0001761918false00017619182024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 09, 2024 |

Erasca, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40602 |

83-1217027 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3115 Merryfield Row Suite 300 |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 465-6511 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

ERAS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On January 9, 2024, representatives of Erasca, Inc. (the Company) will be presenting at the J.P. Morgan Healthcare Conference and will be attending meetings with investors and analysts during the week in connection with the conference. During the presentation and the meetings, the Company will present the corporate presentation attached as Exhibit 99.1 to this report, which is incorporated herein by reference.

The Company’s updated corporate presentation will be posted to the Company’s website, www.erasca.com. The Company plans to use its website to disseminate future updates to its corporate presentation and does not intend to file or furnish a Form 8-K alerting investors each time the presentation is updated.

The information set forth in this Item 7.01 is being furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or under the Exchange Act, whether made before or after the date hereof, except as expressly provided by specific reference in such a filing.

By filing this report and furnishing the information in this Item 7.01, the Company makes no admission as to the materiality of Item 7.01 in this report or the presentation available on the Company’s website. The information contained in the presentation is summary information that is intended to be considered in the context of the Company’s filings with the Securities and Exchange Commission (the SEC) and other public announcements that the Company makes, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is appropriate or as required by applicable law. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases, by updating the Company’s website or through other public disclosure.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Erasca, Inc. Corporate Presentation - January 2024

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Erasca, Inc. |

|

|

|

|

Date: |

January 9, 2024 |

By: |

/s/ Ebun Garner |

|

|

|

General Counsel |

On a Journey to �Erase Cancer Erasca Corporate Presentation January 2024 Exhibit 99.1

We caution you that this presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations and financial position, business strategy, research and development plans, the anticipated timing (including the timing of initiation and the timing of data readouts), costs, design and conduct of our ongoing and planned preclinical studies and clinical trials for our product candidates, the potential benefits from our current or future arrangements with third parties, the timing and likelihood of success of our plans and objectives, the impact of the deprioritization of certain programs, and future results of anticipated product development efforts, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. Actual results may differ from those set forth in this presentation due to the risks and uncertainties inherent in our business, including, without limitation: our approach to the discovery and development of product candidates based on our singular focus on shutting down the RAS/MAPK pathway, a novel and unproven approach; we only have four product candidates in clinical development and all of our other development efforts are in the preclinical or development stage; the analysis of pooled phase 1 and phase 2 naporafenib + trametinib data covers two clinical trials with different designs and inclusion criteria, which cannot be directly compared, and therefore may not be a reliable indicator of efficacy data; preliminary results of clinical trials are not necessarily indicative of final results and one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data and more patient data become available, including the risk that an uPR to treatment may not ultimately result in a cPR to treatment after follow-up evaluations; we have not completed any clinical trials of naporafenib and are reliant on data generated by Novartis in prior clinical trials conducted by it; our planned SEACRAFT trials may not support the registration of naporafenib; our assumptions around which programs may have a higher probability of success may not be accurate, and we may expend our limited resources to pursue a particular product candidate and/or indication and fail to capitalize on product candidates or indications with greater development or commercial potential; potential delays in the commencement, enrollment, and completion of clinical trials and preclinical studies; our dependence on third parties in connection with manufacturing, research, and preclinical and clinical testing; unexpected adverse side effects or inadequate efficacy of our product candidates that may limit their development, regulatory approval, and/or commercialization, or may result in recalls or product liability claims; unfavorable results from preclinical studies or clinical trials; results from preclinical studies or early clinical trials not necessarily being predictive of future results; the inability to realize any benefits from our current licenses, acquisitions, or collaborations, and any future licenses, acquisitions, or collaborations, and our ability to fulfill our obligations under such arrangements; our assumptions around which programs may have a higher probability of success may not be accurate, and we may expend our limited resources to pursue a particular product candidate and/or indication and fail to capitalize on product candidates or indications with greater development or commercial potential; regulatory developments in the United States and foreign countries; later developments with the FDA or European health authorities may be inconsistent with the feedback received to date regarding our development plans and trial designs; fast track designation or orphan drug designation may not lead to a faster development or regulatory review or approval process, and does not increase the likelihood that our product candidates will receive marketing approval; we may not realize the benefits associated with orphan drug designation; our ability to fund our operating plans with our current cash, cash equivalents, and marketable securities into the first half of 2026; and other risks described in our prior filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2022, and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Disclaimer: Forward Looking Statements & Market Data

Our name is our mission: to erase cancer CNS = central nervous system 1 Number of patients alive and free of cancer or free from cancer progression 2 yrs after starting an Erasca regimen, as measured by disease-free survival (adjuvant setting) and progression-free survival (metastatic setting) 2 Unaudited, as of September 30, 2023 Vision to one day erase cancer1 in at least 100,000 patients annually as a leading global oncology company Experienced leadership team and SAB with track record of serial successes Founded by Jonathan Lim, MD & Kevan Shokat, PhD around disruptive idea to target RAS World class scientific advisory board of leading pioneers in RAS/MAPK pathway Team with deep experience in efficient planning and execution of global clinical trials Industry leading portfolio focused on shutting down the RAS/MAPK pathway Naporafenib pan-RAFi with first-in-class (FIC) potential and Fast Track Designation for NRASm melanoma & FIC potential in RAS Q61X solid tumors ERAS-007 ERKi with best-in-class potential for BRAFm CRC ERAS-801, CNS-penetrant EGFRi with FIC potential for EGFR-driven rGBM Strong financial position with high quality investor base and industry visibility $344M in cash, cash equivalents, and marketable securities2; cash runway into H1 2026 One of Fierce Biotech’s 2021 “Fierce 15” most promising biotechnology companies

