Ligand Pharmaceuticals Incorporated (Nasdaq: LGND)

today reported financial results for the three and twelve months

ended December 31, 2024, and provided an operating forecast and

business update. Ligand management will host a conference call and

webcast today beginning at 8:30 a.m. Eastern time to discuss this

announcement and answer questions.

“We achieved significant revenue growth in 2024

driven by strong momentum across our major commercial programs,”

said Todd Davis, CEO of Ligand. “Three of our portfolio products

with blockbuster sales potential, Verona’s Ohtuvayre, Travere’s

Filspari and Merck’s Capvaxive, received FDA approvals in 2024 and

are at an early stage in their growth trajectories. Moreover, the

important addition of Recordati’s Qarziba to our portfolio last

year highlights the expertise of our investment team. Looking ahead

to 2025, we anticipate multiple value-creating milestones,

including the potential for a strategic transaction and subsequent

launch of the recently approved ZELSUVMI™ by mid-2025. We believe

we are well positioned and capitalized to execute on our broad

pipeline of potential investment opportunities to drive significant

future growth and create long-term shareholder value.”

Fourth Quarter 2024 Financial

Results

Total revenues and other income for the fourth

quarter of 2024 were $42.8 million, compared with $28.1 million for

the same period in 2023, with the 52% increase driven primarily by

royalty revenue. Royalties for the fourth quarter of 2024 were

$34.8 million, compared with $22.5 million for the same period in

2023, with the 55% increase primarily attributable to royalties

earned on Ligand’s recently acquired royalty asset, Qarziba, and an

increase in sales of Travere Therapeutics’ Filspari. Captisol®

sales were $7.9 million for the fourth quarter of 2024, compared

with $3.9 million for the same period in 2023, with the increase

due to timing of customer orders. Contract revenue and other income

was $0.1 million for the fourth quarter of 2024, compared with $1.7

million for the same period in 2023, with the difference due to the

timing of partner milestone events.

Cost of Captisol was $2.8 million for the fourth

quarter of 2024, compared with $1.6 million for the same period in

2023, with the change due to an increase in Captisol sales.

Amortization of intangibles was $8.3 million for the fourth

quarters of both 2024 and 2023. Research and development expenses

were $4.4 million for the fourth quarter of 2024, compared with

$5.5 million for the same period in 2023. General and

administrative expenses were $25.6 million for the fourth quarter

of 2024, compared with $16.0 million for the same period in 2023,

with the increase primarily attributable to higher employee-related

expenses and increased operating costs associated with incubating

the Pelthos Therapeutics business. Fair value adjustment to partner

program derivatives was $7.2 million for the fourth quarter of 2024

primarily due to the discontinued development of certain Agenus

partnered programs.

GAAP net loss was $31.1 million, or $1.64 per

share for the fourth quarter of 2024, compared with net income of

$18.2 million, or $1.03 per diluted share, for the same period in

2023. GAAP net loss for the fourth quarter of 2024 included loss of

23.9 million from our short-term investments. Core adjusted net

income from continuing operations for the fourth quarter of 2024

was $25.2 million, or $1.27 per diluted share, compared with $18.6

million, or $1.05 per diluted share, for the same period in 2023.

Core adjusted net income excluded gains from the sale of Viking

Therapeutics common stock in the fourth quarter of 2023. We did not

sell any shares of Viking Therapeutics common stock in the fourth

quarter of 2024. The increase in core adjusted net income was

driven primarily by the 55% increase in royalty revenue. See the

table below for a reconciliation of net income (loss) from

continuing operations to core adjusted net income from continuing

operations.

As of December 31, 2024, Ligand had cash, cash

equivalents and short-term investments of $256.2 million which

included $40.2 million in Viking Therapeutics common stock.

Full Year 2024 Financial

Results

Total revenues and other income for full year

2024 were $167.1 million, compared with $131.3 million for full

year 2023. Royalties for full year 2024 were $108.8 million,

compared with $85.0 million for full year 2023, with the increase

primarily attributable to royalties earned on Qarziba and an

increase in royalties on Filspari. Captisol sales were $30.9

million for full year 2024, compared with $28.4 million for full

year 2023, with the change due to the timing of customer orders.

Contract revenue and other income was $27.5 million for full year

2024, compared with $18.0 million for full year 2023, with the

increase driven by milestone payments of $19.2 million earned

from Verona Pharma upon the approval and commercial launch of

Ohtuvayre.

Cost of Captisol was $11.1 million for full year

2024, compared with $10.5 million for full year 2023, with the

increase due to higher Captisol sales. Amortization of intangibles

was $33.0 million for full year 2024, compared with $33.7 million

for full year 2023. Research and development expenses were $21.4

million for full year 2024, compared with $24.5 million for full

year 2023, with the decrease primarily attributable to lower

employee-related expenses and lab supplies resulting from the

Pelican Technology Holdings spin-off in September 2023. The

decrease was partially offset by additional costs associated with

incubating the Pelthos Therapeutics business. General and

administrative expenses were $78.7 million for full year 2024,

compared with $52.8 million for full year 2023. This increase was

primarily driven by higher stock-based compensation expenses

associated with certain executive departures in addition to

investments made in building out the Company’s business development

and investment team. Additionally, costs associated with incubating

the Pelthos Therapeutics business contributed to the increase.

Financial royalty asset impairment was $30.6 million for the full

year 2024 primarily due to the impairment loss related to the

discontinuation of Takeda’s soticlestat program. Fair value

adjustment to partner program derivatives was $15.1 million for the

full year 2024 primarily due to the discontinuation of certain

Agenus partnered programs. These programs may be relicensed at a

later date, and Ligand would retain its economic interest upon any

relicense activity.

