0000899460false00008994602024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 07, 2024 |

MannKind Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-50865 |

13-3607736 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 Casper Street |

|

Danbury, Connecticut |

|

06810 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (818) 661-5000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

MNKD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, MannKind Corporation issued a press release, a copy of which is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

MannKind Corporation |

|

|

|

|

|

|

Date: November 7, 2024 |

By: |

/s/ David Thomson, Ph.D., J.D. |

|

|

David Thomson, Ph.D., J.D. |

|

|

Corporate Vice President, General Counsel and Secretary |

|

|

|

EXHIBIT 99.1 |

MANNKIND CORPORATION REPORTS

2024 THIRD QUARTER FINANCIAL RESULTS AND

PROVIDES BUSINESS UPDATE

Conference Call to Begin Today at 4:30 p.m. (ET)

•3Q 2024 Total revenues of $70M; +37% vs. 3Q 2023

•YTD 2024 Total revenues of $209M; +49% vs. YTD 2023

•YTD 2024 Net income of $20 million; Non-GAAP net income of $45 million

•Orphan lung disease studies proceeding as planned

oMNKD-101 Phase 3 clinical trial expands globally

oMNKD-201 Phase 1 successfully completed; Plan to meet with FDA in 1H 2025

DANBURY, Conn. and WESTLAKE VILLAGE, Calif. November 7, 2024 (Globe Newswire) — MannKind Corporation (Nasdaq: MNKD) today reported financial results for the quarter ended September 30, 2024.

“Our business demonstrated double-digit revenue growth compared to last year, led by Tyvaso DPI revenues,” said Michael Castagna, PharmD, Chief Executive Officer of MannKind Corporation. “The third quarter has also been marked by strong progress in our clinical development programs, with enrollment underway in the Phase 3 trial of MNKD-101 to study its effect in NTM lung disease and successful completion of a Phase 1 trial of MNKD-201 for IPF. We also recently announced positive topline results from the Afrezza INHALE-3 post-marketing study and expect to announce topline data from the Phase-3 INHALE-1 pediatric study by year-end.”

Third Quarter 2024 Results

Revenue Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

$ Change |

|

|

% Change |

|

|

|

(Dollars in thousands) |

|

Royalties – collaboration |

|

$ |

27,083 |

|

|

$ |

20,218 |

|

|

$ |

6,865 |

|

|

|

34 |

% |

Revenue – collaborations and services |

|

|

23,268 |

|

|

|

13,108 |

|

|

$ |

10,160 |

|

|

|

78 |

% |

Net revenue – Afrezza |

|

|

15,035 |

|

|

|

13,476 |

|

|

$ |

1,559 |

|

|

|

12 |

% |

Net revenue – V-Go |

|

|

4,693 |

|

|

|

4,451 |

|

|

$ |

242 |

|

|

|

5 |

% |

Total revenues |

|

$ |

70,079 |

|

|

$ |

51,253 |

|

|

$ |

18,826 |

|

|

|

37 |

% |

In the third quarter of 2024, compared to the same period in 2023:

•royalties for Tyvaso DPI® increased $6.9 million, or 34%, due to increased sales by United Therapeutics ("UT");

•collaborations and services revenue increased $10.2 million, or 78%, primarily attributable to an increase in manufacturing activities for Tyvaso DPI;

•Afrezza® net revenue increased $1.6 million, or 12%, as a result of higher demand and improved gross-to-net adjustments; and

•V-Go® net revenue increased $0.2 million, or 5%, as a result of improved gross-to-net adjustments and increased price, partially offset by lower product demand.

Commercial product gross margin in the third quarter of 2024 was 84% compared to 78% for the same period in 2023. The increase in gross margin was primarily attributable to an increase in Afrezza net revenue.

Cost of revenue – collaborations and services for the third quarter of 2024 was $14.8 million compared to $10.3 million for the same period in 2023. The $4.5 million increase was primarily attributable to increased manufacturing volume for Tyvaso DPI.

