0001779474FALSE00017794742024-08-022024-08-020001779474us-gaap:CommonClassAMember2024-08-022024-08-020001779474us-gaap:WarrantMember2024-08-022024-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 2, 2024

WM TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39021 | 98-1605615 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

41 Discovery Irvine, California | | 92618 |

| (Address of principal executive offices) | | (Zip Code) |

(844) 933-3627

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | MAPS | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | MAPSW | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 8, 2024, WM Technology, Inc. (the "Company") announced its financial results for the second quarter ended June 30, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference.

The information in Item 2.02 and in the accompanying Exhibit 99.1 is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Director Resignation

On August 2, 2024, Fiona Tan notified WM Technology, Inc. (the “Company”) of her decision to resign as a member of the Company’s board of directors (the “Board”), the Nominating and Corporate Governance Committee of the Board and the Technology Committee of the Board, of which she was the Chairperson, effective September 30, 2024. Ms. Tan’s decision was not based on any disagreement with the Company or on any matter relating to the Company’s operations, policies or practices.

Chief Technology Officer Separation Agreement

As previously reported in the Current Report on Form 8-K filed on July 23, 2024, on July 17, 2024, Duncan Grazier, the Chief Technology Officer of the Company, tendered his resignation from his role as Chief Technology Officer, effective July 31, 2024.

On August 7, 2024, Mr. Grazier and the Company entered into a Separation and Release Agreement (the “Separation Agreement”), providing for the terms of Mr. Grazier’s separation from employment with the Company. Under the Separation Agreement, Mr. Grazier will remain employed with the Company on an “at-will” basis with the title of Special Advisor, assisting the Company in the transition of the Chief Technology Officer role through October 31, 2024. In addition, under the Separation Agreement, the Company has agreed to provide Mr. Grazier with the following separation payments and benefits in lieu of any payments or benefits he may otherwise have been entitled to under the terms of his employment agreement: an amount equal to the equivalent of nine months base salary plus 75% of his 2024 target bonus, less any applicable taxes, deductions and withholdings; nine months of paid COBRA premiums (which cease in the event of new coverage with a subsequent employer); and vesting acceleration of 66,086 restricted stock units. The Separation Agreement contains a release of claims, subject to customary exceptions.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the Separation Agreement, a copy of which will be filed with the Securities and Exchange Commission in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: August 8, 2024 | | |

| | | |

| | | |

| | WM TECHNOLOGY, INC. |

| | | |

| | By: | /s/ Susan Echard |

| | | Susan Echard |

| | | Interim Chief Financial Officer |

| | | |

Exhibit 99.1

WM Technology, Inc. Reports Financial Results

For Second Quarter 2024

The Company Reported Net Revenues of $45.9 million, Net Income of $1.2 million, Adjusted EBITDA of $10.1 million, and Cash of $41.3 million

Irvine, Calif.--(BUSINESS WIRE)--August 8, 2024-- WM Technology, Inc. (“WM Technology” or the “Company”) (Nasdaq: MAPS), a leading technology and software infrastructure provider to the cannabis industry, today announced its financial results for the second quarter ended June 30, 2024.

“We are extremely pleased with our accomplishments this quarter, which reflect the hard work and dedication of our entire team,” said Doug Francis, Executive Chair of WM Technology. “Through our commitment to operational discipline, we have strengthened our financial position, enabling us to invest and build for the future. I am excited about the initiatives we have underway and believe our efforts will position us to capitalize on future opportunities as this industry continues to evolve.”

“Our second quarter profitability and ending cash balance are a result of our continued focus to streamline operational processes and manage client collections,” said Susan Echard, Interim CFO of WM Technology. “I’ve had the opportunity to work closely with all teams across the organization, and I’m impressed by the strong foundation that’s been built and the potential that lies ahead. I look forward to supporting the team’s mission and helping drive the company forward in this dynamic industry.”

Second Quarter 2024 Financial Highlights

•Net revenues for the second quarter ended June 30, 2024 were $45.9 million as compared to $48.4 million in the second quarter of 2023, representing a decline of 5% compared to the prior year period due to our clients continuing to face constrained marketing budgets, the ongoing price deflation in and consolidation of our industry, and the impact on revenue related to the sunset of certain products in the fourth quarter of 2023.

◦Average monthly paying clients(1) of 5,045, was down from 5,609 from the prior year period, largely due to the removal of paying clients from our platform who have become delinquent, the impact on client count related to the sunset of the aforementioned products, as well as expected client churn due to continued industry challenges, such as price deflation and ongoing consolidation.

