false000091276600009127662024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 22, 2024

Laureate Education, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38002 | | 52-1492296 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

PMB 1158, 1000 Brickell Ave, Suite 715

Miami, FL 33131

(Address of principal executive offices, including zip code)

(786) 209-3368

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

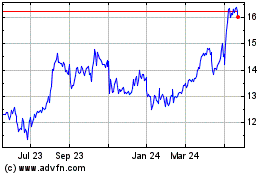

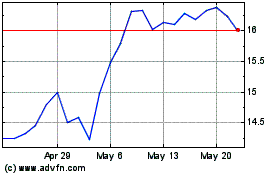

Common Stock, par value $0.004 per share

| LAUR | The NASDAQ Stock Market LLC |

| (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, Laureate Education, Inc. (the “Company”) issued an earnings release announcing its financial results for the quarter and year ended December 31, 2023. A copy of the earnings release is furnished herewith as Exhibit 99.1 and incorporated in this Item 2.02 by reference.

Item 7.01 Regulation FD Disclosure.

On February 22, 2024, the Company made available on the investor relations section of its website its Fourth Quarter & Fiscal Year 2023 Earnings Presentation (the “Presentation”). A copy of the Presentation is furnished herewith as Exhibit 99.2 and incorporated in this Item 7.01 by reference.

Forward-Looking Statements

This Current Report on Form 8-K may include certain disclosures which contain “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions that concern our strategy, plans or intentions. Forward‑looking statements are based on the Company’s current expectations and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 22, 2024, our Quarterly Reports on Form 10-Q to be filed with the SEC and other filings made with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

The information contained in Item 2.02, including Exhibit 99.1 hereto, and Item 7.01, including Exhibit 99.2 hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Such information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| LAUREATE EDUCATION, INC. |

| | |

| | |

| By: | /s/ Richard M. Buskirk |

| Name: | Richard M. Buskirk |

| Title: | Senior Vice President and Chief Financial Officer |

Date: February 22, 2024

Exhibit 99.1

LAUREATE EDUCATION REPORTS FINANCIAL RESULTS FOR THE FOURTH QUARTER AND FULL-YEAR 2023 AND PROVIDES 2024 OUTLOOK

Company Announces New $100 Million Share Repurchase Authorization

MIAMI - February 22, 2024 (GLOBE NEWSWIRE) - Laureate Education, Inc. (NASDAQ: LAUR), which operates five higher education institutions across Mexico and Peru, today announced financial results for the fourth quarter and the year ended December 31, 2023.

Fourth Quarter 2023 Highlights (compared to fourth quarter 2022):

•On a reported basis, revenue increased 18% to $409.4 million. On an organic constant currency basis1, revenue increased by 10%.

•Operating income for the fourth quarter of 2023 was $110.0 million, compared to $78.0 million for the fourth quarter of 2022. The increase versus the fourth quarter of prior year resulted from growth in revenue and cost controls.

•Net income for the fourth quarter of 2023 was $41.7 million, compared to net income of $39.1 million for the fourth quarter of 2022.

•Adjusted EBITDA for the fourth quarter of 2023 was $131.3 million, compared to $94.8 million for the fourth quarter of 2022.

Year Ended December 31, 2023 Highlights (compared to year ended December 31, 2022):

•New enrollments increased 10%.

•Total enrollments increased 6%.

•On a reported basis, revenue increased 19% to $1,484.3 million. On an organic constant currency basis1, revenue was up 11%.

•Operating income for the year was $338.8 million, compared to $270.0 million for 2022. The increase versus the prior year resulted from growth in revenue and cost controls.

•Net income for the year was $107.3 million, compared to net income of $69.0 million for 2022.

•Adjusted EBITDA for the year was $418.6 million, as compared to $338.9 million for 2022.

Eilif Serck-Hanssen, President and Chief Executive Officer, said, “We delivered robust operating performance in 2023, with double-digit revenue growth and historic high operating margins. We remain focused on the strategic priorities we outlined a year ago, and see continued growth opportunities for 2024, even with a softer market backdrop in Peru during the first half of the year. Our strong balance sheet and high free cash flow generation has allowed us to return excess capital to shareholders, and today we are pleased to announce a new $100 million stock buyback authorization.” Mr. Serck-Hanssen added, “I would like to thank our nearly thirty thousand faculty and staff for another strong year, and their continued commitment to academic excellence and putting our students at the center of everything we do. With their help we are transforming the lives of students and communities in Mexico and Peru by providing greater access to affordable quality education.”

1 Organic constant currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items.

Fourth Quarter 2023 Results

For the fourth quarter of 2023, revenue on a reported basis was $409.4 million, an increase of $63.1 million, or 18%, compared to the fourth quarter of 2022. On an organic constant currency basis, revenue increased 10%, due primarily to higher enrollment and better price/mix. Operating income for the fourth quarter of 2023 was $110.0 million, compared to $78.0 million for the fourth quarter of 2022, an increase of $32.0 million. The increase in operating income versus the fourth quarter of prior year resulted from growth in revenue and cost controls. Net income was $41.7 million for the fourth quarter of 2023, compared to net income of $39.1 million in the fourth quarter of 2022, an increase of $2.6 million. Basic and diluted earnings per share were $0.26 for the fourth quarter of 2023.

Adjusted EBITDA for the fourth quarter was $131.3 million, compared to Adjusted EBITDA of $94.8 million for the fourth quarter of 2022.

Year Ended December 31, 2023 Results

New enrollments for full-year 2023 increased 10% compared to new enrollment activity for full-year 2022, and total enrollments were up 6%. New and total enrollments in Peru increased 9% and 3%, respectively, compared to 2022. New and total enrollments in Mexico were up 11% and 9%, respectively, compared to 2022, driven by strong intake cycles in 2023.

For the full-year 2023, revenue on a reported basis was $1,484.3 million, an increase of $242.0 million, or 19%, compared to 2022. On an organic constant currency basis, revenue increased 11%. Operating income for 2023 was $338.8 million compared to $270.0 million for 2022. The increase in operating income versus the prior year resulted from growth in revenue and cost controls. Net income for 2023 was $107.3 million, compared to net income of $69.0 million for 2022, an increase of $38.3 million. Basic and diluted earnings per share for 2023 were $0.69 and $0.68, respectively.

Adjusted EBITDA for the year was $418.6 million, compared to Adjusted EBITDA of $338.9 million for 2022.

Balance Sheet, Cash Flow and Capital Structure

Laureate has a strong balance sheet position. As of December 31, 2023, Laureate had $89.4 million of cash and cash equivalents, and gross debt of $167.4 million. Accordingly, net debt was $78.0 million as of December 31, 2023.

On November 30, 2023, Laureate paid a special cash dividend of approximately $110.2 million ($0.70/share).

As of December 31, 2023, Laureate had 157.6 million total shares outstanding.

New Share Repurchase Program

Laureate’s board of directors has approved a new stock repurchase program to acquire up to $100 million of the Company’s common stock. The Company intends to finance the repurchases with free cash flow, excess cash and liquidity on-hand, including available capacity under its Revolving Credit Facility. The Company’s proposed repurchases may be made from time to time on the open market at prevailing market prices, in privately negotiated transactions, in block trades and/or through other legally permissible means, depending on market conditions and in accordance with applicable rules and regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Repurchases may be effected pursuant to a trading plan adopted in accordance with Rule 10b5-1 of the Exchange Act. The Company’s board will review the share repurchase program periodically and may authorize adjustment of its terms and size or suspend or discontinue the program.

Outlook for Fiscal 2024

Laureate's 2024 outlook shows continued growth opportunities. We expect stronger growth rates in Mexico due to the positive macroeconomic backdrop in that market. For our operations in Peru, we anticipate growth to be more muted in 2024 due to the current economic downturn that market is currently experiencing. However, we do expect an economic recovery in the second half of the year for Peru.

