KVH Industries, Inc., (Nasdaq: KVHI), a leading provider of

innovative, technology-driven connectivity and navigation

solutions, today reported financial results for the fourth quarter

and full year ended December 31, 2020. The company will hold a

conference call to discuss these results at 9:00 a.m. ET today,

which can be accessed at investors.kvh.com. Following the call, a

replay of the webcast will be available through the company’s

website.

Fourth Quarter 2020 Highlights

- Total revenues from continuing

operations increased by 4% year-over-year to $44.1 million.

- Revenues for AgilePlans, our

all-inclusive Connectivity as a Service program for the commercial

maritime sector, were up more than 53% compared to the fourth

quarter of 2019.

- AgilePlans amounted to 73% of total

commercial maritime mini-VSAT Broadband shipments, and 58% of the

total mini-VSAT Broadband shipments for the quarter. AgilePlans now

represent 38% of our mini-VSAT Broadband subscriber base.

- Our mini-VSAT Broadband airtime

revenue increased $1.2 million to $20.3 million, or 6%

year-over-year, driven primarily by a 4% increase in

subscribers.

- TACNAV product sales increased

$3.7 million to $7.2 million in the fourth quarter of 2020

compared to the fourth quarter of 2019, and fiber optic gyro (FOG)

product and OEM product sales decreased $1.3 million, or

17%, in the fourth quarter of 2020 compared to the fourth quarter

of 2019.

- We recorded an aggregate impairment

charge of $10.5 million to goodwill and intangible assets for our

KVH Media Group reporting unit, which has been particularly

impacted due to the global reduction in travel resulting from the

pandemic.

- Taking into account the impact of

this $10.5 million goodwill and intangible asset impairment charge,

net loss from continuing operations in the fourth quarter of 2020

was $11.6 million, or $0.65 per share, compared to a net loss

of $2.9 million, or $0.17 per share, in the fourth quarter of

2019.

- Non-GAAP net income from continuing

operations in the fourth quarter of 2020 was $1.3 million, or $0.07

per share, compared to a net loss of $0.5 million, or $0.03 per

share, in the fourth quarter of 2019.

- Non-GAAP adjusted EBITDA from

continuing operations in the fourth quarter of 2020 was

$3.5 million, compared to $0.7 million in the fourth quarter

of 2019.

Commenting on the quarter, Martin Kits van

Heyningen, KVH’s chief executive officer, said “Like many

businesses around the world, we continued to face challenges from

the pandemic, but ended our year positively, reporting overall

revenue growth and an increase in adjusted EBITDA for the fourth

quarter. I am proud of our team’s ability to continue to deliver

value for our customers. Our revenues grew 4%, despite the

headwinds related to the pandemic, particularly in our Media group

as a result of the ongoing shutdown of cruise ship operations, and

our adjusted EBITDA increased to $3.5 million. Our continued focus

on cost containment, combined with healthy TACNAV revenues and

temporary savings from pandemic-related restrictions, allowed us to

report one of the strongest fourth quarter results from continuing

operations in the past five years. For the full year, although we

reported an increase in GAAP net loss of $5.9 million, which was

largely attributable to the $10.5 million non-cash impairment

charge, we reported an increase in adjusted EBITDA of more than

$7.0 million compared to last year. Against the backdrop of global

economic uncertainty, we are pleased with our overall financial

results for the year and with the positive momentum we are carrying

into the first quarter of 2021.

“In addition to our solid financial results, we

continued to make progress on our key initiatives this year. We

commercialized our photonic integrated chip technology for use

across our FOG products. KVH Watch, our IoT Connectivity as a

Service solution, has developed a growing ecosystem of Watch

Solution Partners, and our AgilePlans program continues to excel,

with record VSAT shipments and steady airtime revenue growth. Our

HTS network now serves a majority of our total subscriber base and

we are working to convert the remainder of our legacy customers to

this new network by the end of 2021. We continue to invest in

longer term opportunities as well, including the autonomous

everything market where our new PIC-based gyros offer needed

precision at a competitive price. We believe these are the

initiatives that will fuel our growth in 2021 and beyond, and we

are confident that the progress we are making now will deliver

sustainable, long-term value to our shareholders. While there

remains significant uncertainty in our markets, we expect the

trends we saw in the fourth quarter to continue. Assuming that the

pandemic continues to recede, and we see a return to more normal

consumer behavior starting in July, we expect the second half of

the year to show stronger growth in both of our markets. As a

result, we anticipate full year revenues to increase by mid-to high

single digits on an annual basis and adjusted EBITDA to grow at a

faster rate than revenue for the full year.”

