UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number 001-34738

Luokung Technology Corp.

(Translation of registrant’s name into English)

B9-8, Block B, SOHO Phase II, No. 9, Guanghua Road,

Chaoyang District,

Beijing People’s Republic of China 100020

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Luokung Technology Corp.

Luokung Technology Corp. Reports

Unaudited Financial Results for the First Six

Months of Fiscal Year 2023

Luokung Technology Corp. (Nasdaq: LKCO) (“Luokung,”

“we” or the “Company”), today announced the unaudited financial results for the six months ended June 30, 2023.

The financial statements and other financial information included in this Form 6-K are prepared in conformity with generally accepted

accounting principles in the United States of America (“U.S. GAAP”).

Financial Highlights for the Six Months Ended June

30, 2023:

Revenues for the six months ended June

30, 2023 decreased 90.1%, to $6,197,913 from $62,808,438 for the six months ended June 30, 2022;

Net loss of $22,458,378 for the six

months ended June 30, 2023 as compared to net loss of $28,859,097 for the six months ended June 30, 2022;

Basic and diluted loss per share was

$1.30 and $2.35 for the six months ended June 30, 2023 and 2022; and

Weighted average shares outstanding

for the six months ended June 30, 2023 were 17,002,940, compared to 13,078,593 for the six months ended June 30, 2022.

“In the first half of the 2023 fiscal year,

our revenue was $6.20 million, a 90.1% decrease from $62.81 million for the same period of the 2022 fiscal year. The decrease was mainly

due to one of our subsidiaries Beijing Wave Function Culture Development Co., Ltd. (“Wave Function”) planned to equity restructure

and had terminated concert party relationship with the Company. Consequently, the Company will no longer consolidate Wave Function’s

financial statements and instead have booked it as long-term investment. As we expect our data service products related to carbon neutralization

and emissions to be implemented in international market, we believe the future growth of this area of the Company’s business is

substantial.” said Mr. Song Xuesong, the Company’s Chief Executive Officer.

Results of Operations - Six Months Ended June

30, 2023 Compared to Six Months Ended June 30, 2022

Revenue

The Company’s revenues primarily consisted

of advertising services, software and services and smart transportation from the Company’s variable interest entities, Jiangsu Zhong

Chuan Rui You Information and Technology Limited (“Zhong Chuan Rui You”), SuperEngine Graphics Software Technology Development

(Suzhou) Co., Ltd (“SuperEngine”) and eMapgo Technologies (Beijing) Co., Ltd. (“EMG”).

Advertising services

Zhong Chuan Rui You derived revenue from the provision

of user acquisition services to their advertisers on the strength of the location-based services (LBS) services they offer; customers

pay them based on performance, as measured by CPI (Cost Per Install), CPM (Cost Per Mile), and CPC (Cost Per Click). They recognize revenue

over time because customers receive and consume the benefit of the advertising services throughout the contract period.

Software and services

SuperEngine generated revenues primarily from

the sales of software licenses and the provision of technology services. License fees include perpetual license fees, term license fees

and royalties. Technology services primarily consist of fees for providing technology support services and technology solution services

that enable customers to gain real-time operational intelligence by harnessing the value of their data.

Revenue for the sale of software licenses is recognized

at the point in time when the right to use the software is provided to customers. Term license fees and royalties are recognized over

time throughout the contract period.

Technology support service revenue is recognized

over time as the services are performed because customers receive and consume the benefit of the performance of services throughout the

contract period. Technology solution service revenue is recognized at the point in time when the service is completed. SuperEngine bills

for services performed in accordance with the terms of each contract. SuperEngine recognizes the revenues associated with these professional

services as services are delivered to the customers.

Smart transportation

Map data licensing

EMG provides perpetual map data licenses to customers

and collects one-time license fees from customers. Revenue is recognized at the point in time when customers obtain the right to use the

map data.

Autonomous driving simulation and verification

test

EMG provides data collection and desensitization

for compliance with legal requirements to which system manufacturers and automobile manufacturers for autonomous driving simulation and

verification testing are subject. Revenues are derived from the provision of data collection and desensitization services for compliance

with legal requirements. Revenues are recognized over time as the services are performed because customers receive and consume the benefit

of the performance of services throughout the contract period.

Map service platform local deployment

Through local deployment, EMG provides a one-time

map service platform license or a map service platform license for a contracted period to certain public sectors and enterprises to support

location-based applications with updates to the map service platform during such contracted period. The map service platform includes

map data and software that support certain map applications including display, search, routing and others. Revenues from a map data license

for a given period are recognized ratably over time because customers receive and consume the benefit of the map services throughout the

contract period.

