false

0001760903

0001760903

2024-03-18

2024-03-18

0001760903

us-gaap:CommonStockMember

2024-03-18

2024-03-18

0001760903

SHOT:WarrantsEachExercisableForOneShareOfCommonStockAt8.50PerShareMember

2024-03-18

2024-03-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 18, 2024

SAFETY

SHOT, INC.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-39569 |

|

83-2455880 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1061

E. Indiantown Rd., Ste. 110, Jupiter, FL 33477

(Address

of principal executive offices) (Zip Code)

(561)

244-7100

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

SHOT |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

| |

|

|

|

|

| Warrants,

each exercisable for one share of Common Stock at $8.50 per share |

|

SHOTW |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure

On

March 18, 2024, Safety Shot, Inc. (the “Company”) issued a press release. A copy of the press release is furnished hereto

as Exhibit 99.1 and incorporated herein by reference.

Exhibits

9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

March 18, 2024

| SAFETY

SHOT, INC. |

|

| |

|

|

| By: |

/s/

Jarrett Boon |

|

| |

Jarrett

Boon |

|

| |

Chief

Executive Officer |

|

Exhibit

99.1

CEO

of Orangetheory Fitness David Long Joins Safety Shot’s Board of Directors

The

results-driven CEO will guide the development and marketing of the world’s very first rapid alcohol detox drink.

| |

● |

Long

has led Orangetheory Fitness through

countless pivotal achievements including the launch of two apps, the creation of a proprietary heart monitor with strategically chosen

partners, and the signing of celebrity brand ambassadors. |

| |

|

|

| |

● |

He

helped expand the European Wax Center concept

from 4 to over 550 locations in less than nine years. |

| |

|

|

| |

● |

He

spearheaded the boom of the therapeutic massage and skincare chain Massage Envy from 25 locations

to 800. |

JUPITER,

FL – March 18, 2024 – Safety Shot, Inc. (Nasdaq: SHOT) (the “Company), a pioneer in innovative well-being

solutions, is excited to announce that David J. Long, the CEO and co-founder of Orangetheory Fitness, has joined the company’s

Board of Directors.

Long

has over 20 years of experience in the fitness and wellness industries, leading and increasing growth for companies. He

has been instrumental in the early stages of several successful franchise brands including Massage Envy, European Wax Center and launching

his wildly successful fitness concept: Orangetheory Fitness.

In

the years since co-founding and leading Orangetheory, the brand has opened some 1,500-plus studios throughout 27 countries and has attracted

one million-plus members. The brand has also crossed the threshold to surpass $1 billion in systemwide sales, accruing more than

US$1.4 billion in annual revenue.

The

Orangetheory CEO regularly appears on television to reach large audiences and is a University of Florida alum who has achieved a lifelong

goal of being named #1 on the Gator100 list of fastest-growing, Gator-owned businesses in the world.

“Safety

Shot is set to change the paradigm of wellness by helping people to more rapidly hydrate and process alcohol consumption. I’m pleased

to join the Safety Shot team and am thrilled to support the launch of this exceptional product,” stated Long.

“We

welcome David to our Board of Directors. We are so proud and excited to bring an amazing asset like this to the Safety Shot team. We

are also excited for shareholders as David has built multiple billion-dollar brands. I am confident that Safety Shot could become the

next one,” stated Safety Shot Chairman of the Board John Gulyas.

About

Safety Shot

Safety

Shot, Inc., has developed a first-of-its-kind beverage that makes you feel better faster from the effects of alcohol by reducing blood

alcohol content and increasing mental clarity. Safety Shot leverages scientifically proven ingredients to enhance metabolic pathways

responsible for breaking down blood alcohol levels. The formulation includes a tailored selection of all-natural vitamins, minerals,

and nootropics, promoting faster alcohol breakdown and aiding in recovery and rehydration. Safety Shot has been available for retail

purchase since the first week of December 2023 at www.DrinkSafetyShot.com and www.Amazon.com. In addition, the Company

plans to introduce business-to-business sales to distributors, retailers, restaurants, and bars in 2024.

Forward

Looking Statements

This

communication contains forward-looking statements regarding Safety Shot, including, the anticipated timing of studies and the results

and benefits thereof. You can generally identify forward-looking statements by the use of forward-looking terminology such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “explore,”

“evaluate,” “intend,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “seek,” “should,” or “will,” or the negative thereof or other variations thereon

or comparable terminology. These forward-looking statements are based on each of the Company’s current plans, objectives, estimates,

expectations, and intentions and inherently involve significant risks and uncertainties, many of which are beyond Safety Shot’s

control. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as

a result of these risks and uncertainties and other risks and uncertainties affecting Safety Shot and, including those described from

time to time under the caption “Risk Factors” and elsewhere in Safety Shot’s Securities and Exchange Commission (SEC)

filings and reports, including Safety Shot’s Annual Report on Form 10-K for the year ended December 31, 2023 and future filings

and reports by Safety Shot. Moreover, other risks and uncertainties of which the combined company is not currently aware may also affect

each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from

those anticipated. Investors are cautioned that forward-looking statements are not guarantees of future performance. The forward-looking

statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements

and reflect the views stated therein with respect to future events at such dates, even if they are subsequently made available by Safety

Shot on its website or otherwise. Safety Shot undertakes no obligation to update or supplement any forward-looking statements to reflect

actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which

the forward-looking statements were made.

Media

Contact:

Phone:

904-477-2306

Email:

emily@pantelidespr.com

Investor

Contact:

Phone:

561-244-7100

Email:

investors@drinksafetyshot.com

v3.24.1

Cover

|

Mar. 18, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 18, 2024

|

| Entity File Number |

001-39569

|

| Entity Registrant Name |

SAFETY

SHOT, INC.

|

| Entity Central Index Key |

0001760903

|

| Entity Tax Identification Number |

83-2455880

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1061

E. Indiantown Rd.

|

| Entity Address, Address Line Two |

Ste. 110

|

| Entity Address, City or Town |

Jupiter

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33477

|

| City Area Code |

(561)

|

| Local Phone Number |

244-7100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| Common Stock [Member] |

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

SHOT

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock at $8.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock at $8.50 per share

|

| Trading Symbol |

SHOTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SHOT_WarrantsEachExercisableForOneShareOfCommonStockAt8.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

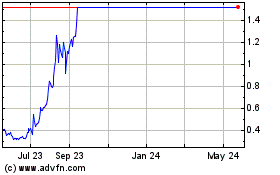

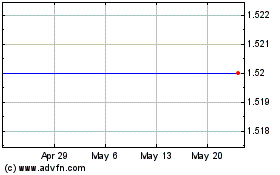

Jupiter Wellness (NASDAQ:JUPW)

Historical Stock Chart

From Apr 2024 to May 2024

Jupiter Wellness (NASDAQ:JUPW)

Historical Stock Chart

From May 2023 to May 2024