Research and development ("R&D") expenses for the third quarter of 2024 were $12.9 million compared to $10.0 million for the same period in 2023. The $2.9 million increase was primarily attributed to increased costs for a Phase 3 clinical study of MNKD-101, a Phase 1 clinical study of a dry-powder formulation of MNKD-201, and personnel costs due to increased headcount following a transaction with Pulmatrix, Inc.

Selling expenses were $13.1 million for the third quarter of 2024 compared to $13.4 million for the same period in 2023. The $0.3 million decrease was primarily due to reduced personnel costs related to a sales force restructuring completed during the first quarter of 2024, partially offset by an increase in promotional activities.

General and administrative expenses were $10.8 million for the third quarter of 2024 compared to $10.5 million for the same period in 2023. The $0.3 million increase was primarily attributable to increases in personnel costs partially offset by reduced consulting fees.

Interest income, net, was $3.2 million for the third quarter of 2024 compared to $1.6 million for the same period in 2023. The $1.6 million increase was primarily due to an increase in the underlying investments from the proceeds of the sale of 1% of our Tyvaso DPI royalties in December 2023 and higher yields on our securities portfolio.

Interest expense on liability for sale of future royalties was $4.1 million for the third quarter of 2024 and was attributable to imputed interest and amortization of debt issuance costs on the liability recorded in connection with the sale of 1% of our Tyvaso DPI royalties in December 2023.

Interest expense on financing liability related to the sale-leaseback of our Danbury manufacturing facility was $2.5 million for the third quarter of 2024 and remained consistent with the same period in 2023.

Interest expense was $1.8 million for the third quarter of 2024 compared to $2.8 million for the same period in 2023. The decrease of $1.0 million was primarily due to repayment of the MidCap credit facility and Mann Group convertible note in April 2024.

Gain on bargain purchase of $5.3 million for the third quarter of 2024 was the result of the excess of the fair value of net assets acquired over the fair value of the consideration paid in the Pulmatrix transaction.

Nine Months September 30, 2024

Revenue Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months

Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

$ Change |

|

|

% Change |

|

|

|

(Dollars in thousands) |

|

Royalties – collaboration |

|

$ |

75,326 |

|

|

$ |

50,951 |

|

|

$ |

24,375 |

|

|

|

48 |

% |

Revenue – collaborations and services |

|

|

74,130 |

|

|

|

35,705 |

|

|

$ |

38,425 |

|

|

|

108 |

% |

Net revenue – Afrezza |

|

|

45,762 |

|

|

|

39,427 |

|

|

$ |

6,335 |

|

|

|

16 |

% |

Net revenue – V-Go |

|

|

13,510 |

|

|

|

14,407 |

|

|

$ |

(897 |

) |

|

|

(6 |

%) |

Total revenues |

|

$ |

208,728 |

|

|

$ |

140,490 |

|

|

$ |

68,238 |

|

|

|

49 |

% |

For the nine months ended September 30, 2024, compared to the same period in 2023:

•royalties related to Tyvaso DPI increased $24.4 million, or 48%, due to increased sales by UT;

•collaborations and services revenue increased $38.4 million, or 108%, primarily attributable to an increase in manufacturing activities for Tyvaso DPI;

•Afrezza net revenue for the nine months ended September 30, 2024 increased $6.3 million, or 16%, primarily as a result of higher demand and price and improved gross-to-net adjustments; and

•V-Go net revenue for the nine months ended September 30, 2024 decreased $0.9 million, or 6%, as a result of lower product demand, partially offset by improved gross-to-net adjustments and increased price.

Commercial product gross margin in the nine months ended September 30, 2024 was 79% compared to 73% for the same period in 2023. The increase in gross margin was primarily attributable to an increase in Afrezza net revenue.

Cost of revenue – collaborations and services for the nine months ended September 30, 2024 was $44.4 million compared to $30.0 million for the same period in 2023. The $14.4 million increase was primarily attributable to increased manufacturing volume for product sold to UT.

