false

0001491419

0001491419

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 7, 2024

LIVEONE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38249 |

|

98-0657263 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

269 South Beverly Drive, Suite 1450

Beverly Hills, CA 90212

(Address

of principal executive offices) (Zip Code)

(310) 601-2505

(Registrant’s

telephone number, including area code)

n/a

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, $0.001 par value per share |

|

LVO |

|

The NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 7, 2024, LiveOne, Inc. (the “Company”) issued a press release announcing its operating and financial highlights

and results for the second quarter and six months ended September 30, 2024. A copy of the press release is attached hereto as Exhibit

99.1.

The

information included herein and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”),

or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item

7.01 Regulation FD Disclosure.

On

October 23, 2024, the Company issued a press release announcing that it plans to hold a conference call and audio webcast to provide

a business update and discuss its operating and financial results for the second quarter ended September 30, 2024 on November 7, 2024.

A copy of the press release is attached hereto as Exhibit 99.2.

The

information included herein and in Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

LIVEONE,

INC. |

| |

|

| Date:

November 7, 2024 |

By: |

/s/

Aaron Sullivan |

| |

Name:

|

Aaron

Sullivan |

| |

Title: |

Chief

Financial Officer |

2

Exhibit

99.1

LiveOne

(Nasdaq: LVO) Reports Q2 Fiscal 2025 Results

| - | Consolidated

Q2 Fiscal 2025 Revenue of $32.6M and YTD Revenue of $65.7M |

| - | Adjusted

EBITDA* (excluding CPS) of $3.3M (Q2 Fiscal 2025) and $6.6M (YTD) |

| - | Audio

Division (Slacker Radio and PodcastOne (Nasdaq: PODC)) Revenue of $31.7M (Q2 Fiscal 2025, +18%), $63.3M (YTD, +21% YoY) |

| - | Maintains

Consolidated Revenue of $120M - $135M |

| |

- |

Maintains Adjusted EBITDA*

of $8M – 15M |

| |

- |

Maintains Audio Division

Revenue of $110M - $120M |

| |

- |

Maintains Audio Division

Adjusted EBITDA* of $12M - $20M |

| - | $12M

buyback program reaffirmed |

| |

- |

4.4M shares repurchased

(~94M outstanding) |

| |

- |

$6.2M remaining in buyback

program |

| |

● |

PodcastOne (Nasdaq: PODC) |

| |

- |

LVO

increased ownership to 72% of PodcastOne (Nasdaq: PODC) |

| |

- |

Acquired 583,000 PODC

shares at average price of $1.77, including additional 224,000 shares this quarter |

| - | Date:

Thursday, November 7, 2024 |

| - | Format:

Live conference call and audio webcast |

LOS

ANGELES, CA, November 7, 2024 - LiveOne (Nasdaq: LVO), an award-winning, creator-first, music, entertainment, and technology

platform, announced today its operating results for the second fiscal quarter ended September 30, 2024 (“Q2 Fiscal 2025”).

As

previously announced with the assistance of J.P. Morgan, LiveOne is continuing a process to explore strategic alternatives to enhance

shareholder value. Potential alternatives may include, among others, a strategic acquisition, divestiture, merger, sale or other form

of business combination. There can be no assurance that LiveOne’s efforts will result in a specific transaction or any particular

outcome or its timing.

Q2

Fiscal 2025 Highlights

| ● | Paid

members as of September 30, 2024 increased 645K or 27%, as compared to the prior year. Total

members including free ad-supported memberships was approximately 4.0 million at September

30, 2024.** |

| ● | PodcastOne

was 12th in PODTRAC’s Podcast Industry Top Publishers Rankings for September

2024 with a U.S. Unique Monthly Audience of ~5.4M and Global Downloads and Streams of ~16.2M. |

Q2

FY25 and Q2 FY24 Results Summary (in $000’s, except per share; unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 32,594 | | |