Based on the current foreign exchange spot rates2, Laureate currently expects its full-year 2024 results to be as follows:

•Total enrollments expected to be in the range of 467,000 to 473,000 students, reflecting growth of 4%-5% versus 2023;

•Revenues expected to be in the range of $1,553 million to $1,568 million, reflecting growth of 5%-6% on an as-reported basis and 5%-6% on an organic constant currency basis versus 2023; and

•Adjusted EBITDA expected to be in the range of $441 million to $451 million, reflecting growth of 5%-8% on an as-reported basis and 6%-9% on an organic constant currency basis versus 2023.

Reconciliations of forward-looking non-GAAP measures, specifically the 2024 Adjusted EBITDA outlook, to the relevant forward-looking GAAP measures are not being provided, as Laureate does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlooks and reconciliations. Due to this uncertainty, the Company cannot reconcile projected Adjusted EBITDA to projected net income without unreasonable effort.

Please see the “Forward-Looking Statements” section in this release for a discussion of certain risks related to this outlook.

Conference Call

Laureate will host an earnings conference call today at 8:30 am ET. Interested parties are invited to listen to the earnings call by registering at https://bit.ly/LAURQ42023 to receive dial-in information. The webcast of the conference call, including replays, and a copy of this press release and the related slides will be made available through the Investor Relations section of Laureate’s website at www.laureate.net.

2 Based on actual FX rates for January 2024, and current spot FX rates (local currency per U.S. Dollar) of MXN 17.05 and PEN 3.88 for February - December 2024. FX impact may change based on fluctuations in currency rates in future periods.

Forward-Looking Statements

This press release includes statements that express Laureate’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, ‘‘forward-looking statements’’ within the meaning of the federal securities laws, which involve risks and uncertainties. Laureate’s actual results may vary significantly from the results anticipated in these forward-looking statements. You can identify forward-looking statements because they contain words such as ‘‘believes,’’ ‘‘expects,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘seeks,’’ ‘‘approximately,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘estimates’’ or ‘‘anticipates’’ or similar expressions that concern our strategy, plans or intentions. In particular, statements regarding the amount, timing, process, tax treatment and impact of any future dividends represent forward-looking statements. All statements we make relating to guidance (including, but not limited to, total enrollments, revenues, and Adjusted EBITDA), and all statements we make relating to our current growth strategy and other future plans, strategies or transactions that may be identified, explored or implemented and any litigation or dispute resulting from any completed transaction are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, including with respect to our current growth strategy and the impact of any completed divestiture or separation transaction on our remaining businesses. Accordingly, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 22, 2024, our subsequent Quarterly Reports on Form 10-Q filed, and to be filed, with the SEC and other filings made with the SEC. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law.

Presentation of Non-GAAP Measures

In addition to the results provided in accordance with U.S. generally accepted accounting principles (GAAP) throughout this press release, Laureate provides the non-GAAP measurements of Adjusted EBITDA, and total debt, net of cash and cash equivalents (or net debt). We have included these non-GAAP measurements because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans.

Adjusted EBITDA consists of net income (loss), adjusted for the items included in the accompanying reconciliation. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, Adjusted EBITDA is a key input into the formula used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Total debt, net of cash and cash equivalents (or net debt) consists of total gross debt, less total cash and cash equivalents. Net debt provides a useful indicator about Laureate’s leverage and liquidity.

Laureate’s calculations of Adjusted EBITDA, and total debt, net of cash and cash equivalents (or net debt) are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Adjusted EBITDA is reconciled from the GAAP measure in the attached table “Non-GAAP Reconciliation.”

We evaluate our results of operations on both an as reported and an organic constant currency basis. The organic constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates, acquisitions and divestitures, and other items. We believe that providing organic constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate organic constant currency amounts using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period, and then exclude the impact of acquisitions and divestitures and other items described in the accompanying presentation.

About Laureate Education, Inc.

Laureate Education, Inc. operates five higher education institutions across Mexico and Peru, enrolling approximately 450,000 students in high-quality undergraduate, graduate, and specialized degree programs through campus-based and online learning. Our universities have a deep commitment to academic quality and innovation, strive for market-leading employability outcomes, and work to make higher education more accessible. At Laureate, we know that when our students succeed, countries prosper, and societies benefit. Learn more at laureate.net.

Key Metrics and Financial Tables

(Dollars in millions, except per share amounts, and may not sum due to rounding)

New and Total Enrollments by segment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| New Enrollments | | Total Enrollments |

| FY 2023 | | FY 2022 | | | | Change | | As of

12/31/2023 | | As of

12/31/2022 | | | | Change |

| Mexico | 153,800 | | | 138,800 | | | | | 11% | | 242,000 | | | 222,800 | | | | | 9% |

| Peru | 87,100 | | | 79,800 | | | | | 9% | | 206,900 | | | 200,200 | | | | | 3% |

| Laureate | 240,900 | | | 218,600 | | | | | 10% | | 448,900 | | | 423,000 | | | | | 6% |

Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the year ended |

| December 31, | | December 31, |

| IN MILLIONS | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Revenues | $ | 409.4 | | | $ | 346.3 | | | $ | 63.1 | | | $ | 1,484.3 | | | $ | 1,242.3 | | | $ | 242.0 | |

| Costs and expenses: | | | | | | | | | | | |

| Direct costs | 279.4 | | | 252.3 | | | 27.1 | | | 1,089.8 | | | 907.4 | | | 182.4 | |

| General and administrative expenses | 18.6 | | | 16.0 | | | 2.6 | | | 52.6 | | | 64.8 | | | (12.2) | |

| Loss on impairment of assets | 1.5 | | | — | | | 1.5 | | | 3.1 | | | 0.1 | | | 3.0 | |

| Operating income | 110.0 | | | 78.0 | | | 32.0 | | | 338.8 | | | 270.0 | | | 68.8 | |

| Interest income | 2.1 | | | 1.9 | | | 0.2 | | | 9.1 | | | 7.6 | | | 1.5 | |

| Interest expense | (3.7) | | | (4.8) | | | 1.1 | | | (21.0) | | | (16.4) | | | (4.6) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other (expense) income, net | (0.5) | | | 0.4 | | | (0.9) | | | (0.3) | | | 0.8 | | | (1.1) | |

| Foreign currency exchange loss, net | (24.1) | | | (14.5) | | | (9.6) | | | (75.7) | | | (17.4) | | | (58.3) | |

| (Loss) gain on disposals of subsidiaries, net | — | | | (0.1) | | | 0.1 | | | 3.6 | | | 1.4 | | | 2.2 | |

| Income from continuing operations before income taxes and equity in net income of affiliates | 83.7 | | | 60.9 | | | 22.8 | | | 254.5 | | | 245.9 | | | 8.6 | |

| Income tax expense | (36.2) | | | (26.2) | | | (10.0) | | | (137.6) | | | (185.4) | | | 47.8 | |

| Equity in net income of affiliates, net of tax | 0.2 | | | 0.2 | | | — | | | 0.2 | | | 0.3 | | | (0.1) | |

| Income (loss) from continuing operations | 47.7 | | | 34.9 | | | 12.8 | | | 117.0 | | | 60.7 | | | 56.3 | |

| (Loss) income from discontinued operations, net of tax | (6.0) | | | 4.2 | | | (10.2) | | | (9.8) | | | 8.3 | | | (18.1) | |

| Net income | 41.7 | | | 39.1 | | | 2.6 | | | 107.3 | | | 69.0 | | | 38.3 | |

| Net loss (income) attributable to noncontrolling interests | 0.1 | | | 0.2 | | | (0.1) | | | 0.3 | | | 0.6 | | | (0.3) | |

| Net income attributable to Laureate Education, Inc. | $ | 41.9 | | | $ | 39.2 | | | $ | 2.7 | | | $ | 107.6 | | | $ | 69.6 | | | $ | 38.0 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings (loss) per share: | | | | | | | | | | | |

| Basic weighted average shares outstanding | 157.4 | | | 161.3 | | | (3.9) | | | 157.3 | | | 167.7 | | | (10.4) | |

| Diluted weighted average shares outstanding | 158.1 | | | 161.9 | | | (3.8) | | | 157.9 | | | 168.3 | | | (10.4) | |

| Basic earnings per share | $ | 0.26 | | | $ | 0.25 | | | $ | 0.01 | | | $ | 0.69 | | | $ | 0.42 | | | $ | 0.27 | |

| Diluted earnings per share | $ | 0.26 | | | $ | 0.25 | | | $ | 0.01 | | | $ | 0.68 | | | $ | 0.41 | | | $ | 0.27 | |