The company has classified the results of the

Videotel business sold in 2019 as a discontinued operation and

therefore Videotel is excluded from the segment information

below.

The company operates in two segments, mobile

connectivity and inertial navigation. In the fourth quarter of

2020, net sales for the mobile connectivity segment remained flat

compared to the fourth quarter of 2019. mini-VSAT Broadband airtime

revenue increased by $1.2 million. The increase was offset

primarily by a $0.7 million decrease in our content service

sales and a $0.2 million decrease in mobile connectivity

product sales. In the fourth quarter of 2020, net sales for our

inertial navigation segment increased by $1.7 million, or 13%,

compared to the fourth quarter of 2019. Inertial navigation sales

increased primarily due to a $3.7 million increase in TACNAV

product sales. This increase was offset in part by a

$1.3 million decrease in FOG and OEM product sales and a

$0.9 million decrease in contracted engineering revenue.

Financial Highlights - From Continuing

Operations (in millions, except per share data)

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| GAAP

Results |

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

44.1 |

|

|

|

$ |

42.5 |

|

|

|

$ |

158.7 |

|

|

|

$ |

157.9 |

|

|

| Net loss |

|

$ |

(11.6 |

) |

|

|

$ |

(2.9 |

) |

|

|

$ |

(21.9 |

) |

|

|

$ |

(16.0 |

) |

|

| Net loss per share |

|

$ |

(0.65 |

) |

|

|

$ |

(0.17 |

) |

|

|

$ |

(1.24 |

) |

|

|

$ |

(0.92 |

) |

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP

Results |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

1.3 |

|

|

|

$ |

(0.5 |

) |

|

|

$ |

(3.5 |

) |

|

|

$ |

(8.2 |

) |

|

| Net income (loss) per

share |

|

$ |

0.07 |

|

|

|

$ |

(0.03 |

) |

|

|

$ |

(0.20 |

) |

|

|

$ |

(0.47 |

) |

|

| Adjusted EBITDA |

|

$ |

3.5 |

|

|

|

$ |

0.7 |

|

|

|

$ |

3.1 |

|

|

|

$ |

(4.2 |

) |

|

For more information regarding our non-GAAP

financial measures, see the tables at the end of this release.

Fourth Quarter Financial Summary

Revenue was $44.1 million for the fourth

quarter of 2020, an increase of 4% compared to $42.5 million

in the fourth quarter of 2019.

Product revenues for the fourth quarter of 2020

were $20.9 million, an increase of 12% compared to the prior

year quarter, primarily due to a $2.4 million increase in

inertial navigation product sales, partially offset by a

$0.2 million decrease in mobile connectivity product sales.

Inertial navigation product sales increased primarily as a result

of a $3.7 million increase in TACNAV product sales, which was

partially offset by a $1.3 million decrease in FOG and OEM

product sales. The decrease in mobile connectivity product sales

was primarily due to a $0.3 million decrease in TracVision

product sales and a $0.2 million decrease in land mobile

product sales. The decrease in TracVision and land mobile product

sales was primarily due to a decline in leisure sales. These

decreases were partially offset by a $0.2 million increase in

mini-VSAT Broadband products and accessories sales.

Service revenues for the fourth quarter of 2020

were $23.2 million, a decrease of 2% compared to the fourth

quarter of 2019, primarily due to a $0.8 million decrease in

inertial navigation service sales. Inertial navigation service

sales decreased primarily due to lower contract engineering service

revenue. This was partially offset by a $0.2 million increase

in mobile connectivity service sales. Mobile connectivity service

sales increased primarily due to a $1.2 million increase in

our mini-VSAT Broadband service sales, which resulted in part from

a 4% increase in subscribers, primarily as a result of AgilePlans.

Partially offsetting this increase was a $0.7 million decrease

in our content service sales.

Primarily as a result of the impairment charges

for our KVH Media business unit of $10.5 million, our operating

expenses increased $9.2 million to $28.4 million for the

fourth quarter of 2020 compared to $19.2 million for the

fourth quarter of 2019. This increase was partially offset by a

$0.5 million decrease in marketing expenses, a $0.5 million

decrease in warranty expense and a $0.4 million decrease in travel

expenses.

