false

0001708176

0001708176

2024-10-26

2024-10-26

0001708176

HOFV:CommonStock0.0001ParValuePerShareMember

2024-10-26

2024-10-26

0001708176

HOFV:WarrantsToPurchase0.064578SharesOfCommonStockMember

2024-10-26

2024-10-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 26, 2024

HALL OF FAME RESORT & ENTERTAINMENT COMPANY

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38363 |

|

84-3235695 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

2014 Champions Gateway, Suite 100

Canton, OH 44708

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (330) 458-9176

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

HOFV |

|

Nasdaq Capital Market |

| Warrants to purchase 0.064578 shares of Common Stock |

|

HOFVW |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

On October 26, 2024, HOF

Village Waterpark, LLC (“Tenant”), a subsidiary of Hall of Fame Resort & Entertainment Company (the “Company”),

received from HFAKOH001 LLC (“Landlord”) a notice of termination due to event of default (the “Notice”) under

the waterpark ground lease agreement, dated as of November 7, 2022, between Tenant and Landlord, as amended on February 23, 2024, February

29, 2024 and May 10, 2024 (as so amended, the “Waterpark Ground Lease”). Under the Waterpark Ground Lease, the Landlord’s

termination requires that Tenant immediately surrender the waterpark premises under such lease to the Landlord and any improvements thereto

(including the construction of new buildings thereon) with all fixtures appurtenant thereto.

The default identified in

the Notice is a payment default under the Waterpark Ground Lease. The Landlord had agreed to forbear exercising remedies for the payment

default until October 25, 2024. As of October 31, 2024, Tenant had not remedied the payment default. The outstanding principal balance

of unpaid base rent under the Waterpark Ground Lease (inclusive of default interest and late fees accrued up to the date of termination)

is approximately $2,600,000.

In addition to unpaid rent,

the Waterpark Ground Lease provides that Landlord is entitled to recover the following as damages: (i) the amount by which the unpaid

rent for what would have been the remaining term of the Waterpark Ground Lease exceeds the then fair market rental value of the waterpark

premises, both discounted to present value, plus (ii) any damages, including without limitation reasonable attorneys’ fees and court

costs, which Landlord sustains as a result of the breach of the covenants of the Waterpark Ground Lease other than for the payment of

rent, in each case plus interest.

The Notice states that Landlord

retains the absolute and unconditional right to pursue any and all remedies available under the Waterpark Ground Lease and related security

agreements and applicable law, concurrently or consecutively, at Landlord’s sole discretion. The Company’s subsidiary HOF

Village Newco, LLC (“Guarantor”) guaranteed Tenant’s obligations under the Waterpark Ground Lease pursuant to a limited

recourse guaranty dated as of November 7, 2022. The security agreements and collateral that support Tenant and Guarantor’s obligations

under the Waterpark Ground Lease consist of the following:

| ● | Tom Benson Hall of Fame Stadium. Guarantor pledged and granted in favor of Landlord 100% of its

membership interests in HOF Village Stadium, LLC (“HOFV Stadium”) and certain related security interests under a Pledge and

Security Agreement dated as of November 7, 2022. HOFV Stadium granted Landlord a security interest in HOFV Stadium’s leasehold interest

in the Tom Benson Hall of Fame Stadium and certain related security interests, pursuant to an Open-End Leasehold Mortgage, Assignment

of Lease and Rents, Security Agreement and Fixture Filing dated as of December 27, 2022. |

| ● | 20% Interest in ForeverLawn Sports Complex. Guarantor pledged and granted in favor of landlord

its 20% interest in the ForeverLawn Sports complex that is held in a joint venture with Sandlot Facilities, LLC, and certain related security

interests, pursuant to a Pledge and Security Agreement dated as of February 23, 2024. |

| ● | Real Estate Adjacent to Hall of Fame Village. Guarantor granted Landlord a security interest in

ten undeveloped residential real estate parcels and four commercial real estate parcels owned by Guarantor located adjacent to Hall of

Fame Village and certain related security interests, pursuant to an Open-End Mortgage, Assignment of Leases and Rents, Security Agreement

and Fixture Filing dated as of February 29, 2024. |

The exercise of certain remedies

by Landlord would be expected to have a material adverse effect on the liquidity, financial condition, and results of operations of the

Company.

The discussion of the Waterpark

Ground Lease above is qualified by reference to a copy of such agreement filed as Exhibit 10.2 to the Company’s Form 8-K filed with

U.S. Securities and Exchange Commission (the “SEC”) on November 9, 2022, which is incorporated herein.

In the absence of additional

sources of liquidity, the Company’s existing cash and cash equivalents and anticipated cash flows from operations are not sufficient

to meet the Company’s current operating and liquidity needs. The Company’s special committee made up of independent, disinterested

directors is continuing discussions with IRG Canton Village Member, LLC (“IRG”), an affiliate of our director Stuart Lichter,

regarding its previously disclosed non-binding proposal to take the company private.

Cautionary Note Concerning Forward-Looking

Statements

Certain statements made in

this Form 8-K are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words and phrases such as “may,”

“until,” “future,” “will,” “would,” “anticipated,” “potential”

and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These

forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown

risks, uncertainties, assumptions, and other important factors, many of which are outside the Company’s control, which could cause

actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors that may affect

actual results or outcomes include, among others, the Company’s ability to secure additional sources of liquidity; remedies pursued

by Landlord for the event of default under the Waterpark Ground Lease; defaults under material agreements; the status of negotiations

regarding IRG’s non-binding proposal to take the Company private; potential litigation involving the Company, including any proceedings,

demands, actions, lawsuits and other claims that potentially could be made by the Company’s creditors and securityholders; the Company’s

ability to execute its business plan and meet its projections; changes in applicable laws or regulations; general economic and market

conditions impacting demand for the Company’s products and services, and in particular economic and market conditions in the resort

and entertainment industry; the inability to maintain the listing of the Company’s shares on Nasdaq; and those risks and uncertainties

discussed from time to time in our reports and other public filings with the SEC. The Company disclaims any obligation to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Document |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

HALL OF FAME RESORT & ENTERTAINMENT COMPANY |

| |

By: |

/s/ Michael Crawford |

| |

|

Name: Michael Crawford |

| |

|

Title: President and Chief Executive Officer |

| |

|

|

| Dated: October 31, 2024 |

|

|

3

v3.24.3

Cover

|

Oct. 26, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 26, 2024

|

| Entity File Number |

001-38363

|

| Entity Registrant Name |

HALL OF FAME RESORT & ENTERTAINMENT COMPANY

|

| Entity Central Index Key |

0001708176

|

| Entity Tax Identification Number |

84-3235695

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2014 Champions Gateway

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Canton

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44708

|

| City Area Code |

330

|

| Local Phone Number |

458-9176

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

HOFV

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase 0.064578 shares of Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase 0.064578 shares of Common Stock

|

| Trading Symbol |

HOFVW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HOFV_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HOFV_WarrantsToPurchase0.064578SharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

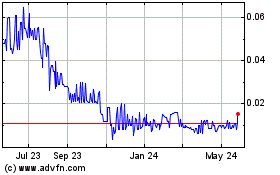

Hall of Fame Resort and ... (NASDAQ:HOFVW)

Historical Stock Chart

From Feb 2025 to Mar 2025

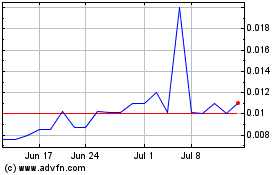

Hall of Fame Resort and ... (NASDAQ:HOFVW)

Historical Stock Chart

From Mar 2024 to Mar 2025