Current Report Filing (8-k)

29 May 2019 - 8:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 27, 2019

EVINE Live Inc.

(Exact name of registrant as specified

in its charter)

|

Minnesota

|

001-37495

|

41-1673770

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

6740 Shady Oak Road,

Eden Prairie, Minnesota 55344-3433

(Address of principal executive offices)

+1 (952) 943-6000

(Registrant’s telephone number,

including area code)

Not applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

EVLV

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 2.02

|

Results of Operations and Financial Condition

|

On May 29, 2019, we issued a press release

disclosing our results of operations and financial condition for our first quarter ended May 4, 2019. The press release is furnished

herewith as Exhibit 99.1.

In accordance with General Instruction B.2

of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of

that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities

Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in that filing.

|

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities

|

On May 29,

2019, we announced that we are implementing a cost optimization event that is expected to result in an approximately 20% reduction

in our non-variable workforce during the current fiscal quarter. As a result of this action, we expect to incur total non-recurring restructuring

charges of approximately $4.0 million to $4.5 million on a pre-tax basis for severance payments and other termination

costs.

An announcement

of the reduction in force has been included in the press release furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 2.05 of this

Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve risks and uncertainties

that could cause actual results to differ materially from expectations, and may relate to, among other things, statements regarding

our current expectations and beliefs as to the timing and scope of the reduction in force plan and the amount and timing of the

related costs. These forward-looking statements speak only as of the date they are made, and we do not undertake any obligation

to revise or update such statements to reflect future events or circumstances.

|

|

Item 5.02

|

Entry into a Material Definitive Agreement

|

In connection with the cost optimization

event, on May 28, 2019 our (a) EVP, Chief Financial Officer, Diana G. Purcel, (b) Chief Accounting Officer, Nicholas J. Vassallo,

(c) EVP, General Counsel & Corporate Secretary, Andrea M. Fike, and (d) our EVP, Managing Director of Brand Development, Nicole

R. Ostoya, will cease to serve in such roles, effective May 28, 2019.

On May 27, 2019, our board of directors

appointed Michael Porter as our SVP, Chief Financial Officer (and principal accounting officer). Mr. Porter, age 38, joined our

company as Director, Financing Planning & Analysis, in July 2015 and was promoted to our Vice President, Finance and Investor

Relations, in November 2016. Prior to joining our company, Mr. Porter served in multiple finance and accounting roles with Target

Corp. from May 2004 to July 2015.

In connection with his promotion, Mr. Porter:

(a) will receive an annual base salary of $300,000, (b) will be eligible for annual cash discretionary bonuses targeted at 40%

of his annual salary with a maximum annual cash discretionary bonus equal to 80% of his annual salary, (c) will receive long term

incentive plan equity awards targeted at 45% of his annual salary, with 50% of the awards granted as stock options and 50% of the

awards granted as restricted stock units and (d) receive a one-time award of 50,000 stock options vesting over three years and

50,000 restricted stock units vesting over three years. Mr. Porter is also designated as a Tier II Executive under our Executives’

Severance Benefit Plan. Pursuant to the severance benefit plan, Mr. Porter is eligible to receive 1 times his highest annual rate

of base salary during the 12-month period immediately preceding the date that he separates from our company. If within a one-year

period (the “Benefit Period”) commencing on the date of a Change in Control (as defined in the severance benefit plan),

his employment is terminated by our company without Cause (as defined in the severance benefit plan) or by him for Good Reason

(as defined in the severance benefit plan), he will be entitled to benefits under the severance benefit plan equal to the sum of:

(i) 1 ¼ times his highest annual rate of base salary during the 12-month period immediately preceding the date that he separates

from service; and (ii) 1 ¼ times the target annual incentive bonus determined from such base salary. In addition, if Mr.

Porter is a participant in the severance benefit plan on the date of the Change in Control he will be entitled to benefits under

the severance benefit plan if his employment is terminated by our company during the Benefit Period or the immediately preceding

six months. He will also be entitled to reimbursement for a portion of the premium amount for COBRA coverage equal to the amount

paid by other similarly situated executives who have not been terminated and who receive similar group, health, dental and life

insurance benefits. We shall provide such reimbursement for a period of 15 months after his employment terminates, subject to his

timely payment of his share of the applicable premiums. All severance pay or benefits are conditioned upon his execution of an

effective release and his or her compliance with applicable covenants under the severance benefit plan (including non-solicitation,

non-disparagement, confidentiality and non-use covenants). This summary description of the severance benefit plan employment agreement

is qualified in its entirety by reference to the severance benefit plan, a copy of which is included as Exhibit 10.1 to this Current

Report on Form 8-K and is incorporated by reference herein.

|

|

Item 7.01

|

Regulation FD Disclosure

|

On

May 29, 2019, we issued a press release. The full text of the press release is attached as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated by reference into this Item 7.01.

The information

in this Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, or otherwise subject to the liabilities under that section, and shall not be deemed to

be incorporated by reference in any filing under the Securities Act of 1933, or the Securities Exchange Act of 1934, except as

expressly set forth by specific reference in such filing.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d)

Exhibits

The following exhibits are being filed or

furnished with this Current Report on Form 8-K:

*

Management compensatory plan/arrangement

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: May 29, 2019

|

|

|

|

EVINE Live Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/

Timothy Peterman

|

|

|

|

|

|

|

|

Timothy Peterman

Chief Executive Officer

|

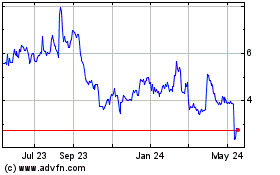

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024