Table of Contents

As filed with the Securities and Exchange Commission on December 6, 2024.

Registration No. 333-282961

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Envirotech Vehicles, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

3714

|

46-0774222

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

1425 Ohlendorf Road

Osceola, AR 72370

(870) 970-3355

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Franklin Lim

Chief Financial Officer

1425 Ohlendorf Road

Osceola, AR 72370

(870) 970-3355

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Michael A. Hedge

K&L Gates LLP

1 Park Plaza, Twelfth Floor

Irvine, CA 92614

(949) 623-3519

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

| |

|

|

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

|

|

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The Selling Securityholder may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED DECEMBER 6, 2024

|

13,609,145 Shares of Common Stock

This prospectus relates to the resale, from time to time, of up to 13,609,145 shares of common stock, par value $0.00001 per share (the “Common Stock”), of Envirotech Vehicles, Inc., a Delaware corporation (the “Company,” “we,” “us,” or “our”), by YA II PN, LTD. (the “Selling Securityholder”). The shares of Common Stock to which this prospectus relates have been or may be issued by us to the Selling Securityholder pursuant to a standby equity purchase agreement, dated as of September 23, 2024 (the “Effective Date”), by and between the Company and the Selling Securityholder (the “Original SEPA”) which was amended and restated on October 31, 2024 (the “A&R SEPA” and together with the Original SEPA, the “SEPA”), from time to time after the date of this prospectus, upon the terms and subject to the conditions set forth in the SEPA.

Such shares of Common Stock include (i) up to 13,545,042 shares of Common Stock that may be issued to the Selling Securityholder pursuant to the SEPA, either in our sole discretion following an Advance Notice (as defined below) or pursuant to an Investor Notice and (ii) 64,103 shares of Common Stock (the “Commitment Shares”) that we issued the Selling Securityholder, upon our execution of the Original SEPA on the Effective Date, as partial consideration for its commitment to purchase shares of our Common Stock in one or more purchases that we may direct them to make, from time to time after the date of this prospectus, pursuant to the SEPA. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of our Common Stock by the Selling Securityholder. However, we may receive up to $25,000,000 aggregate gross proceeds from sales of Common Stock that we may elect to make to the Selling Securityholder pursuant to the SEPA after the date of this prospectus. See “The Standby Equity Purchase Agreement” on page 10 of this prospectus for a description of the SEPA and “Selling Securityholder” on page 14 of this prospectus for additional information regarding the Selling Securityholder.

The Selling Securityholder may sell or otherwise dispose of the Common Stock described in this prospectus in a number of different ways and at varying prices. The Selling Securityholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”), and any profits on the sales of shares of our Common Stock by the Selling Securityholder and any discounts, commissions, or concessions received by the Selling Securityholder are deemed to be underwriting discounts and commissions under the Securities Act. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in any applicable prospectus supplement. We will pay the expenses incurred in registering under the Securities Act the offer and sale of the shares of Common Stock to which this prospectus relates by the Selling Securityholder, including our legal and accounting fees. See the sections “About this Prospectus” on page ii and “Plan of Distribution” on page 19 of this prospectus for more information. No securities may be sold without delivery of this prospectus and any applicable prospectus supplement describing the method and terms of the offering of such securities. You should carefully read this prospectus and any applicable prospectus supplement before you invest in our securities.

We engaged A.G.P./Alliance Global Partners (“AGP”) to act as our financial advisor in connection with this offering. We have agreed to pay AGP a cash fee of 7% based upon the aggregate gross proceeds received from the sales of Common Stock that we elect to make to the Selling Securityholder pursuant to the SEPA. See “Plan of Distribution” on page 19 of this prospectus for additional information regarding this arrangement.

Shares of our Common Stock are listed on the Nasdaq Capital Market under the symbol “EVTV”. On December 4, 2024, the last reported sale price for our Common Stock was $1.41 per share.

Investing in the securities involves a high degree of risk. See the section titled “Risk Factors” beginning on page 7 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC to register the securities described in this prospectus for resale by the Selling Securityholder who may, from time to time, sell the securities described in this prospectus.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section titled “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus and any prospectus supplement filed by us with the SEC in connection with this offering, and the documents incorporated by reference herein and therein. Neither we nor the Selling Securityholder has authorized anyone to provide you with different information. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information in this prospectus and any applicable prospectus supplement is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. The Selling Securityholder is offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted.

Unless otherwise indicated, information contained in this prospectus or any applicable prospectus supplement concerning our industry, including our market opportunity, is based on information from independent industry analysts, market research, publicly available information and industry publications. The third-party sources from which we have obtained information are generally believed to be reliable, but we cannot assure you that such information is accurate or complete. Management estimates contained in this prospectus and any applicable prospectus supplement are based on assumptions made by us using our internal research data and our knowledge of such industry and market, including reference to publicly available information released by independent industry analysts and third-party sources, which we believe to be reasonable. In addition, while we believe such information is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the heading “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

For investors outside the United States: Neither we, nor the Selling Securityholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

As used in this prospectus, unless the context otherwise requires, the terms “Envirotech,” “the Company,” “we,” “us,” “our” and “our company” mean Envirotech Vehicles, Inc., a Delaware corporation, and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus. This summary does not contain all of the information you should consider in making an investment decision. You should read this entire prospectus carefully, including the section titled “Risk Factors,” as well as the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” and our audited financial statements and related notes thereto, which are incorporated by reference into this prospectus, before making an investment decision.

Overview

We are a provider of purpose-built zero-emission electric vehicles focused on reducing the total cost of vehicle ownership and helping fleet operators unlock the benefits of green technology. We serve commercial and last-mile fleets, school districts, public and private transportation service companies and colleges and universities to meet the increasing demand for light to heavy-duty electric vehicles. Our vehicles address the challenges of traditional fuel price cost instability and local, state and federal environmental regulatory compliance. We currently offer Class 2 through 4 logistics vans, Class 4 through 5 urban trucks, school buses, electric forklifts, street sweepers, neighborhood electric vehicles (“NEV”) and right-hand drive vans and urban trucks.

Our vehicles are manufactured by outside, original equipment manufacturer (“OEM”) partners located in China, Malaysia and the Philippines that can be marketed, sold, warrantied and serviced through our developing distribution and service network.

Our vehicles include options for telemetrics for remote monitoring, electric power-export and various levels of grid-connectivity. Our zero-emission products may also grow to include automated charging infrastructure and “intelligent” stationary energy storage that enables fast vehicle charging, emergency back-up facility power, and access to the developing, grid-connected opportunities for the aggregate power available from groups of large battery packs.

