Smart Share Global Limited (Nasdaq: EM) (“Energy Monster” or the

“Company”), a consumer tech company providing mobile device

charging service, today announced its unaudited financial results

for the quarter and fiscal year ended December 31, 2023.

HIGHLIGHTS FOR THE FOURTH QUARTER AND

FULL YEAR 2023

- Net income was RMB87.7 million for

the full year 2023, compared to a net loss of RMB711.2 million for

2022.

- Mobile device charging orders for

the fourth quarter of 2023 was 154.9 million, representing an

increase of 32.8% compared to the same period last year. Mobile

device charging orders for 2023 was 656.4 million, representing a

year-over-year increase of 18.7%.

- As of December 31, 2023, the

Company’s services were available in 1,234 thousand POIs2, compared

with 1,189 thousand as of September 30, 2023 and 997 thousand as of

December 31, 2022.

- As of December 31, 2023, 72.8% of

POIs were operated under our network partner model, compared with

65.5% as of September 30, 2023 and 52.5% as of December 31,

2022.

- As of December 31, 2023, the

Company’s available-for-use power banks3 were 9.2 million, compared

with 8.7 million as of September 30, 2023 and 6.7 million as of

December 31, 2022.

- As of December 31, 2023, cumulative

registered users4 reached 391.5 million, with 12.6 million newly

registered users acquired during the quarter and 57.9 million

acquired during the year.

“During 2023, our operations underwent a notable

transformation after overcoming the challenges in the previous

years, marked by achieving historic highs in mobile device charging

orders and returning to profitability,” said Mars Guangyuan Cai,

Chairman and Chief Executive Officer. “The expansion of our mobile

device charging service network also continued to reach

unprecedented levels, while our operational metrics consistently

achieved new milestones across the board. Our leadership in the

mobile device charging service sector continues to rise, as

evidenced by an increase in market share each year since our

inception. We are enthusiastic about the prospects and trajectory

of the mobile device charging service sector here in China and

remain unwavering in our commitment to delivering sustainable value

to all of our stakeholders.”

“In 2023, our dedication to expanding our mobile

device charging network remained consistent as we utilized a blend

of the direct and network partner models to expand the reach of our

service,” said Peifeng Xu, President. “We proactively pursued new

network partners across all regions to enhance our footprint in

existing regions and extend into new ones. Additionally, our direct

model synergizes with the network partner model, utilizing the

Energy Monster brand to establish partnerships with national and

regional key accounts. The general recovery in offline traffic in

2023 paves the way for stronger growth in 2024 as we continue to

leverage the strengths of both models to drive growth and

profitability.”

“We continued to strengthen our balance sheet

and optimize our working capital during 2023 while our operation

continued to recover towards normalization,” said Maria Yi Xin,

Chief Financial Officer. “The increasing contribution of the

network partner model has been a positive impact on our

profitability during the year. Going into 2024, we expect this

trend to continue as we optimize our portfolio of POIs under the

direct model. The return to profitability in each quarter of 2023

gives us the flexibility to explore different ways of delivering

value to our shareholders as well as investing in new initiatives

that will unlock our growth potential in the future.”

UPDATE ON CONTRACTUAL

ARRANGEMENTStarting in the second quarter of 2023, the

Company has updated its contractual arrangement with its network

partners under the network partner model, shifting the principal

role of providing mobile device charging service from the Company

to network partners. Under the new contractual arrangement, the

Company generates revenue by providing mobile device charging

solutions to network partners, including software and system

service, billing and settlement service, customer call center

service and other services. The ownership rights of cabinets and

power banks under the network partner model, which were previously

held by the Company, have also been transferred to the network

partners under the new contractual arrangement.

Starting in the second quarter of 2023, mobile

device charging revenue generated under the network partner model

has therefore been recorded under mobile device charging solution,

which is now net of incentive fees paid to network partners.

Relatedly, all incentive fees paid to network partners have been

excluded from the Company’s sales and marketing expenses under the

new contractual arrangement. Due to the new contractual

arrangement, the Company now also generates revenue from cabinet

and power bank sales to its network partners as a result of the

shift in ownership rights of the cabinets and power banks under the

network partner model from the Company to the network partners, and

cost of cabinets and power banks sold to the network partners will

be recognized accordingly.