GAAP net loss from continuing operations was

$4.0 million, or $0.22 per share, for full year 2024, compared with

net income of $53.8 million, or $3.03 per diluted share, for full

year 2023. GAAP net loss for full year 2024 included a $30.6

million decrease in the carrying value of the Company’s

investments, primarily in connection with Takeda’s soticlestat, and

a $38.6 million decrease in Ligand’s investment in Primrose Bio.

Adjusted net income from continuing operations for full year 2024

was $156.0 million, or $8.25 per diluted share, compared with net

income of $107.4 million, or $6.09 per diluted share, for full year

2023. Excluding the impact of gains from sales of Viking

Therapeutics common stock, core adjusted net income from continuing

operations for full year 2024 was $108.5 million, or $5.74 per

diluted share, compared with net income of $71.7 million, or $4.06

per diluted share, for full year 2023. See the table below for a

reconciliation of net income (loss) from continuing operations to

core adjusted net income from continuing operations.

2025 Financial Guidance

Ligand is reaffirming the 2025 financial

guidance introduced at its Investor Day on December 10, 2024. The

Company continues to expect 2025 royalty revenue ranging from $135

million to $140 million, revenue from sales of Captisol ranging

from $35 million to $40 million and contract revenue ranging from

$10 million to $20 million. These revenue components result in a

total revenue forecast of $180 million to $200 million. Ligand

notes that with total revenue of $180 million to $200 million,

adjusted earnings per diluted share2 are anticipated to range from

approximately $6.00 to $6.25.

Fourth Quarter 2024 and Recent Business

Highlights

New Royalty Investment

On February 25, 2025, Ligand announced that it

closed a royalty financing agreement with Castle Creek Biosciences,

a late-stage cell and gene therapy company, to support Castle

Creek’s planned D-Fi (FCX-007) Phase 3 clinical study. D-Fi is an

injectable autologous gene-modified cell therapy in development for

the treatment of dystrophic epidermolysis bullosa (DEB), a

devastating, painful, and debilitating rare genetic skin disorder.

D-Fi has been granted Orphan Drug Designation from the U.S. Food

and Drug Administration (FDA). Ligand led a $75 million investment

in D-Fi by committing $50 million to the syndicated round. An

additional $25 million was secured from a syndicate of

co-investors. In return for the $75 million investment, investors

will receive a high- single digit royalty which is shared on a

pro-rated basis; therefore Ligand will net a mid-single digit

royalty.

Portfolio Updates

Ohtuvayre

- On January 7,

2025, Verona reported that more than 3,500 unique healthcare

professionals (HCPs) have prescribed Ohtuvayre and over 16,000

prescriptions were filled of which approximately one-third were

patient refills in 2024. Verona received FDA approval on June 26,

2024 and Ohtuvayre became commercially available in August

2024.

- Ohtuvayre’s

product specific J-code, J7601, became effective on January 1,

2025.

- In November

2024, Verona completed enrollment in a Phase 2 dose-ranging trial

with glycopyrrolate, a long-acting muscarinic antagonist (LAMA),

supporting a fixed-dose combination with ensifentrine for the

maintenance treatment of COPD via a nebulizer. Results are expected

to support initiation of a Phase 2b trial with a fixed dose

combination of ensifentrine with glycopyrrolate in the third

quarter of 2025.

- Verona continues

to enroll subjects in a Phase 2 trial to assess the efficacy and

safety of nebulized ensifentrine in patients with non-cystic

fibrosis bronchiectasis (NCFBE).

Filspari

- On February 11,

2025, Travere announced completion of its Type C meeting with the

FDA and plans to submit a supplemental New Drug Application (sNDA)

seeking traditional approval of Filspari for focal segmental

glomerulosclerosis (FSGS). The sNDA will be based on existing data

from the Phase 3 DUPLEX and Phase 2 DUET studies of Filspari and is

expected to be submitted around the end of the first quarter of

2025.

- On January 30,

2025, Travere’s partner, Renalys Pharma announced completion of

patient enrollment in its registrational Phase 3 clinical trial of

sparsentan for IgAN in Japan.

- In the fourth

quarter of 2024, Travere received 693 new patient start forms

(PSFs), an increase of 37% from the prior quarter, driven by growth

amongst new and repeat prescribers following full approval by the

FDA on September 5, 2024.

- The FDA recently

accepted Travere’s sNDA requesting modification of the liver

monitoring REMS requirement for Filspari in IgAN and assigned a

PDUFA target action date of August 28, 2025.

- CSL Vifor

launched Filspari for the treatment of IgAN in Germany, Austria,

and Switzerland and recently received approval for Filspari in the

UK.

Capvaxive

- On January 31,

2025, Merck announced that the Committee for Medicinal Products for

Human Use (CHMP) of the European Medicines Agency (EMA) recommended

the approval of Capvaxive (Pneumococcal 21-valent Conjugate

Vaccine) for active immunization for the prevention of invasive

disease and pneumonia caused by Streptococcus pneumoniae in

individuals 18 years of age and older. The CHMP’s recommendation

will now be reviewed by the European Commission (EC) for marketing

authorization in the European Union (EU), Iceland, Liechtenstein

and Norway, and a final decision is expected during the second

quarter of 2025.

Qtorin Rapamycin

- On January 10,

2025, Palvella Therapeutics announced the publication of results

from the Phase 2 clinical trial of Qtorin 3.9% rapamycin anhydrous

gel (Qtorin rapamycin) for the treatment of microcystic lymphatic

malformations (MLM) in the Journal of Vascular Anomalies.

