Form 8-K - Current report

20 September 2023 - 10:23PM

Edgar (US Regulatory)

0001682639

false

0001682639

2023-09-19

2023-09-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): September 19, 2023

EYENOVIA, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-38365 |

|

47-1178401 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

295 Madison Avenue, Suite 2400, New York, NY

10017

(Address of Principal Executive Offices, and

Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of each exchange

on which registered) |

| Common stock, par value $0.0001 per share |

|

EYEN |

|

The Nasdaq Stock Market

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01. | Regulation FD Disclosure. |

On

September 19, 2023, the Company began using an updated corporate presentation with various investors and analysts. A copy

of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained

in this Item 7.01, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for purposes

of Section 18 of the Exchange Act, or otherwise subject to the liability of that Section or Sections 11 and 12(a)(2) of

the Securities Act. The information contained in this Item 7.01, including Exhibit 99.1, shall not be incorporated by reference into

any registration statement or other document pursuant to the Securities Act or into any filing or other document pursuant to the Exchange

Act, except as otherwise expressly stated in any such filing.

| Item 9.01. | Financial Statements and Exhibits. |

| 104 | Cover Page Interactive Data File (embedded within the Inline

XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EYENOVIA, INC. |

| |

|

| Date: September 20, 2023 |

/s/ John Gandolfo |

| |

John Gandolfo |

| |

Chief Financial Officer |

Exhibit 99.1

| September 2023

EYEN-COM-V2-0012 |

| 1

Forward-looking Statements

Except for historical information, all the statements, expectations and assumptions contained in this presentation are forward-looking

statements. Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations,

strategies, predictions or any other statements relating to our future activities or other future events or conditions, including estimated

market opportunities for our product candidates and platform technology. These statements are based on current expectations, estimates

and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may,

and in some cases are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous

factors discussed from time to time in documents which we file with the U.S. Securities and Exchange Commission.

In addition, such statements could be affected by risks and uncertainties related to, among other things: risks of our clinical trials,

including, but not limited to, the costs, design, initiation and enrollment, timing, progress and results of such trials; the timing of, and our

ability to submit applications for, obtaining and maintaining regulatory approvals for our product candidates; the potential advantages of

our product candidates and platform technology and the potential for approval of APP13007; the rate and degree of market acceptance

and clinical utility of our product candidates; our estimates regarding the potential market opportunity for our product candidates; reliance

on third parties to develop and commercialize our product candidates; the ability of us and our partners to timely develop, implement and

maintain manufacturing, commercialization and marketing capabilities and strategies for our product candidates; intellectual property

risks; changes in legal, regulatory, legislative and geopolitical environments in the markets in which we operate and the impact of these

changes on our ability to obtain regulatory approval for our products; and our competitive position.

Any forward-looking statements speak only as of the date on which they are made, and except as may be required under applicable

securities laws, Eyenovia does not undertake any obligation to update any forward-looking statements. |

| 2

• Horizontal delivery

• Precision dose

• Digital compliance capabilities

Eyenovia at a Glance

Eyenovia (NASDAQ | EYEN) is a US based medical device and ocular therapeutics company

Optejet® with microdose array print technology

• Patented digital device platform technology

• Exciting and diverse product pipeline

• Multi-faceted business model that combines

partnerships, licensing agreements, internal

product development and sales |

| 3

Over the past 125 years,

changes in eyedropper design

have done little to improve the

usability of topical ophthalmic

medications

Today’s Eyedropper Bottle

Designed for manufacturing ease, not patient ease

1800’s

Glass Pipette

1900’s

Glass Pipette with Bulb

and Separate Vial

Today

Integrated Bottle with Dropper Tip

1. Survey conducted in January 2023 with 100 people (19 - 65+ Age Range, Mean Age = 51YO) who regularly take eye drop medications. Respondents were asked to rank common drug

forms from easiest to most difficult to administer on a 0-10 scale (0 meaning no difficulty, 10 meaning extremely difficult). Of the 11 medication types ranked, eye drops were the third most

difficult behind suppositories and eye ointments. The topical ointments were ranked the easiest to administer with an average score of 1.1, and suppositories ranked the most difficult with a

score of 6.48. Eye drops received an average score of 4.6.

