0001712184false00017121842025-01-292025-01-290001712184us-gaap:CommonClassAMember2025-01-292025-01-290001712184us-gaap:CommonClassCMember2025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 29, 2025

LIBERTY LATIN AMERICA LTD.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Bermuda | | 001-38335 | | 98-1386359 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification #) |

Clarendon House,

2 Church Street,

Hamilton HM 11, Bermuda

(Address of Principal Executive Office)

(303) 925-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered |

| Class A Shares, par value $0.01 per share | LILA | The NASDAQ Stock Market LLC |

| Class C Shares, par value $0.01 per share | LILAK | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01. Entry into a Material Definitive Agreement.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a

Registrant.

On January 29, 2025, Coral-US Co-Borrower LLC (the “Original Co-Borrower”), as borrower and guarantor, entered into the financing arrangements described below. The arrangements amend, supplement and/or restate (as described below) the amended and restated credit agreement originally dated March 7, 2018 made between, among others, Sable International Finance Limited (the “Original Borrower”) and the Original Co-Borrower, as borrowers and guarantors (together, the “Initial Borrowers”), the guarantors named therein (the “Guarantors”), and The Bank of Nova Scotia, as administrative agent (the “Administrative Agent”) and security trustee (the “Security Trustee”) (as amended, restated, supplemented or otherwise modified from time to time prior to the 2025 Additional Facility Effective Date and the 2025 Extension Effective Date, as applicable (each as defined below), the “Existing Credit Agreement”), and as amended, supplemented and/or restated by the Additional Facility Joinder Agreement and the Amendment Agreement (each as defined below) as of the 2025 Additional Facility Effective Date and the 2025 Extension Effective Date, as applicable, the “Amended Credit Agreement”). Each of the Initial Borrowers and the Guarantors is a wholly-owned indirect subsidiary of Liberty Latin America Ltd.

The Original Co-Borrower, the Guarantors, the lenders named therein (the “Term B-7 Facility Lenders”), the Administrative Agent and the Security Trustee entered into an additional facility joinder agreement dated January 29, 2025 (the “Additional Facility Joinder Agreement”), and the Initial Borrowers, the Guarantors, the lenders named therein (the “2025 Extending Class B Revolving Credit Lenders”), the Administrative Agent and the Security Trustee entered into an amendment agreement dated January 29, 2025 (the “Amendment Agreement”), in each case pursuant to the Existing Credit Agreement.

Under the terms of the Additional Facility Joinder Agreement, the Term B-7 Facility Lenders agreed to provide a $1,530 million term loan facility (the “Term B-7 Facility”) to the Original Co-Borrower under and in accordance with the terms of the Existing Credit Agreement. The final maturity date for the Term B-7 Facility is January 31, 2032. The Term B-7 Facility bears interest at a rate of SOFR plus 3.25% subject to a SOFR floor of 0.00%. The proceeds of the advance under the Term B-7 Facility are expected to be used to redeem in full the term loan B-5 facility established under the Existing Credit Agreement and for the payment of any related fees and expenses.

Under the terms of the Amendment Agreement, certain 2025 Extending Class B Revolving Credit Lenders holding 2024 Extended Class B Revolving Credit Commitments agreed to increase their 2024 Extended Class B Revolving Credit Commitments under (and as defined in) the Existing Credit Agreement and all 2025 Extending Class B Revolving Credit Lenders agreed to extend the maturity date of their respective 2024 Extended Class B Revolving Credit Commitments (after giving effect to such increase), in an aggregate principal amount of $460 million (the “2025 Extended Class B Revolving Credit Commitments”), to (i) July 31, 2027, upon the consummation of the 2027 Notes Refinancing (as defined in the Existing Credit Agreement); (ii) April 15, 2029, upon the later of the consummation of the 2027 Notes Refinancing and the Term B-5 Loan Refinancing (as defined in the Existing Credit Agreement); and (iii) January 31, 2031, upon the latest of the consummation of the 2027 Notes Refinancing, the Term B-5 Loan Refinancing and the Term B-6 Loan Refinancing (as defined in the Existing Credit Agreement).

The Term B-7 Facility Lenders and the 2025 Extending Class B Revolving Credit Lenders provided their consents to amendments to certain provisions of the Existing Credit Agreement outlined in, and by way of, the Additional Facility Joinder Agreement and the Amendment Agreement, as applicable. The Term B-7 Facility became effective on January 29, 2025 (the “2025 Additional Facility Effective Date”), and the 2025 Extended Class B Revolving Credit Commitments became effective, on January 29, 2025 (the “2025 Extension Effective Date”).

The obligations of the Initial Borrowers and the Guarantors under the Term B-7 Facility and the 2025 Extended Class B Revolving Credit Commitments will remain guaranteed by the Initial Borrowers and the Guarantors, and will continue to be secured by pledges over the shares of each Guarantor and certain subordinated shareholder loans.