Revenue and Adjusted EBITDA by segment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IN MILLIONS | |

| | | | | % Change | | $ Variance Components |

| For the three months ended December 31, | 2023 | | 2022 | | Reported | | Organic Constant Currency(1) | | Total | | Organic Constant

Currency | | Other | | Acq/Div. | | FX |

| Revenues | | | | | | | | | | | | | | | | | |

| Mexico | $ | 223.1 | | | $ | 179.0 | | | 25% | | 11% | | $ | 44.1 | | | $ | 20.4 | | | $ | — | | | $ | — | | | $ | 23.7 | |

| Peru | 186.3 | | | 167.1 | | | 11% | | 8% | | 19.2 | | | 13.2 | | | — | | | — | | | 6.0 | |

| Corporate & Eliminations | — | | | 0.2 | | | (100)% | | (100)% | | (0.2) | | | (0.2) | | | — | | | — | | | — | |

| Total Revenues | $ | 409.4 | | | $ | 346.3 | | | 18% | | 10% | | $ | 63.1 | | | $ | 33.4 | | | $ | — | | | $ | — | | | $ | 29.7 | |

| | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | |

| Mexico | $ | 67.9 | | | $ | 43.5 | | | 56% | | 40% | | $ | 24.4 | | | $ | 17.2 | | | $ | 0.3 | | | $ | — | | | $ | 6.9 | |

| Peru | 79.8 | | | 65.3 | | | 22% | | 18% | | 14.5 | | | 11.8 | | | — | | | — | | | 2.7 | |

| Corporate & Eliminations | (16.3) | | | (14.0) | | | (16)% | | (16)% | | (2.3) | | | (2.3) | | | — | | | — | | | — | |

| Total Adjusted EBITDA | $ | 131.3 | | | $ | 94.8 | | | 39% | | 28% | | $ | 36.5 | | | $ | 26.6 | | | $ | 0.3 | | | $ | — | | | $ | 9.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | % Change | | $ Variance Components |

| For the year ended December 31, | 2023 | | 2022 | | Reported | | Organic Constant Currency(1) | | Total | | Organic Constant

Currency | | Other | | Acq/Div. | | FX |

| Revenues | | | | | | | | | | | | | | | | | |

| Mexico | $ | 782.6 | | | $ | 613.9 | | | 27% | | 13% | | $ | 168.7 | | | $ | 77.1 | | | $ | — | | | $ | — | | | $ | 91.6 | |

| Peru | 701.7 | | | 624.2 | | | 12% | | 10% | | 77.5 | | | 60.2 | | | — | | | — | | | 17.3 | |

| Corporate & Eliminations | — | | | 4.1 | | | (100)% | | (100)% | | (4.1) | | | (4.1) | | | — | | | — | | | — | |

| Total Revenues | $ | 1,484.3 | | | $ | 1,242.3 | | | 19% | | 11% | | $ | 242.0 | | | $ | 133.1 | | | $ | — | | | $ | — | | | $ | 108.9 | |

| | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | |

| Mexico | $ | 177.0 | | | $ | 123.4 | | | 43% | | 26% | | $ | 53.6 | | | $ | 32.6 | | | $ | 0.4 | | | $ | — | | | $ | 20.6 | |

| Peru | 286.9 | | | 266.7 | | | 8% | | 5% | | 20.2 | | | 12.9 | | | — | | | — | | | 7.3 | |

| Corporate & Eliminations | (45.2) | | | (51.2) | | | 12% | | 12% | | 6.0 | | | 6.0 | | | — | | | — | | | — | |

| Total Adjusted EBITDA | $ | 418.6 | | | $ | 338.9 | | | 24% | | 15% | | $ | 79.7 | | | $ | 51.4 | | | $ | 0.4 | | | $ | — | | | $ | 27.9 | |

(1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” % changes are calculated by dividing the Organic Constant Currency amounts by the 2022 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures.

Consolidated Balance Sheets | | | | | | | | | | | | | | | | | |

| IN MILLIONS | December 31, 2023 | | December 31, 2022 | | Change |

| Assets | | | | | |

| Cash and cash equivalents | $ | 89.4 | | | $ | 85.2 | | | $ | 4.2 | |

| Receivables (current), net | 92.1 | | | 80.7 | | | 11.4 | |

| Other current assets | 42.0 | | | 60.3 | | | (18.3) | |

| | | | | |

| Property and equipment, net | 562.2 | | | 523.4 | | | 38.8 | |

| Operating lease right-of-use assets, net | 371.6 | | | 389.6 | | | (18.0) | |

| Goodwill and other intangible assets | 830.7 | | | 735.1 | | | 95.6 | |

| Deferred income taxes | 71.4 | | | 51.9 | | | 19.5 | |

| Other long-term assets | 49.9 | | | 46.0 | | | 3.9 | |

Current and long-term assets held for sale | 16.3 | | | — | | | 16.3 | |

| Total assets | $ | 2,125.6 | | | $ | 1,972.2 | | | $ | 153.4 | |

| | | | | |

| Liabilities and stockholders' equity | | | | | |

| Accounts payable and accrued expenses | $ | 209.4 | | | $ | 178.6 | | | $ | 30.8 | |

| Deferred revenue and student deposits | 69.4 | | | 51.3 | | | 18.1 | |

| Total operating leases, including current portion | 417.6 | | | 415.9 | | | 1.7 | |

| Total long-term debt, including current portion | 165.1 | | | 232.1 | | | (67.0) | |

| Other liabilities | 303.5 | | | 318.6 | | | (15.1) | |

| Current and long-term liabilities held for sale | 11.5 | | | — | | | 11.5 | |

| Total liabilities | 1,176.5 | | | 1,196.5 | | | (20.0) | |

| Redeemable noncontrolling interests and equity | 1.4 | | | 1.4 | | | — | |

| Total stockholders' equity | 947.7 | | | 774.4 | | | 173.3 | |

| Total liabilities and stockholders' equity | $ | 2,125.6 | | | $ | 1,972.2 | | | $ | 153.4 | |