Full Year Financial Summary

Revenue was $158.7 million for the year

ended December 31, 2020, an increase of 1% compared to $157.9

million for the year ended December 31, 2019.

Product revenues for the year ended December 31,

2020 were $64.6 million, an increase of 4% compared to the

year ended December 31, 2019, which resulted primarily from an

increase of $6.5 million in inertial navigation product sales,

partially offset by a decrease in mobile connectivity product sales

of $3.8 million. The increase in inertial navigation product sales

was due to a $6.1 million increase in TACNAV product sales and

a $0.3 million increase in FOG and OEM product sales. The

decrease in mobile connectivity product sales was due to a

$3.0 million decrease in marine mobile connectivity product

sales, which was primarily driven by a decrease in TracVision

product sales. In addition, there was a $0.8 million decrease

in land mobile product sales. The decrease in TracVision and land

mobile product sales was primarily due to a decline in leisure

sales.

Service revenues for the year ended December 31,

2020 were $94.1 million, a decrease of 2% compared to the year

ended December 31, 2019 primarily due to a decrease of

$3.1 million in inertial navigation service sales, partially

offset by an increase in mobile connectivity service sales of

$1.2 million. The decrease in inertial navigation service

sales was due to a decrease in our contract engineering service

revenue. The increase in mobile connectivity service sales was

primarily due to a $5.0 million increase in our mini-VSAT

Broadband service sales, which resulted in part from a 4% increase

in subscribers, primarily as a result of AgilePlans, and a $0.9

million one-time amount relating to a favorable resolution of a

contractual matter with a particular customer. Partially offsetting

this increase was a $2.7 million decrease in content service

sales, a $0.7 million decrease in our contract engineering

service revenue and a $0.4 million decrease in service repair

revenue.

Primarily as a result of the impairment charges

for our KVH Media business unit of $10.5 million, our operating

expenses increased $5.7 million to $80.5 million in the year

ended December 31, 2020 compared to $74.8 million in the year ended

December 31, 2019. This increase was partially offset by a $1.6

million decrease in travel expense, a $1.1 million decrease in

warranty expense, a $1.0 million decrease in marketing expense and

a $0.9 million decrease in salaries and employee benefits. A

portion of these cost savings were attributable to pandemic-related

travel restrictions and other measures, and we expect that these

expenses will begin to normalize as the pandemic recovery

progresses.

Other Recent Announcements

- KVH Partners with TechBinder for

KVH Watch Maritime IoT Solution.

- KVH Partners with GreenSteam for

KVH Watch Maritime IoT Solution.

- KVH Partners with Kilo Marine for

KVH Watch Maritime IoT Solution.

- KVH Partners with ioCurrents for

KVH Watch Maritime IoT Solution.

- KVH Partners with TMS Maritime

Solutions for KVH Watch Maritime IoT Solution.

- KVH Expands Maritime Network

Coverage for Hudson Bay and North Atlantic.

- Furuno Offers KVH AgilePlans

Maritime VSAT Connectivity in Japan.

Please review the corresponding press releases

for more details regarding these developments.

Conference Call Details

KVH Industries will host a conference call today

at 9:00 a.m. ET through the company’s website. The conference call

can be accessed at investors.kvh.com and listeners are welcome to

submit questions pertaining to the earnings release and conference

call to ir@kvh.com. The audio archive will be available on the

company website within three hours of the completion of the

call.

Non-GAAP Financial Measures

This release provides non-GAAP financial

information, which may include constant-currency revenue, non-GAAP

net income (loss), non-GAAP diluted EPS, and non-GAAP adjusted

EBITDA, as a supplement to our condensed consolidated financial

statements, which are prepared in accordance with generally

accepted accounting principles (“GAAP”). Management uses these

non-GAAP financial measures internally in analyzing financial

results to assess operational performance. Constant-currency

revenue is calculated on the basis of local currency results, using

foreign currency exchange rates applicable to the earlier

comparative period, and management believes that presenting

information on a constant-currency basis helps management and

investors to isolate the impact of changes in those rates from

other factors. The presentation of this financial information is

not intended to be considered in isolation or as a substitute for

the financial information prepared in accordance with GAAP. The

non-GAAP financial measures used in this press release adjust for

specified items that can be highly variable or difficult to

predict. Management generally uses these non-GAAP financial

measures to facilitate financial and operational decision-making,

including evaluation of our historical operating results,

comparison to competitors’ operating results, and determination of

management incentive compensation. These non-GAAP financial

measures reflect an additional way of viewing aspects of our

operations that, when viewed with GAAP results and the

reconciliations to corresponding GAAP financial measures, may

provide a more complete understanding of factors and trends

affecting our business.