SAB includes world’s leading experts in the RAS/MAPK pathway Erasca co-founder. World expert in RAS who pioneered development of approaches to inhibit KRAS G12C (RAS-GDP) and active states of RAS (RAS-GTP) World expert in ERK, having studied nearly every ERK inhibitor that has been or is being developed, as well as targeted therapies directed against KRAS, BRAF, and MEK mutations World expert in targeted oncology therapies who pioneered the development of Gleevec®, which helped launched the precision oncology revolution World expert in structure-based drug design; former head of research at Agouron and former head of Genentech’s Research and Early Development (gRED) World expert in RAS/MAPK pathway signaling and identifying novel combination therapies to shut it down Karen Cichowski, PhD George Demetri, MD Michael Varney, PhD Stephen Blacklow MD, PhD World expert in SHP2 who helped pioneer development of the first SHP2 inhibitor with Novartis Ryan Corcoran, MD, PhD World expert in RAS/MAPK pathway with focus on the SHOC2 phosphatase complex as a unique regulatory node required for efficient pathway activation in the context of diseases such as cancer and RASopathies Pablo Rodriguez-Viciana, PhD Kevan Shokat, PhD

Our singular focus is on the RAS/MAPK pathway P P P MAPK�pathway PI3K�pathway RAS-GTP GRB2 SHP2 GAP GDP GTP P1 NF1 SOS1 RAF MEK PI3K AKT mTOR ERK RAS-GDP EGFR Other RTKs MYC GEF Nodes targeted by Erasca Target upstream and downstream RAS/MAPK nodes with single agents and clamp oncogenic drivers (MAPKlamp) with combinations 1 1 Target RAS directly with single agents and combinations with upstream, downstream, and escape route targeted therapies 2 2 2 Target escape routes enabled by other proteins or pathways to further disrupt RAS/MAPK pathway signaling 3 3 Our Strategy Comprehensively shut down the RAS/MAPK pathway

large molecule small molecule TCR T cell therapy investment Deep modality-agnostic RAS/MAPK pathway-focused pipeline Program/ Company Target Modality Indication Discovery IND-enabling Phase 1 Phase 2 Phase 3 Worldwide Rights Naporafenib BRAF/CRAF Pan-RAS Q61X tissue agnostic NRASm melanoma ERAS-007 ERK1/2 BRAF V600E CRC ERAS-801 EGFR EGFR-altered GBM ERAS-4 Pan-KRAS KRASm solid tumors ERAS-12 EGFR D2/D3 EGFR & RAS/MAPK altered tumors Affini-T KRAS G12V/D KRASm solid tumors SEACRAFT-2 (planned) HERKULES-3 SEACRAFT-1 THUNDERBBOLT-1

Erasca’s clinical development plan generates multiple ways to win for patients Indication Benchmark Regimen tested Erasca trial(s) CTCSA: clinical trial collaboration and supply agreement ORR: overall response rate; DOR: duration of response; GBM: glioblastoma HERKULES-32 BRAFm CRC EC-naïve ERAS-007 + encorafenib + cetuximab ORR 20% mDOR 6.1 mos. BRAFm CRC EC-naïve THUNDERBBOLT-1 EGFR altered rGBM ERAS-801 monotherapy ORR 3-9% mDOR NA EGFR-altered rGBM SEACRAFT-11 naporafenib + trametinib SOC is largely chemo RAS Q61X solid tumors SEACRAFT-2 naporafenib + trametinib ORR 7% mDOR NA NRASm melanoma post-IO 1 May 2023: Trametinib (Mekinist®) for SEACRAFT-1 2 Sep. 2021: Encorafenib (Braftovi®) for HERKULES-3 2 Mar. 2022: Cetuximab (Erbitux®) for HERKULES-3 2 Nov. 2022: Encorafenib (Braftovi®) for HERKULES-3 Active CTCSAs

P P P MAPK�pathway PI3K�pathway RAS-GTP GRB2 SHP2 GAP GDP GTP P1 NF1 SOS1 RAF MEK PI3K AKT mTOR RAS-GDP EGFR Other RTKs MYC GEF Erasca’s naporafenib pan-RAFi could address unmet needs �in over 200k patients in the US and Europe ERK BRAF CRAF naporafenib Addressable Patient Pop. Tumor Type RAS Q61X Solid Tumors 157,000 NRASm Melanoma 54,000 tissue agnostic indication

Naporafenib is a potent and selective inhibitor of BRAF and CRAF with sub-nanomolar IC50 potency and most advanced pan-RAFi in development Assay Value (nM) Biochemical CRAF IC50 (IC50) 0.1 Biochemical BRAF IC50 (IC50) 0.2 Biochemical ARAF Inhibition (IC50) 6.4 Biochemical activity of naporafenib against RAF kinase family Biochemical activity of naporafenib across 456 kinases (KINOMEscan) Source: Monaco K-A, Delach S, et al. LXH254, a Potent and Selective ARAF-Sparing Inhibitor of BRAF and CRAF for the Treatment of MAPK-Driven Tumors. 2021. PMID: 33355204; Ramurthy S, Taft BR, et al. Design and Discovery of N-(3-(2-(2-Hydroxyethoxy)-6-Morpholinopyridin-4-Yl)-4-Methylphenyl)-2-(trifluoromethyl)isonicotinamide, a Selective, Efficacious, and Well-Tolerated RAF Inhibitor Targeting RAS Mutant Cancers: The Path to the Clinic. 2020. PMID: 31059256

