false

0000822663

0000822663

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported):

February 27, 2024

Inter

Parfums, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware |

|

0-16469 |

|

13-3255609 |

(State or other jurisdiction

of

incorporation or organization) |

|

Commission

File Number |

|

(I.R.S. Employer

Identification No.) |

551

Fifth Avenue, New

York, New

York 10176

(Address of Principal Executive Offices)

212.

983.2640

(Registrant’s Telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligations of the registrant under any of

the following provisions (see General Instruction A.2 below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting Material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 280.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 280.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 280.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $.001 par value per share |

|

IPAR |

|

The

Nasdaq Stock Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§280.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition

Certain

portions of our press release dated February 27, 2024, a copy of which is annexed hereto as Exhibit no. 99.1, are incorporated by reference

herein, and are filed pursuant to this Item 2.02. They are as follows:

●

The 1st through 6th, paragraphs and portions of the 7th, 9th and 10th paragraphs

a relating to results of operations

●

The 11th through 14th paragraphs relating to results of operations, and the 15th paragraph relating

to balance sheet information

●

The 22nd through 25th paragraphs relating to the conference call to be held on February 28, 2024

●

The tables of unaudited consolidated statements of income and consolidated balance sheets

Item

7.01. Regulation FD Disclosure

Certain

portions of our press release dated February 27, 2024, a copy of which is annexed hereto as Exhibit no. 99.1, are incorporated by reference

herein, and are filed pursuant to this Item 7.01 and Regulation FD. They are as follows:

●

The 8th and 9th full paragraphs and portions of the 10th paragraph relating to 2024 new product launches

and brand extensions

●

Paragraphs 16 through 18 relating to 2024 guidance

●

Paragraphs 26 and 27, about Inter Parfums, Inc.

●

Portions of the 7th paragraph and paragraph 28 relating to forward looking statements

●

The balance of such press release not otherwise incorporated by reference in Items 2.02 or 8.01

Item

8.01 Other Matters

Certain

portions of our press release dated February 27, 2024, a copy of which is annexed hereto as Exhibit no. 99.1, are incorporated by reference

herein, and are filed pursuant to this Item 8.01. They are as follows:

●

The 19th and 20th paragraphs relating to the increase of our cash dividend are incorporated by reference herein.

●

The 21st paragraph relating to the Share Buyback Program

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused and authorized this report to be signed

on its behalf by the undersigned.

Dated:

February 27, 2024

| |

Inter Parfums, Inc. |

| |

|

| |

By: |

/s/

Michel Atwood |

| |

|

Michel Atwood |

| |

|

Chief Financial Officer |

Exhibit

99.1

FOR

IMMEDIATE RELEASE

INTER

PARFUMS, INC. REPORTS 2023 FOURTH QUARTER AND RECORD FULL YEAR RESULTS

Delivers

2023 Target EPS, Announces 20% Increase in Cash Dividend, and Affirms 2024 Guidance

New

York, New York, February 27, 2024, Inter Parfums, Inc. (NASDAQ GS: IPAR) today reported results for the fourth quarter and full

year ended December 31, 2023.

Fourth

Quarter & Full Year Highlights:

($

in millions, except per share amounts) |

Three

Months Ended

December

31, |

Year

Ended

December

31, |

| 2023 |

2022 |

%

Change |

2023 |

2022 |

%

Change |

| Net

Sales |

$329 |

$311 |

6% |

$1,318 |

$1,087 |

21% |

| Gross

Margin |

64.7% |

64.4% |

+30

bps |

63.7% |

63.9% |

(20

bps) |

| Operating

Income |

$19 |

$23 |

(19%) |

$251 |

$194 |

29% |

| Operating

Margin |

5.7% |

7.5% |

(170

bps) |

19.1% |

17.9% |

+120

bps |

| Net

Income attributable to IP |

$10 |

$17 |

(37%) |

$153 |

$121 |

26% |

| Diluted

EPS |

$0.32 |

$0.52 |

(37%) |

$4.75 |

$3.78 |

26% |

| At

comparable foreign currency exchange rates, consolidated net sales for the three months and year ended December 31, 2023,

