0001872356

false

0001872356

2023-08-16

2023-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 16, 2023 (August 16, 2023)

| Molekule

Group, Inc. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41096 |

|

45-3213164 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification

No.) |

10455 Riverside Dr.

Palm Beach Gardens, FL |

|

33410 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone

number, including area code: (833) 652-5326

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

MKUL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 16, 2023, Molekule

Group, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30,

2023.

The press release is included

as Exhibit 99.1 hereto. The information furnished under this Item 2.02, including the exhibit related thereto, shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed

incorporated by reference in any disclosure document of the Company, except as shall be expressly set forth by specific reference in such

document.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

See the Exhibit Index below, which is incorporated

by reference herein.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MOLEKULE GROUP, INC. |

| |

|

| Dated: August 16, 2023 |

By: |

/s/ Ryan Tyler |

| |

|

Name: |

Ryan Tyler |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

Molekule Reports Second Quarter 2023 Financial

Results

Delivers Q2 Revenue of $13.2 Million, Exceeding

Guidance of $12.0 Million and Representing 58% Sequential Growth

PALM BEACH GARDENS,

Fla. - (August 16, 2023) - Molekule Group, Inc. (“Molekule” or the “Company”) (Nasdaq:

MKUL), a leading air purification technology company, today reported financial results for the three months (“Q2 2023”) ended

June 30, 2023.

Second Quarter 2023 Financial and Operational

Highlights

(Unless otherwise stated, comparisons are made

between Q2 2023 and Q2 2022 results)

| ● | Revenues were $13.2 million, an increase of 58% as compared to the first quarter of 2023. |

| ● | Gross profit was $4.5 million, or $5.7 million on an adjusted basis to exclude $1.2 million of costs resulting from a step up in inventory

value related to purchase accounting. Gross profit margin giving effect to the adjustment was 43%. |

| ● | Operating loss was $11.7 million, or $8.7 million on an adjusted basis to exclude $3.0 million of one-time costs associated primarily

with acquisitions. |

| ● | Net loss from operations was $25.0 million, or

$0.76 per share, including the impacts of the one-time costs referred to above. |

| ● | Filter sales of $9.5 million increased approximately

63% as compared to the first quarter of 2023 reflecting a strong and increasing base of recurring revenues. |

| ● | Announced statistically significant results from

an approximately year-long research study which indicated that Molekule’s Air Pro purifier may reduce hospital length of stay by

approximately two days in COVID-19 patients. |

| ● | Completed a $10 million private placement in

May 2023 with a single institutional investor. Additionally, the Company reached an agreement with its principal lender, to defer

approximately $6.1 million of principal payments through Q1 2025. |

| ● | Entered into a second one-year agreement with

Veterans Integrated Services Network (“VISN 23”), to provide Veterans Affairs (“VA”) center employees and veterans

with real-time, IAQ monitoring and control systems across three VA service centers. The agreement includes an option for up to five

years and provides further opportunity for the Company to demonstrate the strength and versatility of its technology to the VHA network,

which has 18 VISNs and over 1,200 facilities. |

| ● | Introduced new Alexa skill commands, including

turning devices on or off, changing fan speeds or modes, and status checks for filters and indoor air quality. The commands allow consumers

to have increased control over their air purification devices and are available on any Alexa-enabled device via the Alexa app. |

Recent Developments

| ● | Achieved the most successful Amazon Prime Day

in Company history with a 264% increase in purifier sales year over year reflecting our increasing profile within our category at Amazon. |

| ● | Launched Molekule 360, a first-of-its-kind Indoor

Air Quality (“IAQ”) management solution. The new platform was created to allow enterprise-wide deployment for monitoring and

control of thousands of Internet of Things (“IoT”) enabled devices from a single location, across multiple facilities and

cities. |

| ● | Study

published in Nature(1) demonstrated that portable air purifiers utilizing

photoelectrochemical oxidation (“PECO”) filtration, reduce the allergic airway

responses to aerosolized cat dander in an animal model. The study was completed to assess

the ability of PECO technology to provide relief from allergy responses compared to traditional

HEPA-based filtration alone. Molekule devices are the only air purifiers to use patented

PECO technology to destroy pollutants. |

| (1) | Devadoss,

D., Surbaugh, K., Manevski, M., Wickramaratne, C., Chaput, D., Chung, A., de Leon, F., Chand,

H. S., & Dhau, J. S. (2023). Indoor-air purification by photoelectrochemical oxidation

mitigates allergic airway responses to aerosolized cat dander in a murine model. Scientific

Reports, 13(1), 1-14. https://doi.org/10.1038/s41598-023-38155-0 |

Management Commentary

Jason DiBona, CEO of Molekule, stated, “We

are pleased with the speed at which we have integrated to become a leading provider of air purification devices, software and solutions

resulting in significant sequential revenue growth while maintaining solid gross profit margins. This early momentum has accelerated following

the close of the quarter with our record-breaking Amazon Prime sales day, marking the most successful one in Company history. We are also

encouraged by the recurring revenue element of our business resulting from filter subscriptions and replacements, which increased approximately

63% sequentially reflecting streamlining of our e-commerce platform and an improved customer experience on our website.”

