0001580670false00015806702024-10-092024-10-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): October 9, 2024

LGI HOMES, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-36126 | | 46-3088013 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification Number) |

| | | | | | | | | | | | | | | | | |

| 1450 Lake Robbins Drive, | Suite 430, | The Woodlands, | Texas | | 77380 |

| (Address of principal executive offices) | | (Zip Code) |

(281) 362-8998

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | LGIH | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 9, 2024, LGI Homes, Inc. (the “Company”) entered into a Fifth Amendment to Fifth Amended and Restated Credit Agreement with several financial institutions and Wells Fargo Bank, National Association, as administrative agent (the “Credit Agreement Amendment”), which amended the Fifth Amended and Restated Credit Agreement, dated as of April 28, 2021, with several financial institutions and Wells Fargo Bank, National Association, as administrative agent (as amended by amendments thereto dated as of February 22, 2022, April 29, 2022, April 28, 2023, December 5, 2023 and the Credit Agreement Amendment, the “Credit Agreement”). The Credit Agreement Amendment among other things, (a) amended the negative covenant in Section 10.1(g) of the Credit Agreement relating to housing inventory and (b) extended the maturity of the commitments of certain lenders under the Credit Agreement to April 28, 2028. The Credit Agreement matures on April 28, 2028 with respect to $1.085 billion, or 90.0%, of the $1.205 billion of commitments thereunder and on April 28, 2025 with respect to 10.0% of the commitments thereunder.

The description of the Credit Agreement Amendment is qualified in its entirety by reference to the Credit Agreement Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

The exhibits listed below are filed herewith.

Agreements and forms of agreements included as exhibits are included only to provide information to investors regarding their terms. Agreements and forms of agreements listed below may contain representations, warranties and other provisions that were made, among other things, to provide the parties thereto with specified rights and obligations and to allocate risk among them, and no such agreement or form of agreement should be relied upon as constituting or providing any factual disclosures about the Company, any other persons, any state of affairs or other matters.

(d) Exhibits.

| | | | | | | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| LGI HOMES, INC. |

| | |

| Date: October 11, 2024 | By: | /s/ Eric Lipar |

| | Eric Lipar |

| | Chief Executive Officer and Chairman of the Board |

| |

| |

Exhibit 10.1

EXECUTION VERSION

FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT

THIS FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT (this “Agreement”) is dated as of October 9, 2024 (the “Effective Date”), by and among LGI HOMES, INC., a Delaware corporation (the “Borrower”), the Lenders (as defined below) party hereto, and WELLS FARGO BANK, NATIONAL ASSOCIATION, in its capacity as Administrative Agent for the Lenders (together with its successors and assigns, the “Administrative Agent”).

W I T N E S S E T H :

WHEREAS, Borrower, the lenders from time to time party thereto (the “Lenders”), and Administrative Agent entered into that certain Fifth Amended and Restated Credit Agreement dated as of April 28, 2021, as amended by that certain First Amendment to Fifth Amended and Restated Credit Agreement dated as of February 22, 2022, as further amended by that certain Lender Addition and Acknowledgement Agreement and Second Amendment to Fifth Amended and Restated Credit Agreement dated as of April 29, 2022, as further amended by that certain Third Amendment to Fifth Amended and Restated Credit Agreement dated as of April 28, 2023, and as further amended by that certain Fourth Amendment to Fifth Amended and Restated Credit Agreement dated as of December 5, 2023 (as amended, and as the same may have been further amended, restated, amended and restated, supplemented, or otherwise modified from time to time prior to the date hereof, the “Credit Agreement”); and

WHEREAS, the Borrower has requested that the Requisite Lenders amend certain provisions of the Credit Agreement as set forth herein, and the Administrative Agent and the Requisite Lenders have agreed to such amendments, subject to the terms and conditions set forth below.

NOW, THEREFORE, for and in consideration of the above premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the parties hereto, each of the parties hereto hereby covenant and agree as follows:

SECTION 1.Definitions. Unless otherwise specifically defined herein, each term used herein which is defined in the Credit Agreement shall have the meaning assigned to such term in the Credit Agreement. Each reference to “hereof,” “hereunder,” “herein,” and “hereby” and each other similar reference and each reference to “this Agreement” and each other similar reference contained in the Credit Agreement shall from and after the date hereof refer to the Credit Agreement as amended hereby.