For the six months ended June 30, 2023, the Company

had revenue of $6,197,913, as compared to revenue of $62,808,438 for the six months ended June 30, 2022, a decrease of $56,610,525, or

90.1%.

Advertising

For the six months ended June

30, 2023, revenue from advertising was $329,596, a decrease of $56,985,124, or 99.42%, from $57,314,720 for the six

months ended June 30, 2022. The decrease was mainly due to one of our subsidiaries Beijing Wave Function Culture Development Co.,

Ltd. (“Wave Function”) planned to equity restructure and had terminated concert party relationship with the Company. Consequently,

the Company will no longer consolidate Wave Function’s financial statements and instead have booked it as long-term investment.

Software and services

For the six months ended June

30, 2023, revenue from sales of remote sensing and GIS data management service platform software and services decreased by $1,493,824

or 100% in comparison to the six months ended June 30, 2022.

Smart

transportation

For the six months ended June

30, 2023, revenue from smart transportation was $5,868,317, an increase of $1,868,423, or 46.71%, from $3,999,894 for

the six months ended June 30, 2022.

Operating costs and expenses

The Company’s operating costs and expenses

consisted of cost of revenues, selling, general and administrative expenses, and research and development expenses.

Cost of Revenues

Cost of revenues decreased by 94.1% to $3,202,677

for the six months ended June 30, 2023 from $54,394,462 for the six months ended June 30, 2022.

The cost of revenues primarily consisted of traffic

acquisition costs and salary and benefit expenses. The Company’s traffic acquisition costs may vary due to a number of factors,

including scale, targeted audience and the geography of traffic.

Included in salary and benefit expenses are those

for employees directly involved in data collection and processing, direct production costs, which are primarily comprised of field survey-related

costs and hard disk materials costs, and depreciation of facilities and equipment used in data collection and processing.

Selling and marketing expense

The Company’s selling and marketing expense

mainly includes promotional and marketing expenses and compensation for our sales and marketing personnel.

Selling expense totaled $1,534,979 for the six

months ended June 30, 2023, as compared to $3,719,654 for the six months ended June 30, 2022, a decrease of $2,184,675 or 58.7%.

General and administrative expense

The Company’s general and administrative

expenses consisted primarily of salaries and benefits for the Company’s general and administrative personnel, rent, fees and expenses

for legal, accounting and other professional services.

General and administrative expense totaled $7,518,082

for the six months ended June 30, 2023, as compared to $7,883,232 for the six months ended June 30, 2022, a slight decrease of $365,150

or 4.6%.

Research and development expenses

Research and development expenses primarily consisted

of salaries and benefits for research and development personnel.

Research and development expenses totaled $14,544,380

for the six months ended June 30, 2023, as compared to $24,961,934 for the six months ended June 30, 2022, an increase of $10,417,554

or 41.7%. The decrease was primarily attributable to a decrease in salaries and share based compensation due to a decrease in headcount

of staff in the research and development department.

Loss from operations

As a result of the factors described above, for

the six months ended June 30, 2023, loss from operations amounted to $3,202,677 as compared to loss from operations of $54,394,462 for

the six months ended June 30, 2022, a decrease of $51,191,785, or 94.1%.

Other income/expense

Other income/expense primarily included interest

expenses from other loans and foreign currency gains/losses.

For the six months ended June 30, 2023, other

expense, net, amounted to $2,412,361 as compared to other expense, net, of $1,257,134 for the six months ended June 30, 2022, an increase

of $1,155,227, or 91.9%, which was primarily attributable to an increase in other expenses of approximately $953,790, offset by an increase

in foreign currency transaction gain of approximately $262,528.

Net loss

As a result of the factors described above, the

Company’s net loss was $22,458,378 for the six months ended June 30, 2023, compared to net loss of $28,859,097 for the six months

ended June 30, 2022, a decrease of $ 6,400,719 or 22.2%.

Foreign currency translation adjustment

The Company’s reporting currency is the

U.S. dollar. The functional currency of the Company’s subsidiaries (LK Technology, MMB and Mobile Media) is the U.S. dollar and

the functional currency of the Company’s subsidiaries incorporated in China is the Chinese Renminbi (“RMB”). The financial

statements of the Company’s subsidiaries incorporated in China are translated to U.S. dollars using period end exchange rates for

assets and liabilities, and average exchange rates (for the period) for revenue, costs and expenses. Net gains and losses resulting from

foreign exchange transactions are included in the Company’s consolidated statements of operations and comprehensive loss. As a result

of foreign currency translations, which are a non-cash adjustment, the Company reported a foreign currency translation gain of $3,293,075

for the six months ended June 30, 2023, as compared to a foreign currency translation gain of $5,181,476 for the six months ended June

30, 2022. This non-cash gain had the effect of decreasing the Company’s reported comprehensive loss.