Some limitations of non-GAAP net income (loss),

non-GAAP diluted EPS, and non-GAAP adjusted EBITDA, include the

following:

- Non-GAAP net income (loss) and

diluted EPS exclude amortization of intangibles, stock-based

compensation expense, goodwill impairment charge, intangible asset

impairment charge, transaction-related and other non-recurring

legal fees, non-recurring inventory reserve, other non-recurring

costs, foreign exchange transaction gains and losses, the tax

effect of the foregoing and certain discrete tax charges, including

changes in our valuation allowance and other tax adjustments.

- Non-GAAP adjusted EBITDA represents

net income (loss) before interest income, net, income taxes,

depreciation, amortization, stock-based compensation expense,

goodwill impairment charge, intangible asset impairment charge,

transaction-related and other non-recurring legal

fees, non-recurring inventory reserves, other non-recurring

costs and foreign exchange transaction gains and losses.

Other companies, including companies in KVH’s

industry, may calculate these non-GAAP financial measures

differently or not at all, which will reduce their usefulness as a

comparative measure.

Because non-GAAP financial measures exclude the

effect of items that increase or decrease our reported results of

operations, management strongly encourages investors to review our

consolidated financial statements and publicly filed reports in

their entirety. Reconciliations of the non-GAAP financial measures

to the most directly comparable GAAP financial measures are

included in the tables accompanying this release.

About KVH Industries, Inc.

KVH Industries, Inc., (Nasdaq: KVHI), is a

global leader in mobile connectivity and inertial navigation

systems, with innovative technology designed to enable a mobile

world. A market leader in maritime VSAT, KVH designs, manufactures,

and provides connectivity and content services globally. KVH is

also a premier manufacturer of high-performance sensors and

integrated inertial systems for defense and commercial

applications. Founded in 1982, the company is based in Middletown,

RI, with research, development, and manufacturing operations in

Middletown, RI, and Tinley Park, IL, and more than a dozen offices

around the globe.

This press release contains forward-looking

statements that involve risks and uncertainties. For example,

forward-looking statements include statements regarding our

financial goals for future periods, the success of our new

initiatives, our investment plans, our development goals, our

anticipated revenue and earnings, and the impact of our future

initiatives on revenue, competitive positioning, profitability, and

product orders. Actual results could differ materially from the

results projected in or implied by the forward-looking statements

made in this press release. Factors that might cause these

differences include, but are not limited to: the adverse impact of

the COVID-19 pandemic, as well as governmental, business and other

responses thereto and any resulting economic slowdown, on our

revenues, results of operations and financial condition, which

could be material (particularly for our media and other

travel-related businesses); adverse changes in our business,

prospects, financial condition or results of operations that may

necessitate staffing or compensation reductions beyond those

contemplated by the loan forgiveness provisions of the paycheck

protection program (PPP), as a result of which we may not be

entitled to any forgiveness; possible SBA determination that all or

a portion of our PPP loan is not eligible for forgiveness;

unanticipated changes or disruptions in our markets; increased

competition; technological breakthroughs by competitors; changes in

customer priorities or preferences; potential customer

terminations; unanticipated liabilities; the potential that

competitors will design around or invalidate our intellectual

property rights; a history and expectation of continuing losses as

we increase investments in various initiatives; continued

fluctuations in quarterly results; the uncertain duration of the

initial adverse impact on our overall revenues of our AgilePlans

and KVH Watch, under which we recognize no revenue for product

sales, either at the time of shipment or over the contract term;

