0001001115

GEOSPACE TECHNOLOGIES CORP

false

--09-30

Q1

2025

1,000,000

1,000,000

0

0

0

0

0.01

0.01

20,000,000

20,000,000

14,315,262

14,206,082

12,798,897

12,709,381

1,516,365

1,496,701

1

0

0

no

1

0

4

4

6

4

6

0

3

0.1

false

false

false

false

00010011152024-10-012024-12-31

xbrli:shares

00010011152025-01-31

thunderdome:item

iso4217:USD

00010011152024-12-31

00010011152024-09-30

iso4217:USDxbrli:shares

0001001115us-gaap:ProductMember2024-10-012024-12-31

0001001115us-gaap:ProductMember2023-10-012023-12-31

0001001115geos:RentalMember2024-10-012024-12-31

0001001115geos:RentalMember2023-10-012023-12-31

00010011152023-10-012023-12-31

0001001115geos:CommonStockOutstandingMember2024-09-30

0001001115us-gaap:CommonStockMember2024-09-30

0001001115us-gaap:AdditionalPaidInCapitalMember2024-09-30

0001001115us-gaap:RetainedEarningsMember2024-09-30

0001001115us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-30

0001001115us-gaap:TreasuryStockCommonMember2024-09-30

0001001115us-gaap:CommonStockMember2024-10-012024-12-31

0001001115us-gaap:AdditionalPaidInCapitalMember2024-10-012024-12-31

0001001115us-gaap:RetainedEarningsMember2024-10-012024-12-31

0001001115us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-012024-12-31

0001001115us-gaap:TreasuryStockCommonMember2024-10-012024-12-31

0001001115geos:CommonStockOutstandingMember2024-10-012024-12-31

0001001115geos:CommonStockOutstandingMember2024-12-31

0001001115us-gaap:CommonStockMember2024-12-31

0001001115us-gaap:AdditionalPaidInCapitalMember2024-12-31

0001001115us-gaap:RetainedEarningsMember2024-12-31

0001001115us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-31

0001001115us-gaap:TreasuryStockCommonMember2024-12-31

0001001115geos:CommonStockOutstandingMember2023-09-30

0001001115us-gaap:CommonStockMember2023-09-30

0001001115us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001001115us-gaap:RetainedEarningsMember2023-09-30

0001001115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001001115us-gaap:TreasuryStockCommonMember2023-09-30

00010011152023-09-30

0001001115us-gaap:CommonStockMember2023-10-012023-12-31

0001001115us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-31

0001001115us-gaap:RetainedEarningsMember2023-10-012023-12-31

0001001115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012023-12-31

0001001115us-gaap:TreasuryStockCommonMember2023-10-012023-12-31

0001001115geos:CommonStockOutstandingMember2023-10-012023-12-31

0001001115geos:CommonStockOutstandingMember2023-12-31

0001001115us-gaap:CommonStockMember2023-12-31

0001001115us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001001115us-gaap:RetainedEarningsMember2023-12-31

0001001115us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0001001115us-gaap:TreasuryStockCommonMember2023-12-31

00010011152023-12-31

0001001115srt:SubsidiariesMemberus-gaap:NonUsMember2024-12-31

0001001115srt:SubsidiariesMemberus-gaap:NonUsMember2024-09-30

utr:D

xbrli:pure

0001001115us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-10-012024-12-31

0001001115us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2024-10-012024-12-31

0001001115geos:CustomerOneMember2024-12-31

0001001115geos:CustomerOneMember2024-10-012024-12-31

0001001115geos:CustomerOneMember2023-10-012023-12-31

00010011152024-10-01

00010011152023-10-01

0001001115us-gaap:TransferredOverTimeMember2024-10-012024-12-31

0001001115us-gaap:TransferredOverTimeMember2023-10-012023-12-31

0001001115us-gaap:OperatingSegmentsMemberus-gaap:ProductMembergeos:SmartWaterMember2024-10-012024-12-31

0001001115us-gaap:OperatingSegmentsMemberus-gaap:ProductMembergeos:SmartWaterMember2023-10-012023-12-31

0001001115us-gaap:OperatingSegmentsMemberus-gaap:ProductMembergeos:EnergySolutionsMember2024-10-012024-12-31

0001001115us-gaap:OperatingSegmentsMemberus-gaap:ProductMembergeos:EnergySolutionsMember2023-10-012023-12-31

0001001115us-gaap:OperatingSegmentsMemberus-gaap:ProductMembergeos:IntelligentIndustrialMember2024-10-012024-12-31

0001001115us-gaap:OperatingSegmentsMemberus-gaap:ProductMembergeos:IntelligentIndustrialMember2023-10-012023-12-31

0001001115us-gaap:ProductMembersrt:AsiaMember2024-10-012024-12-31

0001001115us-gaap:ProductMembersrt:AsiaMember2023-10-012023-12-31

0001001115us-gaap:ProductMembercountry:CA2024-10-012024-12-31

0001001115us-gaap:ProductMembercountry:CA2023-10-012023-12-31

0001001115us-gaap:ProductMembersrt:EuropeMember2024-10-012024-12-31

0001001115us-gaap:ProductMembersrt:EuropeMember2023-10-012023-12-31

0001001115us-gaap:ProductMembercountry:MX2024-10-012024-12-31

0001001115us-gaap:ProductMembercountry:MX2023-10-012023-12-31

0001001115us-gaap:ProductMembercountry:US2024-10-012024-12-31

0001001115us-gaap:ProductMembercountry:US2023-10-012023-12-31

0001001115us-gaap:ProductMembergeos:OtherMember2024-10-012024-12-31

0001001115us-gaap:ProductMembergeos:OtherMember2023-10-012023-12-31

0001001115us-gaap:CorporateDebtSecuritiesMember2024-12-31

0001001115us-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-12-31

0001001115us-gaap:CorporateDebtSecuritiesMember2024-09-30

0001001115us-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-12-31

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-31

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-31

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-31

0001001115us-gaap:FairValueMeasurementsRecurringMember2024-12-31

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentShorttermDebtSecuritiesMember2024-09-30

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-30

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-30

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-30

0001001115us-gaap:FairValueMeasurementsRecurringMember2024-09-30

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-09-30

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-09-30

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2024-09-30

0001001115us-gaap:FairValueMeasurementsNonrecurringMember2024-09-30

0001001115us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMembergeos:EmergingMarketsMember2024-09-30

0001001115us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMembergeos:EmergingMarketsMember2024-09-30

0001001115us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembergeos:EmergingMarketsMember2024-09-30

0001001115us-gaap:FairValueMeasurementsNonrecurringMembergeos:EmergingMarketsMember2024-09-30

0001001115geos:PromissoryNoteMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMembergeos:SubsidiaryOilAndGasProductManufacturingOperationsInTheRussianFederationMember2024-08-30

0001001115geos:EmergingMarketsMember2023-10-012024-09-30

0001001115geos:WirelessSeismicEquipmentCustomerMember2024-12-31

0001001115geos:WirelessSeismicEquipmentCustomerMember2024-10-012024-12-31

0001001115geos:PromissoryNoteForSaleOfProductMember2024-08-31

0001001115geos:PromissoryNoteForSaleOfProductMember2024-12-31

0001001115geos:PromissoryNoteMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMembergeos:SubsidiaryOilAndGasProductManufacturingOperationsInTheRussianFederationMember2024-08-30

utr:Y

0001001115geos:PromissoryNoteMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMembergeos:SubsidiaryOilAndGasProductManufacturingOperationsInTheRussianFederationMember2024-08-302024-08-30