- Palvella is

currently enrolling approximately 40 subjects in SELVA, a 24-week,

Phase 3, single-arm, baseline-controlled trial of Qtorin rapamycin

for the treatment of MLMs.

- The FDA has

granted Breakthrough Therapy Designation, Fast Track Designation,

and Orphan Drug Designation to Qtorin rapamycin for the treatment

of MLMs. Additionally, the SELVA study is supported by an Orphan

Products Grant from the FDA’s Office of Orphan Products

Development.

- On January 8,

2025, Palvella announced the first patients were dosed in TOIVA, a

multicenter, Phase 2 clinical trial designed to evaluate the safety

and efficacy of Qtorin rapamycin for the treatment of cutaneous

venous malformations (cutaneous VMs).

- The Phase 2

TOIVA study is a single-arm, open-label, baseline-controlled

clinical trial of Qtorin rapamycin administered topically once

daily for the treatment of cutaneous VMs. The Phase 2 study is

expected to enroll approximately 15 participants, ages six and

older, at leading vascular anomaly centers across the United

States.

Other Program Updates

- On January 30,

2025, Takeda announced the decision to discontinue its soticlestat

(TAK-935) development program. This decision follows the June 2024

announcement that the soticlestat Phase 3 SKYLINE study in Dravet

syndrome (DS) and Phase 3 SKYWAY study in Lennox-Gastaut Syndrome

(LGS) missed their primary endpoints. Subsequently, Takeda

discontinued the soticlestat LGS development program and engaged

with the FDA around the totality of evidence for soticlestat

treatment for DS. The FDA informed Takeda that the current clinical

data package would not be sufficient to demonstrate substantial

evidence of effectiveness to support a New Drug Application (NDA)

for soticlestat in DS.

- On January 30,

2025, Sanofi announced the EMA acceptance of the regulatory

submission for Tzield in children and adolescents to delay the

onset of stage 3 type 1 diabetes (T1D) as well as for the early

intervention of stage 3 T1D. Tzield is currently approved in the US

to delay the onset of stage 3 T1D. Sanofi expects a decision in the

second half of 2025.

- On January 10,

2025, Primrose Bio announced a collaboration with Serum Institute

of India Pvt. Ltd. (“SIIPL”) to develop a novel multi-antigen

vaccine for infections that affect millions of people globally.

Both companies will contribute towards the design of the vaccine

with Primrose Bio fully responsible for developing manufacturing

strains using its Pfenex Expression Technology and SIIPL

responsible for further development and commercialization.

- On December 16,

2024, the FDA granted SQ Innovation Inc., Tentative Approval for

Lasix ONYU for the home treatment of fluid overload in congestive

heart failure. Captisol is a key part of the Lasix ONYU novel

high-concentration formulation of furosemide 80mg/2.67mL (30mg/mL),

and Ligand is entitled to milestone payments, royalties and revenue

from material sales. Tentative Approval indicates that Lasix ONYU

has met the regulatory standards for quality, safety and efficacy

required for approval in the United States. Full approval was

precluded because the FDA had granted market exclusivity in the

United States for a competing product until October 2025. SQ

Innovation will seek full approval in the United States after the

expiration of the regulatory exclusivity period. Lasix ONYU now

expects the first products to be available on the market by the end

of 2025.

- On December 13,

2024, CASI Pharmaceuticals, the exclusive marketer of Evomela in

China, received a termination letter from Acrotech, which holds

exclusive worldwide rights to Evomela. The letter alleges that CASI

materially breached the license agreement between Acrotech and CASI

failed to cure that breach. CASI may continue to distribute and

sell Evomela in China for a reasonable wind down period, not to

exceed 24 months.

- On November 19,

2024, Viking Therapeutics presented the final results of its Phase

2b VOYAGE trial of oral small molecule VK2809 in biopsy-confirmed

non-alcoholic steatohepatitis (NASH; also referred to as metabolic

dysfunction associated steatohepatitis, MASH) at the 75th Liver

Meeting® 2024. At the 52-week mark, the drug reduced liver fat

content by an average of 37% to 55% compared to baseline, with all

treatment arms showing statistically significant improvements

compared to placebo.

- On October 28,

2024, Xi’an Xintong Pharmaceuticals Research Co., Ltd was informed

that the China National Medical Products Administration (NMPA)

approved Xinshumu (pradefovir), an oral medication for adult

patients with chronic hepatitis B (HBV). Ligand is entitled to

milestone payments and a 9% royalty on worldwide net sales of

Xinshumu.

Adjusted Financial Measures

Ligand reports adjusted net income from

continuing operations, adjusted net income per diluted share and

adjusted earnings per diluted share in addition to, not as a

substitute for, and does not consider such measures superior to,

financial measures calculated in accordance with GAAP. The Company

also reports a core calculation for each of the foregoing measures

which excludes any realized gain from sales of Viking Therapeutics

common stock. Additionally, adjusted earnings per diluted share is

a key component of the financial metrics utilized by the Company’s

board of directors to measure, in part, management’s performance

and determine significant elements of management’s compensation.

The Company’s financial measures under GAAP include share-based

compensation expense, amortization of debt-related costs,

amortization related to acquisitions and intangible assets, changes

in contingent liabilities, mark-to-market adjustments for amounts

relating to its equity investments in public companies, excess tax

benefit from share-based compensation, transaction costs, income

tax effect of adjusted reconciling items and others that are listed

in the itemized reconciliations between GAAP and non-GAAP adjusted

financial measures included at the end of this press release. A

reconciliation of forward-looking non-GAAP adjusted earnings per

diluted share to the most directly comparable GAAP measures is not

available without unreasonable effort, as certain items cannot be

reasonably predicted because of their high variability, complexity

and low visibility. Specifically, non-cash adjustments that could

be made for changes in contingent liabilities, changes in the

market value of its investments in public companies, share-based

compensation expense and the effects of any discrete income tax

items, directly impact the calculations of our adjusted earnings

per diluted share, which we expect to have a significant impact on

our future GAAP financial results.

