Filed by Nocturne Acquisition Corporation

Pursuant to Rule 425 under

the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange

Act of 1934

Subject Company: Nocturne Acquisition

Corporation

Commission File No.: 001-40259

Date: August 23, 2023

Dear

Fellow Shareholders

Subject:

NASDAQ Listing Update

I

am thrilled to share news of the crossing of a significant milestone in our journey towards becoming a Nasdaq-listed company. August

14 marked a pivotal moment as Nocturne Acquisition Corporation (“Nocturne”) (NASDAQ: MBTC), the special purpose acquisition

company with which Cognos Therapeutics, Inc. (“Cognos” or the “Company”) and soon NASDAQ: COGN intends to consummate

a business combination (the “Business Combination”), successfully filed its preliminary registration statement and proxy

statement/prospectus on Form S-4 in respect of the Business Combination (the “Registration Statement”) with the U.S. Securities

and Exchange Commission (“SEC”). You can access the preliminary Registration Statement on the SEC website through the following

link: SEC Website: Nocturne SPAC S-4

Note

that the Registration Statement is subject to completion and to SEC review as described below.

This

Registration Statement filing represents a crucial step that sets the stage for Cognos to finalize its Business Combination with Nocturne

subsequently secure the listing of the combined company on Nasdaq as Cognos Therapeutics Holdings, Inc. In the context of public company

transactions, filing a Registration Statement is standard procedure and requirement in order to register securities to be issued in a

merger transaction. It serves to disclose, among other things, detailed information about the proposed transaction, risk factors relating

to the merger and the parties thereto, a description of the rights of investors, and financial and other data concerning the companies.

Following

the submission of the Registration Statement with the SEC, there will be an approximate 30-day initial review and approval process. At

the conclusion of this initial review, the SEC will either grant approval or present additional queries and requests. For example, the

SEC may request that the parties amend the Registration Statement one or more times to provide additional disclosures or other revisions

in it, which amendments will also be subject to further SEC review. Upon obtaining SEC approval, Cognos will be poised to submit its

Nasdaq listing application. This phase typically entails a rapid turnaround of about two weeks, as the Nasdaq listing application is

succinct and essentially serves to notify Nasdaq of the SEC's approval of the Registration Statement. Barring unforeseen obstacles, our

current timeline positions us to debut the combined company on Nasdaq in Q4 2023, aligning with our strategic plan.

Recently,

Nocturne and Cognos publicized the Registration Statement filing through a joint press release, accessible via the following link : Cognos/Nocturne

Joint press Release

Our

forthcoming steps to finalize this transformative journey include:

In

the coming weeks, the Company will communicate with you, providing the proxy needed to cast your vote in favor of or against this transaction.

Post-Registration

Statement effectiveness, Continental Stock Transfer & Trust Company will reach out to assist in surrendering your Cognos shares in

exchange for tradable shares of the common stock of the post-closing public company.

Additionally,

the Registration Statement filing affords institutional investors the opportunity to review the prospectus with a focus on potentially

investing in Nocturne/Cognos during the PIPE capital finance round.

Your

steadfast investment support has been integral to our successful final capital raise. Once the Business Combination has been consummated,

the trading of Cognos shares will thereafter occur on Nasdaq, accessible to the wider public.

We

extend our sincere gratitude for your unwavering commitment.

Cautionary

Note Regarding Forward-Looking Statements

This communication is provided for informational purposes only and has been prepared to

assist interested parties in making their own evaluation with respect to the Business Combination between Cognos and Nocturne and related

transactions and for no other purpose. No representations or warranties, express or implied are given in, or in respect of, this communication.

To the fullest extent permitted by law under no circumstances will Cognos, Nocturne or any of their respective subsidiaries, interest

holders, affiliates, representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct,

indirect or consequential loss or loss of profit arising from the use of this communication, its contents, its omissions, reliance on

the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry

and market data used in this communication have been obtained from third-party industry publications and sources as well as from research

reports prepared for other purposes. Neither Cognos nor Nocturne has independently verified the data obtained from these sources and

cannot assure you of the data's accuracy or completeness. This data is subject to change. In addition, this communication does not purport

to be all-inclusive or to contain all the information that may be required to make a full analysis of Nocturne, Cognos or the Business

Combination. Viewers of this communication should each make their own evaluation of Nocturne and Cognos and of the relevance and adequacy

of the information and should make such other investigations as they deem necessary.

In

addition, this communication includes a summary set of risk factors that may have a material impact on Nocturne, Cognos or the Business

Combination. These are not intended to capture all the risks to which Nocturne, Cognos or the Business Combination is subject or may

be subject, and we encourage investors to review the risk factors set forth in the Registration Statement filed with SEC with respect

to the Business Combination (as described further below). If any of these risks materialize or our assumptions prove incorrect, actual

results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither

Nocturne nor Cognos presently know or that Nocturne and Cognos currently believe are immaterial that could also cause actual results

to differ materially from those contained in the forward-looking statements. Factors that may cause such differences include but are

not limited to: (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement;

(2) the inability to complete the Business Combination, including due to the failure to obtain approval of the stockholders of Nocturne

or Cognos

or

other conditions to closing in the Merger Agreement; (3) the inability to obtain or maintain the listing of Nocturne's common stock on

Nasdaq following the Business Combination; (4) the inability to recognize the anticipated benefits of the Business Combination; (5) changes

in applicable laws or regulations; (6) the possibility that Nocturne or Cognos may be adversely affected by other economic or business

factors; and (7) the impact of the global COVID-19 pandemic on any of the foregoing risks and other risks and uncertainties to be identified

in the Registration Statement, including those under "Risk Factors" therein, and in other filings with the SEC made by Nocturne.

In addition, certain statements made herein contain "forward-looking statements" within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995, as amended, reflecting Nocturne's and Cognos' expectations, plans

or forecasts of future events and views as of the date of this communication. Nocturne and Cognos anticipate that subsequent events and

developments will cause Nocturne's and Cognos' assessments to change. However, while Nocturne and Cognos may elect to update these forward-looking

statements at some point in the future, Nocturne and Cognos specifically disclaim any obligation to do so. These forward-looking statements,

which may include, without limitation, words such as "expect," "estimate," "project," "budget,"

"forecast," "anticipate," "intend," "plan," "may," "will", "could,"

"should," "believe," "predict," "potential," "might", "continues," and similar

expressions, involve significant risks and uncertainties (most of which factors are outside of the control of Nocturne or Cognos). Accordingly,

undue reliance should not be placed upon the forward-looking statements, and they should not be relied upon as representing Nocturne's

and Cognos' assessments as of any date subsequent to the date of this communication.

Additional

Information About the Business Combination and Where to Find It

Nocturne

has filed a Registration Statement on Form S-4 with the SEC, which includes a proxy statement/prospectus, that is both the proxy statement

to be distributed to Nocturne's shareholders in connection with its solicitation of proxies for the vote by Nocturne's shareholders with

respect to the Business Combination and other matters as may be described in the Registration Statement, as well as the prospectus, and

relating to the offer and sale of the securities to be issued in the Business Combination. Nocturne urges its investors, shareholders,

and other interested persons to read, when available, the proxy statement/prospectus filed with the SEC and documents incorporated by

reference therein because these documents will contain important information about Nocturne, Cognos and the Business Combination. After

the Registration Statement is declared effective by the SEC, the definitive proxy statement/prospectus and other relevant documents will

be mailed to the shareholders of Nocturne as of the record date established for voting on the Business Combination and will contain important

information about the Business Combination and related matters. Shareholders of Nocturne and other interested persons are advised to

read, when available, these materials (including any amendments or supplements thereto) and any other relevant documents in connection

with Nocturne's solicitation of proxies for the meeting of shareholders to be held to approve, among other things, the Business Combination

because they will contain important information about Nocturne, Cognos and the Business Combination. Shareholders will also be able to

obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus, and other relevant materials

in connection with the transaction without charge, once available, at the SEC's website at www.sec.gov or by directing a request to:

Nocturne Acquisition Corp., Attention: Ka Seng (Thomas) Ao, telephone: 650-935-0312. The information contained on, or that may be accessed

through, the websites referenced in this communication is not incorporated by reference into, and is not a part of, this communication.

Participants

in the Solicitation

Nocturne,

Cognos and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Nocturne's

shareholders in connection with the Business Combination. Nocturne's shareholders and other interested persons may obtain, without charge,

more detailed information regarding the directors and officers of Nocturne in Nocturne's final prospectus filed with the SEC on April

1, 2021, in connection with Nocturne's initial public offering. Information regarding the persons who may, under SEC rules, be deemed

participants in the solicitation of proxies to Nocturne's shareholders in connection with the Business Combination will be set forth

in the proxy statement/prospectus for the Business Combination, when available. Additional information regarding the interests of participants

in the solicitation of proxies in connection with the Business Combination is included in the proxy statement/prospectus that Nocturne

has filed with the SEC. You may obtain free copies of these documents as described above.

Non-Solicitation

This

communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there

be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or jurisdiction. No offer of securities shall be made except by means of

a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Frank

Adell

Chief

Executive Officer

Cognos

Therapeutics, Inc

8/22/2023

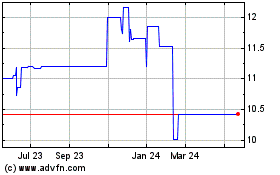

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From Apr 2024 to May 2024

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From May 2023 to May 2024