FALSE000143486800014348682023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 7, 2023

Esperion Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35986 | | 26-1870780 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

3891 Ranchero Drive, Suite 150

Ann Arbor, MI

(Address of principal executive offices)

Registrant’s telephone number, including area code: (734) 887-3903

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | ESPR | | NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2023, Esperion Therapeutics, Inc. issued a press release announcing its financial results for the three and nine months ended September 30, 2023 (the “Press Release”). A copy of the Press Release is furnished herewith as Exhibit 99.1.

The information set forth under Item 2.02 and in Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: November 7, 2023 | Esperion Therapeutics, Inc. |

| |

| By: | /s/ Sheldon L. Koenig |

| | Sheldon L. Koenig |

| | President and Chief Executive Officer |

Esperion Reports Third Quarter 2023 Financial Results

– Q3 U.S. Net Product Revenue Grew 45% Y/Y to $20.3 Million; Q3 Total Revenue Grew 79% Y/Y to $34.0 Million –

– Q3 Retail Prescription Equivalents Grew 33% Y/Y and 8% Q/Q, Demonstrating Sustained Momentum into 2H 2023 –

– Received FDA Acceptance of Application for Expanded CV Risk Reduction Indications with PDUFA Date of March 31; EMA Approval of Expanded Labels on Track and Anticipated in 1H 2024 –

– Presented Two New CLEAR Outcomes Analyses at the European Society of Cardiology (ESC), Further Differentiating NEXLETOL® (bempedoic acid) Tablet and NEXLIZET® (bempedoic acid and ezetimibe) Tablet from Existing LDL-C Lowering Therapies –

ANN ARBOR, Mich., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Esperion (NASDAQ: ESPR) today reported financial results for the third quarter ended September 30, 2023, and provided a business update.

“We continued to deliver on our commitments during the third quarter of 2023, posting strong revenue growth, prudently managing expenses, and executing on our strategic plan to maximize the blockbuster potential of NEXLETOL and NEXLIZET,” said Sheldon Koenig, President and CEO. “We built upon the momentum we generated in the first half of the year, continuing to deliver prescription growth even with our narrow indication and promotional footprint. We made progress toward label expansion, receiving FDA acceptance of our cardiovascular risk reduction indication submissions in the U.S. and with the EMA review process on track in Europe. We anticipate approval in the U.S. by March 31 and in Europe in the first half of 2024. We now have an organization-wide focus on preparation for our new labels, and are laying the groundwork to make changes to our sales organization so that we can hit the ground running the moment we receive approval. We are proud of our first-in-class therapies and look forward to bringing these life-saving medications to millions more patients early next year.”

Third Quarter 2023 Key Accomplishments and Recent Highlights

•Announced the acceptance by the U.S. Food and Drug Administration (FDA) of its Supplemental New Drug Applications (sNDAs) submissions for NEXLETOL and NEXLIZET with a PDUFA, or action, date of March 31, 2024. The review process by the European Medicines Agency (EMA) for expanded indications for NILEMDO® (bempedoic acid) and NUSTENDI® (bempedoic acid and ezetimibe) also remains on track. Both applications for label expansion seek the addition of bempedoic acid for use in cardiovascular risk reduction in patients with or at high risk for atherosclerotic cardiovascular disease. The Company anticipates approval in the U.S. in the first quarter of 2024 and in Europe in the first half of 2024.

•Presented additional pre-specified analyses from landmark trial at ESC 2023. The CLEAR Outcomes Total Events Analysis demonstrated that bempedoic acid reduces total major adverse cardiovascular events including non-fatal myocardial infarction, non-fatal stroke, coronary revascularizations and cardiovascular death by 20%, reinforcing

the value of long-term bempedoic acid use in reducing not just the first, but multiple events over time. Results also demonstrated a risk reduction of 17% in a composite of major adverse cardiovascular events including non-fatal myocardial infarction, non-fatal stroke, and cardiovascular death, 31% in total myocardial infarctions, and 22% in total coronary revascularizations. The CLEAR Outcomes Analysis by Glycemic Status also demonstrated that bempedoic acid reduces time to first major adverse cardiovascular events including non-fatal myocardial infarction, non-fatal stroke and cardiovascular death by 20% in patients with diabetes and does not increase rates of new onset diabetes, a key differentiating feature compared to statins, and which further supports the safety and efficacy of bempedoic acid compared to placebo in patients with and without diabetes. Patients with diabetes constitute a large proportion of the primary prevention population at risk for cardiovascular events. These analyses further differentiate bempedoic acid from existing LDL-C lowering therapies.