In a recent survey conducted by J. Reckner and Associates, consumers reported that

taking eye drops was among the most difficult ways to self-administer medication1 |

| Introducing the Optejet®

Optejet is a drug-device combination product manufactured with a sterile-filled, replaceable drug cartridge

4

Optejet® with replaceable drug cartridge

Spray nozzle with

109 laser-drilled ports

Shutter

Activation button

Ergonomic design

Proprietary, pre-filled drug cartridge

manufactured by Eyenovia |

| 5

Ergonomic Design to Improve Usability

Horizontal delivery, push button dosing and no protruding tip

Eye Dropper Bottle administration

requires head-tilting, squeezing,

and reliance on gravity

Eye Dropper Bottle tips

can touch the eye surface

Optejet has a recessed nozzle,

protected by a shutter when

not in use to prevent cross-contamination

Optejet administration can be done

horizontally with the push of a button |

| 6

Minimal Sufficient Dosing May Improve Therapeutic Index

1 Wirta D. et al, Presentation at 2019 ASCRS meeting | 2 Ianchulev T. et al, Therapeutic Delivery 2018 | 3 Hamrah, P. et al. Cytotoxicity Evaluation for BAK-preserved Latanoprost Delivered By Drop vs.

Microdose Array Print Technology. ARVO 2023 poster. New Orleans, LA| 4 The impact of precision spray dosing of netarsudil 0.02% can be seen when compared to a single drop of the same drug. 5 Arias A. et

al, Patient persistence with first-line antiglaucomatous monotherapy. Clin Ophthalmol. 2010

With 80% less dose volume, reduces excessive exposure to both drugs and preservatives 1,2

Netarsudil 0.02%

delivered via Optejet®

Netarsudil 0.02% delivered

via Eye Dropper Bottle

Minimizes Impact of Preservatives

on Ocular Tissues

Minimizes Excessive Drug

Exposure to Ocular Tissues

When tolerability is poor, patients are very likely to

discontinue their medication or put pressure on the

ophthalmologist to change their treatment5

3

4 |

| 7

Optejet Digital Technology to Improve Delivery of Care

The Optejet® is capable of

automatically tracking usage

Remote Patient Monitoring:

More Data May Benefit All Parties

PATIENT

• Reminders to take medicine

• Ability to track compliance progress

• Opportunity for brand-specific encouragement

PHYSICIAN

• Ability for quicker action with more accurate data

• Opportunity for billing: CPT Code (98980) for

monthly check of compliance data

PAYER

• Cost savings: Less likely to have patient on

second medication if compliance is the issue

• Better outcomes: Compliance with drug therapy

shown to slow disease progression1

1 Shu YH et al. Topical Medication Adherence and Visual Field Progression in Open-angle Glaucoma. J Glaucoma 2021 |

| Target Market Optejet Targeted Differentiation

United States

Addressable

Population

United States

Market $USD*

China

Addressable

Population

US Status Licensee

PROPRIETARY

Pupil dilation

(Mydriasis)

Ease of use, well tolerated, less systemic

absorption, fast recovery time

Procedures:

108M1

$250M 650M8

Eyenovia Commercializing

USA

China

Ocular Surgery Pain

and Inflammation

Eyedrop:

2X day dosing, low AE incidence10

Procedures:

7M2

$200M N/A PDUFA March 2024 USA

Alternative to glasses

for early presbyopia

Ease of use, convenience,

low side effect incidence 7M3 $1B 12M9 Manufacturing registration

batches 1Q 2024

USA

China

Eye Hydration High technology delivery system 117M4 $3.1B N/A FDA device registration discussions USA