Conference Call

Ligand management will host a conference call

and webcast today beginning at 8:30 a.m. Eastern time (5:30 a.m.

Pacific time) to discuss this announcement and answer questions. To

participate via telephone, please dial (800) 715-9871 (North

America toll-free number) using the conference ID 8755336.

International participants outside of Canada may use the toll

number (646) 307-1963 and use the same conference ID. To

participate via live or replay webcast, a link is available at

www.ligand.com.

About Ligand

Pharmaceuticals

Ligand is a biopharmaceutical company enabling

scientific advancement through supporting the clinical development

of high-value medicines. Ligand does this by providing financing,

licensing our technologies or both. Our business model seeks to

generate value for stockholders by creating a diversified portfolio

of biotech and pharmaceutical product revenue streams that are

supported by an efficient and low corporate cost structure. Our

goal is to offer investors an opportunity to participate in the

promise of the biotech industry in a profitable and diversified

manner. Our business model is based on funding programs in mid- to

late-stage drug development in return for economic rights,

purchasing royalty rights in development stage or commercial

biopharmaceutical products and licensing our technology to help

partners discover and develop medicines. We partner with other

pharmaceutical companies to attempt to leverage what they do best

(late-stage development, regulatory management and

commercialization) in order to generate our revenue. We operate two

infrastructure-light royalty generating technology IP platform

technologies. Our Captisol® platform technology is a chemically

modified cyclodextrin with a structure designed to optimize the

solubility and stability of drugs. Our NITRICIL™ platform

technology facilitates tunable dosing, permitting an adjustable

drug release profile to allow proprietary formulations that target

a broad range of indications. We have established multiple

alliances, licenses and other business relationships with the

world’s leading pharmaceutical companies including Amgen, Merck,

Pfizer, Jazz, Gilead Sciences and Baxter International. For more

information, please visit www.ligand.com. Follow Ligand on X

@Ligand_LGND.

We use our investor relations website and X as a

means of disclosing material non-public information and for

complying with our disclosure obligations under Regulation FD.

Investors should monitor our website and our X account, in addition

to following our press releases, SEC filings, public conference

calls and webcasts.

Forward-Looking Statements

This news release contains forward-looking

statements, as defined in Section 21E of the Securities Exchange

Act of 1934, by Ligand that involve risks and uncertainties and

reflect Ligand’s judgment as of the date of this release. All

statements, other than statements of historical fact, could be

deemed to be forward-looking statements. In some instances, words

such as “plans,” “believes,” “expects,” “anticipates,” and “will,”

and similar expressions, are intended to identify forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which reflect our good faith

beliefs (or those of the indicated third parties) and speak only as

of the date hereof. These forward-looking statements include,

without limitation, statements regarding: Ligand’s ability to

expand its portfolio with life sciences royalty opportunities; the

timing of clinical and regulatory events of Ligand’s partners,

including the expected commercial launch of ZELSUVMI or any other

product; the timing of the initiation or completion of preclinical

studies and clinical trials by Ligand and its partners; the timing

of product launches by Ligand or its partners; and guidance

regarding projected 2025 financial results. Actual events or

results may differ from Ligand’s expectations due to risks and

uncertainties inherent in Ligand’s business, including, without

limitation: Ligand relies on collaborative partners for milestone

payments, royalties, materials revenue, contract payments and other

revenue projections and may not receive expected revenue; Ligand

may not receive expected revenue from Captisol material sales;

Ligand and its partners may not be able to timely or successfully

advance any product(s) in its internal or partnered pipeline or

receive regulatory approval and there may not be a market for the

product(s) even if successfully developed and approved; Ligand may

not achieve its guidance for 2025; Ligand faces competition in

acquiring royalties and locating suitable royalties to acquire;

Ligand may not be able to create future revenues and cash flows

through the acquisition of royalties or by developing innovative

therapeutics; products under development by Ligand or its partners

may not receive regulatory approval; the total addressable market

for our partners’ products may be smaller than estimated; Ligand

faces competition with respect to its technology platforms which

may demonstrate greater market acceptance or superiority; Ligand is

currently dependent on a single source sole supplier for Captisol

and failures by such supplier may result in delays or inability to

meet the Captisol demands of its partners; Ligand’s partners may

change their development focus and may not execute on their sales

and marketing plans for marketed products for which Ligand has an

economic interest; Ligand’s collaboration partners may become

insolvent; Ligand’s and its partners’ products may not be proved to

be safe and efficacious and may not perform as expected and

uncertainty regarding the commercial performance of such products;