•Daiichi Sankyo Europe gained approvals in three new countries during the third quarter: the Netherlands, Slovakia, and Spain.

•Announced a strategic collaboration with the American College of Cardiology and Amgen to launch a new quality improvement campaign called “Driving Urgency in LDL Screening,” with the aim of increasing the rate of diagnostic LDL cholesterol screening in patients without a prior cardiac event, as well as those with known cardiovascular disease, in order to help clinicians identify those who need treatment in accordance with medical guidelines.

Third Quarter and YTD 2023 Financial Results

Total revenue was $34.0 million for the three months ended September 30, 2023, and $84.1 million for the nine months ended September 30, 2023, compared to $19.0 million and $56.7 million for the comparable periods in 2022, an increase of 79% and 48%, respectively.

U.S. net product revenue was $20.3 million for the three months ended September 30, 2023, and $57.6 million for the nine months ended September 30, 2023, compared to $14.0 million and $40.9 million for the comparable periods in 2022, an increase of 45% and 41%, respectively, driven by retail prescription growth of 33% and 25%.

Collaboration revenue was $13.7 million for the three months ended September 30, 2023, and $26.5 million for the nine months ended September 30, 2023, compared to $5.0 million and $15.8 million for the comparable periods in 2022, an increase of approximately 174% and 68%, respectively, driven by increased royalty revenue and tablet shipments to international partners.

Research and development expense was $14.9 million for the three months ended September 30, 2023, and $68.4 million for the nine months ended September 30, 2023, compared to $29.1 million and $85.9 million for the comparable periods in 2022, a decrease of 49% and 20%, respectively. The decrease is primarily related to the close-out of our CLEAR Outcomes study.

Selling, general and administrative expense was $33.2 million for the three months ended September 30, 2023, and $97.1 million for the nine months ended September 30, 2023, compared to $25.0 million and $84.9 million for the comparable periods in 2022, an increase of 33% and 14%, respectively. The increase is related to higher legal and promotional costs.

The Company had net losses of $41.3 million for the three months ended September 30, 2023, and $152.9 million for the nine months ended September 30, 2023, compared to net losses of $55.1 million and $178.2 million for the comparable periods in 2022, respectively.

Basic and diluted net losses per share was $0.37 for the three months ended September 30, 2023, and $1.53 for the nine months ended September 30, 2023, compared to basic and diluted net losses per share of $0.81 and $2.78, for the comparable periods in 2022, respectively.

As of September 30, 2023, cash, cash equivalents, and investment securities available-for-sale totaled $114.8 million, compared with $166.9 million as of December 31, 2022.

The Company ended the quarter with approximately 112.1 million shares of common stock outstanding, excluding 2.0 million treasury shares to be purchased in the prepaid forward transaction as part of the convertible debt financing.

Reiterating 2023 Financial Outlook

The Company still expects full year 2023 operating expenses to be approximately $225 million to $245 million, including $25 million in non-cash expenses related to stock compensation.

Conference Call and Webcast Information

Esperion will host a webcast at 8:00 a.m. ET to discuss financial results and business progress. Please click here to pre-register to participate in the conference call and obtain your dial in number and PIN. You can also visit the Esperion website to listen to the call via live webcast. A recorded version will be available under the same link immediately following the conclusion of the conference call. Already registered? Access with your PIN here.

A live webcast can be accessed on the investors and media section of the Esperion website. Access to the webcast replay will be available approximately two hours after completion of the call and will be archived on the Company’s website for approximately 90 days.

INDICATION

NEXLIZET or NEXLETOL are indicated as an adjunct to diet and maximally tolerated statin therapy for the treatment of adults with heterozygous familial hypercholesterolemia or established atherosclerotic cardiovascular disease who require additional lowering of LDL-C.