Comprehensive loss

As a result of the Company’s foreign currency

translation adjustment, the Company’s had comprehensive loss for the six months ended June 30, 2023 of $19,165,303, compared to

comprehensive loss of $23,677,621 for the six months ended June 30, 2022.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate

funds to support its current and future operations, satisfy its obligations and otherwise operate on an ongoing basis. The Company historically

relied on cash flow provided by operations and financing to provide its working capital. At June 30, 2023 and December 31, 2022, the Company

had cash balances of approximately $996,823 and $1,264,881, respectively. A significant portion of these funds are located in financial

institutions located in the PRC and will continue to be indefinitely reinvested in the Company’s operations in the PRC.

The following table sets forth a summary of changes

in the Company’s working capital from December 31, 2022 to June 30, 2023:

| | |

June 30,

2023 | | |

December 31,

2022 | | |

Change | | |

Percentage

Change | |

| Working capital deficit: | |

| | |

| | |

| | |

| |

| Total current assets | |

$ | 13,206,090 | | |

$ | 44,825,670 | | |

$ | (31,619,580 | ) | |

| (70.5 | )% |

| Total current liabilities | |

| 91,490,749 | | |

| 94,831,612 | | |

| (3,340,863 | ) | |

| (3.5 | )% |

| Working capital deficit: | |

$ | (78,284,659 | ) | |

$ | (50,005,942 | ) | |

$ | (28,278,717 | ) | |

| 56.6 | % |

The Company’s working capital deficit increased

by $28,278,717 to a working capital deficit of $78,284,659 at June 30, 2023 from $50,005,942 at December 31, 2022. This increase in working

capital deficit is primarily attributable to a decrease in cash of approximately $268,000, a decrease in accounts receivable of approximately

$5,594,000, a decrease in other receivables of approximately $25,755,000, offset by a decrease in accounts payable of approximately $1,913,000

and a decrease in accrued liabilities and other payables of approximately $1,352,000.

The Company had incurred negative cash flows from

operating activities and net losses for the six months ended June 30, 2023, which raise substantial doubt about the Company’s ability

to continue as a going concern. In order to continue as a going concern and mitigate our liquidity risk, the Company will need additional

capital resources, among other things. Management’s plans to obtain such resources for the Company include (1) endeavoring to enter

into more sales contracts, (2) increasing proceeds from loans from both unrelated and related parties to provide the resources necessary

to fund the development of our business plan and operations, and (3) increasing proceeds from loans from financial institutions and/or

existing investors to increase working capital in order to meet capital demands.

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

(IN U.S. DOLLARS)

| | |

As of

June 30, | | |

As of

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash | |

$ | 996,823 | | |

$ | 1,264,881 | |

| Accounts receivable, net of allowance for expected credit losses | |

| 1,689,850 | | |

| 7,283,566 | |

| Other receivables and prepayment | |

| 10,448,283 | | |

| 36,203,895 | |

| Notes receivable | |

| 71,134 | | |

| 73,328 | |

| Total current assets | |

| 13,206,090 | | |

| 44,825,670 | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net | |

| 1,773,697 | | |

| 3,523,810 | |

| Intangible assets, net | |

| 80,124,913 | | |

| 87,659,719 | |

| Goodwill | |

| 80,294,407 | | |

| 80,294,407 | |

| Investment | |

| 411,490 | | |

| 426,923 | |

| Right-of-use assets | |

| 1,874,079 | | |

| 2,725,777 | |

| Deferred tax assets | |

| 883,918 | | |

| 327,730 | |

| Other assets | |

| 4,836,640 | | |

| 4,849,175 | |

| Equity method investment | |

| 7,788,362 | | |

| - | |

| Other receivables, net (long term) | |

| 9,966,440 | | |

| 9,003,964 | |

| Total non-current assets | |

| 187,953,946 | | |

| 188,811,505 | |

| TOTAL ASSETS | |

| 201,160,036 | | |

| 233,637,175 | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 6,178,322 | | |

| 8,091,759 | |

| Accrued liabilities and other payables | |

| 80,743,079 | | |

| 82,095,458 | |

| Contract liabilities | |

| 1,500,428 | | |

| 2,066,634 | |

| Lease liabilities – current portion | |

| 1,572,843 | | |

| 1,665,410 | |

| Amounts due to related parties | |

| 1,496,077 | | |

| 912,351 | |

| Total current liabilities | |

| 91,490,749 | | |

| 94,831,612 | |

| Non-current liabilities: | |

| | | |

| | |

| Lease liabilities – non-current portion | |

| 430,921 | | |

| 1,148,526 | |

| Accrued liabilities and other payables | |

| 3,226,532 | | |

| 3,347,540 | |

| Total non- current liabilities | |

| 3,657,453 | | |

| 4,496,066 | |

| TOTAL LIABILITIES | |

| 95,148,202 | | |

| 99,327,678 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | |

| Redeemable preferred shares, $ 0.3 par value, 726,496 shares authorized, issued and outstanding at June 30, 2023 and December 31, 2022 | |

