Filed Pursuant to Rule 424(b)(5)

Registration No. 333-270370

PROSPECTUS

Up to $50,000,000

Common Stock

_____________________________

We have entered into a sales agreement, the Sales Agreement, with SVB Securities LLC, or SVB Securities, relating to the sale of our common stock offered by this prospectus. In accordance with the terms of the Sales Agreement, under this prospectus we may offer and sell our common stock, par value $0.00001 per share, having an aggregate offering price of up to $50,000,000 from time to time through SVB Securities, acting as our agent.

Sales of our common stock, if any, under this prospectus will be made by any method permitted that is deemed an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended, or the Securities Act. SVB Securities is not required to sell any specific amount, but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to SVB Securities for sales of shares of our common stock will be 3.0% of the gross price per share sold. See “Plan of Distribution” beginning on page S-11 for additional information regarding the compensation to be paid to SVB Securities. In connection with the sale of the shares of common stock on our behalf, SVB Securities will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of SVB Securities will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to SVB Securities with respect to certain liabilities, including liabilities under the Securities Act.

Our common stock is listed on the Nasdaq Global Market, or Nasdaq, under the trading symbol “EOLS.” The last repoted sale price of our common stock on the Nasdaq Global Market on April 12, 2023 was $8.25 per share.

We are an “emerging growth company” under the federal securities laws and, as such, are subject to reduced public company reporting requirements. See “About the Company—Implications of Being an Emerging Growth Company” in this prospectus.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page S-5 of this prospectus and the risk factors in the documents filed with the U.S. Securities and Exchange Commission, or the SEC, and incorporated by reference herein to read about certain factors you should consider before investing in our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

SVB Securities

The date of this prospectus is June 8, 2023

TABLE OF CONTENTS

In making your investment decision, you should rely only on the information contained in or incorporated by reference into this prospectus or in any free writing prospectus prepared by or on behalf of us. Neither we nor SVB Securities have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference into this prospectus or in any free writing prospectus prepared by or on behalf of us. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor SVB Securities take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

The information contained in or incorporated by reference into this prospectus or in any free writing prospectus prepared by or on behalf of us is current only as of the date of the applicable document, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: Neither we nor SVB Securities have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. The $50,000,000 of common stock that may be offered, issued and sold under this prospectus is included in the $250,000,000 of securities that may be offered, issued and sold by us pursuant to the registration statement.

This prospectus provides certain information to you about this offering of shares of our common stock. If information in this prospectus is inconsistent with documents incorporated by reference in this prospectus filed prior to the date of this prospectus, you should rely on this prospectus. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus —the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

You should rely only on the information contained in, or incorporated by reference into, this prospectus and in any free writing prospectus that we may authorize for use in connection with this offering. We have not, and SVB Securities has not, authorized any other person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus, the documents incorporated by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering, is accurate only as of the date of each respective document. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus, the documents incorporated by reference into this prospectus, and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus entitled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

You should not consider any information in this prospectus or any free writing prospectus to which we have referred you to be investment, legal or tax advice. You should consult your own counsel, accountants and other advisors for legal, tax, business, financial and related advice regarding the purchase of any of the shares of common stock offered hereby.

We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

EVOLUS™, Jeuveau®, Evolux® and Evolysse™ are four of our trademarks that are used in this prospectus. Jeuveau® is the trade name in the United States for our approved product with non-proprietary name, prabotulinumtoxinA-xvfs. The product has different trade names outside of the United States, but is referred to throughout this prospectus as Jeuveau®. This prospectus also includes trademarks, trade names and service marks that are the property of other organizations, such as BOTOX® and BOTOX® Cosmetic, which we refer to throughout this prospectus as BOTOX. Solely for convenience, trademarks and trade names referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and in the documents incorporated by reference herein. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under "Risk Factors" beginning on page S-5 of this prospectus, in our Annual Report on Form 10-K for the period ended December 31, 2022 and in our Quarterly Report on Form 10-Q for the period ended March 31, 2023, along with our consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by reference in this prospectus, before making an investment decision. Unless the context requires otherwise, references in this prospectus to “Evolus,” “our company,” “we,” “us” and “our” refer to Evolus, Inc.