R&D expenses for the nine months ended September 30, 2024 were $34.8 million compared to $22.0 million for the same period in 2023. The $12.8 million increase was primarily attributed to increased expenditures for development activities and a Phase 3 clinical study of MNKD-101, a Phase 1 study of MNKD-201, and personnel costs due to increased headcount as a result of the Pulmatrix transaction.

Selling expenses were $36.2 million in the nine months ended September 30, 2024 compared to $40.8 million for the same period in 2023. The $4.6 million decrease was primarily due to reduced personnel costs related to a sales force restructuring completed during the first quarter of 2024.

General and administrative expenses for the nine months ended September 30, 2024 were $34.2 million compared to $33.0 million for the same period in 2023. The $1.2 million increase was primarily attributable to a loss of $1.4 million related to estimated returns associated with sales of V-Go that pre-date our acquisition of the product and increases in personnel costs, partially offset by reduced consulting fees.

Interest income, net, was $9.8 million for the nine months ended September 30, 2024 compared to $4.4 million for the same period in 2023. The $5.4 million increase was primarily due to an increase in the underlying investments from the proceeds of the sale of 1% of our Tyvaso DPI royalties in December 2023 and higher yields on our securities portfolio.

Interest expense on liability for sale of future royalties was $12.7 million for the nine months ended September 30, 2024 and was attributable to imputed interest and amortization of debt issuance costs on the liability recorded in connection with the sale of 1% of our Tyvaso DPI royalties in December 2023.

Interest expense on financing liability related to the sale-leaseback of our Danbury manufacturing facility was $7.4 million for the nine months ended September 30, 2024 and remained consistent with the same period in 2023.

Interest expense was $10.4 million for the nine months ended September 30, 2024 compared to $12.5 million for the same period in 2023. The decrease of $2.1 million was primarily due to repayment of the MidCap credit facility and Mann Group convertible note in April 2024.

Gain on bargain purchase of $5.3 million for the nine months ended September 30, 2024 was the result of the excess of the fair value of net assets acquired over the fair value of the consideration paid in the Pulmatrix transaction.

Loss on available-for-sale securities for the nine months ended September 30, 2024 was $1.6 million resulting from the modification of the Thirona note terms. Gain on available-for-sale securities for the same period in 2023 was $0.9 million as a result of the change in fair value of the Thirona investment.

Loss on extinguishment of debt of $7.1 million for the nine months ended September 30, 2024 was incurred in connection with the prepayment of the MidCap credit facility and the Mann Group convertible note in April 2024.

Cash, cash equivalents and investments as of September 30, 2024 were $268.4 million.

Non-GAAP Measures

To supplement our condensed consolidated financial statements presented under U.S. generally accepted accounting principles ("GAAP"), we are presenting non-GAAP net income (loss) and non-GAAP net income (loss) per share - diluted, which are non-GAAP financial measures. We are providing these non-GAAP financial measures to disclose additional information to facilitate the comparison of past and present operations, and they are among the indicators management uses as a basis for evaluating our financial performance. We believe that these non-GAAP financial measures, when considered together with our GAAP financial results, provide management and investors with an additional understanding of our business operating results, including underlying trends.

These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures; should be read in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP; have no standardized meaning prescribed by GAAP; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future there may be other items that we may exclude for purposes of our non-GAAP financial measures; and we may in the future cease to exclude items that we have historically excluded for purposes of our non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at our non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measures as used by us in this report have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to similarly titled measures used by other companies.