| 10,204,326 | | |

| 10,204,326 | |

| | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Share capital | |

| | | |

| | |

| Preferred shares, $0.3 par value; 83,333 shares authorized, issued and outstanding at June 30, 2023 and December 31, 2022 | |

| 25,000 | | |

| 25,000 | |

| Ordinary shares, $0.3 par value; 17,517,815 shares authorized; 17,517,817 and 13,368,074 shares issued and outstanding at June 30, 2022 and December 31, 2021 | |

| 5,255,345 | | |

| 4,924,987 | |

| Additional paid-in capital | |

| 346,430,279 | | |

| 343,901,804 | |

| Accumulated deficit | |

| (257,381,388 | ) | |

| (235,249,958 | ) |

| Accumulated other comprehensive income | |

| (1,875,718 | ) | |

| 542,969 | |

| Total equity attributable to owners of the company | |

| 96,204,954 | | |

| 114,144,802 | |

| Non-controlling interest | |

| (397,446 | ) | |

| 9,960,369 | |

| | |

| | | |

| | |

| Total Shareholders’ Equity | |

| 96,602,400 | | |

| 124,105,171 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 201,160,036 | | |

$ | 233,637,175 | |

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(IN U.S. DOLLARS)

| | |

For the Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenues | |

$ | 6,197,913 | | |

$ | 62,808,438 | |

| Less: Operating costs and expenses: | |

| | | |

| | |

| Cost of revenues | |

| 3,202,677 | | |

| 54,394,462 | |

| Selling and marketing | |

| 1,534,979 | | |

| 3,719,654 | |

| General and administrative | |

| 7,518,082 | | |

| 7,883,232 | |

| Research and development | |

| 14,544,380 | | |

| 24,961,934 | |

| Total Operating costs and expenses | |

| 26,800,118 | | |

| 90,959,282 | |

| Loss from operations | |

| (20,602,205 | ) | |

| (28,150,844 | ) |

| Other income (expense): | |

| | | |

| | |

| Interest expense | |

| (1,783,900 | ) | |

| (1,834,958 | ) |

| Foreign exchange losses, net | |

| 151,234 | | |

| (111,294 | ) |

| Other income, net | |

| (779,695 | ) | |

| 689,118 | |

| Total other expense, net | |

| (2,412,361 | ) | |

| (1,257,134 | ) |

| Loss before income taxes | |

| (23,014,566 | ) | |

| (29,407,978 | ) |

| Income tax credit | |

| 556,188 | | |

| 548,881 | |

| Net loss | |

$ | (22,458,378 | ) | |

$ | (28,859,097 | ) |

| Less: Net loss attributable to the non-controlling interest | |

| 326,948 | | |

| (1,914,052 | ) |

| Net loss attributable to owners of the Company | |

$ | (22,131,430 | ) | |

$ | (30,773,149 | ) |

| Comprehensive loss: | |

| | | |

| | |

| Net loss | |

| (22,458,378 | ) | |

| (28,859,097 | ) |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 3,293,075 | | |

| 5,181,476 | |

| Comprehensive loss | |

$ | (19,165,303 | ) | |

$ | (23,677,621 | ) |

| Less: Comprehensive profit (loss) attributable to the non-controlling interest | |

| (1,960,326 | ) | |

| 332,259 | |

| Comprehensive loss attributable to owner of the company | |

$ | (21,125,629 | ) | |

$ | (23,345,362 | ) |

| Net loss per ordinary share: | |

| | | |

| | |

| Basic and Diluted | |

$ | (1.30 | ) | |

$ | (2.35 | ) |

| | |

| | | |

| | |

| Weighted average number of ordinary shares outstanding Basic and Diluted | |

| 17,002,940 | | |

| 13,078,593 | |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Luokung Technology Corp. |

| |

|

| Date: December 28, 2023 |

By |

/s/ Xuesong Song |

| |

|

Xuesong Song |

| |

|

Chief Executive Officer |

9

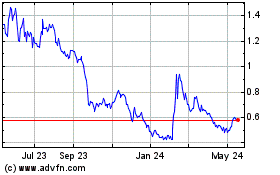

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

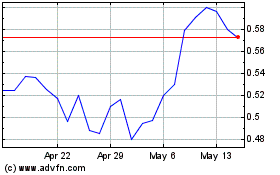

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Nov 2023 to Nov 2024