$ | 28,528 | | |

$ | 65,672 | | |

$ | 56,295 | |

| Operating income (loss) | |

$ | (1,400 | ) | |

$ | (2,515 | ) | |

$ | (2,186 | ) | |

$ | (2,754 | ) |

| Total other income (expense) | |

$ | (926 | ) | |

$ | (5,433 | ) | |

$ | (1,649 | ) | |

$ | (5,610 | ) |

| Net income (loss) | |

$ | (2,317 | ) | |

$ | (7,927 | ) | |

$ | (3,875 | ) | |

$ | (8,422 | ) |

| Adjusted EBITDA* | |

$ | 2,885 | | |

$ | 2,785 | | |

$ | 5,788 | | |

$ | 4,994 | |

| Net income (loss) per share basic and diluted | |

$ | (0.02 | ) | |

$ | (0.09 | ) | |

$ | (0.04 | ) | |

$ | (0.11 | ) |

Q2 Fiscal 2025 Results Summary

Discussion

For

Q2 Fiscal 2025, LiveOne posted revenue of $32.6 million, a 14% increase, as compared to $28.5 million in the same period in the prior

year. The Audio Division revenue was $31.7 million, a 18% increase, as compared to revenue of $26.9 in Q2 Fiscal 2024.

Q2

Fiscal 2025 Operating Loss was ($1.4) million compared to Operating Loss of ($2.5) million in Q2 Fiscal 2024. The $1.0 million decrease

in Operating Income was largely a result of an decrease in operating expenses.

Q2

Fiscal 2025 Adjusted EBITDA* improved to $2.9 million, as compared to Q2 Fiscal 2024 Adjusted EBITDA* of $2.8 million. Q2 Fiscal 2025

Adjusted EBITDA* was comprised of Audio Division Adjusted EBITDA* of $5.4 million, Media Division Adjusted EBITDA* of ($0.8) million

and Corporate Adjusted EBITDA* of ($1.7) million. Audio Division Q2 Fiscal 2025 Adjusted EBITDA* of $5.4 million was driven by improved

Contribution Margin* along with decreases in operating expenses.

Capital

expenditures for Q2 Fiscal 2024 totaled approximately $0.6 million, which were driven by capitalized software costs associated with development

of LiveOne’s integrated music player.

LiveOne

maintains its guidance for its fiscal year ending March 31, 2025 (“Fiscal 2025”) of consolidated revenue of $120 million

- $135 million and Adjusted EBITDA* of $8 million - $15 million, and its guidance for its Audio Division of consolidated revenue of $110

million - $120 million and Adjusted EBITDA* of $12 million - $20 million.

LiveOne’s

senior management will host a live conference call and audio webcast to provide a business update and discuss its operating and financial

results beginning at 10:00 a.m. ET / 7:00 a.m. PT on Thursday, November 7, 2024.

Conference

Call and Webcast:

WHEN:

Thursday, November 7th

TIME: 10:00 AM ET / 7:00 AM PT

DIAL-IN (Toll Free): (800) 715-9871

DIAL IN NUMBER (Local): (646) 307-1963

REPLAY NUMBER: (800) 770-2030

WEBCAST –

Both the live webcast and a replay can be accessed on the Investor Relations section of LiveOne's website at Events | LiveOne.

The

webcast can also be accessed at: https://events.q4inc.com/attendee/127231561

The

timing, price and actual number of shares repurchased under LiveOne’s stock repurchase program, which may include the possibility

of buying back shares of common stock of PodcastOne, will be at the discretion of LiveOne's management and will depend on a variety of

factors, including stock price, general business and market conditions, and alternative investment opportunities. The repurchase program

will continue to be executed consistent with LiveOne's capital allocation strategy, which will continue to prioritize growing LiveOne's

business. Under the stock repurchase program, repurchases can be made from time to time using a variety of methods, including open market

purchases, all in compliance with the rules of the U.S. Securities and Exchange Commission and other applicable legal requirements. The

repurchase program does not obligate LiveOne to acquire any particular amount of shares, and the program may be suspended or discontinued

at any time at LiveOne's discretion. LiveOne will review the stock repurchase program periodically and may authorize adjustment of its

terms and size.

About

LiveOne

Headquartered

in Los Angeles, CA, LiveOne (Nasdaq: LVO) is an award-winning, creator-first, music, entertainment, and technology platform focused

on delivering premium experiences and content worldwide through memberships and live and virtual events. LiveOne's subsidiaries include

Slacker, PodcastOne (Nasdaq: PODC), PPVOne, CPS, LiveXLive, DayOne Music Publishing, Drumify and Splitmind. LiveOne is available

on iOS, Android, Roku, Apple TV, Spotify, Samsung, Amazon Fire, Android TV, and through STIRR's OTT applications. For more information,

visit liveone.com and follow us on Facebook, Instagram, TikTok, YouTube and Twitter at @liveone.