Our Business

Overview

We are a performance beauty company with a customer-centric approach to delivering breakthrough products in the self-pay aesthetic market.

Our first commercial product is Jeuveau®, which is a proprietary 900 kilodalton, or kDa, purified botulinum toxin type A formulation indicated for the temporary improvement in the appearance of moderate to severe glabellar lines, also known as “frown lines,” in adults. Our primary market is the self-pay aesthetic market, which includes medical products purchased by physicians and other customers that are then sold to consumers or used in procedures for aesthetic indications that are not reimbursed by any third-party payor, such as Medicaid, Medicare or commercial insurance. We believe we offer customers and consumers a compelling value proposition with Jeuveau®. Currently, BOTOX (onabotulinumtoxinA) is the neurotoxin market leader, and prior to the approval of Jeuveau®, was the only known 900 kDa botulinum toxin type A complex approved in the United States. We believe aesthetic physicians generally prefer the performance characteristics of the complete 900 kDa neurotoxin complex and are accustomed to injecting this formulation.

United States

In February 2019, we received the approval of our first product Jeuveau® (prabotulinumtoxinA-xvfs) from the U.S. Food and Drug Administration, or FDA. In May 2019, we commercially launched Jeuveau® in the United States.

In November 2021, we announced the initiation of a Phase II clinical trial designed to investigate a higher strength dose of Jeuveau® in the glabellar lines. We completed our patient enrollment in the clinical study evaluating the “extra-strength” dose in the second quarter of 2022 and the trial is expected to be completed in the first half of 2023. If this indication is approved by the FDA after our completion of all necessary clinical trials and regulatory submissions (including a Phase III clinical trial), we will have the opportunity to offer an extra-strength dosage option, which may make Jeuveau® the first multi-strength neurotoxin and give customers and consumers increased treatment options.

On May 9, 2023, we entered into a License, Supply and Distribution Agreement, or the Symatese Agreement, with Symatese S.A.S (“Symatese”), pursuant to which Symatese granted to us an exclusive right to commercialize and distribute five dermal filler product candidates which we collectively refer to as Evolysse™, including the products we refer to as: (i) Lift; (ii) Smooth; (iii) Sculpt; (iv) Lips; and (v) Eye in the United States for aesthetic and dermatological uses. We also have the right of first negotiation to obtain a license from Symatese for any products developed using the same technology as the Evolysse™ line of dermal fillers.

Evolysse™ Lift, Smooth, and Sculpt are currently in advanced stages of clinical trials pursuant to an investigational device exemption, or IDE, from the FDA. We have agreed to a cost-sharing arrangement with Symatese to gain FDA approval of the Evolysse™ Lips and Eye products, and we expect to begin their clinical programs in 2023. Subject to FDA approval, we expect Evolysse™ Lift and Smooth to be commercially launched in the first half of 2025, Evolysse™ Sculpt to be launched in 2026 and Evolysse™ Lips and Eye to be launched in 2027.

International

In August 2018, we received approval from Health Canada for the temporary improvement in the appearance of moderate to severe glabellar lines in adult patients under 65 years of age. We began marketing Jeuveau® in Canada in October 2019 through our distribution partner, Clarion Medical Technologies, Inc., or Clarion.

In September 2019, we received approval from the European Commission, to market Jeuveau® in all 27 European Union, or EU, member states plus the United Kingdom, Iceland, Norway and Liechtenstein. In January 2021, we received a positive decision from the European Commission to add the 50 unit product to the existing approval obtained in September 2019. We commercially launched Jeuveau® in Great Britain in September 2022, in Germany and Austria in February 2023, and we are finalizing plans for entering additional countries in Europe as part of a phased rollout.