Limitations of Use: The effect of NEXLIZET or NEXLETOL on cardiovascular morbidity and mortality has not been determined.

IMPORTANT SAFETY INFORMATION

NEXLIZET is contraindicated in patients with a known hypersensitivity to ezetimibe tablets. Hypersensitivity reactions including anaphylaxis, angioedema, rash, and urticaria have been reported with ezetimibe, a component of NEXLIZET.

Hyperuricemia: Bempedoic acid, a component of NEXLIZET and NEXLETOL, may increase blood uric acid levels which may lead to gout. Hyperuricemia may occur early in treatment and persist throughout treatment, and may lead to the development of gout, especially in patients with a history of gout. Assess uric acid levels periodically as clinically indicated. Monitor for signs and symptoms of hyperuricemia, and initiate treatment with urate-lowering drugs as appropriate.

Tendon Rupture: Bempedoic acid, a component of NEXLIZET and NEXLETOL, is associated with an increased risk of tendon rupture or injury. Tendon rupture occurred within weeks to months of starting NEXLIZET or NEXLETOL. Tendon rupture may occur more frequently in patients over 60 years of age, patients taking corticosteroid or fluoroquinolone drugs, patients with renal failure, and patients with previous tendon disorders. Discontinue NEXLIZET or NEXLETOL at the first sign of tendon rupture. Avoid NEXLIZET or NEXLETOL in patients who have a history of tendon disorders or tendon rupture.

The most common adverse reactions in clinical trials of bempedoic acid (a component of NEXLIZET and NEXLETOL) in ≥2% of patients and greater than placebo, were upper respiratory tract infection, muscle spasms, hyperuricemia, back pain, abdominal pain or discomfort, bronchitis, pain in extremity, anemia, and elevated liver enzymes.

Adverse reactions reported in ≥2% of patients treated with ezetimibe (a component of NEXLIZET) and at an incidence greater than placebo in clinical trials were upper respiratory tract infection, diarrhea, arthralgia, sinusitis, pain in extremity fatigue, and influenza.

In clinical trials of NEXLIZET, the most commonly reported adverse reactions (incidence ≥3% and greater than placebo) observed that not observed in clinical trials of bempedoic acid or ezetimibe, were urinary tract infection, nasopharyngitis, and constipation.

Discontinue NEXLIZET or NEXLETOL when pregnancy is recognized unless the benefits of therapy outweigh the potential risks to the fetus. Because of the potential for serious adverse reactions in a breast-fed infant, breastfeeding is not recommended during treatment with NEXLIZET or NEXLETOL. Report pregnancies to the Esperion Therapeutics, Inc. Adverse Event reporting line at 1-833-377-7633.

Esperion Therapeutics

At Esperion, we discover, develop, and commercialize innovative medicines to help improve outcomes for patients with or at risk for cardiovascular and cardiometabolic diseases. The status quo is not meeting the health needs of millions of people with high cholesterol – that is why our team of passionate industry leaders is breaking through the barriers that prevent patients from reaching their goals. Providers are moving toward reducing LDL-cholesterol levels as low as possible, as soon as possible; we provide the next steps to help get patients there. Because when it comes to high cholesterol, getting to goal is not optional. It is our life’s work. For more information, visit esperion.com and esperionscience.com and follow us on X at twitter.com/EsperionInc.

CLEAR Cardiovascular Outcomes Trial CLEAR Outcomes is part of the CLEAR clinical research program for NEXLETOL® (bempedoic acid) Tablet and NEXLIZET® (bempedoic acid and ezetimibe) Tablet. The CLEAR Program seeks to generate important clinical evidence on the safety and efficacy of bempedoic acid, a first in a class ATP citrate lyase inhibitor contained in NEXLETOL and NEXLIZET and its potential role in addressing additional critical unmet medical needs. More than 60,000 people will have participated in the program by the time of its completion. The CLEAR Program includes 5 label-enabling Phase III studies as well as other key Phase IV studies with the potential to reach more than 70 million people with or at risk for CVD based on elevated LDL-C.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the federal securities laws, including statements regarding marketing

strategy and commercialization plans, current and planned operational expenses, future operations, commercial products, clinical development, including the timing, designs and plans for the CLEAR Outcomes study and its results, plans for potential future product candidates, financial condition and outlook, including expected cash runway, and other statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “suggest,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions. Any express or implied statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause Esperion’s actual results to differ significantly from those projected, including, without limitation, es, profitability, and growth of Esperion’s commercial products, clinical activities and results, supply chain, commercial development and launch plans, the outcomes of legal proceedings, and the risks detailed in Esperion’s filings with the Securities and Exchange Commission. Any forward-looking statements contained in this press release speak only as of the date hereof, and Esperion disclaims any obligation or undertaking to update or revise any forward-looking statements contained in this press release, other than to the extent required by law.

