Smart Share Global Limited (“Energy Monster” or the “Company”), a

consumer tech company providing mobile device charging service,

today announced its unaudited financial results for the quarter

ended March 31, 2022.

HIGHLIGHTS FOR THE FIRST QUARTER OF

2022

- As of March 31, 2022, the Company’s

services were available in 861 thousand POIs, compared with 845

thousand as of December 31, 2021.

- As of March 31,

2022, approximately 38.9% of POIs were operated through our

network partner model, compared with 38.0% as of December 31,

2021.

- As of March 31, 2022, the Company’s

available-for-use power banks3 were 5.7 million.

- As of March 31, 2022, cumulative

registered users reached 298.9 million, with 12.0 million newly

registered users acquired during the quarter.

“The first quarter of 2022 has been a

challenging quarter for Energy Monster in light of the continuous

outbreak of COVID in cities such as Shanghai, Beijing, Shenzhen,

Tianjin, Hangzhou and Changchun. These outbreaks continue to

adversely affect the foot traffic to offline POIs in regions of the

outbreak and surrounding areas. The large-scale outbreaks starting

in Shanghai and Beijing starting in March have more significantly

impacted our operation in the second quarter of 2022, but we are

already seeing a healthy recovery trend starting in June,” said

Mars Guangyuan Cai, Chairman and Chief Executive Officer. “While

the impact of COVID outbreaks have presented a challenging

environment, we continue to stay long-term oriented and focused on

laying the ground work for expanding our market leading position in

China’s mobile device charging service industry.”

“We continue to expand the coverage of our

service network through a combination of our direct operation and

network partner models. Our POI coverage and our user base

continues to increase despite the headwinds brought on by COVID

outbreaks,” said Peifeng Xu, Chief Operating Officer. “We also

launched a series of innovative initiatives that leverage the

advantages of direct operation and network partner models.

Initiatives such as the opening of all regions to both models and

leveraging our direct operation team to attract new network

partners allow us to extract higher levels of synergy between our

two core models.”

“Efficiency has always been a crucial part of

Energy Monster’s operating philosophy and a key differentiator that

set us apart from our peers within the industry. Although the

efficiency of our direct operation and network partner team remains

market-leading, we continue to identify ways to increase their

efficiency through measures such as back-end tool improvement and

model innovation. We also continue to make strides in improving our

asset efficiency through our power bank optimization program and

the launch of our newer generation of cabinets this year,” said

Maria Yi Xin, Chief Financial Officer. “As a result of such

initiatives, our operating efficiency continues to improve as

business development personnels on average are able to cover more

POIs and our asset efficiency continues to increase as we reduce

the average asset for each POI.”

FINANCIAL RESULTS FOR THE FIRST QUARTER

OF 2022

Revenues were RMB737.1 million

(US$116.3 million4) for the first quarter of 2022, representing a

13.0% decrease from the same period in 2021. The decrease was

primarily due to the decrease in revenues from mobile device

charging business as a result of the impact of COVID-19 during the

quarter.

- Revenues from mobile device

charging business decreased by 12.1% to RMB717.7 million

(US$113.2 million) for the first quarter of 2022 from RMB816.8

million in the same period of 2021. The decrease was primarily

attributable to the impact of COVID-19 during the first quarter of

2022.

- Revenues from power bank

sales decreased by 48.3% to RMB12.9 million (US$2.0

million) for the first quarter of 2022 from RMB25.0 million in the

same period of 2021. The decrease was primarily attributable to the

impact of COVID-19 during the first quarter of 2022.

- Revenues from other

revenues, which mainly comprise of revenue from adverting

services and new business initiatives, increased by 25.5% to RMB6.4

million (US$1.0 million) for the first quarter of 2022 from RMB5.1

million in the same period of 2021. The increase was primarily

attributable to the increase in users, advertisement efficiency and

new business initiatives.

Cost of revenues increased by

2.4% to RMB127.6 million (US$20.1 million) for the first quarter of

2022 from RMB124.6 million in the same period last year. The

increase of cost of revenues was primarily due to the increase in

depreciation cost from more equipment in response to the increase

in operational scale.

Research and development

expenses increased by 31.2% to RMB27.1 million (US$4.3

million) for the first quarter of 2022 from RMB20.6 million in the

same period last year. The increase was primarily due to the

increase in personnel related expenses.

Sales and marketing expenses

decreased by 0.3% to RMB659.7 million (US$104.1 million) for the

first quarter of 2022 from RMB661.7 million in the same period last

year. The decrease was primarily due to the decrease in entry fees

and incentive fees paid to location partners.

General and administrative

expenses increased by 2.1% to RMB27.4 million (US$4.3

million) for the first quarter of 2022 from RMB26.8 million in the

same period last year. The increase was primarily due to the

increase in professional service and office rental expenses.

Loss from operations for the

first quarter of 2022 was RMB99.3 million (US$15.7 million),

compared to an income from operations of RMB23.8 million in the

same period last year. The loss from operations was primarily

attributable to the impact of regional COVID-19 outbreaks in

China.

Net loss for the first quarter

of 2022 was RMB96.4 million (US$15.2 million), compared to a net

income of RMB15.1 million in the same period last year.

Adjusted net

loss5 for the first quarter of 2022 was

RMB89.7 million (US$14.1 million), compared to an adjusted net

income of RMB23.2 million in the same period last year.

Net loss attributable to ordinary

shareholders for the first quarter of 2022 was RMB96.4

million (US$15.2 million), compared to a net loss attributable to

ordinary shareholders of RMB4.8 billion in the same period last

year.

As of March 31, 2022, the Company

had cash and cash equivalents, restricted cash and

short-term investments of RMB2.8

billion (US$435.9 million).

BUSINESS OUTLOOKFor the second

quarter of 2022 ending June 30, 2022, the Company expects to

generate RMB660 million to RMB690 million of revenues. This

forecast considers the potential impact of the ongoing COVID-19

outbreaks and reflects the Company’s current and preliminary views

on the market and operational conditions, which are subject to

change, particularly as to the potential impact of COVID-19 on the

economy in China.

CONFERENCE CALL INFORMATIONThe

company will hold a conference call at 8:00 A.M. Eastern Time on

Wednesday, June 15, 2022 (8:00 P.M. Beijing Time on Wednesday, June

15, 2022) to discuss the financial results. Listeners may access

the call by dialing the following numbers:

|

International: |

+65-6780-1201 |

|

United States: |

+1-332-208-9458 |

|

Mainland China: |

+86-400-820-6895 |

|

China Hong Kong: |

+852-3018-8307 |

|

|

|

|

Conference ID / Passcode: |

4174785 |

Participants may also access the call via

webcast: https://edge.media-server.com/mmc/p/7uwui4ox

A telephone replay will be available through

June 22, 2022. The dial-in details are as follows:

|

International: |

+61-2-8199-0299 |

|

United States: |

+1-855-452-5696 |

|

Mainland China: |

+86-400-820-9703 |

|

China Hong Kong: |

+852-3051-2780 |

|

|

|

|

Access Code: |

4174785 |

A live and archived webcast of the conference

call will also be available at the Company's investor relations

website at https://ir.enmonster.com/

ABOUT SMART SHARE GLOBAL

LIMITEDSmart Share Global Limited (Nasdaq: EM), or Energy

Monster, is a consumer tech company with the mission to energize

everyday life. The company is the largest provider of mobile device

charging service in China with the number one market share. The

company provides mobile device charging service through its power

banks, which are placed in POIs such as entertainment venues,

restaurants, shopping centers, hotels, transportation hubs and

public spaces. Users may access the service by scanning the QR

codes on Energy Monster’s cabinets to release the power banks. As

of March 31, 2022, the company had 5.7 million power banks in

861,000 POIs across more than 1,700 counties and county-level

districts in China.

CONTACT USInvestor

RelationsHansen Shiir@enmonster.com

SAFE HARBOR STATEMENTThis press

release contains forward-looking statements. These statements are

made under the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. In some cases,

forward-looking statements can be identified by words or phrases

such as "may," "will," "expect," "anticipate," "target," "aim,"

"estimate," "intend," "plan," "believe," "potential," "continue,"

"is/are likely to," or other similar expressions. Among other

things, the business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. The Company may also

make written or oral forward-looking statements in its reports

filed with, or furnished to, the U.S. Securities and Exchange

Commission ("SEC"), in its annual reports to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about the

Company’s beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and a number of factors could cause actual results

to differ materially from those contained in any forward-looking

statement, including but not limited to the following: Energy

Monster’s strategies; its future business development, financial

condition and results of operations; the impact of technological

advancements on the pricing of and demand for its services;

competition in the mobile device charging service industry; Chinese

governmental policies and regulations affecting the mobile device

charging service industry; changes in its revenues, costs or

expenditures; the risk that COVID-19 or other health risks in China

or globally could adversely affect its operations or financial

results; general economic and business conditions globally and in

China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks,

uncertainties or factors is included in the Company’s filings with

the SEC. All information provided in this press release is as of

the date of this press release, and the Company does not undertake

any duty to update such information, except as required under

applicable law.