In vivo efficacy of naporafenib and trametinib administered across 10 NRASm melanoma PDX models shows strong synergy of combination vs. either monotherapy Untreated Naporafenib 50 mg/kg BID Trametinib 0.3 mg/kg QD Naporafenib 50 mg/kg BID + Trametinib 0.075 mg/kg QD PDX = patient derived xenograft; mg = milligram; kg = kilogram; BID = twice a day; QD = once daily Arrowheads represent models that were treated with a reduced dose of trametinib of 0.0375 mg/kg QD

Naporafenib has been dosed in more than 500 patients to date, establishing its safety, tolerability, and preliminary PoC in multiple indications Source: Novartis Non-Confidential Materials; PoC = proof-of concept P P P MAPK�pathway PI3K�pathway RAS-GTP GRB2 SHP2 GAP GDP GTP P1 NF1 SOS1 RAF MEK PI3K AKT mTOR ERK RAS-GDP EGFR Other RTKs MYC GEF CDK4/6 Study (Trial #) Description N Ph 1 FIH study (LXH254X2101) Naporafenib dose escalation in patients with RAS/MAPK-driven solid tumors 142 Ph 1b combo dose finding (LXH254X2102) Dose-finding study (+ rineterkib, trametinib, or ribociclib) in patients with NRASm melanoma, KRASm or BRAFm NSCLC 241 Ph 2 combo study (LXH254C12201) Evaluating efficacy (+ rineterkib, trametinib or ribociclib) in patients with NRASm or BRAF V600X melanoma 134 Total size of safety database > 500 patients (includes monotherapy and combinations) trametinib naporafenib rineterkib ribociclib

Naporafenib: potential for rapid market entry and multiple ways to benefit patients with RAS/MAPK-driven tumors patients diagnosed annually in the US and EU 157,000 patients diagnosed �annually in the US and EU 54,000 NRASm Melanoma RAS Q61X Solid Tumors Potential for full approval based on high unmet need and alignment on regulatory path Compelling Ph 1 and 2 POC data generated SEACRAFT-2 Phase 3 of naporafenib + trametinib planned to initiate in H1 2024 Potential for path to rapid approval based on high unmet need and tissue agnostic approach SEACRAFT-1 Phase 1b data for naporafenib + trametinib planned in Q2-Q4 2024 POC = proof-of-concept Incidence based on SEER database (US), ECIS database (ECIS), and AACR GENIE

SEACRAFT-1: Naporafenib + trametinib has the potential to provide therapeutic benefit to ~157k patients in the US + EU with RAS Q61X solid tumors Naporafenib (pan-RAFi) Dosed in >500 pts establishing safety and tolerability in a range of doses for combination partners Encouraging anti-tumor activity observed in NRAS Q61X melanoma and KRAS Q61X NSCLC Q61X mutant tumors likely to be CRAF addicted, suggesting potential benefit of pan-RAFi Standard-of-Care Target population: patients with tissue agnostic tumors who have progressed on or for whom there is no standard of care ~157,000 patients1 diagnosed with RAS Q61X solid tumors in the US and Europe annually 1 SEER Database (US) and ECIS Database (EU); AACR Genie Incidence Q61X mutations are promising targets for naporafenib due to their addiction to CRAF

Structural and cell line screening data suggest that differences exist across different RAS mutants in vitro; e.g., Q61X mutant tumors likely to be CRAF addicted Cellular activity of naporafenib across 265 cell lines, separated by RAS mutation type Source: Monaco K-A, Delach S, et al. LXH254, a Potent and Selective ARAF-Sparing Inhibitor of BRAF and CRAF for the Treatment of MAPK-Driven Tumors. 2021. PMID: 33355204

Preliminary clinical PoC in NRAS Q61X melanoma and KRAS Q61X NSCLC supports development in RAS Q61X tissue agnostic solid tumors (SEACRAFT-1) Strong antitumor activity, with confirmed ORR = 44% 15 out of 16 patients had confirmed codon Q61X melanoma (1 patient had no data) Source: LXH254X2102 Ph 1b combination data from Novartis Non-Confidential Materials PoC = proof-of-concept; ORR: overall response rate KRASm NSCLC NRASm Melanoma ORR in Q61/G13R mutated group (n=4) = 75% Confirmed/unconfirmed RECIST responses shown Naporafenib 200mg + trametinib 1mg