SECTION 2.Amendments to the Credit Agreement. On and as of the Effective Date:

(a)Section 1.1 of the Credit Agreement is hereby amended by amending the definition of “Non-Extending Lender”, so that it reads, in its entirety, as follows:

“Non-Extending Lender” means, individually or collectively as the context may suggest or require, (a) with respect to the BMO $15 Million Revolving Note only, BMO Bank N.A., (b) PNC Bank, National Association, (c) Chang Hwa Commercial Bank, Ltd., a New York Branch, (d) Bank of Taiwan, New York Branch, (e) Hua Nan Commercial Bank Ltd., Los Angeles Branch, (f) Mega International Commercial Bank Co., Ltd., Los Angeles Branch, (g) Taiwan Cooperative Bank, Ltd., acting through its Los Angeles Branch, and (h) Hancock Whitney Bank.

(b)Effective as of September 30, 2024, and from and after such date, subject to satisfaction of the conditions precedent described in Section 5 hereof, Section 10.1(g) of the Credit Agreement is hereby amended so that it reads, in its entirety, as follows:

(g) Housing Inventory. (x) Prior to the Third Amendment Effective Date, the Borrower shall not permit the number of Speculative Housing Units and Model Housing Units, as at the end of any fiscal quarter, to exceed the product of (i) the number of Housing Units closed during the period of six (6) months ending on the last day of such fiscal quarter, on an annualized basis, multiplied by (ii) fifty percent (50%), (y) from the Third Amendment Effective Date through and including September 29, 2024, the Borrower shall not permit the number of Speculative Housing Units and Model Housing Units, as at the end of any fiscal quarter, to exceed the product of (i) the greater of (A) the number of Housing Units closed during the period of six (6) months ending on the last day of such fiscal quarter, on an annualized basis, and (B) the number of Housing Units closed during the period of twelve (12) months ending on the last day of such fiscal quarter, multiplied by (ii) fifty percent (50%), and (z) thereafter, the Borrower shall not permit the number of Speculative Housing Units and Model Housing Units, as at the end of any fiscal quarter, to exceed the product of (i) the greater of (A) the number of Housing Units closed during the period of six (6) months ending on the last day of such fiscal quarter, on an annualized basis, and (B) the number of Housing Units closed during the period of twelve (12) months ending on the last day of such fiscal quarter, multiplied by (ii) sixty-five percent (65%).

SECTION 3.Representations and Warranties.

(a)Each of the Borrower, the other Loan Parties and the other Subsidiaries is a corporation, limited liability company, partnership or other legal entity, duly organized or formed, validly existing and in good standing under the jurisdiction of its incorporation or formation, has the power and authority to own or lease its respective properties and to carry on its respective business as now being and hereafter proposed to be conducted and is duly qualified and is in good standing as a foreign corporation, partnership or other legal entity, and authorized to do business, in each jurisdiction in which the character of its properties or the nature of its business requires such qualification or authorization and where the failure to be so qualified or authorized could reasonably be expected to have, in each instance, a Material Adverse Effect.

(b)The Borrower and each other Loan Party has the right and power, and has taken all necessary action to authorize, to execute, deliver (with execution and delivery of this Agreement being limited solely to the Borrower) and perform this Agreement, the Reaffirmation and each of the Loan Documents to which it is a party in accordance with their respective terms and to consummate the transactions contemplated hereby and thereby. Each of this Agreement (solely with respect to the Borrower) and the Reaffirmation has been, and each of the Loan

Documents to which the Borrower or any other Loan Party is a party have been duly executed and delivered by the duly authorized officers of such Person and each is a legal, valid and binding obligation of such Person enforceable against such Person in accordance with its respective terms, except as the same may be limited by bankruptcy, insolvency, and other similar laws affecting the rights of creditors generally and the availability of equitable remedies for the enforcement of certain obligations (other than the payment of principal) contained herein or therein and as may be limited by equitable principles generally.

(c)The execution, delivery (with execution and delivery of this Agreement being limited solely to the Borrower) and performance of this Agreement, the Reaffirmation and the other Loan Documents to which any Loan Party is a party in accordance with their respective terms and the borrowings and other extensions of credit hereunder do not and will not, by the passage of time, the giving of notice, or both: (i) require any Governmental Approval (other than those that have been obtained or could be reasonably be expected to be obtained in the ordinary course of business) or violate any Applicable Law (including all Environmental Laws) relating to the Borrower or any other Loan Party; (ii) conflict with, result in a breach of or constitute a default under the organizational documents of any Loan Party, or any indenture, agreement or other instrument to which the Borrower or any other Loan Party is a party or by which it or any of its respective properties may be bound; or (iii) result in or require the creation or imposition of any Lien upon or with respect to any property now owned or hereafter acquired by any Loan Party other than in favor of the Administrative Agent for its benefit and the benefit of the other Lender Parties.