Ligand or its partners may not be able to protect their

intellectual property and patents covering certain products and

technologies may be challenged or invalidated; Cyber-attacks or

other failures in telecommunications or information technology

systems could result in information theft, data corruption and

significant disruption to Ligand’s business operations; Ligand’s

partners may terminate any of its agreements or development or

commercialization of any of its products; Ligand and its partners

may experience delays in the commencement, enrollment, completion

or analysis of clinical testing for its product candidates, or

significant issues regarding the adequacy of its clinical trial

designs or the execution of its clinical trials, challenges, costs

and charges associated with integrating acquisitions with Ligand’s

existing businesses; Ligand may not be able to successfully

commercialize Pelthos’ berdazimer gel (10.3%) program and may not

be able to outlicense or sell Pelthos’ other programs or assets

(including the NITRICIL technology platform) acquired during the

2023 Novan acquisition or may be unable to execute a strategic

transaction involving Pelthos; Ligand may not be able to

successfully implement its strategic growth plan and continue the

development of its proprietary programs; restrictions under

Ligand’s credit agreement may limit its flexibility in operating

its business and a default under the agreement could result in a

foreclosure of the collateral securing such obligations; and

changes in general economic conditions, including as a result of

war, conflict, epidemic diseases, or the new presidential

administration in the U.S., and ongoing or future litigation could

expose Ligand to significant liabilities and have a material

adverse effect on the Company. The failure to meet expectations

with respect to any of the foregoing matters may reduce Ligand’s

stock price. Additional information concerning these and other risk

factors affecting Ligand can be found in prior press releases

available at www.ligand.com as well as in Ligand’s public periodic

filings with the Securities and Exchange Commission available at

www.sec.gov. Ligand disclaims any intent or obligation to update

these forward-looking statements beyond the date of this release,

including the possibility of additional license fees and milestone

revenues we may receive. This caution is made under the safe harbor

provisions of the Private Securities Litigation Reform Act of

1995.

Other Disclaimers and

Trademarks

The information in this press release regarding

certain third-party products and programs, including Capvaxive, a

Merck product, Filspari, a Travere Therapeutics product, Ohtuvayre,

a Verona Pharma product, Qtorin rapamycin, a Palvella Therapeutics

product candidate, Lasix ONYU, an SQ Innovation product candidate,

Xinshumu, a Xi'an Xintong product, VK2809, a Viking Therapeutics

product candidate, Evomela, a CASI Pharmaceuticals product, and

soticlestat, a Takeda product candidate, comes from information

publicly released by the owners of such products and programs.

Ligand is not responsible for, and has no role in, the development

of such products or programs.

Ligand owns or has rights to trademarks and

copyrights that it uses in connection with the operation of its

business including its corporate name, logos and websites. Other

trademarks and copyrights appearing in this press release are the

property of their respective owners. The trademarks Ligand owns

include Ligand, Captisol, NITRICIL and ZELSUVMI. Solely for

convenience, some of the trademarks and copyrights referred to in

this press release are listed without the ®, © and ™ symbols, but

Ligand will assert, to the fullest extent under applicable law, its

rights to its trademarks and copyrights.

Contacts

Investors: Melanie

Hermaninvestors@ligand.com (858) 550-7761

Media: Kellie Walshmedia@ligand.com (914)

315-6072

|

|

|

[Tables Follow] |

|

|

| |

|

LIGAND PHARMACEUTICALS

INCORPORATEDCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited, in thousands, except per share

amounts) |

| |

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues and other income: |

|

|

|

|

|

|

|

|

|

Revenue from intangible royalty assets |

|

$ |

27,817 |

|

|

$ |

22,463 |

|

|

$ |

95,329 |

|

|

$ |

83,910 |

|

|

Income from financial royalty assets |

|

|

6,990 |

|

|

|

23 |

|

|

|

13,444 |

|

|

|

1,049 |

|

|

Royalties |

|

|

34,807 |

|

|

|

22,486 |

|

|

|

108,773 |

|

|

|

84,959 |

|

|

Captisol |

|

|

7,916 |

|

|

|

3,922 |

|

|

|

30,883 |

|

|

|

28,372 |

|

|

Contract revenue and other income |

|

|

89 |

|

|

|

1,693 |

|

|

|

27,477 |

|

|

|

17,983 |

|

|

Total revenues and other income |

|

|

42,812 |

|

|

|

28,101 |

|

|

|

167,133 |

|

|

|

131,314 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

Cost of Captisol |

|

|

2,837 |

|

|

|

1,641 |

|

|

|

11,074 |

|

|

|

10,512 |

|

|

Amortization of intangibles |

|

|

8,258 |

|

|

|

8,338 |

|

|

|

32,959 |

|

|

|

33,654 |

|

|

Research and development |

|

|

4,425 |

|

|

|

5,488 |

|

|

|

21,425 |

|

|

|

24,537 |

|

|

General and administrative |

|

|

25,605 |

|

|

|

15,992 |

|

|

|

78,654 |

|

|

|

52,790 |

|

|

Financial royalty assets impairment |

|

|

4,081 |

|

|

|

— |

|

|

|

30,572 |

|

|

|

— |

|

|

Fair value adjustments to partner program derivatives |

|

|

7,243 |

|

|

|

— |

|

|

|

15,055 |

|

|

|

— |

|

|

Total operating costs and expenses |

|

|

52,449 |

|

|

|

31,459 |

|

|

|

189,739 |

|

|

|

121,493 |

|

|

Gain on sale of Pelican |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,121 |