The following table reconciles our financial measures for net income (loss) and net income (loss) per share ("EPS") for diluted weighted average shares as reported in our condensed consolidated statements of operations to a non-GAAP presentation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

|

Nine Months |

|

|

Ended September 30, |

|

|

Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net Income |

|

|

Basic EPS |

|

|

Net Income |

|

|

Basic EPS |

|

|

Net Income |

|

|

Basic EPS |

|

|

Net Loss |

|

|

Basic EPS |

|

|

(In thousands except per share data) |

|

GAAP reported net income (loss) |

$ |

11,550 |

|

|

$ |

0.04 |

|

|

$ |

1,721 |

|

|

$ |

0.01 |

|

|

$ |

20,166 |

|

|

$ |

0.07 |

|

|

$ |

(13,339 |

) |

|

$ |

(0.05 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sold portion of royalty revenue (1) |

|

(2,708 |

) |

|

|

(0.01 |

) |

|

|

— |

|

|

|

— |

|

|

|

(7,533 |

) |

|

|

(0.03 |

) |

|

|

— |

|

|

|

— |

|

Interest expense on liability for sale of future royalties |

|

4,089 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

— |

|

|

|

12,720 |

|

|

|

0.04 |

|

|

|

— |

|

|

|

— |

|

Stock compensation |

|

5,227 |

|

|

|

0.02 |

|

|

|

4,601 |

|

|

|

0.02 |

|

|

|

15,540 |

|

|

|

0.06 |

|

|

|

13,836 |

|

|

|

0.05 |

|

Loss (gain) on foreign currency transaction |

|

2,454 |

|

|

|

0.01 |

|

|

|

(2,065 |

) |

|

|

(0.01 |

) |

|

|

526 |

|

|

|

— |

|

|

|

(860 |

) |

|

|

— |

|

Gain on bargain purchase |

|

(5,259 |

) |

|

|

(0.02 |

) |

|

|

— |

|

|

|

— |

|

|

|

(5,259 |

) |

|

|

(0.02 |

) |

|

|

— |

|

|

|

— |

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,050 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

Loss (gain) on available-for-sale securities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,550 |

|

|

|

0.01 |

|

|

|

(932 |

) |

|

|

— |

|

Non-GAAP adjusted net income (loss) |

$ |

15,353 |

|

|

$ |

0.06 |

|

|

$ |

4,257 |

|

|

$ |

0.02 |

|

|

$ |

44,760 |

|

|

$ |

0.16 |

|

|

$ |

(1,295 |

) |

|

$ |

(0.00 |

) |

Weighted average shares used to compute net income (loss)

per share – basic |

|

274,998 |

|

|

|

|

|

|

268,732 |

|

|

|

|

|

|

272,811 |

|

|

|

|

|

|

266,126 |

|

|

|

|

__________________________

(1) Represents the non-cash portion of the 1% royalty on net sales of Tyvaso DPI earned during the periods presented which is remitted to the royalty purchaser and recognized as royalties – collaboration in our consolidated statements of operations. Our revenues from royalties – collaboration during 3Q 2024 and the nine months ended September 30, 2024 totaled $27.1 million and $75.3 million, respectively, of which $2.7 million and $7.5 million, respectively, were attributed to the royalty purchaser.

Clinical Development Update and Anticipated Milestones

Afrezza INHALE-3 (T1D, Afrezza vs. standard of care multiple daily injections or pumps) Phase 4 clinical trial

•Top-level 30-week results demonstrated that switching to or remaining on Afrezza allowed nearly twice as many people to get to the A1C (<7%) goal during the extension period

•Additional data to be presented at Advanced Technologies and Treatments for Diabetes (ATTD) and other conferences in 1H 2025

Afrezza INHALE-1 Pediatric Phase 3 clinical trial

•Primary endpoint analysis results expected in 4Q 2024

•Six-month data with safety extension expected in 1H 2025

•FDA submission for label expansion planned in 2025

MNKD-101 (Clofazimine Inhalation Suspension) Phase 3 (ICoN-1) clinical trial

•Trial cleared to proceed in four countries (U.S., Japan, South Korea and Australia) with a fifth (Taiwan) expected in 4Q 2024

•First patient randomized in the US in 3Q

•Approximately 230 participants to be randomized at 100+ sites for a minimum of 180 evaluable participants

MNKD-201 (nintedanib DPI) Phase 1 clinical trial

•Trial successfully completed, primary objective met demonstrating positive safety results and was well-tolerated in healthy volunteers

•Participants did not experience adverse events typically reported with oral nintedanib

•Preclinical chronic toxicology did not show any adverse findings

•FDA End-of-Phase 1 meeting expected in 1H 2025

Conference Call

MannKind will host a conference call and presentation webcast to discuss these results today at 4:30 p.m. Eastern Time. The webcast will be accessible via a link on MannKind’s website. A replay will also be available in the same location within 24 hours after the call and accessible for approximately 90 days.