The foregoing descriptions of the Additional Facility Joinder Agreement, the Term B-7 Facility, the Amendment Agreement, the 2025 Extended Class B Revolving Credit Commitments, the Amended Credit Agreement and the transactions contemplated thereby are not complete and are subject to, and qualified in their entirety by reference to, the Additional Facility Joinder Agreement and the Amendment Agreement (including in the respective schedules thereto), copies of which will be filed with Liberty Latin America Ltd.’s Annual Report on Form 10-K for the year ended December 31, 2024.

Item 7.01 Regulation FD Disclosure.

The Press Release attached hereto as Exhibit 99.1 is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit No. | Exhibit Name |

| |

| 99.1 | |

| 101.SCH | XBRL Inline Taxonomy Extension Schema Document. |

| 101.DEF | XBRL Inline Taxonomy Extension Definition Linkbase. |

| 101.LAB | XBRL Inline Taxonomy Extension Label Linkbase Document. |

| 101.PRE | XBRL Inline Taxonomy Extension Presentation Linkbase Document. |

| 104 | Cover Page Interactive Data File.* (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | LIBERTY LATIN AMERICA LTD. |

| | |

| | By: | /s/ John M. Winter |

| | | John M. Winter |

| | Senior Vice President, Chief Legal Officer & Secretary |

Date: February 4, 2025

Exhibit 99.1

LIBERTY LATIN AMERICA’S C&W CREDIT SILO PRICES NEW $1.5 BILLION TERM LOAN DUE 2032

• Refinancing transaction significantly extends silo’s weighted average life of debt

DENVER, COLORADO – February 4, 2025: Liberty Latin America’s (“LLA” or the “Company”) largest credit silo, Cable & Wireless (“C&W”), priced a new $1.5 billion term loan at the end of January 2025. This term loan matures in 2032, bears interest at a rate of SOFR + 3.25%, and the net proceeds will be used to repay a $1.5 billion term loan maturing in 2028. This transaction is expected to close on February 18, 2025.

Chris Noyes, Liberty Latin America’s CFO, said, “Combined with the $1.0 billion refinancing of C&W’s Senior Secured and Senior Notes last October, we have now successfully extended the majority of C&W’s maturities beyond 2031, bringing our weighted average life of debt to nearly 6 years. This new $1.5 billion term loan highlights our ability to access markets efficiently, demonstrates the strength of the C&W credit silo, and positions the business for continued growth.”

ABOUT LIBERTY LATIN AMERICA

Liberty Latin America is a leading communications company operating in over 20 countries across Latin America and the Caribbean under the consumer brands BTC, Flow, Liberty and Más Móvil. The communications and entertainment services that we offer to our residential and business customers in the region include digital video, broadband internet, telephony and mobile services. Our business products and services include enterprise-grade connectivity, data center, hosting and managed solutions, as well as information technology solutions with customers ranging from small and medium enterprises to international companies and governmental agencies. In addition, Liberty Latin America operates a subsea and terrestrial fiber optic cable network that connects approximately 40 markets in the region.

Liberty Latin America has three separate classes of common shares, which are traded on the NASDAQ Global Select Market under the symbols “LILA” (Class A) and “LILAK” (Class C), and on the OTC link under the symbol “LILAB” (Class B).

For more information, please visit www.lla.com or contact:

| | | | | |

| Investor Relations: | Media Relations: |

Kunal Patel: ir@lla.com | Kim Larson: llacommunications@lla.com |

Document and Entity Information

|

Jan. 29, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

LIBERTY LATIN AMERICA LTD.

|

| Entity Central Index Key |

0001712184

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

D0

|

| Entity File Number |

001-38335

|

| Entity Tax Identification Number |

98-1386359

|

| Entity Address, Address Line One |

Clarendon House

|

| Entity Address, Address Line Two |

2 Church Street

|

| Entity Address, City or Town |

Hamilton

|

| Entity Address, Postal Zip Code |

HM 11

|

| Entity Address, Country |

BM

|

| City Area Code |

303

|

| Local Phone Number |

925-6000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Shares, par value $0.01 per share

|

| Trading Symbol |

LILA

|

| Security Exchange Name |

NASDAQ

|

| Class C |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class C Shares, par value $0.01 per share

|

| Trading Symbol |

LILAK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

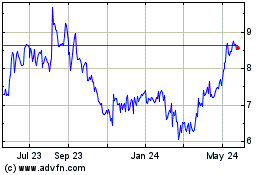

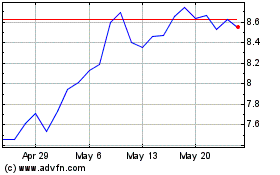

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Feb 2024 to Feb 2025