Starting in the second quarter of 2023, the

classification of revenue has been updated accordingly to more

clearly reflect the results of the two mobile device charging

models. The Company’s mobile device charging operation now consists

of the direct model and the network partner model. Under the direct

model, the Company generates revenue by offering mobile device

charging service and sales of power banks to users. Under the

network partner model, the Company generates revenue by offering

mobile device charging solutions and sales of power banks and

cabinets to network partners.

The table below sets forth the breakdown of

mobile device charging revenue components based on the latest

classification for the periods indicated:

| |

|

|

|

|

|

|

|

|

|

| |

2022Q4 |

|

2023Q3 |

|

2023Q4 |

|

FY2022 |

|

FY2023 |

|

|

thousands RMB |

|

thousands RMB |

|

thousands RMB |

|

thousands RMB |

|

thousands RMB |

|

|

|

|

|

|

|

|

|

|

|

|

Mobile device charging: |

|

|

|

|

|

|

|

|

|

|

Direct Model |

268,841 |

|

284,233 |

|

215,741 |

|

1,617,793 |

|

1,083,300 |

|

Mobile device charging service |

263,367 |

|

278,099 |

|

210,899 |

|

1,587,298 |

|

1,058,636 |

|

Power bank sales |

5,474 |

|

6,134 |

|

4,842 |

|

30,495 |

|

24,664 |

|

Network Partner Model |

318,964 |

|

279,960 |

|

249,958 |

|

1,195,826 |

|

1,785,915 |

|

Mobile device charging service |

309,353 |

|

- |

|

- |

|

1,166,845 |

|

518,743 |

|

Mobile device charging solution |

- |

|

58,759 |

|

60,600 |

|

- |

|

173,152 |

|

Power bank and cabinet sales |

9,611 |

|

221,201 |

|

189,358 |

|

28,981 |

|

1,094,020 |

|

Total mobile device charging |

587,805 |

|

564,193 |

|

465,699 |

|

2,813,619 |

|

2,869,215 |

| |

FINANCIAL RESULTS FOR THE FOURTH QUARTER

OF 2023Revenues were RMB486.6 million

(US$68.5 million5) for the fourth quarter of 2023, representing a

18.3% decrease from the same period in 2022. The decrease was

primarily due to the decrease in mobile device charging revenues as

a result of the change in the contractual arrangement with network

partners.

- Mobile

device charging revenues, which consist

of revenues generated under both direct and network partner models,

decreased by 20.8% to RMB465.7 million (US$65.6 million) for the

fourth quarter of 2023, from RMB587.8 million in the same period of

2022.

- Revenues generated under the direct model, which comprise of

mobile device charging service fees of RMB210.9 million and power

bank sales of RMB4.8 million, decreased by 19.8% to RMB215.7

million for the fourth quarter of 2023, from RMB268.8 million in

the same period of 2022. The decrease was primarily due to the

decrease in number of POIs operated under the direct model.

- Revenues generated under the network partner model, which

comprise of mobile device charging solution fees of RMB60.6 million

and sales of cabinets and power banks of RMB189.4 million,

decreased by 21.6% to RMB250.0 million for the fourth quarter of

2023, from RMB319.0 million in the same period of 2022. The

decrease was primarily due to the change in the contractual

arrangement with network partners. Under the new contractual

arrangement, mobile device charging revenues generated under the

network partner model are net of incentive fees paid to network

partners. The decrease was partially offset by the increase in the

sales of cabinet and power bank to network partners.

- Other

revenues, which primarily comprise of revenue from

advertising services and new business initiatives, increased by

167.7% to RMB20.9 million (US$2.9 million) for the fourth quarter

of 2023, from RMB7.8 million in the same period of 2022. The

increase was primarily attributable to new business initiatives and

the increase in users and advertisement efficiency.

Cost of revenues increased by

41.0% to RMB198.7 million (US$28.0 million) for the fourth quarter

of 2023, from RMB141.0 million in the same period last year. The

increase was primarily due to the increase in sales of cabinets and

power banks under the new contractual arrangement with network

partners, partially offset by the decrease in depreciation

cost.

Research and development

expenses increased by 77.1% to RMB27.6 million (US$3.9

million) for the fourth quarter of 2023, from RMB15.6 million in

the same period last year. The increase was primarily due to the

increase in personnel related expenses.

Sales and marketing expenses

decreased by 60.8% to RMB248.8 million (US$35.0 million) for the

fourth quarter of 2023 from RMB635.2 million in the same period

last year. The decrease was primarily due to the decrease in

incentive fees paid to network partners as a result of the change

in the contractual arrangement with network partners and the

decrease in incentive fees paid to location partners.

