | | | $ | 22,911 | | | 32.8 | % | | $ | 34,225 | | | $ | (11,314) | | | $ | (8,508) | | | $ | (0.27) | |

| | | | | | | | | | | | | |

Non-GAAP Measures

To supplement DZS’s consolidated financial statements presented in accordance with GAAP, DZS reports Adjusted Cost of Revenue, Adjusted Gross Margin, Adjusted Operating Expenses, Adjusted Operating Income (Loss), Adjusted Net Income (including on a per share basis), EBITDA, and Adjusted EBITDA, which are non-GAAP measures DZS believes are appropriate to provide meaningful comparison with, and to enhance an overall understanding of, DZS’s past financial performance and prospects for the future. DZS believes these non-GAAP financial measures provide useful information to both management and investors by excluding specific items that DZS believes are not indicative of core operating results. These items share one or more of the following characteristics: they are unusual and DZS does not expect them to recur in the ordinary course of its business;[1] they do not involve the expenditure of cash; they are unrelated to the ongoing operation of the business in the ordinary course; or their magnitude and timing is largely outside of the Company’s control. Further, each of these non-GAAP measures of operating performance are used by management, as well as industry analysts, to evaluate operations and operating performance and are widely used in the telecommunications and manufacturing industries. Other companies in the telecommunications and manufacturing industries may calculate these metrics differently than DZS does. The presentation of this additional information is not meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP.

DZS defines Adjusted Cost of Revenue as GAAP Cost of Revenue less (i) depreciation and amortization, (ii) stock-based compensation, (iii) restructuring charges, including freight charges and other elevated inventory related costs directly related to the transition to a contract manufacturer, and (iv) the impact of material transactions or events that we believe are not indicative of our core product cost and are not expected to be recurring in nature. We believe Adjusted Cost of Revenue provides the investor more accurate information regarding the actual cost of our products and services, excluding the impact of costs of revenue that are not routine components of our core product cost, for better comparability of our costs of revenue between periods and to other companies.

DZS defines Adjusted Gross Margin as GAAP Gross Margin less (i) depreciation and amortization, (ii) stock-based compensation, (iii) restructuring charges, including freight charges and other elevated inventory related costs directly related to the transition to a contract manufacturer, and (iv) the impact of material transactions or events that we believe are not indicative of our core operating performance and are not expected to be recurring in nature. We believe Adjusted Gross Margin provides the investor more accurate information regarding our core profit margin on sales, excluding the impact of cost of revenue that are not routine components of our core product cost, for better comparability of gross margin between periods and to other companies.

DZS defines Adjusted Operating Expenses as GAAP operating expenses plus or minus (as applicable) (i) depreciation and amortization, (ii) stock-based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits, headquarters and facilities relocation, executive transition, bad debt expense primarily related to a large customer in India, restatement related costs, and legal costs related to certain litigation, each of which is not expected to be recurring in nature. We believe Adjusted Operating Expenses provides the investor more accurate information regarding our core operating expenses, which include research and development costs, selling, general and administrative costs, and amortization of intangible assets, excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies.

DZS defines EBITDA as Net Income (Loss) plus or minus (as applicable) (i) interest expense, net, (ii) income tax provision (benefit), and (iii) depreciation and amortization expense.

DZS defines Adjusted Operating Income (Loss), or Adjusted EBITDA, as GAAP Operating Income (Loss) plus or minus (as applicable) (i) depreciation and amortization, (ii) stock-based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits, headquarters and facilities relocation, executive transition, bad debt expense primarily related to a large customer in India, restatement related costs, and legal costs related to certain litigation, each of which is not expected to be recurring in nature. We believe Adjusted Operating Income (Loss) provides the investor more accurate information regarding our core operating Income (Loss), excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies. The DZS definition of Adjusted Operating Income (Loss) equates to the DZS definition of Adjusted EBITDA.

DZS defines Non-GAAP Net Income (Loss) as GAAP Net Income plus or minus (as applicable) (i) depreciation and amortization, (ii) stock-based compensation, (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits and restructuring charges, including freight charges and other elevated inventory related costs directly related to the transition to a contract manufacturer, headquarters and facilities relocation, executive transition, bad debt expense primarily related to a large customer in India, restatement related costs, and legal costs related to certain litigation, each of which is not expected to be recurring in nature, (iv) unrealized foreign exchange gains and losses, (v) a non-GAAP income tax benefit (provision) based on an estimated tax rate applied against forecasted annual non-GAAP income and (vi) i the tax effect of non-GAAP adjustments to Adjusted Net Income and Adjusted EPS. DZS determines non-GAAP income taxes by computing an annual rate for the Company and applying that single rate (rather than multiple rates by jurisdiction) to its consolidated quarterly results. For 2023, the non-GAAP income tax rate was 18.1% and for 2022 the rate was 20.8%. DZS expects that this methodology will provide a consistent rate throughout the year and allow investors to better understand the impact of income taxes on its results. Due to the methodology applied to its estimated annual tax rate, the Company’s estimated tax rate on non-GAAP income will differ from its GAAP tax rate and from its actual tax liabilities. DZS believes Non-GAAP Net Income (Loss) provides the investor more accurate information regarding our core income, excluding the impact of charges that are not routine components of our core product cost or core operating expenses, for better comparability between periods and to other companies.