SECTION 4.Miscellaneous.

(a)Effect of Agreement. Except as set forth expressly hereinabove, all terms of the Credit Agreement and the other Loan Documents shall be and remain in full force and effect, and shall constitute the legal, valid, binding, and enforceable obligations of the Borrower and each of the Subsidiary Guarantors.

(b)Loan Document. For the avoidance of doubt, the Borrower, the Lenders party hereto and the Administrative Agent hereby acknowledge and agree that this Agreement is a Loan Document.

(c)No Novation or Mutual Departure. The Borrower expressly acknowledges and agrees that (i) there has not been, and this Agreement does not constitute or establish, a novation with respect to the Credit Agreement or any of the other Loan Documents, or a mutual departure from the strict terms, provisions, and conditions thereof, other than with respect to the amendments contained in Section 2 above; and (ii) nothing in this Agreement shall affect or limit the Administrative Agent’s or Lenders’ right to demand payment of liabilities owing from the Borrower to the Administrative Agent or any Lender under, or to demand strict performance of the terms, provisions and conditions of, the Credit Agreement and the other Loan Documents, to exercise any and all rights, powers, and remedies under the Credit Agreement or the other Loan Documents or at law or in equity, or to do any and all of the foregoing, immediately at any time

after the occurrence of a Default or an Event of Default under the Credit Agreement or the other Loan Documents.

(d)Ratification. The Borrower hereby (i) restates, ratifies, and reaffirms each and every term, covenant, and condition, as modified by this Agreement, set forth in the Credit Agreement and the other Loan Documents to which it is a party effective as of the date hereof and (ii) restates and renews in all material respects (except in the case of a representation or warranty qualified by materiality, in which case such representation or warranty shall be true and correct in all respects) each and every representation and warranty heretofore made by it in the Credit Agreement and the other Loan Documents as fully as if made on the date hereof and with specific reference to this Agreement and any other Loan Documents executed or delivered in connection herewith (except with respect to representations and warranties made as of an expressed date, in which case such representations and warranties shall be true and correct as of such date).

(e)No Default. To induce the Administrative Agent and the Lenders party hereto to enter into this Agreement and to continue to make advances pursuant to the Credit Agreement (subject to the terms and conditions thereof), the Borrower hereby acknowledges and agrees that, as of the date hereof, and after giving effect to the terms hereof, there exists (i) no Default or Event of Default and (ii) no right of offset, defense, counterclaim, claim, or objection in favor of the Borrower or any Subsidiary Guarantor arising out of or with respect to any of the Loans or other obligations of the Borrower or the Subsidiary Guarantors owed to the Administrative Agent and the Lenders party hereto under the Credit Agreement or any other Loan Document.

(f)Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same instrument. This Agreement may be executed by each party on separate copies, which copies, when combined so as to include the signatures of all parties, shall constitute a single counterpart of this Agreement.

(g)Fax or Other Transmission. Delivery by one or more parties hereto of an executed counterpart of this Agreement via facsimile, telecopy, or other electronic method of transmission pursuant to which the signature of such party can be seen (including, without limitation, Adobe Corporation’s Portable Document Format) shall have the same force and effect as the delivery of an original executed counterpart of this Agreement. Any party delivering an executed counterpart of this Agreement by facsimile or other electronic method of transmission shall also deliver an original executed counterpart, but the failure to do so shall not affect the validity, enforceability, or binding effect of this Agreement.

(h)Recitals Incorporated Herein. The preamble and the recitals to this Agreement are hereby incorporated herein by this reference.

(i)Section References. Section titles and references used in this Agreement shall be without substantive meaning or content of any kind whatsoever and are not a part of the agreements among the parties hereto evidenced hereby.

(j)Further Assurances. The Borrower agrees to take, at Borrower’s sole cost and expense, such further actions as the Administrative Agent shall reasonably request from time to time to evidence the amendments set forth herein and the transactions contemplated hereby.

(k)Governing Law. This Agreement and the Reaffirmation (as defined below) shall be governed by and construed and interpreted in accordance with the internal laws of the State of New York but excluding any principles of conflicts of law or other rule of law that would cause the application of the law of any jurisdiction other than the laws of the State of New York.