potential delays in the development of a market for our IoT

services; the need to develop an ecosystem of applications for our

new IoT services; higher costs arising from maintaining both the

HTS network and our legacy network; potential challenges or delays

in the transition of customers from our legacy network to our HTS

network, which could result in a material loss of revenue; costs

arising from the termination of our legacy network; the uncertain

impact of federal budget deficits, Congressional deadlock and the

change in administration; the uncertain impact of changes in trade

policy, including actual and potential new or higher tariffs and

trade barriers, as well as trade wars with other countries;

unanticipated obstacles in our photonic chip and other product and

service development, cost engineering and manufacturing efforts;

delays in anticipated orders for our products and services,

including significant orders for TACNAV products, or the potential

failure of such orders to occur; adverse impacts of currency

fluctuations; our ability to successfully commercialize our new

initiatives without unanticipated additional expenses or delays;

potential reduced sales to companies in or dependent upon the

turbulent oil and gas industry; continued substantial fluctuations

in military sales, including to foreign customers; the

unpredictability of defense budget priorities as well as the order

timing, purchasing schedules, and priorities for defense products,

including possible order cancellations; the uncertain impact of

potential budget cuts by government customers; the impact of

extended economic weakness on the sale and use of marine vessels

and recreational vehicles; the potential inability to increase or

maintain our market share in the market for airtime services; the

need to increase sales of the TracPhone V-HTS series products and

related services to maintain and improve airtime gross margins; the

need for, or delays in, qualification of products to customer or

regulatory standards; potential declines or changes in customer

demand, due to economic, weather-related, seasonal, and other

factors, particularly with respect to the TracPhone V-HTS series,

including with respect to new pricing models; increased price and

service competition in the mobile connectivity market; exposure for

potential intellectual property infringement; changes in tax and

accounting requirements or assessments; and export restrictions,

delays in procuring export licenses, and other international risks.

These and other factors are discussed in more detail in our

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission on October 29, 2020. Copies are available

through our Investor Relations department and website,

http://investors.kvh.com. We do not assume any obligation to update

our forward-looking statements to reflect new information and

developments.

KVH Industries, Inc., has used, registered, or applied to

register its trademarks in the USA and other countries around the

world, including but not limited to the following marks: KVH,

TracVision, TracPhone, TACNAV, YOURlink, KVH Watch, mini-VSAT

Broadband, and AgilePlans. Other trademarks are the property of

their respective companies.

|

|

|

|

|

|

| Contact: |

|

KVH Industries, Inc.Brent

Bruun401-845-8194bbruun@kvh.com |

|

FTI ConsultingChristine

Mohrmann212-850-5600 |

KVH INDUSTRIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share amounts,

unaudited)

| |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| Sales: |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

20,926 |

|

|

|

$ |

18,713 |

|

|

|

$ |

64,619 |

|

|

|

$ |

61,925 |

|

|

|

Service |

|

23,201 |

|

|

|

23,763 |

|

|

|

94,114 |

|

|

|

95,968 |

|

|

|

Net sales |

|

44,127 |

|

|

|

42,476 |

|

|

|

158,733 |

|

|

|

157,893 |

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

Costs of product sales |

|

11,996 |

|

|

|

11,131 |

|

|

|

41,608 |

|

|

|

42,887 |

|

|

|

Costs of service sales |

|

15,069 |

|

|

|

15,475 |

|

|

|

59,517 |

|

|

|

61,256 |

|

|

|

Research and development |

|

4,098 |

|

|

|

3,933 |

|

|

|

15,799 |

|

|

|

15,926 |

|

|

|

Sales, marketing and support |

|

7,385 |

|

|

|

8,734 |

|

|

|

29,811 |

|

|

|

33,434 |

|

|

|

General and administrative |

|

6,439 |

|

|

|

6,528 |

|

|

|

24,445 |

|

|

|

25,486 |

|

|

|

Goodwill impairment charge |

|

8,732 |

|

|

|

— |

|

|

|

8,732 |

|

|

|

— |

|

|

|

Intangible asset impairment charge |

|

1,758 |

|

|

|

— |

|

|

|

1,758 |

|

|

|

— |

|

|

|

Total costs and

expenses |

|

55,477 |

|

|

|

45,801 |

|

|

|

181,670 |

|

|

|

178,989 |

|

|

|

Loss from

operations |

|

(11,350 |

) |

|

|

(3,325 |

) |

|

|

(22,937 |

) |

|

|

(21,096 |

) |

|

|

Interest income |

|

237 |

|

|

|

377 |

|

|

|

996 |

|

|

|

2,003 |

|

|

|

Interest expense |

|

9 |

|

|

|

4 |

|

|

|

18 |

|

|

|

1,020 |

|

|

|

Other (expense) income, net |

|

(778 |

) |

|

|

(821 |

) |

|

|

193 |

|

|

|

101 |

|

|

|

Loss from continuing operations before income tax (benefit)