0001001115geos:SemifinishedGoodsAndComponentPartsMember2024-12-31

0001001115geos:SemifinishedGoodsAndComponentPartsMember2024-09-30

0001001115us-gaap:EquipmentMembersrt:MaximumMember2024-12-31

0001001115geos:LeaseReceivableMember2024-10-012024-12-31

0001001115geos:LeaseReceivableMember2023-10-012023-12-31

0001001115geos:LeaseReceivableMember2024-12-31

0001001115us-gaap:EquipmentMember2024-12-31

0001001115us-gaap:EquipmentMember2024-09-30

0001001115us-gaap:LineOfCreditMembergeos:WoodforestNationalBankMember2023-07-26

0001001115us-gaap:LineOfCreditMembergeos:WoodforestNationalBankMember2023-07-262023-07-26

0001001115us-gaap:LineOfCreditMembergeos:WoodforestNationalBankMember2024-12-312024-12-31

0001001115us-gaap:LineOfCreditMembergeos:WoodforestNationalBankMembersrt:MinimumMember2023-07-26

0001001115us-gaap:LetterOfCreditMembergeos:WoodforestNationalBankMember2024-12-31

0001001115us-gaap:LineOfCreditMembergeos:WoodforestNationalBankMember2024-12-31

0001001115us-gaap:LineOfCreditMembergeos:WoodforestNationalBankMember2024-09-30

0001001115us-gaap:RestrictedStockUnitsRSUMember2024-10-012024-12-31

0001001115us-gaap:RestrictedStockUnitsRSUMember2024-12-31

0001001115us-gaap:RestrictedStockUnitsRSUMember2024-10-012024-12-31

0001001115us-gaap:RestrictedStockUnitsRSUMember2023-10-012023-12-31

0001001115geos:AquanaLLSMember2021-07-012021-07-31

0001001115geos:AquanaLLSMember2024-12-31

0001001115us-gaap:OperatingSegmentsMembergeos:SmartWaterMember2024-10-012024-12-31

0001001115us-gaap:OperatingSegmentsMembergeos:SmartWaterMember2023-10-012023-12-31

0001001115us-gaap:OperatingSegmentsMembergeos:EnergySolutionsMember2024-10-012024-12-31

0001001115us-gaap:OperatingSegmentsMembergeos:EnergySolutionsMember2023-10-012023-12-31

0001001115us-gaap:OperatingSegmentsMembergeos:IntelligentIndustrialMember2024-10-012024-12-31

0001001115us-gaap:OperatingSegmentsMembergeos:IntelligentIndustrialMember2023-10-012023-12-31

0001001115us-gaap:CorporateNonSegmentMember2024-10-012024-12-31

0001001115us-gaap:CorporateNonSegmentMember2023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the Quarterly Period Ended December 31, 2024 OR

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from ____ to ____

Commission file number 001-13601

GEOSPACE TECHNOLOGIES CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Texas | 76-0447780 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 7007 Pinemont Houston, Texas | 77040 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 986-4444

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

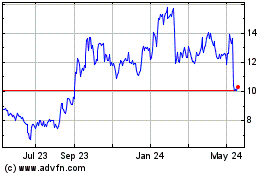

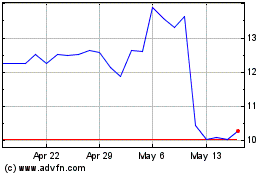

| Common Stock | | GEOS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | | | Accelerated filer | ☒ |

| | | | | | | | |

| Non-accelerated filer | | ☐ | | | | Smaller reporting company | ☒ |

| | | | | | | | |

| | | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of January 31, 2025 the registrant had 12,776,752 shares of common stock, $0.01 par value, per share outstanding.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands except share amounts)

(unaudited)

| | | December 31, 2024 | | | September 30, 2024 | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 1,410 | | | $ | 6,895 | |

| Short-term investments | | | 20,655 | | | | 30,227 | |

| Trade accounts and financing receivables, net | | | 40,645 | | | | 21,868 | |

| Inventories, net | | | 27,921 | | | | 26,222 | |

| Assets held for sale | | | 1,841 | | | | 1,841 | |

| Prepaid expenses and other current assets | | | 2,613 | | | | 2,313 | |

| Total current assets | | | 95,085 | | | | 89,366 | |

| | | | | | | | | |

| Non-current inventories, net | | | 18,742 | | | | 18,031 | |

| Rental equipment, net | | | 12,480 | | | | 14,186 | |

| Property, plant and equipment, net | | | 23,358 | | | | 21,083 | |

| Non-current trade accounts and financing receivables | | | 7,264 | | | | 6,375 | |

| Operating right-of-use assets | | | 400 | | | | 464 | |

| Goodwill | | | 736 | | | | 736 | |

| Other intangible assets, net | | | 1,611 | | | | 1,649 | |

| Other non-current assets | | | 263 | | | | 304 | |

| Total assets | | $ | 159,939 | | | $ | 152,194 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable trade | | $ | 7,312 | | | $ | 8,003 | |

| Operating lease liabilities | | | 130 | | | | 173 | |

| Other current liabilities | | | 9,446 | | | | 9,021 | |

| Total current liabilities | | | 16,888 | | | | 17,197 | |

| | | | | | | | | |

| Non-current operating lease liabilities | | | 309 | | | | 339 | |

| Deferred tax liabilities, net | | | 32 | | | | 34 | |

| Total liabilities | | | 17,229 | | | | 17,570 | |

| | | | | | | | | |

| Commitments and contingencies (Note 11) | | | | | | | | |

| | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| Preferred stock, 1,000,000 shares authorized, no shares issued and outstanding | | | — | | | | — | |

| Common Stock, $.01 par value, 20,000,000 shares authorized; 14,315,262 and 14,206,082 shares issued, respectively; and 12,798,897 and 12,709,381 shares outstanding, respectively | | | 143 | | | | 142 | |

| Additional paid-in capital | | | 97,690 | | | | 97,342 | |

| Retained earnings | | | 63,658 | | | | 55,282 | |

| Accumulated other comprehensive loss | | | (4,699 | ) | | | (4,257 | ) |

| Treasury stock, at cost, 1,516,365 and 1,496,701 shares, respectively | | | (14,082 | ) | | | (13,885 | ) |

| Total stockholders’ equity | | | 142,710 | | | | 134,624 | |

| Total liabilities and stockholders’ equity | | $ | 159,939 | | | $ | 152,194 | |

The accompanying notes are an integral part of the consolidated financial statements.

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(unaudited)

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Revenue: | | | | | | | | |

| Products | | $ | 32,645 | | | $ | 43,714 | |

| Rental | | | 4,578 | | | | 6,318 | |

| Total revenue | | | 37,223 | | | | 50,032 | |

| Cost of revenue: | | | | | | | | |

| Products | | | 14,269 | | | | 23,842 | |

| Rental | | | 2,805 | | | | 3,954 | |

| Total cost of revenue | | | 17,074 | | | | 27,796 | |

| | | | | | | | | |

| Gross profit | | | 20,149 | | | | 22,236 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | | 7,420 | | | | 5,826 | |

| Research and development | | | 4,894 | | | | 3,602 | |

| Provision for recovery of credit losses | | | — | | | | (29 | ) |

| Total operating expenses | | | 12,314 | | | | 9,399 | |

| | | | | | | | | |

| Income from operations | | | 7,835 | | | | 12,837 | |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest expense | | | (44 | ) | | | (56 | ) |

| Interest income | | | 745 | | | | 235 | |

| Foreign currency transaction gains (losses), net | | | (14 | ) | | | (163 | ) |

| Other, net | | | (33 | ) | | | (74 | ) |

| Total other income (loss), net | | | 654 | | | | (58 | ) |

| | | | | | | | | |

| Income before income taxes | | | 8,489 | | | | 12,779 | |

| Income tax expense | | | 113 | | | | 100 | |

| Net income | | $ | 8,376 | | | $ | 12,679 | |

| | | | | | | | | |

| Income per common share: | | | | | | | | |

| Basic | | $ | 0.66 | | | $ | 0.96 | |

| Diluted | | $ | 0.65 | | | $ | 0.94 | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | | 12,753,378 | | | | 13,251,360 | |

| Diluted | | | 12,877,387 | | | | 13,460,516 | |

The accompanying notes are an integral part of the consolidated financial statements.