General and administrative

expenses increased by 12.5% to RMB30.5 million (US$4.3

million) for the fourth quarter of 2023 from RMB27.1 million in the

same period last year. The increase was primarily due to the

increase in personnel related expenses.

Loss from operations for the

fourth quarter of 2023 was RMB32.9 million (US$4.6 million),

compared to a loss from operations of RMB233.9 million in the same

period last year.

Net income for the fourth

quarter of 2023 was RMB2.4 million (US$0.3 million), compared to a

net loss of RMB334.5 million in the same period last year.

Adjusted net income6 for the

fourth quarter of 2023 was RMB5.7 million (US$0.8 million),

compared to an adjusted net loss of RMB327.2 million in the same

period last year.

Net income attributable to ordinary

shareholders for the fourth quarter of 2023 was RMB2.4

million (US$0.3 million), compared to a net loss attributable to

ordinary shareholders of RMB334.5 million in the same period last

year.

As of December 31, 2023, the Company

had cash and cash equivalents, restricted cash and short-term

investments of RMB3.3 billion (US$468.1

million).

FINANCIAL RESULTS FOR FISCAL YEAR

2023

Revenues were RMB3.0 billion

(US$416.7 million) in 2023, representing a 4.2% year-over-year

increase. The increase was primarily due to (i) the increase in

mobile device charging revenue as a result of the general recovery

in offline foot traffic in China, and (ii) the increase in the

sales of power bank and cabinet and mobile device charging solution

revenue under the new contractual arrangement with network

partners, which is partially offset by the decrease in mobile

device charging service fees as a result of the change in the

contractual arrangement with network partners.

- Mobile

device charging revenues, which

consist of revenues generated under both direct and network partner

models, increased by 2.0% to RMB2.9 billion (US$404.1 million) in

2023, from RMB2.8 billion in 2022.

- Revenues generated under the direct model,

which comprise of mobile device charging service fees of RMB1.1

billion and power bank sales of RMB24.7 million, decreased by 33.0%

to RMB1.1 billion in 2023, from RMB1.6 billion in 2022. The

decrease was primarily due to the decrease in number of POIs

operated under the direct model.

- Revenues generated under the network partner

model, which comprise of mobile device charging service

fees of RMB518.7 million, mobile device charging solution fees of

RMB173.2 million and sales of cabinets and power banks of RMB1.1

billion, increased by 49.3% to RMB1.8 billion in 2023, from RMB1.2

billion in 2022. The increase was primarily due to the addition of

revenue generated from sales of cabinets and power banks as a

result of the change in the contractual arrangement with network

partners, which includes a one-time recognition of RMB500.6 million

in sales of cabinets and power banks to network partners during the

second quarter of 2023. The increase was partially offset by the

decrease in mobile device charging service fees due to the change

in the contractual arrangement with network partners. Under the new

contractual arrangement, mobile device charging revenue generated

under the network partner is net of incentive fees paid to network

partners.

- Other

revenues, which primarily comprise of revenue from new

business initiatives and advertising services, increase by 264.0%

to RMB89.4 million (US$12.6 million) in 2023, from RMB24.6 million

in 2022. The increase was primarily attributable to new business

initiatives and the increase in users and advertisement

efficiency.

Cost of revenues increased by

117.2% to RMB1.2 billion (US$170.3 million) in 2023, from RMB556.9

million in 2022. The increase was primarily due to the increase in

sales of cabinets and power banks under the new contractual

arrangement with network partners, which includes a one-time

recognition of RMB455.8 million in cost of cabinets and power banks

sold to network partners. The increase was partially offset by the

decrease in depreciation cost.

Research and development

expenses remained relatively stable at RMB91.5 million

(US$12.9 million) in 2023, compared to RMB90.7 million in 2022.

Sales and marketing expenses

decreased by 44.4% to RMB1.5 billion (US$212.3 million) in 2023,

compared to RMB2.7 billion in 2022. The decrease was primarily due

to the decreases in incentive fees paid to network partners as a

result of the change in the contractual arrangement with network

partners, incentive fees paid to location partners, and personnel

related expenses.

General and administrative

expenses increased by 11.7% to RMB125.5 million (US$17.7

million) in 2023, compared to RMB112.4 million in 2022. The

increase was primarily due to the increase in personnel related

expenses.

