Eagle Bancorp, Inc. Announces 59% Increase in Net Earnings for Full

Year 2004 Over 2003 BETHESDA, Md., Jan. 19 /PRNewswire-FirstCall/

-- Eagle Bancorp, Inc. (NASDAQ:EGBN), the parent company of

EagleBank, today announced net income of $5.1 million for the year

ended December 31, 2004, compared to $3.2 million for the year

ended December 31, 2003, an increase of 59%. On a per-share basis,

the Company earned $0.94 per basic share and $0.90 per diluted

share for 2004 as compared to $0.82 per basic share and $0.77 cents

per diluted share for 2003. Comparisons in earnings per share

between 2004 and 2003 are affected by an increase in the number of

outstanding shares resulting from the issuance of approximately 2.4

million shares in August 2003. For the full year 2004, the Company

reported a return on average assets (ROAA) of 1.04%. This is the

first time the Company has reported a ROAA in excess of 1.00%. For

the year 2003, the ROAA was .86%. Return on average equity was

9.16% for the full year 2004, as compared to 9.45% for 2003. This

ratio was affected by the larger average capital base during 2004

resulting from the August 2003 issuance of shares. Average equity

was 11.38% of average assets for 2004 as compared to 9.05% for

2003. Net earnings for the full year 2004 were positively affected

by strong growth in loans and deposits, an improved net interest

margin, continuing favorable asset quality and good growth in

non-interest income revenues. For the fourth quarter of 2004, net

income was $1.8 million ($0.34 per basic share and $0.32 per

diluted share) as compared to $815 thousand ($0.15 per basic share

and $0.15 per diluted share) for the same quarter in 2003,

representing a 125% increase. A number of factors contributed to

the very strong fourth quarter results, which contributed

significantly to the Company's record earnings for the full year

2004. As anticipated by management, a problem credit of

approximately $2.2 million was resolved in the fourth quarter with

the loan being paid in full. This resolution allowed the Company to

recognize approximately $200 thousand of pre-tax non-recurring

income from the recovery of collection expenses advanced in prior

periods, default interest and the recognition of late charges

accumulated on the loan account. Both lending and deposit activity

were strong in the fourth quarter, and permitted the Company's net

interest income to benefit from increased volumes, in addition to

the improved net interest margin discussed below. Non-interest

income in the fourth quarter of 2004 was $1.3 million compared to

$803 thousand in the fourth quarter of 2003. This increase was due

primarily to increased amounts of gains on the sale of both SBA

loans, where EagleBank is a leading lender in its marketplace, and

increased amounts of gains on the sale of residential mortgage

loans. These same factors together with increases in the amount of

gains on the sale of investment securities represented the primary

increases for the full year 2004 over 2003 in the noninterest

income category. Throughout the year 2004, the Company has

maintained a favorable net interest margin, and as expected,

experienced an increased net interest margin as interest rates

began to rise during 2004. For the year 2004, the Company's net

interest margin improved to 4.36% compared to 4.14% for the year

2003. Deposit and loan growth were particularly strong in the

fourth quarter, with deposits increasing 12%, compared to an

increase for the full year 2004 of 38%, while loans increased 14%

in the fourth quarter, compared to an increase for the full year

2004 of 31%. The Company was in part able to improve the net

interest margin, through continued reliance on core deposits. A

significant factor in the Company achieving its 2004 results is the

quality of its assets. The quality of the loan portfolio has

allowed management to moderate the provision for possible credit

losses. The ratio of non-performing loan to total loans was just

0.03% at December 31, 2004 as compared to .21% at December 31, 2003

and the ratio of net loan losses to average loans was just 0.01%

for the full year 2004 as compared to .10% for the year of 2003.

The provision for loan losses was $675 thousand for the full year

2004 as compared to $1.2 million for the year of 2003. At December

31, 2004, the allowance for credit losses represented 1.02% of

loans outstanding, as compared to 1.16% at December 31, 2003. The

Company reported total assets at December 31, 2004 of $553 million

compared to $443 million at December 31, 2003, a 25% increase. At

December 31, 2004, total deposits amounted to $462 million,

representing a 38% increase over deposits of $336 million at

December 31, 2003, while total loans increased to $416 million at

December 31, 2004 from $318 million at December 31, 2003, a 31%

increase. "We are extremely pleased to report the strong

performance of Eagle Bancorp in 2004," noted both Leonard Abel,

Chairman and Ronald Paul, President and CEO of Eagle Bancorp, Inc.

"We take particular pride in the quality of assets managed by the

Company, which receives ongoing attention by management and the

Board. The strong loan growth experienced in the fourth quarter of

2004 is continuing in the first quarter of 2005 and should

contribute favorably to 2005 results." The Summary of Financial

Information presented on the following pages provides more detail

of the Company's performance for the year ended December 31, 2004

as compared to 2003. Persons wishing additional information should

refer to the Company's Form 10K report to be filed with the

Securities and Exchange Commission on or before March 15, 2005.