Our Solution

Our vehicles are designed to help fleet operators unlock the benefits of technology that reduces GHG, NOx, PM and other pollutants, as well as to address the challenges of local, state and federal regulatory compliance and traditional-fuel price cost instability.

We seek to enable our customers to:

| |

●

|

Add Emission-Compliant Vehicles to Their Fleets. Our commercial fleet vehicles are designed to reduce or eliminate the use of traditional petroleum-based fuels that create greenhouse gases and particulate matter.

|

| |

●

|

Reduce Total Cost of Ownership. Our technology is designed to reduce fuel budgets and maintenance costs by eliminating or reducing the reliance on traditional petroleum-based fuels, instead using the more energy efficient and less variably priced grid-provided electricity.

|

| |

●

|

Prolong Lives of Existing Vehicles. Zero-emission electric vehicles generally have lower maintenance costs. These reduced maintenance costs may take the form of longer service intervals between brake system maintenance, elimination of internal combustion engine oil and oil filter changes, reduction or elimination of transmission oil and oil filter changes, reduction or elimination of air filter changes, elimination of emissions systems services, elimination of diesel emission fluid use, elimination of emissions and the elimination of certification tests.

|

| |

●

|

Plan for Natural Disasters When Fuel Supply May be Interrupted. Our zero-emissions systems are designed, when optionally equipped, to serve as on-site emergency back-up energy storage if grid power becomes intermittent or fails temporarily during natural or man-made disasters.

|

| |

●

|

Improve the Environment Around Vehicles. As a result of our zero-emission systems, drivers, operators, customers and the communities they serve could have healthier environments in and around these vehicles.

|

Our Products and Services

Our products and services primarily include purpose-built, zero-emission vehicles and chassis of all sizes manufactured by OEMs, and are marketed, sold, warrantied and serviced through our developing distribution and service network.

We engage OEMs to design and supply vehicles for us that meet our specifications. In addition, our products and services may in the future include some or all of the following:

| |

●

|

Zero-emission electric systems for ship-through integration by outside OEMs into their own privately branded medium to heavy-duty commercial fleet vehicles.

|

| |

●

|

Automated charging infrastructure for commercial fleet vehicles.

|

| |

●

|

“Intelligent” stationary energy storage that enables fast vehicle charging.

|

| |

●

|

“Intelligent” stationary energy storage that enables emergency back-up facility power during grid power outages.

|

| |

●

|

“Intelligent” stationary energy storage that enables access to the developing grid-connected opportunities for the aggregate power available from groups of large battery packs.

|

| |

●

|

“Intelligent” stationary energy storage that enables avoidance of electric utility demand charges for commercial customers integrated with or independent of Envirotech-supplied, zero-emission fleet vehicle(s).

|

| |

●

|

Energy storage systems (battery packs) replacements with better energy density and/or expected lifecycles for existing electric vehicles and equipment that has outlived their OEM-provided energy storage systems. For example, replace flooded lead acid (“FLA”) battery packs of existing industrial forklifts and underground mining equipment with more energy dense and higher cycle-life battery packs composed of lithium-ion cells.

|

Standby Equity Purchase Agreement with the Selling Securityholder

On September 23, 2024 (the “Effective Date”), we entered into a standby equity purchase agreement, by and between the Company and the Selling Securityholder (the “Original SEPA”) which was amended and restated on October 31, 2024 (the “A&R SEPA” and together with the Original SEPA, the “SEPA”). Pursuant to the SEPA, the Selling Securityholder will advance to the Company, subject to the satisfaction of certain conditions as set forth therein, the principal amount of $3 million (the “Pre-Paid Advance”), which shall be evidenced by convertible promissory notes (the “Promissory Notes”) in two tranches. The Promissory Notes will accrue interest on the outstanding principal balance at an annual rate equal to 0%, which shall increase to an annual rate of 18% upon the occurrence of an Event of Default (as defined in the Promissory Notes) or a Registration Event (as defined in the Promissory Note) for so long as such event remains uncured. The Promissory Notes will mature on the date that is fifty-four (54) weeks after the closing date of the first Pre-Paid Advance. The Promissory Notes are convertible at a conversion price equal to the lower of (i) $2.148 per share or (ii) 93% of the lowest daily VWAP (as defined below) during the five consecutive trading days immediately preceding the conversion date (but no lower than the “floor price” then in effect, which is $0.358, subject to adjustment from time to time in accordance with the terms contained in the Promissory Notes) (the “Conversion Price”).

The first tranche of the Pre-Paid Advance will be in the principal amount of $2 million and advanced on the date of A&R SEPA (the “First Pre-Advance Closing”), and the second tranche of the Pre-Paid Advance will be in the principal amount of $1 million and advanced on the second trading day after this Registration Statement first becoming effective (the “Second Pre-Advance Closing”) (each of the First Pre-Advance Closing and Second Pre-Advance Closing individually referred to as a “Pre-Advance Closing” and collectively referred to as the “Pre-Advance Closings”). At each Pre-Advance Closing, the Selling Securityholder will advance to the Company the principal amount of the applicable tranche of the Pre-Paid Advance, less a discount in the amount equal to 5% of the principal amount of such tranche of the Pre-Paid Advance netted from the purchase price due and structured as an original issue discount.

Pursuant to the SEPA, and upon the satisfaction of the conditions to the Selling Securityholder’s purchase obligation set forth in the SEPA, including the registration of shares of Common Stock issuable pursuant to the SEPA for resale, we will have the right, from time to time, until November 1, 2027, to require the Selling Securityholder to purchase up to $25 million of shares of our Common Stock, subject to certain limitations and conditions set forth in the SEPA, by delivering written notice to the Selling Securityholder (“Advance Notice”).

If there is no balance outstanding under a Promissory Note, we may, in our sole discretion, select the amount of the advance that we desire to issue and sell to the Selling Securityholder in each Advance Notice, subject to a maximum limit equal to 100% of the average of the daily volume traded of the Company’s Common Stock on Nasdaq for the five consecutive trading days immediately preceding the delivery of an Advance Notice (“Maximum Advance Amount”). If there is a balance outstanding under a Promissory Note, we may only submit an Advance Notice (i) if an Amortization Event (as defined below) has occurred and our obligation to make prepayments under the Promissory Notes has not ceased, and (ii) the aggregate purchase price owed to us from such Advances (“Advance Proceeds”) will be paid by the Selling Securityholder by offsetting the amount of the Advance Proceeds against an equal amount outstanding under the Promissory Notes. Pursuant to an Advance Notice, the shares will be issued and sold to the Selling Securityholder at a per share price equal to, at the election of the Company as specified in the relevant Advance Notice: (i) 96% of the Market Price (as defined below) for any period commencing on the receipt of the Advance Notice by the Selling Securityholder (or, if the Advance Notice is submitted to the Selling Securityholder prior to 9:00 a.m. Eastern Time, the opening of trading on such day) and ending on 4:00 p.m. Eastern time on the applicable Advance Notice date (the “Option 1 Pricing Period”), and (ii) 97% of the Market Price for any three consecutive trading days commencing on the day such Advance Notice is delivered (the “Option 2 Pricing Period,” and each of the Option 1 Pricing Period and the Option 2 Pricing Period, a “Pricing Period”).