DZS INC. AND SUBSIDIARIES

Unaudited Reconciliation of GAAP to Non-GAAP Results from Continuing Operations

($ in thousands, except per share data)

Set forth below are reconciliations of Non-GAAP Cost of Revenue, Non-GAAP Gross Profit, Non-GAAP Operating Expenses, Non-GAAP Operating Income (Loss) (also referred to as Adjusted EBITDA), Non-GAAP Net Income (Loss), and Non-GAAP Net Income (Loss) per Diluted Share to GAAP Cost of Revenue, Gross Profit, Operating Expenses, Operating Income (Loss), Net Income (Loss), and Net Income (Loss) per Diluted Share, respectively, which the Company considers to be the most directly comparable U.S. GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 - Continuing Operations |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 15,054 | | | $ | 12,613 | | | 45.6% | | $ | 23,505 | | | $ | (10,892) | | | $ | (13,535) | | | $ | (0.36) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (71) | | | 71 | | | 0.3% | | (1,502) | | | 1,573 | | | 1,573 | | | 0.04 | |

| Stock-based compensation | 11 | | | (11) | | | 0.0% | | (2,143) | | | 2,132 | | | 2,132 | | | 0.06 | |

| Acquisition costs | | | | | | | (52) | | | 52 | | | 52 | | | — | |

| Restructuring and other charges | — | | | — | | | 0.0% | | (288) | | | 288 | | | 288 | | | 0.01 | |

| Litigation and restatement | | | | | | | (2,666) | | | 2,666 | | | 2,666 | | | 0.07 | |

| Amortization of capitalized costs | | | | | | | (303) | | | 303 | | | 303 | | | 0.01 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 325 | | | 0.01 | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | 3,519 | | | 0.09 | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | (1,308) | | | (0.04) | |

| Adjusted (Non-GAAP) amount | $ | 14,994 | | | $ | 12,673 | | | 45.8 | % | | $ | 16,551 | | | $ | (3,878) | | | $ | (3,985) | | | $ | (0.11) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 - Continuing Operations |

| Cost of Revenue | | Gross Profit | | Gross Margin Percentage | | Operating Expenses | | Operating Income (Loss) | | Net Income (Loss) | | Net Income (Loss) per Diluted Share |

| GAAP amount | $ | 27,202 | | | $ | 17,165 | | | 38.7% | | $ | 34,603 | | | $ | (17,438) | | | $ | (20,035) | | | $ | (0.65) | |

| Adjustments to GAAP amounts: | | | | | | | | | | | | | |

| Depreciation and amortization | (104) | | | 104 | | | 0.2% | | (1,650) | | | 1,754 | | | 1,754 | | | 0.06 | |

| Stock-based compensation | (193) | | | 193 | | | 0.4% | | (3,725) | | | 3,918 | | | 3,918 | | | 0.13 | |

| Acquisition costs | | | | | | | (107) | | | 107 | | | 107 | | | — | |

| Restructuring and other charges | | | | | | | (4,152) | | | 4,152 | | | 4,152 | | | 0.13 | |

| Executive transition | | | | | | | 2 | | | (2) | | | (2) | | | — | |

| Long lived assets impairment | | | | | | | (230) | | | 230 | | | 230 | | | 0.01 | |

| Amortization of capitalized costs | | | | | | | (221) | | | 221 | | | 221 | | | 0.01 | |

| Unrealized foreign exchange (gains) losses | | | | | | | | | | | 127 | | | — | |

| Non-GAAP adjustments to tax rate | | | | | | | | | | | (1,739) | | | (0.06) | |

| Tax effect on Non-GAAP adjustments | | | | | | | | | | | 5,768 | | | 0.19 | |

| Adjusted (Non-GAAP) amount | $ | 26,905 | | | $ | 17,462 | | | 39.4 | % | | $ | 24,520 | | | $ | (7,058) | | | $ | (5,500) | | | $ | (0.18) | |

Non-GAAP Measures

To supplement DZS’s consolidated financial statements presented in accordance with GAAP, DZS reports Adjusted Cost of Revenue, Adjusted Gross Margin, Adjusted Operating Expenses, Adjusted Operating Income (Loss), Adjusted Net Income (including on a per share basis), EBITDA, and Adjusted EBITDA, which are non-GAAP measures DZS believes are appropriate to provide meaningful comparison with, and to enhance an overall understanding of, DZS’s past financial performance and prospects for the future. DZS believes these non-GAAP financial measures provide useful information to both management and investors by excluding specific items that DZS believes are not indicative of core operating results. These items share one or more of the following characteristics: they are unusual and DZS does not expect them to recur in the ordinary course of its business;[1] they do not involve the expenditure of cash; they are unrelated to the ongoing operation of the business in the ordinary course; or their magnitude and timing is largely outside of the Company’s control. Further, each of these non-GAAP measures of operating performance are used by management, as well as industry analysts, to evaluate operations and operating performance and are widely used in the telecommunications and manufacturing industries. Other companies in the telecommunications and manufacturing industries may calculate these metrics differently than DZS does. The presentation of this additional information is not meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP.