Consolidated Statements of Cash Flows | | | | | | | | | | | | | | | | | |

| For the year ended December 31, |

| IN MILLIONS | 2023 | | 2022 | | Change |

| Cash flows from operating activities | | | | | |

| Net income | $ | 107.3 | | | $ | 69.0 | | | $ | 38.3 | |

| Depreciation and amortization | 69.6 | | | 59.1 | | | 10.5 | |

| Loss (gain) on sales and disposal of subsidiaries, property and equipment and leases, net | 9.6 | | | (11.1) | | | 20.7 | |

| | | | | |

| | | | | |

| Deferred income taxes | (55.9) | | | (0.5) | | | (55.4) | |

| Unrealized foreign currency exchange loss (gain) | 75.5 | | | 13.9 | | | 61.6 | |

| Income tax receivable/payable, net | 23.3 | | | 31.3 | | | (8.0) | |

| Working capital, excluding tax accounts | (67.1) | | | (52.2) | | | (14.9) | |

| Other non-cash adjustments | 88.5 | | | 68.7 | | | 19.8 | |

Net cash provided by operating activities | 250.8 | | | 178.2 | | | 72.6 | |

| Cash flows from investing activities | | | | | |

| Purchase of property and equipment | (56.4) | | | (52.8) | | | (3.6) | |

| Expenditures for deferred costs | — | | | (0.3) | | | 0.3 | |

| Receipts from sales of discontinued operations, net of cash sold, property and equipment | 4.5 | | | 83.4 | | | (78.9) | |

| | | | | |

Net cash (used in) provided by investing activities | (51.9) | | | 30.3 | | | (82.2) | |

| Cash flows from financing activities | | | | | |

(Decrease) increase in long-term debt, net | (89.7) | | | 62.5 | | | (152.2) | |

| | | | | |

| | | | | |

| Payments of special dividends, special cash distributions, and dividend equivalent rights | (112.5) | | | (253.2) | | | 140.7 | |

| Payments to repurchase common stock | — | | | (282.2) | | | 282.2 | |

| Financing other, net | 0.3 | | | 11.2 | | | (10.9) | |

| Net cash used in by financing activities | (201.9) | | | (461.6) | | | 259.7 | |

| Effects of exchange rate changes on cash | 6.6 | | | 1.2 | | | 5.4 | |

| Change in cash included in current assets held for sale | (0.5) | | | — | | | (0.5) | |

| Net change in cash and cash equivalents | 3.1 | | | (251.8) | | | 254.9 | |

| Cash and cash equivalents at beginning of period | 93.8 | | | 345.6 | | | (251.8) | |

| Cash and cash equivalents at end of period | $ | 96.9 | | | $ | 93.8 | | | $ | 3.1 | |

| | | | | |

Non-GAAP Reconciliations

The following table reconciles Net income to Adjusted EBITDA: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the year ended |

| December 31, | | December 31, |

| IN MILLIONS | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Net income | $ | 41.7 | | | $ | 39.1 | | | 2.6 | | | $ | 107.3 | | | $ | 69.0 | | | 38.3 | |

| Plus: | | | | | | | | | | | |

| Loss (income) from discontinued operations, net of tax | $ | 6.0 | | | $ | (4.2) | | | 10.2 | | | $ | 9.8 | | | $ | (8.3) | | | 18.1 | |

| Income (loss) from continuing operations | $ | 47.7 | | | $ | 34.9 | | | $ | 12.8 | | | $ | 117.0 | | | $ | 60.7 | | | $ | 56.3 | |

| Plus: | | | | | | | | | | | |

| Equity in net income of affiliates, net of tax | (0.2) | | | (0.2) | | | — | | | (0.2) | | | (0.3) | | | 0.1 | |

| Income tax expense (benefit) | 36.2 | | | 26.2 | | | 10.0 | | | 137.6 | | | 185.4 | | | (47.8) | |

| Income from continuing operations before income taxes and equity in net income of affiliates | 83.7 | | | 60.9 | | | 22.8 | | | 254.5 | | | 245.9 | | | 8.6 | |

| Plus: | | | | | | | | | | | |

| Loss (gain) on disposal of subsidiaries, net | — | | | 0.1 | | | (0.1) | | | (3.6) | | | (1.4) | | | (2.2) | |

| Foreign currency exchange loss (gain), net | 24.1 | | | 14.5 | | | 9.6 | | | 75.7 | | | 17.4 | | | 58.3 | |

| Other (income) expense, net | 0.5 | | | (0.4) | | | 0.9 | | | 0.3 | | | (0.8) | | | 1.1 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Interest expense | 3.7 | | | 4.8 | | | (1.1) | | | 21.0 | | | 16.4 | | | 4.6 | |

| Interest income | (2.1) | | | (1.9) | | | (0.2) | | | (9.1) | | | (7.6) | | | (1.5) | |

| Operating income | 110.0 | | | 78.0 | | | 32.0 | | | 338.8 | | | 270.0 | | | 68.8 | |

| Plus: | | | | | | | | | | | |

| Depreciation and amortization | 17.7 | | | 15.5 | | | 2.2 | | | 69.6 | | | 59.1 | | | 10.5 | |

| EBITDA | 127.7 | | | 93.5 | | | 34.2 | | | 408.4 | | | 329.1 | | | 79.3 | |

| Plus: | | | | | | | | | | | |

Share-based compensation expense (2) | 2.2 | | | 1.8 | | | 0.4 | | | 7.1 | | | 8.8 | | | (1.7) | |

Loss on impairment of assets (3) | 1.5 | | | — | | | 1.5 | | | 3.1 | | | 0.1 | | | 3.0 | |

EiP implementation expenses (4) | — | | | (0.5) | | | 0.5 | | | — | | | 0.8 | | | (0.8) | |

| Adjusted EBITDA | $ | 131.3 | | | $ | 94.8 | | | $ | 36.5 | | | $ | 418.6 | | | $ | 338.9 | | | $ | 79.7 | |

(2) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718, "Stock Compensation."

(3) Represents non-cash charges related to impairments of long-lived assets.

(4) Excellence-in-Process (EiP) implementation expenses are related to our enterprise-wide initiative to optimize and standardize Laureate’s processes, creating vertical integration of procurement, information technology, finance, accounting and human resources. It included the establishment of regional shared services organizations (SSOs), as well as improvements to the Company's system of internal controls over financial reporting. The EiP initiative also included other back- and mid-office areas, as well as certain student-facing activities, expenses associated with streamlining the organizational structure, an enterprise-wide program aimed at revenue growth, and certain non-recurring costs incurred in connection with previous dispositions. The EiP initiative was completed as of December 31, 2021, except for certain EiP expenses related to the run out of programs that began in prior periods.

Investor Relations Contact:

ir@laureate.net

Media Contacts: | | | | | | | | |

| Laureate Education | | |

| Adam Smith | | |

| adam.smith@laureate.net | | |

| U.S.: +1 (443) 255 0724 | | |

| Source: Laureate Education, Inc. | | |

1© 2024 Laureate Education, Inc. Fourth Quarter & Year-End 2023 Earnings Presentation February 22, 2024 Exhibit 99.2

2© 2024 Laureate Education, Inc. This presentation includes statements that express Laureate’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, ‘‘forward-looking statements’’ within the meaning of the federal securities laws, which involve risks and uncertainties. Laureate’s actual results may vary significantly from the results anticipated in these forward-looking statements. You can identify forward-looking statements because they contain words such as ‘‘believes,’’ ‘‘expects,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘seeks,’’ ‘‘approximately,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘estimates’’ or ‘‘anticipates’’ or similar expressions that concern our strategy, plans or intentions. All statements we make relating to guidance (including, but not limited to, total enrollments, revenues, and Adjusted EBITDA), and all statements we make relating to our current growth strategy and other future plans, strategies or transactions that may be identified, explored or implemented and any litigation or dispute resulting from any completed transaction are forward- looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, including with respect to our current growth strategy and the impact of any completed divestiture or separation transaction on our remaining businesses. Accordingly, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 22, 2024, our subsequent Quarterly Reports on Form 10-Q filed, and to be filed, with the SEC and other filings made with the SEC. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law. In addition, this presentation contains various operating data, including market share and market position, that are based on internal company data and management estimates. While management believes that our internal company research is reliable and the definitions of our markets which are used herein are appropriate, neither such research nor these definitions have been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources, including those discussed under “Industry and Market Data” in Laureate’s filings with the SEC. Forward Looking Statements