NON-GAAP FINANCIAL MEASUREIn

evaluating its business, the Company considers and uses non-GAAP

adjusted net income/(loss) in reviewing and assessing its operating

performance. The presentation of this non-GAAP financial measure is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

U.S. GAAP. The Company presents this non-GAAP financial

measure because it is used by management to evaluate operating

performance and formulate business plans. The Company believes that

this non-GAAP financial measure helps identify underlying trends in

its business, provide further information about its results of

operations, and enhance the overall understanding of its past

performance and future prospects.

Non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with

U.S. GAAP, and have limitations as analytical tools. The

Company’s non-GAAP financial measure does not reflect all items of

expenses that affect its operations and does not represent the

residual cash flow available for discretionary expenditures.

Further, the Company’s non-GAAP measure may differ from the

non-GAAP information used by other companies, including peer

companies, and therefore its comparability may be limited. The

Company compensates for these limitations by reconciling its

non-GAAP financial measure to the nearest U.S. GAAP

performance measure, which should be considered when evaluating

performance. Investors and others are encouraged to review the

Company’s financial information in its entirety and not rely on a

single financial measure.

The Company defines non-GAAP adjusted net

income/(loss) as net income/(loss) excluding share-based

compensation expenses. For more information on the non-GAAP

financial measure, please see the table captioned “Unaudited

Reconciliation of GAAP and Non-GAAP Results” set forth at the end

of this press release.

______________________________

1 The Company defines number of points of

interests, or POIs, as of a certain day as the total number of

unique locations whose proprietors (location partners) have entered

into contracts with the Company or its network partners on that

day.2 The Company defines cumulative registered users as the total

number of users who have agreed to register their mobile phone

numbers with the Company via its mini programs since inception, and

the number of cumulative registered users of the Company on a

certain date is the number of unique mobile phone numbers that have

been registered with the Company since inception on that date.3 The

Company defines available-for-use power banks as of a certain date

as the number of power banks in circulation on that day.4 The U.S.

dollar (US$) amounts disclosed in this press release, except for

those transaction amounts that were actually settled in U.S.

dollars, are presented solely for the convenience of the readers.

The conversion of Renminbi (RMB) into US$ in this press release is

based on the exchange rate set forth in the H.10 statistical

release of the Board of Governors of the Federal Reserve System as

of March 31, 2022, which was RMB6.3393 to US$1.0000. The

percentages stated in this press release are calculated based on

the RMB amounts.5 See the sections entitled “Non-GAAP Financial

Measure” and “Unaudited Reconciliation of GAAP and Non-GAAP

Results” in this press release for more information.

| |

| Smart Share

Global Limited |

| Unaudited

Consolidated Balance Sheets |

| (In

thousands, except share and per share data, unless otherwise

noted) |

| |

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2021 |

|

|

March 31, 2022 |

|

|

March 31, 2022 |

|

|

RMB |

RMB |

US$ |

|

| |

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

1,296,924 |

|

|

|

957,120 |

|

|

|

150,982 |

|

|

|

Restricted cash |

|

19,671 |

|

|

|

4,601 |

|

|

|

726 |

|

|

|

Short-term investments |

|

1,418,721 |

|

|

|

1,780,399 |

|

|

|

280,851 |

|

|

|

Accounts receivable, net |

|

14,881 |

|

|

|

11,616 |

|

|

|

1,832 |

|

|

|

Notes receivable |

|

5,622 |

|

|

|

5,154 |

|

|

|

813 |

|

|

|

Inventory |

|

4,373 |

|

|

|

3,223 |

|

|

|

508 |

|

|

|

Prepayments and other current assets |

|

487,540 |

|

|

|

396,431 |

|

|

|

62,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

3,247,732 |

|

|

|

3,158,544 |

|

|

|

498,248 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

Long-term restricted cash |

|

20,000 |

|

|

|

21,000 |

|

|

|

3,313 |

|

|

|

Property, equipment and software, net |

|

945,226 |

|

|

|

883,604 |

|

|

|

139,386 |

|

|

|

Long-term prepayments to related parties |

|

20,037 |

|

|

|

13,213 |

|

|

|

2,084 |

|

|

|

Right-of-use assets, net* |

|

- |

|

|

|

23,977 |

|

|

|

3,782 |

|

|

|

Other non-current assets |

|

164,986 |

|

|

|

143,384 |

|

|

|

22,619 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

1,150,249 |

|

|

|

1,085,178 |

|

|

|

171,184 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

4,397,981 |

|

|

|

4,243,722 |

|

|

|

669,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts and notes payable |

|

551,751 |

|

|

|

533,924 |

|

|

|

84,224 |

|

|

|

Amounts due to related parties-current |

|

23,290 |

|

|

|

7,566 |

|

|

|

1,194 |

|

|

|

Salary and welfare payable |

|

120,444 |

|

|

|

101,073 |

|

|

|

15,944 |

|

|

|

Taxes payable |

|

10,195 |

|

|

|

8,373 |

|

|

|

1,321 |

|

|

|

Financing payable-current |

|

84,175 |

|

|

|

82,006 |

|

|

|

12,936 |

|

|

|

Current portion of lease liabilities* |

|

- |

|

|

|

15,918 |

|

|

|

2,511 |

|

|

|

Accruals and other current liabilities |

|

238,510 |

|

|

|

243,893 |

|

|

|

38,473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

1,028,365 |

|

|

|

992,753 |

|

|

|

156,603 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

|

Financing payable-non-current |

|

85,658 |

|

|

|

73,049 |

|

|

|

11,523 |

|

|

|

Non-current lease liabilities* |

|

- |

|

|

|

4,054 |

|

|

|

640 |

|

|

|

Amounts due to related parties-non-current |

|

1,000 |

|

|

|

1,000 |

|

|

|

158 |

|

|

|

Other non-current liability |

|

16,489 |

|

|

|

15,169 |

|

|

|

2,393 |

|

|

|

Deferred tax liabilities, net |

|

34,445 |

|

|

|

34,445 |

|

|

|

5,434 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities |

|

137,592 |

|

|

|

127,717 |

|

|

|

20,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

1,165,957 |

|

|

|

1,120,470 |

|

|

|

176,751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

347 |

|

|

|

347 |

|

|

|

55 |

|

|

|

Treasury stock |

|

(27,784 |

) |

|

|

(41,026 |

) |

|

|

(6,472 |

) |

|

|

Additional paid-in capital |

|

11,799,301 |

|

|

|

11,806,017 |

|

|

|

1,862,353 |

|

|

|

Statutory reserves |

|

16,593 |

|

|

|

16,592 |

|

|

|

2,617 |

|

|

|

Accumulated other comprehensive income |

|

51,556 |

|

|

|

45,721 |

|

|

|

7,212 |

|

|

|

Accumulated deficit |

|

(8,607,989 |

) |

|

|

(8,704,399 |

) |

|

|

(1,373,085 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

3,232,024 |

|

|

|

3,123,252 |

|

|

|

492,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

|

4,397,981 |

|

|

|

4,243,722 |

|

|

|

669,432 |

|

|

| |

|

|

|

|

|

|

|

|

|

| * On 1 January

2022, the Company adopted ASC 842, Leases and used the additional

transition method to initially apply this new lease standard at the

adoption date. Right-of-use assets and lease liabilities were

recognized on the Company's consolidated financial statements. |

|

| |

| |

|

|

|

|

|

|

|

|

|

| Smart Share

Global Limited |

| Unaudited

Consolidated Statements of Comprehensive

Income/(Loss) |

| (In

thousands, except share and per share data, unless otherwise

noted) |

| |

|

|

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

2021 |

|

2022 |

|

|

| |

|

RMB |

|

RMB |

|

US$ |

|

| |

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

Mobile device charging business |

|

816,763 |

|

|

717,739 |

|

|

113,221 |

|

|

|

Power bank sales |

|

25,011 |

|

|

12,932 |

|

|

2,040 |

|

|

|

Others |

|

5,104 |

|

|

6,406 |

|

|

1,011 |

|

|

| |

|

|

|

|

|

|

|

|

Total revenues |

|

846,878 |

|

|

737,077 |

|

|

116,272 |

|

|

| |

|

|

|

|

|

|

|

|

Cost of revenues |

|

(124,622 |

) |

|

(127,553 |

) |

|

(20,121 |

) |

|

|

Research and development expenses |

|

(20,628 |

) |

|

(27,062 |

) |

|

(4,269 |

) |

|

|

Sales and marketing expenses |

|

(661,675 |

) |

|

(659,679 |

) |

|

(104,062 |

) |

|

|

General and administrative expenses |

|

(26,819 |

) |

|

(27,376 |

) |

|

(4,318 |

) |

|

|

Other operating income |

|

10,705 |

|

|

5,277 |

|

|

832 |

|

|

| |

|

|

|

|

|

|

|

|

Income/(loss) from operations |

|

23,839 |

|

|

(99,316 |

) |

|

(15,666 |

) |

|

| |

|

|

|

|

|

|

|

|

Interest and investment income |

|

3,269 |

|

|

11,587 |

|

|

1,828 |

|

|

|

Interest expense to third parties |

|

(10,439 |

) |

|

(8,414 |

) |

|

(1,327 |

) |

|

|

Foreign exchange gain/(loss), net |

|

2,441 |

|

|

(268 |

) |

|

(42 |

) |

|

|

Other loss |

|

(201 |

) |

|

- |

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

Income/(loss) before income tax expense |

|

18,909 |

|

|

(96,411 |

) |

|

(15,207 |

) |

|

| |

|

|

|

|

|

|

|

|

Income tax expense |

|

(3,813 |

) |

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

| Net

income/(loss) |

|

15,096 |

|

|

(96,411 |

) |

|

(15,207 |

) |

|

|

|

|

|

|

|

|

|

|

|

Accretion of convertible redeemable preferred shares |

|

(4,729,719 |

) |

|

- |

|

|

- |

|

|

|

Deemed dividend to preferred shareholders |

|

(104,036 |

) |

|

- |

|

|

- |

|

|

| Net

loss attributable to ordinary shareholders of Smart Share Global

Limited |

|

(4,818,659 |

) |

|

(96,411 |

) |

|

(15,207 |

) |

|

| |

|

|

|

|

|

|

|

| Net

income/(loss) |

|

15,096 |

|

|

(96,411 |

) |

|

(15,207 |

) |

|

| |

|

|

|

|

|

|

|

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of nil tax |

|

(99,036 |

) |

|

(5,835 |

) |

|

(920 |

) |

|

| |

|

|

|

|

|

|

|

|

Total comprehensive loss |

|

(83,940 |

) |

|

(102,246 |

) |

|

(16,127 |

) |

|

| |

|

|

|

|

|

|

|

|

Accretion of convertible redeemable preferred shares |

|

(4,729,719 |

) |

|

- |

|

|

- |

|

|

|

Deemed dividend to preferred shareholders |

|

(104,036 |

) |

|

- |

|

|

- |

|

|

|

Comprehensive loss attributable to ordinary shareholders of

Smart Share Global Limited |

|

(4,917,695 |

) |

|

(102,246 |

) |

|

(16,127 |

) |

|

| |

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares used in

computing net loss per share |

|

|

|

|

|

|

|

| -

basic and diluted |

|

69,535,853 |

|

|

517,408,222 |

|

|

517,408,222 |

|

|

| |

|

|

|

|

|

|

|

| Net

loss per share attributable to ordinary shareholders |

|

|

|

|

|

|

|

| -

basic and diluted |

|

(69.30 |

) |

|

(0.20 |

) |

|

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

| Net

loss per ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

| -

basic and diluted |

|

- |

|

|

(0.40 |

) |

|

(0.06 |

) |

|

| |

|

|

|

|

|

|

|

| Smart Share

Global Limited |

| Unaudited

Reconciliation of GAAP and Non-GAAP Results |

| (In

thousands, except share and per share data, unless otherwise

noted) |

| |

|

|

|

|

|

|

| |

Three months ended March 31, |

|

| |

2021 |

|

2022 |

|

| |

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

Net income/(loss) |

15,096 |

|

(96,411 |

) |

|

(15,207 |

) |

|

| Add: |

|

|

|

|

|

|

|

Share-based compensation |

8,141 |

|

6,716 |

|

|

1,059 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income/(loss) (non-GAAP) |

23,237 |

|

(89,695 |

) |

|

(14,148 |

) |

|

| |

|

|

|

|

|

|

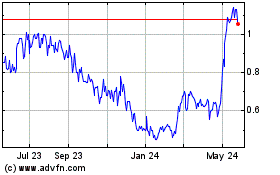

Smart Share Global (NASDAQ:EM)

Historical Stock Chart

From Nov 2024 to Dec 2024

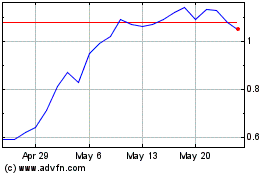

Smart Share Global (NASDAQ:EM)

Historical Stock Chart

From Dec 2023 to Dec 2024