Non-GAAP Presentations. This press release refers to the efficiency

ratio which is computed by dividing noninterest expense by the sum

of net interest income on a tax equivalent basis and noninterest

income. This is a non-GAAP financial measure that we believe

provides investors with important information regarding our

operational efficiency. Comparison of our efficiency ratio with

those of other companies may not be possible because other

companies may calculate the efficiency ratio differently. The

Company, in referring to its net income, is referring to income

under accounting principles generally accepted in the United

States, or "GAAP." Forward looking Statements. This press release

contains forward looking statements within the meaning of the

Securities and Exchange Act of 1934, as amended, including

statements of goals, intentions, and expectations as to future

trends, plans, events or results of Company operations and policies

and regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as "may," "will," "anticipates," "believes," "expects," "plans,"

"estimates," "potential," "continue," "should," and similar words

or phrases. These statements are based upon current and anticipated

economic conditions, nationally and in the Company's market,

interest rates and interest rate policy, competitive factors and

other conditions which by their nature, are not susceptible to

accurate forecast and are subject to significant uncertainty.

Because of these uncertainties and the assumptions on which this

discussion and the forward- looking statements are based, actual

future operations and results in the future may differ materially

from those indicated herein. Readers are cautioned against placing

undue reliance on any such forward-looking statements. The

Company's past results are not necessarily indicative of future

performance. Eagle Bancorp, Inc. Statement of Condition Highlights

December September December (in thousands) 31, 2004 30, 2004 31,

2003 Unaudited Unaudited Audited Assets Cash and cash equivalents $

31,100 $ 50,116 $ 25,103 Interest bearing deposits with other banks

9,594 9,612 4,332 Federal funds sold 15,035 - - Investment

securities available for sale 64,098 65,696 82,581 Loans held for

sale 2,208 3,138 3,649 Loans 415,509 363,823 317,533 Less:

Allowance for credit losses (4,240) (4,176) (3,680) Loans, net

411,269 359,647 313,853 Other assets 19,979 19,479 13,479 Total

Assets $ 553,283 $ 507,688 $ 442,997 Liabilities and Stockholders'

Equity Non interest bearing deposits $ 130,309 $ 113,730 $90,468

Interest bearing deposits 331,978 297,291 245,046 Total deposits

462,287 411,021 335,514 Federal funds purchased and securities sold

under repurchase agreements 23,983 27,370 38,454 Other borrowings

6,333 11,443 14,588 Other liabilities 2,244 1,376 1,429 Total

liabilities 494,897 451,210 389,985 Stockholders' equity 58,436

56,478 53,012 Total Liabilities and Stockholders' Equity $ 553,283

$ 507,688 $ 442,997 Eagle Bancorp, Inc. Statements of Income

Highlights Twelve Months Ended Three Months Ended (in thousands)

December 31, December 31, 2004 2003 2004 2003 (Unaudited) (Audited)

(Unaudited)(Unaudited) Total interest income $ 24,195 $ 18,404 $

7,060 $ 5,044 Total interest expense 4,328 3,953 1,200 905 Net

interest income 19,867 14,451 5,860 4,139 Provision for credit

losses 675 1,175 218 445 Noninterest income 3,858 2,936 1,254 803

Noninterest expense 15,057 11,094 3,971 3,174 Income before incomes

taxes 7,993 5,118 2,925 1,323 Income tax expense 2,906 1,903 1,090

508 Net income $ 5,087 $ 3,215 $ 1,835 $ 815 Per Share Data:

Earnings per share, basic $ 0.94 $ 0.82 $ 0.34 $ 0.15 Earnings per

share, diluted 0.90 0.77 0.32 0.15 Shares outstanding at period end

5,421,730 5,359,303 5,421,730 5,359,303 Weighted average shares

outstanding, basic 5,403,616 3,932,004 5,412,785 5,356,379 Weighted

average shares outstanding, diluted 5,661,951 4,166,128 5,680,169

5,614,773 Book value per share at period end $ 10.78 $ 9.89 $ 10.78

$ 9.89 Eagle Bancorp, Inc. Financial Ratios and Average Balances

Years Ended December 31, Performance Ratios: 2004 2003 (annualized)

(Unaudited) (Audited) Return on average assets 1.04% 0.86% Return

on average equity 9.16% 9.45% Net interest margin 4.35% 4.14%

Efficiency ratio 64.00% 63.34% Other Ratios: Allowance for credit

losses to total loans 1.02% 1.16% Non performing loans to total

loans 0.03% 0.21% Net charge-offs (annualized) to average loans

0.01% 0.10% Average equity to average assets 11.38% 9.05% Tier 1

capital ratio 12.43% 15.30% Total capital ratio 13.33% 16.40%

Average Balances: Assets $ 487,853 $ 375,802 Earning assets $

455,979 $ 349,157 Loans $ 353,537 $ 266,811 Deposits $ 397,788 $

292,953 Stockholders' equity $ 55,507 $ 34,028 DATASOURCE: Eagle

Bancorp, Inc. CONTACT: Ronald D. Paul of Eagle Bancorp, Inc.,

+1-301-986-1800 Web site: http://www.eaglebankmd.com/

Copyright

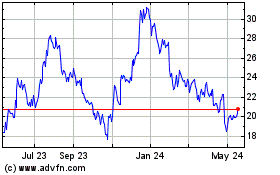

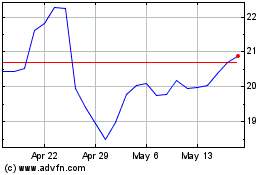

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jul 2023 to Jul 2024