PARTNERED

Treatment of childhood

progressive Myopia

Ease of use, digital monitoring

technology, pediatrics self-dosing 3M5 $4.5B 50M9A USA Ph3 study enrollment may be

completed in 2024

USA

China

POTENTIAL

Glaucoma

Digital monitoring technology,

ease of use, low side effect incidence 3M6 $3B 20M9 Biocompatibility testing of potential

partner’s drug product - -

Dry Eye New drug class, ease of use,

fast onset 31M7 $3.6B 235M9

Pre-IND meeting planned 2H 2023;

exploring partnership options - -

8

Product Pipeline

US and China Markets

• 1. https://bit.ly/44BK4Zf | https://bit.ly/44IwR0K | 2. 2022 Delve Insights, Acute Ocular Pain Report | 3. Population of 40-55YO in the US = 60.8M A , 35% of this population has never needed corrected vision, Assumes product works in 33% of patients BA. Published by Erin Duffin, & 30, S. (2022, September 30). Population of the U.S. by sex and age 2021.

Statista. Retrieved February 3, 2023, from https://bit.ly/45Rv3U6 B. What is 20/20 vision? University of Iowa Hospitals & Clinics. (n.d.). Retrieved February 3, 2023, from https://bit.ly/482g6jT | 4. https://bit.ly/3r2iOFu | 5. Theophanous C, Modjtahedi BS, Batech M, Marlin DS, Luong TQ, Fong DS. Myopia prevalence and risk factors in children. Clin

Ophthalmol. 2018 Aug 29;12:1581-1587. doi: 10.2147/OPTH.S164641. PMID: 30214142; PMCID: PMC6120514. U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 2021.| Banashefski B, Rhee MK, Lema GMC. High Myopia Prevalence across Racial Groups in the United States: A Systematic Scoping Review. J Clin Med.

2023 Apr 21;12(8):3045. doi: 10.3390/jcm12083045 | 6.https://bit.ly/3Rcqdwz. | 7. Frost & Sullivan, Prospectus, World Bank 370M Adjusted to fit patient criteria | 8. J&J Global Eye Health Survey 2020 | https://bit.ly/45EsCEM | 9. Frost & Sullivan, Prospectus, World Bank | 9A. Frost & Sullivan, Prospectus, World Bank 150M adjusted for the highest at risk

patients, 1/3rd of children | 10. Korenfeld M, Walters T, Martel J, Nunez D, Wang L. A Phase 3 Study of APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension 0.05%) to Treat Inflammation and Pain after Cataract Surgery. ASCRS presentation. San Diego. May 5-8 2023. |

| 9

• MydCombi is the first and only FDA-approved fixed-dose

combination ophthalmic spray indicated for inducing mydriasis

for diagnostic procedures and in conditions where short term

pupil dilation is desired

• Pupil dilation (mydriasis) is part of a comprehensive eye exam

and ocular surgery

– Estimated 108 million dilations in US annually

– Estimated $250 million US market opportunity1

• Eyedrops are the current standard of care and ripe for

innovation

– Multiple eyedrops usually needed

– Patient discomfort and avoidance

– Time consuming administration and slow recovery to “normal”

– Cross-contamination risk

1. $200M annual sales of pharmaceutical mydriatic products used during 108M office-based exams ($2 * 100M) + $50M of single bottle mydriatic agents used cataract

replacement surgery ($12.5 x 4M)

MydCombi™

For pupil dilation and mydriasis |

| 10

MydCombi™

Speed and simplicity with each spray

1

Indication: MYDCOMBI (tropicamide 1% and phenylephrine HCl 2.5%) ophthalmic spray is indicated to induce mydriasis for routine diagnostic procedures and in conditions where short term pupil dilation is desired. IMPORTANT SAFETY INFORMATION. CONTRAINDICATIONS: Known

hypersensitivity to any component of the formulation. WARNINGS AND PRECAUTIONS. FOR TOPICAL OPHTHALMIC USE. NOT FOR INJECTION. This preparation may cause CNS disturbances which may be dangerous in pediatric patients. The possibility of psychotic reaction and behavioral disturbance

due to hypersensitivity to anticholinergic drugs should be considered. Mydriatics may produce a transient elevation of intraocular pressure. Significant elevations in blood pressure have been reported. Caution in patients with elevated blood pressure. Rebound miosis has been reported one day