3© 2024 Laureate Education, Inc. In addition to the results provided in accordance with U.S. generally accepted accounting principles (GAAP) throughout this presentation, Laureate provides the non-GAAP measurements of Adjusted EBITDA and its related margin, Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total debt, net of cash and cash equivalents (or net debt), and Free Cash Flow. We have included these non-GAAP measurements because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. Adjusted EBITDA consists of net income (loss), adjusted for the items included in the accompanying reconciliation. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, Adjusted EBITDA is a key input into the formula used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin, which is calculated by dividing Adjusted EBITDA by revenue, provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. Adjusted EBITDA to Unlevered Free Cash Flow Conversion consists of Unlevered Free Cash Flow (which is defined as cash flows from operating activities, less capital expenditures (net of sales of PP&E), plus net cash interest expense) divided by Adjusted EBITDA. Adjusted EBITDA to Unlevered Free Cash Flow provides useful information to investors and others in understanding and evaluating our ability to generate cash flows. Total debt, net of cash and cash equivalents (or net debt) consists of total gross debt, less total cash and cash equivalents. Net debt provides a useful indicator about Laureate’s leverage and liquidity. Free Cash Flow consists of operating cash flow minus capital expenditures. Free Cash Flow provides a useful indicator about Laureate’s ability to fund its operations and repay its debt. Laureate’s calculations of Adjusted EBITDA and its related margin, Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total debt, net of cash and cash equivalents (or net debt), and Free Cash Flow are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Adjusted EBITDA and Free Cash Flow are reconciled from their respective GAAP measures in the attached tables “Non-GAAP Reconciliation”. We evaluate our results of operations on both an as reported and an organic constant currency basis. The organic constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates, acquisitions and divestitures, and other items. We believe that providing organic constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate organic constant currency amounts using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local- currency operating results for the current period, and then exclude the impact of acquisitions and divestitures and other items described in the accompanying presentation. . Presentation of Non-GAAP Measures

4© 2024 Laureate Education, Inc. SUMMARY OVERVIEW Note: Throughout this presentation amounts may not sum to totals due to rounding

5© 2024 Laureate Education, Inc. Executive Summary ✓ Fourth quarter Revenue and Adjusted EBITDA ahead of guidance; Net Income of $42M in Q4 ✓ Robust performance in FY 2023 – continued growth, margin expansion and cash generation ‒ Delivered double-digit growth in Revenue and Adjusted EBITDA, margins at historic high and Adjusted EBITDA to Unlevered FCF Conversion of 49%1 ‒ FY results: Revenue of $1,484M, Adjusted EBITDA of $419M and Net Income of $107M ✓ 2024 outlook shows continued growth opportunities ‒ Mexico: Strong growth expectations; favorable macro backdrop including nearshoring tailwinds ‒ Peru: Growth more muted due to current economic downturn; expect recovery in 2H 2024 ✓ Maintaining target financial profile provided on year-end 2022 earnings call, with 8-10% Revenue CAGR on a constant currency basis2 and Adjusted EBITDA to Unlevered FCF Conversion of 50%1 ✓ Strong balance sheet with continued commitment to return capital to shareholders ‒ Returned $110M of capital to shareholders in 2023 via special cash dividend in November ‒ Announcing today a new $100M stock buyback authorization Strong FY 2023 Results – Delivering on Commitments to Investors (1) Unlevered Free Cash Flow defined as Cash From Operations, less capital expenditures (net of sales of PP&E), plus net cash interest expense. Adjusted EBITDA to Unlevered Free Cash Flow Conversion defined as Unlevered Free Cash Flow divided by Adjusted EBITDA. (2) Over 3-5 year period, beginning with FY 2023 (as provided on February 23, 2023)

6© 2024 Laureate Education, Inc. Key Academic Highlights in 2023 Unwavering Commitment to Academic Quality UPC in Peru: For the third consecutive year, UPC in Peru was ranked the #1 Education Brand in the country by Merco, and even more impressively, was ranked 9th among all organizations across various industries in the country. UVM in Mexico: Ranked as the 2nd Best Private University in the Reader’s Digest 2023 Ranking of Private Universities in Mexico. UPN in Peru: For the third consecutive year, the UPN Technology and Innovation Support Center (CATI) was named the best in Peru, boasting the highest number of patent applications in the country. UNITEC in Mexico: Reaccredited for maximum period (7 years) by the Federation of Mexican Private Institutions of Higher Education (FIMPES). Universidad Peruana de Ciencias Aplicadas (UPC) Universidad del Valle de México (UVM) Universidad Privada del Norte (UPN) Universidad Tecnológica de México (UNITEC)

7© 2024 Laureate Education, Inc. COMPELLING INVESTMENT CHARACTERISTICS

8© 2024 Laureate Education, Inc. Mexico Peru Combined Population (M) 129M 32M 161M Higher Education Students (000s) 5,193 1,841 7,034 Higher Education Gross Participation Rate1 34%2 52%2 38% Market Share for Private Institutions2 43% 74% 54% Large Markets with Low Penetration Rates in Higher Education Sources: UNESCO, World Bank, Secretaría de Educación Pública (Mexico), Superintendencia Nacional de Educación Superior Universitaria (Peru), Ministry of Education of Peru. Data as of year-end 2022. Attractive Markets with Strong Growth Opportunities Fueled by Increasing Participation Rates (1) Defined as total enrollments as compared to 18-24 year old population; European Union (EU) is based on management estimate. (2) Includes 12% participation in Technical/Vocation institutions in Peru, 1% in Mexico. (3) Private institution market share in higher education; for Mexico and Combined includes all states in which UVM or UNITEC have operations (total private market share for all of Mexico is 37%); for Peru based on total country. U.S. E.U. 60% 56%

9© 2024 Laureate Education, Inc. Leading University Portfolio in Mexico & Peru Operating Leading Brands in Attractive Market Segments • 1960 Brand Founded Market Segment Ratings / Rankings ◼ Ranked Top 10 university in Mexico ◼ 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Responsibility QS StarsTM Overall Universidad del Valle de México (UVM) Premium/ Traditional Enrollment @ 12/31/23 113,200 1966 ◼ Largest private university in Mexico ◼ 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Responsibility Universidad Tecnológica de México (UNITEC) Value/ Teaching128,800 1994 ◼ Ranked Top 5 university in Peru ◼ 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Responsibility Premium/ Traditional 69,700 1994 ◼ 3rd largest private university in Peru ◼ 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Responsibility Value/ Teaching 117,200 1983 ◼ One of the largest private technical / vocational institutes in PeruTechnical/ Vocational 20,000 Universidad Peruana de Ciencias Aplicadas (UPC) Universidad Privada del Norte (UPN) CIBERTEC M e x ic o P e ru Sources: QS Stars™, Guía Universitaria (UVM), AmericaEconomia (UPC)

10© 2024 Laureate Education, Inc. Q4 & FY 2023 PERFORMANCE RESULTS

11© 2024 Laureate Education, Inc. 2023 Fourth Quarter – Financial Summary Q4 ’23 Variance Vs. Q4 ‘22 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 8K 40% 40% • Not a material intake period, impacted by timing of intakes Total Enrollment 449K 6% 6% • Mexico +9%, Peru +3% • Driven by new enrollment growth Revenue $409 18% 10% • Driven by enrollment growth and favorable price/mix Adj. EBITDA $131 39% 28% • Strong underlying trends Adj. EBITDA margin 32.1% 469 bps 460 bps • Strong revenue flow thru driven by both segments (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Strong Underlying Trends During the Fourth Quarter

