Reborn Coffee, Inc. (NASDAQ: REBN) ("Reborn", or the "Company"), a

California-based retailer of specialty coffee, has reported its

financial and operational results for the fiscal year ended

December 31, 2023.

Key Financial and Operational

Highlights

- Revenue increased 109% to $1.8

million in Q4'23 from $0.9 million in Q4'22.

- Revenue increased 84% to $6.0

million in FY'23 from $3.2 million in FY'22.

- Ended FY'23 with 14 open locations,

with one location in development.

- Company-operated

store sales increased to $5.7 million, or 79%, in the year ended

December 31, 2023, compared to the same period in 2022.

- Company-operated

store gross profit was $4.0 million for the year ended December 31,

2023, compared to $2.1 million for the same period in 2022.

Q4 2023 and Subsequent

Events

- Held grand

opening of a new flagship store under the newly incorporated Reborn

Coffee Malaysia, at the Exchange TRX mall in Kuala Lumpur,

Malaysia.

- Strategic

partnership with Sheikh Hamed, the respected owner of Abu Dhabi's

Millennium Hotel, paving the way for Reborn’s dynamic entry into

the vibrant UAE market, establishing its first retail location in

Abu Dhabi, UAE.

- Partnered with

pet fashion brand Sgt. Puppa to offer pet attire and accessories at

pet social café set to open in Pasadena, CA in May 2024.

- Partnered with

TOUS les JOURS, a franchise French-Asian bakery café chain, to

bring an exclusive Valentine's Day coffee blend to TOUS les JOURS'

Cerritos, California flagship location and through ecommerce.

- Announced a

strategic partnership with Hour Loop (NASDAQ: HOUR), a leading

online retailer engaged in e-commerce, to offer the Company's

high-quality coffee products on Amazon through the Amazon

Marketplace program.

- Expanded

partnership with Hour Loop to offer new Reborn branded Organic

Volcanic Tea through the Amazon Marketplace program.

- Closed a $1.0

million private placement equity investment from accredited

investor, allowing Reborn Coffee to continue expanding its

footprint both in the U.S. and internationally.

- Closed a $1.0

million private placement equity investment from Chairman Farooq

Arjomand to further enhance product offerings and expand market

reach.

- Converted $1.0

million of outstanding debt held by the Company's Vice Chairman of

the Board of Directors, Dennis Egidi, into common equity.

Management Commentary

“The fourth quarter of 2023 was highlighted by

record revenue growth, improving margins, the launch of a flagship

store in Kuala Lumpur, and a strengthened balance sheet to continue

our global expansion,” said Jay Kim, Chief Executive Officer of

Reborn. “Our company-operated record store sales were driven by

operational execution across our retail locations, which also drove

fourth quarter store margins up 710 basis points to 73.2%. We

continued to leverage our ongoing store revenue growth, supported

by new products and strategic marketing initiatives, to focus on

strategic expansion into new online and geographic channels.

“Internationally, we announced the grand opening

of a new flagship store under the newly incorporated Reborn Coffee

Malaysia, at the Exchange TRX mall in Kuala Lumpur, Malaysia during

the quarter. The Exchange TRX is a 17-acre integrated development

set to become one of Asia's leading lifestyle hubs, including world

class shopping and dining, residential homes and office spaces. Our

global expansion initiatives and launch into the Southeast Asian

market aligns with our brand ethos and are anticipated to

significantly augment revenue streams. We also continued to make

progress with our partner Sheikh Hamed, the respected owner of Abu

Dhabi's Millennium Hotel, to establish our first retail location in

Abu Dhabi, UAE.

“To drive additional customer engagement, we

launched several new partner initiatives during the quarter and in

early 2024. A strategic partnership with pet fashion brand Sgt.

Puppa, a fashion and lifestyle brand for trendy pooches and their

families, will add a specially curated selection of pet attire and

accessories at the Reborn Pet Social Cafe launching in the second

quarter. The enthusiastic response to our Reborn Pet Social Cafe

announcement motivated us to elevate this concept with Sgt. Puppa's

exclusive product line, aiming to significantly boost sales.

“A special distribution partnership with TOUS

les JOURS, a franchise French-Asian bakery café chain, for an

exclusive Valentine's Day coffee blend gave us the opportunity to

introduce Reborn to customers at TOUS les JOURS' Cerritos,

California flagship location. The blend was also available via our

website and online ecommerce platform, highlighting our solidified

presence in the ecommerce space. We continue to demonstrate

remarkable growth and reach through leading online platforms,

including Amazon. With an established strategic partnership with

Hour Loop and direct sales through our website, we are well

positioned to distribute our premium coffee products more

efficiently and effectively to customers nationwide.