About MannKind

MannKind Corporation (Nasdaq: MNKD) focuses on the development and commercialization of innovative inhaled therapeutic products and devices to address serious unmet medical needs for those living with endocrine and orphan lung diseases.

We are committed to using our formulation capabilities and device engineering prowess to lessen the burden of diseases such as diabetes, nontuberculous mycobacterial (NTM) lung disease, pulmonary fibrosis, and pulmonary hypertension. Our signature technologies – dry-powder formulations and inhalation devices – offer rapid and convenient delivery of medicines to the deep lung where they can exert an effect locally or enter the systemic circulation, depending on the target indication.

With a passionate team of Mannitarians collaborating nationwide, we are on a mission to give people control of their health and the freedom to live life.

Please visit mannkindcorp.com to learn more, and follow us on LinkedIn, Facebook, X or Instagram.

Forward-Looking Statements

Statements in this press release that are not statements of historical fact are forward-looking statements that involve risks and uncertainties. These statements include, without limitation, statements regarding the expected timing of patient enrollment and global expansion in a clinical study of MNKD-101; the expected timing for data read-outs from clinical studies of Afrezza; timing for an end-of-Phase 1 meeting with the FDA for MNKD-201; and the timing of a planned FDA submission for Afrezza. Words such as “believes,” “anticipates,” “plans,” “expects,” “intend,” “will,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon MannKind’s current expectations. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks associated with developing product candidates; risks and uncertainties related to unforeseen delays that may impact the timing of clinical trials and reporting data; risks associated with safety and other complications of our products and product candidates; risks associated with the regulatory review process; and other risks detailed in MannKind’s filings with the Securities and Exchange Commission (“SEC”), including under the “Risk Factors” heading of its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 27, 2024, and subsequent periodic reports on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement, and MannKind undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release.

Tyvaso DPI is a trademark of United Therapeutics Corporation.

AFREZZA, MANNKIND, and V-GO are registered trademarks of MannKind Corporation.

# # #

MannKind Contacts:

Investor Relations

Ana Kapor

(818) 661-5000

Email: ir@mnkd.com

Media Relations

Christie Iacangelo

(818) 292-3500

Email: media@mnkd.com

MANNKIND CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended September 30, |

|

|

Nine Months

Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(In thousands except per share data) |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue – commercial product sales |