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(unaudited)

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Net income | | $ | 8,376 | | | $ | 12,679 | |

| Other comprehensive income (loss): | | | | | | | | |

| Change in unrealized gains (losses) on available-for-sale securities, net of tax | | | (43 | ) | | | 15 | |

| Foreign currency translation adjustments | | | (399 | ) | | | 491 | |

| Total other comprehensive income (loss) | | | (442 | ) | | | 506 | |

| Total comprehensive income | | $ | 7,934 | | | $ | 13,185 | |

The accompanying notes are an integral part of the consolidated financial statements.

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE three months ended December 31, 2024 and 2023

(in thousands, except share amounts)

(unaudited)

| | | Common Stock | | | | | | | | | | | Accumulated | | | | | | | | | |

| | | | | | | | | | | Additional | | | | | | | Other | | | | | | | | | |

| | | Shares | | | | | | | Paid-In | | | Retained | | | Comprehensive | | | Treasury | | | | | |

| | | Outstanding | | | Amount | | | Capital | | | Earnings | | | Loss | | | Stock | | | Total | |

| Balance at October 1, 2024 | | | 12,709,381 | | | $ | 142 | | | $ | 97,342 | | | $ | 55,282 | | | $ | (4,257 | ) | | $ | (13,885 | ) | | $ | 134,624 | |

| Net income | | | — | | | | — | | | | — | | | | 8,376 | | | | — | | | | — | | | | 8,376 | |

| Other comprehensive income | | | — | | | | — | | | | — | | | | — | | | | (442 | ) | | | — | | | | (442 | ) |

| Issuance of common stock pursuant to the vesting of restricted stock units | | | 109,180 | | | | 1 | | | | (1 | ) | | | — | | | | — | | | | — | | | | — | |

| Purchase of treasury stock | | | (19,664 | ) | | | — | | | | — | | | | — | | | | — | | | | (197 | ) | | | (197 | ) |

| Stock-based compensation | | | — | | | | — | | | | 349 | | | | — | | | | — | | | | — | | | | 349 | |

| Balance at December 31, 2024 | | | 12,798,897 | | | $ | 143 | | | $ | 97,690 | | | $ | 63,658 | | | $ | (4,699 | ) | | $ | (14,082 | ) | | $ | 142,710 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at October 1, 2023 | | | 13,188,489 | | | $ | 140 | | | $ | 96,040 | | | $ | 61,860 | | | $ | (17,824 | ) | | $ | (7,500 | ) | | $ | 132,716 | |

| Net income | | | — | | | | — | | | | — | | | | 12,679 | | | | — | | | | — | | | | 12,679 | |

| Other comprehensive income | | | — | | | | — | | | | — | | | | — | | | | 506 | | | | — | | | | 506 | |

| Issuance of common stock pursuant to the vesting of restricted stock units | | | 128,601 | | | | 2 | | | | (2 | ) | | | — | | | | — | | | | — | | | | — | |

| Stock-based compensation | | | — | | | | — | | | | 406 | | | | — | | | | — | | | | — | | | | 406 | |

| Balance at December 31, 2023 | | | 13,317,090 | | | $ | 142 | | | $ | 96,444 | | | $ | 74,539 | | | $ | (17,318 | ) | | $ | (7,500 | ) | | $ | 146,307 | |

The accompanying notes are an integral part of the consolidated financial statements.

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 8,376 | | | $ | 12,679 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | | |

| Deferred income tax expense | | | — | | | | 8 | |

| Rental equipment depreciation | | | 1,884 | | | | 3,313 | |

| Property, plant and equipment depreciation | | | 867 | | | | 822 | |

| Amortization of intangible assets | | | 37 | | | | 109 | |

| Amortization of premiums (accretion of discounts) on short-term investments | | | (104 | ) | | | (115 | ) |

| Stock-based compensation expense | | | 349 | | | | 406 | |

| Provision for recovery of credit losses | | | — | | | | (29 | ) |

| Inventory obsolescence expense | | | 506 | | | | 20 | |

| Gross profit from sale of rental equipment | | | (15,978 | ) | | | (19,350 | ) |

| Gain on disposal of property, plant and equipment | | | (86 | ) | | | — | |

| Realized gain on investments | | | (10 | ) | | | — | |

| Effects of changes in operating assets and liabilities: | | | | | | | | |

| Trade accounts and financing receivables | | | (3,622 | ) | | | 8,001 | |

| Inventories | | | (2,988 | ) | | | (4,059 | ) |

| Other assets | | | (196 | ) | | | 179 | |

| Accounts payable trade | | | (690 | ) | | | (478 | ) |

| Other liabilities | | | 146 | | | | 1,146 | |

| Net cash provided by (used in) operating activities | | | (11,509 | ) | | | 2,652 | |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Purchase of property, plant and equipment | | | (3,199 | ) | | | (779 | ) |

| Proceeds from the sale of property, plant and equipment | | | 89 | | | | — | |

| Investment in rental equipment | | | (373 | ) | | | (2,558 | ) |

| Proceeds from the sale of rental equipment | | | 65 | | | | 597 | |

| Proceeds from the sale of short-term investments | | | 9,660 | | | | — | |

| Payments received on note receivable related to sale of subsidiary | | | 45 | | | | — | |

| Net cash provided by (used in) investing activities | | | 6,287 | | | | (2,740 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Purchase of treasury stock | | | (197 | ) | | | — | |

| Net cash used in financing activities | | | (197 | ) | | | — | |

| | | | | | | | | |

| Effect of exchange rate changes on cash | | | (66 | ) | | | 192 | |

| Increase (decrease) in cash and cash equivalents | | | (5,485 | ) | | | 104 | |

| Cash and cash equivalents, beginning of period | | | 6,895 | | | | 18,803 | |

| Cash and cash equivalents, end of period | | $ | 1,410 | | | $ | 18,907 | |

| | | | | | | | | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | |

| Cash paid for income taxes | | $ | 113 | | | $ | — | |

| Accounts and financing receivables related to sale of rental equipment | | | 16,112 | | | | 30,048 | |

| Inventory transferred to rental equipment | | | 36 | | | | 593 | |

The accompanying notes are an integral part of the consolidated financial statements.

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

1. Significant Accounting Policies

Basis of Presentation

The consolidated balance sheet of Geospace Technologies Corporation and its subsidiaries (the “Company”) at September 30, 2024, was derived from the Company’s audited consolidated financial statements at that date. The consolidated balance sheet at December 31, 2024 and the consolidated statements of operations, comprehensive income, stockholders’ equity and cash flows for the three months ended December 31, 2024 and 2023 were prepared by the Company without audit. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows were made. All significant intercompany balances and transactions have been eliminated. The results of operations for the three months ended December 31, 2024, are not necessarily indicative of the operating results for a full year or of future operations.