In January 2023, we received approval from the Australian Therapeutics Good Administration, or TGA, for regulatory approval of our neurotoxin in Australia.

Implications of Being an Emerging Growth Company

We currently qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as we remain an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies. These provisions include, but are not limited to:

•being permitted to have only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure;

•an exemption from compliance with the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act;

•reduced disclosure about executive compensation arrangements in our periodic reports, registration statements and proxy statements; and

•exemptions from the requirements to seek non-binding advisory votes on executive compensation or golden parachute arrangements.

In addition, the JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to “opt out” of this provision and to comply with new or revised accounting standards as required of publicly-traded companies generally. This decision to opt out of the extended transition period is irrevocable.

A company that qualifies as an emerging growth company at the time of its initial public offering remains an emerging growth company until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the initial public offering, (ii) the first fiscal year after our annual gross revenues are $1.235 billion or more, (iii) the date on which we have, during the immediately preceding three-year period, issued more than $1.0 billion in non-convertible debt securities or (iv) the end of any fiscal year in which the market value of our common stock held by non-affiliates is $700 million or more as of the end of the second quarter of that fiscal year. We will cease being an emerging growth company on December 31, 2023.

Company Information

We were incorporated in the State of Delaware in November 2012. Our principal executive offices are located at 520 Newport Center Drive, Suite 1200, Newport Beach, California 92660, and our telephone number is (949) 284-4555. Our website address is www.evolus.com. We do not incorporate the information on or accessible through our website into this prospectus. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus. Our website address is included in this prospectus as an inactive textual reference only.

THE OFFERING

| | | | | | | | |

| Common stock offered by us | | Common stock having an aggregated offering price of up to $50,000,000 |

| | |

| Common stock to be outstanding after this offering | | Up to 62,604,094 shares assuming sales of 5,720,823 shares of our common stock in this offering at an offering price of $8.74 per share, the last reported sale price of our common stock on The Nasdaq Global Market on June 6, 2023. The actual number of shares issued will vary depending on the sales price under this offering. |

| | |

| Manner of offering | | We will sell the shares of our common stock offered hereby by any method permitted that is deemed an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act, through our agent SVB Securities. See the section entitled “Plan of Distribution” on page S-11 of this prospectus. |

| | |

| Use of proceeds | | We currently plan to use the net proceeds from this offering for business development, working capital and other general corporate purposes. See “Use of Proceeds” for more information. |

| | |

| Nasdaq Global Market symbol | | “EOLS” |

| | |

| Risk factors | | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of certain factors to consider carefully before deciding to purchase any shares of our common stock. |

The number of shares of our common stock to be outstanding after this offering is based on 56,883,271 shares of common stock outstanding as of March 31, 2023, and excludes as of that date:

•5,824,197 shares of our common stock issuable upon the exercise of outstanding stock options under our Evolus, Inc. 2017 Omnibus Incentive Plan (the "2017 Plan") at a weighted average exercise price of $9.60 per share, and 169,158 shares of our common stock issuable upon the exercise of outstanding inducement stock options outside the 2017 Plan at a weighted average exercise price of $9.06 per share;

•3,257,469 shares of our common stock issuable upon the vesting and settlement of restricted stock units outstanding under the 2017 Plan and 36,443 shares of our common stock issuable upon the vesting and settlement of inducement restricted stock units outside of the 2017 Plan;

•1,277,515 shares of our common stock reserved for future issuance under the 2017 Plan.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding to invest in our common stock, you should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus and in the documents incorporated by reference herein, including the risks described in the “Risk Factors” section of our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future, including subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. If any of these risks actually occur, our business, prospects, operating results and financial condition could suffer materially. In such event, the trading price of our common stock could decline and you might lose all or part of your investment.

Risks Related to this Offering

If you purchase our common stock sold in this offering, you may experience immediate and substantial dilution in the net tangible book value of your common stock. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to you.