SEACRAFT-2: Naporafenib + trametinib has the potential to be first-in-class targeted treatment for NRASm melanoma Naporafenib (pan-RAFi) Successfully completed US/EU EOP2 process for Phase 3 design Napo + tram demonstrated compelling efficacy across Phase 1 and 2 studies (mPFS ~5 months) FDA Fast Track Designation Potential to be first-to-market in NRASm melanoma Standard-of-Care NRAS mutation related to aggressive disease traits No targeted therapy approved for NRASm melanoma Current treatment options post-IO are dismal (see chart) ~54,000 patients1 diagnosed with NRASm melanoma in the US and Europe annually 1 SEER Database (US) and ECIS Database (EU); AACR Genie ORR: overall response rate; mPFS: median progression free survival; NCCN: National Comprehensive Cancer Network; SOC: standard of care; EOP2: end-of-Phase 2 Incidence Time from Randomization (months) PFS (%) Approved SOC: dacarbazine (chemo) 1.5 mos. mPFS, 7% ORR NCCN: binimetinib (MEKi) 2.8 mos. mPFS, 15% ORR Adapted from Dummer et al. (Lancet Oncol (2017) 18:435-445) Note: Benchmarks are most relevant for SC-2 although study was conducted in a 1/2L setting

NRASm melanoma case study: partial response with naporafenib + trametinib Source: Novartis Non-Confidential Materials On treatment Pre-treatment

Compelling, reproducible clinical efficacy across studies and doses MEKi Published literature SOC Pooled Ph 1 and Ph 24 Binimetinib1 Trametinib2 Chemo3 Naporafenib + Trametinib 45mg 2mg 1g/m2 IV 200mg+1mg 400mg+0.5mg N=269 N=33 N=133 N=39 N=32 ORR n (%) 41 (15%) 5 (15%) 9 (7%) 12 (31%) 7 (22%) DCR n (%) 157 (58%) N/A 33 (25%) 28 (72%) 21 (66%) mDOR months 6.9 ~6.9* NE 7.4 10.2 mPFS months 2.8 ~2.8* 1.5 5.1 4.9 *Assumes trametinib efficacy is similar to published binimetinib efficacy results US FDA Fast Track Designation: Dec 2023 Compelling efficacy for both doses evaluated to date High unmet medical need for NRASm melanoma patients post-IO PFS for napo + tram across doses exceeds PFS for approved SOC and single agent MEKi’s 1 Dummer et al 2017; binimetinib is administered BID 2 Pooled analysis from the following publications: Falchook et al, 2012; Pigne et al, 2023; Salzmann et al, 2022; trametinib is administered QD 3 Dacarbazine is the approved chemotherapy in this indication 4 Ph 1 = CLXH254X2102 with DCO 4 Aug 2022; Ph 2 = CLXH254C12201 with DCO 30 Dec 2022 PFS includes both responders and non-responders SOC: standard of care; N/A: not available; NE: not estimable; DCO: data cutoff; DCR: disease control rate; mDOR: median duration of response; ORR: objective response rate; mPFS: median progression free survival The pooled phase 1 and phase 2 napo + tram data covers two clinical trials with different designs and inclusion criteria, which cannot be directly compared, and therefore may not be a reliable indicator of efficacy data

Naporafenib + trametinib demonstrated a favorable, manageable safety profile AE: adverse event; BID: twice daily; QD: once daily; SC: SEACRAFT Phase 1 data in NRASm melanoma from De Braud et al AACR 2022 AE profile consistent with expected toxicities associated with RAF and MEK inhibition 400+0.5 dose safe and tolerable 200+1 dose safe but less tolerable without mandatory primary rash prophylaxis Primary prophylaxis of rash being implemented in both SC-1 and SC-2 provides opportunity to further improve safety and tolerability

Dose optimization designed to enhance combination benefit/risk profile to increase probability of regulatory success in light of Project Optimus naporafenib range of potentially efficacious doses* 400mg BID 100mg BID 200mg BID 0.5mg QD 1mg QD Data from SEACRAFT-1 and SEACRAFT-2 complement each other, allowing us to efficiently test the full effective dose range of naporafenib + trametinib within the two trials to optimize the benefit/risk profile in both indications of interest * As part of the naporafenib + trametinib combination BID: twice a day; QD: once a day trametinib range of potentially efficacious doses* 400 + 0.5 100 + 1 SEACRAFT-2 dose SEACRAFT-1 dose 200 + 1

SEACRAFT-2: NRASm Melanoma (Two-stage Phase 3) Pivotal Phase 3 and Phase 1b trial designs capitalize on promising efficacy signals and support potential successful registration in multiple indications Solid Tumors Post-available therapy RAS Q61X (NRAS, HRAS, KRAS) naporafenib + trametinib (200mg + 1mg) Stage 1: Dose Optimization Stage 2: Regulatory Approval Metastatic Melanoma Post-ICI NRASm (Q61X and non-Q61X) naporafenib + trametinib (400mg + 0.5mg) R trametinib (2mg) naporafenib + trametinib (100mg + 1mg) Study Endpoints ORR, DOR (primary) Metastatic Melanoma Post-ICI NRASm (Q61X and non-Q61X) R naporafenib + trametinib (Dose selected in Stage 1*) physician’s choice (trametinib, DTIC, TMZ) Study Endpoints PFS, OS (dual primary) ORR, DOR (secondary) SEACRAFT-1: RAS Q61X (Single-arm Phase 1b) N~350 N~60 – 120 N~30 – 100 * Dose selection informed by data on 400+0.5 and 100+1 from SEACRAFT-2 Stage 1 as well as 200+1 from SEACRAFT-1 Note: Naporafenib dosed on a BID schedule; trametinib dosed on a QD schedule PFS endpoint acceptable for potential initial approval