◦Average monthly net revenues per paying client(2) increased to $3,033 from $2,878 in the prior year period, due to churn of lower paying clients, including the clients using the aforementioned sunset products, which typically had a lower average selling price.

•Net income was $1.2 million as compared to $2.0 million in the prior year period.

•Adjusted EBITDA(3) decreased to $10.1 million from $10.2 million from the prior year period.

•Total shares outstanding across Class A and Class V Common Stock were 152.4 million as of June 30, 2024.

•Cash increased to $41.3 million as of June 30, 2024, as compared to $34.4 million as of December 31, 2023.

Reconciliations of GAAP to non-GAAP financial measures have been provided in the tables included in this release.

______________________________

(1)Average monthly paying clients are defined as the average of the number of paying clients billed in a month across a particular period (and for which services were provided).

(2)Average monthly net revenues per paying client is defined as the average monthly net revenues for any particular period divided by the average monthly paying clients in the same respective period. Average monthly net revenues per paying client is calculated in the same manner as our previously-reported

“average monthly revenue per paying client,” and the description of the metric is being updated solely to clarify that it is calculated using net revenues. Average monthly net revenues per paying client has been retrospectively adjusted to reflect the restatement of previously reported net revenues.

(3)For further information about how we calculate EBITDA and Adjusted EBITDA as well as limitations of their use and a reconciliation of EBITDA and Adjusted EBITDA to net income (loss), see “Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA” below.

Restatement of Previously Reported 2023 Quarterly Net Revenues and Credit Losses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2023 | | Six Months Ended

June 30, 2023 |

| Previously Reported | | Adjustment | | As Restated | | Previously Reported | | Adjustment | | As Restated |

| Net revenues | $ | 50,852 | | | $ | (2,429) | | | $ | 48,423 | | | $ | 98,859 | | | $ | (4,020) | | | $ | 94,839 | |

| General and administrative expenses | $ | 19,208 | | | $ | (2,429) | | | $ | 16,779 | | | $ | 41,708 | | | $ | (4,020) | | | $ | 37,688 | |

| Total costs and expenses | $ | 47,069 | | | $ | (2,429) | | | $ | 44,640 | | | $ | 99,224 | | | $ | (4,020) | | | $ | 95,204 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, 2023 | | |

| Previously Reported | | Adjustment | | As Restated | | | | | | |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | | | | | | | | | | | |

| Provision for credit losses | $ | 3,605 | | | $ | (4,020) | | | $ | (415) | | | | | | | |

| | | | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | | | |

| Accounts receivable | $ | (1,138) | | | $ | 4,020 | | | $ | 2,882 | | | | | | | |

Business Outlook

Based on information available as of August 8, 2024, WM Technology is issuing guidance for the third quarter of 2024 as follows:

•Net revenues are estimated to be approximately $44 million.

•Non-GAAP Adjusted EBITDA(3) is estimated to be approximately $7 million.

The guidance provided above is only an estimate of what we believe is realizable as of the date of this release. We are not readily able to provide a reconciliation of projected Non-GAAP Adjusted EBITDA to projected net income (loss) without unreasonable effort. This guidance assumes that no business acquisitions, investments, restructurings, or legal settlements are concluded in the period. Our results are based on assumptions that we believe to be reasonable as of this date, but may be materially affected by many factors, as discussed below in “Forward-Looking Statements.” Actual results may vary from the guidance and the variations may be material. We undertake no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.

Investor Conference Call and Webcasts

The Company will host a conference call and webcast today, Thursday, August 8, 2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) at https://edge.media-server.com/mmc/p/uyee5au8. A webcast replay will also be archived at ir.weedmaps.com.

The Company has used, and intends to continue to use, the investor relations portion of its website as a means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD.

About WM Technology

Founded in 2008, WM Technology operates Weedmaps, a leading cannabis marketplace for consumers, as well as a broad set of eCommerce and compliance software solutions for cannabis businesses and brands in U.S. state-legal markets. WM Technology holds a strong belief in the power of cannabis and the importance of enabling safe, legal access to consumers worldwide.

Over the past 15 years, the Weedmaps marketplace has become a premier destination for cannabis consumers to discover and browse cannabis-related products, access daily dispensary deals, order ahead for pick-up and delivery by participating retailers (where applicable) and learn about the plant. The Company also offers eCommerce-enablement tools designed to help cannabis retailers and brands reach consumers, create business efficiency, and manage industry-specific compliance needs.

The Company is committed to advocating for full U.S. legalization, industry-wide social equity, and continued education about the plant through key partnerships and cannabis subject matter experts.

Headquartered in Irvine, California, WM Technology supports remote and hybrid work for eligible employees. Visit us at www.weedmaps.com.

