UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

KENTUCKY FIRST FEDERAL

BANCORP

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a- 6(i)(1) and 0-11 |

Parent Company of First Federal Savings and

Loan of Hazard

and First Federal Savings Bank of Kentucky

October 16, 2023

Dear Stockholder:

We invite you to attend the annual meeting of stockholders

of Kentucky First Federal Bancorp to be held at the Challenger Learning Center on the campus of Hazard Community and Technical College

located at One Community College Drive, Hazard, Kentucky on Thursday, November 16, 2023, at 4:30 p.m., Eastern time.

The attached proxy statement and accompanying notice

of annual meeting describe in detail the formal business to be transacted at the meeting. During the meeting, we will also report on the

Company’s operations to date. Directors and officers of Kentucky First Federal Bancorp, First Federal Savings and Loan Association

of Hazard, and First Federal Savings Bank of Kentucky will be present to respond to any questions the stockholders may have.

ON BEHALF OF THE BOARD OF DIRECTORS, WE URGE

YOU TO SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD AS SOON AS POSSIBLE EVEN IF YOU CURRENTLY PLAN TO ATTEND THE ANNUAL MEETING.

Your vote is important, regardless of the number of shares you own. Voting by proxy will not prevent you from voting in person but will

ensure that your vote is counted if you are unable to attend the annual meeting.

On behalf of the Board of Directors and all the

employees of Kentucky First Federal, First Federal of Hazard and First Federal of Kentucky, we wish to thank you for your continued support.

| Sincerely, |

|

Sincerely, |

| |

|

|

| /s/ Tony D.

Whitaker | |

/s/ Don D.

Jennings |

| Tony D. Whitaker |

|

Don D. Jennings |

| Chairman of the Board |

|

President and |

| |

|

Chief Executive Officer |

KENTUCKY FIRST FEDERAL BANCORP

655 Main Street

P.O. Box 1069

Hazard, Kentucky 41702

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE |

4:30

p.m. on Thursday, November 16, 2023 |

| |

|

| PLACE |

Challenger

Learning Center |

| |

Hazard

Community and Technical College Campus |

| |

One

Community College Drive |

| |

Hazard,

Kentucky 41701 |

| |

|

| ITEMS OF BUSINESS |

(1) |

To

elect two directors to serve for a term of three years; |

| |

|

|

| |

(2) |

To

ratify the selection of FORVIS, LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2024; |

| |

|

|

| |

(3) |

To

vote on a non-binding resolution to approve the compensation of the named executive officers; and |

| |

(4) |

Such

other business as may properly come before the meeting. Note: The Board of Directors is not aware of any other business to come before

the meeting. |

| RECORD DATE |

In

order to vote, you must have been a stockholder at the close of business on September 29, 2023. |

| |

|

| PROXY VOTING |

It

is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy

card or voting instruction card sent to you. You can revoke a proxy at any time prior to its exercise at the meeting by following

the instructions in the proxy statement. A copy of the proxy statement and the enclosed proxy card are also available on the Internet

at https://materials.proxyvote.com/491292. |

| |

|

| |

BY

ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/

Lee

Ann Hockensmith |

| |

Lee

Ann Hockensmith |

| |

Secretary |

Hazard,

Kentucky

October

16, 2023

KENTUCKY FIRST FEDERAL BANCORP

PROXY STATEMENT

GENERAL INFORMATION

We are providing this proxy statement to you in

connection with the solicitation of proxies by the Board of Directors of Kentucky First Federal Bancorp (“Kentucky First Federal”

or “the Company”) for the 2023 annual meeting of stockholders and for any adjournment or postponement of the meeting. The

annual meeting will be held at the Challenger Learning Center on the campus of Hazard Community and Technical College located at One Community

College Drive, Hazard, Kentucky on Thursday, November 16, 2023, at 4:30 pm., Eastern time, and at any adjournment thereof.

We intend to mail this proxy

statement and the enclosed proxy card to stockholders of record beginning on or about October 16, 2023.

NOTICE OF AVAILABILITY OF

PROXY MATERIALS

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Stockholders to be Held on November 16, 2023.

The proxy statement and the 2023 Annual Report

to Stockholders are available on the Internet at https://materials.proxyvote.com/491292.

Who Can Vote at the Meeting

You are entitled to vote the

shares of the Company’s common stock that you owned as of the close of business on September 29, 2023. As of the close of business

on September 29, 2023 (the “Record Date”), a total of 8,086,715 shares of the Company’s common stock were outstanding.

Each share of common stock is entitled to one vote.

Ownership

of Shares; Attending the Meeting

You

may own shares of Kentucky First Federal in one of the following ways:

| ● | Directly

in your name as the stockholder of record; |

| ● | Indirectly

through a broker, bank or other holder of record in “street name”; or |

| ● | Indirectly

in the Kentucky First Federal Employee Stock Ownership Plan (“ESOP”). |

If

your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials

directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the annual meeting.

If

you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial

owner, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction card

that accompanies your proxy materials. Your broker, bank or other holder of record may allow you to provide voting instructions by telephone

or by the Internet. Please see the voting instruction card provided by your broker, bank or other holder of record that accompanies this

proxy statement. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent

brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of the Company’s

common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or other

nominee who is the record holder of your shares.

If

you are a participant in the ESOP, see “Participants in the Kentucky First Federal Employee Stock Ownership Plan”

for information on how to vote the shares of Company common stock credited to your ESOP account.

Quorum

and Vote Required

Quorum.

We will have a quorum and will be able to conduct the business of the annual meeting if the holders of at least a majority of the

outstanding shares of common stock entitled to vote are present at the meeting, either in person or by proxy. Because First Federal MHC

owns in excess of 50% of the outstanding shares of the Company’s common stock, the votes it casts will insure the presence of a

quorum.

Votes

Required for Proposals. At this year’s annual meeting, stockholders will elect two directors to serve for a term of three

years. In voting on the election of directors, you may vote in favor of the nominees or withhold your vote as to all nominees, or withhold

votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality

of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected.

In

voting to ratify the appointment of FORVIS, LLP as the Company’s independent registered public accounting firm, you may vote in

favor of this proposal, vote against this proposal, or abstain from voting. To be approved, this matter requires the affirmative vote

of a majority of the votes represented at the annual meeting and entitled to vote on the proposal.

In

the advisory vote on the non-binding resolution to approve the compensation of the named executive officers, you may vote in favor of

the proposal, vote against the proposal or abstain from voting. To approve the non-binding resolution on an advisory basis, the affirmative

vote of a majority of the votes represented at the annual meeting and entitled to vote on the proposal is required.

How

We Count Votes. If you return valid proxy instructions or attend the meeting in person, we will count your shares for purposes

of determining whether there is a quorum, even if you abstain from voting. Broker non-votes, if any, also will be counted for purposes

of determining the existence of a quorum.

In

the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In

voting to ratify the appointment of the independent registered public accountants or the non-binding resolution to approve the compensation

of the named executive officers, abstentions will count as votes against the proposal, and broker non-votes will not be counted as votes

cast and will have no effect on the outcome of the voting on the proposal.