For more investor information, please visit ir.liveone.com.

Forward-Looking

Statements

All

statements other than statements of historical facts contained in this press release are “forward-looking statements,” which

may often, but not always, be identified by the use of such words as “may,” “might,” “will,” “will

likely result,” “would,” “should,” “estimate,” “plan,” “project,” “forecast,”

“intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,”

“target” or the negative of such terms or other similar expressions. These statements involve known and unknown risks, uncertainties

and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by

such statements, including: LiveOne’s reliance on its largest OEM customer for a substantial percentage of its revenue; LiveOne’s

ability to consummate any proposed financing, acquisition, spin-out, special dividend, merger, distribution or transaction, the timing

of the consummation of any such proposed event, including the risks that a condition to the consummation of any such event would not

be satisfied within the expected timeframe or at all, or that the consummation of any proposed financing, acquisition, spin-out, merger,

special dividend, distribution or transaction will not occur or whether any such event will enhance shareholder value; LiveOne’s

ability to continue as a going concern; LiveOne’s ability to attract, maintain and increase the number of its users and paid members;

LiveOne identifying, acquiring, securing and developing content; LiveOne’s intent to repurchase shares of its and/or PodcastOne’s

common stock from time to time under LiveOne’s announced stock repurchase program and the timing, price, and quantity of repurchases,

if any, under the program; LiveOne’s ability to maintain compliance with certain financial and other covenants; LiveOne successfully

implementing its growth strategy, including relating to its technology platforms and applications; management’s relationships with

industry stakeholders; LiveOne’s ability to extend and/or refinance its indebtedness and/or repay its indebtedness when due; uncertain

and unfavorable outcomes in legal proceedings and/or LiveOne’s ability to pay any amounts due in connection with any such legal

proceedings; changes in economic conditions; competition; risks and uncertainties applicable to the businesses of LiveOne’s subsidiaries;

and other risks, uncertainties and factors including, but not limited to, those described in LiveOne’s Annual Report on Form 10-K

for the fiscal year ended March 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 1, 2024,

and in LiveOne’s other filings and submissions with the SEC. These forward-looking statements speak only as of the date hereof,

and LiveOne disclaims any obligation to update these statements, except as may be required by law. LiveOne intends that all forward-looking

statements be subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

**Included

in the total number of paid members for the reported periods are certain members which are the subject of a contractual dispute. LiveOne

is currently not recognizing revenue related to these members. Total number of paid members does not reflect the new terms of LiveOne’s

renewed partnership with Tesla, and LiveOne will separately disclose in the future the results of its efforts to convert Tesla drivers

(accounted as paid members as of September 30, 2024) who will now be eligible to convert to become direct customers of LiveOne.

*

About Non-GAAP Financial Measures

To

supplement our consolidated financial statements, which are prepared and presented in accordance with the accounting principles generally

accepted in the United States of America ("GAAP"), we present Contribution Margin (Loss) and Adjusted Earnings Before Interest

Tax Depreciation and Amortization ("Adjusted EBITDA"), which are non-GAAP financial measures, as measures of our performance.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, or as a substitute for, or

superior to, operating loss and or net income (loss) or any other performance measures derived in accordance with GAAP or as an alternative

to net cash provided by operating activities or any other measures of our cash flows or liquidity.

We

use Contribution Margin (Loss) and Adjusted EBITDA to evaluate the performance of our operating segments. We believe that information

about these non-GAAP financial measures assists investors by allowing them to evaluate changes in the operating results of our business

separate from non-operational factors that affect operating income (loss) and net income (loss), thus providing insights into both operations

and the other factors that affect reported results. Adjusted EBITDA is not calculated or presented in accordance with GAAP. A limitation

of the use of Adjusted EBITDA as a performance measure is that it does not reflect the periodic costs of certain amortizing assets used

in generating revenue in our business. Accordingly, Adjusted EBITDA should be considered in addition to, and not as a substitute for

operating income (loss), net income (loss), and other measures of financial performance reported in accordance with GAAP. Furthermore,

this measure may vary among other companies; thus, Adjusted EBITDA as presented herein may not be comparable to similarly titled measures

of other companies.