Esperion Contact Information:

Investors:

Alexis Callahan

investorrelations@esperion.com

(406) 539-1762

Media:

Tiffany Aldrich

corporateteam@esperion.com

(616) 443-8438

ESPERION Therapeutics, Inc.

Balance Sheet Data

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| Cash and cash equivalents | | $ 114,833 | | $ 124,775 |

| Investments | | — | | 42,086 |

| Working capital | | 80,519 | | 154,375 |

| Total assets | | 221,305 | | 247,939 |

| Revenue interest liability | | 267,400 | | 243,605 |

| Convertible notes, net of issuance costs | | 261,165 | | 259,899 |

| Common stock | | 112 | | 75 |

| Accumulated deficit | | (1,492,940) | | (1,340,036) |

| Total stockholders' deficit | | (410,004) | | (323,778) |

ESPERION Therapeutics, Inc.

Statement of Operations

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Revenues: | | | | | | | | | | | |

| Product sales, net | $ | 20,251 | | | $ | 13,964 | | | $ | 57,575 | | | $ | 40,896 | | | | | |

| Collaboration revenue | 13,718 | | | 5,016 | | | 26,509 | | | 15,761 | | | | | |

| Total Revenues | 33,969 | | | 18,980 | | | 84,084 | | | 56,657 | | | | | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Cost of goods sold | 13,377 | | | 6,506 | | | 31,815 | | | 22,807 | | | | | |

| Research and development | 14,885 | | | 29,143 | | | 68,365 | | | 85,894 | | | | | |

| Selling, general and administrative | 33,240 | | | 24,954 | | | 97,100 | | | 84,944 | | | | | |

| Total operating expenses | 61,502 | | | 60,603 | | | 197,280 | | | 193,645 | | | | | |

| | | | | | | | | | | |

| Loss from operations | (27,533) | | | (41,623) | | | (113,196) | | | (136,988) | | | | | |

| | | | | | | | | | | |

| Interest expense | (14,995) | | | (14,153) | | | (43,919) | | | (42,481) | | | | | |

| Other income, net | 1,278 | | | 659 | | | 4,211 | | | 1,297 | | | | | |

| Net loss | $ | (41,250) | | | $ | (55,117) | | | $ | (152,904) | | | $ | (178,172) | | | | | |

| | | | | | | | | | | |

| Net loss per common share - basic and diluted | $ | (0.37) | | | $ | (0.81) | | | $ | (1.53) | | | $ | (2.78) | | | | | |

| | | | | | | | | | | |

| Weighted-average shares outstanding - basic and diluted | 111,869,478 | | | 67,806,292 | | | 99,973,647 | | | 64,021,248 | | | | | |

| | | | | | | | | | | |

Cover Page

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity Registrant Name |

Esperion Therapeutics, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35986

|

| Entity Tax Identification Number |

26-1870780

|

| Entity Address, Address Line One |

3891 Ranchero Drive

|

| Entity Address, Address Line Two |

Suite 150

|

| Entity Address, City or Town |

Ann Arbor

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48108

|

| City Area Code |

734

|

| Local Phone Number |

887-3903

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ESPR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001434868

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

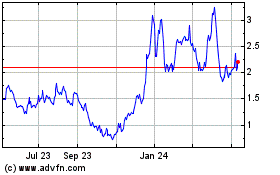

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Apr 2024 to May 2024

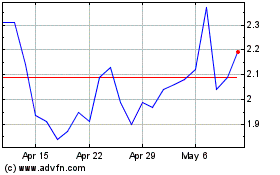

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From May 2023 to May 2024