Report of Foreign Issuer (6-k)

02 May 2020 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2020

Commission File Number: 001-34656

Huazhu Group Limited

(Translation of registrant’s name into English)

No. 2266

Hongqiao Road

Changning District

Shanghai 200336

People’s Republic of China

(86) 21 6195-2011

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): ☐

Huazhu Group Limited (the “Company”) completed the acquisition of all shares of Steigenberger

Hotels Aktiengesellschaft (“Deutsche Hospitality”) on January 2, 2020. The financial statements of Deutsche Hospitality for the year ended December 31, 2019 were prepared in accordance with the International Financial Reporting

Standards, or IFRS, as issued by the International Accounting Standards Board. The unaudited pro forma condensed combined financial information included in Exhibit 99.2 to this report on Form 6-K has been

prepared using the acquisition method of accounting under existing U.S. generally accepted accounting principles, or U.S. GAAP. The unaudited pro forma condensed combined financial information is based on certain assumptions and pro forma

adjustments, which are preliminary and subject to further revisions as additional information becomes available and additional analyses are performed, including the final assessment of the determination of differences between IFRS and U.S. GAAP, and

of the application of purchase price adjustments, and which have been made solely for the purpose of providing unaudited pro forma condensed combined financial information. The table below sets forth the reconciliation of EBITDA to unaudited net

loss extracted from the unaudited pro forma condensed combined financial information, which is the most directly comparable U.S. GAAP measure, for the year ended December 31, 2019 of Deutsche Hospitality:

|

|

|

|

|

|

|

|

|

Year Ended

December 31,

|

|

|

|

|

2019

|

|

|

|

|

(EUR in millions)

|

|

|

Unaudited net loss attributable to Deutsche Hospitality (U.S. GAAP)

|

|

|

(2

|

)

|

|

Interest income

|

|

|

(0

|

)

|

|

Interest expense

|

|

|

13

|

|

|

Income tax expense

|

|

|

3

|

|

|

Depreciation and amortization

|

|

|

28

|

|

|

|

|

|

|

|

|

EBITDA (Non-GAAP)

|

|

|

42

|

|

|

|

|

|

|

|

Note:

The Company uses earnings before interest income, interest expense, income tax expense (benefit) and depreciation and amortization, or EBITDA, a non-GAAP financial measure, to assess Deutsche Hospitality’s results of operations before the impact of investing and financing transactions and income taxes. Given the significant investments that Deutsche

Hospitality has made in leasehold improvements, depreciation and amortization expense comprises a significant portion of Deutsche Hospitality’s cost structure. The Company believes that EBITDA is widely used by other companies in the lodging

industry and may be used by investors as a measure of Deutsche Hospitality’s financial performance.

The presentation of EBITDA should not be

construed as an indication that future results of Deutsche Hospitality will be unaffected by other charges and gains that Company considers to be outside the ordinary course of Deutsche Hospitality’s business. The use of EBITDA has certain

limitations. Depreciation and amortization expense, income tax, interest income and interest expense have been and will be incurred and are not reflected in the presentation of EBITDA. Each of these items should also be considered in the overall

evaluation of the results of Deutsche Hospitality. Additionally, EBITDA does not consider capital expenditures or other investing activities and should not be considered as a measure of Deutsche Hospitality’s liquidity.

The term EBITDA is not defined under U.S. GAAP or IFRS, and EBITDA is not a measure of net income, operating income, operating performance or liquidity

presented in accordance with U.S. GAAP or IFRS. When assessing the operating and financial performance of Deutsche Hospitality, you should not consider these data in isolation or as a substitute for its net income, operating income or any other

operating performance measure that is calculated in accordance with U.S. GAAP. In addition, EBITDA of Deutsche Hospitality may not be comparable to EBITDA or similarly titled measures utilized by other companies since such other companies may not

calculate EBITDA in the same manner as the Company does for Deutsche Hospitality.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Huazhu Group Limited

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: May 1, 2020

|

|

|

|

By:

|

|

/s/ Qi Ji

|

|

|

|

|

|

Name:

|

|

Qi Ji

|

|

|

|

|

|

Title:

|

|

Executive Chairman of the Board of Directors,

Chief Executive Officer

|

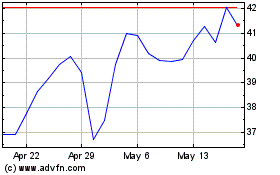

H World (NASDAQ:HTHT)

Historical Stock Chart

From Jun 2024 to Jul 2024

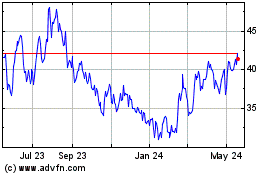

H World (NASDAQ:HTHT)

Historical Stock Chart

From Jul 2023 to Jul 2024