The price per share of our common stock being offered may be higher than the net tangible book value per share of our outstanding common stock prior to this offering. Assuming that an aggregate of 5,720,823 shares of common stock are sold at a price of $8.74 per share, the last reported sale price of our common stock on the Nasdaq Global Market on June 6, 2023, for aggregate gross proceeds of approximately $50,000,000, and after deducting commissions and estimated offering expenses payable by us, new investors in this offering would incur immediate dilution of $8.96 per share. For a more detailed discussion of the foregoing, see the section entitled “Dilution” below. To the extent outstanding stock options are exercised or restricted stock units are settled, there would be further dilution to new investors. In addition, to the extent we raise additional capital in the future and we issue additional shares of common stock or securities convertible or exchangeable for our common stock, our then existing stockholders may experience dilution and the new securities may have rights senior to those of our common stock offered in this offering.

Our management will have broad discretion over the actual amounts and timing of the expenditure of the proceeds from this offering, if any, and might not apply the proceeds in ways that enhance our operating results or increase the value of your investment.

We currently plan to use the net proceeds from this offering, if any, for business development, working capital and other general corporate purposes. Our management will have broad discretion over the actual amounts and timing of the expenditure of the net proceeds from this offering within those categories, and accordingly, investors in this offering will need to rely upon the judgment of our management with respect to the use of proceeds, with only limited information concerning management’s specific intentions. Our management might not apply the proceeds in ways that enhance our operating results or increase the value of your investment. Pending our use of the net proceeds from this offering, we plan to invest the net proceeds in a variety of capital preservation investments, including short and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

The actual number of shares of common stock we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to SVB Securities at any time throughout the term of the Sales Agreement. The per share price of the shares of common stock that are sold by SVB Securities after delivering a placement notice will fluctuate based on the market price of our common stock during the sales period and limits we set with SVB Securities. Because the price per share of each share of common stock sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares of common stock that will be ultimately issued.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares of common stock at different times will likely pay different prices.

Investors who purchase shares of common stock in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the

timing, prices, and number of shares of our common stock sold, and there is no minimum or maximum sales price required by the Sales Agreement, although our Board of Directors may from time to time establish a minimum sales price at which we may sell shares of our common stock in this offering. Investors may experience a decline in the value of their common stock as a result of common stock sales made at prices lower than the prices they paid.

If we or SVB Securities terminates the Sales Agreement, we may incur additional fees and expenses and experience delays or disruptions in our financing and other plans.

The Sales Agreement provides that neither we nor SVB Securities may assign our respective rights or obligations under the Sales Agreement without the prior written consent of the other party; provided, however, that SVB Securities may assign its rights and obligations thereunder to an affiliate of SVB Securities without obtaining our consent, so long as such affiliate is a registered broker-dealer. SVB Securities and we also have the right, by giving three days’ prior written notice as specified in the Sales Agreement, to terminate the Sales Agreement in each party’s sole discretion at any time.

In connection with the pending bankruptcy filing by SVB Financial Group, or SVBFG, the ultimate parent of SVB Securities, SVBFG has announced that it is evaluating strategic alternatives for SVB Securities. If, as a result of that evaluation, SVB Securities seeks to assign the Sales Agreement to a non-affiliate and we do not consent to such assignment, we may elect to terminate the Sales Agreement with SVB Securities. It is also possible that either we or SVB Securities may at any time and for any reason, whether in connection with the bankruptcy of SVBFG, the results of SVBFG’s evaluation of strategic alternatives for SVB Securities or otherwise, choose to terminate the Sales Agreement. If the Sales Agreement is terminated, we would no longer be able to sell the shares of common stock offered hereby and would be required to enter into a new sales agreement with one or more other sales agents and file a prospectus supplement with the SEC to continue an at-the-market offering of shares of our common stock or seek other financing alternatives. Such events could cause us to incur additional fees and expenses and may delay or disrupt our financing plans and our ability to take actions for which we may otherwise have used the net proceeds from the sale of shares of common stock offered hereby.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein may contain or incorporate forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements, including statements about future events, our business, financial condition, results of operations and prospects, our industry and the regulatory environment in which we operate, are subject to risks and uncertainties. Any statements contained herein, in the accompanying prospectus or the documents incorporated by reference herein or therein that are not statements of historical or current facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, or other comparable terms intended to identify statements about the future. The forward-looking statements included herein are based on our current expectations, assumptions, estimates and projections, which we believe to be reasonable, and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. These risks and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond our control, include, but are not limited to, the following:

•We currently depend entirely on the successful commercialization of our only commercial product, Jeuveau®. If we are unable to successfully market and sell Jeuveau®, we may not generate sufficient revenue to continue our business.

•We have a limited operating history and have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future. We have only one approved product, which, together with our limited operating history, makes it difficult to assess our future viability.

•We are reliant on Symatese to achieve regulatory approval for the Evolysse™ dermal filler product line in the United States. Failure to obtain approval for the Evolysse™ product line would negatively affect our ability to sell these products.

•We may require additional financing to fund our future operations, and a failure to obtain additional capital when so needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our operations.

•If we or our counterparties do not comply with the terms of our settlement agreements with Medytox, Inc., or Medytox, we may face litigation or lose our ability to market and sell Jeuveau®, which would materially and adversely affect our ability to carry out our business and our financial condition and ability to continue as a going concern.

•The terms of the Settlement Agreement with Medytox will reduce our profitability and may affect the extent of any discounts we may offer to our customers.

•Our business, financial condition and operations have been, and may in the future be, adversely affected by the COVID-19 outbreak or other similar outbreaks.

•We rely on the license and supply agreement, as amended, with Daewoong, which we refer to as the Daewoong Agreement, to provide us with exclusive rights to distribute Jeuveau® in certain territories. Any termination or loss of significant rights, including exclusivity, under the Daewoong Agreement would materially and adversely affect our development and commercialization of Jeuveau®.

•Our failure to successfully in-license, acquire, develop and market additional product candidates or approved products would impair our ability to grow our business.

•Jeuveau® faces, and any of our future product candidates will face, significant competition and our failure to effectively compete may prevent us from achieving significant market penetration and expansion.

•Jeuveau® may fail to achieve the broad degree of physician adoption and use or consumer demand necessary for commercial success.

•Our ability to market Jeuveau® is limited to use for the treatment of glabellar lines, and if we want to expand the indications for which we market Jeuveau®, we will need to obtain additional regulatory approvals, which will be expensive and may not be granted.

•Third party claims of intellectual property infringement may prevent or delay our commercialization efforts and interrupt our supply of products.

•If we or any of our current or future licensors, including Daewoong, are unable to maintain, obtain or protect intellectual property rights related to Jeuveau® or any of our future product candidates, we may not be able to compete effectively in our market.

•We may need to increase the size of our organization, including our sales and marketing capabilities, in order to further market and sell Jeuveau® and we may experience difficulties in managing this growth.

•We rely on our digital technology and applications and our business and operations would suffer in the event of computer system failures or breach.

•We are subject to extensive government regulation, and we may face delays in or not obtain regulatory approval of our product candidates and our compliance with ongoing regulatory requirements may result in significant additional expense, limit or delay regulatory approval or subject us to penalties if we fail to comply.

•The anticipated use of proceeds from this offering, if any.

These risks and uncertainties are described in more detail in Item 1A “Risk Factors” included in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. You should carefully consider these risks, as well as the additional risks described under “Risk Factors” in this prospectus and in other documents we file with the SEC in the future, including subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, which may from time to time amend, supplement or supersede the risks and uncertainties we disclose. We also operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

The forward-looking statements included herein or incorporated herein by reference are based on current expectations of management based on available information and are believed to be reasonable. In light of the significant risks and uncertainties inherent in the forward-looking statements included herein or incorporated herein by reference, the inclusion of such information should not be regarded as a representation by us or any other person that such results will be achieved, and investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. Except as required by law, we undertake no obligation to revise any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents incorporated by reference herein with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by the cautionary statements referenced above.