Mr. DiBona added, “Our recently launched

first-of-its-kind Molekule 360 hub has experienced a favorable response from early adopters. The industry leaders who are implementing

our solution are recognizing its ease of use and unique ability to empower them to cost-effectively and sustainably improve indoor air

quality to protect the health of everyone who enters their locations.”

Mr. DiBona continued, “We firmly believe

we are on the precipice of an indoor air quality revolution as poor air quality more regularly impacts the lives of the general population,

whether as a result of environmental concerns such as wildfires, fumes and emissions from industrial accidents, or viruses and pathogens.

We’ve recently seen efforts from organizations such as the CDC and ASHRAE to further improve public health by establishing formal

recommendations and standards for IAQ. We applaud their leadership as our understanding of the detrimental health effects associated with

poor IAQ grows and we believe this is a significant step towards safeguarding the well-being of the public.”

Mr. DiBona concluded, “The time is

now for us to accelerate our offerings and showcase our full range of products and services that enhance safety across various sectors,

including direct consumer, through our retail partners, education, healthcare and B2B. Through our commitment to research and innovation,

we have developed cutting-edge technologies and rigorous quality standards to ensure that customers can rely on our products for exceptional

protection. We believe our large range of trusted, and FDA approved, products will further solidify our position as a leading force in

the industry.”

Financial Results for Three Months and Six

Months Ended June 30, 2023

Revenues for the three months ended June 30,

2023 were approximately $13.2 million, an increase of approximately 58% as compared to the first quarter of 2023.

For the three months ended June 30, 2023,

the Company incurred approximately $15.0 million of selling, general and administrative (“SG&A”) expenses. SG&A expenses

were primarily due to an increase in salaries and wages, stock-based compensation, marketing expense, legal fees, public company costs

and rent expense. On an adjusted basis to exclude one-time costs of approximately $1.8 million, SG&A was approximately $13.2 million.

The change in fair value of the warrant liability

was a non-cash loss of approximately $12.1 million resulting from an increase in the fair value of the warrant liability.

Net loss was approximately $25.0 million, or $0.76

per share, for the three months ended June 30, 2023. On an adjusted basis to exclude approximately $3.0 million of one-time costs

and the non-cash change in fair value of the warrant liability of $12.1 million, net loss was approximately $9.9 million, or $0.30 per

share.

Transaction Update and Full Year Outlook

Merger Agreement with Aura

As previously disclosed, on February 26,

2023, we entered into the Agreement and Plan of Merger, dated as of February 26, 2023 (the “Merger Agreement”), by and

among us, Aura Smart Air Ltd., a company organized under the laws of the State of Israel (“Aura”) and Avatar Merger Sub Ltd.,

a company organized under the laws of the State of Israel, our wholly owned subsidiary.

On August 14, 2023, we informed Aura that

we were terminating the Merger Agreement, in accordance with Section 8.02 and Section 8.01(c)(i) of the Merger Agreement.

We believe that Aura has committed a material and incurable breach of Section 6.02 of the Merger Agreement such that we are entitled

to terminate the Merger Agreement pursuant to Section 8.01(c)(i)(B) of the Merger Agreement. On August 14, 2023, Aura notified

us that it disputed the termination of the Merger Agreement and believes that we have breached Section 6.09 of the Merger Agreement.

We dispute that we are in breach of the Merger Agreement.

Notwithstanding the termination of the Merger

Agreement, we intend to continue discussions with Aura regarding mutually beneficial future sales, marketing and technology collaboration

and intend to continue discussions regarding the parties’ current arrangements in connection with, and certain disagreements under,

the Technology Collaboration Agreement and Co-Distribution Agreement entered into contemporaneously with the Merger Agreement.