) |

|

Operating income (loss) from continuing operations |

|

|

(9,637 |

) |

|

|

(3,358 |

) |

|

|

(22,606 |

) |

|

|

11,942 |

|

|

Non-operating income and expenses: |

|

|

|

|

|

|

|

|

|

Gain from short-term investments |

|

|

(23,899 |

) |

|

|

16,025 |

|

|

|

75,024 |

|

|

|

46,365 |

|

|

Interest income, net |

|

|

1,048 |

|

|

|

1,562 |

|

|

|

5,018 |

|

|

|

7,055 |

|

|

Other non-operating expense, net |

|

|

(6,712 |

) |

|

|

2,868 |

|

|

|

(54,918 |

) |

|

|

(1,702 |

) |

|

Total non-operating (expenses) income, net |

|

|

(29,563 |

) |

|

|

20,455 |

|

|

|

25,124 |

|

|

|

51,718 |

|

|

Income before income tax from continuing operations |

|

|

(39,200 |

) |

|

|

17,097 |

|

|

|

2,518 |

|

|

|

63,660 |

|

|

Income tax benefit (expense) |

|

|

8,112 |

|

|

|

1,091 |

|

|

|

(6,550 |

) |

|

|

(9,841 |

) |

|

Net income (loss) from continuing operations |

|

|

(31,088 |

) |

|

|

18,188 |

|

|

|

(4,032 |

) |

|

|

53,819 |

|

|

Net loss from discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,665 |

) |

|

Net income (loss): |

|

$ |

(31,088 |

) |

|

$ |

18,188 |

|

|

$ |

(4,032 |

) |

|

$ |

52,154 |

|

| |

|

|

|

|

|

|

|

|

|

Basic net income (loss) from continuing operations per share |

|

$ |

(1.64 |

) |

|

$ |

1.04 |

|

|

$ |

(0.22 |

) |

|

$ |

3.11 |

|

|

Basic net loss from discontinued operations per share |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(0.10 |

) |

|

Basic net income (loss) per share |

|

$ |

(1.64 |

) |

|

$ |

1.04 |

|

|

$ |

(0.22 |

) |

|

$ |

3.02 |

|

|

Shares used in basic per share calculation |

|

|

18,974 |

|

|

|

17,466 |

|

|

|

18,290 |

|

|

|

17,298 |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income (loss) from continuing operations per share |

|

$ |

(1.64 |

) |

|

$ |

1.03 |

|

|

$ |

(0.22 |

) |

|

$ |

3.03 |

|

|

Diluted net loss from discontinued operations per share |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(0.09 |