ERAS-007 ERKi could address unmet needs in ~45k patients annually�in the US and Europe P P P MAPK�pathway PI3K�pathway RAS-GTP GRB2 SHP2 GAP GDP GTP P1 NF1 SOS1 RAF MEK PI3K AKT mTOR ERK RAS-GDP EGFR Other RTKS MYC GEF ERAS-007 BRAF V600E CRC 45,000 Addressable Patient Pop. Tumor Type

We believe ERAS-007 is the most potent ERK inhibitor in development, with a uniquely longer target residence time Assay Type Assay ERAS-007 IC50 (nM) Biochemical ERK1 2 ERK2 2 Cell-based mechanistic (HT-29) pRSK 7 ERAS-007 was designed to be a potent, selective, reversible, oral inhibitor of ERK1/2 Compound koff (s-1) Residence Time (min) ERAS-007 0.30 x 10-4 550 Ulixertinib 10.1 x 10-4 16 Ravoxertinib 13.9 x 10-4 12 ERAS-007 had longer target residence time vs. other ERKi’s, which may allow for longer intervals between doses in patients

HERKULES-3: ERAS-007 + EC is a potential best-in-class treatment for patients with BRAF V600E CRC ERAS-007 (ERKi) Inhibiting the terminal RAS/MAPK pathway node has potential to shut down oncogenic signaling and prevent reactivation Early signals of clinical efficacy in EC-naïve BRAFm CRC Clinical data reinforce ability to safely combine ERAS-007 with multiple agents Standard-of-Care Encorafenib + cetuximab (EC) has improved SOC for patients but prognosis is still poor Durability is largely limited by treatment resistance Triplet of binimetinib (MEKi) + EC only marginally improved clinical efficacy ~45,000 patients1 diagnosed with BRAF V600E CRC in the US and Europe annually 1 SEER Database (US) and ECIS Database (EU); AACR Genie ORR: overall response rate; mPFS: median progression free survival Adapted from Tabanero et al. (JCO (2021) 4: 273-284) *Control arm: investigators’ choice of either cetuximab + irinotecan or cetuximab + FOLFIRI * Incidence

ERAS-007 + EC in BRAFm CRC:�Robust in vivo combination activity in BRAF V600E CRC ERAS-007 60 mpk QD dose showed similar activity to 30 mpk BID, either as a mono or combo Tx with encor. +/- cetux. ERAS-007 combinations were generally well tolerated across the tested models as demonstrated by the minimal percentage body weight changes observed. TGI in WiDr (BRAF V600E CRC) EC-sensitive CDX Model * TGI in RKO (BRAF V600E CRC) EC-resistant CDX Model *p-value < 0.01 TGI = tumor growth inhibition; Cetux. = cetuximab; Encor. = encorafenib; EC = encorafenib plus cetuximab (BEACON regimen); mpk = milligrams per kilogram; BID = twice a day; Q3D = once every 3 days; QD = once daily

Meaningful activity in EC-naïve BRAFm CRC supports initial focus on and dose expansion of this patient segment Efficacy-Evaluable BRAFm CRC Patients Time on Treatment (Weeks) ERAS-007 150 mg QW + EC ERAS-007 75 mg BID-QW + EC ERAS-007 100 mg BID-QW + EC First response PD Death Treatment discontinuation Treatment ongoing Best Change in Sum of Measurable Target Lesion Diameters From Baseline (%) Efficacy-Evaluable Patients In EC-naïve BRAFm CRC patients at the highest dose tested (100 mg BID-QW): 50% (3/6) response rate (2 confirmed PR, 1 uPR1) 67% (4/6) disease control rate2 Both confirmed responders were still on treatment as of the data cutoff date with duration of exposure >40 weeks BEACON mDOE 19 weeks3 In EC-naïve BRAFm CRC patients across all dose levels: 38% (3/8) response rate 63% (5/8) disease control rate Data cutoff as of 21MAY2023 Response on the bar represents the best overall response based on investigator assessments. 1 Per site communication, the patient with uPR was still in response at the subsequent scan (26MAY2023), which was conducted 25 days after the first post-baseline scan 2 Disease control rate (DCR) = CR + PR + SD; uPR is included 3 Median duration of exposure (mDOE) as reported in Kopetz et al. NEJM 2019 EC: encorafenib + cetuximab; PD: progressive disease; CR: complete response; PR: confirmed partial response; uPR: unconfirmed partial response; SD: stable disease; mDOE: median duration of exposure ERAS-007 QW: ERAS-007 oral once a week / ERAS-007 BID-QW: ERAS-007 oral twice a day on a single day each week