Outlook

Notwithstanding the successful launch of Molekule

360 hub, integration of software and device technologies and growth in organic revenues through sales of consumables and through important

retail partnerships, the Company is exploring opportunities to reduce its cost base. Backlog and orders for our new indoor air quality

solutions from enterprise and commercial customers have fallen below expectations for the second half of the year resulting in efforts

to defer or eliminate excess costs while the Company continues to build a market and demand for its indoor air quality services and platform.

The Company is providing revenue guidance for

the second half of 2023 of $28.5 to $33.5 million reflecting an increase of approximately 32% to 55% over the first half of the year.

Balance Sheet and Liquidity

Total current assets were approximately $39.3

million as of June 30, 2023, and total current liabilities were approximately $17.3 million as of June 30, 2023. Net working

capital was approximately $22.1 million as of June 30, 2023. Cash was approximately $5.3 million as of June 30, 2023.

Based on the current liquidity position of the

Company and delays in orders from the B2B business, the Company's Board of Directors and management are continuing to explore various

capital raising opportunities, including but not limited to a rights offering or private placement of securities, or other means of financing

during the third quarter of 2023. Some or all of the net proceeds from any capital raise would be used to manage and help alleviate costs

associated with developing our products and services, conducting research and development and funding operations.

In addition, the Company will continue to consider

other ways to maximize shareholder value, including but not limited to cost-cutting measures to maximize available resources, as well

as a potential restructuring or reorganization of the Company. The Company believes that any savings generated from such cost-reduction

or restructuring activities which are ultimately adopted, along with any projected capital raise, would enable the Company to continue

operations while the Company continues to seek new sources of financing to stabilize its finances and operations.

There can be no assurances, however, that the

Company will be able to secure any such additional capital in the third quarter of 2023 or in the future, on acceptable terms and

conditions, or at all, or that any cost-cutting measures and/or potential restructuring or reorganization of the Company will be sufficient

to continue operations.

Financial results

and analyses are available on the Company’s investor relations website: https://investors.molekule.com.

About Molekule

References to “Molekule”

herein include Molekule Group, Inc. (Nasdaq: MKUL) and its consolidated subsidiaries, including Molekule, Inc. Molekule is

creating safer, healthier indoor environments worldwide, starting with our most essential resource: the air we breathe. Based on over

25 years of research and development, the company creates scientifically tested technology to improve indoor air quality for individuals,

businesses, schools, hospitals and organizations of all sizes. Molekule's lineup of air purification solutions incorporates medical-grade

high-efficiency particulate air filtration and the company’s patented photoelectrochemical oxidation (PECO) technology, which surpasses

traditional filters by effectively destroying a wide range of pollutants, including volatile organic compounds, mold, bacteria, viruses

and allergens. These devices have undergone rigorous assessments by third-party laboratories, earning FDA clearance as medical devices.

It’s all part of Molekule’s vision of changing the world from the indoors out. For more details, please visit molekule.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based upon current beliefs and expectations of our management and are subject to known and unknown

risks and uncertainties. Words or expressions such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “estimates,” “may,” “will,” “projects,” “could,” “should,”

“would,” “seek,” “forecast,” or other similar expressions help identify forward-looking statements.

Factors that could cause actual events to differ include, but are not limited to:

| ● | general economic conditions in the markets where we operate; |

| ● | the impact of the COVID-19 pandemic and related prophylactic measures; |

| ● | expected timing of regulatory approvals and product launches; |

| ● | non-performance of third-party vendors and contractors; |

| ● | risks related to our ability to successfully sell our products and the market reception to and performance

of our products, including our new Molekule 360 indoor air quality management solutions; |

| ● | the possibility that our products do not ultimately perform in line with our testing or that prior test

results may not be replicated in future studies; |

| ● | our compliance with, and changes to, applicable laws and regulations; |

| ● | our limited operating history; |

| ● | our ability to manage growth; |

| ● | our ability to obtain additional financing when and if needed; |

| ● | our ability to expand product offerings; |

| ● | our ability to compete with others in our industry; |

| ● | our ability to protect our intellectual property; |

| ● | the ability of certain stockholders to determine the outcome of matters that require stockholder approval; |

| ● | our ability to retain the listing of our common stock on Nasdaq; |

| ● | our ability to defend against legal proceedings; |

| ● | success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | the ability to successfully integrate Molekule, Inc.; |

| ● | the incurrence of unexpected costs, liabilities or delays relating to our merger with Molekule, Inc.; |

| ● | the risk that goodwill or identifiable intangible assets (including such items recorded with respect to

our merger with Molekule, Inc.) could become impaired; and our ability to successfully consummate acquisitions; and |

| ● | other economic, business, competitive, and regulatory factors affecting the businesses of the Company

generally, including but not limited to those set forth in Molekule’s filings with the SEC, including in the “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Molekule’s

latest annual report on Form 10-K, as amended, and other SEC filings. |

Forward-looking statements are not guarantees

of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking

statements as a result of various factors. Although we believe that the expectations reflected in the forward-looking statements are reasonable

based on information currently available, we cannot assure you that the expectations will prove to have been correct. Accordingly, you

should not place undue reliance on these forward-looking statements. In any event, these statements speak only as of the date of this

release. We assume no obligation to revise or update any of the forward-looking statements to reflect events or circumstances after the

date of this release or to reflect new information or the occurrence of unanticipated events.

Contacts

Media Contact

Press@molekule.com

Investor Relations Contacts

Ryan Tyler

Chief Financial Officer, Molekule

Ryan.Tyler@molekule.com

MATTIO Communications

molekule@mattio.com

Financial Statements

MOLEKULE GROUP, INC. AND SUBSIDIARIES

Balance Sheets

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Cash | |

$ | 5,269,376 | | |

$ | 22,062,657 | |

| Other current assets | |

| 34,074,855 | | |

| 2,722,296 | |

| Total current assets | |

| 39,344,231 | | |

| 24,784,953 | |

| Non-current assets | |

| 86,095,781 | | |

| 4,373,933 | |

| Total assets | |

$ | 125,440,012 | | |

$ | 29,158,886 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities | |

$ | 17,296,455 | | |

$ | 4,562,253 | |

| Non-current liabilities | |

| 67,438,501 | | |

| 4,893,431 | |

| Total liabilities | |

| 84,734,956 | | |

| 9,455,684 | |

| Total equity | |

| 40,705,056 | | |

| 19,703,202 | |

| Total liabilities and stockholders' equity | |

$ | 125,440,012 | | |

$ | 29,158,886 | |

MOLEKULE GROUP, INC. AND SUBSIDIARIES

Statements of Operations

(Unaudited)

| | |

Three Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Product revenues | |

$ | 13,242,959 | | |

$ | 70,918 | |

| Cost of sales | |

| 8,763,888 | | |

| 36,126 | |

| Gross profit | |

| 4,479,071 | | |

| 34,792 | |

| Operating expenses: | |

| | | |

| | |

| Selling, general and administrative | |

| 15,005,356 | | |

| 4,105,066 | |

| Research and development | |

| 1,174,846 | | |

| 579,061 | |

| Total operating expenses | |

| 16,180,202 | | |

| 4,684,127 | |

| Loss from operations | |

| (11,701,131 | ) | |

| (4,649,335 | ) |

| Change in fair value of warrant liability | |

| (12,050,500 | ) | |

| (650,000 | ) |

| Interest expense | |

| (1,443,009 | ) | |

| — | |

| Other expense | |

| 132,242 | | |

| — | |

| Total other expense | |

| (1,310,767 | ) | |

| — | |

| Loss before income tax benefit | |

| (25,062,398 | ) | |

| (5,299,335 | ) |

| Income tax benefit | |

| 93,156 | | |

| (127,058 | ) |

| Net loss | |

$ | (24,969,242 | ) | |

$ | (5,172,277 | ) |

| Net loss per share: | |

| | | |

| | |

| Basic and diluted | |

$ | (0.76 | ) | |

$ | (0.37 | ) |

| Weighted-average common shares outstanding: | |

| | | |

| | |

| Basic and diluted | |

| 33,017,565 | | |

| 13,894,119 | |

MOLEKULE GROUP, INC. AND SUBSIDIARIES

Statements of Cash Flows

(Unaudited)

| | |

Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Net cash flows used in operating activities | |

| (11,285,744 | ) | |

| (2,485,229 | ) |

| Net cash flows used in investing activities | |

| (762,927 | ) | |

| (125,990 | ) |

| Net cash flows provided by financing activities | |

| 9,546,208 | | |

| 14,000,551 | |

| Net increase in cash | |

| (2,502,463 | ) | |

| 11,389,332 | |

| Cash, beginning of period | |

| 8,401,581 | | |

| 17,774,097 | |

| Cash, end of period | |

$ | 5,899,118 | | |

$ | 29,163,429 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

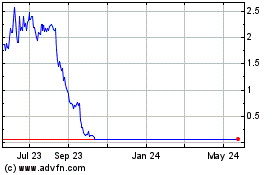

Molekule (NASDAQ:MKUL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Molekule (NASDAQ:MKUL)

Historical Stock Chart

From Mar 2024 to Mar 2025