expense |

|

(11,900 |

) |

|

|

(3,773 |

) |

|

|

(21,766 |

) |

|

|

(20,012 |

) |

|

| Income tax (benefit)

expense |

|

(263 |

) |

|

|

(863 |

) |

|

|

174 |

|

|

|

(4,003 |

) |

|

|

Net loss from continuing operations |

|

$ |

(11,637 |

) |

|

|

$ |

(2,910 |

) |

|

|

$ |

(21,940 |

) |

|

|

$ |

(16,009 |

) |

|

| |

|

|

|

|

|

|

|

|

| (Loss) income from

discontinued operations, net of tax |

|

— |

|

|

|

(573 |

) |

|

|

— |

|

|

|

49,264 |

|

|

|

Net (loss) income |

|

$ |

(11,637 |

) |

|

|

$ |

(3,483 |

) |

|

|

$ |

(21,940 |

) |

|

|

$ |

33,255 |

|

|

| |

|

|

|

|

|

|

|

|

| Net loss from

continuing operations per common share: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.65 |

) |

|

|

$ |

(0.17 |

) |

|

|

$ |

(1.24 |

) |

|

|

$ |

(0.92 |

) |

|

| Net (loss) income from

discontinued operations per common share: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.00 |

|

|

|

$ |

(0.03 |

) |

|

|

$ |

0.00 |

|

|

|

$ |

2.82 |

|

|

| Net (loss) income per

common share |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.65 |

) |

|

|

$ |

(0.20 |

) |

|

|

$ |

(1.24 |

) |

|

|

$ |

1.90 |

|

|

| Weighted average

number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

17,772 |

|

|

|

17,548 |

|

|

|

17,669 |

|

|

|

17,459 |

|

|

KVH INDUSTRIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, unaudited)

| |

|

December 31,2020 |

|

December 31,2019 |

| ASSETS |

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

37,719 |

|

|

$ |

48,272 |

|

|

Accounts receivable, net |

|

33,687 |

|

|

32,891 |

|

|

Inventories, net |

|

24,674 |

|

|

23,465 |

|

|

Other current assets and contract assets |

|

4,980 |

|

|

4,646 |

|

|

Total current

assets |

|

101,060 |

|

|

109,274 |

|

|

Property and equipment, net |

|

56,273 |

|

|

53,584 |

|

|

Goodwill |

|

6,592 |

|

|

15,408 |

|

|

Intangible assets, net |

|

2,254 |

|

|

4,943 |

|

|

Right of use assets |

|

6,893 |

|

|

6,286 |

|

|

Other non-current assets and contract assets |

|

10,446 |

|

|

9,851 |

|

|

Deferred income tax asset |

|

73 |

|

|

45 |

|

|

Total assets |

|

$ |

183,591 |

|

|

$ |

199,391 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

27,525 |

|

|

$ |

31,116 |

|

|

Contract liabilities |

|

4,445 |

|

|

4,443 |

|

|

Current portion of long-term debt |

|

4,992 |

|

|

— |

|

|

Current operating lease liability |

|

3,826 |

|

|

2,831 |

|

|

Total current

liabilities |

|

40,788 |

|

|

38,390 |

|

|

Other long-term liabilities |

|

674 |

|

|

1,292 |

|

|

Long-term operating lease liability |

|

3,204 |

|

|

3,482 |

|

|

Long-term contract liabilities |

|

4,688 |

|

|

5,476 |

|

|

Deferred income tax liability |

|

418 |

|

|

762 |

|

|

Long-term debt, excluding current portion |

|

1,935 |

|

|

— |

|

|

Stockholders’ equity |

|

131,884 |

|

|

149,989 |

|

|

Total liabilities and

stockholders’ equity |

|

$ |

183,591 |

|

|

$ |

199,391 |

|

KVH INDUSTRIES, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET LOSS FROM

CONTINUING OPERATIONSTO NON-GAAP NET INCOME (LOSS)