USE OF PROCEEDS

We will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. We may issue and sell common stock having aggregate sales proceeds of up to $50,000,000 from time to time. Because there is no minimum offering amount required as a condition to complete this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

We currently plan to use the net proceeds from this offering for business development, working capital and other general corporate purposes. Our management will have broad discretion over the actual amounts and timing of the expenditure of the net proceeds from this offering within those categories, and accordingly, investors in this offering will need to rely upon the judgment of our management with respect to the use of proceeds. We may also use a portion of the net proceeds to acquire or invest in businesses, products and technologies that are complementary to our own, although we have no current commitments or agreements with respect to any acquisitions as of the date of this prospectus.

Pending our use of the net proceeds from this offering, we plan to invest the net proceeds in a variety of capital preservation investments, including short and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the price per share you pay in this offering and the as adjusted net tangible book value per share of our common stock immediately after this offering.

Our net tangible book value (deficit) as of March 31, 2023 was approximately $(62.2) million or $(1.09) per share of common stock. Our net tangible book value (deficit) is the amount of our total tangible assets less our liabilities and our net tangible book value (deficit) per share is our net tangible book value (deficit) divided by the number of shares of common stock outstanding, in each case as of the date specified.

After giving effect to the sale by us of shares of our common stock in this offering in the aggregate amount of $50.0 million, at an assumed offering price of $8.74 per share, the last reported sale price of our common stock on the Nasdaq Global Market on June 6, 2023, and after deducting commissions and estimated offering expenses payable by us, our as adjusted net tangible book value (deficit) as of March 31, 2023 would have been $(13.79) million, or $(0.22) per share. This amount represents an immediate increase in as adjusted net tangible book value of $0.87 per share to our existing stockholders and an immediate dilution of $8.96 in net tangible book value (deficit) to new investors purchasing shares of common stock in this offering. Dilution per share to new investors is determined by subtracting as adjusted net tangible book value per share after this offering from the assumed offering price per share paid by new investors.

The following table illustrates this dilution on a per share basis. The as adjusted information is illustrative only and will adjust based on the actual price to the public, the actual number of shares sold and other terms of the offering determined at the time shares of our common stock are sold pursuant to this prospectus. The as adjusted information also assumes that all of our common stock in the aggregate amount of $50.0 million is sold at an assumed offering price of $8.74 per share, the last reported sale price of our common stock on the Nasdaq Global Market on June 6, 2023. The shares sold in this offering, if any, will be sold from time to time at various prices.

| | | | | | | | | | | |

| Assumed public offering price per share | | | $8.74 |

Net tangible book value (deficit) per share as of March 31, 2023 | $ | (1.09) | | | |

| Increase in net tangible book value (deficit) per share attributable to this offering | $ | 0.87 | | | |

| As adjusted net tangible book value (deficit) per share after this offering | | | (0.22) | |

| Dilution per share to investors purchasing in this offering | | | $ | 8.96 | |

The number of shares of our common stock to be outstanding after this offering is based on 56,883,271 shares of common stock outstanding as of March 31, 2023, and excludes as of that date:

•5,824,197 shares of our common stock issuable upon the exercise of outstanding stock options under the 2017 Plan at a weighted average exercise price of $9.60 per share, and 169,158 shares of our common stock issuable upon the exercise of outstanding inducement stock options outside the 2017 Plan at a weighted average exercise price of $9.06 per share;

•3,257,469 shares of our common stock issuable upon the vesting and settlement of restricted stock units outstanding under the 2017 Plan and 36,443 shares of our common stock issuable upon the vesting and settlement of inducement restricted stock units outside of the 2017 Plan;

•1,277,515 shares of our common stock reserved for future issuance under the 2017 Plan.

Furthermore, we may choose to raise additional capital through the sale of equity or convertible debt securities due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that any outstanding stock options are exercised, outstanding restricted stock units are settled, new stock options or restricted stock units are issued under the 2017 Plan or we issue additional shares of common stock or other equity or convertible debt securities in the future, there will be further dilution to investors purchasing in this offering.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with SVB Securities, as sales agent, under which we may issue and sell shares of common stock having an aggregate offering price of up to $50,000,000 from time to time through SVB Securities as our sales agent. Sales of shares of common stock, if any, under this prospectus will be made at market prices by any method that is deemed to be an “at-the-market” offering, as defined in Rule 415 under the Securities Act, including sales made directly on the Nasdaq Global Market or any other trading market for our common stock. If authorized by us in writing, SVB Securities may purchase shares of our common stock as principal.

SVB Securities will offer shares of our common stock subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and SVB Securities. We will designate the maximum amount of common stock to be sold through SVB Securities on a daily basis or otherwise determine such maximum amount together with SVB Securities. Subject to the terms and conditions of the Sales Agreement, SVB Securities will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell on our behalf all of the shares of common stock requested to be sold by us. We may instruct SVB Securities not to sell shares of common stock if the sales cannot be effected at or above the price designated by us in any such instruction. SVB Securities or we may suspend the offering of shares of our common stock being made through SVB Securities under the Sales Agreement upon proper notice to the other party. SVB Securities and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in each party's sole discretion at any time. The offering of shares of our common stock pursuant to the Sales Agreement will otherwise terminate upon the termination of the Sales Agreement as provided therein.

The aggregate compensation payable to SVB Securities as sales agent will be an amount equal to 3.0% of the gross proceeds of any shares sold through it pursuant to the Sales Agreement. We have also agreed to reimburse SVB Securities up to $50,000 of actual outside legal expenses incurred by SVB Securities in connection with this offering. We have also agreed to reimburse SVB Securities for certain ongoing fees of its legal counsel. We estimate that the total expenses of the offering payable by us, excluding commissions payable to SVB Securities under the Sales Agreement, will be approximately $100,000.

SVB Securities will provide written confirmation to us following the close of trading on the Nasdaq Global Market on each day in which shares of common stock are sold through it as sales agent under the Sales Agreement. Each confirmation will include the number of shares of common stock sold through it as sales agent on that day, the volume weighted average price of the shares of common stock sold, the percentage of the daily trading volume and the net proceeds to us.

Settlement for sales of shares of common stock will occur, unless the parties agree otherwise, on the second business day that is also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will report at least quarterly the number of shares of common stock sold through SVB Securities under the Sales Agreement, the net proceeds to us and the compensation paid by us to SVB Securities in connection with the sales of shares of common stock during the relevant period.

SVB Securities has advised us of the following: SVB Securities is a wholly-owned indirect subsidiary of SVB Financial Group, or SVBFG. Since SVBFG’s acquisition of SVB Securities, then known as Leerink Partners, in 2019, there has never been any cross-ownership between any of SVBFG’s other past or present operating units, including Silicon Valley Bank. SVB Securities conducts its day-to-day operations under the supervision of its own management, with its own employees, that do not overlap with the management and employees of SVBFG or SVBFG’s other subsidiaries. SVB Securities operates with its own capital, that is separate from, and not commingled with, assets of the other SVBFG operations. On March 17, 2023, SVBFG commenced a voluntary Chapter 11 proceeding to preserve value. As publicly disclosed by SVBFG, neither SVB Securities nor any of its assets is included in the Chapter 11 filing. Because SVB Securities is not part of the SVBFG bankruptcy filing, creditors of SVBFG do not have any claims to any assets of SVB Securities. SVB Securities continues to operate in the ordinary course and is not subject to oversight by the Bankruptcy Court. Similarly, the seizure by the FDIC, and the subsequent sale, of Silicon Valley Bank had no direct impact on SVB Securities or its operations. Accordingly, we do not believe that SVBFG’s bankruptcy filing will have any impact on this offering or on SVB Securities’ ability to perform its duties as our sales agent.

