Moringa Acquisition Corp (Nasdaq: MACA) (“

Moringa”

or the “

Company”) announced today that, in

connection with its previously announced extraordinary general

meeting in lieu of the 2023 annual general meeting of shareholders

of the Company to be held at 9:00 a.m. Eastern Time/4:00 p.m. local

(Israel) time on August 16, 2023 (the

“

Extraordinary Meeting”) for the

purpose of considering and voting on, among other proposals, a

proposal to extend the date by which the Company must consummate an

initial business combination (the “

Extension”)

from August 19, 2023 (the “

Current

Termination Date”) to August 19, 2024 or such

earlier date as may be determined by the Company’s board of

directors, in its sole discretion (such new termination date, the

“

Extension Date”), the Company’s

sponsor, Moringa Sponsor, L.P., and/or its wholly-owned subsidiary

Moringa Sponsor (US) L.P. (collectively, the

“

Sponsor”), or the Sponsor’s designees, will make

additional contributions to the Company’s trust account following

the approval and implementation of the Extension.

If the requisite shareholder proposals are approved at the

Extraordinary Meeting and the Extension is implemented, the Sponsor

or its designees will deposit into the Company’s trust account as a

loan (a “Contribution”, and the Sponsor or its

designee making such Contribution, a

“Contributor”), on the Current Termination Date,

and the 19th day of each subsequent calendar month until, but

excluding, the Extension Date, the lesser of (x) $15,000 and (y)

$0.025 per public share multiplied by the number of public shares

outstanding on such applicable date (each date on which a

Contribution is to be deposited into the trust account, a

“Contribution Date”).

The Company has not asked the Sponsor to reserve for, nor has

the Company independently verified whether the Sponsor will have

sufficient funds to satisfy, any such Contributions. If a

Contributor fails to make a Contribution by an applicable

Contribution Date, the Company will liquidate and dissolve as soon

as practicable after such date and in accordance with the Company’s

Amended and Restated Memorandum and Articles of Association, as

amended. The Contributions will be evidenced by a non-interest

bearing, unsecured promissory note and will be repayable by the

Company upon consummation of an initial business combination. If

the Company does not consummate an initial business combination by

the Extension Date, any such promissory notes will be repaid only

from funds held outside of the trust account or will be forfeited,

eliminated or otherwise forgiven. Any Contribution is conditioned

on the approval of the requisite shareholder proposals at the

Extraordinary Meeting and the implementation of the Extension. No

Contribution will occur if such proposals are not approved or the

Extension is not implemented. If the Company has consummated an

initial business combination or announced its intention to commence

winding up prior to any Contribution Date, any obligation to make

Contributions will terminate.

The Company expects that the proceeds held in the trust account

will continue to be invested in United States government treasury

bills with a maturity of 185 days or less or in money market funds

investing solely in U.S. Treasuries and meeting certain conditions

under Rule 2a-7 under the Investment Company Act of 1940, as

amended, as determined by the Company, or in an interest bearing

demand deposit account, until the earlier of: (i) the completion of

the Company’s initial business combination, or (ii) the

liquidation, and distribution of the proceeds from, the trust

account.

Further information related to attendance, voting and the

proposals to be considered and voted on at the Extraordinary

Meeting is described in the definitive proxy statement related to

the Extraordinary Meeting filed by the Company with the Securities

and Exchange Commission (the “SEC”) on July 26,

2023 (the “Definitive Proxy Statement”), as

supplemented by Moringa’s supplemental notification regarding the

Extraordinary Meeting filed with the SEC under cover of Schedule

14A on August 10, 2023 (the “Supplement”).

About Moringa Acquisition

Corp

Moringa Acquisition Corp is a blank check company formed for the

purpose of effecting a merger, amalgamation, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination with one or more businesses. The Company is led by Ilan

Levin, Chairman and CEO of the Company, and Gil Maman, Chief

Financial Officer of the Company.

Forward Looking Statements

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Certain of these

forward-looking statements can be identified by the use of words

such as “believes,” “expects,” “intends,” “plans,” “estimates,”

“assumes,” “may,” “should,” “will,” “seeks,” or other similar

expressions. Such statements may include, but are not limited to,

statements regarding the approval of certain shareholder proposals

at the Extraordinary Meeting, the implementation of the Extension

or any Contributions to the trust account. These statements are

based on current expectations on the date of this press release and

involve a number of risks and uncertainties that may cause actual

results to differ significantly, including those risks set forth in

the Definitive Proxy Statement, the Company’s most recent Annual

Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q

and other documents filed with the SEC. Copies of such filings are

available on the SEC’s website at www.sec.gov. The Company does not

assume any obligation to update or revise any such forward-looking

statements, whether as the result of new developments or otherwise.

Readers are cautioned not to put undue reliance on forward-looking

statements.

Additional Information and Where to Find

It

The Definitive Proxy Statement has been mailed to the Company’s

shareholders of record as of the record date for the Extraordinary

Meeting. Investors and security holders of the Company are advised

to read the Definitive Proxy Statement, as supplemented by the

Supplement, because it contains important information about the

Extraordinary Meeting and the Company. Investors and security

holders of the Company may also obtain a copy of the Definitive

Proxy Statement, as well as other relevant documents that have been

or will be filed by the Company with the SEC, without charge and

once available, at the SEC’s website at www.sec.gov or by directing

a request to: Advantage Proxy, Inc., P.O. Box 13581, Des Moines, WA

98198; Telephone—Toll Free: (877) 870-8565; Collect: (206)

870-8565; Email: ksmith@advantageproxy.com.

Participants in the

Solicitation

The Company and certain of its directors and executive officers

and other persons may be deemed to be participants in the

solicitation of proxies from the Company’s shareholders in respect

of the proposals to be considered and voted on at the Extraordinary

Meeting. Information concerning the interests of the directors and

executive officers of the Company is set forth in the Definitive

Proxy Statement, which may be obtained free of charge from the

sources indicated above.

Contacts

Gil Maman, Moringa Acquisition

Corp– gil@moringaac.com

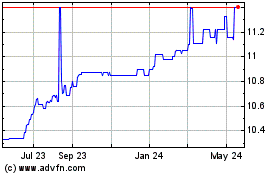

Moringa Acquisition (NASDAQ:MACA)

Historical Stock Chart

From Oct 2024 to Nov 2024

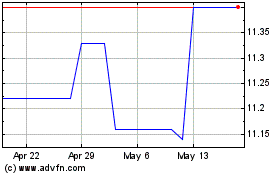

Moringa Acquisition (NASDAQ:MACA)

Historical Stock Chart

From Nov 2023 to Nov 2024