Key Tronic Corporation Announces Results for the Second Quarter of Fiscal Year 2024

07 February 2024 - 8:25AM

Key Tronic Corporation (Nasdaq: KTCC), a provider

of electronic manufacturing services (EMS), today announced its

results for the quarter ended December 30, 2023.

For the second quarter of fiscal year 2024, Key Tronic reported

total revenue of $145.4 million, up 18% from $123.7 million in the

same period of fiscal year 2023. Revenue growth for the second

quarter of fiscal year 2024 was driven by increased production at

the Company’s US-based and Vietnam-based facilities, as well as by

the sale of approximately $8.1 million of inventory from a

discontinued program. For the first six months of fiscal year 2024,

total revenue was $293.2 million, up 12% from $261.0 million in the

same period of fiscal year 2023.

For the second quarter of fiscal year 2024, the Company’s gross

margin was 8.1% and operating margin was 2.7%, compared to a gross

margin of 7.2% and an operating margin of 2.9% in the same period

of fiscal year 2023. The increase in gross margin in the second

quarter of fiscal year 2024 reflects a favorable product mix for

the quarter and improved operating efficiencies.

For the second quarter of fiscal year 2024, net income was $1.1

million or $0.10 per share, compared to $1.0 million or $0.09 per

share for the same period of fiscal year 2023. For the first six

months of fiscal year 2024, net income was $1.4 million or $0.13

per share, compared to $2.1 million or $0.20 per share for the same

period of fiscal year 2023. The Company’s profitability in fiscal

year 2024 continued to be negatively impacted by increased labor

costs, unfavorable foreign currency exchange rates in Mexico and

higher interest rates on its line of credit.

“We’re pleased with the successful ramp of new programs in the

second quarter of fiscal 2024, driven by increased utilization of

our US and Vietnam facilities,” said Craig Gates, President and

Chief Executive Officer. “During the quarter, we continued to

expand our customer base, winning new programs involving security

products, medical devices and military aerospace. We also continued

to make gradual improvements in our gross margins and continued to

make significant reductions to inventory, as well as reducing our

accounts payable, debt and other liabilities.”

“While we continue to see the favorable trend of contract

manufacturing returning to North America, the strength of the

Mexican peso and continued wage increases in Mexican wages,

particularly along the US-Mexico border, have created a shift in

the way we allocate our production across our US and Juarez

locations. In order to remain competitive, our Juarez site will be

restructured to focus on higher-volume manufacturing, while

lower-volume products with higher service level requirements will

migrate to our other sites.

Accordingly, we are currently reducing our workforce in Mexico

and will incur $1.0 million to $2.5 million of severance in the

third quarter. We currently expect the payback period for these

severance costs to be less than six months and our US and Vietnam

facilities to contribute a growing portion of our revenue in coming

periods.”

The financial data presented for the second quarter of fiscal

year 2024 should be considered preliminary and could be subject to

change, as the Company’s independent auditor has not completed

their review procedures.

Business OutlookFor the third quarter of fiscal

2024, Key Tronic expects to report revenue in the range of $135

million to $145 million. The Company also expects to incur a

severance expense in the range of $1.0 million to $2.5 million from

headcount reductions in its Mexico-based operations, resulting in a

net income in the range of $0.00 to $0.15 per diluted share. These

expected results assume an effective tax rate of 20% in the coming

quarter.

Conference CallKeytronic will host a conference

call to discuss its financial results at 2:00 PM Pacific (5:00 PM

Eastern) today. A broadcast of the conference call will be

available at www.keytronic.com under “Investor Relations” or by

calling 877-400-0505 or +1-323-701-0225 (Access Code: 5587222). A

replay will be available at www.keytronic.com under “Investor

Relations”.

About Key TronicKeytronic is a leading contract

manufacturer offering value-added design and manufacturing services

from its facilities in the United States, Mexico, China and

Vietnam. The Company provides its customers with full engineering

services, materials management, worldwide manufacturing facilities,

assembly services, in-house testing, and worldwide distribution.