Certain information and footnote disclosures normally included in financial statements presented in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") were omitted pursuant to the rules of the Securities and Exchange Commission. The accompanying consolidated financial statements should be read in conjunction with the financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the Company’s fiscal year ended September 30, 2024.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the use of estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. The Company considers many factors in selecting appropriate operational and financial accounting policies and controls, and in developing the estimates and assumptions that are used in the preparation of these financial statements. The Company continually evaluates its estimates, including those related to revenue recognition, credit loss, collectability of rental revenue, inventory obsolescence reserves, self-insurance reserves, product warranty reserves, useful lives of long-lived assets, impairment of long-lived assets, impairment of goodwill and other intangible assets and deferred income tax assets. The Company bases its estimates on historical experience and various other factors that are believed to be reasonable under the circumstances. While management believes current estimates are reasonable and appropriate, actual results may differ from these estimates under different conditions or assumptions.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original or remaining maturity at the time of purchase of three months or less to be cash equivalents. At December 31, 2024 and September 30, 2024, cash and cash equivalents included $0.9 million and $1.1 million, respectively, held by the Company’s foreign subsidiaries and branch offices.

Concentration of Credit Risk

The Company sells products to customers throughout the United States and various foreign countries. The Company’s normal credit terms for trade receivables are 30 days. In certain situations, credit terms may be extended to 60 days or longer. The Company performs ongoing credit evaluations of its customers and generally does not require collateral for its trade receivables. Additionally, the Company provides long-term financing in the form of promissory notes and sales-type leases when competitive conditions require such financing. In such cases, the Company may require collateral. Allowances are recognized immediately for expected credit losses. The Company determines the allowance for credit losses through a review of several factors, including historical collection experience, customer credit worthiness, current aging of customer accounts and financial conditions of its customers. Receivables are charged off against the allowance whenever it is probable that the balance will not be recoverable.

The Company had trade accounts and financing receivables from one customer of $22.5 million at December 31, 2024. During the three months ended December 31, 2024 and 2023, the Company recognized revenue from this customer of $18.7 million and $31.7 million, respectively.

Impairment of Long-lived Assets

The Company's long-lived assets are reviewed for impairment whenever an event or circumstance indicates that the carrying amount of an asset or group of assets may not be recoverable. The impairment review, if necessary, includes a comparison of the expected future cash flows (undiscounted and without interest charges) to be generated by an asset group with the associated carrying value of the related assets. If the carrying value of the asset group exceeds the expected future cash flows, an impairment loss is recognized to the extent that the carrying value of the asset group exceeds its fair value. During the quarter ended December 31, 2024, no events or changes in circumstances were identified indicating the carrying value of any of the Company's asset groups may not be recoverable.

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued guidance which updates reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. The guidance is effective for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The guidance shall be applied retrospectively to all prior periods presented in the financial statements. The Company is currently evaluating the provisions of this guidance and the impact on its consolidated financial statements.

In December 2023, the FASB issued guidance improvements on income tax disclosure which will require the Company to disclose specified additional information in its income tax rate reconciliation and provide additional information for reconciling items that meet a quantitative threshold. The guidance will also require the Company to disaggregate its income taxes paid disclosure by federal, state and foreign taxes, with further disaggregation required for significant individual jurisdictions. The Company will adopt this guidance in its fourth quarter of fiscal year 2026. The guidance allows for adoption using either a prospective or retrospective transition method. The adoption of this guidance is not expected to have any material impact on its consolidation financial statements.

In November 2024, the FASB, as further amended in January 2025, issued guidance requiring enhanced disclosures in financial statements by requiring detailed disclosures of specific expenses like inventory purchases, employee compensation, depreciation, and intangible asset amortization. The guidance is effective for fiscal years beginning after December 15, 2026, and interim periods within fiscal years beginning after December 15, 2027. Early adoption is permitted. The Company is currently evaluating the provisions of this guidance and the impact on its consolidated financial statements.

All other new accounting pronouncements that have been issued, but not yet effective, are currently being evaluated and at this time are not expected to have a material impact on the Company's financial position or results of operations.

2. Revenue Recognition

In accordance with ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”), the Company recognizes revenue when performance of contractual obligations are satisfied, generally when control of the promised goods or services is transferred to its customers, in an amount that reflects the consideration it expects to be entitled to in exchange for those goods or services.

The Company primarily derives product revenue from the sale of its manufactured products. Revenue from these product sales, including the sale of used rental equipment, is recognized when obligations under the terms of a contract are satisfied, control is transferred and collectability of the sales price is probable. The Company records deferred revenue when customer funds are received prior to shipment or delivery or performance has not yet occurred. The Company assesses collectability during the contract assessment phase. In situations where collectability of the sales price is not probable, the Company recognizes revenue when it determines that collectability is probable or when non-refundable cash is received from its customers and there is not a significant right of return. Transfer of control generally occurs with shipment or delivery, depending on the terms of the underlying contract. The Company’s products are generally sold without any customer acceptance provisions, and the Company’s standard terms of sale do not allow customers to return products for credit.

Revenue from engineering services is recognized as services are rendered over the duration of a project, or as billed on a per hour basis. Field service revenue is recognized when services are rendered and is generally priced on a per day rate.

The Company also generates revenue from short-term rentals under operating leases of its manufactured products. Rental revenue is recognized as earned over the rental period if collectability of the rent is reasonably assured. Rentals of the Company’s equipment generally range from daily rentals to minimum rental periods of up to one year. The Company has determined that ASC 606 does not apply to rental contracts, which are within the scope of ASC Topic 842, Leases.

As permissible under ASC 606, sales taxes and transaction-based taxes are excluded from revenue. The Company does not disclose the value of unsatisfied performance obligations for contracts with an original expected duration of one year or less. Additionally, the Company expenses costs incurred to obtain contracts when incurred because the amortization period would have been one year or less. These costs are recorded in selling, general and administrative expenses.

The Company has elected to treat shipping and handling activities in a sales transaction after the customer obtains control of the goods as a fulfillment cost and not as a promised service. Accordingly, fulfillment costs related to the shipping and handling of goods are accrued at the time of shipment. Amounts billed to a customer in a sales transaction related to reimbursable shipping and handling costs are included in revenue and the associated costs incurred by the Company for reimbursable shipping and handling expenses are reported in cost of revenue.

At December 31, 2024 and September 30, 2024, the Company had no deferred contract liabilities and no deferred contract costs. During the three months ended December 31, 2024, no revenue was recognized from deferred contract liabilities and no cost of revenue was recognized from deferred contract costs. During the three months ended December 31, 2023, revenue of $45,000 was recognized from deferred contract liabilities and no cost of revenue was recorded from deferred contract costs. At December 31, 2024, all contracts had an original expected duration of one year or less. At December 31, 2024 and October 1 2024, the Company had accounts receivable from contracts of $12.0 million and $13.4 million, respectively. At December 31, 2023 and October 1, 2023, the Company had accounts receivable from contracts of $37.6 million and $10.9 million, respectively.

For the three months ended December 31, 2024, no revenue recognized from contracts with customers satisfied over-time. For the three months ended December 31, 2023, revenue from contracts with customers satisfied over-time was $45,000, which was from the Company's Intelligent Industrial segment. All other revenue from contracts with customers was recognized at a point-in time. For each of the Company’s operating segments, the following table presents revenue (in thousands) only from the sale of products and the performance of services under contracts with customers. Therefore, the table excludes all revenue earned from rental contracts.