after installation. Remove contact lenses before using. DRUG INTERACTIONS. Atropine-like Drugs: May exaggerate the adrenergic pressor response. Cholinergic Agonists and Ophthalmic Cholinesterase Inhibitors: May interfere with the antihypertensive action of carbachol, pilocarpine, or

ophthalmic cholinesterase inhibitors. Potent Inhalation Anesthetic Agents: May potentiate cardiovascular depressant effects of some inhalation anesthetic agents. ADVERSE REACTIONS. Most common ocular adverse reactions include transient blurred vision, reduced visual acuity, photophobia,

superficial punctate keratitis, and mild eye discomfort. Increased intraocular pressure has been reported following the use of mydriatics. Systemic adverse reactions including dryness of the mouth, tachycardia, headache, allergic reactions, nausea, vomiting, pallor, central nervous system

disturbances and muscle rigidity have been reported with the use of tropicamide. To report SUSPECTED ADVERSE REACTIONS, contact Eyenovia, Inc. At 1-833-393-6684 or FDA at 1-800-FDA-1088 (www.fda.gov/medwatch) www.mydcombi.comfor FULL PRESCRIBING INFORMATION

The only FDA approved fixed-dose combination of the leading

pupil dilating drugs

Reliable time to peak efficacy and dilation resolution

In clinical studies 97% of patients reported zero side effects1

To check on availability in your area, please go to

MydCombi.com

1. Wirta DL, Walters TR, Flynn WJ, Rathi S, Ianchulev T. Mydriasis with micro-array print touch-free tropicamide-phenylephrine fixed combination MIST: pooled randomized Phase III trials.

Ther Deliv. 2021 Mar;12(3):201-214. |

| 11

MydCombi Product Overview

First and only FDA Approved ophthalmic spray for mydriasis

• Two Phase 3 clinical trials evaluated the

efficacy of MYDCOMBI for achievement

of mydriasis.

• MYDCOMBI was statistically superior to

tropicamide administered alone and

phenylephrine administered alone.

• Nearly all (94%) subject eyes achieved

clinically significant effect by achieving

pupil diameter of ≥ 6 mm at 35-minute

post-dose compared to 78% of eyes

administered tropicamide alone and 1.6%

of eyes administered phenylephrine alone.

• Clinically effective mydriasis was observed

as early as 20 minutes. |

| 12

AP13007 is Formosa’s APNT™ formulation of

clobetasol propionate ophthalmic nanosuspension

APP13007

Breakthrough formulation science for ophthalmic steroids1

APNT™ (Active Pharmaceutical

Nanoparticle Technology) is

designed to reduce particle size

leading to improved dissolution,

bioavailability, improves the

patient experience and lowers

the risk of contamination

1. Data on File, Formosa Pharmaceuticals |

| 13

• CPN-301, A Multicenter, Randomized,

Double-Masked, Placebo-Controlled, Parallel-Group Study to Evaluate the Efficacy and

Safety of APP13007 for the Treatment of

Inflammation and Pain after Cataract Surgery

• 395 subjects of which 180 on active, 197 on

placebo completed the study

– Mean age 68 YO

– ~40% male, ~ 60% female

– Multiple races/ethnicity represented

• 107 subjects (100 on placebo, 7 on active)

rescued during the 14-day study for

insufficient pain or inflammation control

PRIMARY EFFICACY ENDPOINTS

APP13007 was statistically and clinically

significantly superior to placebo

(p<0.001) for both primary efficacy

endpoints:

• Proportion of subjects with anterior

chamber cell (ACC) count = 0 (ACC

Grade=0) at POD8 maintained through

POD15

• Proportion of subjects with Ocular Pain

Grade = 0 at POD4 maintained

through POD15

APP13007

Breakthrough formulation science for ophthalmic steroids1

1. Korenfeld M, Walters T, Martel J, Nunez D, Wang L. A Phase 3 Study of APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension

0.05%) to Treat Inflammation and Pain after Cataract Surgery. ASCRS presentation. San Diego. May 5-8 2023 |

| 14

• Adverse events occurred in 21% of active

and 20% of placebo subjects

– There was one serious adverse event in the

placebo arm

• Adverse events occurring in the study eye

in 2% of subjects or more:

– Anterior chamber inflammation (4% in active, 2%

in placebo)

– Corneal oedema (2% in active, 5% in placebo)

– Eye pain (2% in placebo)

• There was one report of IOP elevation

(21mmHg or greater and CFB of 10mmHg)

in the active group

– IOP change from baseline was not significantly

different between the two groups at any study visit

APP13007

Results from the first of two completed phase 3 studies 1

1. Data on File, Formosa Pharmaceuticals |

| 15

FDA PDUFA date in March 2024 for the Treatment of Inflammation and Pain after Cataract Surgery

APP13007

A potent steroid with a future in the Optejet

• Short and mid-term revenue

opportunity ($1.3B market)

• Synergistic commercialization

with MydCombi

2024

Post-ocular surgery treatment

2027

• Potential dry eye product in

the Optejet ($3.6B market)

Dry eye treatment |

| 16

October 2023

FDA Meeting

2024 2027

March 2026

NDA filing

Dry eye phase 3 studies

March 2024

PDUFA

Potential dry eye program

2025

May 2024

APP13007

National Launch

January 2027

Dry eye approval

Post surgical pain and inflammation

2026

AP13007

A potential for multiple indications |

| 17

Apersure™ for Presbyopia

• Presbyopia is the age-related loss of near vision

that occurs as the lens becomes inelastic

• 18 million people aged 40 – 55 in the

US have presbyopia, with roughly half never

having to use glasses earlier in their lives

• Apersure is a lifestyle product designed to avoid the

appearance and inconvenience of reading glasses

– Use “as needed” with rapid onset

improvement of near vision

– Easy to administer

– Discreet – compatible with modern lifestyle |

| 18

Apersure™

Phase 3 clinical results

• Vision-1

1 and Vision-2

2 clinical studies

– 6.0x more patients achieved ≥ 3-line gain on a

vision chart in the active group vs. placebo3,5

– Well-tolerated with fewer than 2% of patients

reporting moderate hyperemia4

, instillation

discomfort, or brow ache

• People prefer Apersure over eyedrops

– Among 100 presbyopic patients aged 40-55,

80% said they would prefer Apersure over the

traditional eyedrop bottle5

– Price sensitivity tests indicate approximately

$100 for 80 doses would be well accepted

1. https://clinicaltrials.gov/ct2/show/NCT04657172 | 2. https://clinicaltrials.gov/ct2/show/NCT05114486

3. Cohort of subjects with baseline DCNVA < 0.6 logMAR | 4. Resolved by 3-hours post dose | 5. Data on file

Apersure delivered

via Optejet |

| 19

Apersure™ is the invisible second pair of glasses

• Existing and future presbyopia eye drops do not fit

with the business model of optometrists who use eye

glass frames as a revenue source for their practice

• With Apersure, optometrists can sell this Optejet

based product alongside glasses as an additional

benefit for their patients

• Easy and neat application

• Discreet on-demand dosing that lasts for 4 hours

• In a market research survey consisting of 100

Optometrists across the US, Apersure was predicted

to have the largest market share of approved and

potential products

1. VISION-1 & 2 Studies, data on file. 2, 3. Survey conducted in May 2022 by J. Reckner and Associates, data on file.

12% 15% 18% 25% 30%

Apersure | Eyenovia

Vuity | Abbvie

CSF-1 | Orasis

Acelcedine | Lenz Therapeutics

Nyxol and Pilocarpine | Ocuphire

Market Share of Products Predicted by Optometrists

Apersure

Vuity

CSF-1

Acelcedine

Nyxol and

Pilocarpine |

| 20

Apersure™

1. Population of 40-55YO in the US = 60.8MA , 35% of this population has never needed corrected visionB, assumes product will work for 33% of the remaining population

