UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of September 2023

Commission File Number: 001-39131

LIMINAL BIOSCIENCES INC.

(Translation of registrant’s name into English)

440 Armand-Frappier

Boulevard, Suite 300

Laval, Québec

H7V 4B4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨ Form

40-F

INCORPORATION BY REFERENCE

This Report on Form 6-K (the “Report”)

and Exhibit 99.1 to this Report are hereby expressly incorporated by reference into the registrant’s registration statements on

Form F-3 (File nos. 333-251055, 333-245703 and 333-251065) filed with the Securities and Exchange Commission on December 1, 2020, December

2, 2020 and December 2, 2020, respectively, and the registration statement on Form S-8 (File no. 333-235692) filed with the Securities

and Exchange Commission on December 23, 2019.

EXHIBIT LIST

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

|

|

|

|

|

| |

|

|

|

Liminal BioSciences Inc. |

| |

|

|

|

| Date: September 19,

2023 |

|

|

|

By: |

|

/s/ Bruce Pritchard |

| |

|

|

|

|

|

Name |

|

Bruce Pritchard |

| |

|

|

|

|

|

Title: |

|

Chief Executive Officer |

EXHIBIT 99.1

LIMINAL BIOSCIENCES RECEIVES FINAL COURT ORDER

FOR PLAN OF ARRANGEMENT WITH STRUCTURED ALPHA LP

LAVAL, QC and CAMBRIDGE, England, Sept. 19, 2023 /CNW/

- Liminal BioSciences Inc. (NASDAQ: LMNL) ("Liminal BioSciences" or the "Company"), is pleased to announce

that it received the final order of the Ontario Superior Court of Justice (Commercial List) approving the previously-announced plan of

arrangement under section 192 of the Canada Business Corporations Act (the "Arrangement") pursuant to which Structured

Alpha LP ("SALP"), a limited partnership managed by its general partner, Thomvest Asset Management Ltd., will acquire all of

the issued and outstanding common shares of Liminal BioSciences (the "Shares") not currently owned by SALP or its affiliates

and associates at a price of US$8.50 per Share, payable in cash (the "Arrangement").

The Arrangement was previously approved by the Company's

shareholders at the special meeting of the Company held on September 15, 2023.

It is currently anticipated that the Arrangement will

be completed on or about September 26th, 2023, subject to the satisfaction or waiver of certain other customary conditions

precedent to the Arrangement. Further details regarding the Arrangement are described in the management information circular dated August

16, 2023 (the "Circular") mailed to Liminal BioSciences shareholders in connection with the Arrangement, as well as in the supplement

to the Circular dated September 12, 2023, each of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca and on

EDGAR at www.sec.gov.

About Liminal BioSciences Inc.

Liminal BioSciences is a development stage biopharmaceutical

company focused on discovering and developing novel and distinctive small molecule therapeutics that modulate G protein-coupled receptors,

or GPCR, pathways. Liminal BioSciences is designing proprietary novel small molecule therapeutic candidates with the intent of developing

best/first in class therapeutics for the treatment of metabolic, inflammatory and fibrotic diseases with significant unmet medical needs,

using our integrated drug discovery platform, medicinal chemistry expertise and deep understanding of the GPCR biology. Liminal BioSciences'

pipeline is currently made up of three programs. The candidate selected for clinical development, LMNL6511, a selective antagonist for

the GPR84 receptor, is expected to commence a Phase 1 clinical trial in the second half of 2023. Liminal BioSciences is also developing

LMNL6326 as an antagonist for the OXER1 receptor, targeting treatment of eosinophil-driven disease, and GPR40 agonists, both of which

are at the preclinical stage. In addition to these programs, Liminal BioSciences continues to explore other development opportunities

to add to its pipeline.

Liminal BioSciences has active business operations

in Canada and the United Kingdom.