Its customers include some of the world’s leading original

equipment manufacturers. For more information about Keytronic

visit: www.keytronic.com

Forward-Looking StatementsSome of the

statements in this press release are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include, but are not limited to

those including such words as aims, anticipates, believes,

continues, estimates, expects, hopes, intends, plans, predicts,

projects, targets, or will, similar verbs, or nouns corresponding

to such verbs, which may be forward looking. Forward-looking

statements also include other passages that are relevant to

expected future events, performances, and actions or that can only

be fully evaluated by events that will occur in the future.

Forward-looking statements in this release include, without

limitation, the Company’s statements regarding its expectations

with respect to financial conditions and results, including revenue

and earnings, demand for certain products and the effectiveness of

some of its programs, business from customers and programs, and

impacts from operational streamlining. There are many factors,

risks and uncertainties that could cause actual results to differ

materially from those predicted or projected in forward-looking

statements, including but not limited to: the future of the global

economic environment and its impact on our customers and suppliers;

the availability of components from the supply chain; the

availability of a healthy workforce; the accuracy of suppliers’ and

customers’ forecasts; development and success of customers’

programs and products; timing and effectiveness of ramping of new

programs; success of new-product introductions; the risk of legal

proceedings or governmental investigations relating to the subject

of the internal investigation by the Company’s Audit Committee and

related or other unrelated matters; acquisitions or divestitures of

operations or facilities; technology advances; changes in pricing

policies by the Company, its competitors, customers or suppliers;

impact of new governmental legislation and regulation, including

tax reform, tariffs and related activities, such trade negotiations

and other risks; and other factors, risks, and uncertainties

detailed from time to time in the Company’s SEC filings.

| |

|

KEY TRONIC CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF INCOME(In

thousands, except per share amounts)(Unaudited) |

| |

| |

Three Months Ended |

Six Months Ended |

| |

December 30,2023 |

|

December 31,2022 |

December 30,2023 |

|

December 31,2022 |

|

Net sales |

$ |

145,417 |

|

|

$ |

123,708 |

|

$ |

293,180 |

|

|

$ |

260,971 |

|

| Cost of sales |

|

133,654 |

|

|

|

114,788 |

|

|

270,555 |

|

|

|

241,672 |

|

|

Gross profit |

|

11,763 |

|

|

|

8,920 |

|

|

22,625 |

|

|

|

19,299 |

|

| Research, development and

engineering expenses |

|

1,758 |

|

|

|

2,287 |

|

|

3,999 |

|

|

|

4,583 |

|

| Selling, general and

administrative expenses |

|

6,057 |

|

|

|

5,735 |

|

|

11,841 |

|

|

|

11,391 |

|

| Gain on insurance proceeds,

net of losses |

|

— |

|

|

|

(2,710 |

) |

|

(431 |

) |

|

|

(3,644 |

) |

|

Total operating expenses |

|

7,815 |

|

|

|

5,312 |

|

|

15,409 |

|

|

|

12,330 |

|

|

Operating income |

|

3,948 |

|

|

|

3,608 |

|

|

7,216 |

|

|

|

6,969 |

|

| Interest expense, net |

|

2,961 |

|

|

|

2,507 |

|

|

5,972 |

|

|

|

4,394 |

|

|

Income before income taxes |

|

987 |

|

|

|

1,101 |

|

|

1,244 |

|

|

|

2,575 |

|

| Income tax (benefit)