ERAS-007 + EC was generally well tolerated with primarily Grade 1 or 2 TRAEs observed Data cutoff 23MAR2023 / * Related to ERAS-007 aEC: encorafenib 300 mg oral daily + cetuximab 500 mg/m2 intravenous infusion once every 2 weeks bERAS-007 QW: ERAS-007 oral once a week. cERAS-007 BID-QW: ERAS-007 oral twice a day on a single day each week No Grade 4 or 5 TRAEs were observed ERAS-007 100 mg BID-QW dose is being expanded in combination with approved doses of EC to assess signals of efficacy in patients with EC-naïve BRAF V600E mCRC ERAS-007 Dose + ECa 150 mg QWb (n = 2) 75 mg BID-QWc (n = 6) 100 mg BID-QWc (n = 12) ALL (n = 20) Preferred Term Any Grade n (%) Grade ≥ 3 n (%) Any Grade n (%) Grade ≥ 3 n (%) Any Grade n (%) Grade ≥ 3 n (%) Any Grade n (%) Grade ≥ 3 n (%) Fatigue 1 (50) 1 (50) 3 (50) 0 3 (25) 0 7 (35) 1 (5) Diarrhea 0 0 2 (33) 0 4 (33) 0 6 (30) 0 Headache 0 0 3 (50) 0 3 (25) 1 (8) 6 (30) 1 (5) Anaemia 1 (50) 0 2 (33) 1 (17) 2 (17) 1 (8) 5 (25) 2 (10) Nausea 0 0 3 (50) 0 2 (17) 0 5 (25) 0 Subretinal fluid 0 0 1 (17) 0 3 (25) 0 4 (20) 0 Vomiting 1 (50) 0 2 (33) 0 1 (8) 0 4 (20) 0 Treatment-related* Adverse Events Reported in ≥ 20% of All Patients (arranged by descending frequency in the ALL Any Grade column)

ERAS-801 EGFRi could address high unmet need in 37k patients in US and EU P P P MAPK�pathway PI3K�pathway RAS-GTP GRB2 SHP2 GAP GDP GTP P1 NF1 SOS1 RAF MEK PI3K AKT mTOR ERK RAS-GDP EGFR Other RTKS MYC GEF ERAS-801 Glioblastoma multiforme 37,000 Addressable Patient Pop. Tumor Type

Poor activity of legacy EGFRi in GBM due to minimal activity against GBM-specific EGFR alterations and poor CNS penetration TCGA Cell, 2013 GBM: glioblastoma; CNS: central nervous system; PFS: progression free survival; OS: overall survival Therapy (brain penetration %) Clinical Trial Results*: NSCLC/BrCa Clinical Trial Results: GBM Erlotinib (8%) Recurrent NSCLC: Improved PFS and OS vs. chemo (Ph 3) Failed (Ph 2) Lapatinib (0.1%) Recurrent HER2 BrCa: Improved PFS vs. chemo (Ph 3) Failed (Ph 2) Gefitinib (1.1%) 1L NSCLC: Improved PFS and OS vs. chemo (Ph 3) Failed (Ph 2) Afatinib (0.7%) 1L NSCLC: Improved PFS vs. chemo (Ph 3) Failed (Ph 2) *For illustrative purposes only and not a head-to-head comparison. Differences exist between trial designs and subject characteristics and caution should be exercised when comparing data across studies.

THUNDERBBOLT-1: ERAS-801 (CNS-penetrant EGFRi) designed to overcome the limitations of current GBM treatments Higher CNS penetration over legacy EGFR inhibitors Broad activity against oncogenic and wildtype EGFR Potential as a monotherapy treatment FDA Orphan Drug Designation and Fast Track Designation SOC for rGBM is chemotherapy (3-9% ORR) No EGFR inhibitors are approved for the treatment of GBM Minimal activity against GBM-specific EGFR alterations and poor CNS penetration have limited use of EGFR inhibitors in GBM 1 SEER Database (US) and ECIS Database (EU); AACR Genie ORR: objective response rate; GBM: glioblastoma; CNS: central nervous system Incidence ~37,000 patients1 diagnosed with glioblastoma in the US and Europe annually Standard-of-Care ERAS-801 Nearly 60% of patients have an EGFR alteration of which 85% have an EGFR amplification

ERAS-801, a potent EGFRvIII/wt inhibitor with a Kp,uu over 4-fold higher than approved EGFR inhibitors, was specifically designed to inhibit EGFR in GBM 1 Kp,uu is a measure of the ratio of unbound brain concentration to unbound plasma concentration Kim M, et al. Brain Distribution of a Panel of Epidermal Growth Factor Receptor Inhibitors Using Cassette Dosing in Wild-Type and Abcb1/Abcg2-Deficient Mice. Drug Metab. Dispos., 2019. PMID: 30705084 Compound Company Kp, brain (mouse) Kp,uu, brain (mouse)1 ERAS-801 Erasca 3.7 1.2 osimertinib AstraZeneca 0.99 0.29 afatinib Boehringer Ingelheim 0.25 0.05 erlotinib Genentech 0.06 0.13 gefitinib AstraZeneca 0.36 0.10 dacomitinib Pfizer 0.61 0.49 erlotinib lapatinib osimertinib ERAS-801

ERAS-801 significantly extends survival at clinically relevant exposures in an�EGFR amplified and EGFRvIII model EGFR amplified and EGFRvIII patient-derived GBM model *** *** p-value < 0.005 Doses are estimated to reflect clinically relevant human exposures

THUNDERBBOLT-1: Dose escalation cohorts 20mg 280mg 320mg MTD 240mg 40mg 80mg MTD-1 160mg Safety Expansion EGFR amp mandatory Evaluate safety, tolerability, PK/PD, and preliminary efficacy including PET and CSF sampling Determine RP2D Clinicaltrials.gov: NCT05222802 Note: ERAS-801 dosed QD MTD: maximum tolerated dose; MTD-1 (aka, MTD-minus-1): one dose level below MTD; QD: once daily; amp: amplified; RP2D: recommended Phase 2 dose