“Operationally during the quarter, we took the

opportunity to strengthen our balance sheet in anticipation of

strategic milestones in 2024. Two investments totaling $2.0 million

will allow us to continue expanding our footprint in the U.S. and

internationally, as well as provide working capital and funds for

general corporate purposes. We also exchanged debt for equity with

our longstanding Director, reducing our debt by $1.0 million. This

conversion strengthens the company's financial structure and

signals to investors and stakeholders the promising future that

lies ahead for Reborn.

“Looking ahead into 2024, we are highly focused

on our retail expansion strategy, preparing for new company-owned

retail locations in Southern California and new flagships in states

such as Texas, as well as global locations including South Korea,

Austria, and Dubai with our partners. In partnership with a leading

online retailer, we are driving e-commerce expansion to a national

audience. We continue to seek new partnerships and opportunities

that will increase customer engagement and broaden our service

portfolio. Taken together, our strong customer demand, new product

innovation and effective operational execution across our retail

locations will empower us to continue our momentum and build long

term shareholder value,” concluded Kim.

Anticipated Milestones

- Open 4 flagship

Reborn Café locations in the U.S., targeting cities such as San

Francisco, San Diego, Houston, and Kansas City.

- Open up to 20

company-owned retail locations.

- Open up to 20

Franchised locations nationwide.

- Open 10+

overseas locations outside the U.S., targeting countries such as

South Korea, Malaysia, Dubai, Indonesia, Kazakhstan, India,

Thailand, and the UK.

- Flagship Store

in Daejeon, South Korea: Showcasing the Cutting-Edge 4th Wave

Coffee Concept. Home to a State of the Art Roasting R&D

Facility for innovation.

- Open First Pet

Friendly Indoor Café “Reborn N Pet Social in city of Pasadena

California.

- Joint R&D

projects with coffee farms in locations such as Hawaii, Colombia,

Ethiopia and Indonesia.

- Expand B2B

marketing to wholesale clubs and other major outlets and expand

ecommerce marketing with online initiatives by launching its own

Amazon marketplace.

- Launch of Reborn

Mobile App services.

- Launch new

Reborn-branded products such red tea bag packs and cold brew

cans.

Fourth Quarter and Fiscal Year 2023

Financial Results

Revenues were $1.8 million for the three months

ended December 31, 2023, compared to $0.9 million for the

comparable period in 2022, representing an increase of 109%.

Revenue increased 84% in the year ending December 31, 2023, to $6.0

million, up from $3.2 million for the comparable period in 2022.

The increase in sales for the periods was primarily driven by the

opening of new locations, and the continued focus on marketing

efforts to grow brand recognition.

Company-operated store gross profit was $1.2

million for the three-month period ended December 31, 2023,

compared to $0.6 million for the comparable period in 2022. Q4'23

company-operated store gross margins improved to 73.2% compared to

66.1% for the same period in 2022.

Company-operated store gross profit was $4.0

million for the year ended December 31, 2023, compared to $2.1

million for the same period in 2022. Year-over-year

company-operated store gross margins improved to 69.2%.

Total operating costs and expenses for the

three-month period ended December 31, 2023, were $2.8 million

compared to $2.0 million for the comparable period in 2022,

representing an increase of 39%. Total operating costs and expenses

for the year ended December 31, 2023, were $9.8 million compared to

$6.8 million for the comparable period in 2022, representing an

increase of 45%.

Net loss for the fourth quarter of 2023 was $1.0

million, compared to a net loss of $1.1 million for the fourth

quarter of 2022. Net loss for the year ending December 31, 2023,

was $4.0 million, compared to a net loss of $3.6 million for the

year ending December 31, 2022.

Net cash used in operating activities for the

twelve months ended December 31, 2023, was $2.9 million, compared

to $3.3 million for the twelve months ended December 31, 2022.

Cash and cash equivalents totaled $0.7 million

as of December 31, 2023, compared to $3.0 million as of December

31, 2022.

About Reborn Coffee

Reborn Coffee, Inc. (NASDAQ: REBN) is focused on

serving high quality, specialty-roasted coffee at retail locations,

kiosks, and cafes. Reborn is an innovative company that strives for

constant improvement in the coffee experience through exploration

of new technology and premier service, guided by traditional

brewing techniques. Reborn believes they differentiate themselves

from other coffee roasters through innovative techniques, including

sourcing, washing, roasting, and brewing their coffee beans with a

balance of precision and craft. For more information, please visit

www.reborncoffee.com.

Forward-Looking Statements

All statements in this release that are not

based on historical fact are "forward-looking statements." While

management has based any forward-looking statements included in

this release on its current expectations, the information on which

such expectations were based may change. Forward-looking statements

involve inherent risks and uncertainties which could cause actual

results to differ materially from those in the forward-looking

statements, as a result of various factors including those risks

and uncertainties described in the Risk Factors and Management's

Discussion and Analysis of Financial Condition and Results of

Operations sections of our recent filings with the Securities and

Exchange Commission ("SEC") including our Form 10-K for the year

ended December 31, 2023, which can be found on the SEC's website at

www.sec.gov. Such risks, uncertainties, and other factors include,

but are not limited to, the Company's ability to continue as a

going concern as indicated in an explanatory paragraph in the

Company's independent registered public accounting firm's audit

report as a result of recurring net losses, among other things, the

Company's ability to successfully open the additional locations

described herein as planned or at all, the Company's ability to

expand its business both within and outside of California

(including as it relates to increasing sales and growing Average

Unit Volumes at our existing stores), the degree of customer

loyalty to our stores and products, the impact of COVID-19 on

consumer traffic and costs, the fluctuation of economic conditions,

competition and inflation. We urge you to consider those risks and

uncertainties in evaluating our forward-looking statements. We

caution readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date made.

The Company undertakes no obligation to update these statements for

revisions or changes after the date of this release, except as

required by law.

Contacts

Investor Relations Contact:Chris TysonExecutive

Vice PresidentMZ North AmericaREBN@mzgroup.us 949-491-8235

Company Contact:Reborn Coffee,

Inc.ir@reborncoffee.com

| |

|

Consolidated Balance Sheet |

|

|

|

December 31, |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

ASSETS |

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

676,448 |

|

|

$ |

3,019,035 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $0

and $0, respectively |

|

|

47,361 |

|

|

|

780 |

|

|

Inventories, net |

|

|

166,281 |

|

|

|

132,343 |

|

|

Prepaid expense and other current assets |

|

|

773,949 |

|

|

|

477,850 |

|

|

Total current assets |

|

|

1,664,039 |

|

|

|

3,630,008 |

|

|

Property and equipment, net |

|

|

2,100,146 |

|

|

|

1,581,805 |

|

|

Operating lease right-of-use asset |

|

|

4,227,815 |

|

|

|

3,010,564 |

|

|

Other assets |

|

|

1,008,419 |

|

|

|

235,164 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

9,000,419 |

|

|

$ |

8,457,541 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

399,346 |

|

|

$ |

87,809 |

|

|

Accrued expenses and current liabilities |

|

|

598,468 |

|

|

|

233,053 |

|

|

Loans payable to financial institutions |

|

|

791,353 |

|

|

|

44,664 |

|

|

Loan payable to other |

|

|

300,000 |

|

|

|

- |

|

|

Current portion of loan payable, emergency injury disaster loan

(EIDL) |

|

|

30,060 |

|

|

|

30,060 |

|

|

Current portion of loan payable, payroll protection program

(PPP) |

|

|

45,678 |

|

|

|

45,678 |

|

|

Current portion of operating lease liabilities |

|

|

847,990 |

|

|

|

624,892 |

|

| Total current liabilities |

|

|

3,012,895 |

|

|

|

1,066,156 |

|

|

Loans payable to financial institutions, less current portion |

|

|

335,147 |

|

|

|

6,234 |

|

|

Loan payable, emergency injury disaster loan (EIDL), less current

portion |

|

|

469,940 |

|

|

|

469,940 |

|

|

Loan payable, payroll protection program (PPP), less current

portion |

|

|

51,595 |

|

|

|

98,697 |

|

|

Operating lease liabilities, less current portion |

|

|

3,556,999 |

|

|

|

2,529,985 |

|

| Total liabilities |

|

|

7,426,576 |

|

|

|

4,171,012 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Common Stock, $0.0001 par value, 40,000,000 shares authorized; and

14,929,390 and 13,162,723 shares issued and outstanding at December

31, 2023 and 2022, respectively |

|

|

1,493 |

|

|

|

1,316 |

|

|

Preferred Stock, $0.0001 par value, 1,000,000 shares authorized; no

shares issued and outstanding at December 31, 2023 and 2022 |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

17,601,837 |

|

|

|

16,317,014 |

|

|

Accumulated deficit |

|

|

(16,029,487 |

) |

|

|

(12,031,801 |

) |

|

Total stockholders’ equity |

|

|

1,573,843 |

|

|

|

4,286,529 |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

9,000,419 |

|

|

$ |

8,457,541 |

|

| |

|

Consolidated Statements of Operations |

| |

|

Years Ended December 31, |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Net

revenues: |

|

|

|

|

|

|

|

Stores |

|

$ |

5,712,630 |

|

|

$ |

3,184,491 |

|

|

Wholesale and online |

|

|

241,356 |

|

|

|

56,032 |

|

|

Total net revenues |

|

|

5,953,986 |

|

|

|

3,240,523 |

|

| |

|

|

|

|

|

|

|

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

Product, food and drink costs—stores |

|

|

1,758,494 |

|

|

|

1,092,573 |

|

|

Cost of sales—wholesale and online |

|

|

105,714 |

|

|

|

24,542 |

|

|

General and administrative |

|

|

7,967,856 |

|

|

|

5,663,950 |

|

|

Total operating costs and expenses |

|

|

9,832,064 |

|

|

|

6,781,065 |

|

| |

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(3,878,078 |

) |

|

|

(3,540,542 |

) |

| |

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

(6,283 |

) |

|

|

16,440 |

|

|

Interest expense |

|

|

(129,480 |

) |

|

|

(29,195 |

) |

|

Gain on the sale of building |

|

|

16,955 |

|

|

|

- |

|

| Total other income (expense),

net |

|

|

(118,808 |

) |

|

|

(12,755 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(3,996,886 |

) |

|

|

(3,553,297 |

) |

| |

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

|

800 |

|

|

|

1,600 |

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,997,686 |

) |

|

$ |

(3,554,897 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per share: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.30 |

) |

|

$ |

(0.29 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

13,230,613 |

|

|

|

12,173,031 |

|

| |

|

Consolidated Statements of Cash Flows |

| |

|

Years Ended December 31, |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(3,997,686 |

) |

|

$ |

(3,554,897 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Stock compensation |

|

|

285,000 |

|

|

|

441,001 |

|

|

Operating lease |

|

|

271,854 |

|

|

|

21,065 |

|

|

Depreciation |

|

|

262,019 |

|

|

|

210,616 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(46,581 |

) |

|

|

(780 |

) |

|

Inventories |

|

|

(33,938 |

) |

|

|

(43,466 |

) |

|

Prepaid expense and other current

assets |

|

|

(1,069,354 |

) |

|

|

(521,176 |

) |

|

Accounts payable |

|

|

311,537 |

|

|

|

42,062 |

|

|

Accrued expenses and current

liabilities |

|

|

1,226,193 |

|

|

|

108,518 |

|

|

Net cash used in

operating activities |

|

|

(2,790,956 |

) |

|

|

(3,297,058 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(1,019,353 |

) |

|

|

(681,531 |

) |

|

Net cash used in investing

activities |

|

|

(1,019,353 |

) |

|

|

(681,531 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

- |

|

|

|

7,200,000 |

|

|

Payment for offering costs |

|

|

- |

|

|

|

(997,870 |

) |

|

Proceeds from Line of Credit |

|

|

1,000,000 |

|

|

|

685,961 |

|

|

Repayment of Line of Credit |

|

|

- |

|

|

|

(685,961 |

) |

|

Proceeds from loans |

|

|

514,824 |

|

|

|

262,215 |

|

|

Repayments of loans |

|

|

(47,102 |

) |

|

|

(355,783 |

) |

|

Repayments of equipment loan payable |

|

|

- |

|

|

|

(15,989 |

) |

|

Net cash provided by financing

activities |

|

|

1,467,722 |

|

|

|

6,092,573 |

|

| |

|

|

|

|

|

|

|

|

| Net (decrease) increase in

cash |

|

|

(2,342,587 |

) |

|

|

2,113,984 |

|

| |

|

|

|

|

|

|

|

|

| Cash at beginning of

period |

|

|

3,019,035 |

|

|

|

905,051 |

|

| |

|

|

|

|

|

|

|

|

| Cash at end of period |

|

$ |

676,448 |

|

|

$ |

3,019,035 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of non-cash financing activities: |

|

|

|

|

|

|

|

|

|

Conversion of credit line to common stock issuances |

|

$ |

1,000,000 |

|

|

$ |

|

|

|

Issuance of common shares for service |

|

$ |

285,000 |

|

|

$ |

441,000 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid during the years for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

129,000 |

|

|

$ |

8,500 |

|

|

Income taxes |

|

$ |

800 |

|

|

$ |

1,600 |

|

|

Lease liabilities and assets |

|

$ |

1,240,000 |

|

|

$ |

903,000 |

|

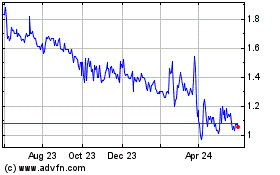

Hour Loop (NASDAQ:HOUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

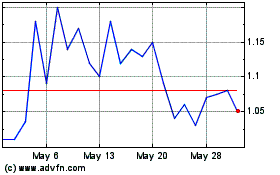

Hour Loop (NASDAQ:HOUR)

Historical Stock Chart

From Dec 2023 to Dec 2024