For so long as there is a balance outstanding under a Promissory Note, the Selling Securityholder, at its sole discretion, may deliver to us a notice (“Investor Notice”), to cause an Advance Notice to be deemed delivered to the Selling Securityholder and the issuance of shares of our Common Stock to the Selling Securityholder pursuant to an Advance. The Selling Securityholder may select the amount of the Advance pursuant to an Investor Notice up to the Maximum Advance Amount, provided that the amount of the Advance selected shall not exceed the balance owed under all Promissory Notes outstanding on the date of delivery of the Investor Notice. The shares will be issued and sold to the Selling Securityholder pursuant to an Investor Notice at a per share price equal to the Conversion Price that would be applicable to the amount of the Advance selected by the Selling Securityholder if such amount were to be converted as of the date of delivery of the Investor Notice. The Selling Securityholder will pay the purchase price for such shares to be issued pursuant to the Investor Notice by offsetting the amount of the purchase price to be paid by the Selling Securityholder against an amount outstanding under the Promissory Notes.

Under applicable Nasdaq rules and pursuant to the SEPA, in no event may we issue or sell to the Selling Securityholder shares of our Common Stock in excess of 3,297,883 shares of Common Stock (the “Exchange Cap”), which is 19.9% of the shares of Common Stock outstanding immediately prior to the execution of the Original SEPA, unless (i) we obtain stockholder approval to issue shares of Common Stock in excess of the Exchange Cap or (ii) the average price of all applicable sales of Common Stock under the SEPA equals or exceeds $1.868 (reference price under Nasdaq Rules) per share (which represents the lower of (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the Effective Date; or (ii) the average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the Effective Date). In any event, we may not issue or sell any shares of our Common Stock under the SEPA if such issuance or sale would breach any applicable Nasdaq listing rules.

Actual sales of shares of our Common Stock to the Selling Securityholder under the SEPA will depend on a variety of factors, which may include, among other things, market conditions, the trading price of our Common Stock and determinations by us as to the appropriate sources of funding for our business and its operations.

We may not issue or sell any shares of Common Stock to the Selling Securityholder under the SEPA which, when aggregated with all other shares of Common Stock then beneficially owned by the Selling Securityholder and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the Selling Securityholder and its affiliates beneficially owning more than 4.99% of the then-outstanding shares of Common Stock (the “Beneficial Ownership Limitation”). However, the Beneficial Ownership Limitation does not prevent the Selling Securityholder from selling some or all of the shares of Common Stock it acquires and then acquiring additional shares, consequently resulting in the Selling Securityholder being able to sell in excess of the 4.99% Beneficial Ownership Limitation despite not holding more than 4.99% of our outstanding shares of Common Stock at any given time.

The net proceeds to us under the SEPA will depend on the frequency and prices at which we sell shares of Common Stock to the Selling Securityholder. Upon the effectiveness of the registration statement of which this prospectus forms a part, we expect that any proceeds received by us from such sales to the Selling Securityholder will be used for working capital. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present agreements to enter into any acquisitions or investments.

The Selling Securityholder has agreed that, except as otherwise expressly provided in the SEPA, it and its affiliates will not engage in any short sales of the Common Stock during the term of the SEPA.

The SEPA will automatically terminate on the earliest to occur of (i) November 1, 2027, provided that if any Promissory Notes are then outstanding, such termination will be delayed until such date that the outstanding balance of any Promissory Note has been repaid or any outstanding Promissory Note has been otherwise terminated in accordance with its terms or (ii) the date on which the Selling Securityholder shall have purchased from us under the SEPA $25.0 million of shares of our Common Stock. We have the right to terminate the SEPA upon five trading days’ prior written notice to the Selling Securityholder, provided that there are no outstanding Advance Notices under which we are yet to issue Common Stock and provided that we have paid all amounts owed to the Selling Securityholder pursuant to the SEPA and the Promissory Notes. We and the Selling Securityholder may also agree to terminate the SEPA by mutual written consent. Neither we nor the Selling Securityholder may assign or transfer our respective rights and obligations under the SEPA, and no provision of the SEPA may be modified or waived by us or the Selling Securityholder other than by an instrument in writing signed by both parties.

As consideration for the Selling Securityholder’s commitment to purchase shares of Common Stock at our direction upon the terms and subject to the conditions set forth in the SEPA, prior to the Effective Date, we issued the Commitment Shares and paid a structuring fee in an aggregate amount of $25,000.

The SEPA contains customary representations, warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in the SEPA were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement and may be subject to limitations agreed upon by the contracting parties.

The description of the SEPA does not purport to be complete and is qualified in its entirety by reference to the full text of the SEPA, a copy of which is filed as an exhibit to the registration statement of which this prospectus forms a part and is incorporated herein by reference.

Because the purchase price per share to be paid by the Selling Securityholder for the shares of Common Stock that we may elect to sell to the Selling Securityholder under the SEPA, if any, will fluctuate based on the market prices of our Common Stock during the applicable Pricing Period, as of the date of this prospectus we cannot reliably predict the number of shares of Common Stock that we will sell to the Selling Securityholder under the SEPA, the actual purchase price per share to be paid by the Selling Securityholder for those shares, or the actual gross proceeds to be raised by us from those sales, if any. As of October 25, 2024, there were 16,622,010 shares of Common Stock outstanding, of which 14,800,868 shares were held by non-affiliates. If all of the 13,609,145 shares offered for resale by the Selling Securityholder under the registration statement of which this prospectus forms a part were issued and outstanding as of October 25, 2024, such shares would represent approximately 45.1% of the total number of shares of our Common Stock outstanding and approximately 48.0% of the total number of outstanding shares of Common Stock held by non-affiliates.