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Smart Water | | $ | 7,288 | | | $ | 4,234 | |

| Energy Solutions | | | 19,826 | | | | 33,706 | |

| Intelligent Industrial | | | 5,531 | | | | 5,774 | |

| Total | | $ | 32,645 | | | $ | 43,714 | |

See Note 12 for more information on the Company’s operating business segments.

For each of the geographic areas where the Company operates, the following table presents revenue (in thousands) from the sale of products and services under contracts with customers. The table excludes all revenue earned from rental contracts:

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Asia (including Russian Federation) | | $ | 18,057 | | | $ | 32,216 | |

| Canada | | | 369 | | | | 1,226 | |

| Europe | | | 1,398 | | | | 1,378 | |

| Mexico | | | 1,281 | | | | 166 | |

| United States | | | 11,423 | | | | 8,418 | |

| Other | | | 117 | | | | 310 | |

| Total | | $ | 32,645 | | | $ | 43,714 | |

Revenue is attributable to countries based on the ultimate destination of the product sold, if known. If the ultimate destination is not known, revenue is attributable to countries based on the geographic location of the initial shipment.

3. Short-term Investments

The Company classifies its short-term investments as available-for-sale securities. Available-for-sale securities are carried at fair market value with net unrealized gains and losses reported as a component of accumulated other comprehensive income (loss) in stockholders’ equity.

The Company’s short-term investments were composed of the following (in thousands):

| | | As of December 31, 2024 | |

| | | Amortized Cost | | | Unrealized Gains | | | Unrealized Losses | | | Estimated Fair Value | |

| Short-term investments: | | | | | | | | | | | | | | | | |

| Corporate bonds | | $ | 16,899 | | | $ | 7 | | | $ | — | | | $ | 16,906 | |

| U.S. treasury securities and securities of U.S. government-sponsored agency | | | 3,742 | | | | 7 | | | | — | | | | 3,749 | |

| Total | | $ | 20,641 | | | $ | 14 | | | $ | — | | | $ | 20,655 | |

| | | As of September 30, 2024 | |

| | | Amortized Cost | | | Unrealized Gains | | | Unrealized Losses | | | Estimated Fair Value | |

| Short-term investments: | | | | | | | | | | | | | | | | |

| Corporate bonds | | $ | 21,814 | | | $ | 35 | | | $ | — | | | $ | 21,849 | |

| U.S. treasury securities and securities of U.S. government-sponsored agency | | | 8,356 | | | | 22 | | | | — | | | | 8,378 | |

| Total | | $ | 30,170 | | | $ | 57 | | | $ | — | | | $ | 30,227 | |

The Company had no securities in a material unrealized loss position at December 31, 2024 and September 30, 2024 and does not believe the unrealized losses associated with these securities represent credit losses based on the evaluation of evidence, which includes an assessment of whether it is more likely than not it will be required to sell or intend to sell the investment before recovery of the investments amortized cost basis. A gain of $10,000 was realized during the three months ended December 31, 2024 from the sale of short-term investments. No gains or losses were recognized during the three months ended December 31, 2023 from the sale of short-term investments.

4. Fair Value of Financial Instruments

The Company’s financial instruments generally include cash and cash equivalents, short-term investments, trade accounts and financing receivables and accounts payable. Due to the short-term maturities of cash and cash equivalents, trade accounts receivable and accounts payable, the carrying amounts of these financial instruments are deemed to approximate their fair value on the respective balance sheet dates. The Company measures its short-term investments at fair value on a recurring basis.

The following tables present the fair value of the Company’s short-term investments, note receivable on sale of subsidiary and Emerging Markets asset group intangible assets by valuation hierarchy and input (in thousands):

| | | As of December 31, 2024 | |

| | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Totals | |

| Short-term investments: | | | | | | | | | | | | | | | | |

| Corporate bonds | | $ | — | | | $ | 16,906 | | | $ | — | | | $ | 16,906 | |

| U.S. treasury securities and securities of U.S. government-sponsored agency | | | — | | | | 3,749 | | | | — | | | | 3,749 | |

| Total | | $ | — | | | $ | 20,655 | | | $ | — | | | $ | 20,655 | |

| | | As of September 30, 2024 | |

| | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Totals | |

| Recurring: | | | | | | | | | | | | | | | | |

| Short-term investments: | | | | | | | | | | | | | | | | |

| Corporate bonds | | $ | — | | | $ | 21,849 | | | $ | — | | | $ | 21,849 | |

| U.S. treasury securities and securities of U.S. government-sponsored agency | | | — | | | | 8,378 | | | | — | | | | 8,378 | |

| Total | | $ | — | | | $ | 30,227 | | | $ | — | | | $ | 30,227 | |

| | | | | | | | | | | | | | | | | |

| Nonrecurring: | | | | | | | | | | | | | | | | |

| Note receivable on sale of subsidiary | | $ | — | | | $ | — | | | $ | 2,600 | | | $ | 2,600 | |

| Emerging Markets asset group intangible assets | | | — | | | | — | | | | — | | | | — | |

| Total | | $ | — | | | $ | — | | | $ | 2,600 | | | $ | 2,600 | |

Assets and liabilities Measured on a Nonrecurring basis

In August 2024, the Company performed a fair value analysis on its $3.5 million promissory note obtained in connection with its subsidiary sale as of the transaction date. The measurements utilized to determine the implied fair value of the note receivable obtained significant unobservable inputs (Level 3). The derivation of discount rate utilized in the analysis was based on comparable market yields. Based on the analysis, the Company recorded a $0.9 million discount to fair value on this note receivable. Also see Note 5 for more information.

At September 30, 2024, the Company performed a recoverability assessment on its long-lived assets of it Emerging Markets asset group in which its carrying value was compared to the estimated undiscounted cash flows over the remaining useful life of the asset group's primarily asset, its developed technology. Accordingly, a fair value analysis was performed. Based on the assessment, the Company determined the fair value of the asset was less than its carrying value and recorded an impairment charge of $2.8 million on this asset group, which impaired its intangible assets in their entirety. The Company determined the fair value of this asset group to be approximately zero. The measurements utilized to determine the implied fair value represented significant unobservable inputs (Level 3).

5. Trade Accounts and Financing Receivables

Trade accounts receivable, net (excluding financing receivables) are reflected in the following table (in thousands):

| | | December 31, 2024 | | | September 30, 2024 | |

| Trade accounts receivable | | $ | 19,510 | | | $ | 16,151 | |

| Allowance for credit losses | | | (4 | ) | | | (4 | ) |

| Total | | | 19,506 | | | | 16,147 | |

| Less current portion | | | (19,506 | ) | | | (14,637 | ) |

| Non-current trade accounts receivable | | $ | — | | | $ | 1,510 | |

The Company determines the allowance for credit losses through a review of several factors, including historical collection experience, customer credit worthiness, current aging of customer accounts and current financial conditions of its customers. Trade accounts receivable balances are charged off against the allowance whenever it is probable that the receivable balance will not be recoverable.