(l)Electronic Signatures.

(i) Each of the parties hereto consents to do business electronically in connection with this Agreement, any other Loan Document and the transactions contemplated hereby or thereby. Delivery of an executed counterpart of a signature page of this Agreement or any other Loan Documents by telecopy, emailed pdf or any other electronic means that reproduces an image of the actual executed signature page shall be effective as delivery of a manually executed counterpart of this Agreement or such other Loan Document.

(ii) The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to any document, instrument, amendment, restatement, modification, reaffirmation, assignment and acceptance or other agreement to be signed in connection with this Agreement, any other Loan Document and the transactions contemplated hereby or thereby shall be deemed to include Electronic Signatures, deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity, admissibility into evidence and enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, Uniform Real Property Electronic Recording Act, if applicable, the New York State Electronic Signatures and Records Act, the Illinois Electronic Commerce Security Act or any other similar state laws based on the Uniform Electronic Transactions Act, if applicable; provided that nothing herein shall require the Administrative Agent to accept Electronic Signatures in any form or format without its prior written consent, which consent can be withheld in its sole discretion.

(iii) Without limiting the generality of the foregoing, each of the parties hereto hereby (i) agrees that, for all purposes, including without limitation, in connection with any workout, restructuring, enforcement of remedies, bankruptcy proceedings, other proceedings or litigation arising out of or related to this

Agreement, the other Loan Documents and the transactions contemplated hereby or thereby, electronic images of this Agreement or any other Loan Documents (in each case, including with respect to any signature pages thereto) shall have the same legal effect, validity, admissibility into evidence and enforceability as any paper original, and (ii) waives any argument, defense or right to contest the validity, admissibility into evidence or enforceability of this Agreement, the Loan Documents or the transactions contemplated hereby or thereby based solely on the lack of paper original copies of any Loan Documents, including with respect to any signatures thereon. For the avoidance of doubt, the parties hereto hereby agree that this provision shall apply in equal force and have the same enforceability, validity and admissibility into evidence to each other Loan Document and any amendment, restatement, modification, reaffirmation, assignment and acceptance or other document related to this Agreement or such other Loan Document whether or not expressly stated therein.

(iv) Even though the parties agree that such Electronic Signatures are legally enforceable and intended to be effective for all purposes, the signing parties agree if requested by Administrative Agent in its sole discretion to promptly deliver to Administrative Agent the requested original document bearing an original manual signature, (i) in order to reduce the risk of fraud, comply with potentially applicable regulations, (ii) to the extent required or advisable to be delivered in connection with any program made available to the Administrative Agent or any of its affiliates by the Federal Reserve System or any Federal Reserve Bank, the U.S. Treasury Department or any other federal or state regulatory body, (iii) to the extent required pursuant to the order of any court or administrative agency or in any pending legal, judicial or administrative proceeding, or as otherwise as required by applicable law, rule or regulation or compulsory legal process, or as requested by a governmental and/or regulatory authority (including any self-regulatory authority, such as the National Association of Insurance Commissioners), or (iv) for other operational or risk management purposes.

(v) As used in this section, “Electronic Signature” means an electronic sound, symbol, or process attached to, or associated with, a contract or other record and adopted by a Person with the intent to sign, authenticate or accept such contract or record.

SECTION 5.Conditions Precedent. This Agreement shall become effective only upon the satisfaction of the following conditions precedent:

(a)The Administrative Agent shall have received each of the following, each in form and substance reasonably satisfactory to the Administrative Agent:

(i) counterparts of this Agreement duly executed by the Borrower, the Lenders that constitute the Requisite Lenders and the Administrative Agent; and

(ii) counterparts of the Consent, Reaffirmation and Agreement of Subsidiary Guarantors (the “Reaffirmation”) attached hereto duly executed by each of the Subsidiary Guarantors; and

(b)pursuant to, and in accordance with, Section 13.2 of the Credit Agreement, the Borrower shall have paid to the Administrative Agent all fees and expenses incurred in connection with the preparation, negotiation and closing of this Agreement and the documents, instruments and agreements related thereto, if the same have been invoiced in reasonable detail delivered to the Borrower at least one Business Day before the earlier of (i) the satisfaction of the conditions in Section 7(a) above and (ii) the date this Agreement becomes effective.

