UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 28, 2024

Energem

Corp.

(Exact

name of registrant as specified in its charter)

Cayman

Islands

(State

or other jurisdiction of incorporation)

| 001-41070 |

|

N/A |

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

Level

3, Tower 11, Avenue 5, No. 8,

Jalan

Kerinchi, Bangsar South

Wilayah

Persekutuan Kuala Lumpur, Malaysia 59200

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code +(60) 3270 47622

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Units,

each consisting of one Class A ordinary share, par value $0.0001 per share, and one redeemable warrant |

|

ENCPU |

|

The

Nasdaq Stock Market LLC |

| Class

A ordinary shares included as part of the units |

|

ENCP |

|

The

Nasdaq Stock Market LLC |

| Redeemable

warrants included as part of the units, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

ENCPW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.07. Submission of Matters to a Vote of Security Holders.

On

February 28, 2024, the shareholders of Energem Corp. (the “Company”) held an extraordinary general meeting of shareholders

(the “Shareholder Meeting”) for the following purposes:

As

of the record date for the Shareholder Meeting, 4,620,007 shares were entitled to vote at the Shareholder Meeting and 3,930,829 shares

were present and voted by proxy or in person, representing 85.083% of the shares entitled to vote at the Shareholder Meeting, which constituted

a quorum.

At

the Extraordinary General Meeting, a vote among the holders of Class A Ordinary Shares of the Company, par value $0.0001 per share and

Class B Ordinary Shares of the Company, par value $0.0001 per share (the “Ordinary Shares”) was taken on the following proposals

and with respect to Proposal 6 specifically, a vote among the holders of Class B Ordinary Shares of the Company, par value $0.0001 per

share was taken):

Proposal

No. 1 – The NTA Proposal

“RESOLVED,

as a special resolution, that subject to the approval of the Business Combination Proposal and with effect prior to the consummation

of the proposed Business Combination: (a) the current memorandum and articles of association of the Energem be amended by deleting Article 36.5(c)

in its entirety.” The following is a tabulation of the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 3,703,475

(80.162%) |

|

227,352

(4.921%) |

|

2 |

Proposal

No. 2 – The Business Combination Proposal

“RESOLVED,

as an ordinary resolution, that Energem’s entry into the Share Purchase Agreement, dated August 1, 2022 (the SPA) by and

among Energem Corp., a Cayman Islands exempted company, Graphjet Technology Sdn. Bhd., a Malaysian private limited company, Swee Guan

Hoo, solely in his capacity as the representative for the shareholders of Purchaser after the closing, the individuals listed on the

signature page of the SPA under the heading “Selling Shareholders” and Lee Ping Wei solely in his additional capacity as

representative for the Selling Shareholders, the consummation of the transactions contemplated by the SPA, including the issuance of

the transaction consideration thereunder, and the performance by Energem of its obligations thereunder thereby be ratified, approved,

adopted and confirmed in all respects.” The following is a tabulation of the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 3,703,475

(80.162%) |

|

227,352

(4.921%) |

|

2 |

Proposal

No. 3 – The M&A Proposal

“RESOLVED,

as a special resolution, that subject to the passing of the NTA Proposal, the Business Combination Proposal, the Share Issuance Proposal

and the Equity Incentive Plan Proposal, Energem Corp. change its name from “Energem Corp.” to “GRAPHJET TECHNOLOGY”

and, subject to the provisions of the Companies Act (Revised), the change of name shall take effect on and from the Closing Date, and

RESOLVED,

as a special resolution, that subject to the passing of the NTA Proposal, the Business Combination Proposal, the Share Issuance Proposal

and the Equity Incentive Plan Proposal, the amended and restated memorandum of association and the articles of association, copies of

which are attached to the proxy statement/prospectus, be and are hereby adopted as the memorandum and articles of association of Energem

in substitution for and to the exclusion of the entirety of Energem’s current memorandum of association and articles of association,

with effect on and from the Closing Date.” The following is a tabulation of the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 3,703,475

