Lancaster Colony Corporation (Nasdaq: LANC) today reported

results for the company’s fiscal fourth quarter and fiscal year

ended June 30, 2024.

Fourth Quarter Summary

- Consolidated fourth quarter net sales declined 0.4% to $452.8

million. Retail segment net sales declined 0.8% in the quarter to

$234.2 million, driven by the impact of our tactical decision to

exit our perimeter-of-the-store bakery product lines this past

March. Foodservice segment net sales were essentially flat at

$218.6 million as deflationary pricing offset volume growth.

- Consolidated gross profit increased $4.4 million to $97.6

million.

- Consolidated operating income increased $30.2 million to $41.7

million. Restructuring and impairment charges reduced this year’s

fourth quarter operating income by $2.7 million while impairment

charges reduced last year’s fourth quarter operating income by

$25.0 million.

- Fourth quarter net income was $1.26 per diluted share versus

$0.33 per diluted share last year. Restructuring and impairment

charges reduced this year’s fourth quarter net income by $0.08 per

diluted share whereas impairment charges reduced last year’s fourth

quarter net income by $0.70 per diluted share.

CEO David A. Ciesinski commented, “We were pleased to report

gross profit growth of 4.8% in the fourth quarter despite the

modest sales decline. In the Retail segment, our licensed items

continued to perform well, as the recently introduced Subway®

sandwich sauces and Texas Roadhouse® steak sauces provided

incremental sales growth to our lineup of licensed sauces and

dressings. Our category-leading New York BRAND® Bakery frozen

garlic bread also achieved solid volume gains in the quarter.

Excluding the perimeter-of-the-store bakery product lines that we

exited in March, Retail net sales increased 1.4% and Retail sales

volume, measured in pounds shipped, increased 1.2%. In the

Foodservice segment, flat net sales reflect the unfavorable impact

of deflationary pricing while the segment’s sales volume improved

4.2%, driven by increased demand from several of our national chain

restaurant account customers.”

“The $4.4 million increase in fourth quarter gross profit

resulted in a gross profit margin of 21.6%, an increase of 110

basis points versus the prior year driven by our cost savings

programs. As anticipated, we did not benefit from pricing net of

commodity costs, or PNOC, in our fiscal fourth quarter.”

Fourth Quarter Results

Consolidated net sales decreased 0.4% to $452.8 million. Retail

segment net sales declined 0.8% to $234.2 million while the

segment’s sales volume, measured in pounds shipped, was flat.

Excluding the perimeter-of-the-store bakery product lines that we

exited in March, specifically our Flatout® and Angelic Bakehouse®

brands, Retail net sales increased 1.4% and Retail sales volume

increased 1.2%. In the Foodservice segment, net sales were

essentially unchanged at $218.6 million including the unfavorable

impact of deflationary pricing while Foodservice sales volume

increased 4.2%.

Consolidated gross profit increased $4.4 million to $97.6

million as our cost savings programs more than offset higher labor

costs and the impact of deflationary pricing.

SG&A expenses decreased $3.5 million to $53.2 million as

expenditures for Project Ascent, our ERP initiative, continued to

wind down and consumer spending was also lower. These lower costs

were partially offset by increased investments in personnel and IT.

Expenditures for Project Ascent totaled $0.5 million in the

current-year quarter versus $5.6 million last year.

Restructuring and impairment charges of $2.7 million are

attributed to our decision to exit our perimeter-of-the-store

bakery product lines this past March. The associated property and

equipment for those product lines were sold or disposed of during

the fourth quarter, and we do not anticipate any additional related

charges going forward. In the prior-year quarter, impairment

charges of $25.0 million resulted from a reduction in the carrying

value of certain intangible assets attributed to the now

discontinued Flatout product line.

Consolidated operating income increased $30.2 million to $41.7

million as impacted by the net reduction of $22.3 million in

restructuring and impairment charges along with the improved gross

profit and reduced SG&A expenses.

Net income increased $25.7 million to $34.8 million, or $1.26

per diluted share, versus $9.2 million, or $0.33 per diluted share,

last year. In the current-year quarter, the restructuring and

impairment charges reduced net income by $2.1 million, or $0.08 per

diluted share, while expenditures for Project Ascent reduced net

income by $0.4 million, or $0.01 per diluted share. In the

prior-year quarter, impairment charges reduced net income by $19.3

million, or $0.70 per diluted share, while expenditures for Project

Ascent reduced net income by $4.3 million, or $0.16 per diluted

share.