[SIGNATURES ON FOLLOWING PAGES.]

IN WITNESS WHEREOF, each of the Borrower, the Administrative Agent, and the Lenders party hereto has caused this Agreement to be duly executed by its duly authorized officer as of the day and year first above written.

BORROWER:

LGI HOMES, INC.,

a Delaware corporation

By: /s/ Eric T. Lipar

Name: Eric T. Lipar

Title: Chief Executive Officer

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

ADMINISTRATIVE AGENT AND LENDERS:

WELLS FARGO BANK, NATIONAL ASSOCIATION, as the Administrative Agent and as a Lender

By: /s/ Amanda Henley

Name: Amanda Henley

Title: Executive Director

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

BANK OF AMERICA, N.A.,

as a Lender

By: /s/ Cheryl Sneor

Name: Cheryl Sneor

Title: Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

BMO BANK N.A.,

as a Lender

By: /s/ Lisa Smith Boyer

Name: Lisa Smith Boyer

Title: Director

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

CADENCE BANK,

a Mississippi state banking corporation,

as a Lender

By: /s/ Ryan Davis

Name: Ryan Davis

Title: Sr. Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

CITIZENS BANK, N.A., as a Lender

By: /s/ Carmen Malizia

Name: Carmen Malizia

Title: Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

FIFTH THIRD BANK, NATIONAL ASSOCIATION, as a Lender

By: /s/ Ted Smith

Name: Ted Smith

Title: Senior Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

FIRST NATIONAL BANK OF PENNSYLVANIA, as a Lender

By: /s/ Clark W. Gregory

Name: Clark W. Gregory

Title: Senior Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

FLAGSTAR BANK, N.A.,

as a Lender

By: /s/ Jerry Schillaci

Name: Jerry Schillaci

Title: First Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

HANCOCK WHITNEY BANK,

as a Lender

By: /s/ Paul Johnson

Name: Paul Johnson

Title: SVP

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

MEGA INTERNATIONAL COMMERCIAL BANK CO., LTD, LOS ANGELES BRANCH,

as a Lender

By: /s/ Kuang-Hua Wang

Name: Kuang-Hua Wang

Title: Vice President & General Manager

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

PNC BANK, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Dante G. Intindola

Name: Dante G. Intindola

Title: Officer

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

REGIONS BANK,

as a Lender

By: /s/ Edward Sprigg

Name: Edward Sprigg

Title: Senior Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

TEXAS CAPITAL BANK,

formerly known as TEXAS CAPITAL BANK, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Barbara Gremmer

Name: Barbara Gremmer

Title: Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

THIRD COAST BANK, a

Texas state bank as a Lender

By: /s/ Tiffany Weber

Name: Tiffany Weber

Title: Bank Officer

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

U.S. BANK NATIONAL ASSOCIATION,

as a Lender

By: /s/ Brandi Roberts

Name: Brandi Roberts

Title: Senior Vice President

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

VERITEX COMMUNITY BANK,

as a Lender

By: /s/ Ben Weimer

Name: Ben Weimer

Title: Director - Builder Finance

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

WOODFOREST NATIONAL BANK,

as a Lender

By: /s/ Michael Sparks

Name: Michael Sparks

Title: AVP

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

CONSENT, REAFFIRMATION AND AGREEMENT OF SUBSIDIARY GUARANTORS

October 9, 2024

Each of the undersigned, in favor of and for the benefit of the Lenders and the Administrative Agent, (a) acknowledges receipt of the foregoing Fifth Amendment to Fifth Amended and Restated Credit Agreement (the “Agreement”), (b) consents to the execution and delivery of the Agreement, and (c) reaffirms all of its obligations and covenants under that certain (i) Fifth Amended and Restated Subsidiary Guaranty dated as of April 28, 2021 (as heretofore amended, restated or otherwise modified from time to time, the “Subsidiary Guaranty”), and (ii) each of the Loan Documents to which it is a party (together with the Subsidiary Guaranty, as heretofore amended, restated or otherwise modified from time to time, the “Guarantor Documents”), and agrees that none of its obligations and covenants shall be reduced or limited by the execution and delivery of the Agreement.

Each of the undersigned hereby acknowledges and agrees that, as of the date hereof, and after giving effect to the terms hereof, there exists (i) no Default or Event of Default and (ii) no right of offset, defense, counterclaim, claim, or objection in favor of any Subsidiary Guarantor arising out of or with respect to any of the Loans or other obligations of the Borrower or the Subsidiary Guarantor owed to the Administrative Agent and the Lenders party to the Agreement under the Credit Agreement, Guarantor Documents or any other Loan Document.