) |

|

Diluted net income (loss) per share |

|

$ |

(1.64 |

) |

|

$ |

1.03 |

|

|

$ |

(0.22 |

) |

|

$ |

2.94 |

|

|

Shares used in diluted per share calculation |

|

|

18,974 |

|

|

|

17,676 |

|

|

|

18,290 |

|

|

|

17,757 |

|

|

|

|

LIGAND PHARMACEUTICALS

INCORPORATEDCONDENSED CONSOLIDATED BALANCE

SHEETS(unaudited, in thousands) |

|

|

| |

|

December 31, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

256,165 |

|

$ |

170,309 |

|

Accounts receivable, net |

|

|

38,376 |

|

|

32,917 |

|

Inventory |

|

|

14,114 |

|

|

23,969 |

|

Income tax receivable |

|

|

4,073 |

|

|

6,395 |

|

Other current assets |

|

|

18,831 |

|

|

3,839 |

|

Total current assets |

|

|

331,559 |

|

|

237,429 |

| |

|

|

|

|

|

Goodwill and other intangible assets, net |

|

|

371,898 |

|

|

402,976 |

|

Long-term portion of financial royalty assets, net |

|

|

185,024 |

|

|

62,291 |

|

Noncurrent derivative assets |

|

|

10,583 |

|

|

3,531 |

|

Property and equipment, net |

|

|

15,133 |

|

|

15,607 |

|

Operating lease right-of-use assets |

|

|

6,907 |

|

|

6,062 |

|

Finance lease right-of-use assets |

|

|

2,766 |

|

|

3,393 |

|

Equity method investment in Primrose Bio |

|

|

— |

|

|

12,595 |

|

Other investments |

|

|

10,908 |

|

|

36,726 |

|

Deferred income taxes, net |

|

|

72 |

|

|

214 |

|

Other assets |

|

|

6,924 |

|

|

6,392 |

|

Total assets |

|

$ |

941,774 |

|

$ |

787,216 |

| |

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

33,139 |

|

$ |

14,894 |

|

Income tax payable |

|

|

1,199 |

|

|

— |

|

Deferred revenue |

|

|

1,278 |

|

|

1,222 |

|

Current contingent liabilities |

|

|

206 |

|

|

256 |

|

Current operating lease liabilities |

|

|

1,266 |

|

|

403 |

|

Current finance lease liabilities |

|

|

24 |

|

|

7 |

|

Total current liabilities |

|

|

37,112 |

|

|

16,782 |

| |

|

|

|

|

|

Long-term contingent liabilities |

|

|

3,475 |

|

|

2,942 |

|

Long-term operating lease liabilities |

|

|

5,815 |

|

|

5,755 |

|

Deferred income taxes, net |

|

|

32,524 |

|

|

31,622 |

|

Other long-term liabilities |

|

|

32,409 |

|

|

29,202 |

|

Total liabilities |

|

|

111,335 |

|

|

86,303 |

| |

|

|

|

|

|

Total stockholders' equity |

|

|

830,439 |

|

|

700,913 |

|

Total liabilities and stockholders' equity |

|

$ |

941,774 |

|

$ |

787,216 |

|

|

|

LIGAND PHARMACEUTICALS

INCORPORATEDADJUSTED FINANCIAL

MEASURES(Unaudited, in thousands, except per share

amounts) |

|

|

| |

|

Three months ended December 31, |

|

Year ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations |

|

$ |

(31,088 |

) |

|

$ |

18,188 |

|

|

$ |

(4,032 |

) |

|

$ |

53,819 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

7,524 |

|

|

|

5,721 |

|

|

|

41,089 |

|

|

|

25,743 |

|

|

Non-cash interest expense (1) |

|

|

786 |

|

|

|

81 |

|

|

|

2,724 |

|

|

|

240 |

|

|

Amortization of intangible assets |

|

|

8,258 |

|

|

|

8,338 |

|

|

|

32,959 |

|

|

|

33,654 |

|

|

Amortization of financial royalty assets (2) |

|

|

3,824 |

|

|

|

(23 |

) |

|

|

10,811 |

|

|

|

(1,049 |

) |

|

Change in contingent liabilities (3) |

|

|

(310 |

) |

|

|

(397 |

) |

|

|

683 |

|

|

|

(265 |

) |

|

Pelthos operating loss |

|

|

4,386 |

|

|

|

5,183 |

|

|

|

20,879 |

|

|

|

5,520 |

|

|

Transaction costs |

|

|

— |

|

|

|

(210 |

) |

|

|

— |

|

|

|

3,078 |

|

|

Loss (gain) from short-term investments |

|

|

23,899 |

|

|

|

(16,025 |

) |

|

|

(75,024 |

) |

|

|

(46,365 |

) |

|

Realized gain (loss) from short-term investments |

|

|

(21 |

) |

|

|

7,180 |

|

|

|

59,897 |

|

|

|

44,377 |

|

|

Gain on sale of Pelican |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,121 |

) |

|

Provision for current expected credit losses on financial royalty

assets |

|

|

(852 |

) |

|

|

405 |

|

|

|

(4,315 |

) |

|

|

3,595 |

|

|

Impairment of financial royalty assets (4) |

|

|

4,081 |

|

|

|

— |

|

|

|

30,572 |

|

|

|

924 |

|

|

Decrease in investments in Primrose Bio (5) |

|

|

1,245 |

|

|

|

1,761 |

|

|

|

38,609 |

|

|

|

1,829 |

|

|

Loss (gain) from derivative assets |

|

|

12,478 |

|

|

|

(250 |

) |

|

|

27,133 |

|

|

|

(250 |

) |

|

Other (6) |

|

|

3,627 |

|

|

|

94 |

|

|

|

7,701 |

|

|

|

780 |

|

|

Income tax effect of adjusted reconciling items above |

|

|

(12,478 |

) |

|

|

816 |

|

|

|

(34,158 |

) |

|

|

(9,144 |

) |

|

Discrete tax expense related to increase in unrecognized tax

benefits (7) |

|

|

— |

|

|

|

(7,206 |

) |

|

|

426 |

|

|

|

(7,206 |

) |

|

Excess tax benefit (shortfall) from share-based compensation

(8) |

|

|

(139 |

) |

|

|

757 |

|

|

|

87 |

|

|

|

228 |

|

|

Adjusted net income from continuing

operations |

|

$ |

25,220 |

|

|

$ |

24,413 |

|

|

$ |

156,041 |

|

|

$ |

107,387 |

|

|

Realized gain from sales of VKTX stock, net of tax |

|

|

— |

|

|

|

(5,780 |

) |

|

|

(47,563 |

) |

|

|

(35,720 |

) |

|

Core adjusted net income from continuing

operations |

|

$ |

25,220 |

|

|

$ |

18,633 |

|

|

$ |

108,478 |

|

|

$ |

71,667 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted per-share amounts attributable to common

shareholders: |

|

|

|

|

|

|

|

|

|

Diluted net income (loss) per share from continuing operations |

|

$ |

(1.64 |

) |

|

$ |

1.03 |

|

|

$ |

(0.22 |

) |

|

$ |

3.03 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

0.38 |

|

|

|

0.32 |

|

|

|

2.17 |

|

|

|

1.46 |

|

|

Non-cash interest expense (1) |

|

|

0.04 |

|

|

|

— |

|

|

|

0.14 |

|

|

|

0.01 |

|

|

Amortization of intangible assets |

|

|

0.41 |

|

|

|

0.47 |

|

|

|

1.74 |

|

|

|

1.91 |

|

|

Amortization of financial royalty assets (2) |

|

|

0.19 |

|

|

|

— |

|

|

|

0.57 |

|

|

|

(0.06 |

) |

|

Change in contingent liabilities (3) |

|

|

(0.02 |

) |

|

|

(0.02 |

) |

|

|

0.04 |

|

|

|

(0.02 |

) |

|

Pelthos operating loss |

|

|

0.22 |

|

|

|

0.29 |

|

|

|

1.10 |

|

|

|

0.31 |

|

|

Transaction costs |

|

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

|

|

0.17 |

|

|

Loss (gain) from short-term investments |

|

|

1.20 |

|

|

|

(0.91 |

) |

|

|

(3.97 |

) |

|

|

(2.63 |

) |

|

Realized gain (loss) from short-term investments |

|

|

— |

|

|

|

0.41 |

|

|

|

3.17 |

|

|

|

2.52 |

|

|

Gain on sale of Pelican |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.12 |