In connection with the sales of shares of common stock on our behalf, SVB Securities will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to SVB Securities will be deemed to be underwriting

commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to SVB Securities against certain liabilities, including liabilities under the Securities Act. As sales agent, SVB Securities will not engage in any transactions that stabilize our common stock.

LEGAL MATTERS

The validity of the shares of common stock being offered by this prospectus will be passed upon for us by O’Melveny & Myers LLP. Goodwin Procter LLP, is acting as counsel for SVB Securities in connection with this offering.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the SEC a registration statement on Form S-3, including exhibits and schedules, under the Securities Act, with respect to the shares of common stock offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement and its exhibits. For further information with respect to us and the common stock offered hereby, we refer you to the registration statement and the exhibits and schedules filed thereto. Statements contained in this prospectus, including documents that we have incorporated by reference, regarding the contents of any contract or any other document that is filed or incorporated by reference as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed or incorporated by reference as an exhibit to the registration statement. You should review the complete document to evaluate these statements. You may obtain copies of the registration statement and its exhibits via the SEC’s EDGAR database.

We file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers, including our company, that file electronically with the SEC. You may obtain documents that we file with the SEC at http://www.sec.gov.

We also make these documents available on our website at www.evolus.com. Our website and the information contained or connected to our website is not incorporated by reference into this prospectus. The information contained in, or that can be accessed through, our website is not part of this prospectus. The prospectus included in this filing is part of a registration statement filed by us with the SEC. You may also request a copy of these filings, at no cost, by writing us at 520 Newport Center Drive, Suite 1200, Newport Beach, California 92660, Attention: General Counsel or telephoning us at (949) 284-4555.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain of the information we file with the SEC. This means we can disclose important information to you by referring you to another document that has been filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus. We incorporate by reference the documents listed below that we have previously filed with the SEC:

•our Current Report on Form 8-K (other than information furnished rather than filed) filed with the SEC on May 9, 2023; and

•the description of our common stock contained in Exhibit 4.3 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 8, 2023, which updated the description thereof contained in our Registration Statement on Form 8-A (File No. 001-38381) filed with SEC on February 1, 2018, and any amendment or report filed for the purpose of updating such description.

We also incorporate by reference into this prospectus additional documents that we may file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of the registration statement of which this prospectus forms a part and prior to its effectiveness and until the completion or termination of the offering of the securities described in this prospectus. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements. We will not, however, incorporate by reference in this prospectus any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K after the date of this prospectus unless, and except to the extent, specified in such Current Reports. Any statements contained in a previously filed document incorporated by reference into this prospectus are deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, or in a subsequently filed document also incorporated by reference herein, modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to each person, including any beneficial owner, to whom this prospectus is delivered, on written or oral request, a copy of any or all of the documents incorporated by reference into this prospectus, including exhibits to these documents. You should direct any requests for documents to us at the address or telephone referenced above under “Where You Can Find Additional Information.” You may also access the documents incorporated by reference into this prospectus through our website at www.evolus.com. Except for the specific incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated into this prospectus or the registration statement of which it forms a part.

$50,000,000

Common Stock

PROSPECTUS

SVB Securities

June 8, 2023

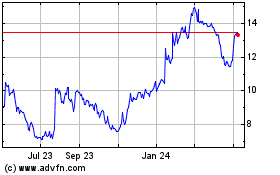

Evolus (NASDAQ:EOLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

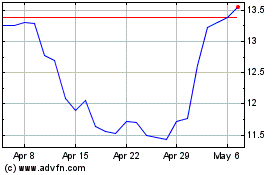

Evolus (NASDAQ:EOLS)

Historical Stock Chart

From Apr 2023 to Apr 2024