increased 4% and 20%, respectively, compared to the same periods in 2022. Of note, the average dollar/euro exchange rate for

the 2023 fourth quarter was 1.08 compared to 1.02 in the fourth quarter of 2022, while for the full year, the average dollar/euro

exchange rate for 2023 was 1.08 compared to 1.05 in 2022, leading to a positive 2% foreign exchange impact for net sales for

the fourth quarter and 1% for the full year. |

Operational

Commentary

Jean

Madar, Chairman & Chief Executive Officer of Inter Parfums noted, “Ongoing demand for our brands, strong holiday season

sell-through, and a dynamic fragrance market resulted in a strong 2023 fourth quarter and record full year net sales and earnings

results.

“Of

special note, for the first time ever, each of our three largest brands generated sales in excess of $200 million. In 2023, Jimmy

Choo emerged as our largest brand, growing sales by 19%, and Montblanc and Coach sales rose by 15% and 25%, respectively.

“Our

fourth largest brand, GUESS, grew sales by a robust 23%. With a strategically planned pipeline of innovation, the brand is well

on its way to also exceed $200 million in sales in the coming years. Lastly, with growth of 21% for 2023, the fragrance sales

performance of Ferragamo has remained strong and continues to present significant growth opportunity.”

He

continued, “Especially gratifying, all of our markets experienced excellent growth last year. North America, Europe, and

Asia, our three largest markets, achieved sales gains of 22%, 21% and 17%, respectively. Our sales in the Middle East rose by

22% and Central and South America by 33%.

“Travel

retail and China sales did not have a meaningful effect on our sales, as they constitute a small portion of our business. We continue

to believe the Chinese market and travel retail offer great promise and stand ready to make strategic investments to grow our

business in China when the market opportunity aligns with market visibility.”

Mr.

Madar continued, “The new year is on track for continued growth as our aggressive advertising and promotion spend in the

fourth quarter drove sell-through for our retail partners, enabling 2024 first half restocking orders. Initial shipments of Lacoste

fragrances began in January, and Roberto Cavalli fragrances started shipping in February. Since signing both license agreements,

we have curated their collections and revitalized their best sellers. We are also developing impactful omnichannel advertising

and promotional campaigns to welcome back brand loyalists and attract influential fragrance enthusiasts to the newest members

of our fragrance portfolio.

“Following

initial success with Phase 1 of our Abercrombie & Fitch Fierce roll-out in certain major markets, including Europe,

Mexico, and Australia, in the final quarter of 2023, we have commenced with Phase 2 this year, further expanding into Western

Europe and Latin America, and may include other flankers of the Fierce family of products.

“We

recently introduced the highly concentrated, four scent luxury Cashmere Collection for Donna Karan and, across our brand

portfolio, we have a vibrant pipeline of new product launches in the works unveiling throughout 2024 including a new blockbuster

fragrance debuting for Lacoste,” Mr. Madar concluded.

Financial

Commentary

Michel

Atwood, Chief Financial Officer of Inter Parfums pointed out, “We achieved our 2023 bottom line goal of $4.75 per diluted

share despite a $3.1 million tax assessment as the result of a tax audit undergone by our majority owned French subsidiary, Interparfums

SA, for the 2020 and 2021 tax years. Excluding this one-time impact, we would have delivered $4.82 per diluted share for the full

year, largely beating our guidance.”

Mr.

Atwood continued, “Consolidated gross margin as a percentage of net sales for 2023 and 2022 was nearly identical, with higher

selling prices and channel/product mix offsetting the inflation headwinds and segment mix.

“SG&A

as a percentage of net sales declined to 44.6% from 45.3% in 2022, largely driven by sales growth during 2023, which allowed for

better absorption of fixed operating costs and favorable segment mix. While we spent $107 million in the fourth quarter, a 23%

increase compared to same period in 2022, we finished the year below our advertising and promotion target of 21% of net sales,

coming in at 19.7% due in part to better than expected sales.

“These

factors led to $251 million in operating income, a 29% increase compared to 2022, and an operating profit margin of 19%, a 120

basis-point improvement from 2022,” Mr. Atwood pointed out.

“Finally,

our financial position remains strong. We closed the year with $183 million in cash, cash equivalents and short term investments,

and working capital of $514 million resulting in a working capital ratio of 2.6 to 1.”

Reaffirms

2024 Guidance

Mr.

Atwood concluded, “We are a global Company operating in over 120 countries, and while the fragrance industry remains strong,

and retailers finished the year with healthy inventories, the political climate both in the Middle East and throughout Eastern

Europe leads us to keep our guidance unchanged due to lack of visibility. As the year unfolds and we attain greater clarity, we

will revisit our guidance. At this time, we are reaffirming our 2024 guidance, which calls for net sales of $1.45 billion, resulting

in earnings per diluted share of $5.15. This represents a 10% increase in net sales and an 8% increase in earnings per diluted

share.

“As

we previously reported and included in our guidance, the Lacoste non-cash amortization expense of the acquisition cost is expected

to reduce our 2024 earnings per diluted share by approximately $0.11.”

Guidance

assumes that the average dollar/euro exchange rate remains at current levels.

Announces

20% Increase in Cash Dividend

Mr.

Atwood also announced, “Our Board of Directors approved a 20% increase in the annual dividend to $3.00 per share. The decisive

factors motivating our board's decision include our robust financial standing, promising growth opportunities, and commitment

to delivering value to our shareholders.”

The

next quarterly cash dividend of $0.75 per share is payable on March 29, 2024 to shareholders of record on March 15, 2024.

Share

Buyback Program

In

December 2022, our Board of Directors authorized a share repurchase program for our outstanding common stock. During 2023, the

Company repurchased 116,860 shares at a cost of $15.4 million. These shares are classified as treasury shares on the accompanying

consolidated balance sheet. In February 2024, our Board of Directors authorized the Company to continue repurchasing up to 130,000

shares throughout 2024.

Conference

Call

Management

will conduct a conference call to discuss financial results and business developments at 11:00 am ET on Wednesday, February 28,

2024.

Interested

parties may participate in the live call by dialing (877) 423-9820 (toll-free) or (201) 493-6749 (international).

Participants

are asked to dial-in approximately 10 minutes before the conference call is scheduled to begin.

A

live audio webcast will also be available in the “Events” tab within the Investor Relations section of the Company’s

website at www.interparfumsinc.com, or by clicking here. The conference call will be available for webcast replay

for approximately 90 days following the live event.

About

Inter Parfums, Inc.

Operating

in the global fragrance business since 1982, Inter Parfums, Inc. produces and distributes a wide array of prestige fragrance and

fragrance-related products under license agreements with brand owners. The Company manages its business in two operating segments,

European based operations, through its 72% owned subsidiary, Interparfums SA, and United States based operations, through wholly

owned subsidiaries in the United States and Italy.

The

portfolio of prestige brands includes Abercrombie & Fitch, Anna Sui, Boucheron, Coach, Donna Karan/DKNY, Emanuel Ungaro, Ferragamo,

Graff, GUESS, Hollister, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lacoste, MCM, Moncler, Montblanc, Oscar de la Renta, Roberto

Cavalli, and Van Cleef & Arpels, whose products are distributed in over 120 countries around the world through an extensive

and diverse network of distributors. Inter Parfums, Inc. is also the registered owner of several trademarks including Lanvin and

Rochas.

Forward-Looking

Statements

Statements

in this release which are not historical in nature are forward-looking statements. Although we believe that our plans, intentions,

and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such plans, intentions,

or expectations will be achieved. In some cases, you can identify forward-looking statements by forward-looking words such as

"anticipate," "believe," "could," "estimate," "expect," "intend,"

"may," "should," "will," and "would," or similar words. You should not rely on forward-looking

statements, because actual events or results may differ materially from those indicated by these forward-looking statements as

a result of a number of important factors. These factors include, but are not limited to, the risks and uncertainties discussed

under the headings “Forward Looking Statements” and "Risk Factors" in Inter Parfums' annual report on Form

10-K for the fiscal year ended December 31, 2023 and the reports Inter Parfums files from time to time with the Securities and

Exchange Commission. Inter Parfums does not intend to and undertakes no duty to update the information contained in this press

release.

Contact

Information:

| Inter Parfums, Inc. |

or |

The Equity Group Inc. |

| Michel Atwood |

|

Karin Daly |

| Chief Financial Officer |

|

Investor Relations Counsel |

| (212) 983-2640 |

|

(212) 836-9623 / kdaly@equityny.com |

| www.interparfumsinc.com |

|

www.theequitygroup.com |

See

Accompanying Tables

INTER PARFUMS, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2023, and 2022

(In thousands except

share and per share data)

| Assets | |

2023 | | |

2022 | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 88,462 | | |

$ | 104,713 | |

| Short-term investments | |

| 94,304 | | |

| 150,833 | |

| Accounts receivable, net | |

| 247,240 | | |

| 197,584 | |

| Inventories | |

| 371,859 | | |

| 289,984 | |

| Receivables, other | |

| 7,012 | | |

| 28,803 | |

| Other current assets | |

| 29,458 | | |

| 15,650 | |

| Income taxes receivable | |

| 691 | | |

| 157 | |

| Total current assets | |

| 839,026 | | |

| 787,724 | |

| Property, equipment and leasehold improvements, net | |

| 169,222 | | |

| 166,722 | |

| Right-of-use assets, net | |

| 28,613 | | |

| 27,964 | |

| Trademarks, licenses and other intangible assets, net | |

| 296,356 | | |

| 290,853 | |

| Deferred tax assets | |

| 14,545 | | |

| 11,159 | |

| Other assets | |

| 21,567 | | |

| 24,120 | |

| Total assets | |

$ | 1,369,329 | | |

$ | 1,308,542 | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Loans payable - banks | |

$ | 4,420 | | |

$ | -- | |

| Current portion of long-term debt | |

| 29,587 | | |

| 28,547 | |

| Current portion of lease liabilities | |

| 5,951 | | |

| 5,296 | |

| Accounts payable - trade | |

| 97,409 | | |

| 88,388 | |

| Accrued expenses | |

| 178,880 | | |

| 213,621 | |

| Income taxes payable | |

| 8,498 | | |

| 8,715 | |

| Total current liabilities | |

| 324,745 | | |

| 344,567 | |

| Long–term debt, less current portion | |

| 127,897 | | |

| 151,494 | |

| Lease liabilities, less current portion | |

| 24,517 | | |

| 24,335 | |

| Equity: | |

| | | |

| | |

| Inter Parfums, Inc. shareholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value. Authorized 1,000,000 shares: | |

| | | |

| | |

| none issued | |

| -- | | |

| -- | |

| Common stock, $0.001 par value. Authorized 100,000,000 shares: | |

| | | |

| | |

| outstanding, 32,004,660 and 31,967,300 shares | |

| | | |

| | |

| on December 31, 2023, and 2022, respectively | |

| 32 | | |

| 32 | |

| Additional paid-in capital | |

| 98,565 | | |

| 90,186 | |

| Retained earnings | |

| 693,848 | | |

| 620,095 | |

| Accumulated other comprehensive loss | |

| (40,188 | ) | |

| (56,056 | ) |

| Treasury stock, at cost, 9,981,665 and 9,864,805 common shares | |

| | | |

| | |

| on December 31, 2023, and 2022, respectively | |

| (52,864 | ) | |

| (37,475 | ) |

| Total Inter Parfums, Inc. shareholders’ equity | |

| 699,393 | | |

| 616,782 | |

| Noncontrolling interest | |

| 192,777 | | |

| 171,364 | |

| Total equity | |

| 892,170 | | |

| 788,146 | |

| Total liabilities and equity | |

$ | 1,369,329 | | |

$ | 1,308,542 | |

| | |

| | | |

| | |

| INTER

PARFUMS, INC. AND SUBSIDIARIES |

| |

| Consolidated

Statements of Income |

| |

| (In

thousands except per share data) |

| |

| | |

Three

Months Ended

December 31, | | |

Twelve

Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net

sales | |

$ | 328,739 | | |

$ | 310,788 | | |

$ | 1,317,675 | | |

$ | 1,086,653 | |

| Cost

of sales | |

| 116,029 | | |

| 110,706 | | |

| 478,597 | | |

| 392,231 | |

| Gross

margin | |

| 212,710 | | |

| 200,082 | | |

| 839,078 | | |

| 694,422 | |

| Selling,

general and administrative expenses | |

| 193,830 | | |

| 169,122 | | |

| 587,696 | | |

| 492,370 | |

| Impairment

loss | |

| -- | | |

| 7,749 | | |

| -- | | |

| 7,749 | |

| Income

from operations | |

| 18,880 | | |

| 23,211 | | |

| 251,382 | | |

| 194,303 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other

expenses (income): | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| 4,223 | | |

| 1,010 | | |

| 11,253 | | |

| 3,599 | |

| Loss

(gain) on foreign currency | |

| 2,238 | | |

| 4,166 | | |

| 1,582 | | |

| 1,921 | |

| Interest

and investment (income) | |

| (2,308 | ) | |

| (3,145 | ) | |

| (10,729 | ) | |

| (5,486 | ) |

| Other

(income) expense | |

| (192 | ) | |

| 147 | | |

| (317 | ) | |

| 50 | |

| | |

| 3,961 | | |

| 2,178 | | |

| 1,789 | | |

| 84 | |

| Income

before income taxes | |

| 14,919 | | |

| 21,033 | | |

| 249,593 | | |

| 194,219 | |

| Income

taxes | |

| 6,689 | | |

| 4,104 | | |

| 61,817 | | |

| 43,182 | |

| Net

income | |

| 8,230 | | |

| 16,929 | | |

| 187,776 | | |

| 151,037 | |

| Less:

Net income attributable to the noncontrolling interest | |

| (2,190 | ) | |

| 330 | | |

| 35,122 | | |

| 30,099 | |

| Net

income attributable to Inter Parfums, Inc. | |

$ | 10,420 | | |

$ | 16,599 | | |

$ | 152,654 | | |

$ | 120,938 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

income attributable to Inter Parfums, Inc. common shareholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.33 | | |

$ | 0.52 | | |

$ | 4.77 | | |

$ | 3.80 | |

| Diluted | |

$ | 0.32 | | |

$ | 0.52 | | |

$ | 4.75 | | |

$ | 3.78 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average number of shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 31,977 | | |

| 31,893 | | |

| 31,994 | | |

| 31,859 | |

| Diluted | |

| 32,112 | | |

| 32,025 | | |

| 32,140 | | |

| 31,989 | |

| Dividends

declared per share | |

$ | 0.625 | | |

$ | 0.50 | | |

$ | 2.50 | | |

$ | 2.00 | |

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

0-16469

|

| Entity Registrant Name |

Inter

Parfums, Inc.

|

| Entity Central Index Key |

0000822663

|

| Entity Tax Identification Number |

13-3255609

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

551

Fifth Avenue,

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10176

|

| City Area Code |

212

|

| Local Phone Number |

983.2640

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $.001 par value per share

|

| Trading Symbol |

IPAR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

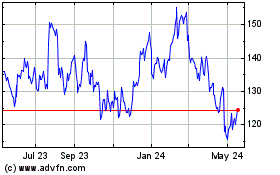

Inter Parfums (NASDAQ:IPAR)

Historical Stock Chart

From Apr 2024 to May 2024

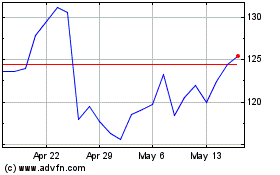

Inter Parfums (NASDAQ:IPAR)

Historical Stock Chart

From May 2023 to May 2024