A. Published by Erin Duffin, & 30, S. (2022, September 30). Population of the U.S. by sex and age 2021. Statista. Retrieved February 3, 2023, from https://www.statista.com/statistics/241488/population-of-the-us-by-sex-and-age/ | B. What is 20/20 vision? University of Iowa Hospitals & Clinics. (n.d.). Retrieved February 3, 2023, from https://uihc.org/health-topics/what-2020-vision

Market Receptivity

High among optometrists who are intrigued by the

ability to sell the device through their offices; high

among patients who are attracted to the benefits of

the device

Potential Market Size 3.5 million people1 @ $250 per year = $877M

Pricing

Approximately $100 per cartridge (similar to Vuity on

a per-use basis); market research indicates patients

would use 2.5 cartridges/year on average

Reimbursement

Status

Cash-pay cosmeceutical; can be purchased with

HSA/FSA funds

The only presbyopia treatment with the Optejet that may enhance office economics |

| 21

Apersure NDA Timeline

NDA Filing Targeted for YE 2024

March 28th 2023

FDA Meeting 2024

Gen-2 Line Validation

Q2 to Q3

Gen-2

Registration

Filling Q1

Drug Manufacturing

Q4

2025

NDA Filing

YE 2024

12-month Registration Stability

Q1 2024 to Q2 2025 |

| 22

• Begins in early childhood, with genetic link1

• Elongation of sclera/retina with morbidity

and vision problems2

• Urgent need for FDA-approved drug

therapies to slow myopia progression

• Atropine may slow myopia progression

by at least 60%3

MicroPine for Delaying Progression of Myopia in Children

Progression of Myopic Maculopathy

Normal Macula Myopic Maculopathy

Affects ~25M children in the US alone,

with ~5M considered to have high myopia risk4

1 Jones LA, Sinnott LT, Mutti DO, Mitchell GL, Moeschberger ML, Zadnik K. Parental history of myopia, sports and outdoor activities, and future myopia. Invest Ophthalmol Vis Sci. 2007 Aug;48(8):3524-32.

2 Eye and Contact Lens. 2004; 30

3 Chia A, Chua WH, Cheung YB, et al. Atropine for the treatment of childhood Myopia: Safety and efficacy of 0.5%, 0.1%, and 0.01% doses (Atropine for the Treatment of Myopia 2). Ophthalmology 2012;119:347-354

4 Theophanous C. Myopia Prevalence and Risk Factors in Children. Clinical Ophthalmology. December 2018. U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 2019. |

| 23

• Precision-dosed atropine spray

developed specifically for children

– Easy, daily use by children1

– Lower drug volume exposure to enhance

comfort and minimize systemic exposure

– Can communicate with smart devices to

track treatment adherence and provide

family reminders

• Compliance data shows promise

compared with historical treatments

MicroPine for Delaying Progression of Myopia in Children

1 Data on file with Eyenovia. 2 Naito 2018: Naito T, Yoshikawa K, Namiguchi K, Mizoue S, Shiraishi A, et al. (2018) Comparison of success rates in eye drop instillation between sitting position and supine

position. PLOS ONE 13(9): e0204363. Patel 1995: Patel SC, Spaeth GL. Compliance in patients prescribed eyedrops for glaucoma. Ophthalmic Surg. 1995 May-Jun;26(3):233-6. Winfield, 1990: Winfield AJ,

Jessiman D, Williams A, Esakowitz L. A study of the causes of non-compliance by patients prescribed eyedrops. Br J Ophthalmol. 1990 Aug;74(8):477-80. 3. Matsui, 1997: Matsui DM. Drug compliance in

pediatrics. Clinical and research issues. Pediatr Clin North Am. 1997 Feb;44(1):1-14.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0 5 10 15 20 25

Six-Month Daily Treatment Compliance

28 Children Age 6 – 13 YO1

Average of compliance rates from published ophthalmic studies2

Average of compliance rates from published pediatric studies3

Subject number

Correctly Administered Doses / Total Potential Doses |

| 24

MicroPine

A Pediatric Therapy Designed with Children in Mind

Market Receptivity

Very high to the device due to the potential benefits

it may offer; well accepted by children in the

CHAPERONE study

Potential Market Size

If one assumes the annual cost of these drugs is

$2,400, then with 1.9 million children treated1,2

,

a market size of over $4.5 billion in the US alone.