Fiscal Year Results

For the fiscal year ended June 30, 2024, net sales increased

2.7% to $1.87 billion compared to $1.82 billion a year ago. Net

income for the fiscal year totaled $158.6 million, or $5.76 per

diluted share, versus the prior-year amount of $111.3 million, or

$4.04 per diluted share. In fiscal 2024, restructuring and

impairment charges reduced net income by $11.4 million, or $0.42

per diluted share, and expenditures for Project Ascent decreased

net income by $6.3 million, or $0.23 per diluted share. In fiscal

2023, expenditures for Project Ascent decreased net income by $23.0

million, or $0.84 per diluted share, while restructuring and

impairment charges reduced net income by $19.3 million, or $0.70

per diluted share.

Fiscal 2025 Outlook

Mr. Ciesinski commented, “Looking ahead to fiscal 2025, we

anticipate Retail segment sales will continue to benefit from

volume growth led by our licensing program, including increased

sales from the new products, flavors and sizes we introduced in

fiscal 2024. We are also excited to share that our partnership with

Texas Roadhouse has expanded beyond steak sauces to include their

popular dinner rolls, which we introduced with a regional pilot

test in June. In addition, we anticipate continued positive sales

momentum for our New York BRAND® Bakery frozen garlic bread

products in fiscal 2025 driven by the introduction of a

great-tasting gluten-free garlic bread, along with volume growth

for our Marzetti® refrigerated dressings. In the Foodservice

segment, we expect sales volume to be led by growth from select

quick-service restaurant customers in our mix of national chain

restaurant accounts, while external factors, including U.S.

economic performance and consumer behavior, may impact demand. With

respect to our input costs, in aggregate we do not foresee

significant impacts from commodity cost inflation or deflation in

the coming year. We also expect to drive margin improvement through

our cost savings programs.”

Conference Call on the Web

The company’s fourth quarter and fiscal year-end conference call

is scheduled for this morning, August 22, at 10:00 a.m. ET. Access

to a live webcast of the call is available through a link on the

company’s Internet home page at www.lancastercolony.com. A replay

of the webcast will also be made available on the company’s

website.

About the Company

Lancaster Colony Corporation is a manufacturer and marketer of

specialty food products for the retail and foodservice

channels.

Forward-Looking Statements

We desire to take advantage of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995 (the “PSLRA”).

This news release contains various “forward-looking statements”

within the meaning of the PSLRA and other applicable securities

laws. Such statements can be identified by the use of the

forward-looking words “anticipate,” “estimate,” “project,”

“believe,” “intend,” “plan,” “expect,” “hope” or similar words.

These statements discuss future expectations; contain projections

regarding future developments, operations or financial conditions;

or state other forward-looking information. Such statements are

based upon assumptions and assessments made by us in light of our

experience and perception of historical trends, current conditions,

expected future developments; and other factors we believe to be

appropriate. These forward-looking statements involve various

important risks, uncertainties and other factors, many of which are

beyond our control, which could cause our actual results to differ

materially from those expressed in the forward-looking statements.

Some of the key factors that could cause actual results to differ

materially from those expressed in the forward-looking statements

include:

- efficiencies in plant operations and our overall supply chain

network;

- price and product competition;

- changes in demand for our products, which may result from

changes in consumer behavior or loss of brand reputation or

customer goodwill;

- the impact of customer store brands on our branded retail

volumes;

- adequate supply of labor for our manufacturing facilities;

- stability of labor relations;

- adverse changes in freight, energy or other costs of producing,

distributing or transporting our products;

- the reaction of customers or consumers to pricing actions we

take to offset inflationary costs;

- inflationary pressures resulting in higher input costs;

- fluctuations in the cost and availability of ingredients and

packaging;

- capacity constraints that may affect our ability to meet demand

or may increase our costs;

- dependence on contract manufacturers, distributors and freight

transporters, including their operational capacity and financial

strength in continuing to support our business;

- the impact of any regulatory matters affecting our food

business, including any additional requirements imposed by the FDA

or any state or local government;

- dependence on key personnel and changes in key personnel;

- cyber-security incidents, information technology disruptions,

and data breaches;

- the potential for loss of larger programs or key customer

relationships;

- failure to maintain or renew license agreements;

- geopolitical events that could create unforeseen business

disruptions and impact the cost or availability of raw materials

and energy;

- significant shifts in consumer demand and disruptions to our

employees, communities, customers, supply chains, production

planning, operations, and production processes resulting from the

impacts of epidemics, pandemics or similar widespread public health

concerns and disease outbreaks;

- the possible occurrence of product recalls or other defective

or mislabeled product costs;

- the success and cost of new product development efforts;

- the lack of market acceptance of new products;

- the extent to which good-fitting business acquisitions are

identified, acceptably integrated, and achieve operational and

financial performance objectives;

- the effect of consolidation of customers within key market

channels;

- maintenance of competitive position with respect to other

manufacturers;

- the outcome of any litigation or arbitration;

- changes in estimates in critical accounting judgments;

- the impact of fluctuations in our pension plan asset values on

funding levels, contributions required and benefit costs; and

- risks related to other factors described under “Risk Factors”

in other reports and statements filed by us with the Securities and

Exchange Commission, including without limitation our Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q (available at

www.sec.gov).