Allowance for credit losses related to trade accounts receivable are reflected in the following table (in thousands):

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Allowance for credit losses: | | | | | | | | |

| Beginning of period | | | 4 | | | | 125 | |

| Provision for credit losses | | | — | | | | 43 | |

| Recoveries | | | — | | | | (72 | ) |

| Write-offs | | | — | | | | (7 | ) |

| Currency translation | | | — | | | | 3 | |

| End of period | | $ | 4 | | | $ | 92 | |

In November 2024, the Company entered into a sales-type lease with a customer on wireless seismic equipment from its rental fleet. The lease matures in October 2025. Future minimum payments required under the lease at December 31, 2024, were $16.7 including $0.6 million of unearned income. Interest income of $0.1 million was recognized for the three months ended December 31, 2024. The ownership of the equipment will transfer to the customer at the end of the lease term.

In August 2024, the Company entered into a $9.4 million promissory note with a customer related to a product sale. The note bears interest at 9.5% per annum. Pursuant to an amendment in the first quarter of fiscal year 2025, the maturity of the note was extended from December 2025 to June 2026. The note bears interest at 9.5% per annum. The note is collateralized by the product sold.

In August 2024, the Company entered into a $3.5 million promissory note with the buyer of its Russian subsidiary. The note bears interest at 5% per annum and is for a 10-year term. Principal and interest payments of $37,000 are due monthly. Based on a fair value analysis performed at the date of sale, a discount to fair value of $0.9 million was placed on the note. Interest income on the amortization of the discount is being recognized under the effective interest method.

Credit quality indicators used for the financing receivables consisted of historical collection experience, internal credit risk grades and collateral. The Company determined the allowance for credit losses through a review of several factors, including historical collection experience, customer credit worthiness, current aging of customer accounts and current financial conditions of its customers.

6. Inventories

Inventories consist of the following (in thousands):

| | | December 31, 2024 | | | September 30, 2024 | |

| Finished goods | | $ | 18,692 | | | $ | 18,099 | |

| Work in process | | | 5,506 | | | | 3,626 | |

| Raw materials | | | 31,975 | | | | 30,941 | |

| Obsolescence reserve (net realizable value adjustment) | | | (9,510 | ) | | | (8,413 | ) |

| Total | | | 46,663 | | | | 44,253 | |

| Less current portion | | | 27,921 | | | | 26,222 | |

| Non-current portion | | $ | 18,742 | | | $ | 18,031 | |

Inventory obsolescence expense for the three months ended December 31, 2024 and 2023, was $506,000 and $20,000, respectively. Raw materials include semi-finished goods and component parts that totaled approximately $10.6 million and $8.6 million at December 31, 2024 and September 30, 2024, respectively.

7. Rental Equipment

The Company leases equipment to customers which generally range from daily rentals to minimum rental periods of up to one year. All of the Company’s current leasing arrangements for which the Company acts as lessor, are classified as operating leases, except for one sales-type lease. The majority of the Company’s rental revenue is generated from its marine-based wireless seismic data acquisition systems.

The Company regularly evaluates the collectability of its lease receivables on a lease-by-lease basis. The evaluation primarily consists of reviewing past due account balances and other factors such as the credit quality of the customer, historical trends of the customer and current economic conditions. The Company suspends revenue recognition when the collectability of amounts due are no longer probable and concurrently records a direct write-off of the lease receivable to rental revenue and limits future rental revenue recognition to cash received. As of December 31, 2024, the Company’s trade accounts receivable included lease receivables of $4.7 million.

Rental revenue related to leased equipment for the three months ended December 31, 2024 and 2023 was $4.5 million and $6.2 million, respectively.

Future minimum lease obligations due from the Company’s leasing customers on operating leases executed as of December 31, 2024, were $0.8 million, all of which is expected to be due within the next 12 months.

Rental equipment consisted of the following (in thousands):

| | | December 31, 2024 | | | September 30, 2024 | |

| Rental equipment, primarily wireless recording equipment | | $ | 49,220 | | | $ | 63,111 | |

| Accumulated depreciation | | | (36,740 | ) | | | (48,925 | ) |

| | | $ | 12,480 | | | $ | 14,186 | |

8. Long-Term Debt

On July 26, 2023, the Company entered into a credit agreement (“the Agreement”) with Woodforest National Bank, as sole lender. The Agreement refinanced the Company's credit agreement dated May 6, 2022, with Amerisource Funding, Inc., as administrative agent and as a lender, and Woodforest National Bank, as a lender. The Agreement provides a revolving credit facility with a maximum availability of $15 million. Availability under the Agreement is determined based upon a borrowing base comprised of certain of the Company’s domestic assets which include (i) 80% of eligible accounts, plus (ii) 90% of eligible foreign insured accounts, plus (iii) 25% of eligible inventory plus (iv) 50% of the orderly liquidation value of eligible equipment, in each case subject to certain limitations and adjustments. Interest shall accrue on outstanding borrowings at a rate equal to Term SOFR (Secured Overnight Financing Rate) plus a margin equal to 3.25% per annum (7.75% at December 31, 2024). The Company is required to make monthly interest payments on borrowed funds. The Agreement is secured by substantially all of the Company's assets, except for certain excluded property. The Agreement requires the Company to maintain a minimum (i) consolidated tangible net worth of $100 million, (ii) liquidity of $5 million, and (iii) current ratio no less than 2.00 to 1.00, in each case tested quarterly. The Agreement also requires the Company to maintain a springing minimum interest coverage ratio of 1.50 to 1.00, tested quarterly whenever there is an outstanding balance on the revolving credit facility. The Agreement expires in July 2025. At December 31, 2024, the Company's borrowing availability under the Agreement was $12.1 million after consideration of a $0.1 million outstanding letter of credit. At December 31, 2024, the Company was in compliance with all covenants under the Agreement. The Company had no borrowings outstanding under the Agreement at December 31, 2024, and September 30, 2024.

9. Stock-Based Compensation

During the three months ended December 31, 2024, the Company issued 143,500 restricted stock units (“RSUs”) under its 2014 Long Term Incentive Plan, as amended. The RSUs issued include both time-based and performance-based vesting provisions. The weighted average grant date fair value of each RSU was $13.29 per unit. The grant date fair value of the RSUs was $1.9 million, which will be charged to expense over the next four years as the restrictions lapse. Compensation expense for the RSUs was determined based on the closing market price of the Company’s stock on the date of grant applied to the total number of units that are anticipated to fully vest. Each RSU represents a contingent right to receive one share of the Company’s common stock upon vesting. As of December 31, 2024, there were 359,215 RSUs outstanding.

For the three months ended December 31, 2024 and 2023, stock-based compensation expense was $0.3 million and $0.4 million, respectively. As of December 31, 2024, the Company had unrecognized compensation expense of $3.4 million relating to RSUs that is expected to be recognized over the next four years.

10. Earnings Per Common Share

The following table summarizes the calculation of net earnings and weighted average common shares and common equivalent shares outstanding for purposes of the computation of earnings per share (in thousands, except share and per share data):

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Net income | | $ | 8,376 | | | $ | 12,679 | |

| Weighted average number of common share equivalents: | | | | | | | | |

| Common shares used in basic earnings per share | | | 12,753,378 | | | | 13,251,360 | |

| Common share equivalents outstanding related to RSUs | | | 124,009 | | | | 209,156 | |

| Total weighted average common shares and common share equivalents used in diluted earnings per share | | | 12,877,387 | | | | 13,460,516 | |

| Earnings per share: | | | | | | | | |

| Basic | | $ | 0.66 | | | $ | 0.96 | |

| Diluted | | $ | 0.65 | | | $ | 0.94 | |

For the calculation of diluted earnings per share for the three months ended December 31, 2024 and 2023, there were 235,206 and 212,217 non-vested RSUs, respectively, excluded from the calculation of weighted average shares outstanding since their impact on diluted earnings per share were antidilutive.