Potential royalty stream of several hundred

million dollars

Pricing Licensed to Bausch + Lomb

Reimbursement Status Licensed to Bausch + Lomb. We expect coverage to

be like other ophthalmic prescription medications

1. Theophanous, C., Modjtahedi, B. S., Batech, M., Marlin, D. S., Luong, T. Q., & Fong, D. S. (2018, August 29). Myopia prevalence and risk factors in children. Clinical ophthalmology

(Auckland, N.Z.). Retrieved February 3, 2023, from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6120514/

2. Bureau, U. S. C. (2022, April 7). Children data. Census.gov. Retrieved February 3, 2023, from https://www.census.gov/topics/population/children/data.html |

| 25

Multiple Commercialization Partners

Arctic Vision – A China-based ophthalmic

biotech focusing on breakthrough therapies,

with a leading portfolio covering pre-clinical

stage to commercial stage products

Licenses – MicroPine, MicroLine and MydCombi

licensed for Greater China and South Korea;

clinical study enrollment underway

Bausch+Lomb – One of the world's largest

suppliers of contact lenses, lens care products,

prescription pharmaceuticals, intraocular lenses

and other eye care products

Licenses– MicroPine licensed for the US

and Canada

Potential Long Term Income Stream

License agreements with a total value of over $90M in potential payments + royalties

Ongoing discussions with multiple partners in glaucoma and dry eye |

| 26

Broad Intellectual Property Portfolio

• Key claims covered with multiple patents

– 16 US Patents Issued; 1 pending

– 95 foreign issued; 32 pending

– Many in effect beyond 2031

• Clinical data and regulatory approval

adds another layer of IP |

| 27

Financial Snapshot (June 2023)*

Nasdaq: EYEN

Common Shares Outstanding 38.2M

Equity Grants Outstanding Under Stock Plans 5.3M

Warrants 6.1M

Fully Diluted Shares 49.6M

Cash $17.5M

Debt $15.8M

* Does not include $12M capital raise August 2023 |

| 28

Experienced Leadership Team

Bren Kern

Chief Operating Officer

Michael Rowe

Chief Executive Officer

John Gandolfo

Chief Financial Officer |

| 29

National launch

of MydCombi

Approval of

APP13007

Planned Apersure

NDA Filing

Q1 2024 Q2 2024 Q3 2024 Q4 2024

National launch of

APP13007

Upcoming Potential Milestones |

| 30

• Optejet platform technology with ergonomic design facilitates ease

of use and delivers precise doses

– Addresses many long-term unmet clinical needs surrounding the use of

conventional eye drops

– Protected with a strong intellectual property portfolio

• Eyenovia owns a pipeline of products in large therapeutic categories

– With multiple commercial partnerships in place and more being developed

• Poised for leadership as a technology partner and therapy provider

in potentially huge markets

• First FDA approved product May 2023

– MydCombi (tropicamide and phenylephrine HCl ophthalmic spray) 1%/2.5%

– Validates the underlying Optejet technology

Investment Summary |

Cover

|

Sep. 19, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 19, 2023

|

| Entity File Number |

001-38365

|

| Entity Registrant Name |

EYENOVIA, INC.

|

| Entity Central Index Key |

0001682639

|

| Entity Tax Identification Number |

47-1178401

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

295 Madison Avenue

|

| Entity Address, Address Line Two |

Suite 2400

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

833

|

| Local Phone Number |

393-6684

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EYEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

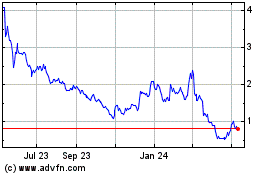

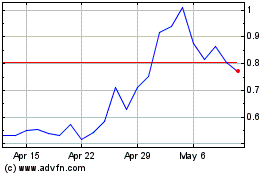

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Apr 2023 to Apr 2024