Contribution

Margin (Loss) is defined as Revenue less Cost of Sales. Adjusted EBITDA is defined as earnings before interest, other (income) expense,

income tax expense, depreciation and amortization and before (a) non-cash GAAP purchase accounting adjustments for certain deferred revenue

and costs, (b) legal, accounting and other professional fees directly attributable to acquisition activity, (c) employee severance payments

and third party professional fees directly attributable to acquisition or corporate realignment activities, (d) certain non-recurring

expenses associated with legal settlements or reserves for legal settlements in the period that pertain to historical matters that existed

at acquired companies prior to their purchase date and a one-time minimum guarantee to effectively terminate a live events distribution

agreement post COVID-19, and (e) certain stock-based compensation expense. Management does not consider these costs to be indicative

of our core operating results.

With

respect to projected full fiscal year 2025 Adjusted EBITDA, a quantitative reconciliation is not available without unreasonable efforts

due to the high variability, complexity and low visibility with respect to purchase accounting adjustments, acquisition-related charges

and legal settlement reserves excluded from Adjusted EBITDA. We expect that the variability of these items to have a potentially unpredictable,

and potentially significant, impact on our future GAAP financial results.

For

more information on these non-GAAP financial measures, please see the tables entitled "Reconciliation of Non-GAAP Measure to GAAP

Measure" included at the end of this release.

LiveOne IR

Contact:

Liviakis Financial Communications, Inc.

(415) 389-4670

john@liviakis.com

Press

Contact:

LiveOne

press@liveone.com

Financial

Information

The

tables below present financial results for the three and six months ended September 30, 2024 and 2023.

LiveOne ,

Inc.

Consolidated Statements of Operations (Unaudited)

(In thousands, except share and per share amounts)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

$ | 32,594 | | |

$ | 28,528 | | |

$ | 65,672 | | |

$ | 56,295 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 24,518 | | |

| 20,547 | | |

| 49,605 | | |

| 39,748 | |

| Sales and marketing | |

| 1,491 | | |

| 2,253 | | |

| 2,922 | | |

| 4,157 | |

| Product development | |

| 1,160 | | |

| 1,439 | | |

| 2,231 | | |

| 2,685 | |

| General and administrative | |

| 6,283 | | |

| 6,352 | | |

| 11,790 | | |

| 11,760 | |

| Impairment of intangible assets | |

| — | | |

| — | | |

| 176 | | |

| — | |

| Amortization of intangible assets | |

| 542 | | |

| 452 | | |

| 1,134 | | |

| 699 | |

| Total operating expenses | |

| 33,994 | | |

| 31,043 | | |

| 67,858 | | |

| 59,049 | |

| Loss from operations | |

| (1,400 | ) | |

| (2,515 | ) | |

| (2,186 | ) | |

| (2,754 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (808 | ) | |

| (780 | ) | |

| (1,667 | ) | |

| (2,198 | ) |

| Other income (expense) | |

| (118 | ) | |

| (4,653 | ) | |

| 18 | | |

| (3,412 | ) |

| Total other expense, net | |

| (926 | ) | |

| (5,433 | ) | |

| (1,649 | ) | |

| (5,610 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before provision (benefit) for income taxes | |

| (2,326 | ) | |

| (7,948 | ) | |

| (3,835 | ) | |

| (8,364 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision (benefit) for income taxes | |

| (9 | ) | |

| (21 | ) | |

| 40 | | |

| 58 | |

| Net loss | |

| (2,317 | ) | |

| (7,927 | ) | |

| (3,875 | ) | |

| (8,422 | ) |

| Net loss attributable to non-controlling interest | |

| (458 | ) | |

| (347 | ) | |

| (846 | ) | |

| (347 | ) |

| Net loss attributed to LiveOne | |

$ | (1,859 | ) | |

$ | (7,580 | ) | |

$ | (3,029 | ) | |

$ | (8,075 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share – basic and diluted | |

$ | (0.02 | ) | |

$ | (0.09 | ) | |

$ | (0.04 | ) | |

$ | (0.11 | ) |

| Weighted average common shares – basic and diluted | |

| 94,658,182 | | |

| 87,222,168 | | |

| 94,605,055 | | |

| 87,097,201 | |

LiveOne ,

Inc.