Forward-looking statements speak only as of the date they are

made, and we undertake no obligation to update such forward-looking

statements, except as required by law. Management believes these

forward-looking statements to be reasonable; however, you should

not place undue reliance on statements that are based on current

expectations.

LANCASTER COLONY CORPORATION

CONDENSED CONSOLIDATED STATEMENTS

OF INCOME (Unaudited)

(In thousands except per-share

amounts)

Three Months Ended June 30,

Fiscal Year Ended June 30,

2024

2023

2024

2023

Net sales

$

452,825

$

454,661

$

1,871,759

$

1,822,527

Cost of sales

355,207

361,487

1,439,457

1,433,959

Gross profit

97,618

93,174

432,302

388,568

Selling, general & administrative

expenses

53,193

56,730

218,065

222,091

Restructuring and impairment charges

2,737

24,969

14,874

24,969

Operating income

41,688

11,475

199,363

141,508

Other, net

2,122

974

6,152

1,789

Income before income taxes

43,810

12,449

205,515

143,297

Taxes based on income

8,982

3,283

46,902

32,011

Net income

$

34,828

$

9,166

$

158,613

$

111,286

Net income per common share: (a)

Basic

$

1.27

$

0.33

$

5.77

$

4.04

Diluted

$

1.26

$

0.33

$

5.76

$

4.04

Cash dividends per common share

$

0.90

$

0.85

$

3.55

$

3.35

Weighted average common shares

outstanding:

Basic

27,447

27,461

27,440

27,462

Diluted

27,482

27,490

27,461

27,482

(a) Based on the weighted average number of shares outstanding

during each period.

LANCASTER COLONY CORPORATION

BUSINESS SEGMENT INFORMATION

(Unaudited)

(In thousands)

Three Months Ended June 30,

Fiscal Year Ended June 30,

2024

2023

2024

2023

NET SALES

Retail

$

234,194

$

236,183

$

988,424

$

965,370

Foodservice

218,631

218,478

883,335

857,157

Total Net Sales

$

452,825

$

454,661

$

1,871,759

$

1,822,527

OPERATING

INCOME

Retail

$

47,702

$

10,269

$

207,660

$

139,464

Foodservice

18,982

25,319

97,094

106,349

Nonallocated Restructuring and Impairment

Charges

(2,737

)

—

(14,874

)

—

Corporate Expenses

(22,259

)

(24,113

)

(90,517

)

(104,305

)

Total Operating Income

$

41,688

$

11,475

$

199,363

$

141,508

LANCASTER COLONY CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

(In thousands)

June 30, 2024

June 30, 2023

ASSETS

Current assets:

Cash and equivalents

$

163,443

$

88,473

Receivables

95,560

114,967

Inventories

173,252

158,265

Other current assets

11,738

12,758

Total current assets

443,993

374,463

Net property, plant and equipment

477,696

482,206

Other assets

285,242

256,325

Total assets

$

1,206,931

$

1,112,994

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

118,811

$

111,758

Accrued liabilities

65,158

56,994

Total current liabilities

183,969

168,752

Noncurrent liabilities and deferred income

taxes

97,190

81,975

Shareholders’ equity

925,772

862,267

Total liabilities and shareholders’

equity

$

1,206,931

$

1,112,994

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821150384/en/

Dale N. Ganobsik Vice President, Corporate Finance and Investor

Relations Lancaster Colony Corporation Phone: 614/224-7141 Email:

ir@lancastercolony.com

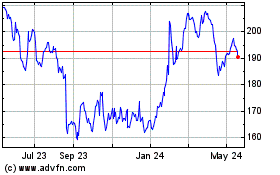

Lancaster Colony (NASDAQ:LANC)

Historical Stock Chart

From Jan 2025 to Feb 2025

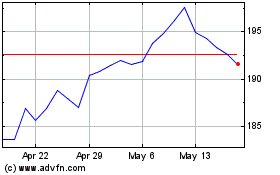

Lancaster Colony (NASDAQ:LANC)

Historical Stock Chart

From Feb 2024 to Feb 2025