) |

|

Provision for current expected credit losses on financial royalty

assets |

|

|

(0.04 |

) |

|

|

0.02 |

|

|

|

(0.23 |

) |

|

|

0.21 |

|

|

Impairment of financial royalty assets (4) |

|

|

0.21 |

|

|

|

— |

|

|

|

1.62 |

|

|

|

0.05 |

|

|

Decrease in investments in Primrose Bio (5) |

|

|

0.06 |

|

|

|

0.10 |

|

|

|

2.04 |

|

|

|

0.10 |

|

|

Loss from derivative assets |

|

|

0.63 |

|

|

|

(0.01 |

) |

|

|

1.43 |

|

|

|

(0.01 |

) |

|

Other (6) |

|

|

0.19 |

|

|

|

0.01 |

|

|

|

0.42 |

|

|

|

0.05 |

|

|

Income tax effect of adjusted reconciling items above |

|

|

(0.63 |

) |

|

|

0.05 |

|

|

|

(1.80 |

) |

|

|

(0.49 |

) |

|

Discrete tax expense related to increase in unrecognized tax

benefits (7) |

|

|

— |

|

|

|

(0.41 |

) |

|

|

0.02 |

|

|

|

(0.41 |

) |

|

Excess tax benefit (shortfall) from share-based compensation

(8) |

|

|

(0.01 |

) |

|

|

0.04 |

|

|

|

— |

|

|

|

0.01 |

|

|

Adjustment for shares excluded due to anti-dilution effect on GAAP

net loss |

|

|

0.08 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

Adjusted diluted net income per share from continuing

operations |

|

$ |

1.27 |

|

|

$ |

1.38 |

|

|

$ |

8.25 |

|

|

$ |

6.09 |

|

|

Realized gain from sales of VKTX stock, net of tax |

|

|

— |

|

|

|

(0.33 |

) |

|

|

(2.51 |

) |

|

|

(2.03 |

) |

|

Core adjusted diluted net income per share from continuing

operations |

|

$ |

1.27 |

|

|

$ |

1.05 |

|

|

$ |

5.74 |

|

|

$ |

4.06 |

|

| |

|

|

|

|

|

|

|

|

|

GAAP - weighted average number of common shares - diluted |

|

|

18,974 |

|

|

|

17,676 |

|

|

|

18,290 |

|

|

|

17,757 |

|

|

Shares excluded due to anti-dilutive effect on GAAP net loss |

|

|

931 |

|

|

|

— |

|

|

|

619 |

|

|

|

— |

|

|

Diluted effect of the 2023 Notes (9) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(119 |

) |

|

Adjusted weighted average number of common shares - diluted |

|

|

19,905 |

|

|

|

17,676 |

|

|

|

18,909 |

|

|

|

17,638 |

|

(1) Amounts represent (a) non-cash interest

expense in connection with the royalty and milestone payments

purchase agreement assumed as part of the Novan asset acquisition

in September 2023; and (b) non-cash debt related costs that are

calculated in accordance with the authoritative accounting guidance

for our revolving credit facility and convertible debt instruments

that were settled in cash.

(2) Amounts represent the adjustments to the

effective interest income recognized to total contractual payments

recognized in the period.

(3) Amounts represent changes in fair value of

contingent consideration related to CyDex and Metabasis

transactions.

(4) Amounts represent the impairment of

financial royalty assets primarily related to the discontinuation

of Takeda’s soticlestat program.

(5) In June 2024, Primrose Bio announced a

Series B preferred share offering. Management applies the

measurement alternative for its investment in the Series A

preferred shares of Primrose Bio. Management concluded the Series B

financing was a relevant transaction for determining an observable

price change and revalued its Series A investment resulting in a

downward adjustment of $25.8 million in the price of the Series A

shares during the fiscal year 2024. The unrealized loss on the

Series A preferred shares was an indicator that the losses in

common shares (equity method investment) are other than temporary.

As a result, management recorded a $5.8 million impairment charge

to its equity method investment in addition to Ligand's share of

the net loss of Primrose Bio recognized during fiscal year

2024.

(6) Amounts primarily relate to loss on other

investment and restructuring costs.

(7) Amounts represent discrete tax benefit

related to the release of FIN48 reserves associated with certain

R&D tax credits during the fourth quarter of 2023 due to the

lapse of applicable statute of limitation.

(8) Excess tax benefits from share-based

compensation are recorded as a discrete item within the provision

for income taxes on the consolidated statements of operations as a

result of the adoption of an accounting pronouncement (ASU 2016-09)

on January 1, 2017. Prior to the adoption, the amount was

recognized in additional paid-in capital on the consolidated

statement of stockholders’ equity.

(9) Excluding the impact from the adoption of

accounting pronouncement (ASU 2020-06) on January 1, 2022 as the

Company intended to settle the principal balance in cash. Under the

standard, the Company is required to reflect the dilutive effect of

the 2023 Notes by application of the if-converted method. The 2023

Notes were fully paid off on May 15, 2023, the debt maturity

date.

________________________________________________________1 A

reconciliation of forward-looking non-GAAP adjusted earnings per

diluted share to the most directly comparable GAAP measure is not

available without unreasonable effort, as certain items cannot be

reasonably predicted because of their high variability, complexity

and low visibility. Specifically, non-cash adjustments that could

be made for changes in contingent liabilities, changes in the

market value of investments in public companies, share-based

compensation expense and the effects of any discrete income tax

items, directly impact the calculation of our adjusted earnings per

diluted share.

2 A reconciliation of forward-looking non-GAAP

adjusted earnings per diluted share to the most directly comparable

GAAP measure is not available without unreasonable effort, as

certain items cannot be reasonably predicted because of their high

variability, complexity and low visibility. Specifically, non-cash

adjustments that could be made for changes in contingent

liabilities, changes in the market value of investments in public

companies, share-based compensation expense and the effects of any

discrete income tax items, directly impact the calculation of our

adjusted earnings per diluted share.

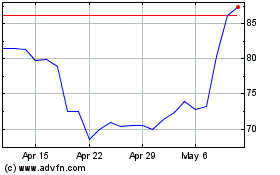

Ligand Pharmaceuticals (NASDAQ:LGND)

Historical Stock Chart

From Jan 2025 to Feb 2025

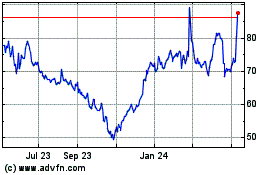

Ligand Pharmaceuticals (NASDAQ:LGND)

Historical Stock Chart

From Feb 2024 to Feb 2025