Loss from operations was RMB1.1

million (US$0.2 million) in 2023, compared to a loss from

operations of RMB621.2 million in 2022.

Net income was RMB87.7 million

(US$12.4 million) in 2023, compared to a net loss of RMB711.2

million in 2022.

Adjusted net income was

RMB108.1 million (US$15.2 million) in 2023, compared to an adjusted

net loss of RMB683.0 million in 2022.

Net income attributable to ordinary

shareholders was RMB87.7 million (US$12.4 million) in

2023, compared to a net loss attributable to ordinary shareholders

of RMB711.2 million in 2022.

CONFERENCE CALL INFORMATIONThe

company will hold a conference call at 8:00 A.M. Eastern Time on

Thursday, March 28, 2024 (8:00 P.M. Beijing Time on Thursday, March

28, 2024) to discuss the financial results. Upon registration, each

participant will receive dial-in details to join the conference

call.

Event Title: Energy Monster Fourth Quarter and

Fiscal Year 2023 Earnings CallPre-registration link:

https://s1.c-conf.com/diamondpass/10037927-hg76t5.html

Participants may also access the call via webcast:

https://edge.media-server.com/mmc/p/ibx8vz3c

A telephone replay will be available through April

4, 2024. The dial-in details are as follows:

|

International: |

+61-7-3107-6325 |

|

United States: |

+1-855-883-1031 |

|

Mainland China: |

+86-400-120-9216 |

|

China Hong Kong: |

+852-800-930-639 |

|

|

|

|

Access Code: |

10037927 |

|

|

|

A live and archived webcast of the conference

call will also be available at the Company’s investor relations

website at https://ir.enmonster.com/.

ABOUT SMART SHARE GLOBAL

LIMITEDSmart Share Global Limited (Nasdaq: EM), or Energy

Monster, is a consumer tech company with the mission to energize

everyday life. The Company is the largest provider of mobile device

charging service in China with the number one market share. The

Company provides mobile device charging service through its power

banks, which are placed in POIs such as entertainment venues,

restaurants, shopping centers, hotels, transportation hubs and

public spaces. Users may access the service by scanning the QR

codes on Energy Monster’s cabinets to release the power banks. As

of December 31, 2023, the Company had 9.2 million power banks in

1,234,000 POIs across more than 2,000 counties and county-level

districts in China.

CONTACT USInvestor

RelationsHansen Shiir@enmonster.com

SAFE HARBOR STATEMENTThis press

release contains forward-looking statements. These statements are

made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. In some cases,

forward-looking statements can be identified by words or phrases

such as “may,” “will,” “expect,” “anticipate,” “target,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to,” or other similar expressions. Among other

things, the business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. The Company may also

make written or oral forward-looking statements in its reports

filed with, or furnished to, the U.S. Securities and Exchange

Commission (“SEC”), in its annual reports to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about the

Company’s beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and a number of factors could cause actual results

to differ materially from those contained in any forward-looking

statement, including but not limited to the following: Energy

Monster’s strategies; its future business development, financial

condition and results of operations; the impact of technological

advancements on the pricing of and demand for its services;

competition in the mobile device charging service industry; Chinese

governmental policies and regulations affecting the mobile device

charging service industry; changes in its revenues, costs or

expenditures; general economic and business conditions globally and

in China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks,

uncertainties or factors is included in the Company’s filings with

the SEC. All information provided in this press release is as of

the date of this press release, and the Company does not undertake

any duty to update such information, except as required under

applicable law.

NON-GAAP FINANCIAL MEASUREIn

evaluating its business, the Company considers and uses non-GAAP

adjusted net income/(loss) in reviewing and assessing its operating

performance. The presentation of this non-GAAP financial measure is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

U.S. GAAP. The Company presents this non-GAAP financial

measure because it is used by management to evaluate operating

performance and formulate business plans. The Company believes that

this non-GAAP financial measure helps identify underlying trends in

its business, provide further information about its results of

operations, and enhance the overall understanding of its past

performance and future prospects.

Non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with

U.S. GAAP, and have limitations as analytical tools. The

Company’s non-GAAP financial measure does not reflect all items of

expenses that affect its operations and does not represent the

residual cash flow available for discretionary expenditures.

Further, the Company’s non-GAAP measure may differ from the

non-GAAP information used by other companies, including peer

companies, and therefore its comparability may be limited. The

Company compensates for these limitations by reconciling its

non-GAAP financial measure to the nearest U.S. GAAP

performance measure, which should be considered when evaluating

performance. Investors and others are encouraged to review the

Company’s financial information in its entirety and not rely on a

single financial measure.