Consolidated Balance Sheets (Unaudited)

(In thousands)

| | |

September 30, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| | |

| | |

| |

| Assets | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 11,053 | | |

$ | 6,987 | |

| Restricted cash | |

| 30 | | |

| 155 | |

| Accounts receivable, net | |

| 14,079 | | |

| 13,205 | |

| Inventories | |

| 1,675 | | |

| 2,187 | |

| Prepaid expense and other current assets | |

| 2,138 | | |

| 1,801 | |

| Total Current Assets | |

| 28,975 | | |

| 24,335 | |

| Property and equipment, net | |

| 3,749 | | |

| 3,646 | |

| Goodwill | |

| 23,379 | | |

| 23,379 | |

| Intangible assets, net | |

| 10,986 | | |

| 12,415 | |

| Other assets | |

| 854 | | |

| 88 | |

| Total Assets | |

$ | 67,943 | | |

$ | 63,863 | |

| | |

| | | |

| | |

| Liabilities, Mezzanine Equity and Stockholders’ Equity (Deficit) | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 29,575 | | |

$ | 26,953 | |

| Accrued royalties | |

| 13,358 | | |

| 10,862 | |

| Notes payable, current portion | |

| 690 | | |

| 692 | |

| Deferred revenue | |

| 649 | | |

| 728 | |

| Senior secured line of credit | |

| 7,000 | | |

| 7,000 | |

| Derivative liabilities | |

| — | | |

| 607 | |

| Total Current Liabilities | |

| 51,272 | | |

| 46,842 | |

| Notes payable, net | |

| 431 | | |

| 771 | |

| Other long-term liabilities | |

| 9,317 | | |

| 9,354 | |

| Deferred income taxes | |

| 339 | | |

| 339 | |

| Total Liabilities | |

| 61,359 | | |

| 57,306 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine Equity | |

| | | |

| | |

| Redeemable convertible preferred stock, $0.001 par value; 100,000 shares authorized; none and 5,000 shares issued and outstanding as of September 30, 2024 and March 31, 2024, respectively | |

| — | | |

| 4,962 | |

| Stockholders’ Equity (Deficit) | |

| | | |

| | |

| Preferred stock, $0.001 par value; 10,000,000 shares authorized; 13,187 and 18,814 shares issued and outstanding as of September 30, 2024 and March 31, 2024, respectively | |

| 13,187 | | |

| 18,814 | |

| Common stock, $0.001 par value; 500,000,000 shares authorized; 94,578,077 and 88,627,420 shares issued and outstanding as of September 30, 2024 and December 31, 2024, net of treasury shares, respectively | |

| 95 | | |

| 92 | |

| Additional paid in capital | |

| 230,933 | | |

| 216,116 | |

| Treasury stock | |

| (250 | ) | |

| (4,782 | ) |

| Accumulated deficit | |

| (248,623 | ) | |

| (238,984 | ) |

| Total LiveOne's Stockholders’ Deficit | |

| (4,658 | ) | |

| (8,744 | ) |

| Non-controlling interest | |

| 11,242 | | |

| 10,339 | |

| Total equity (deficit) | |

| 6,584 | | |

| 1,595 | |

| Total Liabilities, Mezzanine Equity and Stockholders’ Equity (Deficit) | |

$ | 67,943 | | |

$ | 63,863 | |

LiveOne ,

Inc.

Reconciliation of Non-GAAP Measure to GAAP Measure

Adjusted EBITDA* Reconciliation (Unaudited)

(In thousands)

| | |

| | |

| | |

| | |

Non- | | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

Recurring | | |

| | |

| | |

| |

| | |

Net | | |

Depreciation | | |

| | |

Acquisition and | | |

Other | | |

(Benefit) | | |

| |

| | |

Income | | |

and | | |

Stock-Based | | |

Realignment | | |

(Income) | | |

Provision | | |

Adjusted | |

| | |

(Loss) | | |

Amortization | | |

Compensation | | |

Costs (1) | | |

Expense (2) | | |

for Taxes | | |

EBITDA* | |

| Three Months Ended September 30, 2024 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Operations – PodcastOne | |