About Structured Alpha LP

Thomvest Asset Management Ltd. is the general partner

of SALP. Thomvest Asset Management Ltd. and its affiliates are a group of investment companies that make investments on behalf of Peter

J. Thomson and his family.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of Canadian and U.S. securities laws. Some of the forward-looking statements can be identified by the use of forward-looking

words. Statements that are not historical in nature, including the words "anticipate," "expect," "suggest,"

"plan," "believe," "intend," "estimate," "target," "project," "should,"

"could," "would," "may," "will," "forecast" and other similar expressions are intended

to identify forward-looking statements. These forward-looking statements generally include statements that are predictive in nature and

depend upon or refer to future events or conditions, including, but not limited to statements related to Liminal BioSciences' business

in general, the ability to complete and the timing of completion of the Arrangement and the other transactions contemplated by the arrangement

agreement between Liminal BioSciences and SALP, including the parties' ability to satisfy the conditions to the consummation of the Arrangement

and the possibility of any termination of the agreement.

These statements are "forward-looking" because

they are based on our current expectations about the markets we operate in and on various estimates and assumptions. Actual events or

results may differ materially from those anticipated in these forward-looking statements if known or unknown risks affect our business,

or if our estimates or assumptions turn out to be inaccurate. Among the factors that could cause actual results to differ materially from

those described or projected herein include, but are not limited to, risks associated with: uncertainties with respect to the timing of

the Arrangement; the risk that competing offers or acquisition proposals will be made; the possibility that various conditions to the

consummation of the offer may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant

approval for the consummation of the Arrangement at all or on acceptable terms or within expected timing; the risk that stockholder litigation

in connection with the Arrangement may result in significant costs of defense, indemnification and liability; the effects of disruption

from the Arrangement on Liminal BioSciences' business and the fact that the announcement and pendency of the Arrangement may make it more

difficult to establish or maintain relationships with employees and business partners; uncertainties associated generally with research

and development, clinical trials and related regulatory reviews and approvals; Liminal BioSciences' ability to continue to comply with

Nasdaq Listing Rule 5450(a)(1) to remain listed on Nasdaq; Liminal BioSciences' expected cash runway and Liminal BioSciences' ability

to actively seek and close on opportunities to monetize non-core assets or commercial opportunities related to our assets; Liminal BioSciences'

reliance on third parties to conduct, supervise and monitor existing clinical trials and potential future clinical trials; developments

from Liminal BioSciences' competitors and the marketplace for Liminal BioSciences' product candidates; and business, operations and clinical

development timelines and plans may be adversely affected by geopolitical events and macroeconomic conditions, including rising inflation

and interest rates and uncertain credit and financial markets, and matters related thereto; and other risks and uncertainties affecting

Liminal BioSciences, including in the Annual Report on Form 20-F for the year ended December 31, 2022, as well as other filings and reports

Liminal BioSciences may make from time to time. As a result, we cannot guarantee that any given forward-looking statement will materialize.

Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements and estimates, which

speak only as of the date hereof. We assume no obligation to update any forward-looking statement contained in this press release even

if new information becomes available, as a result of future events or for any other reason, unless required by applicable securities laws

and regulations.

View original content to download multimedia:https://www.prnewswire.com/news-releases/liminal-biosciences-receives-final-court-order-for-plan-of-arrangement-with-structured-alpha-lp-301932546.html

SOURCE Liminal BioSciences Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2023/19/c2783.html

%CIK: 0000135117

For further information: Nicole Rusaw, Chief Financial Officer, n.rusaw@liminalbiosciences.com

CO: Liminal BioSciences Inc.

CNW 16:22e 19-SEP-23

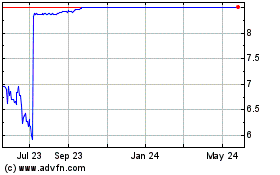

Liminal BioSciences (NASDAQ:LMNL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Liminal BioSciences (NASDAQ:LMNL)

Historical Stock Chart

From Jan 2024 to Jan 2025