(80.162%) |

|

227,352

(4.921%) |

|

2 |

Proposal

No. 4 – The Share Issuance Proposal

“RESOLVED,

as an ordinary resolution, that for the purposes of complying with Nasdaq Listing Rule 5635, the issuance by Energem of an aggregate

of up to 138,000,000 Energem Class A Ordinary Shares to the Selling Shareholders pursuant to the Share Purchase Agreement, be approved

and adopted in all respects.” The following is a tabulation of the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 3,703,475

(80.162%) |

|

227,352

(4.921%) |

|

2 |

Proposal

No. 5 – The Equity Incentive Plan Proposal

“RESOLVED,

as an ordinary resolution, that the Equity Incentive Plan be adopted and approved with effect on and from the Closing Date.” The

following is a tabulation of the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 3,671,385

(79.467%) |

|

259,442

(5.616%) |

|

2 |

Proposal

No. 6 – The Director Appointment Proposal

“RESOLVED,

as an ordinary resolution, that assuming the NTA Proposal, the Business Combination Proposal, the Share Issuance Proposal and the Equity

Incentive Plan Proposal are each approved and adopted, Aiden Lee Ping Wei (Executive Director); Aw Jeen Rong (Executive Director); Hoo

Swee Guan (Executive Director); Ng Keok Chai (Independent Director); Ng Ah Lek (Independent Director); Wong Kok Seong (Independent Director);

and Doris Wong Sing Ee (Independent Director) shall be appointed as directors of the Company whereby Wong Kok Seong, Doris Wong Sing

Ee and Hoo Swee Guan are to serve until the 2023 annual meeting of shareholders; Ng Keok Chai and Ng Ah Lek are to be appointed as directors

of the Company to serve until the 2024 annual meeting of shareholders, and Aiden Lee Ping Wei and Aw Jeen Rong are to be appointed as

directors of the Company to serve until the 2025 annual meeting of shareholders, with effect on and from the Closing Date.” The

following is a tabulation of the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 2,875,000

(100.0%) |

|

0

(0%) |

|

2 |

Proposal

No. 7 – The Adjournment Proposal

“RESOLVED,

as an ordinary resolution, that the adjournment of the Extraordinary General Meeting to a later date or dates, if necessary to permit

further solicitation and vote of proxies if it is determined by Energem that more time is necessary or appropriate to approve one or

more Proposals at the Extraordinary General Meeting be approved and adopted in all respects.” The following is a tabulation of

the voting results:

Energem

Corp. Ordinary Shares:

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 3,703,445

(80.161%) |

|

227,382

(4.922%) |

|

2 |

Item

7.01 Regulation FD Disclosure.

Attached

as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is a copy of the press release issued

by the Company on February 28, 2024 announcing the Meeting results.

The

foregoing Exhibit 99.1 and the information set forth therein is being furnished pursuant to Item 7.01 and shall not be deemed to be filed

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject

to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed with this Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, Energem Corp. has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

ENERGEM

CORP. |

| |

|

|

| Date:

March 4, 2024 |

By: |

/s/

Swee Guan Hoo |

| |

Name:

|

Swee

Guan Hoo |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Energem

Corp. Announces Shareholder Approval of Business Combination with Graphjet Technology Sdn. Bhd.

~

Shareholders of Energem Corp. Approve Business Combination

on

February 28, 2024 ~

~

Upon Closing, the Combined Company is Expected to Trade on Nasdaq Under the Ticker “GTI” ~

Kuala

Lumpur – February 28, 2024 – Energem Corp. (“Energem”) (Nasdaq: ENCP, ENCPW), a publicly-traded special purpose

acquisition company, today announced that its shareholders voted to approve the previously announced

business combination with Graphjet Technology Sdn. Bhd., a Malaysian private limited company

(“Graphjet”), owner of the world’s first and the only patented technology to recycle palm kernel shells, generated

in the production of palm seed oil, to produce single layer graphene and artificial graphite for electric vehicle batteries, medical

devices, and home appliance, and all other proposals presented at Energem’s extraordinary

general meeting held on February 28, 2024.

Energem

shareholders approved the business combination proposal with 80.162% votes in favor of the approximately 85.083% of Energem votes cast

at the meeting. Energem plans to file the results of the meeting, as tabulated by an independent inspector of elections, on a Form 8-K

with the Securities and Exchange Commission (the “SEC”).

Subject

to the satisfaction or waiver of the other customary closing conditions, the business combination is expected to close on or about March

6, 2024. Following the closing, the combined company will operate as GRAPHJET TECHNOLOGY and has applied to list its ordinary shares

and warrants on the Nasdaq Global Market® under the new ticker symbols “GTI” and “GTIWW,”

respectively.

About

Graphjet Technology Sdn. Bhd.

Graphjet

Technology Sdn. Bhd. was founded in 2019 in Malaysia as an innovative graphene and graphite producer. Graphjet Technology has the world’s

first patent-pending technology to recycle palm kernel shells generated in the production of palm seed oil to produce single layer graphene

and artificial graphite. Graphjet’s sustainable production methods utilizing palm kernel shells, a waste agricultural product that

is common in Malaysia, will set a new shift in Graphite and Graphene supply chain of the world. Nelson Mullins Riley & Scarborough

LLP is acting as legal counsel to Graphjet Technology in the business combination.

About

Energem Corp.

Energem

is a blank check company formed for the purposes of effecting a merger, capital share exchange, asset acquisition, share purchase, reorganization,

or similar business combination with one or more energy and/or sustainable natural resource companies. In November 2021, Energem consummated

an initial public offering of 11.5 million units (reflecting the underwriters’ full exercise of their over-allotment option), each

unit consists of one Class A ordinary share and one redeemable warrant, each warrant entitles the holder to purchase one Class A ordinary

share at a price of $11.50 per share.

ARC

Group Limited acted as sole financial advisor, EF Hutton

LLC served as Capital Markets Advisor to Energem, and Ogier (Cayman) LLP acted as Cayman Islands counsel.

Rimon

P.C. served as U.S. counsel to Energem in its initial public offering and is acting as legal counsel to Energem in the business combination.

Ong, Ric & Partners (Malaysia) served as local counsel to Energem.

Important

Information and Where to Find It

This

press release relates to the Business Combination between Graphjet and Energem. This press

release does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. In connection with the transaction described herein, Graphjet

and Energem, and/or a successor entity of the transaction has filed or will file relevant materials with the SEC, including an

effective Registration Statement on Form S-4, which includes a proxy statement/prospectus of Energem, which will be filed with the SEC

promptly following the date of this press release. The definitive proxy statement will be sent to all Energem shareholders. Graphjet

and Energem, and/or a successor entity of the transaction will also file other documents regarding the proposed transaction with

the SEC. Before making any voting or investment decision, investors and security holders of Energem are urged to read the Registration

Statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with

the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors

and security holders will be able to obtain free copies of the Registration Statement, the proxy statement/prospectus and all other relevant

documents filed or that will be filed with the SEC by Graphjet and Energem, or any successor

entity of the transaction through the website maintained by the SEC at www.sec.gov.

The

documents filed or that will be filed by Energem with the SEC also may be obtained free

of charge upon written request to Energem Corp., Level 3, Tower 11, Avenue 5, No. 8, Jalan Kerinchi,

Bangsar South, Wilayah Persekutuan, Kuala Lumpur, Malaysia or via email to Energem’s executive director, Doris Wong Sing

Ee at doris@energemcorp.com.

The

documents filed or that will be filed by Graphjet or any successor entity of the business

combination with the SEC may be obtained free of charge upon written request to SEC at www.sec.gov or by directing a request to

Graphjet Technology, Unit No. L4-E-8, Enterprise 4, Technology Park Malaysia Bukit Jalil, 57000 Kuala Lumpur, Wilayah Persekutuan Kuala

Lumpur, Malaysia or via email to Graphjet’s Chief Executive Officer, Aiden Lee Ping Wei at aidenlee@graphjettech.com.

Participants

in the Solicitation

Graphjet,

Energem and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules,

be deemed to be participants in the solicitation of proxies from Energem’ shareholders in connection with the proposed transaction.

Additional information regarding the identity of all potential participants in the solicitation

of proxies to Energem’s shareholders in connection with the Business Combination and other matters to be voted upon at the Extraordinary

General Meeting, and their direct and indirect interests, by security holdings or otherwise, is set forth in Energem’ proxy statement.

Investors may obtain such information by reading such proxy statement.

Non-Solicitation

This

press release is for informational purposes only and relates to a proposed business combination

between Graphjet and Energem and is not intended and does not constitute a proxy statement or solicitation of a proxy, consent

or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer to

sell or a solicitation of an offer or invitation for the sale or purchase of the securities,

assets or the business of Energem or Graphjet, nor shall there be any sale of any such securities

in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offer of securities shall be deemed to be

made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements contained in this press release constitute “forward-looking statements” within the meaning of federal securities

laws. Forward-looking statements may include, but are not limited to, statements with respect to (i)

trends in the graphite and graphene raw materials industry, including changes in demand and supply related to Graphjet’s products

and services; (ii) Graphjet’s growth prospects and Graphjet’s market size; (iii) Graphjet projected financial and operational

performance including relative to its competitors; (iv) new product and service offerings Graphjet may introduce in the future; (v) the

potential transaction, including the implied enterprise value, the expected post-closing ownership structure and the likelihood and ability

of the parties to consummate the potential transaction successfully; (vi) the risk the proposed business combination may not be completed

in a timely manner or at all, which may adversely affect the price of Energem’s securities; (vii) the failure to satisfy the conditions

to the consummation of the proposed business combination, including the approval of the proposed business combination by the shareholders

of Energem; (viii) the effect of the announcement or pendency of the proposed business combination on Energem’s or Graphjet’s

business relationships, performance and business generally; (ix) the outcome of any legal proceedings that be instituted against Energem or

Graphjet related to the proposed business combination or any agreement related thereto; (x) the ability to maintain the listing of Energem on

Nasdaq; (xi) the price of Energem’s securities, including volatility resulting from changes in the competitive and regulated industry

in which Graphjet operates, variations in performance across competitors, changes in laws and regulations affecting Graphjet’s

business and changes in the combined capital structure; (xii) the ability to implement business pans, forecasts, and other expectations

after the completion of the proposed business combination and identify and realize additional opportunities; and (xiii) other statements

regarding Energem’s or Graphjet’s expectations, hopes, beliefs, intentions and strategies regarding the future.

In

addition, any statements that refer to projections forecasts or other characterizations of future events or circumstances, including

any underlying assumptions are forward-looking statements. he words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “outlook,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would,” and similar expressions may identify forward-looking statements, but the absence of these

words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements

about future events that are based on current expectations and assumptions and, as a result, are subject, are subject to risks and uncertainties.

You

should carefully consider the risks and uncertainties described in the “Risk Factors” section of Energem’s Registration

Statement on Form S-1, any proxy statement relating to the transaction filed by Energem with the SEC, other documents filed by Energem

from time to time with SEC, and any risk factors made available to you in connection with Energem, Graphjet, and the transaction. These

forward-looking statements involve a number of risks and uncertainties (some of which are beyond the control of Graphjet and Energem)

and other assumptions, that may cause the actual results or performance to be materially different from those expressed or implied by

these forward-looking statements. Readers are cautioned not to put undue reliance on forward-looking statements, and Graphjet and Energem

assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by securities and other applicable laws. Neither Graphjet and Energem gives any assurance

that either Graphjet or Energem, respectively, will achieve its expectations.

Contact

Energem

Corp.

Level

3, Tower 11, Avenue 5, No. 8

Jalan

Kerinchi, Bangsar South Wilayah Persekutuan

Kuala

Lumpur, Malaysia

Attn:

Mr. Swee Guan Hoo

Chief

Executive Officer

Tel:

+ (60) 3270 47622

Source:

Energem Corp.

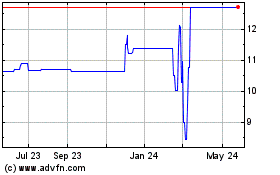

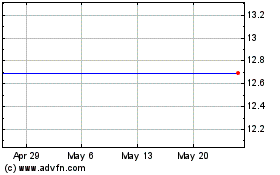

Energem (NASDAQ:ENCPU)

Historical Stock Chart

From Apr 2024 to May 2024

Energem (NASDAQ:ENCPU)

Historical Stock Chart

From May 2023 to May 2024