This Consent, Reaffirmation, and Agreement of Subsidiary Guarantors (this “Consent”) may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same instrument. This Consent may be executed by each party on separate copies, which copies, when combined so as to include the signatures of all parties, shall constitute a single counterpart of the Consent. Delivery by one or more parties hereto of an executed counterpart of this Consent via facsimile, telecopy, or other electronic method of transmission pursuant to which the signature of such party can be seen (including, without limitation, Adobe Corporation’s Portable Document Format) shall have the same force and effect as the delivery of an original executed counterpart of this Consent. Any party delivering an executed counterpart of this Consent by facsimile or other electronic method of transmission shall also deliver an original executed counterpart, but the failure to do so shall not affect the validity, enforceability, or binding effect of this Consent.

[SIGNATURES ON FOLLOWING PAGE]

IN WITNESS WHEREOF, each of the undersigned has caused this Consent to be duly executed by its duly authorized officer as of the day and year first above written.

SUBSIDIARY GUARANTORS:

LGI HOMES-TEXAS, LLC

LGI HOMES AZ CONSTRUCTION, LLC

LGI HOMES – E SAN ANTONIO, LLC

LGI HOMES – ARIZONA, LLC

LGI HOMES – FLORIDA, LLC

LGI HOMES – GEORGIA, LLC

LGI CROWLEY LAND PARTNERS, LLC

LGI HOMES CORPORATE, LLC

LGI HOMES AZ SALES, LLC

LGI HOMES – NEW MEXICO, LLC

LGI HOMES NM CONSTRUCTION, LLC

LUCKEY RANCH PARTNERS, LLC

LGI HOMES – COLORADO, LLC

LGI HOMES – NC, LLC

LGI HOMES – SC, LLC

LGI HOMES – TENNESSEE, LLC

LGI HOMES – WASHINGTON, LLC

LGI HOMES – OREGON, LLC

LGI HOMES – ALABAMA, LLC

LGI HOMES – MINNESOTA, LLC

LGI HOMES – OKLAHOMA, LLC

LGI LIVING, LLC

LGI HOMES – CALIFORNIA, LLC

LGI HOMES – MARYLAND, LLC

LGI HOMES – VIRGINIA, LLC

LGI HOMES – WEST VIRGINIA, LLC

LGI HOMES – WISCONSIN, LLC

LGI HOMES – PENNSYLVANIA, LLC

LGI HOMES – UTAH, LLC

By: LGI Homes Group, LLC,

its Manager

By: /s/ Eric T. Lipar

Name: Eric T. Lipar

Title: Manager

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

LGI HOMES – NEVADA, LLC

By: /s/ Eric T. Lipar

Name: Eric T. Lipar

Title: Authorized Signatory

RIVERCHASE ESTATES PARTNERS, LLC

By: LGI Homes Group, LLC,

its Sole Member

By: /s/ Eric T. Lipar

Name: Eric T. Lipar

Title: Manager

LGI HOMES GROUP, LLC

By: /s/ Eric T. Lipar

Name: Eric T. Lipar

Title: Manager

[WFB/LGI – FIFTH AMENDMENT TO FIFTH AMENDED AND RESTATED CREDIT AGREEMENT]

Cover Page Cover Page

|

Oct. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 09, 2024

|

| Entity Registrant Name |

LGI HOMES, INC.

|

| Entity Central Index Key |

0001580670

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36126

|

| Entity Tax Identification Number |

46-3088013

|

| Entity Address, Address Line One |

1450 Lake Robbins Drive,

|

| Entity Address, Address Line Two |

Suite 430,

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77380

|

| City Area Code |

281

|

| Local Phone Number |

362-8998

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

LGIH

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

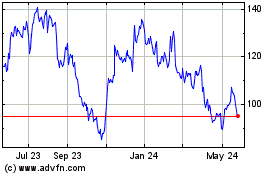

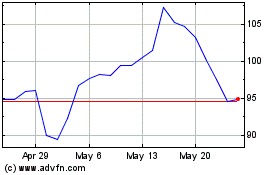

LGI Homes (NASDAQ:LGIH)

Historical Stock Chart

From Oct 2024 to Nov 2024

LGI Homes (NASDAQ:LGIH)

Historical Stock Chart

From Nov 2023 to Nov 2024