$ | (1,669 | ) | |

$ | 394 | | |

$ | 861 | | |

$ | - | | |

$ | - | | |

$ | 11 | | |

$ | (403 | ) |

| Operations – Slacker | |

| 3,866 | | |

| 743 | | |

| 526 | | |

| 30 | | |

| 642 | | |

| - | | |

| 5,807 | |

| Operations – Media | |

| (1,687 | ) | |

| 214 | | |

| 198 | | |

| 404 | | |

| 30 | | |

| - | | |

| (841 | ) |

| Corporate | |

| (2,827 | ) | |

| 2 | | |

| 706 | | |

| 207 | | |

| 254 | | |

| (20 | ) | |

| (1,678 | ) |

| Total | |

$ | (2,317 | ) | |

$ | 1,353 | | |

$ | 2,291 | | |

$ | 641 | | |

$ | 926 | | |

$ | (9 | ) | |

$ | 2,885 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Three Months Ended September 30, 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operations – PodcastOne | |

$ | (10,873 | ) | |

$ | 253 | | |

$ | 854 | | |

$ | 413 | | |

$ | 9,447 | | |

$ | - | | |

$ | 94 | |

| Operations – Slacker | |

| 2,250 | | |

| 694 | | |

| 998 | | |

| 742 | | |

| 354 | | |

| - | | |

| 5,038 | |

| Operations – Media | |

| 3,168 | | |

| 294 | | |

| 178 | | |

| 107 | | |

| (4,308 | ) | |

| - | | |

| (561 | ) |

| Corporate | |

| (2,472 | ) | |

| 3 | | |

| 686 | | |

| 78 | | |

| (60 | ) | |

| (21 | ) | |

| (1,786 | ) |

| Total | |

$ | (7,927 | ) | |

$ | 1,244 | | |

$ | 2,716 | | |

$ | 1,340 | | |

$ | 5,433 | | |

$ | (21 | ) | |

$ | 2,785 | |

| | |

| | |

| | |

| | |

Non- | | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

Recurring | | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

Acquisition | | |

| | |

| | |

| |

| | |

Net Income | | |

Depreciation and | | |

Stock-Based | | |

and

Realignment | | |

Other

(Income) | | |

(Benefit)

Provision | | |

Adjusted | |

| | |

(Loss) | | |

Amortization | | |

Compensation | | |

Costs (1) | | |

Expense (2) | | |

for Taxes | | |

EBITDA* | |

| Six Months Ended September 30, 2024 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Operations – PodcastOne | |

$ | (3,036 | ) | |

$ | 1,013 | | |

$ | 1,254 | | |

$ | 38 | | |

$ | - | | |

$ | 11 | | |

$ | (720 | ) |

| Operations – Slacker | |

| 7,218 | | |

| 1,493 | | |

| 1,032 | | |

| 176 | | |

| 1,313 | | |

| - | | |

| 11,231 | |

| Operations - Media | |

| (3,077 | ) | |

| 431 | | |

| 517 | | |

| 600 | | |

| 60 | | |

| - | | |

| (1,469 | ) |

| Corporate | |

| (4,980 | ) | |

| 3 | | |

| 1,188 | | |

| 229 | | |

| 276 | | |

| 29 | | |

| (3,254 | ) |

| Total | |

$ | (3,875 | ) | |

$ | 2,940 | | |

$ | 3,991 | | |

$ | 1,043 | | |

$ | 1,649 | | |

$ | 40 | | |

$ | 5,788 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Six Months Ended September 30, 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operations – PodcastOne | |