Effect

of Not Casting Your Vote. If you hold your shares in street name it is critical that you cast your vote if you want it to count

in the election of directors or on the advisory vote regarding the compensation of our named executive officers (Proposals 1 and 3 of

this proxy statement). Current regulations restrict the ability of your bank or broker to vote your uninstructed shares in the election

of directors and other matters on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your bank

or broker how to vote in the election of directors or with respect to the advisory votes regarding the compensation of our named executive

officers, no votes will be cast on these matters on your behalf. These are referred to as broker non-votes. Your bank or broker does,

however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent

registered public accounting firm (Proposal 2 of this proxy statement).

Voting

by Proxy

The

Board of Directors of the Company is sending you this proxy statement for the purpose of requesting that you allow your shares of Company

common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Company common stock

represented at the annual meeting by properly executed and dated proxy cards will be voted according to the instructions indicated on

the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as determined

by the Company’s Board of Directors.

The

Board of Directors recommends that you vote:

| ● | “FOR”

election of our nominees for director; |

| ● | “FOR”

ratification of FORVIS, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30,

2024; and |

| ● | “FOR”

the approval of the compensation of the named executive officers. |

If

any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will

vote your shares as determined by a majority of the Board of Directors. This includes a motion to adjourn or postpone the annual meeting

in order to solicit additional proxies. If the annual meeting is postponed or adjourned, your Company common stock may be voted by the

persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. We do not know of any other

matters to be presented at the annual meeting.

You

may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must either advise the Secretary

of the Company in writing before your common stock has been voted at the annual meeting, deliver a later-dated proxy or attend the meeting

and vote your shares in person. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

Participants

in the Kentucky First Federal Employee Stock Ownership Plan

If

you are an ESOP participant you will receive a voting instruction card that reflects the shares of Company common stock credited to

your ESOP account that you may direct the ESOP trustees to vote on your behalf under the plan. Under the terms of the ESOP, the ESOP

trustees vote all allocated shares of Company common stock held by the ESOP as directed by the plan participants. As of December 31,

2022, all shares of Company common stock held in the ESOP Trust have been allocated. Please return your ESOP voting instruction

card in the envelope provided on or before November 8, 2023.

CORPORATE

GOVERNANCE AND BOARD MATTERS

Director

Independence

The

Company’s Board of Directors currently consists of eight members, all of whom are independent under the listing standards of the

Nasdaq Stock Market, except William H. Johnson, Tony D. Whitaker and Don D. Jennings. In determining the independence of its directors,

the Board considered transactions, relationships and arrangements between the Company and its directors that are not required to be disclosed

in this proxy statement under the heading “Other Information Relating to Directors and Executive Officers -- Transactions with

Related Persons.” These include loans and lines of credit made by the banks in the ordinary course of business, which are made

in compliance with federal lending regulations regarding loans to insiders and approved by the appropriate bank board of directors. In

determining that Director Stephen G. Barker is independent, the Board of Directors considered that the law firm, Stephen G. Barker, Attorney

at Law, of which he is the sole owner, received $32,760 in legal fees from First Federal Savings and Loan Association of Hazard (“First

Federal of Hazard”) for services provided to First Federal of Hazard during the year ended June 30, 2023.

Board

Leadership Structure and Board’s Role in Risk Oversight

Mr.

Tony D. Whitaker serves as Chairman of the Board of the Company and First Federal of Hazard. Mr. Whitaker served as the President and

Chief Executive Officer of the Company until December 31, 2012. Mr. Don D. Jennings now serves as President and Chief Executive Officer

of the Company and has done so since December 31, 2012. The Board of Directors has not designated a lead independent director.

Though

different individuals serve in the position of Chairman of the Board and Chief Executive Officer, the Chairman of the Board had served

as Chief Executive Officer until December 31, 2012, and continues to serve as an executive officer and; therefore, is not independent

under the listing standards of the Nasdaq Stock Market. The Company’s Board of Directors endorses the view that one of its primary

functions is to protect stockholders’ interests by providing independent oversight of management, including the Chief Executive

Officer. However, the Board does not believe that mandating a particular structure is necessary to achieve effective oversight. The Board

of the Company is currently comprised of eight directors , five of whom are independent directors under the listing standards

of the Nasdaq Stock Market. The Chairman of the Board has no greater nor lesser vote on matters considered by the Board than any other

director, and the Chairman does not vote on any related party transaction. All directors of the Company, including the Chairman, are

bound by fiduciary obligations, imposed by law, to serve the best interests of the stockholders. Accordingly, having an independent director

serve as Chairman would not serve to enhance or diminish the fiduciary duties of any director of the Company.

To

further strengthen the regular oversight of the full Board, all various committees of the Board are comprised of independent directors.

The Compensation Committee of the Board consists solely of independent directors. The Compensation Committee reviews and evaluates the

performance of all executive officers of the Company, including the Chief Executive Officer and reports to the Board. In addition, the

Audit Committee, which is comprised solely of independent directors, oversees the Company’s financial practices, regulatory compliance,

accounting procedures and financial reporting functions. In the opinion of the Board of Directors, an independent chairman

or the designation of a lead independent director does not add any value to this already effective process.

Risk

is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number

of risks, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk and reputation risk. Our Compensation

Committee reviews our compensation policies and practices to help ensure there is a direct relationship between pay levels and corporate

performance and return to shareholders . Management is responsible for the day-to-day management of risks the Company faces,

while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk

oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented

by management are adequate and functioning as designed. To do this, the Chairman of the Board meets regularly with management to discuss

strategy and risks facing the Company. Senior management attends the board meetings and is available to address any questions or concerns

raised by the Board on risk management and any other matters. The Chairman of the Board and independent members of the Board work

together to provide strong, independent oversight of the Company’s management and affairs through its standing committees and,

when necessary, special meetings of independent directors.

Committees

of the Board of Directors

Below

we provide the Company’s standing committees and their members. All members of each committee are independent in accordance with

the listing requirements of the Nasdaq Stock Market. The Board’s Audit, Compensation, and Nominating/Corporate Governance Committees

each operate under a written charter that has been approved by the Board of Directors. Each committee reviews and reassesses the adequacy

of its charter at least annually.

Audit

Committee. The Company has a separately designated Audit Committee established in accordance with Section 3(a)(58)(A) of the

Exchange Act. The Audit Committee is comprised of Chairman David R. Harrod, Walter G. Ecton, Jr., Lou Ella R. Farler, and William D.

Gorman, Jr. The committee met four times during the year. The Company’s Board of Directors has determined that one member of the

Audit Committee, David R. Harrod, qualifies as an “audit committee financial expert” under the rules of the Nasdaq Stock

Market.

The

function of the Audit Committee is to review and discuss the audited financial statements with management, internal audit and the independent

auditors; to determine the independent accountants’ qualifications and independence; to engage the independent auditors of the

Company; to review the internal audit function and internal accounting controls; to review the internal audit plan; to review the Company’s

compliance with legal and regulatory requirements; and to review the Company’s auditing, accounting and financial processes generally.

The Audit Committee operates under a written charter, a copy of which is posted on the website of First Federal Savings Bank of Kentucky

at www.ffsbky.bank, under the Policies tab.

Compensation

Committee. The Compensation Committee is comprised of Chairman William D. Gorman, Jr., Lou Ella R. Farler, David R. Harrod, and

Walter G. Ecton, Jr. The committee met once during the year. The Compensation Committee evaluates the compensation and fringe benefits

of the directors, officers and employees and recommends changes. The Compensation Committee reviews all components of compensation,

including salaries, cash incentive plans, equity incentive plans and various employee benefit matters. Decisions by the Compensation

Committee with respect to the compensation of executive officers are approved by the full Board of Directors. The Chief Executive Officer

makes recommendations to the Compensation Committee regarding compensation of directors and executive officers other than himself, but

final compensation decisions are made by the Board of Directors based on the recommendation of the Compensation Committee.

The

Compensation Committee operates under a written charter that establishes the Compensation Committee’s responsibilities. The Compensation

Committee and the Board of Directors review the Charter periodically to ensure that the scope of the charter is consistent with the Compensation

Committee’s expected role. Under the charter, the Compensation Committee is charged with general responsibility for the oversight

and administration of the Company’s compensation program. The charter vests in the Compensation Committee principal responsibility

for determining the compensation of the Chief Executive Officer based on the Compensation Committee’s evaluation of his performance.

The charter also authorizes the Compensation Committee to engage consultants and other professionals without management approval to the

extent deemed necessary to discharge its responsibilities. The Compensation Committee charter is posted on the website of First Federal

Savings Bank of Kentucky at www.ffsbky.bank, under the Policies tab.

Nominating/Corporate

Governance Committee. The Nominating/Corporate Governance Committee is comprised of Chairman Walter G. Ecton, Jr., Lou Ella R.

Farler, David R. Harrod, and William D. Gorman, Jr. The Board of Directors’ Nominating/Corporate Governance Committee nominates

directors to be voted on at the annual meeting and recommends nominees to fill any vacancies on the Board of Directors. The Board of

Directors has adopted a charter for the Nominating/Corporate Governance Committee a copy of which is posted on the website of First Federal

Savings Bank of Kentucky at www.ffsbky.bank, under the Policies tab.

It

is the policy of the Nominating/Corporate Governance Committee to consider director candidates recommended by security holders who appear

to be qualified to serve on the Company’s Board of Directors. Any stockholder wishing to recommend a candidate for consideration

by the Nominating/Corporate Governance Committee as a possible director nominee for election at an upcoming annual meeting of stockholders

must provide written notice to the Nominating/Corporate Governance Committee of such stockholder’s recommendation of a director

nominee no later than the July 1st preceding the annual meeting of stockholders. Notice should be provided to: Secretary,

Kentucky First Federal Bancorp, P.O. Box 535, Frankfort, Kentucky 40602. Such notice must contain the following information:

| ● | The

name of the person recommended as a director candidate; |

| ● | All

information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to

Regulation 14A under the Securities Exchange Act of 1934; |

| ● | The

written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving

as a director if elected; |

| ● | As

to the stockholder making the recommendation, the name and address, as he or she appears on the Company’s books, of such stockholder;

provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit

his or her name and address, along with a current written statement from the record holder of the shares that reflects ownership of the

Company’s common stock; and |

| ● | A

statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such

person. |

In

its deliberations, the Nominating/Corporate Governance Committee considers a candidate’s personal and professional integrity, knowledge

of the banking business and involvement in community, business and civic affairs, and also considers whether the candidate would provide

for adequate representation of the banks’ market areas. Any nominee for director made by the Nominating/Corporate Governance Committee

must be highly qualified with regard to some or all the attributes listed in the preceding sentence. In searching for qualified director

candidates to fill vacancies in the Board, the Nominating/Corporate Governance Committee solicits the Company’s then current directors

for the names of potential qualified candidates. Moreover, the Nominating/Corporate Governance Committee may ask its directors to pursue

their own business contacts for the names of potentially qualified candidates. The Nominating/Corporate Governance Committee would then

consider the potential pool of director candidates, select a candidate based on the candidate’s qualifications and the Board’s

needs, and conduct a thorough investigation of the proposed candidate’s background to ensure there is no past history that would

cause the candidate not to be qualified to serve as a director of the Company. In the event a stockholder has submitted a proposed nominee,

the Nominating/Corporate Governance Committee would consider the proposed nominee in the same manner in which the Nominating/Corporate

Governance Committee would evaluate nominees for director recommended by directors.

The

Nominating Committee seeks to create a Board that is strong in its collective knowledge and has a diversity of skills and experience

with respect to accounting and finance, management and leadership, vision and strategy, business operations, business judgment, industry

knowledge and corporate governance. Accordingly, the Board of Directors will consider the following criteria in selecting nominees: financial,

regulatory and business experience; familiarity with and participation in the local community; integrity, honesty and reputation; dedication

to the Company and its stockholders; independence; and any other factors the Board of Directors deems relevant, including age, diversity,

size of the Board of Directors and regulatory disclosure obligations.

With

respect to nominating an existing director for re-election to the Board of Directors, the Nominating/Corporate Governance Committee will

consider and review an existing director’s Board and committee attendance and performance, length of Board service, experience,

skills and contributions that the existing director brings to the Board and independence.

Board

and Committee Meetings

The

Board of Directors of the Company meets quarterly and may have additional special meetings. During the year ended June 30, 2023, the

Board of Directors of the Company met nine times. No director attended fewer than 75% in the aggregate of the total number of Company

Board of Directors meetings held during the year ended June 30, 2023 and the total number of meetings held by Committees on which they

served during such fiscal year.

Director

Attendance at Annual Meeting of Stockholders

Directors

are expected to prepare themselves for and to attend all Board meetings, the annual meeting of stockholders and the meetings of the Committees

on which they serve, with the understanding that on occasion a director may be unable to attend a meeting. All of the directors attended

the Company’s 2022 annual meeting of stockholders held on November 17, 2022. Due to COVID-19 concerns, some directors attended

that meeting by phone.

Code

of Ethics and Business Conduct

The

Company has adopted a Code of Ethics and Business Conduct that applies to all of its directors, officers and employees. To obtain a copy

of this document at no charge, please write to Kentucky First Federal Bancorp, P.O. Box 535, Frankfort, Kentucky 40602-0535, or call

toll-free (888) 818-3372 and ask for Investor Relations.

Director

Compensation

The

following table provides the compensation received by individuals who served as non-employee directors of the Company during the 2023

fiscal year. This table includes compensation for services performed by non-employee directors of the Company for First Federal of Hazard

and First Federal Savings Bank of Kentucky (“First Federal of Kentucky”). See the section on “Meeting Fees for Non-Employee

Directors” for detailed compensation earned by non-employee directors. This table excludes perquisites, which did not exceed $10,000

in the aggregate for each director.

| Name | |

Fees Earned

or Paid in

Cash ($) | | |

Total

($) | |

| Stephen G. Barker | |

| 18,400 | | |

| 18,400 | |

| Walter G. Ecton, Jr. | |

| 18,400 | | |

| 18,400 | |

| Lou Ella R. Farler | |

| 18,400 | | |

| 18,400 | |

| William D. Gorman, Jr. | |

| 18,400 | | |

| 18,400 | |

| David R. Harrod | |

| 18,000 | | |

| 18,000 | |

| William H. Johnson | |

| 18,000 | | |

| 18,000 | |

| Tony D. Whitaker (1) | |

| 11,200 | | |

| 11,200 | |

| (1) | Mr.

Whitaker also serves as executive Chairman to the Company and First Federal of Hazard, pursuant

to which he regularly advises the Chief Executive Officers on strategic and operational matters.

Mr. Whitaker receives a salary of $55,000 per year for these services, which amount is not

included in the table above. As an employee of the Company and First Federal of Hazard, Mr.

Whitaker participates in the employer-sponsored dental insurance, cancer insurance and medical

transport plans at no cost to his employers. |

Meeting

Fees for Non-Employee Directors. The following tables set forth the applicable retainers and fees that are paid to all non-employee

directors for their service on the boards of directors of the Company, First Federal of Hazard and First Federal of Kentucky. Officers

of the Company who are directors are not compensated for their service as directors. Officers of either Bank who are also directors are

not compensated for their service as directors.

| Board of Directors of Kentucky First Federal | |

| |

| Fee per month | |

$ | 600 | |

| There is no additional compensation for attendance at committee meetings. | |

| | |

| | |

| | |

| Board of Directors of First Federal of Hazard | |

| | |

| Fee per month | |

$ | 900 | |

| Fee per Committee Meeting (1) | |

$ | 400 | |

| | |

| | |

| Board of Directors of First Federal of Kentucky | |

| | |

| Fee per month | |

$ | 900 | |

| Fee per Committee Meeting (1) | |

$ | 100 | |

| (1) |

Non-employee directors receive a per committee fee for committee meetings held on days on which the board does not meet, except for Executive

Committee meetings for which they are not compensated. |

AUDIT

RELATED MATTERS

Report

of the Audit Committee

The

Company’s management is responsible for the Company’s internal controls and financial reporting process. The independent

registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements

and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee

oversees the Company’s internal controls and financial reporting on behalf of the Board of Directors.

In

this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm.

Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance

with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements

with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered

public accounting firm matters required to be discussed pursuant to the Public Accounting Oversights Board Auditing Standard No. 1301

(Communication with Audit Committees), including the quality, not just the acceptability, of the accounting principles, the reasonableness

of significant judgments, and the clarity of the disclosures in the financial statements.

In

addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm

required by the applicable requirements of the Public Company Accounting Oversight Board and has discussed with the independent registered

public accounting firm the auditors’ independence from the Company and its management. In concluding that the auditors are independent,

the Audit Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with its

independence.

The

Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its

audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss

the results of its examination, its evaluation of the Company’s internal controls, and the overall quality of the Company’s

financial reporting.

In

performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee

relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and

reports, and of the independent registered public accounting firm who, in its report, express an opinion on the conformity of the Company’s

financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent

basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate

internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore,

the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not

assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that

the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the Public

Company Accounting Oversight Board or that the Company’s independent registered public accounting firm is in fact “independent.”

In

reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has

approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year

ended June 30, 2023 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors also have

approved, subject to stockholder ratification, the selection of FORVIS, LLP as the Company’s independent registered public accounting

firm for the 2024 fiscal year.

Members

of the Audit Committee

David

R. Harrod (Chairman)

Walter

G. Ecton, Jr.

Lou

Ella R. Farler

William

D. Gorman, Jr.

Auditor

Fees

The

following table sets forth the fees billed to the Company for the fiscal years ended June 30, 2023 and June 30, 2022 by FORVIS, LLP.

| | |

2023 | | |

2022 | |

| Audit fees (1) | |

$ | 97,000 | | |

$ | 88,400 | |

| Audit-related fees (2) | |

| 19,000 | | |

| 16,848 | |

| Tax fees (3) | |

| 0 | | |

| 14,560 | |

| All other fees | |

| — | | |

| — | |

| Total | |

$ | 116,000 | | |

$ | 119,808 | |

| (1) | Audit

fees consist of fees for professional services rendered for the audit of the Company’s

annual financial statements. |

| (2) | Audit-related

fees include review of quarterly reports on Form 10-Q filed by the Company. |

| (3) | Beginning

with the 2023 fiscal year, the Company contracted with Mountjoy Chilton Medley, LLP, now

known as Cherry Bekaert, to assist in tax preparation. |

Pre-Approval

of Services by the Independent Auditor

The

Audit Committee does not have a policy for the pre-approval of non-audit services to be provided by the Company’s independent registered

public accounting firm. Any such services would be considered on a case-by-case basis. All non-audit services provided by the independent

auditors in fiscal years 2023 and 2022 were approved by the Audit Committee before the independent auditors were engaged to provide the

services. Certain services such as the review of the Company’s public filings, review of the Company’s tax returns, and general

discussions with management regarding accounting issues, which may be construed as necessary for the accurate completion of the audit,

are approved in advance on an annual basis.

STOCK

OWNERSHIP

The

following table sets forth certain information regarding the beneficial ownership of our common stock as of September 29, 2023 by (i)

persons known to the Company who beneficially own more than 5% of our common stock, (ii) each of the Company’s directors, (iii)

the non-director executive officers, and (iv) by all directors and executive officers as a group.

| | |

Amount

and

Nature of

Beneficial

Ownership(1) | | |

Percent of

Class(2) | |

| Persons

Owning Greater than 5%: | |

| | | |

| | |

| | |

| | | |

| | |

| First Federal MHC | |

| 4,727,938 | | |

| 57.9 | % |

| 655 Main Street | |

| | | |

| | |

| P.O. Box 1069 | |

| | | |

| | |

| Hazard, Kentucky 41702 | |

| | | |

| | |

| | |

| | | |

| | |

| Directors: | |

| | | |

| | |

| | |

| | | |

| | |

| Tony D. Whitaker | |

| 117,124 | (3) | |

| 1.5 | |

| Don D. Jennings | |

| 76,619 | | |

| 1.0 | |

| Stephen G. Barker | |

| 28,731 | | |

| * | |

| Walter G. Ecton, Jr. | |

| 25,052 | (4) | |

| * | |

| Lou Ella R. Farler | |

| 31,671 | | |

| * | |

| William D. Gorman, Jr. | |

| 11,666 | | |

| * | |

| David R. Harrod | |

| 9,495 | | |

| * | |

| William H. Johnson | |

| 46,710 | | |

| * | |

| | |

| | | |

| | |

| Executive

Officers Who Are Not Directors: | |

| | | |

| | |

| | |

| | | |

| | |

| R. Clay Hulette | |

| 74,528 | (5) | |

| * | |

| Jaime Coffey | |

| 7,419 | | |

| * | |

| | |

| | | |

| | |

| All directors, nominees, and executive officers

of the Company as a group (10) persons) | |

| 429,015 | (6) | |

| 5.3 | |

| * | Represents

less than 1% of the shares outstanding. |

| (1) | Includes

shares allocated to the account of the individuals under the Kentucky First Federal Employee Stock Ownership Plan, with respect to which

the individual has voting but not investment power as follows: Mr. Jennings — 6,694 shares; Mr. Hulette — 5,809 shares; and

Mrs. Coffey –7,419 . |

| (2) | Based

on a total of 8,086,715 shares of Common Stock outstanding as of the Record Date. |

| (3) | Includes

15,000 shares owned by Mr. Whitaker’s spouse. |

| (4) | Includes

600 shares in Mr. Ecton’s spouse’s IRA. |

| (5) | Includes

47,029 shares owned by Mr. Hulette’s spouse. |

| (6) | Includes

62,629 shares owned by spouses of insiders. |

ITEMS

TO BE VOTED ON BY STOCKHOLDERS

ITEM

1 — ELECTION OF DIRECTORS

The

Company’s Board of Directors consists of eight members and is divided into three equal classes with approximately one-third of

the directors elected each year. The Nominating/Corporate Governance Committee of the Board of Directors has nominated Walter G. Ecton,

Jr. and Tony Whitaker to serve as directors for a three-year term or until their respective successors have been elected and qualified.

Our nominees are currently members of the Company’s Board.

Pursuant

to the Company’s Bylaws, there is no cumulative voting for the election of directors. As a result, directors are elected by a plurality

of the votes present in person or by proxy at a meeting at which a quorum is present. This means that the nominees receiving the greatest

number of votes will be elected. In the election of directors, votes that are withheld and broker non-votes will have no effect on the

outcome of the election.

Unless

you indicate on the proxy card that your shares should not be voted for certain nominees, the Board of Directors intends that the proxies

solicited by it will be voted for the election of all of the Board’s nominees. If any nominee is unable to serve, the persons named

in the proxy card would vote your shares to approve the election of any substitute proposed by the Board of Directors. At this time,

the Board knows of no reason why any nominee might be unavailable to serve.

The

Board of Directors recommends a vote “FOR” the election of Messrs. Ecton and Whitaker.

Information

regarding the Board of Directors’ nominees for election and the directors continuing in office is provided below. Unless otherwise

stated, each individual has held his or her current occupation for the last five years. The age indicated for each individual is as of

September 29, 2023. The indicated period of service as a director includes the period of service as a director of one of our bank subsidiaries.

Nominees

for Election as Director

The

nominees for Director to serve for a three-year term expiring in 2026:

Walter

G. Ecton, Jr. has been a director of the Company since its inception in March 2005. He has been engaged in the private practice

of law in Richmond, Kentucky since 1979. He has served as a director of First Federal of Hazard since 2004. Age 69. Director since 2005.

Mr.

Ecton is a graduate of Centre College and received his Juris Doctorate of law from the University of Kentucky where he was a member of

the Kentucky Law Journal. Mr. Ecton also earned a Master’s Degree in Business Administration from the University of Kentucky. In

addition to his private practice, Mr. Ecton served as an Assistant’s Commonwealth’s Attorney from 1981-1993. Mr. Ecton previously

served as legal counsel to First Federal of Richmond, Kentucky and as an advisory director of Great Financial Bank and U.S. Bank. His

knowledge of the banking industry through this service and through his extensive education and legal career provides the Board valuable

expertise.

Tony

D. Whitaker has served as Chairman of the of the Company since its inception in March 2005 and executive Chairman since December

31, 2012. He served as Chief Executive Officer of the Company from its inception until his retirement on December 31, 2012 and as President

and Chief Executive Officer of First Federal of Hazard from 1997 until his retirement on December 31, 2012. He also serves as Chairman

of the First Federal of Hazard board, on which he has served as a director since 1993. Mr. Whitaker was President of First Federal

Savings Bank in Richmond, Kentucky from 1980 until 1994. From 1994 until 1996, Mr. Whitaker was the President of the central Kentucky

region and served on the Board of Great Financial Bank, a $3 billion savings and loan holding company located in Louisville, Kentucky.

Mr. Whitaker served as a director of the Federal Home Loan Bank of Cincinnati from 1991 to 1997, including a term as Vice-Chairman.

He served on the Board of America’s Community Bankers, a national banking trade group, from 2001 to 2007. Mr. Whitaker has

served on the Board of Directors, including a term as Chairman, of Pentegra Group, Inc., a financial services company specializing in

retirement benefits, since 2002. He served as Chairman of the Kentucky Bankers Association in 2011-12. Age 77. Director since 1993.

Based

on his level of experience and the breadth of his career, Mr. Whitaker has few peers among bankers still actively working. His expertise

in the Kentucky thrift community is incomparable. He is an ongoing leader of Kentucky First Federal and as such provides extremely valuable

service to our board.

Directors

Continuing in Office

The

following Directors have terms ending in 2024:

Stephen

G. Barker has been a director of the Company since its inception in March 2005. Mr. Barker is the President and General

Counsel for Kentucky River Properties LLC, which owns significant land, mineral, oil and gas and timber resources in Kentucky.

Kentucky River’s lessees include several nationally known publicly traded resource producers. Mr. Barker has been employed by

Kentucky River Coal Corporation and Kentucky River Properties LLC since 1985, and has served as Assistant General Counsel, Executive

Vice President and Assistant Secretary. Mr. Barker is a Director and a member of the Executive Committee of the National

Council of Coal Lessors in Washington, D.C. Mr. Barker has been in the private practice of law in Hazard since 1980 and

has provided legal representation to First Federal since 1982. Mr. Barker also served as Master Commissioner for

the Perry Circuit Court and is a member and past President of the Perry County Bar Association. He is

a member of the Kentucky Bar Association and the American Bar Association and is admitted to practice before the Kentucky Supreme

Court and the U.S. District Court for the Eastern District of Kentucky. Prior to obtaining his Juris Doctorate from the

University of Kentucky College of Law, Mr. Barker received a Bachelor of Science in Forestry from the University of

Kentucky and was a forester and served as District Conservationist with the United States Department of Agriculture Soil

Conservation Service in eastern Kentucky. Mr. Barker continues to serve as a District Supervisor and Secretary and

Treasurer of the Perry County Conservation District. He is a member of the Society of American Foresters. Mr. Barker is a

private pilot and a member of the Aircraft Owners and Pilots Association and is Chairman of the Hazard

Perry County Airport Board which manages the Wendell H. Ford Regional Airport near Hazard. Mr. Barker has also served on the

Board of Directors of the Company’s wholly owned subsidiary, First Federal Savings and Loan Association of Hazard since 1997.

Age 69. Director since 1997.

Mr.

Barker’s long service to First Federal of Hazard represents a valuable level of expertise and commitment, along with his extensive

knowledge of real estate derived from his legal career make him an exceptional member of the board.

Lou

Ella R. Farler was appointed to the Company’s Board of Directors on January 27, 2022. Previously, she is retired President

and Chief Executive Officer of First Federal of Hazard and served from January 1, 2013 until her retirement on January 1, 2019. Her career

at First Federal began in 1975. She has served on the board of First Federal of Hazard since 2011. Mrs. Farler has served her community

on various civic committees and was a Hazard City Commissioner from 2002-2012. Age 66. Director since 2022.

Mrs.

Farler’s many years of banking experience and strong ties to the Hazard community are the basis for her appointment to the board

and for continued exemplary service to the organization.

David

R. Harrod has been a director of the Company since its inception in March 2005. Mr. Harrod is a certified public accountant and

is a principal of Harrod and Associates, P.S.C., a Frankfort, Kentucky-based accounting firm. He currently serves as a Director and Treasurer

of the Franklin County Industrial Development Authority. He has served as a Director of Frankfort First Bancorp, Inc. and First Federal

of Kentucky since 2003. He also serves as Chairman of the Audit Committee of Kentucky First Federal. Age 64. Director since 2003.

Mr.

Harrod’s financial expertise is a necessary component of the board. His career in public accounting, which has included audit work

for a publicly-traded financial institution, affords him an exceptional level of knowledge that is highly appropriate as he chairs the

Company’s audit committee and, as such, is the liaison between the board and the independent public accountants.

The

following Directors have terms ending in 2025:

William

D. Gorman, Jr. was elected as a director of First Federal Savings & Loan of Hazard on December 16, 2010. He follows in the

footsteps of his late father, Mayor William D. Gorman, who served as a director of First Federal Savings & Loan of Hazard and Kentucky

First Federal. Mr. Gorman served as President and Chief Executive Officer of Hazard Insurance Group, LLC through July 31, 2014. Earlier,

he was Vice President and General Manager of WKYH-TV in Hazard and was founder of radio station WYZQ, now WQXY in Hazard. In 2004, he

served as President of the Independent Insurance Agents of Kentucky. He is a member and past president of the Hazard Lions Club. He has

served on the Hazard-Perry County Tourism Commission and on the Board of Directors of both Kentucky Education Television and Hazard Appalachian

Regional Hospital. Mr. Gorman is a graduate of the University of Kentucky. Age 74. Director since 2010.

Mr.

Gorman’s many years as an important part of the business and civic communities of Hazard and Perry County, as well as his past

service to First Federal of Hazard, make him an excellent member of the Board.

Don

D. Jennings has served as President and as a Director of the Company since its inception in March 2005. On January 1, 2013, he

was appointed Chief Executive Officer of the Company. Prior to the merger between Kentucky First Federal and Frankfort First Bancorp,

he served as President and Chief Executive Officer of Frankfort First Bancorp. He currently also serves as President and Chief Executive

Officer of First Federal of Kentucky, where he has been employed since 1991. He currently serves on the board of the Kentucky Bankers

Association and has previously served on the American Bankers Association Mutual Advisory Committee and the American Bankers Association

Government Relations Committee. Age 58. Director since 1998.

Mr.

Jennings has extensive knowledge of the workings of both public companies and banks. He was intimately involved in the formation of both

Kentucky First Federal and Frankfort First Bancorp and has played a major role in the structure of the entire corporation

William

H. Johnson is the retired Danville-Lancaster Area President of First Federal Savings Bank, a capacity in which he served from

January 2013 until March 2022. Previously, he served as President and Chief Executive Officer of Central Kentucky Federal Savings Bank

and CKF Bancorp from August 2005 until that bank’s merger with First Federal Savings Bank. He joined Central Kentucky Federal Savings

Bank as Senior Vice President in September 1998 and was named Secretary in April 1999. Prior to that, he served for 16 years as Vice

President and Regional Manager of Great Financial Bank, F.S.B. and for seven years as Managing Officer of Commonwealth First Federal

Savings and Loan Association, Danville, Kentucky. He has served on the Board of Directors of the Kentucky Bankers Association. Age 73.

Director since 2013.

Mr.

Johnson’s experience in the Danville community and the Danville banking market are nearly unequalled. His knowledge of the area

as well as his experience in managing Central Kentucky Federal puts him in position to provide valuable insight to the Board of Kentucky

First Federal.

Executive

Officers Who Are Not Directors

The

following sets forth information with respect to the executive officers of the Company who do not serve on the Board of Directors.

R.

Clay Hulette has served as Vice President, Treasurer and Chief Financial Officer of the Company since its inception in March

2005. Since 2000, he has served as Vice President and Chief Financial Officer of Frankfort First. In January 2012, Mr. Hulette was named

as a Director of First Federal of Kentucky. In March 2007, he was named President of First Federal of Kentucky, having served as Vice

President and Treasurer since 2000. On January 1, 2013, he was appointed Frankfort Area President for First Federal of Kentucky. He has

been employed by First Federal of Kentucky since 1997. He is a Certified Public Accountant. Mr. Hulette’s spouse, Teresa Hulette,

serves as Executive Vice President of First Federal of Kentucky. Age 61.

Jaime

Steele Coffey has served as President and Chief Executive Officer of First Federal of Hazard since January 1, 2019. She has been

employed by the bank since 2012 and has worked in various areas including lending and compliance. She was appointed Vice President in

2016. She is a member of the Hazard Independent College Foundation Board, the Hazard Lions Club and serves on the lending committee with

Red Bud Housing, part of the Housing Development Alliance. She also serves on the Board of Directors of the Kentucky Bankers Association.

Age 44.

The

information shown below is our Board Matrix based on voluntary self-identification of each member of our Board.

Board

Diversity Matrix

| | |

As of June 30, 2023 | | |

As of June 30, 2022 | |

| Board Size: |

|

| |

| Total Number of Directors | |

8 | | |

8 | |

| Gender: | |

Male | | |

Female | | |

Non-

Binary | | |

Gender

Undisclosed | | |

Male | | |

Female | | |

Non-

Binary | | |

Gender

Undisclosed | |

| Number of directors based on gender identity | |

| 7 | | |

| 1 | | |

| 0 | | |

| - | | |

| 7 | | |

| 1 | | |

| 0 | | |

| - | |

| Number of directors who identify in any of the categories below: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Alaskan Native or American Indian | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Asian | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Hispanic or Latinx | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Native Hawaiian or Pacific Islander | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| White | |

| 7 | | |

| 1 | | |

| - | | |

| - | | |

| 7 | | |

| 1 | | |

| - | | |

| - | |

| Two or More Races or Ethnicities | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| LGBTQ+ | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| - | | |

| | |

| Undisclosed | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| - | | |

| | |

ITEM

2—RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The

Audit Committee of the Board of Directors has appointed FORVIS, LLP to be the Company’s independent registered public accounting

firm for the fiscal year ending June 30, 2024, subject to ratification by stockholders. There are no plans for a representative of FORVIS,

LLP to be present at the 2023 annual meeting.

If

the ratification of the appointment of the independent registered public accounting firm is not approved by stockholders at the annual

meeting, the Audit Committee will consider other independent registered public accounting firms.

The

Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of the independent registered

public accounting firm.

ITEM

3—ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant

to Section 14A of the Exchange Act and Rule 14a-21(a) thereunder, we are providing our stockholders with the opportunity to express their

views, on a non-binding advisory basis, on the compensation of the named executive officers as disclosed in this proxy statement. This

vote, which is often referred to as the “say-on-pay” vote, provides stockholders with the opportunity to endorse or not endorse

the following resolution:

“RESOLVED,

that the compensation paid to the Company’s named executive officers, as described in the tabular disclosure regarding named

executive officer compensation and the accompanying narrative disclosure in this proxy statement is hereby

approved”

At

our prior annual meetings, our stockholders overwhelmingly approved the say on pay proposal.

At

the Annual Meeting of Kentucky First Federal in 2019, stockholders were asked to vote on the frequency this vote should be held. Upon

the recommendation of the Board, the stockholders voted to hold this vote annually.

Because

your vote is advisory, it will not be binding upon the Board of Directors. However, the Compensation Committee will take into account

the outcome of the vote when considering future executive compensation arrangements.

The

Board of Directors recommends a vote “FOR” approval of the compensation of the named executive officers.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The

following table provides information concerning the total compensation awarded, earned, or paid to the principal executive officer of

the company and for the two other most highly compensated executive officers of the Company who received a salary of $100,000 or more

during the years ended June 30, 2023 and 2022.

| Name and Principal Position |

|

Year |

|

|

Salary ($) |

|

|

All Other

Compensation

($) (1) |

|

|

Total

($) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Don D. Jennings |

|

2023 |

|

|

|

190,000 |

|

|

|

13,674 |

|

|

|

203,674 |

|

| Chief Executive Officer of Kentucky First Federal and First Federal Savings Bank of Kentucky; Chairman of First Federal Savings Bank of Kentucky. |

|

2022 |

|

|

|

190,000 |

|

|

|

21,631 |

|

|

|

211,631 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| R. Clay Hulette, |

|

2023 |

|

|

|

171,022 |

|

|

|

13,123 |

|

|

|

184,145 |

|

| Vice President, Chief Financial Officer and Treasurer of Kentucky First Federal; Area President and Director of First Federal Savings Bank of Kentucky |

|

2022 |

|

|

|

171,022 |

|

|

|

19,788 |

|

|

|

190,810 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Teresa Hulette, |

|

2023 |

|

|

|

112,750 |

|

|

|

11,413 |

|

|

|

124,613 |

|

| Executive Vice President First Federal Savings Bank of Kentucky |

|

2022 |

|

|

|

107,529 |

|

|

|

15,511 |

|

|

|

123,040 |

|

| (1) | Includes

ESOP allocations for Mr. Jennings, Mr. Hulette and Mrs. Hulette, which were valued at $3,181,

$2,741, and $1,548 for 2023 and $11,244, $9,511, and $5,778 for 2022, respectively. During

fiscal 2022 and 2023, our named executive officers did not receive perquisites or other personal

benefits that exceeded the greater of $25,000 or 10% of total perquisites and personal benefits. |

Pay

Versus Performance

In

accordance with SEC rules, the following tables describe how the compensation of our named executive officers align with our performance.

| Year | |

Summary

Compensation

Table Total for

PEO ($)(1)(2) | | |

Compensation

Actually Paid to

PEO ($)(3) | | |

Average

Summary

Compensation

Table Total for

non-PEO

Named

Executive

Officers ($)(2)(4) | | |

Average

Compensation

Actually Paid

to non-PEO

Named

Executive

Officers ($)(2)(5) | | |

Value of

Initial Fixed

$100

Investment

Based on

Total

Shareholder

Return ($)(6) | | |

Net Income ($)

(in thousands)(7) | |

| 2023 | |

$ | 203,674 | | |

$ | 203,674 | | |

$ | 154,399 | | |

$ | 154,399 | | |

$ | 108.42 | | |

$ | 933 | |

| 2022 | |

$ | 211,631 | | |

$ | 211,631 | | |

$ | 156,925 | | |

$ | 156,925 | | |

$ | 120.71 | | |

$ | 1,590 | |

| (1) | As

reported in the Summary Compensation Table on page 16 of this proxy statement |

| | |

| (2) | During

fiscal years 2023 and 2022, our principal executive officer (“PEO”) was Don D.

Jennings, and our non-PEO Named Executive Officers (“non-PEO NEOs”) were R. Clay

Hulette and Teresa Hulette. |

| | |

| (3) | We

had no outstanding equity awards for fiscal years 2023 and 2022. Accordingly, no equity award

adjustments are applicable to the compensation paid to the PEO in 2023 and 2022. |

| | |

| (4) | Average

summary compensation total for non-PEO NEOs represents the average of the SCT total compensation

paid to the non-PEO NEOs during each of the years in the SCT. |

| | |

| (5) | We

had no outstanding equity awards for fiscal years 2023 and 2022. Accordingly, no equity award

adjustments are applicable to the compensation paid to the non-PEO named executive officers

in 2023 and 2022. |

| | |

| (6) | Cumulative

total shareholder return (“TSR”) assumes an initial investment of $100 investment

as of market close on June 30, 2021 |

| | |

| (7) | Net

Income as reported on page 25 of the Company’s Annual Report on Form 10-K for the fiscal

year ended June 30, 2023. |

Analysis

of the Information Presented in the Pay Versus Performance Table

We

generally seek to incentivize long-term performance, and therefore do not specifically align our performance measures with “compensation

actually paid” (as computed in accordance with Item 402(v) of Regulation S-K) for a particular year. In accordance with Item 402(v)

of Regulation S-K we are providing the following descriptions of the relationships between information presented in the Pay Versus Performance

Table.

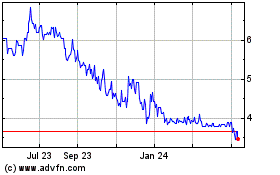

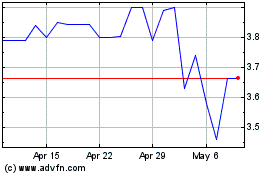

Compensation

Actually Paid (“CAP”) and Company TSR

TSR

amounts reported in the graph assume an initial fixed investment of $100. CAP to PEO #1, Don Jennings, was $203,674 in 2023 and $211,631

in 2022. CAP to the non-PEO NEOs averaged $154,399 in 2023 and $156,925 in 2022. The Company does not use TSR to determine compensation

levels or inventive plan payouts, therefore the PEO and non-PEO NEOs CAP does not fluctuate with changes to TSR.

Compensation Actually Paid and Net Income

CAP to PEO #1, Don Jennings, was $203,674 in 2023 and $211,631 in 2022.

CAP to the non-PEO NEOs averaged $154,399 in 2023 and $156,925 in 2022. The Company reported net income of $933 thousand in 2023 and

$1.6 million in 2022. The Company does not use net income to determine compensation levels or incentive plan payouts, therefore the PEO

and non-PEO NEOs CAP does not fluctuate with changes to net income.

Employment

Agreements

The

Company and First Federal of Kentucky each maintain employment agreements with Don D. Jennings, President and Chief Operating Officer

of Kentucky First Federal and Chairman and Chief Executive Officer of First Federal of Kentucky and with R. Clay Hulette Vice President

and Chief Financial Officer of Kentucky First Federal and Frankfort Area President of First Federal of Kentucky. Such employment agreements

are referred to herein as the “Agreements.” The Agreements provide for three-year terms and are currently set to expire on

August 15, 2025, unless otherwise renewed by the respective boards of directors. The current base salary under the agreements for Messrs.

Jennings and Hulette are $190,000 and $171,022, respectively. In addition to establishing a base salary, the Agreements provide for,

among other things, participation in stock-based and other benefit plans, as well as certain fringe benefits.

On

September 1, 2023, Mr. Hulette notified the Board of his intention to retire as of January 2, 2024. His retirement was not the result

of any dispute or disagreement with the company. Mr. Hulette will remain a member of the board of First Federal Savings Bank of Kentucky.

His employment agreements with the Company and First Federal of Kentucky were not renewed by the Compensation Committee and will be considered

terminated at the time of his retirement.

The

Agreements also provide that Kentucky First Federal and First Federal of Kentucky may terminate the employment of Messrs. Jennings or

Hulette for cause, as defined in the Agreements, at any time. No compensation or benefits are payable upon termination of either officer

for cause. Each of the officers may also voluntarily terminate his employment by providing 90 days prior written notice. Upon voluntary

termination, the officer receives only compensation and vested benefits through the termination date.

The

Agreements terminate upon the officer’s death, and his estate receives any compensation due through the last day of the calendar

month of death. The Agreements also allow the appropriate Boards to terminate the employment of Messrs. Jennings or Hulette due to disability,

as defined in the Agreements. A disabled executive receives any compensation and benefits provided for under the agreement for any period

prior to termination during which the executive was unable to work due to disability. Messrs. Jennings and Hulette also may receive disability

benefits under First Federal of Kentucky’s long-term disability plan(s) without reduction for any payments made under the Agreement.

During a period of disability, to the extent reasonably capable of doing so, the officer agrees to provide assistance and undertake reasonable

assignments for the employers.

The

Agreements also require Messrs. Jennings and Hulette to agree not to compete with Kentucky First Federal, First Federal of Hazard or

First Federal of Kentucky for one year following a termination of employment, other than in connection with a change in control. Kentucky

First Federal or First Federal of Kentucky will pay or reimburse Messrs. Jennings and Hulette for all reasonable costs and legal fees

paid or incurred by him in any dispute or question of interpretation regarding the Agreements, if the executive is successful on the

merits in a legal judgment, arbitration proceeding or settlement. The Agreements also provide Messrs. Jennings and Hulette with indemnification

to the fullest extent legally allowable.

Under

the Agreements, if either Kentucky First Federal or First Federal of Kentucky terminates the employment of Messrs. Jennings or Hulette

without cause, or if Messrs. Jennings or Hulette resigns under specified circumstances that constitute constructive termination, he receives

his base salary and continued employee benefits for the remaining term of the Agreement, as well as continued health, life and disability

coverage under the same terms such coverage is provided to other senior executives, or comparable individual coverage.

Under

the Agreements, if, within one year after a change in control (as defined in the Agreements), either of Messrs. Jennings or Hulette voluntarily

terminates his employment under circumstances discussed in the Agreement, or involuntarily terminates employment, the executive receives

a cash payment equal to three times his average annual compensation over the five most recently completed calendar years preceding the

change in control. He also receives continued employee benefits and health, life and disability insurance coverage for thirty-six months

following termination of employment.

Section

280G of the Internal Revenue Code provides that severance payments that equal or exceed three times the individual’s “base

amount” are deemed to be “excess parachute payments” if they are contingent upon a change in control. Individuals receiving

excess parachute payments are subject to a 20% excise tax on the amount of the payment in excess of their base amount, and the employer

is not entitled to deduct any parachute payments over the base amount. The Agreements limit payments made to Messrs. Jennings or Hulette

in connection with a change in control to amounts that will not exceed the limits imposed by Section 280G.

Outstanding

Equity Awards at Fiscal Year End

There

were no outstanding equity awards at the year ended June 30, 2023.

Retirement

Plan

Mr.

Jennings, Mr. Hulette, and Mrs. Hulette participate in the Financial Institution Retirement Plan (the “Retirement Plan”)

to provide retirement benefits for eligible employees. Employees are eligible to participate in the Retirement Plan after the completion

of one year of employment and attainment of age 21. The formula for normal retirement benefits payable annually 1.50%, under the Financial

Institution Retirement Plan, of the average of the participant’s highest five years of compensation multiplied by the participant’s

years of service. Beneficiaries under the First Federal of Kentucky Retirement Plan may have the option of receiving all or some benefits

in a lump sum.

The

present value of accumulated benefits for the First Federal of Kentucky Retirement Plan is calculated using the accrued benefit multiplied

by a present value factor based on an assumed age 65 retirement date, the 1994 Group Annuity Mortality table projected five years and

an interest rate of 5.00% for 50% of the benefit and 7.75% for 50% of the benefit, discounted to current age at an assumed interest rate

of 7.75%. Effective April 30, 2019, the plan has been frozen . No new benefit will accrue for any employee, including the

officers named above, as long as the freeze remains in place.

OTHER

INFORMATION RELATING TO DIRECTORS AND EXECUTIVE OFFICERS

Section

16(a) Beneficial Ownership Reporting Compliance

Pursuant

to regulations promulgated under the Securities Exchange Act of 1934, as amended, the Company’s officers and directors and all

persons who own more than 10% of the Common Stock (“Reporting Persons”) are required to file reports detailing their ownership

and changes of ownership in the Common Stock and to furnish the Company with copies of all such ownership reports that are filed. Based

solely on the Company’s review of the copies of such ownership reports which it has received in the past fiscal year or with respect

to the past fiscal year, or written representations that no annual report of changes in beneficial ownership were required, the Company

believes that during fiscal year 2023 all Reporting Persons have complied with these reporting requirements.

Transactions

with Related Persons

First

Federal of Hazard and First Federal of Kentucky both offer loans to their directors and executive officers. These loans were made in

the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the

time for comparable transactions with other persons and did not involve more than the normal risk of collectability or present other

unfavorable features. Under current law, the Banks’ loans to directors and executive officers are required to be made on substantially

the same terms, including interest rates and collateral, as those prevailing for comparable transactions with other persons who are not

related to the lender and must not involve more than the normal risk of repayment or present other unfavorable features. Furthermore,

all loans to such persons must be approved in advance by a disinterested majority of the Bank’s Board of Directors. At June 30,

2023, loans to directors and executive officers and their affiliates totaled $915,454, or 1.8%, of the Company’s stockholders’

equity, at that date. Any transaction with a director, nominee for director, executive officer or 5% stockholder or with a family member

of any such person must be approved in advance by the Audit Committee of the Board of Directors.

SUBMISSION

OF BUSINESS PROPOSALS AND STOCKHOLDER NOMINATIONS

The

Company must receive proposals that stockholders seek to include in the proxy statement for the Company’s next annual meeting no

later than June 18, 2024. If next year’s annual meeting is held on a date more than 30 calendar days from November 16, 2024, a