Anticipated key milestones and clinical trial readouts 1 Data to include safety, pharmacokinetics (PK), and efficacy at relevant dose(s) in relevant population(s) of interest Program Mechanism Trial Name�Indication (Combo partner if applicable) Anticipated Milestone Naporafenib�Pan-RAF inhibitor SEACRAFT-1 �RAS Q61X Solid Tumors (+ trametinib) Q2 2024 – Q4 2024: Ph 1b combination data1 SEACRAFT-2�NRASm Melanoma (+ trametinib) H1 2024: Ph 3 pivotal trial initiation 2025: Ph 3 stage 1 randomized dose optimization data1 ERAS-007 ERK1/2 inhibitor HERKULES-3 EC-naïve BRAFm CRC (+ encorafenib and cetuximab) H1 2024: Ph 1b combination data1 ERAS-801 CNS-penetrant EGFR inhibitor THUNDERBBOLT-1 Glioblastoma 2024: Ph 1 monotherapy data1

Compelling investment thesis Experienced team with track record of serial successes Seasoned drug developers who have advanced multiple programs from discovery to IND to global approvals World-class Scientific Advisory Board Includes leading pioneers in: KRAS (Shokat, UCSF), SHP2 (Blacklow, HMS), ERK (Corcoran, MGH), RAS/MAPK pathway (Rodriguez-Viciana, UCL; Cichowski, HMS), precision oncology (Demetri, DFCI), and biopharma (Varney, Genentech) Broad portfolio to erase cancer We have built one of the deepest pipelines in the industry to comprehensively shut down the RAS/MAPK pathway, with the potential to address unmet needs in over 5 million patients globally THREE clinical-stage compounds Differentiated profiles including naporafenib, a Phase 3-ready pan-RAF inhibitor for NRASm melanoma and Q61X tissue agnostic solid tumors, ERAS-007 ERK inhibitor, and ERAS-801, a CNS-penetrant EGFR inhibitor for GBM Multiple potential near-term and long-term value drivers Focused clinical development plan with multiple clinical readouts in 2024 and beyond and a strong research engine to drive first-in-class or best-in-class compounds into the clinic

Thank You!

* Post-Osimertinib resistant population shown for EGFRm NSCLC except for SCLC transformation ** Co-occurring activating MAPK pathway alterations exclude EGFR overexpression Source: SEER database (2020), ECIS database (2020), GLOBOCAN database (2020), The AACR Project GENIE Consortium version 8.1 (2020), TCGA Research Network: https://www.cancer.gov/tcga, Tyner JW et al. (2018) PMID: 30333627, Brenner CW et al (2013) PMID: 24120142, Chen J et al. (2020) PMID: 32015526, and Ostrom QT, et al. (2020) PMID: 33123732 New cases estimated worldwide per annum (thousands; numbers may not add up due to rounding) Blue ocean opportunities Red ocean opportunities Alterations GBM HNSCC NSCLC CRC Melanoma PDAC Other solid tumors AML US EU ROW Global EGFR*/FLT3 125 513 184 338 - - - 61 82 222 917 1,220 NF1 25 58 98 34 33 1.9 434 3.2 75 159 453 687 KRAS G12C - 2.8 240 57 - 5.1 45 0.1 36 82 232 350 KRAS G12D 0.2 4.7 68 238 0.5 178 201 1.3 65 171 456 692 RAS Q61X 0.4 23 35 80 69 32 155 4.1 51 106 242 399 RAS G13R - 9.4 5.9 5.5 2.1 - 14 0.5 3.6 8.1 26 37 Other RAS 0.6 31 162 452 4.4 211 331 13 112 291 800 1,203 BRAF V600E/K 2.0 1.9 23 180 93 1.4 158 0.4 63 127 271 461 BRAF Class 2 0.4 3.8 18 6.9 5.3 0.5 57 - 11 23 58 92 BRAF Class 3 0.1 0.9 12 17 2.5 - 29 0.2 6.1 15 40 61 Other BRAF - - 3.9 - 1.9 0.3 0.5 - 0.7 1.0 4.9 6.6 MEK 0.2 1.9 12 8.8 4.6 0.2 22 - 5.2 11 33 50 Co-occurring activating MAPK pathway alterations** 1.4 10 62 59 37 7.1 84 3.0 33 69 162 264 US 12 29 93 114 77 51 153 11 542 EU 34 76 194 398 116 124 324 18 1,285 Rest of World 109 555 635 964 60 264 1,053 57 3,696 Global 155 660 923 1,476 253 438 1,530 86 5,522 ~5.5m lives at stake annually worldwide with RAS/MAPK pathway alterations;�70+% of unmet needs are “blue oceans” with no approved targeted therapies

Naporafenib: Potential first-in-class pan-RAF inhibitor DCC-3084 IRICoR-Ipsen CUL-BRAF Degrader IND-enabling Licensed from IRICoR PRECLINICAL Most advanced pan-RAF inhibitor Dosed in more patients (500+) than any other pan-RAF inhibitor in development Potential to be first-to-market and raise SOC in prioritized indications PoC established Evaluating naporafenib in indications where it has already shown promising PoC – namely, NRASm melanoma and RAS Q61X solid tumors Strong complementarity with Erasca pipeline Highly complementary, if not synergistic, with the rest of Erasca’s RAS/MAPK pathway-targeting pipeline naporafenib (Ph 3 ready) + trametinib: Ph 1 and 2 ORR 33% in NRASm melanoma belvarafenib (Ph 1b1) + cobimetinib: ORR 26% (5/19) in NRASm melanoma tovorafenib (Ph 1b2) + pimasertib (investigational MEKi): in progress exarafenib (Ph 13) + binimetinib: ORR 29% (2/7 efficacy evaluable) 1 Belvarafenib is also being evaluated for the treatment of BRAF Class II mutant or fusion-positive tumors and BRAF Class III mutant positive tumors in a Ph 2 platform trial 2 NDA has been accepted for tovorafenib in its lead indication, frontline pLGG (pediatric low-grade glioma) 3 Exarafenib in Ph 1b for monotherapy indication in BRAF-driven tumors ORR: overall response rate; SOC: standard of care; PoC: proof-of-concept lifirafenib (Ph 1b) + mirdametinib (investigational MEKi): ORR 23% (14/62) plixorafenib (Ph 2) JZP815 (Ph 1) dimer breaker + cobicistat: in progress Monotherapy evaluation in progress CLINICAL brimarafenib (Ph 1) + mirdametinib (investigational MEKi): in progress BDTX-4933 Ph 1 in KRASm NSCLC

ERAS-007: Potential best-in-class ERK1/2 inhibitor in a field marked by attrition 51 Hit-and-run profile optimizing efficacy, tolerability Highest potency and longest target residence time of known ERKi’s enable ERAS-007 to be dosed intermittently instead of daily like other clinical ERKi’s Safety and tolerability established Comparable if not better tolerability than other clinical ERKi’s particularly as it relates to rash Intermittent dosing regimen has the potential to further optimize clinical utility Encouraging signs of efficacy Monotherapy responses observed in FIH and HERKULES-1 trials Meaningful initial activity observed in patients with EC-naïve BRAFm CRC treated with ERAS-007 + EC ERAS-007 (Ph 2) + EC: 50% (3/6) RR in EC-naïve CRC; expansion ongoing ASTX029 (Ph 2) Monotx dose level identified in FIH study ulixertinib (Ph 2) Being evaluated in monotx and +HCQ; CoM through 2025 temuterkib (Ph 1) Reported monotherapy ORR of 0% (n=51) JSI-1187 (Ph 1) ATG-017 (Ph 1) + dabrafenib: dose escalation for BRAF V600E/K solid tumors First data readout and RP2D were expected Q1/Q2 2023 MK-8353 (Ph 1) rineterkib (Ph 1) ORR 20% (3/15 efficacy evaluable); not listed in pipeline Reported monotx ORR of 2% (n=65); not listed on pipeline GDC-004 KO-947 CC-90003 Tolerability issues Placed on partial clinical hold; IV administered MTD “did not offer sufficiently encouraging profile to proceed” TERMINATED CLINICAL MTD: maximum tolerated dose; monotx: monotherapy; HCQ: hydroxychloroquine; CoM: composition of matter patent; ORR: overall response rate; RR: response rate; EC: encorafenib + cetuximab; RP2D: recommended Phase 2 dose; FIH: First-in-Human

BRAF V600E CRC Cell Lines MEKi combination ERKi combinations Binimetinib 1 µM + Encorafenib 0.1 µM ERAS-007 0.1 µM + Encorafenib 0.1 µM LY3214996 1 µM + Encorafenib 0.1 µM Ravoxertinib 1 µM + Encorafenib 0.1 µM RKO HT29 MAPK Feedback Reactivation No Reactivation Reactivation Reactivation Source: Unpublished data P-RSK P-ERK GAPDH P-RSK P-ERK GAPDH P-RSK GAPDH P-RSK P-ERK GAPDH 0 4 24 48 72h 0 4 24 48 72h ERAS-007 blocked the MAPK feedback reactivation observed with MEK or other ERK plus BRAF inhibitor combinations

Goal is to maximize the time above IC90 to improve cancer cell killing, while maintaining Cmin near or below IC50 to give normal cells a treatment break (i.e., extend time below IC50) Dosing Regimen Cmax, ng/mL Cmin, ng/mL T>IC90 T<IC50 250 mg QW 425 3 ~2/7 ~1/7 50 mg BID-QW 103 3 ~2/7 ~1/7 80 mg BID-QW 165 5 ~3/7 ~0.5/7 100 mg D1D2 BIW 186 5 ~2/7 ~0.5/7 100 mg D1D4 BIW 183 11 ~2/7 0 Phase 1 PK data showed QW is preferable to QD dosing; Simulations suggest BID-QW dosing may improve PK/PD profiles and combinability even more

v3.23.4

Document And Entity Information

|

Jan. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 09, 2024

|

| Entity Registrant Name |

Erasca, Inc.

|

| Entity Central Index Key |

0001761918

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40602

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

83-1217027

|

| Entity Address, Address Line One |

3115 Merryfield Row

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(858)

|

| Local Phone Number |

465-6511

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

ERAS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

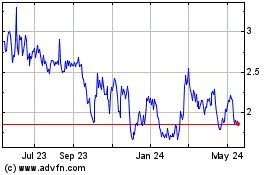

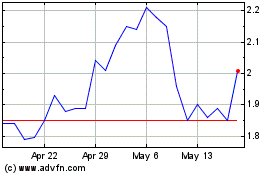

Erasca (NASDAQ:ERAS)

Historical Stock Chart

From Mar 2024 to May 2024

Erasca (NASDAQ:ERAS)

Historical Stock Chart

From May 2023 to May 2024