Forward-Looking Statements

This press release includes “forward-looking statements” regarding the Company’s future business expectations which involve risks and uncertainties. Forward looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including the Company’s financial and business performance, including key business metrics and any underlying assumptions thereunder; market opportunity and the Company’s ability to acquire new clients and retain existing clients; expectations and timing related to commercial product launches; success of the Company’s go-to-market strategy; the Company’s ability to scale its business and expand its offerings; the Company’s competitive advantages and growth strategies; the Company’s future capital requirements and sources and uses of cash; the Company’s ability to obtain funding for its future operations; the impact of the material weaknesses in the Company’s internal controls and ability to remediate these material weaknesses in the timing the Company anticipates, or at all; the outcome of any known and unknown litigation and regulatory proceedings; changes in domestic and foreign business, market, financial, political and legal conditions; the effect of macroeconomic conditions, including but not limited to inflation, uncertain credit and global financial markets, recent and potential future disruptions in access to bank deposits or lending commitments due to bank failures and geopolitical events, including the military conflicts between Russia and Ukraine and Israel and Hamas and occurrence of a catastrophic event, including but not limited to severe weather, war, or terrorist attack; future global, regional or local economic and market conditions affecting the cannabis industry; the development, effects and enforcement of and changes to laws and regulations, including with respect to the cannabis industry; the Company’s ability to successfully capitalize on new and existing cannabis markets, including its ability to successfully monetize its solutions in those markets; the Company’s ability to manage future growth; the Company’s ability to effectively anticipate and address changes in the end-user market in the cannabis industry; the Company’s ability to develop new products and solutions, bring them to market in a timely manner, and make enhancements to its platform; the Company’s ability to maintain and grow its two-sided marketplace, including its ability to acquire and retain paying clients; the effects of competition on the Company’s future business; the Company’s success in retaining or recruiting, or changes required in, officers, key employees or directors; cyber-attacks and security vulnerabilities; the possibility that the Company may be adversely affected by other economic, business or competitive and those factors discussed in the Company’s 2023 Annual Report on Form 10-K filed with the SEC on May 24, 2024 and subsequent Form 10-Qs or Form 8-Ks filed with the SEC. If any of these risks materialize or these assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as

representing the Company’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Use of Non-GAAP Financial Measures

Our financial statements, including net income (loss), are prepared in accordance with principles generally accepted in the United States of America (“GAAP”).

To provide investors with additional information regarding our financial results, we have disclosed EBITDA and Adjusted EBITDA, both of which are non-GAAP financial measures that we calculate as net income (loss) before interest, taxes and depreciation and amortization expense in the case of EBITDA and further adjusted to exclude stock-based compensation, change in fair value of warrant liability, transaction related bonus, legal settlements and other legal costs, reduction in force, asset impairment charges, change in TRA liability and other non-cash, unusual and/or infrequent costs in the case of Adjusted EBITDA. Below we have provided a reconciliation of net income (loss) (the most directly comparable GAAP financial measure) to EBITDA; and from EBITDA to Adjusted EBITDA.

We present EBITDA and Adjusted EBITDA because these metrics are key measures used by our management to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of investment capacity. Accordingly, we believe that EBITDA and Adjusted EBITDA provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management.

Each of EBITDA and Adjusted EBITDA has limitations as an analytical tool, and you should not consider any of these non-GAAP financial measures in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are as follows:

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; and

•EBITDA and Adjusted EBITDA do not reflect tax payments that may represent a reduction in cash available to us.

Because of these limitations, you should consider EBITDA and Adjusted EBITDA alongside other financial performance measures, including net income (loss), our GAAP expenses, and our other GAAP results.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except for share data)

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets | | | | |

| Cash | | $ | 41,292 | | | $ | 34,350 | |

| Accounts receivable, net | | 7,000 | | | 11,158 | |

| Prepaid expenses and other current assets | | 5,547 | | | 5,978 | |

| Total current assets | | 53,839 | | | 51,486 | |

| Property and equipment, net | | 25,909 | | | 24,255 | |

| Goodwill | | 68,368 | | | 68,368 | |

| Intangible assets, net | | 2,230 | | | 2,507 | |

| Right-of-use assets | | 13,064 | | | 15,629 | |

| | | | |

| Other assets | | 4,553 | | | 4,776 | |

| Total assets | | $ | 167,963 | | | $ | 167,021 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued expenses | | $ | 18,563 | | | $ | 21,182 | |

| Deferred revenue | | 5,844 | | | 5,918 | |

| Operating lease liabilities, current | | 4,471 | | | 6,493 | |

| Tax receivable agreement liability, current | | 1,455 | | | 122 | |

| | | | |

| Total current liabilities | | 30,333 | | | 33,715 | |

| Operating lease liabilities, non-current | | 24,632 | | | 26,550 | |

| Tax receivable agreement liability, non-current | | 1,123 | | | 1,634 | |

| Warrant liability | | 975 | | | 585 | |

| Other long-term liabilities | | 1,714 | | | 1,386 | |

| Total liabilities | | 58,777 | | | 63,870 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders’ equity | | | | |

| Preferred Stock - $0.0001 par value; 75,000,000 shares authorized; no shares issued and outstanding at June 30, 2024 and December 31, 2023 | | — | | | — | |

| Class A Common Stock - $0.0001 par value; 1,500,000,000 shares authorized; 96,948,250 shares issued and outstanding at June 30, 2024 and 94,383,053 shares issued and outstanding at December 31, 2023 | | 10 | | | 9 | |

| Class V Common Stock - $0.0001 par value; 500,000,000 shares authorized, 55,486,361 shares issued and outstanding at June 30, 2024 and December 31, 2023 | | 5 | | | 5 | |

| Additional paid-in capital | | 87,005 | | | 80,884 | |

| Accumulated deficit | | (62,562) | | | (64,518) | |

| Total WM Technology, Inc. stockholders’ equity | | 24,458 | | | 16,380 | |

| Noncontrolling interests | | 84,728 | | | 86,771 | |

| | | | |

| Total stockholders’ equity | | 109,186 | | | 103,151 | |

| Total liabilities and stockholders’ equity | | $ | 167,963 | | | $ | 167,021 | |

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except for share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 As Restated1 | | 2024 | | 2023 As Restated1 |

| Net revenues | $ | 45,903 | | | $ | 48,423 | | | $ | 90,292 | | | $ | 94,839 | |

| | | | | | | |

| Costs and expenses | | | | | | | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | 2,245 | | | 3,239 | | | 4,547 | | | 6,733 | |

| Sales and marketing | 11,069 | | | 12,567 | | | 20,703 | | | 24,627 | |

| Product development | 9,642 | | | 9,200 | | | 18,871 | | | 20,134 | |

| General and administrative | 18,529 | | | 16,779 | | | 35,055 | | | 37,688 | |

| Depreciation and amortization | 3,187 | | | 2,855 | | | 6,124 | | | 6,022 | |

| Total costs and expenses | 44,672 | | | 44,640 | | | 85,300 | | | 95,204 | |

| Operating income (loss) | 1,231 | | | 3,783 | | | 4,992 | | | (365) | |

| Other income (expenses), net | | | | | | | |

| Change in fair value of warrant liability | 460 | | | (1,045) | | | (390) | | | (320) | |

| Change in tax receivable agreement liability | (395) | | | (520) | | | (938) | | | (620) | |

| Other income (expense) | (60) | | | (235) | | | (460) | | | (681) | |

| Income (loss) before income taxes | 1,236 | | | 1,983 | | | 3,204 | | | (1,986) | |

| Provision for income taxes | 42 | | | — | | | 51 | | | — | |

| Net income (loss) | 1,194 | | | 1,983 | | | 3,153 | | | (1,986) | |

| Net income (loss) attributable to noncontrolling interests | 478 | | | 757 | | | 1,197 | | | (737) | |

| Net income (loss) attributable to WM Technology, Inc. | $ | 716 | | | $ | 1,226 | | | $ | 1,956 | | | $ | (1,249) | |

| | | | | | | |

| Class A Common Stock: | | | | | | | |

| Basic income (loss) per share | $ | 0.01 | | | $ | 0.01 | | | $ | 0.02 | | | $ | (0.01) | |

| Diluted income (loss) per share | $ | 0.01 | | | $ | 0.01 | | | $ | 0.02 | | | $ | (0.01) | |

| | | | | | | |

| Class A Common Stock: | | | | | | | |

| Weighted average basic shares outstanding | 95,342,596 | | | 92,851,349 | | | 95,023,380 | | | 92,589,011 | |

| Weighted average diluted shares outstanding | 97,275,700 | | | 93,622,582 | | | 96,647,173 | | | 92,589,011 | |

___________________________

1. For the three and six months ended June 30, 2023, net revenues and general and administrative expenses have been retrospectively adjusted to reflect the restatement of previously reported revenue and credit losses. See Note 2, “Summary of Significant Accounting Policies,” of Form 10-Q for the period ended June 30, 2024 filed with the SEC.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 As Restated1 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 3,153 | | | $ | (1,986) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 6,124 | | | 6,022 | |

| Change in fair value of warrant liability | 390 | | | 320 | |

| Change in tax receivable agreement liability | 938 | | | 620 | |

| Amortization of right-of-use lease assets | 2,385 | | | 2,423 | |

| Stock-based compensation | 5,571 | | | 8,092 | |

| Gain on lease termination | (109) | | | — | |

| Provision (benefit) for credit losses | (616) | | | (415) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 4,774 | | | 2,882 | |

| Prepaid expenses and other current assets | 328 | | | 1,623 | |

| Other assets | 123 | | | 41 | |

| Accounts payable and accrued expenses | 610 | | | (12,880) | |

| Deferred revenue | (74) | | | 406 | |

| Operating lease liabilities | (3,543) | | | (3,056) | |

| Net cash provided by operating activities | 20,054 | | | 4,092 | |

| | | |

| Cash flows from investing activities | | | |

| Capitalized software and expenditures | (7,140) | | | (5,806) | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (7,140) | | | (5,806) | |

| | | |

| Cash flows from financing activities | | | |

| Repayments of insurance premium financing | — | | | (1,450) | |

| Distributions | (5,950) | | | (1,002) | |

| Proceeds from repayment of related party note | 96 | | | 187 | |

| Tax receivable agreement payment | (116) | | | — | |

| Taxes paid related to net share settlement of equity awards | (2) | | | (1) | |

| Net cash used in financing activities | (5,972) | | | (2,266) | |

| | | |

| Net increase (decrease) in cash | 6,942 | | | (3,980) | |

| Cash – beginning of period | 34,350 | | | 28,583 | |

| Cash – end of period | $ | 41,292 | | | $ | 24,603 | |

___________________________

1. For the six months ended June 30, 2023, provision (benefit) for credit losses and change in accounts receivable have been retrospectively adjusted to reflect the restatement of previously reported revenue and credit losses. See Note 2, “Summary of Significant Accounting Policies,” of Form 10-Q for the period ended June 30, 2024 filed with the SEC.

WM TECHNOLOGY, INC. AND SUBSIDIARIES

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| Net income (loss) | $ | 1,194 | | | $ | 1,983 | | | $ | 3,153 | | | $ | (1,986) | |

| Provision for income taxes | 42 | | | — | | | 51 | | | — | |

| Depreciation and amortization expenses | 3,187 | | | 2,855 | | | 6,124 | | | 6,022 | |

| Interest income | (40) | | | (12) | | | (51) | | | (12) | |

| EBITDA | 4,383 | | | 4,826 | | | 9,277 | | | 4,024 | |

| Stock-based compensation | 2,752 | | | 3,709 | | | 5,571 | | | 8,092 | |

| Change in fair value of warrant liability | (460) | | | 1,045 | | | 390 | | | 320 | |

| Transaction related bonus (recovery) expense | — | | | (275) | | | — | | | 2,567 | |

| Legal settlements and other legal costs | 3,020 | | | 666 | | | 3,513 | | | 1,533 | |

| Reduction in force (recovery) expense | — | | | (264) | | | — | | | 201 | |

| | | | | | | |

| | | | | | | |

| Change in tax receivable agreement liability | 395 | | | 520 | | | 938 | | | 620 | |

| Adjusted EBITDA | $ | 10,090 | | | $ | 10,227 | | | $ | 19,689 | | | $ | 17,357 | |

Contacts

Investor Relations:

investors@weedmaps.com

Media Contract:

press@weedmaps.com

v3.24.2.u1

Cover Page

|

Aug. 02, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 02, 2024

|

| Entity Registrant Name |

WM TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39021

|

| Entity Tax Identification Number |

98-1605615

|

| Entity Address, Address Line One |

41 Discovery

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92618

|

| City Area Code |

844

|

| Local Phone Number |

933-3627

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001779474

|

| Amendment Flag |

false

|

| Class A Common Stock, $0.0001 par value per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

MAPS

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

MAPSW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

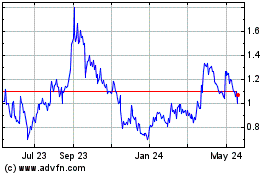

WM Technology (NASDAQ:MAPS)

Historical Stock Chart

From Dec 2024 to Jan 2025

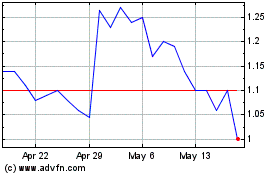

WM Technology (NASDAQ:MAPS)

Historical Stock Chart

From Jan 2024 to Jan 2025