FROM CONTINUING OPERATIONS(in thousands, except

per share amounts, unaudited)

| |

|

Three months ended December 31, |

|

Year endedDecember 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Net loss from continuing operations - GAAP |

|

$ |

(11,637 |

) |

|

|

$ |

(2,910 |

) |

|

|

$ |

(21,940 |

) |

|

|

$ |

(16,009 |

) |

|

|

Amortization of intangibles |

|

264 |

|

|

|

248 |

|

|

|

1,004 |

|

|

|

980 |

|

|

|

Stock-based compensation expense |

|

1,003 |

|

|

|

1,140 |

|

|

|

3,462 |

|

|

|

4,159 |

|

|

|

Goodwill impairment charge |

|

8,732 |

|

|

|

— |

|

|

|

8,732 |

|

|

|

— |

|

|

|

Intangible asset impairment charge |

|

1,758 |

|

|

|

— |

|

|

|

1,758 |

|

|

|

— |

|

|

|

Transaction-related and other non-recurring legal fees |

|

— |

|

|

|

— |

|

|

|

201 |

|

|

|

224 |

|

|

|

Non-recurring inventory reserve |

|

— |

|

|

|

122 |

|

|

|

— |

|

|

|

2,259 |

|

|

|

Other non-recurring costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

216 |

|

|

|

Foreign exchange transaction loss |

|

707 |

|

|

|

988 |

|

|

|

48 |

|

|

|

181 |

|

|

|

Tax effect on the foregoing |

|

(736 |

) |

|

|

(502 |

) |

|

|

(1,270 |

) |

|

|

(1,664 |

) |

|

|

Change in valuation allowance and other tax adjustments (a) |

|

1,226 |

|

|

|

456 |

|

|

|

4,513 |

|

|

|

1,504 |

|

|

| Net income (loss) from

continuing operations - Non-GAAP |

|

$ |

1,317 |

|

|

|

$ |

(458 |

) |

|

|

$ |

(3,492 |

) |

|

|

$ |

(8,150 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) from

continuing operations per common share - Non-GAAP |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.07 |

|

|

|

$ |

(0.03 |

) |

|

|

$ |

(0.20 |

) |

|

|

$ |

(0.47 |

) |

|

|

Diluted |

|

$ |

0.07 |

|

|

|

$ |

(0.03 |

) |

|

|

$ |

(0.20 |

) |

|

|

$ |

(0.47 |

) |

|

| |

|

|

|

|

|

|

|

|

| Weighted average

number of common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

17,772 |

|

|

|

17,548 |

|

|

|

17,669 |

|

|

|

17,459 |

|

|

|

Diluted |

|

17,972 |

|

|

|

17,548 |

|

|

|

17,669 |

|

|

|

17,459 |

|

|

(a) Represents a change in the

valuation allowance on current year United States net operating

losses, research and development tax credits and uncertain tax

position adjustments.

KVH INDUSTRIES, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET LOSS FROM

CONTINUING OPERATIONS TO NON-GAAPEBITDA AND

NON-GAAP ADJUSTED EBITDA FROM CONTINUING

OPERATIONS(in thousands, unaudited)