The Company defines non-GAAP adjusted net

income/(loss) as net income/(loss) excluding share-based

compensation expenses. For more information on the non-GAAP

financial measure, please see the table captioned “Unaudited

Reconciliation of GAAP and Non-GAAP Results” set forth at the end

of this press release.

|

Smart Share Global Limited |

|

Unaudited Consolidated Balance Sheets |

|

(In thousands, except share and per share data, unless

otherwise noted) |

| |

|

|

|

|

|

|

| |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2023 |

|

RMB |

RMB |

US$ |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

948,773 |

|

|

594,348 |

|

|

83,712 |

|

|

Restricted cash |

|

14,608 |

|

|

167,542 |

|

|

23,598 |

|

|

Short-term investments |

|

2,091,198 |

|

|

2,541,889 |

|

|

358,018 |

|

|

Accounts receivable, net⁷ |

|

16,482 |

|

|

269,736 |

|

|

37,992 |

|

|

Inventory |

|

1,051 |

|

|

106,530 |

|

|

15,004 |

|

|

Prepayments and other current assets⁷ |

|

228,672 |

|

|

345,744 |

|

|

48,697 |

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

3,300,784 |

|

|

4,025,789 |

|

|

567,021 |

|

| |

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

Long-term restricted cash |

|

21,000 |

|

|

20,000 |

|

|

2,817 |

|

|

Property, equipment and software, net |

|

886,460 |

|

|

322,806 |

|

|

45,466 |

|

|

Long-term prepayments to related parties |

|

71 |

|

|

- |

|

|

- |

|

|

Right-of-use assets, net |

|

12,442 |

|

|

16,353 |

|

|

2,303 |

|

|

Other non-current assets⁷ |

|

35,898 |

|

|

21,621 |

|

|

3,046 |

|

|

Deferred tax assets, net |

|

30,986 |

|

|

18,804 |

|

|

2,648 |

|

| |

|

|

|

|

|

|

|

Total non-current assets |

|

986,857 |

|

|

399,584 |

|

|

56,280 |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

4,287,641 |

|

|

4,425,373 |

|

|

623,301 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts and notes payable |

|

810,197 |

|

|

764,741 |

|

|

107,712 |

|

|

Salary and welfare payable |

|

111,274 |

|

|

143,653 |

|

|

20,233 |

|

|

Taxes payable |

|

147,367 |

|

|

214,738 |

|

|

30,245 |

|

|

Financing payable-current |

|

76,272 |

|

|

- |

|

|

- |

|

|

Current portion of lease liabilities |

|

9,761 |

|

|

7,399 |

|

|

1,042 |

|

|

Accruals and other current liabilities |

|

268,007 |

|

|

336,959 |

|

|

47,459 |

|

|

|

|

|

|

|

|

|

| Total current

liabilities |

|

1,422,878 |

|

|

1,467,490 |

|

|

206,691 |

|

| |

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

Financing payable-non-current |

|

32,281 |

|

|

- |

|

|

- |

|

|

Non-current lease liabilities |

|

854 |

|

|

7,641 |

|

|

1,076 |

|

|

Amounts due to related parties-non-current |

|

1,000 |

|

|

1,000 |

|

|

141 |

|

|

Other non-current liabilities |

|

189,323 |

|

|

195,585 |

|

|

27,548 |

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities |

|

223,458 |

|

|

204,226 |

|

|

28,765 |

|

|

|

|

|

|

|

|

|

| Total

liabilities |

|

1,646,336 |

|

|

1,671,716 |

|

|

235,456 |

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

|

Ordinary shares |

|

347 |

|

|

347 |

|

|

49 |

|

|

Treasury stock |

|

(6,816 |

) |

|

(5,549 |

) |

|

(782 |

) |

|

Additional paid-in capital |

|

11,786,482 |

|

|

11,791,570 |

|

|

1,660,808 |

|

|

Statutory reserves |

|

16,593 |

|

|

16,593 |

|

|

2,337 |

|

|

Accumulated other comprehensive income |

|

163,928 |

|

|

182,824 |

|

|

25,750 |

|

|

Accumulated deficit⁷⁸ |

|

(9,319,229 |

) |

|

(9,232,128 |

) |

|

(1,300,317 |

) |

|

|

|

|

|

|

|

|

| Total shareholders'

equity |

|

2,641,305 |

|

|

2,753,657 |

|

|

387,845 |

|

|

|

|

|

|

|

|

|

| Total liabilities and

shareholders' equity |

|

4,287,641 |

|

|

4,425,373 |

|

|

623,301 |

|

| |

|

|

|

|

|

|

|

7 On January 1, 2023, the Company adopted ASU 2016-13, Financial

Instruments -- Credit Losses (Topic 326), using the modified

retrospective method and the adoption did not have material impact

on the consolidated financial statements. |

|

8 On January 1, 2023, the Company adopted ASU 2016-13, Financial

Instruments -- Credit Losses (Topic 326) and recognized a

cumulative-effect adjustment of RMB640 (US$93) to the opening

accumulated deficit at the adoption date. |

| |

|

|

|

|

|

|

|

|

|

|

Smart Share Global Limited |

|

Unaudited Consolidated Statements of Comprehensive

Income/(Loss) |

|

(In thousands, except share and per share data, unless

otherwise noted) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended December

31, |

|

Twelve months ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

| |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile device charging |

|

587,805 |

|

|

465,699 |

|

|

65,592 |

|

|

2,813,619 |

|

|

2,869,215 |

|

|

404,120 |

|

|

Others |

|

7,815 |

|

|

20,921 |

|

|

2,947 |

|

|

24,571 |

|

|

89,432 |

|

|

12,596 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

revenues |

|

595,620 |

|

|

486,620 |

|

|

68,539 |

|

|

2,838,190 |

|

|

2,958,647 |

|

|

416,716 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

(140,953 |

) |

|

(198,711 |

) |

|

(27,988 |

) |

|

(556,923 |

) |

|

(1,209,464 |

) |

|

(170,349 |

) |

|

Research and development expenses |

|

(15,565 |

) |

|

(27,567 |

) |

|

(3,883 |

) |

|

(90,655 |

) |

|

(91,461 |

) |

|

(12,882 |

) |

|

Sales and marketing expenses |

|

(635,199 |

) |

|

(248,792 |

) |

|

(35,042 |

) |

|

(2,712,330 |

) |

|

(1,507,432 |

) |

|

(212,317 |

) |

|

General and administrative expenses |

|

(27,148 |

) |

|

(30,546 |

) |

|

(4,302 |

) |

|

(112,403 |

) |

|

(125,528 |

) |

|

(17,680 |

) |

|

Other operating (loss)/income |

|

(10,682 |

) |

|

(13,860 |

) |

|

(1,952 |

) |

|

12,876 |

|

|

(25,827 |

) |

|

(3,638 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(233,927 |

) |

|

(32,856 |

) |

|

(4,628 |

) |

|

(621,245 |

) |

|

(1,065 |

) |

|

(150 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and investment income |

|

11,212 |

|

|

30,797 |

|

|

4,338 |

|

|

52,389 |

|

|

117,247 |

|

|

16,514 |

|

|

Interest expense to third parties |

|

(4,624 |

) |

|

- |

|

|

- |

|

|

(31,282 |

) |

|

(4,228 |

) |

|

(596 |

) |

|

Foreign exchange gain/(loss), net |

|

7,271 |

|

|

4,955 |

|

|

698 |

|

|

3,787 |

|

|

(3,255 |

) |

|

(458 |

) |

|

Other (loss)/income, net |

|

(4 |

) |

|

90 |

|

|

13 |

|

|

(413 |

) |

|

63 |

|

|

9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss)/income before

income tax expense |

|

(220,072 |

) |

|

2,986 |

|

|

421 |

|

|

(596,764 |

) |

|

108,762 |

|

|

15,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

(114,476 |

) |

|

(579 |

) |

|

(82 |

) |

|

(114,476 |

) |

|

(21,021 |

) |

|

(2,961 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

(loss)/income |

|

(334,548 |

) |

|

2,407 |

|

|

339 |

|

|

(711,240 |

) |

|

87,741 |

|

|

12,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to ordinary shareholders of Smart Share Global

Limited |

|

(334,548 |

) |

|

2,407 |

|

|

339 |

|

|

(711,240 |

) |

|

87,741 |

|

|

12,358 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

(loss)/income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of nil tax |

|

(31,734 |

) |

|

(19,194 |

) |

|

(2,703 |

) |

|

112,372 |

|

|

18,896 |

|

|

2,661 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive

(loss)/income |

|

(366,282 |

) |

|

(16,787 |

) |

|

(2,364 |

) |

|

(598,868 |

) |

|

106,637 |

|

|

15,019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

(loss)/income attributable to ordinary shareholders of Smart Share

Global Limited |

|

(366,282 |

) |

|

(16,787 |

) |

|

(2,364 |

) |

|

(598,868 |

) |

|

106,637 |

|

|

15,019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of ordinary shares used in computing net (loss)/income per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

- basic |

|

518,821,908 |

|

|

519,819,227 |

|

|

519,819,227 |

|

|

518,307,406 |

|

|

519,802,240 |

|

|

519,802,240 |

|

|

- diluted |

|

518,821,908 |

|

|

519,819,227 |

|

|

519,819,227 |

|

|

518,307,406 |

|

|

519,802,240 |

|

|

519,802,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income per

share attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

- basic |

|

(0.64 |

) |

|

0.00 |

|

|

0.00 |

|

|

(1.37 |

) |

|

0.17 |

|

|

0.02 |

|

|

- diluted |

|

(0.64 |

) |

|

0.00 |

|

|

0.00 |

|

|

(1.37 |

) |

|

0.17 |

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income per

ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

- basic |

|

(1.28 |

) |

|

0.00 |

|

|

0.00 |

|

|

(2.74 |

) |

|

0.34 |

|

|

0.04 |

|

|

- diluted |

|

(1.28 |

) |

|

0.00 |

|

|

0.00 |

|

|

(2.74 |

) |

|

0.34 |

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Smart Share Global Limited |

|

Unaudited Reconciliation

of GAAP and Non-GAAP

Results |

|

(In thousands, except share and per share data, unless

otherwise noted) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended December

31, |

|

Twelve months ended September 30, |

| |

2022 |

|

2023 |

|

2022 |

|

2023 |

| |

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income |

(334,548 |

) |

|

2,407 |

|

339 |

|

(711,240 |

) |

|

87,741 |

|

12,358 |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

7,377 |

|

|

3,309 |

|

466 |

|

28,245 |

|

|

20,339 |

|

2,865 |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted for tax effects |

- |

|

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net (loss)/income (non-GAAP) |

(327,171 |

) |

|

5,716 |

|

805 |

|

(682,995 |

) |

|

108,080 |

|

15,223 |

| |

|

|

|

|

|

|

|

|

|

|

|

____________________

1 The Company defines mobile device charging

orders for a given period as the total number of completed orders

placed by registered users of the mobile device charging business

under both the direct and network partner models in that given

period, without any adjustment for orders that may qualify for

discounts or incentives.2 The Company defines number of points of

interests, or POIs, as of a certain day as the total number of

unique locations whose proprietors (location partners) have entered

into contracts with the Company or its network partners on that day

and have at least one cabinet assigned to the location.3 The

Company defines available-for-use power banks as of a certain date

as the number of power banks in circulation on that day.4 The

Company defines cumulative registered users as the total number of

users who have agreed to register their mobile phone numbers with

the Company via its mini programs since inception, and the number

of cumulative registered users of the Company on a certain date is

the number of unique mobile phone numbers that have been registered

with the Company since inception on that date.5 The U.S. dollar

(US$) amounts disclosed in this press release, except for those

transaction amounts that were actually settled in U.S. dollars, are

presented solely for the convenience of the readers. The conversion

of Renminbi (RMB) into US$ in this press release is based on the

exchange rate set forth in the H.10 statistical release of the

Board of Governors of the Federal Reserve System as of December 31,

2023, which was RMB7.0999 to US$1.0000. The percentages stated in

this press release are calculated based on the RMB amounts.6 See

the sections entitled “Non-GAAP Financial Measure” and “Unaudited

Reconciliation of GAAP and Non-GAAP Results” in this press release

for more information.

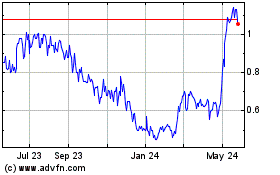

Smart Share Global (NASDAQ:EM)

Historical Stock Chart

From Dec 2024 to Jan 2025

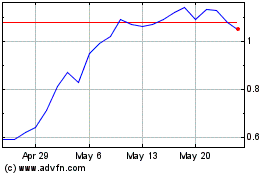

Smart Share Global (NASDAQ:EM)

Historical Stock Chart

From Jan 2024 to Jan 2025