12© 2024 Laureate Education, Inc. 2023 FY – Financial Summary FY ’23 Variance Vs. FY ‘22 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 241K 10% 10% • Strong intakes during 2023 • Mexico +11%, Peru +9% Total Enrollment 449K 6% 6% • Mexico +9%, Peru +3% • Driven by new enrollment growth Revenue $1,484 19% 11% • Strong enrollment growth and favorable price/mix Adj. EBITDA $419 24% 15% • Strong revenue growth and productivity gains, partially offset by final return to campus expenses Adj. EBITDA margin 28.2% 92 bps 110 bps • Continued focus on margin expansion driven primarily by Mexico, as well as Corporate G&A reductions (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Robust Operating Performance in FY 2023 Adjusted EBITDA Margin at Historic High for Laureate

13© 2024 Laureate Education, Inc. SEGMENT RESULTS

14© 2024 Laureate Education, Inc. (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Mexico Segment Results Q4 Results FY Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q4 ’23 Organic/CC Vs. Q4 ’22 (1) FY ’23 Organic/CC Vs. FY ’22 (1) New Enrollment 7K 41% 154K 11% • Strong primary and secondary intakes in 2023 Total Enrollment 242K 9% 242K 9% • Driven by new enrollment growth Revenue $223 11% $783 13% • Driven by enrollment growth and favorable price/mix Adj. EBITDA $68 40% $177 26% • Strong revenue growth and productivity gains, partially offset by final return to face-to- face classes at campuses Adj. EBITDA margin 30.4% 614 bps 22.6% 247 bps • Growth and productivity gains, partially offset by final return to campus expenses Strong Intake Cycles Driving Double-Digit Growth in Revenue and Profitability

15© 2024 Laureate Education, Inc. Peru Segment Results (1) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. Q4 Results FY Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q4 ’23 Organic/CC Vs. Q4 ’22 (1) FY ’23 Organic/CC Vs. FY ’22 (1) New Enrollment 1K n.m. 87K 9% • Strong growth during primary intake cycle in Q1 • Secondary intake in Q3 impacted by macroeconomic headwinds Total Enrollment 207K 3% 207K 3% • New enrollment volume offset by higher attrition during Q3 secondary intake related to macroeconomic conditions Revenue $186 8% $702 10% • Strong H1 revenue growth partially offset by macroeconomic headwinds in H2 Adj. EBITDA $80 18% $287 5% • Strong revenue growth partially offset by final return to campus expenses Adj. EBITDA margin 42.8% 368 bps 40.9% (187 bps) • Margin impacted by final return to campus expenses Strong Revenue Growth Partially Offset by Final Return to Campus Expenses

16© 2024 Laureate Education, Inc. OUTLOOK

17© 2024 Laureate Education, Inc. 2024 Outlook – Executive Summary ✓ Market dynamics remain favorable for the private sector in Mexico and Peru ✓ 2024 outlook reflects differing macroeconomic conditions by market – Mexico: Strong growth expectations; favorable macro backdrop including nearshoring tailwinds – Peru: Growth more muted due to current economic downturn; expect recovery in 2H 2024 ✓ 2024 Revenue growth expected at 5%-6% Vs. 20231 (up 5%-6% on an organic constant currency basis2) ✓ 2024 Adjusted EBITDA growth expected at 5%-8% Vs. 20231 (up 6%-9% on an organic constant currency basis2) ✓ Adjusted EBITDA Margin accretion of 0.4pts3 (0.5pts FX neutral) driven by Mexico's continued margin optimization as well as additional reduction of corporate expenses ✓ Adjusted EBITDA to Unlevered Free Cash Flow Conversion in the high 30% range – Includes one-time legacy Laureate payments of ~$45M primarily driven by deferred taxes – Absent legacy Laureate clean-up items, our Adjusted EBITDA to Unlevered Free Cash Flow conversion is targeted to reach 50% in 2024, in line with our stated target profile (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 17.05 & PEN 3.88 for February through December 2024. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. (2) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations (if applicable), acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. (3) At mid-point of 2024 guidance provided. Note: An outlook for 2024 net income and reconciliation of the forward-looking 2024 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA or its related margin to projected net income or its related margin without unreasonable effort.

18© 2024 Laureate Education, Inc. 2024 Outlook1 Note: An outlook for 2024 net income and reconciliation of the forward-looking 2024 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. ($ in millions) (Enrollments rounded to the nearest thousand) Current FY 2024 Outlook (1) Total Enrollment 467K - 473K Revenue $1,553 - $1,568 Adjusted EBITDA $441 - $451 Continued Top Line Growth and Margin Expansion (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 17.05 & PEN 3.88 for February through December 2024. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded.

19© 2024 Laureate Education, Inc. Q1 2024 Guidance Details Note: An outlook for Q1 2024 net income and reconciliation of the forward-looking Q1 2024 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. ($ in millions) Q1 2024 Outlook (1) Revenue $266 - $271 Adjusted EBITDA $23 - $26 (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 17.05 & PEN 3.88 for February through March 2024. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. • Start of classes shifted in both Mexico and Peru for certain programs causing unfavorable timing impact of ($12M) in Revenue and ($10M) in Adjusted EBITDA for Q1. Offsetting favorable impact to be reflected Q2-Q4 • One-time restructuring cost ($5M) related to Mexico margin optimization plan Q1 Outlook Unfavorably Impacted by Academic Calendar and Restructuring (Largely Out-of-Session Seasonally Low Period)

20© 2024 Laureate Education, Inc. APPENDIX

21© 2024 Laureate Education, Inc. Q4 ’23 B / (W) Notes ($ in millions) Reported Vs. Q4 ’22 Adjusted EBITDA 131 37 Depreciation & Amort. (18) (2) Interest Expense, net (2) 1 Impairments (1) (1) Other (27) (11) • Non-cash FX translation loss on intercompany loans Income Tax (36) (10) Income/(Loss) From Continuing Operations 48 13 Discontinued Operations (Net of Tax) (6) (10) • Indemnification on prior sale Net Income / (Loss) 42 3 Income from Continuing Operations Improved Versus Prior Year 2023 Fourth Quarter – Net Income Reconciliation

22© 2024 Laureate Education, Inc. FY ’23 B / (W) Notes ($ in millions) Reported Vs. FY ’22 Adjusted EBITDA 419 80 Depreciation & Amort. (70) (11) Interest Expense, net (12) (3) Impairments (3) (3) Other (79) (55) • Non-cash FX translation loss on intercompany loans Income Tax (138) 48 • Prior year included discrete tax expenses Income/(Loss) From Continuing Operations 117 56 Discontinued Operations (Net of Tax) (10) (18) Net Income / (Loss) 107 38 2023 FY – Net Income Reconciliation Income from Continuing Operations Improved Versus Prior Year

23© 2024 Laureate Education, Inc. Q4 2023 Capitalization and Return of Capital Return of Capital Actions: • Q4 2023: $110M ($0.70 per share) special cash dividend • Today: New $100M stock buyback authorization announced Strong Balance and Cash Accretive Business Model Allow For Continued Return of Capital ($ in millions) Total Company as of 12/31/23 Gross Debt $167 Less: Cash & Cash Equivalents ($89) Net Debt $78 ➢ Total current shares outstanding of 158M shares as of December 31st

24© 2024 Laureate Education, Inc. 2024 Full Year Guidance Details Continued Top Line Growth and Margin Expansion ($ in millions) (Enrollments rounded to the nearest thousand) Total Enrollment Revenues Adj. EBITDA 2023 FY Results Adjusted 449K $1,484 $419 Organic Growth 18K - 24K $77 - $92 $27 - $37 Organic Growth % 4% - 5% 5% - 6% 6% - 9% 2024 FY Guidance (Constant Currency) 467K - 473K $1,561 - $1,576 $446 - $456 FX Impact (spot FX) (1) ($8) ($5) 2024 FY Guidance (@ spot FX) (1) 467K - 473K $1,553 - $1,568 $441 - $451 As Reported Growth % 4% - 5% 5% - 6% 5% - 8% (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 17.05 & PEN 3.88 for February through December 2024. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2024 net income and reconciliation of the forward-looking 2024 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort.