$ | (11,083 | ) | |

$ | 339 | | |

$ | 938 | | |

$ | 719 | | |

$ | 9,850 | | |

$ | - | | |

$ | 763 | |

| Operations – Slacker | |

| 5,831 | | |

| 1,408 | | |

| 1,214 | | |

| 874 | | |

| 102 | | |

| - | | |

| 9,429 | |

| Operations - Media | |

| 2,392 | | |

| 543 | | |

| 213 | | |

| 133 | | |

| (4,952 | ) | |

| - | | |

| (1,671 | ) |

| Corporate | |

| (5,562 | ) | |

| 8 | | |

| 1,229 | | |

| 130 | | |

| 610 | | |

| 58 | | |

| (3,527 | ) |

| Total | |

$ | (8,422 | ) | |

$ | 2,298 | | |

$ | 3,594 | | |

$ | 1,856 | | |

$ | 5,610 | | |

$ | 58 | | |

$ | 4,994 | |

| (1) | Non-Recurring

Acquisition and Realignment Costs include non-cash GAAP purchase accounting adjustments for certain deferred revenue and costs, legal,

accounting and other professional fees directly attributable to acquisition activity, employee severance payments and third party professional

fees directly attributable to acquisition or corporate realignment activities, and certain non-recurring expenses associated with legal

settlements or reserves for legal settlements in the period that pertain to historical matters that existed at acquired companies prior

to their purchase date |

| (2) | Other

(income) expense above primarily includes interest expense and change in fair value of derivative liabilities. These are included in

the statement of operations in other income (expense) and are an add back to net loss above in the reconciliation of Adjusted EBITDA*

to loss. |

| * |

See the

definition of Adjusted EBITDA under “About Non-GAAP Financial Measures” within this release. |

LiveOne ,

Inc.

Reconciliation of Non-GAAP Measure to GAAP Measure

Contribution Margin* Reconciliation (Unaudited)

(In thousands)

| | |

Three Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue: | |

$ | 32,594 | | |

$ | 28,528 | |

| Less: | |

| | | |

| | |

| Cost of sales | |

| (24,518 | ) | |

| (20,547 | ) |

| Amortization of developed technology | |

| (691 | ) | |

| (726 | ) |

| Gross Profit | |

| 7,385 | | |

| 7,255 | |

| | |

| | | |

| | |

| Add back amortization of developed technology: | |

| 691 | | |

| 726 | |

| Contribution Margin* | |

$ | 8,076 | | |

$ | 7,981 | |

| | |

Six Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue: | |

$ | 65,672 | | |

$ | 56,295 | |

| Less: | |

| | | |

| | |

| Cost of sales | |

| (49,605 | ) | |

| (39,748 | ) |

| Amortization of developed technology | |

| (1,466 | ) | |

| (1,473 | ) |

| Gross Profit | |

| 14,601 | | |

| 15,074 | |

| | |

| | | |

| | |

| Add back amortization of developed technology: | |

| 1,466 | | |

| 1,473 | |

| Contribution Margin* | |

$ | 16,067 | | |

$ | 16,547 | |

| * |

See the

definition of Contribution Margin under “About Non-GAAP Financial Measures” within this release. |

8

Exhibit

99.2

LiveOne

(NASDAQ:LVO) to Announce Second Quarter Fiscal Year 2025 Financial Results and Host Investor Webcast on

Thursday November 7, 2024

-

Investor Webcast on Thursday, November 7, 2024 at 10:00am ET / 7:00am PT

LOS

ANGELES, Oct. 23, 2024 -- LiveOne (Nasdaq: LVO), a leading digital media company, plans to announce its operating and financial results

for its second quarter fiscal year 2025 ended September 30, 2024 on Thursday, November 7, 2024.

LiveOne’s

senior management will host a live conference call and audio webcast to provide a business update and discuss its operating and financial

results beginning at 10:00 am ET / 7:00 am PT on Thursday, November 7, 2024.

***PARTICIPANT

DIAL INS***

Participants

call one of the allocated dial-in numbers (below) and advise the Operator of either the Conference ID 6175953 or Conference

Name. If the client has selected Approved Participant List, these Participants will be prioritized &/or authorized to participate

in Q&A.

USA

/ International Toll +1 (646) 307-1963

USA

- Toll-Free (800) 715-9871

Canada

- Toronto (647) 932-3411

Canada

- Toll-Free (800) 715-9871

***WEBCAST

DETAILS***

Event

Title: LiveOne (LVO) Earnings Call

Event

Date: November 7, 2024 07:00 AM (GMT-08:00) Pacific Time (US and Canada)

Attendee

URL: https://events.q4inc.com/attendee/678575326

Conference

Call Replay

An

audio recording of the Event will be available via the Echo Replay platform.

To

access the platform by phone, please dial-in using one of the numbers listed below and input Playback ID: 6175953 followed by

# key:

US

& Canada Toll-Free:+1(800) 770-2030

US

Toll:+1(609) 800-9909

Echo

Replay will expire on Saturday, 7th December 2024 11:59 PM PST

About

LiveOne

Headquartered

in Los Angeles, CA, LiveOne (Nasdaq: LVO) is an award-winning, creator-first, music, entertainment, and technology platform focused

on delivering premium experiences and content worldwide through memberships and live and virtual events. LiveOne’s subsidiaries include

Slacker Radio, PodcastOne (Nasdaq: PODC), PPVOne, CPS, LiveXLive, DayOne Music Publishing, Drumify and Splitmind. LiveOne is available

on iOS, Android, Roku, Apple TV, Spotify, Samsung, Amazon Fire, Android TV, and through STIRR’s OTT applications. For more information,

visit liveone.com and follow us on Facebook, Instagram, TikTok, YouTube and Twitter at @liveone. For more investor information,

please visit ir.liveone.com.

Forward-Looking

Statements

All

statements other than statements of historical facts contained in this press release are “forward-looking statements,” which

may often, but not always, be identified by the use of such words as “may,” “might,” “will,” “will

likely result,” “would,” “should,” “estimate,” “plan,” “project,” “forecast,”

“intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,”

“target” or the negative of such terms or other similar expressions. These statements involve known and unknown risks, uncertainties

and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by

such statements, including: LiveOne’s reliance on one key customer for a substantial percentage of its revenue; LiveOne’s

and PodcastOne’s ability to consummate any proposed financing, acquisition, spin-out, special dividend, merger, distribution or

transaction, including the spin-out of LiveOne’s pay-per-view business, the timing of the consummation of any such proposed event,

including the risks that a condition to the consummation of any such event would not be satisfied within the expected timeframe or at

all, or that the consummation of any proposed financing, acquisition, spin-out, merger, special dividend, distribution or transaction

will not occur or whether any such event will enhance shareholder value; PodcastOne’s ability to continue as a going concern; PodcastOne’s

ability to attract, maintain and increase the number of its listeners; PodcastOne identifying, acquiring, securing and developing content;

LiveOne’s intent to repurchase shares of its and/or PodcastOne’s common stock from time to time under LiveOne’s announced

stock repurchase program and the timing, price, and quantity of repurchases, if any, under the program; LiveOne’s ability to maintain

compliance with certain financial and other covenants; PodcastOne successfully implementing its growth strategy, including relating to

its technology platforms and applications; management’s relationships with industry stakeholders; uncertain and unfavorable outcomes

in legal proceedings; changes in economic conditions; competition; risks and uncertainties applicable to the businesses of LiveOne and/or

its other subsidiaries; and other risks, uncertainties and factors including, but not limited to, those described in PodcastOne’s

Annual Report on Form 10-K for the fiscal year ended March 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”)

on July 1, 2024, and in PodcastOne’s other filings and submissions with the SEC. These forward-looking statements speak only as

of the date hereof, and PodcastOne disclaims any obligation to update these statements, except as may be required by law. PodcastOne

intends that all forward-looking statements be subject to the safe-harbor provisions of the Private Securities Litigation Reform Act

of 1995.

LiveOne

IR Contact:

Liviakis Financial Communications, Inc.

(415) 389-4670

john@liviakis.com

LiveOne

Press Contact:

LiveOne

press@liveone.com

Follow

LiveOne on social media: Facebook, Instagram, TikTok, YouTube, and Twitter at @liveone.

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

001-38249

|

| Entity Registrant Name |

LIVEONE, INC.

|

| Entity Central Index Key |

0001491419

|

| Entity Tax Identification Number |

98-0657263

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

269 South Beverly Drive

|

| Entity Address, Address Line Two |

Suite 1450

|

| Entity Address, City or Town |

Beverly Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90212

|

| City Area Code |

(310)

|

| Local Phone Number |

601-2505

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

LVO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

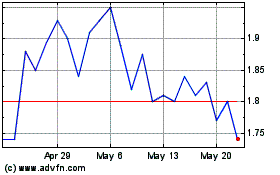

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Jan 2025 to Feb 2025

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Feb 2024 to Feb 2025