| |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

GAAP net loss from continuing operations |

|

$ |

(11,637 |

) |

|

|

$ |

(2,910 |

) |

|

|

$ |

(21,940 |

) |

|

|

$ |

(16,009 |

) |

|

|

Income tax (benefit) expense |

|

(263 |

) |

|

|

(863 |

) |

|

|

174 |

|

|

|

(4,003 |

) |

|

|

Interest income, net |

|

(228 |

) |

|

|

(373 |

) |

|

|

(978 |

) |

|

|

(983 |

) |

|

|

Depreciation and amortization |

|

3,386 |

|

|

|

2,594 |

|

|

|

11,663 |

|

|

|

9,778 |

|

|

| Non-GAAP

EBITDA |

|

(8,742 |

) |

|

|

(1,552 |

) |

|

|

(11,081 |

) |

|

|

(11,217 |

) |

|

|

Stock-based compensation expense |

|

1,003 |

|

|

|

1,140 |

|

|

|

3,462 |

|

|

|

4,159 |

|

|

|

Goodwill impairment charge |

|

8,732 |

|

|

|

— |

|

|

|

8,732 |

|

|

|

— |

|

|

|

Intangible asset impairment charge |

|

1,758 |

|

|

|

— |

|

|

|

1,758 |

|

|

|

— |

|

|

|

Non-recurring inventory reserve |

|

— |

|

|

|

122 |

|

|

|

— |

|

|

|

2,259 |

|

|

|

Transaction-related and other non-recurring legal fees |

|

— |

|

|

|

— |

|

|

|

201 |

|

|

|

224 |

|

|

|

Other non-recurring costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

216 |

|

|

|

Foreign exchange transaction loss |

|

707 |

|

|

|

988 |

|

|

|

48 |

|

|

|

181 |

|

|

| Non-GAAP adjusted

EBITDA from continuing operations |

|

$ |

3,458 |

|

|

|

$ |

698 |

|

|

|

$ |

3,120 |

|

|

|

$ |

(4,178 |

) |

|

KVH INDUSTRIES, INC. AND

SUBSIDIARIESREVENUE AND OPERATING INCOME (LOSS) BY

SEGMENT FROM CONTINUING OPERATIONS(in millions

except for percentages, unaudited)

| Segment Net

Sales |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| Mobile connectivity

sales |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

7.3 |

|

|

$ |

7.6 |

|

|

$ |

27.9 |

|

|

$ |

31.6 |

|

| Service |

|

22.6 |

|

|

22.4 |

|

|

91.6 |

|

|

90.4 |

|

|

Net sales |

|

$ |

29.9 |

|

|

$ |

30.0 |

|

|

$ |

119.5 |

|

|

$ |

122.0 |

|

| |

|

|

|

|

|

|

|

|

| Inertial navigation

sales |

|

|

|

|

|

|

|

|

| Product |

|

$ |

13.6 |

|

|

$ |

11.1 |

|

|

$ |

36.8 |

|

|

$ |

30.3 |

|

| Service |

|

0.6 |

|

|

1.4 |

|

|

2.5 |

|

|

5.6 |

|

| Net

sales |

|

$ |

14.2 |

|

|

$ |

12.5 |

|

|

$ |

39.3 |

|

|

$ |

35.9 |

|

| Operating (Loss)

Income |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Mobile connectivity |

|

$ |

(10.6 |

) |

|

$ |

(1.5 |

) |

|

$ |

(10.1 |

) |

|

$ |

(5.6 |

) |

| Inertial

navigation |

|

4.1 |

|

|

3.0 |

|

|

4.8 |

|

|

3.0 |

|

| |

|

(6.5 |

) |

|

1.5 |

|

|

(5.3 |

) |

|

(2.6 |

) |

|

Unallocated |

|

(4.8 |

) |

|

(4.8 |

) |

|

(17.7 |

) |

|

(18.5 |

) |

| Loss from

operations |

|

$ |

(11.3 |

) |

|

$ |

(3.3 |

) |

|

$ |

(23.0 |

) |

|

$ |

(21.1 |

) |

(1) Mobile connectivity loss from operations for

the fourth quarter of 2020 includes a $10.5 million goodwill and

intangible asset impairment charge.

| |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

(percentage of total revenue) |

|

(percentage of total revenue) |

| Mobile Connectivity

Revenue Components |

|

|

|

|

|

|

|

|

|

Product sales |

|

17 |

% |

|

18 |

% |

|

18 |

% |

|

20 |

% |

|

mini-VSAT Broadband airtime |

|

46 |

% |

|

45 |

% |

|

51 |

% |

|

48 |

% |

|

Content service |

|

4 |

% |

|

6 |

% |

|

5 |

% |

|

6 |

% |

| Inertial Navigation

Revenue Components |

|

|

|

|

|

|

|

|

|

FOG-based products |

|

14 |

% |

|

18 |

% |

|

16 |

% |

|

16 |

% |

|

Tactical navigation products |

|

16 |

% |

|

8 |

% |

|

7 |

% |

|

3 |

% |

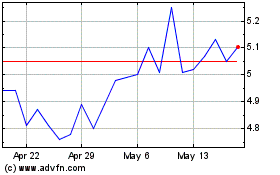

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

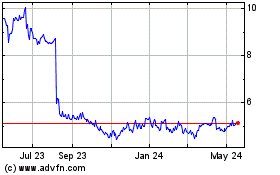

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jul 2023 to Jul 2024