25© 2024 Laureate Education, Inc. Q1 2024 Guidance Details 1Q Guidance ($ in millions) Revenues Adj. EBITDA 2023 Q1 Results As Reported $251 $33 Timing Impact Intra-Year (academic calendar) ($12) ($10) 2023 Q1 Results Adjusted $239 $23 Organic Growth $13 - $18 $3 - $6 Organic Growth % (excl. Mexico restructuring) 5% - 7% 13% - 26% One-time restructuring (Mexico margin optimization plan) - ($5) 2024 Q1 Guidance (Constant Currency) $252 - $257 $21 - $24 FX Impact (spot FX) (1) $14 $2 2024 Q1 Guidance (@ spot FX) (1) $266 - $271 $23 - $26 (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 17.05 & PEN 3.88 for February through March 2024. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for Q1 2024 net income and reconciliation of the forward-looking Q1 2024 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Q1 Outlook Unfavorably Impacted by Academic Calendar and Restructuring (Largely Out-of-Session Seasonally Low Period) Start of classes shifted in both Mexico and Peru for certain programs, offsetting favorable impact to be reflected in Q2-Q4

26© 2024 Laureate Education, Inc. • Large intake cycles at end of Q1 (Peru) and end of Q3 (Mexico) drive seasonality of earnings • Q2 and Q4 are typically Laureate’s strongest earnings quarters Revenue Seasonality Adjusted EBITDA Seasonality New Enrollments Seasonality Reported FCF Intra-Year Seasonality Trends Factors Affecting Seasonality ◼ Main intake cycles: – Q1 - Peru – Q3 - Mexico ◼ Academic calendar ◼ FX trends 28% 22% 48% 2% 38% 10% 49% 2% 37% 11% 50% 3% 39% 10% 48% 3% Q1 Q2 Q3 Q4 2020 2021 2022 2023 (14%) 46% 24% 44% 4% 42% 30% 24% 8% 43% 21% 28% 8% 42% 19% 31% Q1 Q2 Q3 Q4 2020 2021 2022 2023 19% 30% 24% 28% 18% 30% 25% 27% 17% 31% 24% 28% 17% 31% 24% 28% Q1 Q2 Q3 Q4 2020 2021 2022 2023

27© 2024 Laureate Education, Inc. Financial Results & Tables

28© 2024 Laureate Education, Inc. Financial Tables Note: Dollars in millions, except per share amounts, and may not sum to total due to rounding Consolidated Statements of Operations For the three months ended December 31, For the year ended December 31, IN MILLIONS 2023 2022 Change 2023 2022 Change Revenues $ 409.4 $ 346.3 $ 63.1 $ 1,484.3 $ 1,242.3 $ 242.0 Costs and expenses: Direct costs 279.4 252.3 27.1 1,089.8 907.4 182.4 General and administrative expenses 18.6 16.0 2.6 52.6 64.8 (12.2) Loss on impairment of assets 1.5 — 1.5 3.1 0.1 3.0 Operating income 110.0 78.0 32.0 338.8 270.0 68.8 Interest income 2.1 1.9 0.2 9.1 7.6 1.5 Interest expense (3.7) (4.8) 1.1 (21.0) (16.4) (4.6) Other (expense) income, net (0.5) 0.4 (0.9) (0.3) 0.8 (1.1) Foreign currency exchange loss, net (24.1) (14.5) (9.6) (75.7) (17.4) (58.3) (Loss) gain on disposals of subsidiaries, net — (0.1) 0.1 3.6 1.4 2.2 Income from continuing operations before income taxes and equity in net income of affiliates 83.7 60.9 22.8 254.5 245.9 8.6 Income tax expense (36.2) (26.2) (10.0) (137.6) (185.4) 47.8 Equity in net income of affiliates, net of tax 0.2 0.2 — 0.2 0.3 (0.1) Income from continuing operations 47.7 34.9 12.8 117.0 60.7 56.3 (Loss) income from discontinued operations, net of tax (6.0) 4.2 (10.2) (9.8) 8.3 (18.1) Net income 41.7 39.1 2.6 107.3 69.0 38.3 Net loss (income) attributable to noncontrolling interests 0.1 0.2 (0.1) 0.3 0.6 (0.3) Net income attributable to Laureate Education, Inc. $ 41.9 $ 39.2 $ 2.7 $ 107.6 $ 69.6 $ 38.0 Basic and diluted earnings (loss) per share: Basic weighted average shares outstanding 157.4 161.3 (3.9) 157.3 167.7 (10.4) Diluted weighted average shares outstanding 158.1 161.9 (3.8) 157.9 168.3 (10.4) Basic earnings per share $ 0.26 $ 0.25 $ 0.01 $ 0.69 $ 0.42 $ 0.27 Diluted earnings per share $ 0.26 $ 0.25 $ 0.01 $ 0.68 $ 0.41 $ 0.27

29© 2024 Laureate Education, Inc. Financial Tables Note: Dollars in millions, and may not sum to total due to rounding Revenue and Adjusted EBITDA by segment: Quarter IN MILLIONS % Change $ Variance Components For the three months ended December 31, 2023 2022 Reported Organic Constant Currency(1) Total Organic Constant Currency Other Acq/Div. FX Revenues Mexico $ 223.1 $ 179.0 25% 11% $ 44.1 $ 20.4 $ — $ — $ 23.7 Peru 186.3 167.1 11% 8% 19.2 13.2 — — 6.0 Corporate & Eliminations — 0.2 (100)% (100)% (0.2) (0.2) — — — Total Revenues $ 409.4 $ 346.3 18% 10% $ 63.1 $ 33.4 $ — $ — $ 29.7 Adjusted EBITDA Mexico $ 67.9 $ 43.5 56% 40% $ 24.4 $ 17.2 $ 0.3 $ — $ 6.9 Peru 79.8 65.3 22% 18% 14.5 11.8 — — 2.7 Corporate & Eliminations (16.3) (14.0) (16)% (16)% (2.3) (2.3) — — — Total Adjusted EBITDA $ 131.3 $ 94.8 39% 28% $ 36.5 $ 26.6 $ 0.3 $ — $ 9.6 (1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. The "Organic Constant Currency" % changes are calculated by dividing the Organic Constant Currency amounts by the 2022 Revenues and Adjusted EBITDA amounts.

30© 2024 Laureate Education, Inc. Financial Tables Note: Dollars in millions, and may not sum to total due to rounding Revenue and Adjusted EBITDA by segment: Year-to-Date IN MILLIONS % Change $ Variance Components For the year ended December 31, 2023 2022 Reported Organic Constant Currency(2) Total Organic Constant Currency Other Acq/Div. FX Revenues Mexico $ 782.6 $ 613.9 27% 13% $ 168.7 $ 77.1 $ — $ — $ 91.6 Peru 701.7 624.2 12% 10% 77.5 60.2 — — 17.3 Corporate & Eliminations — 4.1 (100)% (100)% (4.1) (4.1) — — — Total Revenues $ 1,484.3 $ 1,242.3 19% 11% $ 242.0 $ 133.1 $ — $ — $ 108.9 Adjusted EBITDA Mexico $ 177.0 $ 123.4 43% 26% $ 53.6 $ 32.6 $ 0.4 $ — $ 20.6 Peru 286.9 266.7 8% 5% 20.2 12.9 — — 7.3 Corporate & Eliminations (45.2) (51.2) 12% 12% 6.0 6.0 — — — Total Adjusted EBITDA $ 418.6 $ 338.9 24% 15% $ 79.7 $ 51.4 $ 0.4 $ — $ 27.9 (2) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures, and other items. Other items include the impact of acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets. The "Organic Constant Currency" % changes are calculated by dividing the Organic Constant Currency amounts by the 2022 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures.