provision |

|

(97 |

) |

|

|

134 |

|

|

(175 |

) |

|

|

456 |

|

|

Net income |

$ |

1,084 |

|

|

$ |

967 |

|

$ |

1,419 |

|

|

$ |

2,119 |

|

|

Net income per share — Basic |

$ |

0.10 |

|

|

$ |

0.09 |

|

$ |

0.13 |

|

|

$ |

0.20 |

|

|

Weighted average shares outstanding — Basic |

|

10,762 |

|

|

|

10,762 |

|

|

10,762 |

|

|

|

10,762 |

|

|

Net income per share — Diluted |

$ |

0.10 |

|

|

$ |

0.09 |

|

$ |

0.13 |

|

|

$ |

0.20 |

|

|

Weighted average shares outstanding — Diluted |

|

10,889 |

|

|

|

10,832 |

|

|

10,889 |

|

|

|

10,832 |

|

| |

|

KEY TRONIC CORPORATION AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS(In

thousands)(Unaudited) |

| |

| |

|

December 30, 2023 |

|

July 1, 2023 |

| ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

2,953 |

|

|

3,603 |

|

|

Trade receivables, net of allowance for doubtful accounts of $72

and $23 |

|

134,892 |

|

|

150,600 |

|

|

Contract assets |

|

27,770 |

|

|

29,925 |

|

|

Inventories, net |

|

124,054 |

|

|

137,911 |

|

|

Other |

|

22,612 |

|

|

27,510 |

|

|

Total current assets |

|

312,281 |

|

|

349,549 |

|

| Property, plant and equipment,

net |

|

28,935 |

|

|

28,870 |

|

| Operating lease right-of-use

assets, net |

|

18,104 |

|

|

16,202 |

|

| Other assets: |

|

|

|

|

|

|

Deferred income tax asset |

|

13,161 |

|

|

12,254 |

|

|

Other |

|

6,243 |

|

|

11,397 |

|

|

Total other assets |

|

19,404 |

|

|

23,651 |

|

| Total assets |

|

378,724 |

|

|

418,272 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

91,358 |

|

|

115,899 |

|

|

Accrued compensation and vacation |

|

5,677 |

|

|

13,351 |

|

|

Current portion of debt, net |

|

5,610 |

|

|

7,849 |

|

|

Other |

|

15,721 |

|

|

14,867 |

|

|

Total current liabilities |

|

118,366 |

|

|

151,966 |

|

| Long-term liabilities: |

|

|

|

|

|

|

Term loans |

|

6,465 |

|

|

6,726 |

|

|

Revolving loan |

|

108,429 |

|

|

114,805 |

|

|

Operating lease liabilities |

|

12,380 |

|

|

10,317 |

|

|

Deferred income tax liability |

|

22 |

|

|

274 |

|

|

Other long-term obligations |

|

627 |

|

|

3,567 |

|

|

Total long-term liabilities |

|

127,923 |

|

|

135,689 |

|

| Total liabilities |

|

246,289 |

|

|

287,655 |

|

| Shareholders’ equity: |

|

|

|

|

|

|

Common stock, no par value—shares authorized 25,000; issued and

outstanding 10,762 and 10,762 shares, respectively |

|

47,839 |

|

|

47,728 |

|

|

Retained earnings |

|

84,405 |

|

|

82,986 |

|

|

Accumulated other comprehensive income (loss) |

|

191 |

|

|

(97 |

) |

|

Total shareholders’ equity |

|

132,435 |

|

|

130,617 |

|

| Total liabilities and

shareholders’ equity |

|

378,724 |

|

|

418,272 |

|

|

|

|

|

|

|

|

CONTACTS: |

|

Brett Larsen |

|

Michael Newman |

|

|

|

Chief Financial Officer |

|

Investor Relations |

|

|

|

Key Tronic Corporation |

|

StreetConnect |

|

|

|

(509) 927-5500 |

|

(206) 729-3625 |

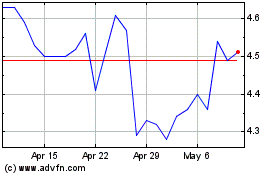

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

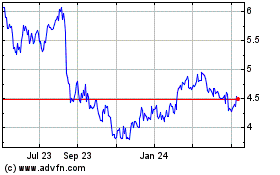

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Apr 2023 to Apr 2024