|

$ |

19,728 |

|

|

$ |

17,927 |

|

|

$ |

59,272 |

|

|

$ |

53,834 |

|

Revenue – collaborations and services |

|

|

23,268 |

|

|

|

13,108 |

|

|

|

74,130 |

|

|

|

35,705 |

|

Royalties – collaboration |

|

|

27,083 |

|

|

|

20,218 |

|

|

|

75,326 |

|

|

|

50,951 |

|

Total revenues |

|

|

70,079 |

|

|

|

51,253 |

|

|

|

208,728 |

|

|

|

140,490 |

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

3,197 |

|

|

|

3,995 |

|

|

|

12,621 |

|

|

|

14,749 |

|

Cost of revenue – collaborations and services |

|

|

14,826 |

|

|

|

10,259 |

|

|

|

44,377 |

|

|

|

29,955 |

|

Research and development |

|

|

12,926 |

|

|

|

9,989 |

|

|

|

34,755 |

|

|

|

22,047 |

|

Selling |

|

|

13,093 |

|

|

|

13,440 |

|

|

|

36,189 |

|

|

|

40,752 |

|

General and administrative |

|

|

10,823 |

|

|

|

10,538 |

|

|

|

34,168 |

|

|

|

33,027 |

|

Loss (gain) on foreign currency transaction |

|

|

2,454 |

|

|

|

(2,065 |

) |

|

|

526 |

|

|

|

(860 |

) |

Total expenses |

|

|

57,319 |

|

|

|

46,156 |

|

|

|

162,636 |

|

|

|

139,670 |

|

Income from operations |

|

|

12,760 |

|

|

|

5,097 |

|

|

|

46,092 |

|

|

|

820 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

3,179 |

|

|

|

1,580 |

|

|

|

9,790 |

|

|

|

4,429 |

|

Interest expense on liability for sale of future royalties |

|

|

(4,089 |

) |

|

|

— |

|

|

|

(12,720 |

) |

|

|

— |

|

Interest expense on financing liability |

|

|

(2,470 |

) |

|

|

(2,459 |

) |

|

|

(7,361 |

) |

|

|

(7,332 |

) |

Interest expense |

|

|

(1,801 |

) |

|

|

(2,815 |

) |

|

|

(10,419 |

) |

|

|

(12,474 |

) |

Gain on bargain purchase |

|

|

5,259 |

|

|

|

— |

|

|

|

5,259 |

|

|

|

— |

|

Other income |

|

|

32 |

|

|

|

318 |

|

|

|

32 |

|

|

|

286 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(7,050 |

) |

|

|

— |

|

(Loss) gain on available-for-sale securities |

|

|

— |

|

|

|

— |

|

|

|

(1,550 |

) |

|

|

932 |

|

Total other expense |

|

|

110 |

|

|

|

(3,376 |

) |

|

|

(24,019 |

) |

|

|

(14,159 |

) |

Income (loss) before income tax expense |

|

|

12,870 |

|

|

|

1,721 |

|

|

|

22,073 |

|

|

|

(13,339 |

) |

Income tax expense |

|

|

1,320 |

|

|

|

— |

|

|

|

1,907 |

|

|

|

— |

|

Net income (loss) |

|

$ |

11,550 |

|

|

$ |

1,721 |

|

|

$ |

20,166 |

|

|

$ |

(13,339 |

) |

Net income (loss) per share – basic |

|

$ |

0.04 |

|

|

$ |

0.01 |

|

|

$ |

0.07 |

|

|

$ |

(0.05 |

) |

Weighted average shares used to compute net income (loss)

per share – basic |

|

|

274,998 |

|

|

|

268,732 |

|

|

|

272,811 |

|

|

|

266,126 |

|

Net income (loss) per share – diluted |

|

$ |

0.04 |

|

|

$ |

0.01 |

|

|

$ |

0.07 |

|

|

$ |

(0.05 |

) |

Weighted average shares used to compute net income (loss)

per share – diluted |

|

|

284,693 |

|

(1) |

|

323,770 |

|

(1) |

|

281,407 |

|

(1) |

|

266,126 |

|

__________________________

(1) Diluted weighted average shares ("DWAS") differs from basic due to the weighted average number of shares that would be outstanding upon exercise or vesting of outstanding share-based payments to employees and conversion of convertible notes. For the three and nine months ended September 30, 2024 DWAS included and 9,695 and 8,596, respectively, shares of outstanding share-based payments. 44,120 shares issuable upon conversion of our Senior convertible notes were excluded as their effect would be antidilutive. For the three months ended September 30, 2023 DWAS included 7,548 shares of outstanding share-based payments, 44,120 shares issuable upon conversion of our Senior convertible notes, and 3,370 shares issuable upon conversion of our Mann Group convertible note.

MANNKIND CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

(In thousands except share

and per share data) |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

62,373 |

|

|

$ |

238,480 |

|

Short-term investments |

|

|

189,215 |

|

|

|

56,619 |

|

Accounts receivable, net |

|

|

18,184 |

|

|

|

14,901 |

|

Inventory |

|

|

26,663 |

|

|

|

28,545 |

|

Prepaid expenses and other current assets |

|

|

31,229 |

|

|

|

34,848 |

|

Total current assets |

|

|

327,664 |

|

|

|

373,393 |

|

Restricted cash |

|

|

735 |

|

|

|

— |

|

Long-term investments |

|

|

16,796 |

|

|

|

7,155 |

|

Property and equipment, net |

|

|

85,339 |

|

|

|

84,220 |

|

Goodwill |

|

|

1,931 |

|

|

|

1,931 |

|

Other intangible assets |

|

|

5,313 |

|

|

|

1,073 |

|

Other assets |

|

|

26,422 |

|

|

|

7,426 |

|

Total assets |

|

$ |

464,200 |

|

|

$ |

475,198 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

6,444 |

|

|

$ |

9,580 |

|

Accrued expenses and other current liabilities |

|

|

37,386 |

|

|

|

42,036 |

|

Liability for sale of future royalties – current |

|

|

11,755 |

|

|

|

9,756 |

|

Financing liability – current |

|

|

9,998 |

|

|

|

9,809 |

|

Deferred revenue – current |

|

|

6,518 |

|

|

|

9,085 |

|

Recognized loss on purchase commitments – current |

|

|

— |

|

|

|

3,859 |

|

Midcap credit facility – current |

|

|

— |

|

|

|

20,000 |

|

Total current liabilities |

|

|

72,101 |

|

|

|

104,125 |

|

Senior convertible notes |

|

|

227,941 |

|

|

|

226,851 |

|

Liability for sale of future royalties – long term |

|

|

137,140 |

|

|

|

136,054 |

|

Financing liability – long term |

|

|

94,005 |

|

|

|

94,319 |

|

Deferred revenue – long term |

|

|

65,150 |

|

|

|

69,794 |

|

Recognized loss on purchase commitments – long term |

|

|

62,638 |

|

|

|

60,942 |

|

Operating lease liability |

|

|

12,167 |

|

|

|

3,925 |

|

Milestone liabilities |

|

|

2,813 |

|

|

|

3,452 |

|

Financing lease liability |

|

|

171 |

|

|

|

— |

|

Midcap credit facility – long term |

|

|

— |

|

|

|

13,019 |

|

Mann Group convertible note |

|

|

— |

|

|

|

8,829 |

|

Accrued interest – Mann Group convertible note |

|

|

— |

|

|

|

56 |

|

Total liabilities |

|

|

674,126 |

|

|

|

721,366 |

|

Stockholders' deficit: |

|

|

|

|

|

|

Undesignated preferred stock, $0.01 par value – 10,000,000 shares authorized;

no shares issued or outstanding as of September 30, 2024 or December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value – 800,000,000 shares authorized;

275,775,038 and 270,034,495 shares issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively |

|

|

2,753 |

|

|

|

2,700 |

|

Additional paid-in capital |

|

|

2,995,974 |

|

|

|

2,980,539 |

|

Accumulated other comprehensive income |

|

|

588 |

|

|

|

— |

|

Accumulated deficit |

|

|

(3,209,241 |

) |

|

|

(3,229,407 |

) |

Total stockholders' deficit |

|

|

(209,926 |

) |

|

|

(246,168 |

) |

Total liabilities and stockholders' deficit |

|

$ |

464,200 |

|

|

$ |

475,198 |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

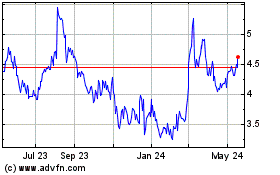

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Jan 2025 to Feb 2025

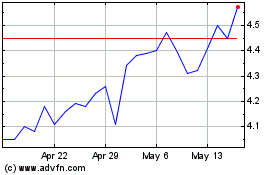

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Feb 2024 to Feb 2025