11. Commitments and Contingencies

Contingent Compensation Costs

In connection with the acquisition of Aquana, LLC (“Aquana”) in July 2021, the Company is subject to additional contingent cash payments to the former members of Aquana over a six-year earn-out period. The contingent payments, if any, will be derived from certain eligible revenue generated during the earn-out period from products and services sold by Aquana. There is no maximum limit to the contingent cash payments that could be made. The merger agreement with Aquana requires the continued employment of a certain key employee and former member of Aquana for the first four years of the six year earn-out period in order for any of Aquana’s former members to be eligible for any earn-out payments. Due to the continued employment requirement, no liability has been recorded for the estimated fair value of earn-out payments for this transaction. Earn-outs achieved are recorded as compensation expense when incurred.

Legal Proceedings

The Company is involved in various pending legal actions in the ordinary course of its business. Management is unable to predict the ultimate outcome of these actions, because of the inherent uncertainty of such actions. However, management believes that the most probable, ultimate resolution of current pending matters will not have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows.

12. Segment Information

Effective October 1, 2024, the Company changed the composition of its three operating business segments and changed its methodology for allocating manufacturing costs including overhead and other costs of revenue to the segments.

The Company's business segments are now comprised of: Smart Water, Energy Solutions and Intelligent Industrial. The Smart Water segment emphasizes the Company’s targeted approach in the water management industry. This business segment contains the Hydroconn® smart water connectivity offerings and the Company's Aquana products. The Energy Solutions segment encompass' the Company’s traditional business in oil and gas land and marine exploration products, reservoir monitoring solutions, and will additionally incorporate emerging energy solutions and microseismic monitoring. This segment will include energy-related business from Quantum’s SADAR® products and associated analytics. The Intelligent Industrial segment includes seismic sensor products used for vibration monitoring geotechnical applications such as mine safety applications and earthquake detection, designs seismic products targeted at the border and perimeter security markets, imaging products, as well as providing contract manufacturing services. The change methodology for allocating manufacturing costs affected each business segment's operating income (loss) but had no effect on consolidated operating income.

The following table summarizes the Company’s segment information (in thousands). Segment information for the three months ended December 31, 2024 and 2023, has been recast for comparability.

| | | Three Months Ended | |

| | | December 31, 2024 | | | December 31, 2023 | |

| Revenue: | | | | | | | | |

| Smart Water | | $ | 7,288 | | | $ | 4,234 | |

| Energy Solutions | | | 24,282 | | | | 39,911 | |

| Intelligent Industrial | | | 5,577 | | | | 5,813 | |

| Corporate | | | 76 | | | | 74 | |

| Total | | $ | 37,223 | | | $ | 50,032 | |

| | | | | | | | | |

| Income (loss) from operations: | | | | | | | | |

| Smart Water | | $ | 370 | | | $ | 1,095 | |

| Energy Solutions | | | 13,282 | | | | 15,068 | |

| Intelligent Industrial | | | (940 | ) | | | (191 | ) |

| Corporate | | | (4,877 | ) | | | (3,135 | ) |

| Total | | $ | 7,835 | | | $ | 12,837 | |

The Company's manufacturing operations for its operating business segments are combined. Therefore, the Company does not segregate and report separate balance sheet accounts for each of its segments and therefore, no total asset information is presented in the table above.

13. Income Taxes

Consolidated income tax expense for the each of the three months ended December 31, 2024 and 2023, was $0.1 million. The primary difference between the Company's effective tax rate and the statutory rate is adjustments to the valuation allowance against deferred tax assets.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following is management’s discussion and analysis of the major elements of our consolidated financial statements. You should read this discussion and analysis together with our consolidated financial statements, including the accompanying notes, and other detailed information appearing elsewhere in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the year ended September 30, 2024.

Forward-Looking Statements

This Quarterly Report on Form 10-Q and the documents incorporated by reference herein contain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by terminology such as “may”, “will”, “should”, “could”, “intend”, “expect”, “plan”, “budget”, “forecast”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue”, “evaluating” or similar words. Statements that contain these words should be read carefully because they discuss our future expectations, contain projections of our future results of operations or of our financial position or state other forward-looking information. Examples of forward-looking statements include, among others, statements that we make regarding our expected operating results, the timing, adoption, results and success of our rollout of our Aquana smart water valves and cloud-based control platform, future demand for our Quantum security solutions, the adoption and sale of our products in various geographic regions, potential tenders for permanent reservoir monitoring systems, future demand for OBX rental equipment, the adoption of Quantum's SADAR® product monitoring of subsurface reservoirs, the completion of new orders for channels of our GCL system, the fulfillment of customer payment obligations, the impact of the current armed conflict between Russia and Ukraine, our ability to manage changes and the continued health or availability of management personnel, volatility and direction of oil prices, anticipated levels of capital expenditures and the sources of funding therefor, and our strategy for growth, product development, market position, financial results and the provision of accounting reserves. These forward-looking statements reflect our current judgment about future events and trends based on the information currently available to us. However, there will likely be events in the future that we are not able to predict or control. The factors listed under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2024, as well as other cautionary language in such Annual Report and this Quarterly Report on Form 10-Q, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Such examples include, but are not limited to, the failure of the Quantum and OptoSeis® or Aquana technology transactions to yield positive operating results, decreases in commodity price levels, the failure of our products to achieve market acceptance (despite substantial investment by us), our sensitivity to short term backlog, delayed or cancelled customer orders, product obsolescence resulting from poor industry conditions or new technologies, credit losses associated with customer accounts, inability to collect on financing receivables, lack of further orders for our OBX rental equipment, failure of our Quantum products to be adopted by the border and security perimeter market or a decrease in such market due to governmental changes, and infringement or failure to protect intellectual property. The occurrence of the events described in these risk factors and elsewhere in this Quarterly Report on Form 10-Q could have a material adverse effect on our business, results of operations and financial position, and actual events and results of operations may vary materially from our current expectations. We assume no obligation to revise or update any forward-looking statement, whether written or oral, that we may make from time to time, whether as a result of new information, future developments or otherwise.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available to the public over the internet at the SEC’s website at www.sec.gov. Our SEC filings are also available to the public on our website at www.geospace.com. From time to time, we may post investor presentations on our website under the “Investor Relations” tab. Please note that information contained on our website, whether currently posted or posted in the future, is not a part of this Quarterly Report on Form 10-Q or the documents incorporated by reference in this Quarterly Report on Form 10-Q.

Overview

Unless otherwise specified, the discussion in this Quarterly Report on Form 10-Q refers to Geospace Technologies Corporation and its subsidiaries. We design and manufacture sophisticated technology solutions for applications in energy exploration, smart water management as well as industrial and Internet of Things. Our seismic equipment and services are marketed to the energy exploration industry and used to locate, characterize and monitor hydrocarbon producing reservoirs. We also market our seismic products to other industries for vibration monitoring, border and perimeter security and various geotechnical applications. We design and manufacture other products of a non-seismic nature, including water meter connector cables, imaging equipment, remote shutoff water valves and Internet of Things ("IoT") platform. Additionally, the company provides specialized contract manufacturing services. In recent years, the revenue contribution from our non-energy related products has grown to represent nearly half of our total revenue. Our business diversification strategy has centered largely on translating expertise in ruggedized engineering and technology manufacturing into expanded customer markets.