Although the SEPA provides that we may, in our discretion, from time to time after the date of this prospectus and during the term of the SEPA, direct the Selling Securityholder to purchase shares of our Common Stock from us in one or more advances under the SEPA, for a maximum aggregate purchase price of up to $25 million, only 13,609,145 shares of Common Stock are being registered for resale under the registration statement of which this prospectus forms a part. While the market price of our Common Stock may fluctuate from time to time after the date of this prospectus and, as a result, the actual purchase price to be paid by the Selling Securityholder under the SEPA for shares of our Common Stock, if any, may also fluctuate, in order for us to receive the full amount of the Selling Securityholder’ commitment under the SEPA, it is possible that we may need to issue and sell more than the number of shares being registered for resale under the registration statement of which this prospectus forms a part.

If it becomes necessary for us to issue and sell to the Selling Securityholder more shares than are being registered for resale under this prospectus in order to receive aggregate gross proceeds equal to $25 million under the SEPA, we must first (i) to the extent necessary, obtain stockholder approval prior to issuing shares of the Common Stock in excess of the Exchange Cap in accordance with applicable Nasdaq rules, and (ii) file with the SEC one or more additional registration statements to register under the Securities Act the resale by the Selling Securityholder of any such additional shares of our Common Stock, which the SEC must declare effective, in each case, before we may elect to sell any additional shares of our Common Stock to the Selling Securityholder under the SEPA. The number of shares of our Common Stock ultimately offered for resale by the Selling Securityholder depends upon the number of shares of Common Stock, if any, we ultimately sell to the Selling Securityholder under the SEPA.

Implications of Being a Smaller Reporting Company

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we will continue to be permitted to make certain reduced disclosures in our periodic reports and other documents that we file with the SEC.

Company and Other Information

Our company was originally incorporated under the laws of the state of Florida on August 6, 2012, as ADOMANI, Inc., and, in November 2016, was reincorporated in the state of Delaware under the same name.

On March 15, 2021, we completed our acquisition of Envirotech Drive Systems, Inc., a Delaware corporation (“EVTDS”), and subsequently changed our company’s name from ADOMANI, Inc. to Envirotech Vehicles, Inc., effective as of May 26, 2021.

Our principal executive offices are located at 1425 Ohlendorf Road, Osceola, Arkansas 72370. Our telephone number is (870) 970-3355. Our corporate website address is www.evtvusa.com. The information contained on our website is not incorporated by reference into this prospectus and inclusion of our website address in this prospectus is an inactive textual reference only.

THE OFFERING

|

Issuer:

|

|

Envirotech Vehicles, Inc.

|

| |

|

|

|

Shares of Common Stock offered by the Selling Securityholder:

|

|

Up to 13,609,145 shares of our Common Stock.

|

| |

|

|

|

Common stock outstanding before this offering:

|

|

16,622,010 shares of our Common Stock. (1)

|

| |

|

|

|

Common stock to be outstanding after giving effect to the issuance of the shares registered for resale hereunder:

|

|

30,167,052 shares of our Common Stock.(1)

|

| |

|

|

|

Use of proceeds:

|

|

We will not receive any proceeds from the resale of shares of Common Stock included in this prospectus by the Selling Securityholder. However, we expect to receive proceeds from sales of Common Stock that we may elect to make to the Selling Securityholder pursuant to the SEPA, if any, from time to time in our discretion. The net proceeds from sales, if any, under the SEPA, will depend on the frequency and prices at which we sell shares of Common Stock to the Selling Securityholder after the date of this prospectus. See the section of this prospectus titled “The Standby Equity Purchase Agreement” for a description of how the price we may sell shares of Common Stock to the Selling Securityholder is calculated pursuant to the SEPA.

We currently intend to use the net proceeds that we receive from sales of our Common Stock to the Selling Securityholder, if any, under the SEPA primarily for working capital. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present agreements to enter into any acquisitions or investments. See “Use of Proceeds” on page 12 of this prospectus for additional information.

|

| |

|

|

|

Market for Common Stock:

|

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “EVTV.”

|

| |

|

|

|

Risk factors:

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus for a discussion of factors you should consider before making a decision to invest in our securities.

|

| |

(1)

|

The number of shares of our Common Stock to be outstanding immediately before this offering, as shown above, is as of October 25, 2024. The number of shares of our Common Stock to be outstanding immediately after this offering, as shown above, is based on 16,622,010 shares of Common Stock outstanding as of October 25, 2024, and excludes, as of such date:

|

| |

●

|

32,717,163 shares of Common Stock reserved for issuance under the 2017 Equity Incentive Plan;

|

| |

●

|

1,901,631 shares of Common Stock issuable upon the exercise of outstanding warrants at a weighted-average exercise price of $12.79 per share; and

|

| |

●

|

5,644,030 shares of Common Stock issuable upon the exercise of stock options, with a weighted-average exercise price of $2.59 per share.

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein and therein contain “forward-looking statements” and information within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which are subject to the “safe harbor created by these sections, that involve substantial risks and uncertainties. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology intended to identify statements about the future. These forward-looking statements include, but are not limited to, statements regarding our:

| |

●

|

ability to generate demand for our zero-emission commercial fleet vehicles in order to generate revenue;

|

| |

●

|

dependence upon external sources for the financing of our operations;

|

| |

●

|

ability to effectively execute our business plan;

|

| |

●

|

ability and our suppliers’ ability to scale our zero-emission products assembling processes effectively and quickly from low volume production to high volume production;

|

| |

●

|

ability to manage our expansion, growth and operating expenses and reduce and adequately control the costs and expenses associated with operating our business;

|

| |

●

|

ability and our manufacturing partners’ ability to navigate the current disruption to the global supply chain and procure the raw materials, parts, and components necessary to produce our vehicles on terms acceptable to us and our customers;

|

| |

●

|

ability to obtain, retain and grow our customers;

|

| |

●

|

ability to enter into, sustain and renew strategic relationships on favorable terms;

|

| |

●

|

ability to achieve and sustain profitability;

|

| |

●

|

ability to evaluate and measure our current business and future prospects;

|

| |

●

|

ability to compete and succeed in a highly competitive and evolving industry;

|

| |

●

|

ability to respond and adapt to changes in electric vehicle technology; and

|

| |

●

|

ability to protect our intellectual property and to develop, maintain and enhance a strong brand.

|

Although the forward-looking statements in this prospectus are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, future transactions, results, performance, achievements our outcomes are unknown. The expectations reflected in our forward-looking statements may not be attained, or deviations from them could be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this prospectus or otherwise make public statements updating our forward-looking statements.

