Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

23 January 2023 - 10:02PM

Edgar (US Regulatory)

0001816319

false

--03-31

2023-01-20

0001816319

2023-01-20

2023-01-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January 2023

Commission File Number 001-41418

Lytus Technologies Holdings PTV. Ltd.

(Translation of registrant’s name into English)

Business Center 1, M Floor

The Meydan Hotel

Nad Al Sheba, Dubai, UAE

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Entry into a Material Definitive Agreement

On

December 11, 2022, Lytus Technologies Holdings PTV. Ltd. (the “Company”) entered into, and on January 17, 2023, the

Company’s board of directors (the “Board”) approved, a Modification Agreement (the “Modification Agreement”)

by and between the Company and Reachnet Cable Services Pvt. Ltd. (“Reachnet”), which Modification Agreement modifies

the Agreement to Acquire Customer List previously entered into by the Company and Reachnet on June 20, 2019, as subsequently amended.

The Board decided to enter into the Modification Agreement based on its analysis of a technology readiness of Reachnet conducted to obtain

an estimate of the additional investment that would be required to proceed with the Reachnet Agreement. Pursuant to the Modification Agreement,

the Company and Reachnet have agreed that the Company will acquire 1 million of Reachnet’s subscribers, as well as Reachnet’s

core business assets that are needed to serve those 1 million subscribers. The previous agreement between the Company and Reachnet provided

that the Company would acquire approximately 1.8 million of Reachnet’s customers for $58.29 million; under the Modification Agreement,

the Company will instead acquire one million of Reachnet’s customers for consideration of $11.5 million.

In connection with the Modification

Agreement, on December 12, 2022, the Company and Reachnet entered into, and on January 17, 2023 the Board approved, a Deed of Assignment

(the “Deed of Assignment”), pursuant to which Reachnet assigned its interest in the Agreement for Acquisition dated

August 11, 2022, by and between Reachnet and Sri Sai Cable and Broad Band Private Limited (“Sri Sai” and such agreement,

the “Sri Sai Agreement”), to the Company. Pursuant to such arrangement, as modified, the Company has been assigned 1 million subscribers

and a 51% equity interest in Sri Sai. The Company has assumed Reachnet’s payment obligations under the Sri Sai Agreement, which total

$10 million, which consists of:

| ● | $1

million has been paid to date to the shareholders of Sri Sai, as partial payment for the Company’s 51% equity interest in Sri Sai; |

| ● | $1.5

million is payable by January 31, 2023 to the shareholders of Sri Sai, for the remaining amount due to the shareholders of Sri Sai for

the Company’s 51% equity interest in Sri Sai; |

| ● | $7.5

million is payable, in accordance with the terms of the original agreement between Reachnet and Sri Sai, which is included as exhibit

10.3 hereto, as capital infusion for capital expenditures, in the form of convertible debentures to be issued by Sri Sai; and |

The remaining consideration

of $1.5 million will be retained by the Company as “reserved and payable” to Reachnet for 0.1 million additional subscribers,

along with core operating assets.

The

foregoing description of the Modification Agreement, the Deed of Assignment and the Sri Sai Agreement does not purport to be a complete

description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the full text of

such agreements, copies of which are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively.

Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 19, 2023, the Board accepted

the resignation of Mr. Jagjit Singh Kohli, a member of the Board, in accordance with India law, from the Board. Mr. Kohli will continue

to serve as the Chief Executive Officer of Lytus Technologies Private Limited, the Company’s wholly-owned subsidiary. Mr. Kohli

has expressed his inability to act as a director due to personal reasons. Mr. Kohli’s resignation was not a result of any disagreement

with the Company on any matter relating to the Company’s operations, policies or practices. Mr. Kohli did not serve as a member

of any of the Board’s committees. As permitted by India law, Mr. Kohli’s resignation will be effective retroactively as of

January 11, 2023.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: January 20, 2023

|

|

Lytus Technologies Holdings PTV. Ltd. |

| |

|

| |

By: |

/s/ Dharmesh Pandya |

| |

|

Name: |

Dharmesh Pandya |

| |

|

Title: |

Chief Executive Officer |

2

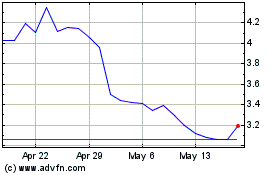

Lytus Technologies Holdi... (NASDAQ:LYT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lytus Technologies Holdi... (NASDAQ:LYT)

Historical Stock Chart

From Jan 2024 to Jan 2025