Effective October 1, 2024, the Company changed the composition of its three operating business segments and changed its methodology for allocating manufacturing costs including overhead and other costs of revenue to the segments. The business segments are now comprised of: Smart Water, Energy Solutions and Intelligent Industrial. The change methodology for allocating manufacturing costs affected each segment's operating income (loss) but had no effect on consolidated operating income.

Products and Product Development

Smart Water

Our Smart Water business segment comprises our market dominant water meter connector cable series known as Hydroconn®, and our Aquana branded remote shut-off water valves and cloud-based IoT Platform. In municipal and utility applications, our smart water products support the global smart meter connectivity water utility market. These products provide our customers with highly reliable automated meter-reading and automated meter infrastructure with our robust water-proof connectors. Our highly-ruggedized outdoor valves include the AquaFlex™ and AquaFlow™ remote shut off valves.

In commercial applications for multi-family and real estate property management, our remote sensing water valves offer asset managers the ability to gather accurate usage information, implement occupancy-based billing and submetering as well as guard against costly leak and burst events. The AquaSense remote disconnect valve and AquaControl smart water IoT platform allow customers that manage multi-family and commercial properties to monitor their properties for leak and burst events, with real-time notifications, complimented with our remote-shut off to stop water damage. These products also allow water utilities to control and monitor water use remotely, discontinue or limit service without placing its employees in potential harm or danger.

Energy Solutions

Our Energy Solutions business segment has historically accounted for the majority of our revenue. Geoscientists use seismic data primarily in connection with the exploration, development and production of oil and gas reserves to map potential and known hydrocarbon bearing formations and the geologic structures that surround them. This segment’s products include wireless seismic data acquisition systems, reservoir characterization products and services, and traditional seismic exploration products such as geophones, hydrophones, leader wire, connectors, cables, marine streamer retrieval and steering devices and various other seismic products.

Our seismic sensor, cable and connector products are compatible with most major competitive seismic data acquisition systems currently in use. Revenue from these products results primarily from seismic contractors purchasing our products as components of new seismic data acquisition systems or to repair and replace components of seismic data acquisition systems already in use.

We have developed multiple versions of a land-based wireless (or nodal) seismic data acquisition system including our most recent launch of the Pioneer™, an ultralight wireless sensor product. We believe our wireless sensor systems allows our customers to operate more effectively and efficiently because of its reduced environmental impact, lower weight, ease of operation, and which require less maintenance.

We have also developed a marine-based wireless seismic data acquisition system called the OBX, and recently released Mariner® and Mariner Deep™. Similar to our land-based wireless systems, these marine wireless systems may be deployed in virtually unlimited channel configurations and do not require interconnecting cables between each station. Through December 31, 2024, we have sold 35,000 OBX stations and we currently have 13,000 OBX stations in our rental fleet. The Mariner® is a continuous, cable-free, four channel autonomous, shallow water ocean bottom recorder designed for extended duration seabed ocean bottom seismic data acquisition. Through December 31, 2024, we have sold 7,600 Mariner® nodes.

Additionally, we have developed high-definition permanent reservoir monitoring systems ("PRM") for land and ocean-bottom applications in producing oil and gas fields. Our primary offering, OptoSeis® fiber optic sensing technology, provides high-definition seismic data acquisition systems with a flexible architecture allowing them to be configured as a subsurface system for both land and marine reservoir-monitoring projects. We are in the process of responding to a large-scale seabed PRM tender from a major oil and gas producer. The project is expected to be awarded in the third quarter of fiscal year 2025. We have also entered into a contract for two Front-End Engineering and Design studies with this producer which is expected to be completed in the fourth quarter of fiscal year 2025. We have not received any orders for a large-scale seabed PRM system since 2012.

We also have a derivative of the OptoSeis® technology for high temperature downhole applications. The product known as Insight by OptoSeis offers a passive, all-optical downhole sensor network - no electronics downhole - resulting in years long operational lifetime at 150 °C.

We also produce a seismic borehole acquisition systems that employ a fiber optic augmented wireline capable of very high data transmission rates. These systems are used for several reservoir monitoring applications, including an application pioneered by us allowing operators and service companies to monitor and measure the results of hydraulic fracturing operations.

Lastly, our SADAR® technology provides passive seismic real-time monitoring in emerging energy applications such as Carbon Capture and Storage (CCS) and geothermal energy. Our customers include various agencies of the U.S. government including the Department of Defense, Department of Energy, Department of Homeland Security and other agencies as well as energy companies needing real-time monitoring of seismic data.

Intelligent Industrial

Our Intelligent Industrial segment is comprised of diverse software and hardware solutions leveraging decades of sensor technologies for use by the U.S. Federal government, specialized contractors and academia. This segment also includes specialized contract manufacturing in the United States along with solutions for industrial screen printers.

For more than a decade our sensor products have been used for national security and homeland defense applications. More recently our SADAR® technology, has been used for border and perimeter security surveillance, cross-border tunneling detection and other products targeted at movement monitoring, intrusion detection and situational awareness. Our seismic sensors provide unique high definition, low frequency sensing that allows for vibration monitoring in industrial machinery, mine safety and earthquake detection.

Our imaging products include electronic pre-press products that employ direct thermal imaging, direct-to-screen printing systems, and digital inkjet printing technologies targeted at the commercial graphics, industrial graphics, textile and flexographic printing industries.

Our robust manufacturing capabilities have allowed us to provide specialized contract manufacturing services for printed circuit board manufacturing, cabling and harnesses, machining, injection molding and electronic system assembly. We are certified to the latest revisions of ISO9001, 14001, 13485, and AS9100 standards and are committed to quality manufacturing, document and process control, qualification, non-conformance handling as well as continuous improvement. We maintain environmentally sound working conditions in all of our facilities.

Consolidated Results of Operations

We report and evaluate financial information for three segments: Smart Water, Energy Solutions, and Intelligent Industrial Markets. Summary financial data by business segment follows (in thousands):

| |

|

Three Months Ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| Smart Water |

|

|

|

|

|

|

|

|

| Product revenue |

|

$ |

7,288 |

|

|

$ |

4,234 |

|

| Income from operations |

|

|

370 |

|

|

|

1,095 |

|

| Energy Solutions |

|

|

|

|

|

|

|

|

| Product revenue |

|

|

19,826 |

|

|

|

33,706 |

|

| Rental revenue |

|

|

4,456 |

|

|

|

6,205 |

|

| Total revenue |

|

|

24,282 |

|

|

|

39,911 |

|

| Income from operations |

|

|

13,282 |

|

|

|

15,068 |

|

| Intelligent Industrial |

|

|

|

|

|

|

|

|

| Product revenue |

|

|

5,531 |

|

|

|

5,774 |

|

| Rental revenue |

|

|

46 |

|

|

|

39 |

|

| Total revenue |

|

|

5,577 |

|

|

|

5,813 |

|

| Loss from operations |

|

|

(940 |

) |

|

|

(191 |

) |

| Corporate |

|

|

|

|

|

|

|

|

| Rental revenue |

|

|

76 |

|

|

|

74 |

|

| Loss from operations |

|

|

(4,877 |

) |

|

|

(3,135 |

) |

| Consolidated Totals |

|

|

|

|

|

|

|

|

| Product revenue |

|

|

32,645 |

|

|

|

43,714 |

|

| Rental revenue |

|

|

4,578 |

|

|

|

6,318 |

|

| Total revenue |

|

|

37,223 |

|

|

|

50,032 |

|

| Income from operations |

|

|

7,835 |

|

|

|

12,837 |

|

Business Overview