You should refer to the risks and uncertainties described in the “Risk Factors” section contained in this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate, and you should not place undue reliance on these forward-looking statements.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before you invest in our securities, you should consider the risks described below, together with all of the other information included or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, which has been filed with the SEC and is incorporated by reference in this prospectus, as well as any updates thereto contained in subsequent filings with the SEC, before deciding whether to purchase our securities in this offering. If any of the risks described below or incorporated by reference actually occur, our business, financial condition, results of operations and future prospects could be materially and adversely affected. In that event, the market price of our Common Stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations and stock price.

Risks Related to this Offering

It is not possible to predict the actual number of shares we will sell under the SEPA to the Selling Securityholder, or the actual gross proceeds resulting from those sales.

On September 23, 2024, we entered into the Original SEPA with the Selling Securityholder which was amended and restated on October 31, 2024 by the A&R SEPA (collectively referred to herein as the “SEPA”), pursuant to which the Selling Securityholder has committed to purchase up to $25 million of shares of our Common Stock, subject to certain limitations and conditions set forth in the SEPA. The shares of our Common Stock that may be issued under the SEPA may be sold by us to the Selling Securityholder at our discretion from time to time for a period of up to 36 months following the execution of the SEPA, unless the SEPA is earlier terminated.

We generally have the right to control the timing and amount of any sales of our shares of Common Stock to the Selling Securityholder under the SEPA. Generally, sales of our Common Stock, if any, to the Selling Securityholder under the SEPA will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to the Selling Securityholder all, some or none of the shares of our Common Stock that may be available for us to sell to the Selling Securityholder pursuant to the SEPA.

Because the purchase price per share to be paid by the Selling Securityholder for the shares of Common Stock that we may elect to sell to the Selling Securityholder under the SEPA, if any, will fluctuate based on the market prices of our Common Stock prior to each advance made pursuant to the SEPA, if any, it is not possible for us to predict, as of the date of this prospectus and prior to any such sales, the number of shares of Common Stock that we will sell to the Selling Securityholder under the SEPA, the purchase price per share that the Selling Securityholder will pay for shares purchased from us under the SEPA, or the aggregate gross proceeds that we will receive from those purchases by the Selling Securityholder under the SEPA, if any.

Investors who buy shares at different times will likely pay different prices.

Pursuant to the SEPA, we will generally have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold to the Selling Securityholder. If and when we do elect to sell shares of our Common Stock to the Selling Securityholder pursuant to the SEPA, after the Selling Securityholder has acquired such shares, the Selling Securityholder may resell all, some or none of such shares at any time or from time to time in its discretion and at different prices. As a result, investors who purchase shares from the Selling Securityholder in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution, and in some cases substantial dilution, and different outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase from the Selling Securityholder in this offering as a result of future sales made by us to the Selling Securityholder at prices lower than the prices such investors paid for their shares in this offering. In addition, if we sell a substantial number of shares to the Selling Securityholder under the SEPA, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with the Selling Securityholder may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales.

Sales of a substantial number of our securities in the public market by our existing stockholders could cause the price of our shares of Common Stock to fall.

The Selling Securityholder can resell, under this prospectus, up to 13,609,145 shares of Common Stock, consisting of (i) up to 13,545,042 shares of Common Stock that we may elect to sell to the Selling Securityholder, from time to time from and after the Commencement Date pursuant to the SEPA and (ii) 64,103 shares of Common Stock we issued to the Selling Securityholder on the Effective Date, as partial consideration for its commitment to purchase shares of our Common Stock that we may direct the Selling Securityholder to purchase from us pursuant to the SEPA, from time to time after the date of this prospectus and during the term of the SEPA. If all of the 13,609,145 shares offered for resale by the Selling Securityholder under this prospectus were issued and outstanding as of October 25, 2024 (without taking into account the 19.99% exchange cap limitation), such shares would represent approximately 45.1% of the total number of outstanding shares of Common Stock and approximately 48.0% of the total number of outstanding shares of Common Stock held by non-affiliates of our company, in each case as of October 25, 2024.

Sales of a substantial number of our shares of Common Stock in the public market by the Selling Securityholder and/or by our other existing stockholders, or the perception that those sales might occur, could depress the market price of our shares of Common Stock and could impair our ability to raise capital through the sale of additional equity securities.

Our management team will have broad discretion over the use of the net proceeds from our sale of shares of Common Stock to the Selling Securityholder, if any, and you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our management team will have broad discretion as to the use of the net proceeds from our sale of shares of Common Stock to the Selling Securityholder, if any, and we could use such proceeds for purposes other than those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management team with regard to the use of those net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending their use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for us. The failure of our management team to use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flows.

Risks Related to the Ownership of Our Securities

The price of our Common Stock is and is likely to continue to be volatile and fluctuate substantially, which could result in substantial losses for our stockholders and may prevent you from reselling your shares at or above the price you paid for your shares.

The market price of our Common Stock is and is likely to remain volatile and may fluctuate significantly in response to numerous factors, many of which are beyond our control, including:

| |

●

|

overall performance of the equity markets;

|

| |

●

|

the development and sustainability of an active trading market for our Common Stock;

|

| |

●

|

our operating performance and the performance of other similar companies;

|

| |

●

|

changes in the estimates of our operating results that we provide to the public, our failure to meet these projections or changes in recommendations by securities analysts that elect to follow our Common Stock;

|

| |

●

|

press releases or other public announcements by us or others, including our filings with the SEC;

|

| |

●

|

changes in the market perception of all-electric and hybrid products and services generally or in the effectiveness of our products and services in particular;

|

| |

●

|

announcements of technological innovations, new applications, features, functionality or enhancements to products, services or products and services by us or by our competitors;

|

| |

●

|

announcements of acquisitions, strategic alliances or significant agreements by us or by our competitors;

|

| |

●

|

announcements of customer additions and customer cancellations or delays in customer purchases;

|

| |

●

|

announcements regarding litigation involving us;

|

| |

●

|

recruitment or departure of key personnel;

|

| |

●

|

changes in our capital structure, such as future issuances of debt or equity securities;

|

| |

●

|

our entry into new markets;

|

| |

●

|

regulatory developments in the United States or foreign countries;

|

| |

●

|

the economy as a whole, market conditions in our industry, and the industries of our customers;

|

| |

●

|

the expiration of market standoff or contractual lock-up agreements;

|

| |

●

|

the size of our market float; and

|

| |

●

|

any other factors discussed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

|

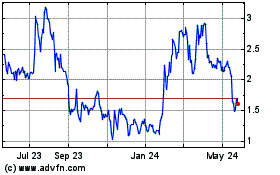

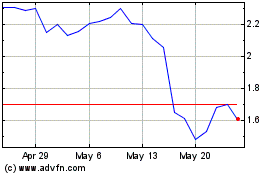

The market price and volume of our Common Stock could fluctuate, and in the past has fluctuated, relative to our limited public float. We are particularly subject to fluctuations as reported on Nasdaq. During the period January 1, 2023 through December 31, 2023, the closing price of a share of our Common Stock reached a high of $3.92 and a low of $1.03, with daily trade volumes reaching a high of 291,200 and a low of 1,500. During the period January 1, 2022 through December 31, 2022, the closing price of a share of our Common Stock reached a high of $7.40 and a low of $1.98, with daily trade volumes reaching a high of 430,809 and a low of 2,476. During the year ended December 31, 2021, the closing price of a share of our Common Stock reached a high of $16.20 and a low of $3.80, with daily trade volumes reaching a high of 351,028 and a low of 3,594. In addition, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many technology companies. Stock prices of many technology companies have fluctuated in a manner unrelated or disproportionate to the operating performance of those companies.

Future sales of our Common Stock could lower our stock price and dilute existing stockholders.

We may, in the future, sell additional shares of Common Stock in subsequent public or private offerings. We cannot predict the size or terms of future issuances of our Common Stock or the effect, if any, that future sales and issuances of shares of our Common Stock will have on the market price of our Common Stock. Sales of substantial amounts of our Common Stock, or the perception that such sales could occur, may adversely affect prevailing market prices for our Common Stock. In addition, these sales may be dilutive to existing stockholders.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our Common Stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. If few securities analysts commence coverage of us, or if industry analysts cease coverage of us, the trading price for our Common Stock would be negatively affected. If one or more of the analysts who cover us downgrade our Common Stock or publish inaccurate or unfavorable research about our business, our Common Stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for our Common Stock could decrease, which might cause our Common Stock price and trading volume to decline.

We may fail to meet our publicly announced guidance or other expectations about our business, which would cause our stock price to decline.

We may provide guidance regarding our expected financial and business performance, such as projections regarding sales and production, as well as anticipated future revenues, gross margins, profitability and cash flows. Correctly identifying key factors affecting business conditions and predicting future events is inherently an uncertain process and our guidance may not ultimately be accurate. Our guidance is based on certain assumptions such as those relating to anticipated production and sales volumes and average sales prices, supplier and commodity costs, and planned cost reductions. If our guidance is not accurate or varies from actual results due to our inability to meet our assumptions or the impact on our financial performance that could occur as a result of various risks and uncertainties, the market value of our Common Stock could decline significantly.

We do not intend to pay dividends for the foreseeable future.

We have never declared nor paid cash dividends on our capital stock. We currently intend to retain any future earnings to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future. Consequently, stockholders must rely on sales of their Common Stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment.

Provisions in our charter documents and under Delaware law could discourage a takeover that stockholders may consider favorable.

Provisions in our certificate of incorporation and bylaws may have the effect of delaying or preventing a change of control or changes in our management. These provisions include the following:

| |

●

|

authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to defend against a takeover attempt;

|

| |

●

|

establish a classified board of directors, as a result of which the successors to the directors whose terms have expired will be elected to serve from the time of election and qualification until the third annual meeting following their election;

|

| |

●

|

require that directors only be removed from office for cause and only upon a supermajority stockholder vote;

|

| |

●

|

provide that vacancies on the board of directors, including newly created directorships, may be filled only by a majority vote of directors then in office rather than by stockholders;

|

| |

●

|

prevent stockholders from calling special meetings; and

|

| |

●

|

prohibit stockholder action by written consent, requiring all actions to be taken at a meeting of the stockholders.

|

In addition, we are governed by the provisions of Section 203 of the General Corporation Law of the State of Delaware (the “DGCL”), which generally prohibits a Delaware corporation from engaging in a broad range of business combinations with any “interested” stockholder for a period of three years following the date on which the stockholder becomes an “interested” stockholder.

THE STANDBY EQUITY PURCHASE AGREEMENT

On September 23, 2024 (the “Effective Date”), we entered into a standby equity purchase agreement, by and between the Company and the Selling Securityholder (the “Original SEPA”) which was amended and restated on October 31, 2024 (the “A&R SEPA” and together with the Original SEPA, the “SEPA”). Pursuant to the SEPA, the Selling Securityholder will advance to the Company, subject to the satisfaction of certain conditions as set forth therein, the principal amount of $3 million (the “Pre-Paid Advance”), which shall be evidenced by convertible promissory notes (the “Promissory Notes”) in two tranches. The Promissory Notes will accrue interest on the outstanding principal balance at an annual rate equal to 0%, which shall increase to an annual rate of 18% upon the occurrence of an Event of Default (as defined in the Promissory Notes) for so long as such event remains uncured. The Promissory Notes will mature on the date that is fifty-four (54) weeks after the closing date of the first Pre-Paid Advance. The Promissory Notes are convertible at a conversion price equal to the lower of (i) $2.148 per share or (ii) 93% of the lowest daily VWAP (as defined below) during the five consecutive trading days immediately preceding the conversion date (but no lower than the “floor price” then in effect, which is $0.358, subject to adjustment from time to time in accordance with the terms contained in the Promissory Notes).

The first tranche of the Pre-Paid Advance will be in the principal amount of $2 million and advanced on the date of A&R SEPA (the “First Pre-Advance Closing”), and the second tranche of the Pre-Paid Advance will be in the principal amount of $1 million and advanced on the second trading day after this Registration Statement first becoming effective (the “Second Pre-Advance Closing”) (each of the First Pre-Advance Closing and Second Pre-Advance Closing individually referred to as a “Pre-Advance Closing” and collectively referred to as the “Pre-Advance Closings”). At each Pre-Advance Closing, the Selling Securityholder will advance to the Company the principal amount of the applicable tranche of the Pre-Paid Advance, less a discount in the amount equal to 5% of the principal amount of such tranche of the Pre-Paid Advance netted from the purchase price due and structured as an original issue discount.

Pursuant to the SEPA, and upon the satisfaction of the conditions to the Selling Securityholder’s purchase obligation set forth in the SEPA, including the registration of shares of Common Stock issuable pursuant to the SEPA for resale, we will have the right, from time to time, until November 1, 2027, to require the Selling Securityholder to purchase up to $25 million of shares of our Common Stock, subject to certain limitations and conditions set forth in the SEPA, by delivering written notice to the Selling Securityholder (“Advance Notice”).

If there is no balance outstanding under a Promissory Note, we may, in our sole discretion, select the amount of the advance that we desire to issue and sell to the Selling Securityholder in each Advance Notice, subject to a maximum limit equal to 100% of the average of the daily volume traded of the Company’s Common Stock on Nasdaq for the five consecutive trading days immediately preceding the delivery of an Advance Notice (“Maximum Advance Amount”). If there is a balance outstanding under a Promissory Note, we may only submit an Advance Notice (i) if an Amortization Event (as defined below) has occurred and our obligation to make prepayments under the Promissory Notes has not ceased, and (ii) the aggregate purchase price owed to us from such Advances (“Advance Proceeds”) shall be paid by the Selling Securityholder by offsetting the amount of the Advance Proceeds against an equal amount outstanding under the Promissory Notes. Pursuant to an Advance notice, the shares will be issued and sold to the Selling Securityholder at a per share price equal to, at the election of the Company as specified in the relevant Advance Notice: (i) 96% of the Market Price (as defined below) for any period commencing on the receipt of the Advance Notice by the Selling Securityholder (or, if the Advance Notice is submitted to the Selling Securityholder prior to 9:00 a.m. Eastern Time, the opening of trading on such day) and ending on 4:00 p.m. Eastern time on the applicable Advance Notice date (the “Option 1 Pricing Period”), and (ii) 97% of the Market Price for any three consecutive trading days commencing on the day such Advance Notice is delivered (the “Option 2 Pricing Period,” and each of the Option 1 Pricing Period and the Option 2 Pricing Period, a “Pricing Period”). “Market Price” is defined as, for any Option 1 Pricing Period, the daily volume weighted average price of the Common Stock on Nasdaq as reported by Bloomberg L.P. (“VWAP”) during the Option 1 Pricing Period, and for any Option 2 Pricing Period, the lowest daily VWAP of the Common Stock during the Option 2 Pricing Period. If, with respect to an Option 1 Pricing Period, the total number of shares of Common Stock traded on Nasdaq during the applicable Pricing Period is less than the Volume Threshold (as defined below), then the number of shares of Common Stock issued and sold pursuant to such Advance Notice will be reduced to the greater of (a) 30% of the trading volume of the Common Stock on Nasdaq during the relevant Pricing Period as reported by Bloomberg L.P. or (b) the number of shares of Common Stock sold by the Selling Securityholder during such Pricing Period, but in each case not to exceed the amount requested in the Advance Notice. “Volume Threshold” is defined as a number of shares of Common Stock equal to the quotient of (a) the number of shares requested by the Company in the Advance Notice divided by (b) 0.30. “Amortization Event” is defined as (i) the daily VWAP of our Common Stock is less than the floor price then in effect for five trading days during a period of seven consecutive trading days, (ii) we have issued to the Selling Securityholder, pursuant to the transactions contemplated in the Promissory Notes and the SEPA, in excess of 99% of the shares of Common Stock available under the Exchange Cap (as defined in the Promissory Notes), where applicable, or (iii) any time after 90 days from the date of the issuance of the Promissory Notes, the Selling Securityholder is unable to utilize a Registration Statement to resell the shares of Common Stock issuable upon the conversion of the Promissory Notes for a period of ten (10) consecutive trading days.

For so long as there is a balance outstanding under a Promissory Note, the Selling Securityholder, at its sole discretion, may deliver to us a notice (“Investor Notice”), to cause an Advance Notice to be deemed delivered to the Selling Securityholder and the issuance of shares of our Common Stock to the Selling Securityholder pursuant to an Advance. The Selling Securityholder may select the amount of the Advance pursuant to an Investor Notice up to the Maximum Advance Amount, provided that the amount of the Advance selected shall not exceed the balance owed under all Promissory Notes outstanding on the date of delivery of the Investor Notice. The shares will be issued and sold to the Selling Securityholder pursuant to an Investor Notice at a per share price equal to the Conversion Price that would be applicable to the amount of the Advance selected by the Selling Securityholder if such amount were to be converted as of the date of delivery of the Investor Notice. The Selling Securityholder will pay the purchase price for such shares to be issued pursuant to the Investor Notice by offsetting the amount of the purchase price to be paid by the Selling Securityholder against an amount outstanding under the Promissory Notes.

Under applicable Nasdaq rules and pursuant to the SEPA, in no event may we issue or sell to the Selling Securityholder shares of our Common Stock in excess of 3,297,883 shares of Common Stock (the “Exchange Cap”), which is 19.9% of the shares of Common Stock outstanding immediately prior to the execution of the SEPA, unless (i) we obtain stockholder approval to issue shares of Common Stock in excess of the Exchange Cap or (ii) the average price of all applicable sales of Common Stock under the SEPA equals or exceeds $1.868 (reference price under Nasdaq Rules) per share (which represents the lower of (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the SEPA; or (ii) the average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the Effective Date). In any event, we may not issue or sell any shares of our Common Stock under the SEPA if such issuance or sale would breach any applicable Nasdaq listing rules.

Actual sales of shares of our Common Stock to the Selling Securityholder under the SEPA will depend on a variety of factors, which may include, among other things, market conditions, the trading price of our Common Stock and determinations by us as to the appropriate sources of funding for our business and its operations.

We may not issue or sell any shares of Common Stock to the Selling Securityholder under the SEPA which, when aggregated with all other shares of Common Stock then beneficially owned by the Selling Securityholder and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the Selling Securityholder and its affiliates beneficially owning more than 4.99% of the then-outstanding shares of Common Stock (the “Beneficial Ownership Limitation”). However, the Beneficial Ownership Limitation does not prevent the Selling Securityholder from selling some or all of the shares of Common Stock it acquires and then acquiring additional shares, consequently resulting in the Selling Securityholder being able to sell in excess of the 4.99% Beneficial Ownership Limitation despite not holding more than 4.99% of our outstanding shares of Common Stock at any given time.

The net proceeds to us under the SEPA will depend on the frequency and prices at which we sell shares of Common Stock to the Selling Securityholder. Upon the effectiveness of the registration statement of which this prospectus forms a part, we expect that any proceeds received by us from such sales to the Selling Securityholder will be used for working capital. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present agreements to enter into any acquisitions or investments.

The Selling Securityholder has agreed that, except as otherwise expressly provided in the SEPA, it and its affiliates will not engage in any short sales of the Common Stock during the term of the SEPA.

The SEPA will automatically terminate on the earliest to occur of (i) the first day of the month next following the 36-month anniversary of the date of the SEPA, provided that if any Promissory Notes are then outstanding, such termination will be delayed until such date that the outstanding balance of any Promissory Note has been repaid or any outstanding Promissory Note has been otherwise terminated in accordance with its terms or (ii) the date on which the Selling Securityholder shall have purchased from us under the SEPA $25.0 million of shares of our Common Stock. We have the right to terminate the SEPA upon five trading days’ prior written notice to the Selling Securityholder, provided that there are no outstanding Advance Notices under which we are yet to issue Common Stock and provided that we have paid all amounts owed to the Selling Securityholder pursuant to the SEPA and the Promissory Notes. We and the Selling Securityholder may also agree to terminate the SEPA by mutual written consent. Neither we nor the Selling Securityholder may assign or transfer our respective rights and obligations under the SEPA, and no provision of the SEPA may be modified or waived by us or the Selling Securityholder other than by an instrument in writing signed by both parties.

As consideration for the Selling Securityholder’s commitment to purchase shares of Common Stock at our direction upon the terms and subject to the conditions set forth in the SEPA, prior to the Effective Date, we issued the Commitment Shares and paid a structuring fee in an aggregate amount of $25,000.

The SEPA contains customary representations, warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in the SEPA were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement and may be subject to limitations agreed upon by the contracting parties.

The description of the SEPA does not purport to be complete and is qualified in its entirety by reference to the full text of the SEPA, a copy of which is filed as an exhibit to the registration statement of which this prospectus forms a part and is incorporated herein by reference.

Because the purchase price per share to be paid by the Selling Securityholder for the shares of Common Stock that we may elect to sell to the Selling Securityholder under the SEPA, if any, will fluctuate based on the market prices of our Common Stock during the applicable Pricing Period, as of the date of this prospectus we cannot reliably predict the number of shares of Common Stock that we will sell to the Selling Securityholder under the SEPA, the actual purchase price per share to be paid by the Selling Securityholder for those shares, or the actual gross proceeds to be raised by us from those sales, if any. As of October 25, 2024, there were 16,622,010 shares of Common Stock outstanding, of which 14,800,868 shares were held by non-affiliates. If all of the 13,609,145 shares offered for resale by the Selling Securityholder under the registration statement of which this prospectus forms a part were issued and outstanding as of October 25, 2024, such shares would represent approximately 45.1% of the total number of shares of our Common Stock outstanding and approximately 48.0% of the total number of outstanding shares of Common Stock held by non-affiliates.

Although the SEPA provides that we may, in our discretion, from time to time after the date of this prospectus and during the term of the SEPA, direct the Selling Securityholder to purchase shares of our Common Stock from us in one or more advances under the SEPA, for a maximum aggregate purchase price of up to $25 million, only 13,609,145 shares of Common Stock are being registered for resale under the registration statement of which this prospectus forms a part. While the market price of our Common Stock may fluctuate from time to time after the date of this prospectus and, as a result, the actual purchase price to be paid by the Selling Securityholder under the SEPA for shares of our Common Stock, if any, may also fluctuate, in order for us to receive the full amount of the Selling Securityholder’ commitment under the SEPA, it is possible that we may need to issue and sell more than the number of shares being registered for resale under the registration statement of which this prospectus forms a part.

If it becomes necessary for us to issue and sell to the Selling Securityholder more shares than are being registered for resale under this prospectus in order to receive aggregate gross proceeds equal to $25 million under the SEPA, we must first (i) to the extent necessary, obtain stockholder approval prior to issuing shares of the Common Stock in excess of the Exchange Cap in accordance with applicable Nasdaq rules, and (ii) file with the SEC one or more additional registration statements to register under the Securities Act the resale by the Selling Securityholder of any such additional shares of our Common Stock, which the SEC must declare effective, in each case, before we may elect to sell any additional shares of our Common Stock to the Selling Securityholder under the SEPA. The number of shares of our Common Stock ultimately offered for resale by the Selling Securityholder depends upon the number of shares of Common Stock, if any, we ultimately sell to the Selling Securityholder under the SEPA.

USE OF PROCEEDS

All of the shares of our Common Stock offered by the Selling Securityholder pursuant to this prospectus will be sold by the Selling Securityholder for its own respective account. We will not receive any of the direct proceeds from these sales. However, we expect to receive proceeds under the SEPA from sales of Common Stock that we may elect to make to the Selling Securityholder pursuant to the SEPA, if any, from time to time in our discretion. See the section of this prospectus titled “Plan of Distribution” elsewhere in this prospectus for more information.

We currently expect to use any net proceeds we receive under the SEPA primarily for working capital. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present agreements to enter into any acquisitions or investments. As of the date of this prospectus, we cannot specify with certainty all of the particular uses, and the respective amounts we may allocate to those uses, for any net proceeds we receive. Accordingly, we will retain broad discretion over the use of these proceeds and could utilize the proceeds in ways that do not necessarily improve our results of operations or enhance the value of our securities.

DETERMINATION OF OFFERING PRICE

We cannot currently determine the price or prices at which shares of Common Stock may be sold by the Selling Securityholder under this prospectus.

MARKET INFORMATION

Our Common Stock is currently listed on the Nasdaq Capital Market under the symbol “EVTV.” As of October 25, 2024, there were 163 holders of record of our Common Stock. The actual number of stockholders of our Common Stock is greater than the number of record holders and includes holders of our Common Stock whose shares of Common Stock are held in street name by brokers and other nominees.

DIVIDEND POLICY

We have never declared or paid any dividends on our Common Stock and do not anticipate that we will pay any dividends to holders of our Common Stock in the foreseeable future. Instead, we currently plan to retain any earnings to finance the growth of our business. Any future determination relating to dividend policy will be made at the discretion of our board of directors and will depend on our financial condition, results of operations and capital requirements as well as other factors deemed relevant by our board of directors.

SELLING SECURITYHOLDER

This prospectus relates to the possible resale from time to time by the Selling Securityholder of up to 13,609,145 shares of Common Stock that have been and may be issued by us to the Selling Securityholder under the SEPA. For additional information regarding the shares of Common Stock included in this prospectus, see the section titled “The Standby Equity Purchase Agreement” above.

We are registering the shares of Common Stock included in this prospectus pursuant to the provisions of the SEPA we entered into with the Selling Securityholder, in order to permit the Selling Securityholder to offer the shares included in this prospectus for resale from time to time. Except for the transactions contemplated by the SEPA, and as set forth in the section titled “Plan of Distribution” in this prospectus, the Selling Securityholder has not had any material relationship with us within the past three years.