DZS defines Adjusted Cost of Revenue as GAAP Cost of Revenue less (i) depreciation and amortization, (ii) stock-based compensation, (iii) restructuring charges, including freight charges and other elevated inventory related costs directly related to the transition to a contract manufacturer, and (iv) the impact of material transactions or events that we believe are not indicative of our core product cost and are not expected to be recurring in nature. We believe Adjusted Cost of Revenue provides the investor more accurate information regarding the actual cost of our products and services, excluding the impact of costs of revenue that are not routine components of our core product cost, for better comparability of our costs of revenue between periods and to other companies.

DZS defines Adjusted Gross Margin as GAAP Gross Margin less (i) depreciation and amortization, (ii) stock-based compensation, (iii) restructuring charges, including freight charges and other elevated inventory related costs directly related to the transition to a contract manufacturer, and (iv) the impact of material transactions or events that we believe are not indicative of our core operating performance and are not expected to be recurring in nature. We believe Adjusted Gross Margin provides the investor more accurate information regarding our core profit margin on sales, excluding the impact of cost of revenue that are not routine components of our core product cost, for better comparability of gross margin between periods and to other companies.

DZS defines Adjusted Operating Expenses as GAAP operating expenses plus or minus (as applicable) (i) depreciation and amortization, (ii) stock-based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits, headquarters and facilities relocation, executive transition, bad debt expense primarily related to a large customer in India, restatement related costs, and legal costs related to certain litigation, each of which is not expected to be recurring in nature. We believe Adjusted Operating Expenses provides the investor more accurate information regarding our core operating expenses, which include research and development costs, selling, general and administrative costs, and amortization of intangible assets, excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies.

DZS defines EBITDA as Net Income (Loss) plus or minus (as applicable) (i) interest expense, net, (ii) income tax provision (benefit), and (iii) depreciation and amortization expense.

DZS defines Adjusted Operating Income (Loss), or Adjusted EBITDA, as GAAP Operating Income (Loss) plus or minus (as applicable) (i) depreciation and amortization, (ii) stock-based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits, headquarters and facilities relocation, executive transition, bad debt expense primarily related to a large customer in India, restatement related costs, and legal costs related to certain litigation, each of which is not expected to be recurring in nature. We believe Adjusted Operating Income (Loss) provides the investor more accurate information regarding our core operating Income (Loss), excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies. The DZS definition of Adjusted Operating Income (Loss) equates to the DZS definition of Adjusted EBITDA.

DZS defines Non-GAAP Net Income (Loss) as GAAP Net Income plus or minus (as applicable) (i) depreciation and amortization, (ii) stock-based compensation, (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits and restructuring charges, including freight charges and other elevated inventory related costs directly related to the transition to a contract manufacturer, headquarters and facilities relocation, executive transition, bad debt expense primarily related to a large customer in India, restatement related costs, and legal costs related to certain litigation, each of which is not expected to be recurring in nature, (iv) unrealized foreign exchange gains and losses, (v) a non-GAAP income tax benefit (provision) based on an estimated tax rate applied against forecasted annual non-GAAP income and (vi) i the tax effect of non-GAAP adjustments to Adjusted Net Income and Adjusted EPS. DZS determines non-GAAP income taxes by computing an annual rate for the Company and applying that single rate (rather than multiple rates by jurisdiction) to its consolidated quarterly results. For 2023, the non-GAAP income tax rate was 18.1% and for 2022 the rate was 20.8%. DZS expects that this methodology will provide a consistent rate throughout the year and allow investors to better understand the impact of income taxes on its results. Due to the methodology applied to its estimated annual tax rate, the Company’s estimated tax rate on non-GAAP income will differ from its GAAP tax rate and from its actual tax liabilities. DZS believes Non-GAAP Net Income (Loss) provides the investor more accurate information regarding our core income, excluding the impact of charges that are not routine components of our core product cost or core operating expenses, for better comparability between periods and to other companies.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

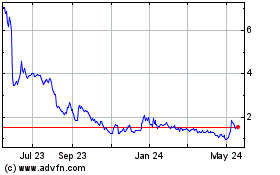

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Oct 2024 to Nov 2024

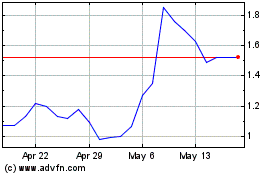

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Nov 2023 to Nov 2024