31© 2024 Laureate Education, Inc. Financial Tables Consolidated Balance Sheets Note: Dollars in millions, and may not sum to total due to rounding IN MILLIONS December 31, 2023 December 31, 2022 Change Assets Cash and cash equivalents $ 89.4 $ 85.2 $ 4.2 Receivables (current), net 92.1 80.7 11.4 Other current assets 42.0 60.3 (18.3) Property and equipment, net 562.2 523.4 38.8 Operating lease right-of-use assets, net 371.6 389.6 (18.0) Goodwill and other intangible assets 830.7 735.1 95.6 Deferred income taxes 71.4 51.9 19.5 Other long-term assets 49.9 46.0 3.9 Current and long-term assets held for sale 16.3 — 16.3 Total assets $ 2,125.6 $ 1,972.2 $ 153.4 Liabilities and stockholders' equity Accounts payable and accrued expenses $ 209.4 $ 178.6 $ 30.8 Deferred revenue and student deposits 69.4 51.3 18.1 Total operating leases, including current portion 417.6 415.9 1.7 Total long-term debt, including current portion 165.1 232.1 (67.0) Other liabilities 303.5 318.6 (15.1) Current and long-term liabilities held for sale 11.5 — 11.5 Total liabilities 1,176.5 1,196.5 (20.0) Redeemable noncontrolling interests and equity 1.4 1.4 — Total stockholders' equity 947.7 774.4 173.3 Total liabilities and stockholders' equity $ 2,125.6 $ 1,972.2 $ 153.4

32© 2024 Laureate Education, Inc. Financial Tables Consolidated Statements of Cash Flows Note: Dollars in millions, and may not sum to total due to rounding For the year ended December 31, IN MILLIONS 2023 2022 Change Cash flows from operating activities Net income $ 107.3 $ 69.0 $ 38.3 Depreciation and amortization 69.6 59.1 10.5 Loss (gain) on sales and disposal of subsidiaries, property and equipment and leases, net 9.6 (11.1) 20.7 Deferred income taxes (55.9) (0.5) (55.4) Unrealized foreign currency exchange loss 75.5 13.9 61.6 Income tax receivable/payable, net 23.3 31.3 (8.0) Working capital, excluding tax accounts (67.1) (52.2) (14.9) Other non-cash adjustments 88.5 68.7 19.8 Net cash provided by operating activities 250.8 178.2 72.6 Cash flows from investing activities Purchase of property and equipment (56.4) (52.8) (3.6) Expenditures for deferred costs — (0.3) 0.3 Receipts from sales of discontinued operations, net of cash sold, property and equipment 4.5 83.4 (78.9) Net cash (used in) provided by investing activities (51.9) 30.3 (82.2) Cash flows from financing activities (Decrease) increase in long-term debt, net (89.7) 62.5 (152.3) Special cash distribution (112.5) (253.2) 140.7 Payments to repurchase common stock — (282.2) 282.2 Financing other, net 0.3 11.2 (10.9) Net cash used in by financing activities (201.9) (461.6) 259.7 Effects of exchange rate changes on cash 6.6 1.2 5.4 Change in cash included in current assets held for sale (0.5) — (0.5) Net change in cash and cash equivalents 3.1 (251.8) 254.9 Cash and cash equivalents at beginning of period 93.8 345.6 (251.8) Cash and cash equivalents at end of period $ 96.9 $ 93.8 $ 3.1

33© 2024 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliation (1 of 2) Note: Dollars in millions, and may not sum to total due to rounding The following table reconciles Net Income to Adjusted EBITDA and Adjusted EBITDA margin: For the three months ended December 31, For the year ended December 31, IN MILLIONS 2023 2022 Change 2023 2022 Change Net income $ 41.7 $ 39.1 $ 2.6 $ 107.3 $ 69.0 $ 38.3 Plus: Loss (income) from discontinued operations, net of tax 6.0 (4.2) 10.2 9.8 (8.3) 18.1 Income (loss) from continuing operations 47.7 34.9 12.8 117.0 60.7 56.3 Plus: Equity in net income of affiliates, net of tax (0.2) (0.2) — (0.2) (0.3) 0.1 Income tax expense (benefit) 36.2 26.2 10.0 137.6 185.4 (47.8) Income from continuing operations before income taxes and equity in net income of affiliates 83.7 60.9 22.8 254.5 245.9 8.6 Plus: Loss (gain) on disposal of subsidiaries, net — 0.1 (0.1) (3.6) (1.4) (2.2) Foreign currency exchange loss (gain), net 24.1 14.5 9.6 75.7 17.4 58.3 Other (income) expense, net 0.5 (0.4) 0.9 0.3 (0.8) 1.1 Interest expense 3.7 4.8 (1.1) 21.0 16.4 4.6 Interest income (2.1) (1.9) (0.2) (9.1) (7.6) (1.5) Operating income 110.0 78.0 32.0 338.8 270.0 68.8 Plus: Depreciation and amortization 17.7 15.5 2.2 69.6 59.1 10.5 EBITDA 127.7 93.5 34.2 408.4 329.1 79.3 Plus: Share-based compensation expense (3) 2.2 1.8 0.4 7.1 8.8 (1.7) Loss on impairment of assets (4) 1.5 — 1.5 3.1 0.1 3.0 EiP implementation expenses (5) — (0.5) 0.5 — 0.8 (0.8) Adjusted EBITDA $ 131.3 $ 94.8 $ 36.5 $ 418.6 $ 338.9 $ 79.7 Revenues $ 409.4 $ 346.3 $ 63.1 $ 1,484.3 $ 1,242.3 $ 242.0 Income (loss) from continuing operations margin 11.7 % 10.1 % 157 bps 7.9 % 4.9 % 299 bps Adjusted EBITDA margin 32.1 % 27.4 % 469 bps 28.2 % 27.3 % 92 bps (3) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718, "Stock Compensation." (4) Represents non-cash charges related to impairments of long-lived assets. (5) Excellence-in-Process (EiP) implementation expenses are related to our enterprise-wide initiative to optimize and standardize Laureate’s processes, creating vertical integration of procurement, information technology, finance, accounting and human resources. It included the establishment of regional shared services organizations (SSOs), as well as improvements to the Company's system of internal controls over financial reporting. The EiP initiative also included other back- and mid-office areas, as well as certain student-facing activities, expenses associated with streamlining the organizational structure, an enterprise-wide program aimed at revenue growth, and certain non-recurring costs incurred in connection with previous dispositions. The EiP initiative was completed as of December 31, 2021, except for certain EiP expenses related to the run out of programs that began in prior periods.

34© 2024 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliation (2 of 2) Note: Dollars in millions, and may not sum to total due to rounding The following table presents Free cash flow and reconciles Net cash flows from operating activities to Free cash flow: For the year ended December 31, IN MILLIONS 2023 2022 2021 Net cash provided by (used in) operating activities $ 250.8 $ 178.2 $ (156.1) Capital expenditures: Purchase of property and equipment (56.4) (52.8) (50.4) Expenditures for deferred costs — (0.3) (5.8) Free cash flow $ 194.4 $ 125.1 $ (212.3)

35© 2024 Laureate Education, Inc.

v3.24.0.1

Cover Page

|

Feb. 22, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

Laureate Education, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38002

|

| Entity Tax Identification Number |

52-1492296

|

| Entity Address, Address Line One |

PMB 1158, 1000 Brickell Ave, Suite 715

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33131

|

| City Area Code |

786

|

| Local Phone Number |

209-3368

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.004 per share

|

| Entity Emerging Growth Company |

false

|

| Trading Symbol |

LAUR

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000912766

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |